U.S Oil Reserve (USOR) has emerged as one of the fastest-moving tokens on

Solana in January 2026, gaining over 660% in a week in mid-January, with daily trading volumes hovering over $27 million, and a market cap crossing $55 million, price behavior more typical of a hype-cycle

memecoin than a regulated real-world asset (RWA).

This article breaks down what U.S Oil Reserve (USOR) token actually is, why it’s trending now, what’s behind the BlackRock and Trump-related rumors, how to buy USOR token, and the key risks traders should factor in before taking exposure.

What Is U.S Oil Reserve (USOR) Crypto?

United States Oil Reserve (USOR) is a Solana Program Library (SPL) token launched in early January 2026 that promotes the idea of bringing U.S. oil reserve–themed assets on-chain. From a technical standpoint, USOR behaves like a standard Solana token: users can buy, sell, and trade it on decentralized exchanges, track balances and transfers on public explorers, and monitor liquidity and price data through

on-chain tools such as

Dex Screener and Birdeye.

USOR is also accessible through

BingX ChainSpot, offering a centralized interface for trading an otherwise on-chain asset.

Project materials and promotional content frequently reference “government-verified reserves,” “federal custody,” and U.S. energy security, implying links to official oil stockpiles. However, no statements or confirmations from the U.S. Department of Energy (DOE) or other government agencies support these claims, and there is no disclosed legal structure, audited reserve report, or redemption mechanism tying USOR tokens to physical barrels of oil. As a result, any oil-backed or proof-of-reserves framing remains self-published narrative, not independently verified fact.

In market practice, USOR functions primarily as a narrative-driven cryptocurrency, often grouped with meme tokens aligned to the

RWA trend rather than regulated

commodity tokenization. Its valuation is driven mainly by community speculation, social media momentum, and geopolitical headlines, not enforceable ownership rights or regulated oil exposure. This distinction is critical: while blockchain data can transparently show token supply, wallet distribution, and transaction history, it cannot verify off-chain oil custody or government endorsement.

How Does the USOR Token Work?

USOR operates as a standard Solana SPL token whose market behavior is driven by on-chain liquidity and trading activity rather than off-chain cash flows or utility. Traders typically acquire USOR by swapping

SOL or, in some pools,

stablecoins for USOR through decentralized liquidity pools, with most activity concentrated in USOR/SOL pairs on

Solana DEXs. Because liquidity is relatively thin compared with large-cap assets, price discovery is highly sensitive to order flow; large buys or sells can move the market quickly, and a small number of large wallets can materially influence short-term price action.

U.S Oil Reserve (USOR) Tokenomics

USOR is issued as a Solana Program Library (SPL) token on the Solana network, with a fixed maximum supply of 1,000,000,000 tokens, nearly all of which are already in circulation according to major trackers. The token follows a non-inflationary model, with the entire supply minted at or near launch, no announced mint authority for future issuance, and no publicly disclosed vesting schedules or unlock cliffs, meaning supply-side dilution risk is currently limited to secondary market activity.

USOR primarily trades via USOR/SOL pairs on Solana-based DEXs, and its official contract address is USoRyaQjch6E18nCdDvWoRgTo6osQs9MUd8JXEsspWR, which traders should verify carefully due to the presence of copycat contracts.

Who Created the U.S. Oil Reserve (USOR) Token?

Public information about the creators of USOR is extremely limited. The project is attributed only to an anonymous “USOR team”, with no disclosed founders, corporate entity, or identifiable developers. Since launch, no credible independent sources, on-chain attribution tools, or mainstream reports have identified individuals or organizations behind the token. Official communications focus heavily on themes such as U.S. energy independence, reserve transparency, and digital proof-of-reserves, but omit team biographies, governance structures, or verifiable contact details, an approach commonly seen in speculative or meme-style crypto launches.

As of January 2026, BlackRock and Trump have no verified or official connection to USOR. The rumors stem from wallet labeling and social media narrative association, where some trackers tag addresses as “BlackRock-linked” or “Trump Team,” but these labels are heuristic and community-assigned, not confirmations of ownership, endorsement, or involvement. Without official statements, regulatory filings, or institution-published wallet disclosures, these claims should be treated as speculation rather than evidence.

Key On-Chain Features of USOR

USOR’s design and market behavior reflect a technically functional Solana token with active on-chain trading, while its real-world oil reserve claims remain narrative-driven rather than independently verified.

1. Built on Solana: Leverages Solana’s high-performance network, enabling near-instant transaction finality and very low fees compared with many other blockchains.

2. Fixed supply model: A total of 1 billion USOR tokens were minted at launch, with no announced inflation or additional issuance, creating a capped supply structure.

3. Full on-chain transparency: All transfers, wallet balances, and holder distributions can be independently audited using public explorers such as Solscan.

4. Active market tracking: Third-party dashboards aggregate real-time data on price, liquidity depth, trading volume, and holder activity across the ecosystem.

5. Key limitation: Despite active trading and transparent on-chain data, all claims of oil reserve backing, federal custody, or digital proof-of-reserves rely solely on project-published information, with no independent audits, third-party attestations, or verified links to government-held oil inventories.

U.S Oil Reserve Token Gains Over 660% in Mid-Jan 2026: Main Drivers

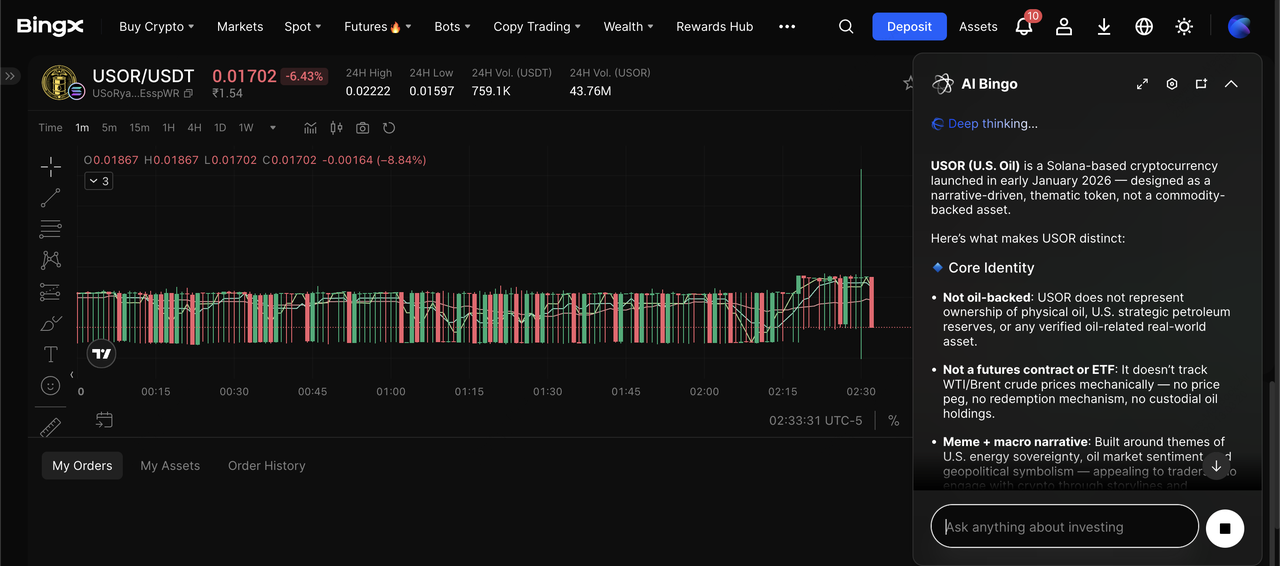

USOR token price chart on BingX

USOR’s rise is being driven first and foremost by exceptional short-term market performance, followed by a convergence of narrative catalysts. In recent trading sessions, USOR has posted triple-digit percentage gains over short timeframes, with 24-hour moves exceeding 200% and 7-day gains above 600% at peak momentum. During this surge, its market capitalization expanded into the $55 million range, while daily trading volume climbed above $27 million, levels that are unusually high for a Solana microcap and typical of tokens in a hype-driven discovery phase. This price behavior signals a momentum-led market, where attention and liquidity matter more than fundamentals. And here are the top 3 reasons behind USOR's gains:

1. Speculative momentum and turnover: USOR has recorded triple-digit percentage moves over short windows, including 24-hour gains above 200% and 7-day gains exceeding 600% at peak momentum. During these periods, 24-hour trading volume surged above $27 million, conditions that typically favor short-term trading, rapid rotation, and memecoin-style attention cycles rather than long-term accumulation.

2. Macro oil narrative tailwinds: Oil remains one of the most geopolitically sensitive commodities, with U.S. energy policy shifts, sanctions enforcement, and supply disruptions frequently dominating headlines. At the same time, crude markets continue to be shaped by OPEC+ production policy, global inventory levels, and demand expectations tied to growth and interest-rate outlooks. In this environment, tokens like USOR benefit from simplified

oil exposure narratives, even when there is no direct linkage to physical oil or futures markets.

3. Political and institutional rumor loops: Social media activity on X and Reddit has amplified engagement through unverified claims of “BlackRock-linked wallets,” Trump-related endorsements, or government alignment. While unsupported by official disclosures, these narratives have driven sharp spikes in mentions, wallet activity, and short-term inflows, accelerating visibility and liquidity regardless of factual accuracy.

Together, these factors have created a self-reinforcing hype cycle, where strong price action fuels narrative attention, which in turn attracts more speculative capital, reinforcing the view that USOR’s current trend is momentum- and sentiment-driven rather than fundamentals-based.

Where can You Buy and Trade U.S Oil Reserve (USOR) Token

If you’re looking to buy U.S. Oil Reserve (USOR), the most straightforward option is BingX ChainSpot powered by

BingX AI, which lets you access on-chain tokens like USOR directly from your BingX account without managing manual wallet connections. Alternatively, experienced users can explore on-chain Solana options via

self-custody wallets and

decentralized exchanges.

Option 1: Buy U.S Oil Reserve (USOR) Coin on BingX ChainSpot

USOR/USDT trading pair on ChainSpot powered by BingX AI insights

BingX ChainSpot is an on-chain trading feature that lets you buy and sell blockchain-native tokens like U.S Oil (USOR) directly from your BingX account, with listings sourced from on-chain liquidity while keeping assets settled into your Spot balance for seamless trading. Here's how you can buy USOR tokens on BingX ChainSpot:

1. Log in / sign up on BingX and complete Advanced Identity Verification (

Advanced KYC) for ChainSpot access.

2. Fund your Spot account with

USDT. ChainSpot ets you trade on-chain tokens using your Spot USDT balance.

3. In the BingX app or website, go to Spot → ChainSpot.

4. If it’s your first time using ChainSpot, complete the risk questionnaire and accept the risk warning to unlock trading.

5. Use the search bar, type USOR to find the

USOR/USDT trading pair, verify you’re selecting the correct token/market shown in the ChainSpot listing.

6. Enter the USDT amount you want to spend (or the USOR amount you want to receive), review the estimated execution price/fees, then confirm the swap/trade. On-chain pricing can move fast due to liquidity and slippage.

7. After execution, your purchased USOR is automatically transferred to your BingX Spot account, where you can view holdings or sell when you want.

Option 2: Buy USOR On-Chain in the Solana Ecosystem

As an alternative to centralized access, USOR can be traded directly on Solana decentralized exchanges, giving users full self-custody, on-chain transparency, and direct exposure to liquidity pool pricing.

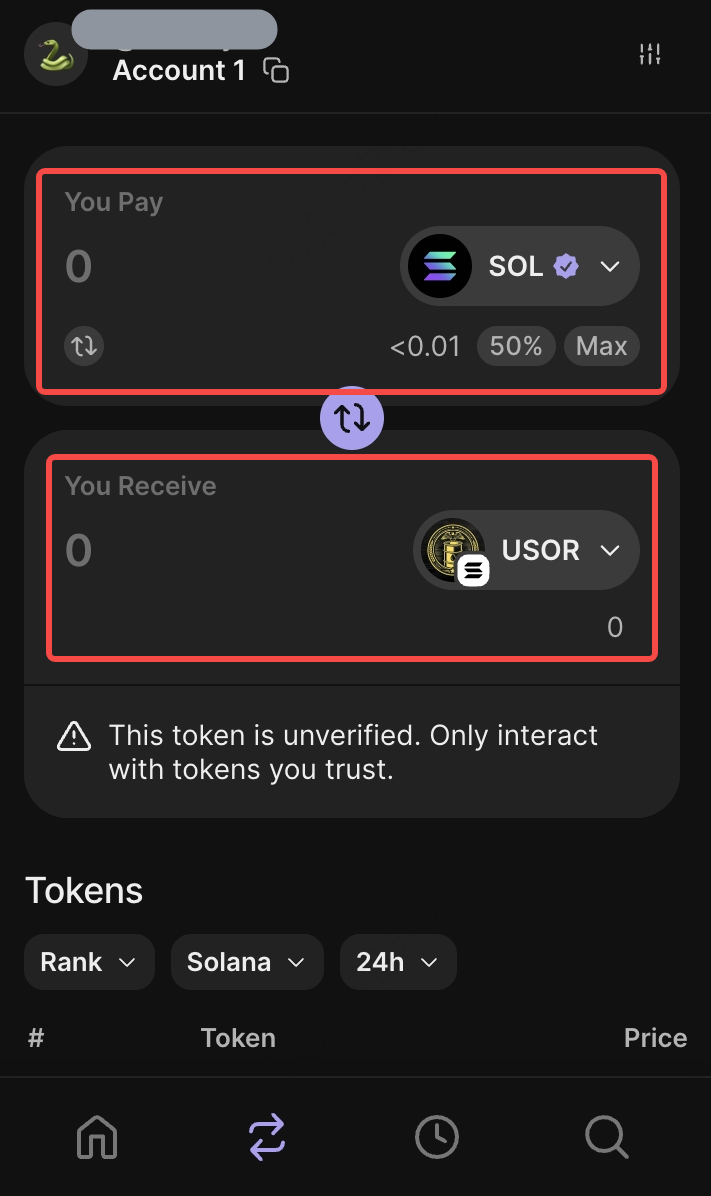

i. Phantom Wallet's Built-in Swap

1. Install and open the

Phantom Wallet, then ensure it’s funded with SOL for swaps and gas fees.

2. Go to the Swap tab, select SOL or another supported token as the input and USOR as the output.

3. Verify the USOR contract address, review the quoted price and slippage, then confirm the swap directly from your wallet using on-chain liquidity.

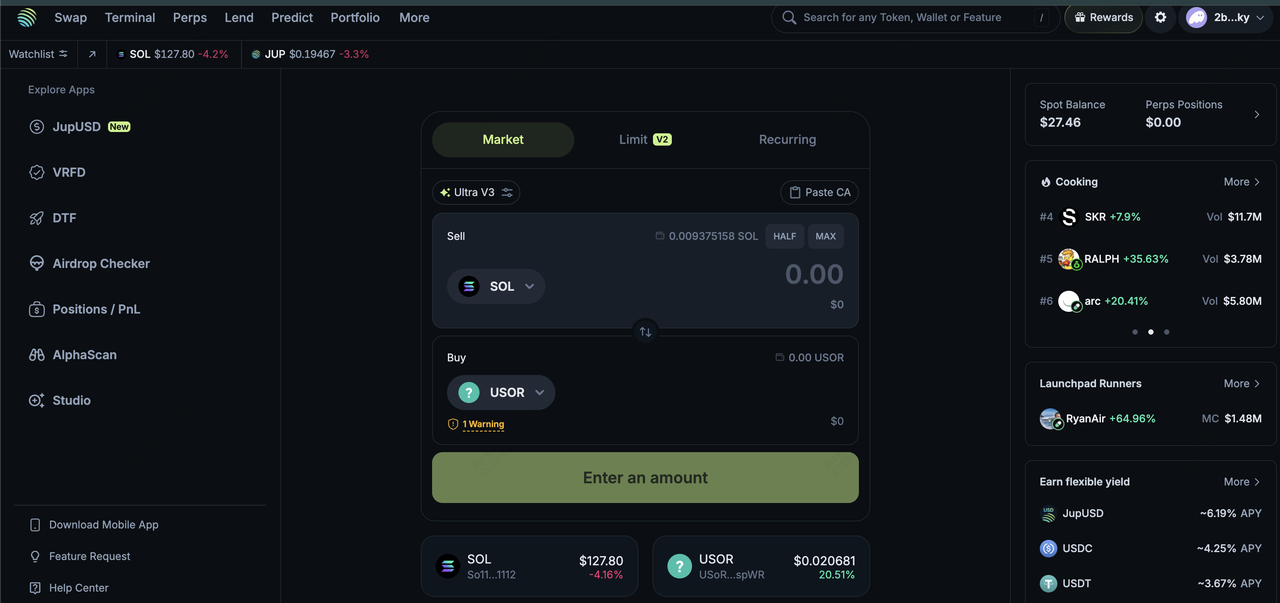

ii. Jupiter DEX Aggregator

2. Select SOL or a supported token as the input and USOR as the output, then verify the correct contract address.

3. Review the routed price, slippage, and execution details, and confirm the swap to execute across multiple Solana liquidity pools.

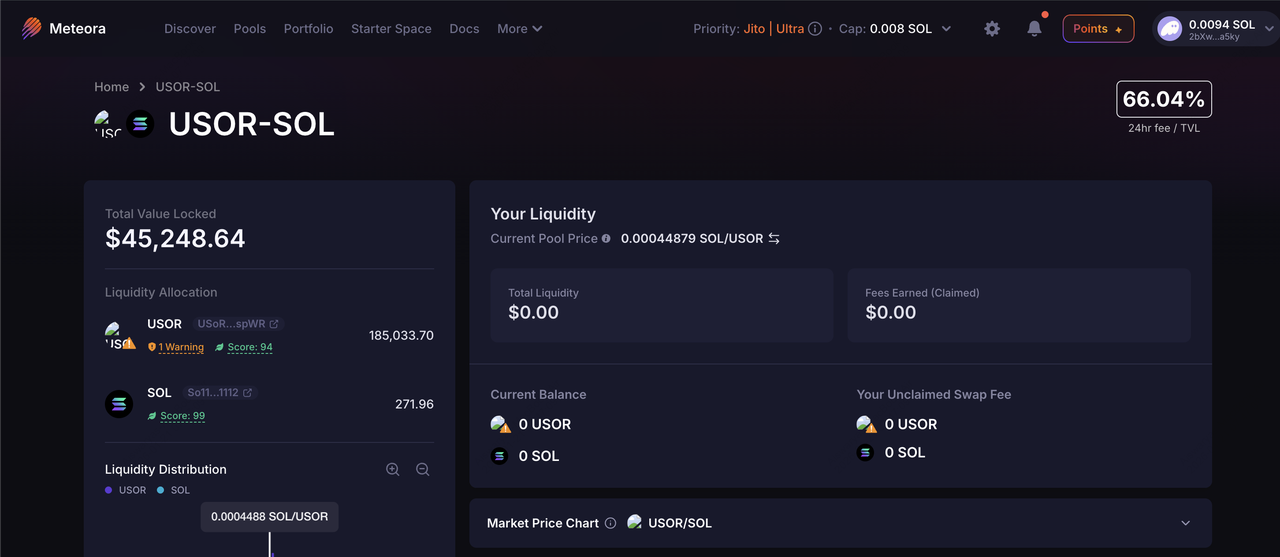

iii. Meteora DEX and Liquidity Pools

1. Open

Meteora and connect your Solana wallet like

Solflare funded with SOL for gas fees.

2. Locate the USOR/SOL liquidity pool, verify the official USOR contract address, and enter your trade size.

3. Review pool depth, expected slippage, and execution price, then confirm the swap, with pricing determined by real-time supply–demand dynamics.

Key Things to Note Before Trading USOR On-Chain

On-chain trading requires a self-custody Solana wallet, SOL for gas fees, and careful attention to liquidity depth and slippage, as USOR’s volatility and holder concentration can cause rapid price swings. Smart-contract risk and execution price impact are also higher on DEXs, making this route better suited for experienced users who actively monitor market conditions. To get started smoothly, many users choose to

buy SOL on BingX and transfer it to their Solana wallet to fund swaps and transaction fees.

Top 5 Risks to Consider Before Buying U.S Oil Reserve (USOR) Coin

Before buying U.S. Oil Reserve (USOR), it’s important to recognize that the token carries a high-risk, speculation-driven profile, where price action is heavily influenced by liquidity, sentiment, and narrative momentum rather than fundamentals.

1. Contract risk: Always verify the official contract address across multiple reputable trackers, as Solana has many lookalike tokens designed to exploit trending narratives.

2. Liquidity and slippage risk: USOR trades in relatively thin liquidity pools, meaning large orders can face significant slippage, and fast price moves can result in poor execution or difficulty exiting positions.

3. Whale and concentration risk: As a microcap asset, holder concentration matters; a small number of large wallets can materially influence price direction over short timeframes.

4. Unverified oil-backed claims: Treat any references to oil reserves, government verification, or federal custody as marketing, not fact. Legitimate commodity tokenization normally requires independent audits, custody disclosures, and enforceable redemption rights, none of which have been publicly confirmed for USOR.

5. Macro-driven volatility: Oil-related headlines and geopolitical developments can rapidly shift sentiment, leading to sharp pumps followed by equally fast reversals when attention moves elsewhere.

Is USOR Legit?

U.S. Oil Reserve (USOR) is technically legitimate as a Solana token. It exists on-chain, can be transferred, and is actively traded. However, its claims of being oil-backed or government-verified remain unproven, meaning USOR should be treated as a high-risk, narrative-driven asset rather than a regulated or fundamentals-backed investment.

Conclusion: Should You Trade USOR Token?

U.S. Oil Reserve (USOR) is technically a real, actively traded Solana token, but its positioning as a “U.S. oil reserve” or government-verified asset remains unproven, with price action largely driven by momentum, social narratives, and short-term speculation rather than fundamentals.

If you choose to trade USOR, approach it with conservative position sizing, clear entry and exit plans, and an expectation of sharp volatility, particularly in thin liquidity environments. For beginners or users who prefer a simpler setup, BingX ChainSpot offers a more convenient way to access USOR without managing on-chain wallets or DEX execution directly, while still keeping

risk management front and center.

Risk Reminder: Cryptocurrency trading involves significant risk, and tokens like USOR can experience extreme volatility driven by market sentiment, liquidity conditions, and unverified narratives. This article is for informational purposes only and does not constitute financial advice. Always do your own research, use appropriate risk management, and only trade amounts you can afford to lose.

Related Reading