HumidiFi, the largest proprietary automated market maker (prop AMM) on

Solana, is preparing to launch its long-awaited token WET through Jupiter’s new Decentralized Token Formation (DTF) platform. HumidiFi processes more than 1 billion USD in daily trading volume and accounts for roughly 35% of Solana’s spot DEX activity. Its rapid rise and central role in Solana’s liquidity flow have made the WET sale one of the most anticipated token launches of 2025.

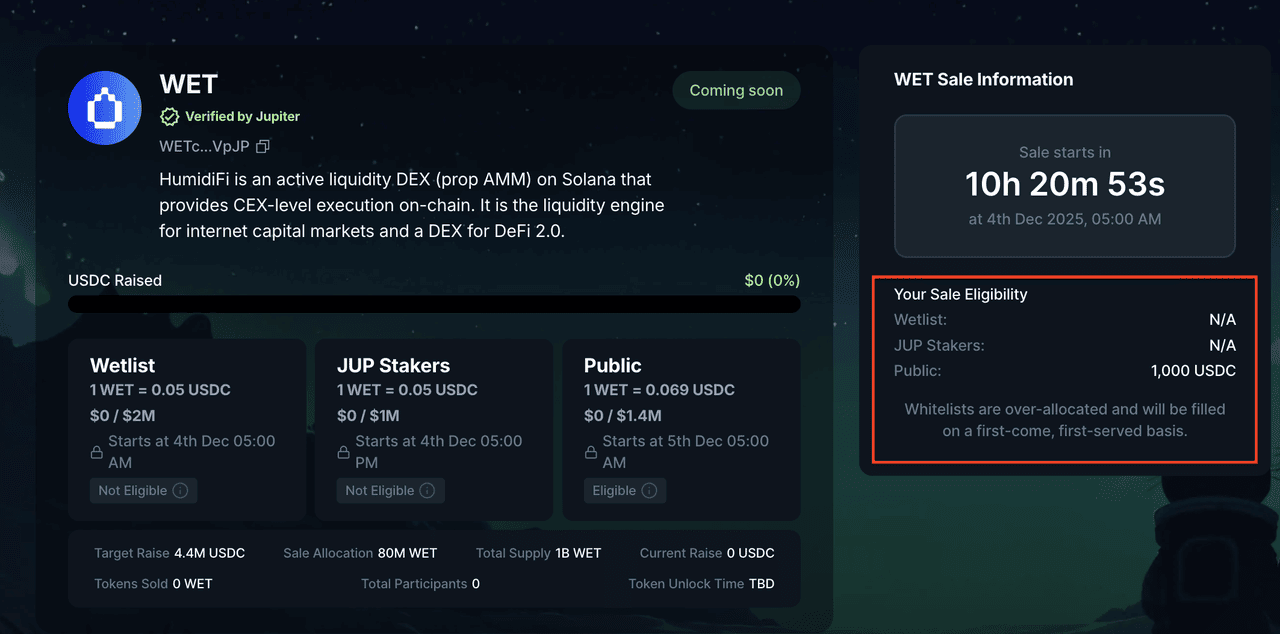

The WET public sale begins on December 3, giving HumidiFi users, Jupiter stakers, and everyday Solana traders the chance to participate in the first token ever launched on Jupiter DTF. The platform is a fully on-chain token formation system designed to make token launches transparent, verifiable, and accessible, without private rounds or complex allocation structures.

This BingX guide walks you through everything you need to know before the sale begins, including how HumidiFi works, what the WET token is designed for, a complete overview of its tokenomics, and a clear step-by-step explanation of how to join the WET public sale through Jupiter DTF.

What Is HumidiFi, the Largest Solana AMM, and How Does It Work?

Source: HumidiFi X (Twitter)

HumidiFi is a proprietary

automated market maker (prop AMM) built to deliver fast, deep, and efficient liquidity across Solana’s trading ecosystem. Unlike traditional AMMs that rely on public liquidity pools, HumidiFi uses an active-liquidity model and its own capital to update prices in real time and react instantly to market movements. This approach allows it to consistently offer tighter spreads and better execution quality than other Solana AMMs.

In less than a year since launching in May 2025, HumidiFi has become a dominant force in

Solana’s trading ecosystem. According to Blockworks Research, the protocol handles more than 1 billion USD in daily volume, and its liquidity powers roughly 35% of all spot DEX activity on the network. On major pairs like

SOL/USDC, HumidiFi often drives over 25% of total trading flow, giving it outsized influence in setting prices and maintaining market stability across Solana.

Most traders never interact with HumidiFi directly. Instead,

Jupiter, Solana’s leading DEX aggregator, routes trades to HumidiFi whenever it provides the best price. As a result, HumidiFi effectively powers a significant share of the network’s liquidity behind the scenes.

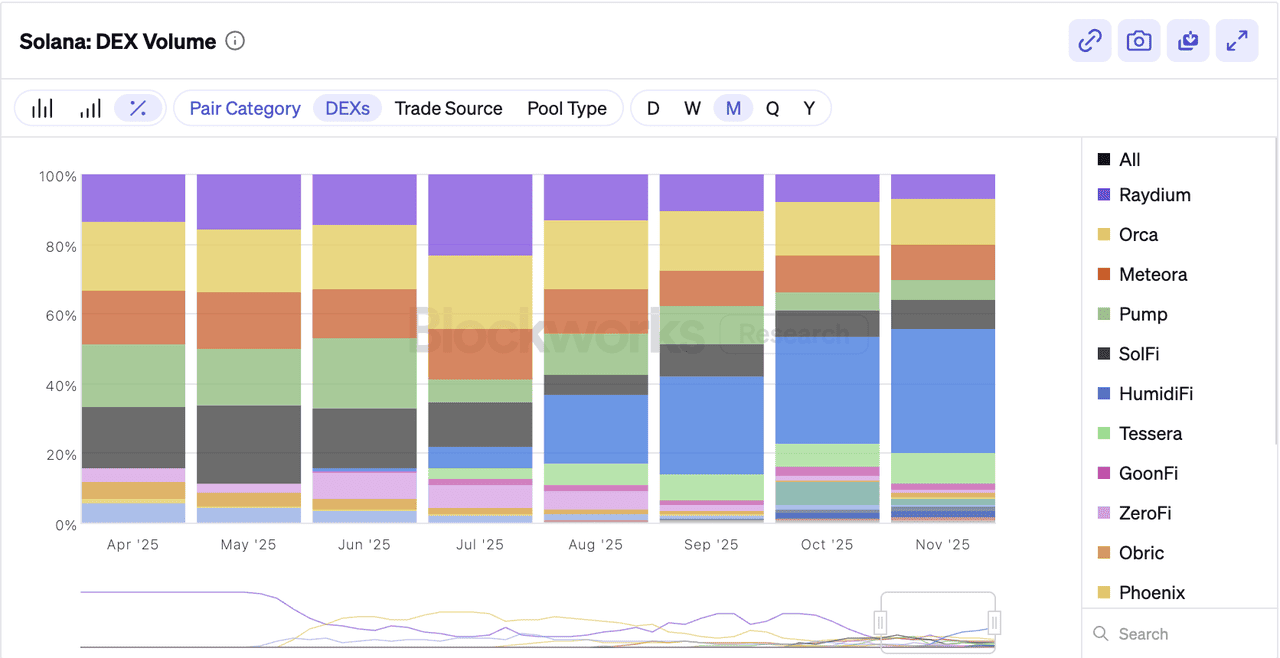

How HumidiFi Becomes the Largest DEX on Solana

Source: Blockworks Research

1. High market share: HumidiFi handles more than 1 billion USD in daily trading volume and about 35% of Solana’s spot DEX activity.

2. Deep liquidity on major pairs: Regularly captures 25%+ market share on pairs like SOL/USDC, reinforcing its dominance across core markets.

3. Tight spreads: Achieves spreads around 5 bps, significantly tighter than traditional AMMs, which improves execution quality for traders.

4. Best-execution routing through Jupiter: Jupiter frequently routes trades to HumidiFi because it consistently offers the most competitive prices across the ecosystem.

HumidiFi’s strong market presence and consistent performance have made it the backbone of Solana’s growing trading activity. This sets the stage for its upcoming WET token launch on Jupiter DTF.

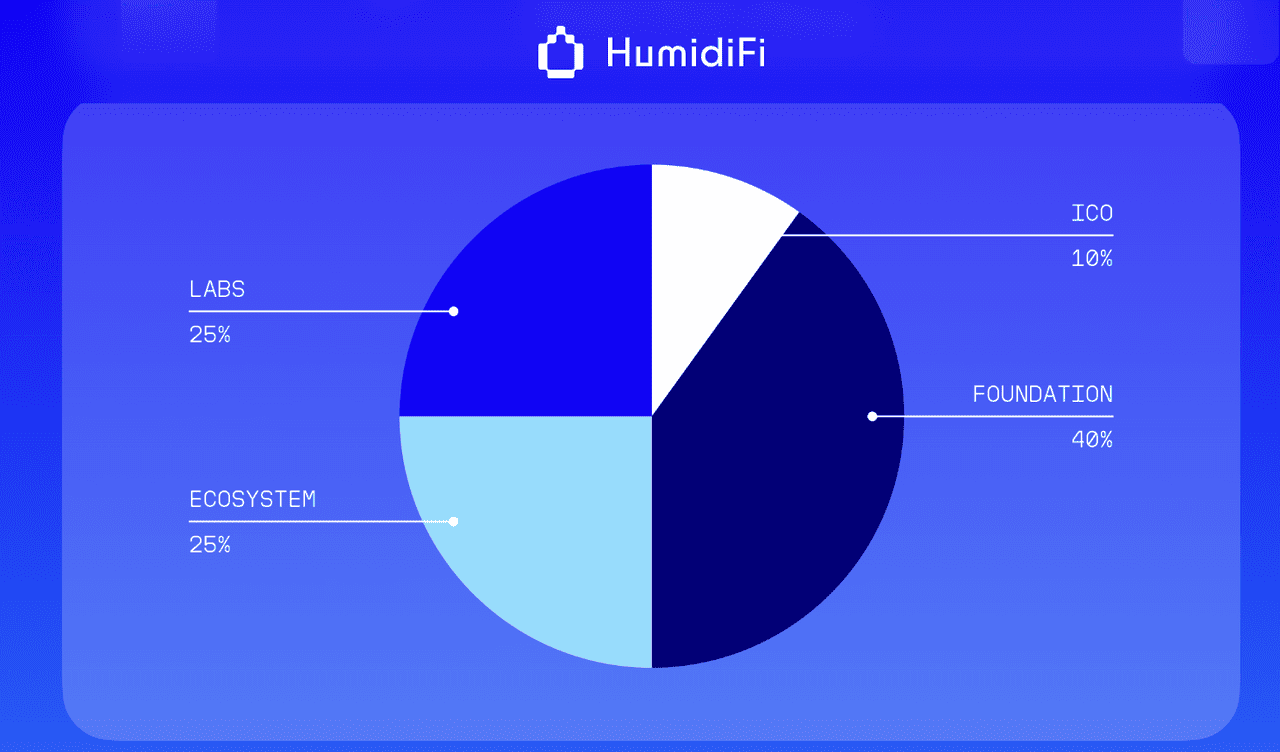

HumidiFi (WET) Tokenomics Overview

Source: HumidiFi Tokenomics

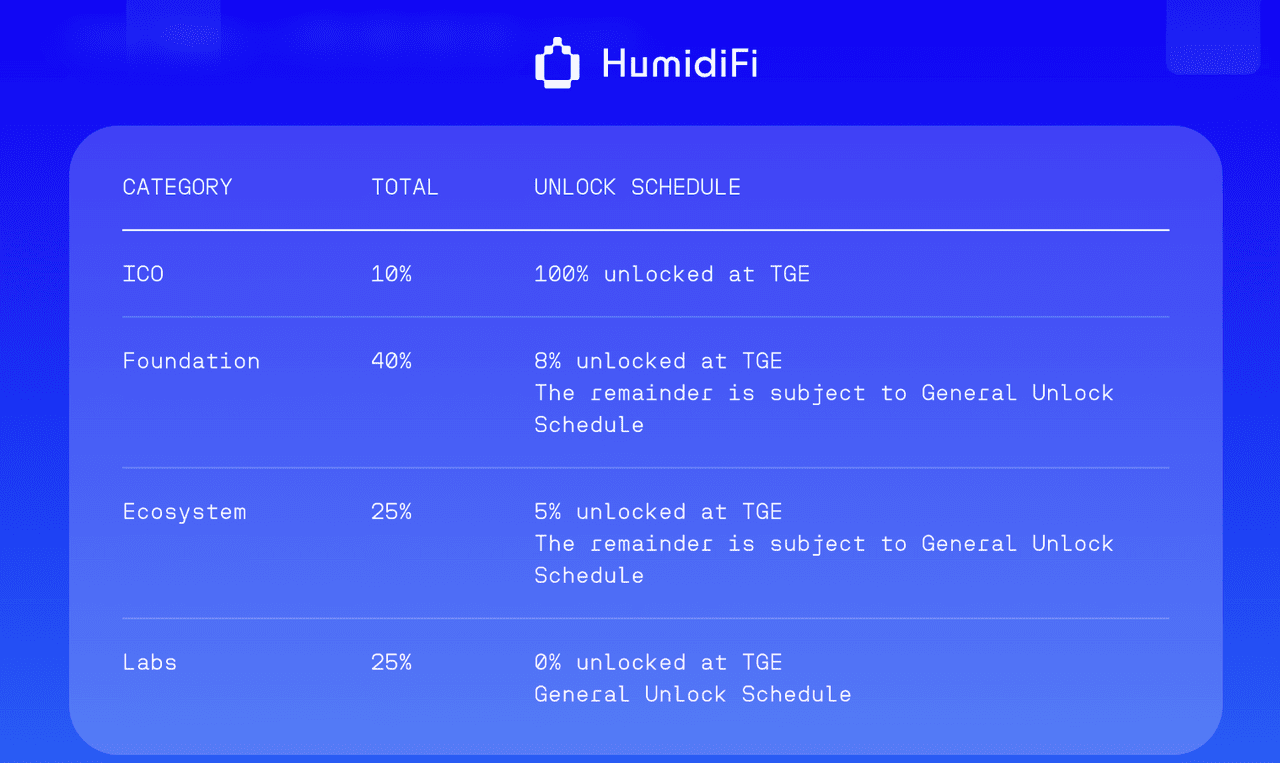

The WET token is the native utility asset powering HumidiFi’s active-liquidity ecosystem on Solana. With a fixed supply of 1,000,000,000 WET, the token is launching through Jupiter’s Decentralized Token Formation (DTF) platform using a distribution model designed to prioritize transparency, fairness, and broad community access.

HumidiFi has opted for a fully public launch with no private or VC rounds. All allocations flow through the three DTF sale phases, and vesting schedules will be strictly enforced on-chain via Jup Lock, ensuring complete visibility for token holders.

WET Token Utilities

According to the $WET litepaper, WET functions primarily as a utility token that supports HumidiFi’s trading incentives and fee structure.

Key functions include:

• Day-one staking: Users can stake WET to unlock trading fee rebates on HumidiFi.

• On-chain tier system: The protocol automatically reads a user’s staking tier to apply fee rebates on every trade.

• Long-term utility roadmap: While initial utility focuses on trading incentives, the team will release additional details as the ecosystem expands.

However, in the official announcement of WET tokenomics, the team behind HumidiFi has highlighted that WET is designed specifically for platform utility and should be understood within that framework.

WET Token Allocation

Source: HumidiFi Tokenomics

• Fixed Supply: 1,000,000,000 WET. No private or VC rounds

• ICO: 10%, fully unlocked at TGE

• Foundation: 40%, with 8% unlocked at TGE and the remainder following the General Unlock Schedule

• Ecosystem: 25%, with 5% unlocked at TGE and the remainder following the General Unlock Schedule

• Labs: 25%, unlocked entirely according to the General Unlock Schedule

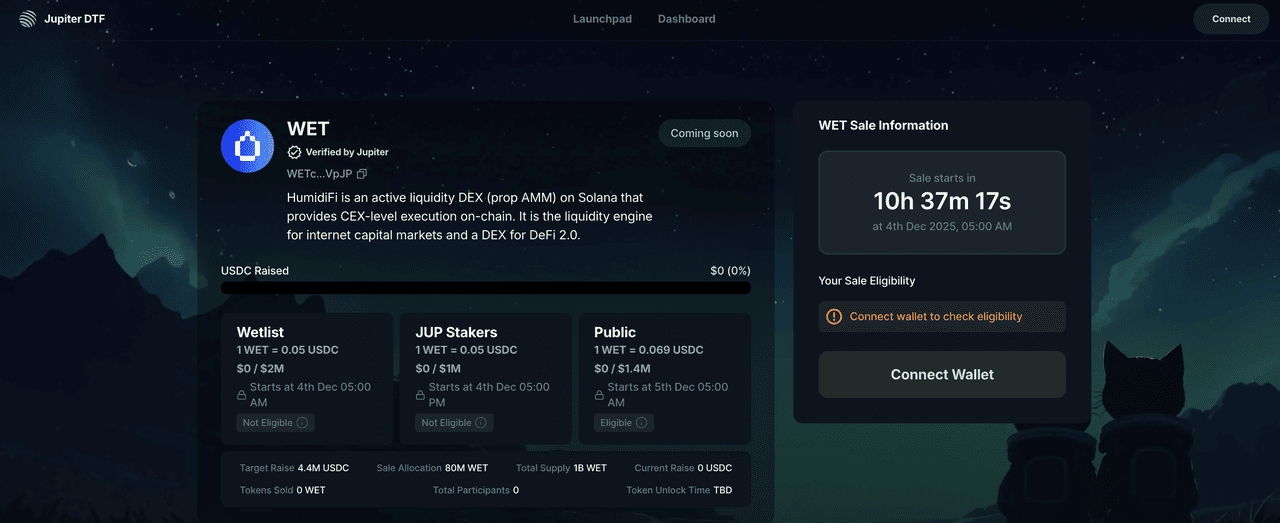

WET Token Public Sale on Dec. 3: How to Participate in the WET ICO

The WET token sale will take place exclusively on Jupiter’s Decentralized Token Formation (DTF) platform across three first-come, first-served phases. All whitelist phases are overallocated, meaning allocations can fill quickly once each phase opens.

WET Token Public Sale Key Timeline & Details

| Category |

Phase 1: Wetlist Sale |

Phase 2: Jupiter Stakers Sale |

Phase 3: Public Sale |

| Time |

Dec 3, 10 AM – 10 PM EST |

Dec 3, 10 PM – Dec 4, 10 AM EST |

Dec 4, 10 AM – 10 PM EST |

| Price |

0.05 USDC |

0.05 USDC |

0.069 USDC |

| Allocation |

60M WET (6%) |

20M WET (2%) |

20M WET (2%) |

| Details |

Reserved for HumidiFi users, contributors, and community members. Tiered purchase caps. Overallocated and closes once filled. |

Reserved for Jupiter stakers with tiered purchase limits:

• Tier 1: 1,000–9,999 JUP → 200 USDC

• Tier 2: 10,000–49,999 JUP → 500 USDC

• Tier 3: 50,000–499,999 JUP → 2,500 USDC

• Tier 4: 500,000–999,999 JUP → 5,000 USDC

• Tier 5: 1,000,000+ JUP → 10,000 USDC

Overallocated and fills on fastest participation.

|

Open to all Solana users with a USDC-funded wallet. 1,000 USDC purchase cap. First-come, first-served. |

WET Public Sale Allocations (Part of the 10% ICO Category)

Within the 10% ICO allocation, the public-facing sale phases through Jupiter DTF account for 10% of total supply and are split into the following confirmed sale segments:

• 6% - Wetlist Sale: HumidiFi users, contributors, and community members.

• 2% - Jupiter Stakers Sale: Eligibility based on time-weighted JUP staking tiers.

• 2% - Public Sale: Open to all users via Jupiter DTF.

These three components collectively comprise the full 10% ICO allocation, which is fully unlocked at TGE.

How to Participate in the WET ICO on Jupiter DTF

Participating in the WET token sale on Jupiter DTF is straightforward, but timing and preparation matter because all phases are first-come, first-served. Before the sale opens, users should ensure their wallets are funded, eligible, and ready to transact quickly. Below is a simple six-step walkthrough that covers everything you need to join the WET ICO confidently and avoid last-minute issues.

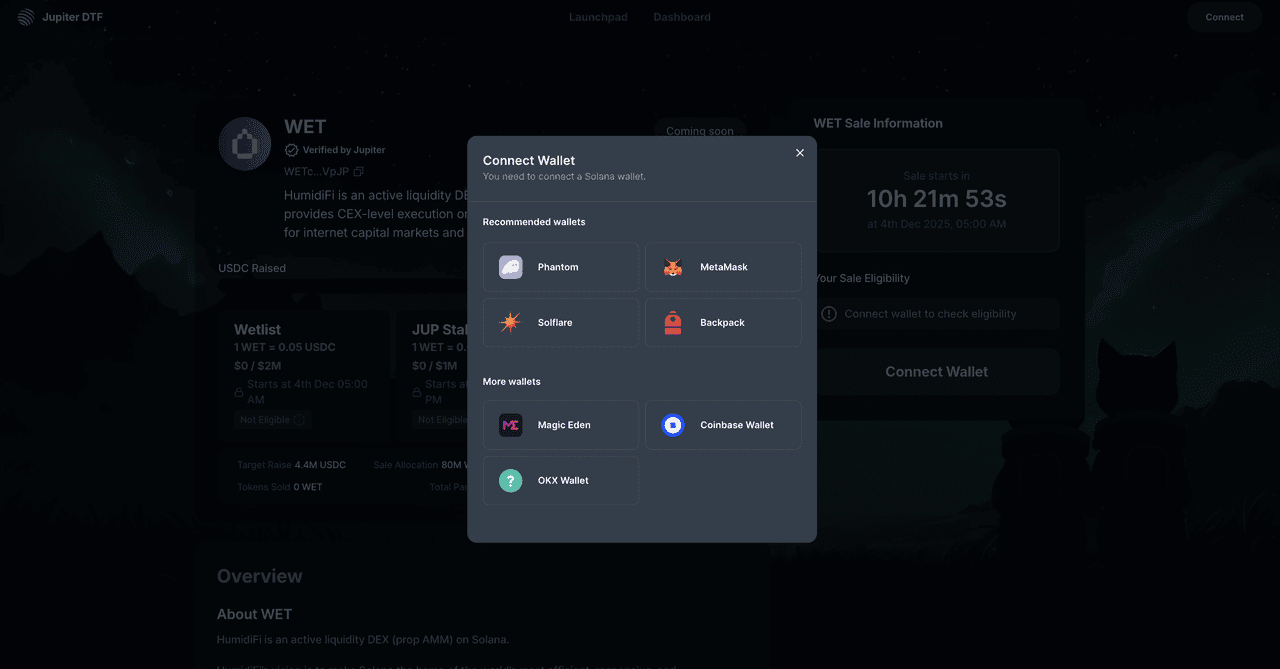

Step 1: Set up a Solana wallet

Install a Solana-compatible wallet such as

Phantom,

Solflare,

Metamask or Backpack, and securely back up your seed phrase.

Step 2: Fund your wallet with USDC and SOL

Transfer

USDC for the token purchase and SOL for transaction fees into your Solana wallet. If you prefer a simple on-ramp, you can

buy USDC and SOL on BingX and withdraw them directly to your Solana address. You can also use

BingX AI to check real-time market prices and track USDC and SOL movements before making your purchase.

Step 3: Visit the official Jupiter DTF sale page

Step 4: Connect your wallet

Select “Connect Wallet,” choose your Solana wallet, and approve the connection so the interface can read your eligibility and purchase limits.

Step 5: Select your phase and complete your purchase

Step 6: Wait for TGE to claim and trade WET

After the sale ends, WET will be claimable at TGE, with liquidity launching first on HumidiFi and

Meteora. Once you claim your tokens, you may trade or sell them on supported platforms, including centralized exchanges such as BingX when listings become available.

When Will the WET Token TGE?

According to the token information outlined in the official materials, the WET token generation event (TGE) is expected to take place shortly after the token sale concludes, with the current expected date listed as December 5, 2025. At TGE:

• WET tokens will be distributed to participants according to their purchased allocations.

• Liquidity pools will be launched immediately on HumidiFi and Meteora, ensuring that trading is available without delay.

• All allocations and vesting schedules will be locked and enforced on-chain via Jup Lock for complete transparency.

The exact TGE time will be announced by HumidiFi and Jupiter closer to the launch, but the expected timeline places TGE within one to two days following the end of the public sale.

Will There Be a WET Airdrop and How to Participate?

There is no confirmed WET airdrop based on the official information available. All allocations released so far focus on the three token sale phases through Jupiter DTF, covering the Wetlist Sale, Jupiter Stakers Sale, and Public Sale. None of these phases include a retroactive or free token distribution.

HumidiFi did create a Wetlist leaderboard to recognize active users and contributors. The snapshot for this leaderboard was taken on November 11, 2025 at 11:11:11, and qualifying wallets receive priority access to the Wetlist Sale. However, this mechanism serves as a sale eligibility system, not an airdrop.

At this stage, HumidiFi has not announced any official

airdrop program, nor has it indicated that WET will include retroactive rewards. Users interested in participating in the token distribution must do so through the DTF sale phases outlined in the token sale timeline.

Final Thoughts

HumidiFi’s rise from its launch in May 2025 to becoming Solana’s most active liquidity venue has reshaped the network’s trading landscape. Its deep liquidity, tight spreads, and strong integration with Jupiter have positioned it as a core part of Solana’s market infrastructure.

The WET token launch on Jupiter DTF introduces a fully transparent, on-chain distribution model with no private rounds, on-chain vesting through Jup Lock, and immediate liquidity at TGE. With its clear sale structure and strong market presence, HumidiFi’s WET sale is set to be one of the most important Solana token events of 2025.

For users participating in Solana’s growing ecosystem, the WET sale offers a straightforward way to engage with one of the network’s fastest-growing liquidity engines.

Related Reading

Frequently Asked Questions (FAQs) on HumidiFi (WET)

1. What is the WET token?

WET is HumidiFi’s native utility token with a fixed supply of 1,000,000,000. It powers staking-based fee rebates and other platform utilities. WET is launched entirely through Jupiter’s Decentralized Token Formation (DTF) platform.

2. Which wallets should I use to join the WET Public Sale?

WET is a Solana SPL token, so you can use any

Solana-compatible wallet to join the sale. Common options include Phantom, Solflare, Backpack, and

Ledger Hard Wallet (through a Solana interface). As long as the wallet can connect to Jupiter DTF, it will work for participating in the WET Public Sale and claiming WET at TGE.

3. When is the WET public sale?

The WET public sale takes place on December 4, from 10 AM to 10 PM EST on Jupiter DTF. It is the final phase of the token launch and is open to all Solana users with a USDC-funded wallet.

The full sale schedule is:

• Wetlist Sale: December 3, 10 AM – 10 PM EST

• Jupiter Stakers Sale: December 3, 10 PM – December 4, 10 AM EST

• Public Sale: December 4, 10 AM – 10 PM EST

4. What is the price of WET during the public sale?

• Wetlist Sale: 0.05 USDC

• Jupiter Stakers Sale: 0.05 USDC

• Public Sale: 0.069 USDC

5. Who can participate in each WET ICO phase?

• Wetlist Sale: HumidiFi users, contributors, and community members

• Jupiter Stakers Sale: Eligible wallets based on time-weighted JUP staking tier

• Public Sale: Open to all Solana users with a USDC-funded wallet

6. Is there a WET airdrop?

There is no confirmed WET airdrop. The Wetlist leaderboard snapshot taken on November 11, 2025 at 11:11:11 only determines priority sale access and does not distribute free tokens.

7. When is the WET Token Generation Event (TGE)?

The expected $WET TGE is December 5, 2025, shortly after the Public Sale ends. Purchased tokens become claimable at TGE, and liquidity launches immediately on HumidiFi and Meteora.