Crypto’s momentum is shifting again, and this time BNB Chain is leading the charge. After years of steady building, 2025 has become BNB’s breakout year. Its native token

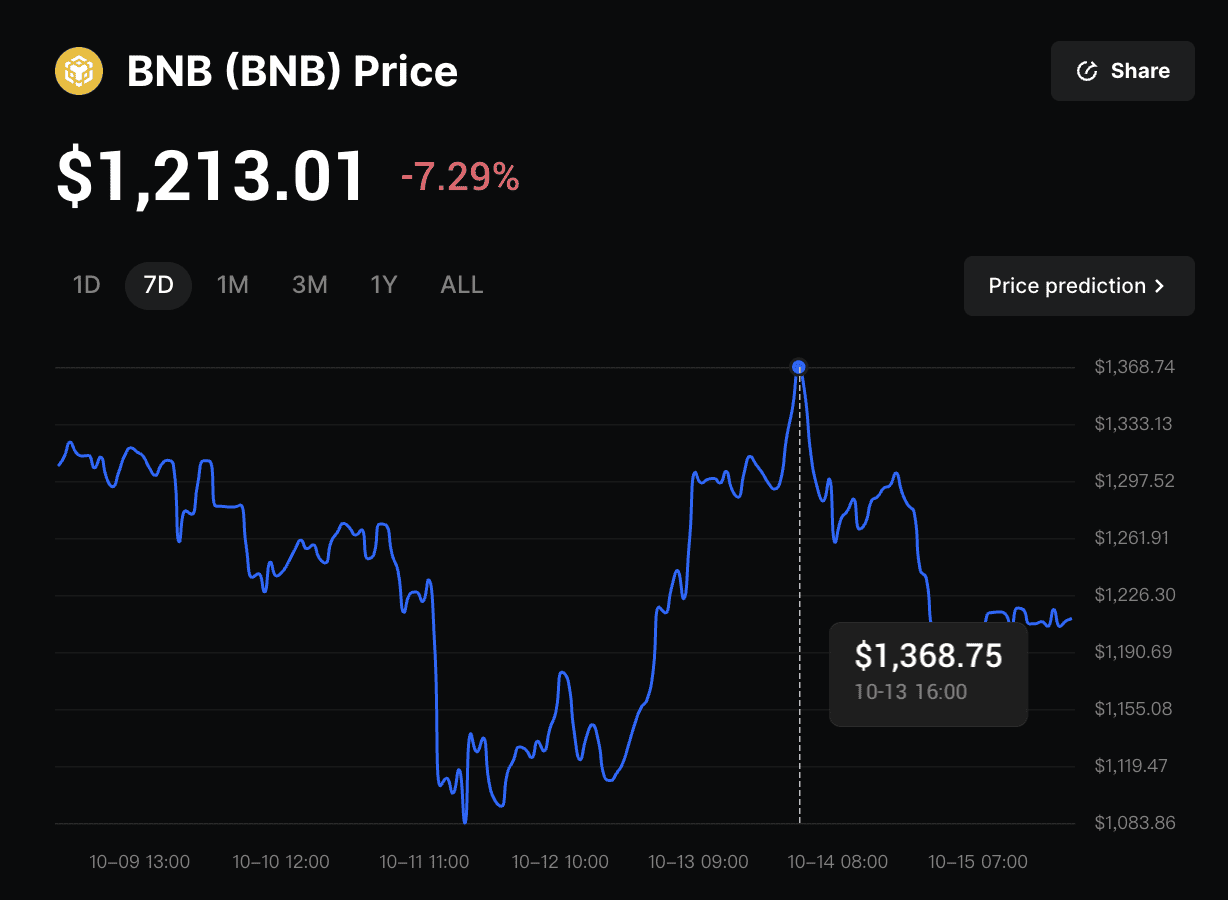

BNB recently reached a new all-time high of $1368.75 on October 13, 2025, driven by surging on-chain activity, renewed market confidence, and a wave of new ecosystem growth.

Transaction volumes are climbing, new DeFi protocols are launching, and even memecoins are bringing fresh liquidity into the network. At the heart of this revival are projects like Aster, a fast-growing perpetuals DEX, and the community-driven

BNB Meme Season, which together have reignited enthusiasm around the BNB ecosystem.

Looking beyond the causes of BNB’s rally, this article explores 7 BNB ecosystem projects most likely to shape the network’s next phase. From

DeFi and

staking to

restaking and

memecoins, these initiatives show how the ecosystem is maturing while staying open to new waves of innovation and attention.

What Is BNB Chain and BNB Ecosystem’s Role in DeFi

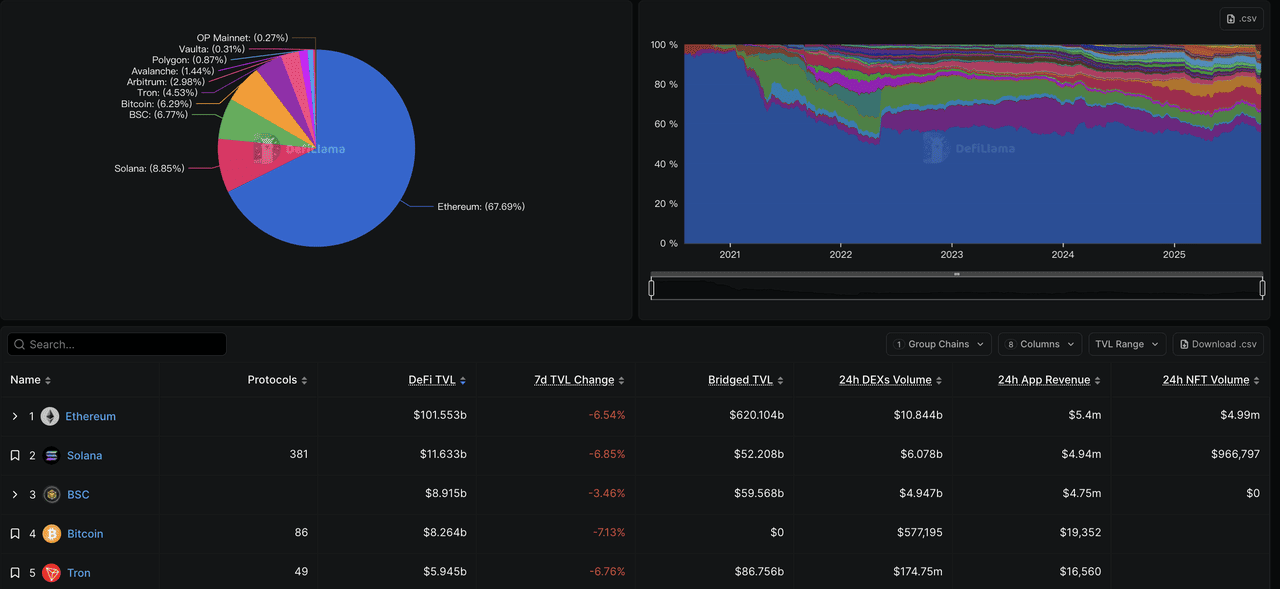

BNB Ecosystem ranks 3rd among L1s by TVL | Source:

DefiLlama.

BNB Chain is a high-performance Layer 1 blockchain designed for scalability, low transaction fees, and developer accessibility. It supports a wide range of decentralized applications across DeFi, GameFi, NFTs, and infrastructure. Fully compatible with the Ethereum Virtual Machine (EVM), it enables developers to deploy or migrate smart contracts easily, making it one of the most active networks by user count and transaction volume.

As of October 2025, BNB Chain ranks 3rd among all Layer 1 blockchains by DeFi TVL, holding around $8.9 billion, or roughly 6.8% of the total market share, according to

DefiLlama. Its ecosystem continues to expand through leading protocols such as PancakeSwap, Lista, and Aster, each contributing to liquidity growth and sustained network activity.

The BNB ecosystem extends beyond the chain itself, encompassing liquidity protocols, staking platforms, and launchpads that collectively support long-term growth. It is powered by BNB, the native token used for gas, governance, and staking, with a quarterly auto-burn mechanism that permanently removes tokens based on on-chain activity. In essence, BNB Chain provides the foundation, while its ecosystem drives the momentum that keeps it one of the most active and fast-evolving Layer 1 networks in 2025..

What’s Driving BNB Ecosystem Momentum in 2025?

BNB Chain’s momentum in 2025 reflects a gradual build-up of network activity and developer engagement rather than a sudden breakout. Consistent user growth, new project launches, and a broader market recovery have strengthened its position this year. The points below highlight the key developments behind this trend.

1. BNB’s Record Highs Reflect Sustained On-Chain Activity

BNB’s price momentum mirrors its network fundamentals. On October 13, 2025, the token reached a new all-time high of $1,368.75, alongside a 61% rise in monthly active users since January.

Token Terminal data shows activity climbing from 36 million to 58.1 million users by October, driving higher transactions and gas volume.

This activity powers BNB’s auto-burn mechanism, which permanently removes tokens each quarter. In July 2025, BNB Chain completed its 32nd burn, destroying 1,595,599 BNB (about $1.02 billion). Over 3.17 million BNB have already been burned this year, underscoring consistent network use and a healthy demand base.

2. DeFi Growth and New Protocols Drive BNB Chain’s 2025 Expansion

BNB Chain’s DeFi landscape has expanded rapidly through both established protocols and new entrants. PancakeSwap continues to dominate with around $1.3 billion TVL, while lending and staking platforms such as Lista and Venus have deepened liquidity across the network.

One of the year’s standout additions is Aster, a cross-chain

perpetuals DEX that has surpassed 2 million users and $2 billion in TVL, according to Messari. Its rise signals a broader revival in developer activity and DeFi experimentation on BNB Chain, supported by improved infrastructure, lower transaction costs, and an active user base.

3. BNB Meme Season Expands On-Chain Engagement Beyond DeFi

BNB DEXs volumes surpassed $6B per day amid the BNB Meme Season | Source:

DefiLlama

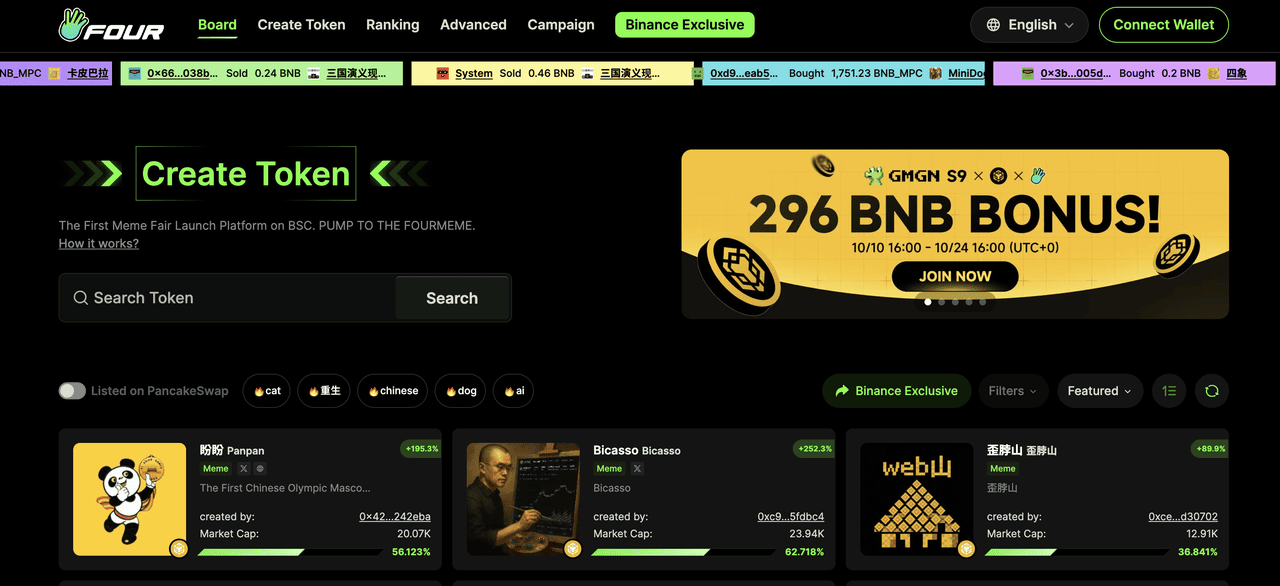

The emergence of BNB Meme Season has introduced a cultural layer to the network’s activity. Sparked by a viral “4” motto in early October, traders and creators launched a wave of meme tokens that captured community attention and renewed interest in the chain.

At the center is Four.meme, a BNB-native launchpad that allows instant, low-cost token creation. Its simplicity has driven record experimentation, onboarding thousands of new wallets and boosting daily transactions. While speculative, this meme-driven activity has brought fresh liquidity and visibility to smaller projects, adding social momentum to BNB Chain’s ongoing growth.

Top 7 BNB Ecosystem Tokens to Watch in 2025

As BNB Chain enters its most active growth phase yet, several ecosystem projects stand out for their innovation, user traction, and long-term potential. From decentralized trading and staking to meme culture and wallet adoption, these tokens highlight the breadth of activity driving BNB Chain’s renewed momentum in 2025.

1. Binance Coin (BNB) - The Core Utility Token Powering BNB Chain

BNB remains the cornerstone of the BNB Chain, serving as gas for transactions, a staking asset for validators, and a governance token for on-chain proposals. Its auto-burn mechanism permanently reduces supply each quarter, directly linking network activity to token scarcity. By October 2025, more than 3.17 million BNB had been burned for the year, reflecting strong usage and steady ecosystem participation.

Beyond its role as gas and collateral, BNB anchors liquidity across DeFi protocols and launchpads while supporting restaking and

yield strategies. Its liquidity dominance keeps it at the center of most financial applications on the network, maintaining stability and interoperability across the growing BNB ecosystem.

2. Aster (ASTER) - The Fastest-Growing Perp DEX on BNB Chain

Aster (ASTER) has quickly become one of the leading protocols within the BNB ecosystem, designed to make derivatives trading simpler, faster, and more capital-efficient. The platform supports both spot and perpetual markets and operates across multiple networks, including

BNB Chain,

Ethereum,

Solana, and

Arbitrum. Its modular liquidity system enables cross-chain trading with lower

slippage and deeper liquidity, offering a smoother on-chain derivatives experience.

Since

its token generation event in September 2025, Aster has surpassed 2 million users and $2 billion in total value locked (TVL), according to Messari. This rapid expansion reflects the growing demand for decentralized derivatives and underscores Aster’s role as a key driver of BNB Chain’s DeFi growth in 2025.

3. PancakeSwap (CAKE) - The Largest DEX for BNB DeFi

PancakeSwap (CAKE) continues to dominate decentralized trading on BNB Chain, accounting for the majority of its DEX volume and liquidity. With a TVL of around $3.7 billion as of Q4 2025, the platform remains one of the largest DeFi protocols across all chains. It supports a wide range of products, including swaps, yield farming, staking,

prediction markets, and perpetual trading.

In 2025, PancakeSwap has expanded through cross-chain deployments and automated yield strategies. These updates ensure it remains the backbone of BNB Chain’s liquidity infrastructure, connecting both DeFi veterans and retail users in a consistent and low-cost trading environment.

4. Four.meme (FORM) - The Memecoin Launchpad Powering BNB Meme Season

Four.meme (FORM) has emerged as one of the defining platforms of the BNB Meme Season, acting as a

memecoin launchpad where users can instantly mint and list meme tokens with minimal cost. Its simplified interface and direct integration with BNB Chain have made token creation accessible to anyone, sparking a surge of grassroots experimentation and social activity.

According to

Dune Analytics, Four.meme recorded more than 47,800 unique token contracts created on October 8, 2025, marking its highest daily activity since launch. This rapid growth reflects how meme-driven participation has turned into a network-wide phenomenon. While speculative, Four.meme demonstrates how BNB Chain’s low fees and active community can transform cultural trends into measurable on-chain growth, bridging creativity and liquidity in a way few ecosystems have achieved.

5. Lista DAO (LISTA) - The Core Liquid Staking Protocol on BNB Chain

Lista DAO (LISTA) provides liquid staking for BNB, allowing users to earn staking rewards while keeping their assets tradable. Its model issues staking derivatives that can be used across DeFi protocols for lending, farming, or trading, improving capital efficiency across the network.

As of late 2025, Lista’s TVL sits around $420 million, according to

DeFiLlama. The protocol is becoming a crucial component of BNB Chain’s staking economy, integrating with DeFi platforms that let users redeploy staked assets for additional yield opportunities.

6. Venus (XVS) - The Primary Lending Market of BNB Chain

Venus Protocol (XVS) remains BNB Chain’s leading platform for lending and borrowing, offering decentralized credit markets backed by over-collateralized assets. It also issues VAI, a decentralized

stablecoin used within the ecosystem. With a TVL exceeding $2.1 billion in 2025, Venus ranks among the top three DeFi lending protocols on BNB Chain.

The project continues to refine its risk management and collateral frameworks, providing stable liquidity even during market volatility. With more activity from institutional lenders and integrations with staking protocols, Venus remains a foundational layer for credit and liquidity in BNB’s DeFi ecosystem.

7. Trust Wallet Token (TWT) - The Self-Custody Wallet Token on BNB Chain

Trust Wallet Token (TWT) powers Trust Wallet, one of the most widely used self-custody wallets within the BNB ecosystem. With over 80 million downloads and millions of monthly active users, Trust Wallet plays a central role in onboarding users to DeFi, NFTs, and dApps on BNB Chain.

The TWT token incentivizes wallet usage, community participation, and governance decisions. As self-custody adoption grows amid increasing regulatory scrutiny of exchanges, Trust Wallet’s accessibility and integration with BNB Chain applications make TWT an important gateway asset for retail users and builders alike.

How to Buy and Trade BNB Ecosystem Tokens on BingX

Whether you are investing for the long term, trading short-term volatility, or looking to capture new opportunities within the BNB ecosystem, BingX offers both Spot and Futures Markets to help you take action.

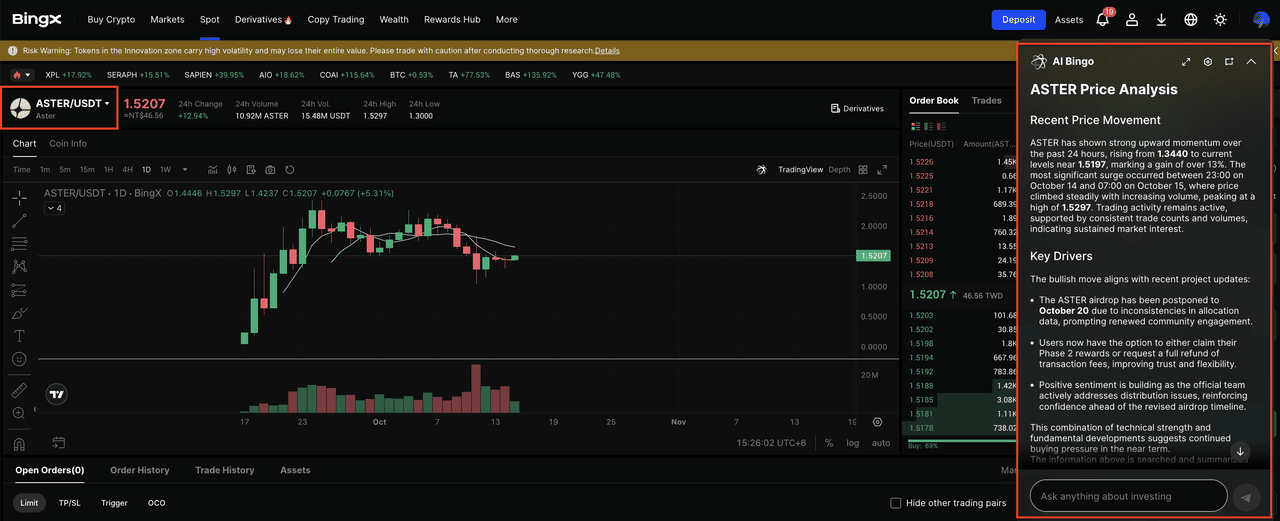

With BingX AI built directly into the interface, you can access real-time insights, market analysis, and price forecasts to make smarter and faster trading decisions.

1. Buy or Sell BNB Ecosystem Tokens on the Spot Market

If your goal is to accumulate tokens like BNB, CAKE, or XVS, or to buy during price pullbacks, the Spot Market is the most straightforward option.

Step 2: Click the AI icon on the chart to activate BingX AI, which will display support and resistance levels, detect breakout zones, and highlight optimal entry points.

Step 3: Choose between a Market Order for instant execution or a Limit Order at your desired price. Once filled, your tokens will appear in your BingX balance, ready to hold or withdraw to an external wallet.

2. Trade BNB Ecosystem Tokens with Leverage on Futures

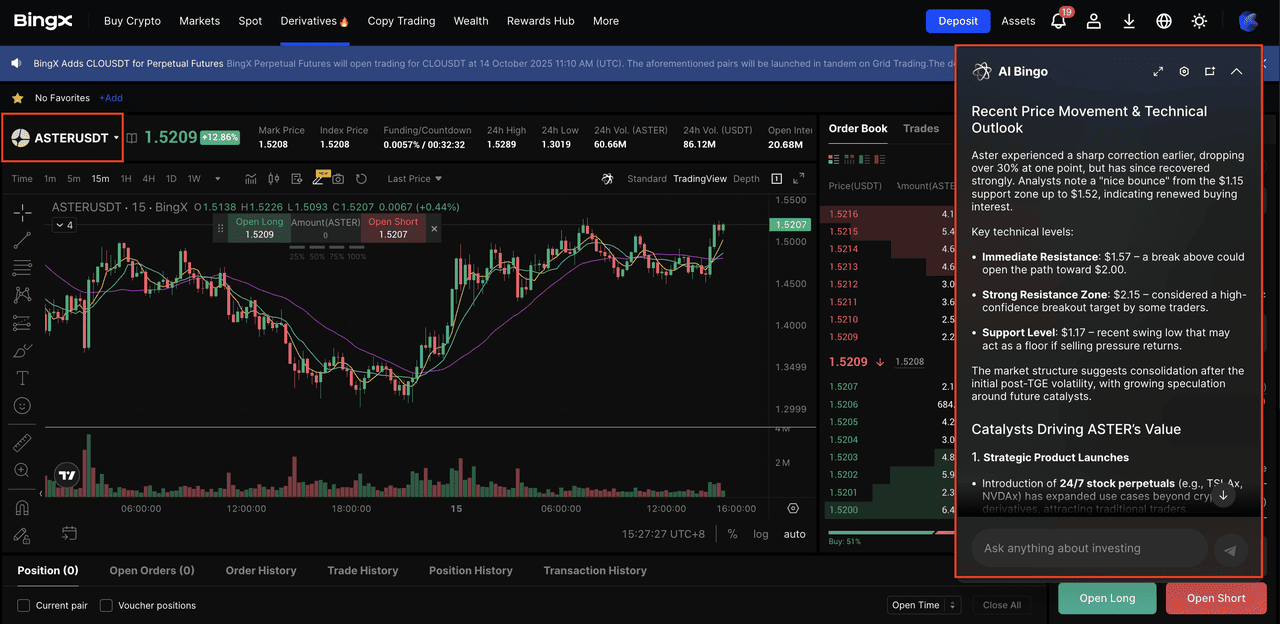

For active traders, the BingX Futures Market allows you to trade BNB ecosystem tokens with leverage, enabling profit opportunities in both rising and falling markets.

Step 2: Click the AI icon on the chart to activate BingX AI, which analyzes price trends, momentum, and volatility in real time to assist your entry.

Step 3: Set your leverage level, select an entry price, and place a Long (Buy) or Short (Sell) order depending on your market view. Manage your position with

Stop-Loss and Take-Profit levels for effective risk control.

Final Thoughts

BNB Chain’s momentum in 2025 highlights how a mix of innovation and community activity can sustain long-term growth. With established protocols like PancakeSwap and Venus driving liquidity, and new entrants such as Aster, Lista, and Four.meme adding fresh energy, the ecosystem continues to expand across DeFi, staking, and social trading.

As BNB Chain evolves, its strength lies in its balance between usability and experimentation. For traders and investors, following these key projects provides a window into where the next phase of growth may emerge. BingX makes it easy to buy, trade, and explore BNB ecosystem tokens in both spot and futures markets.

Related Reading