JPY Coin (JPYC) is Japan’s first Financial Services Agency (FSA)–approved, yen-pegged

stablecoin, issued and redeemed at a fixed 1 JPYC = 1 Japanese yen. It is legally classified as an electronic payment instrument under Japan’s Payment Services Act and is issued by JPYC Inc., a licensed Type II Fund Transfer Service Provider.

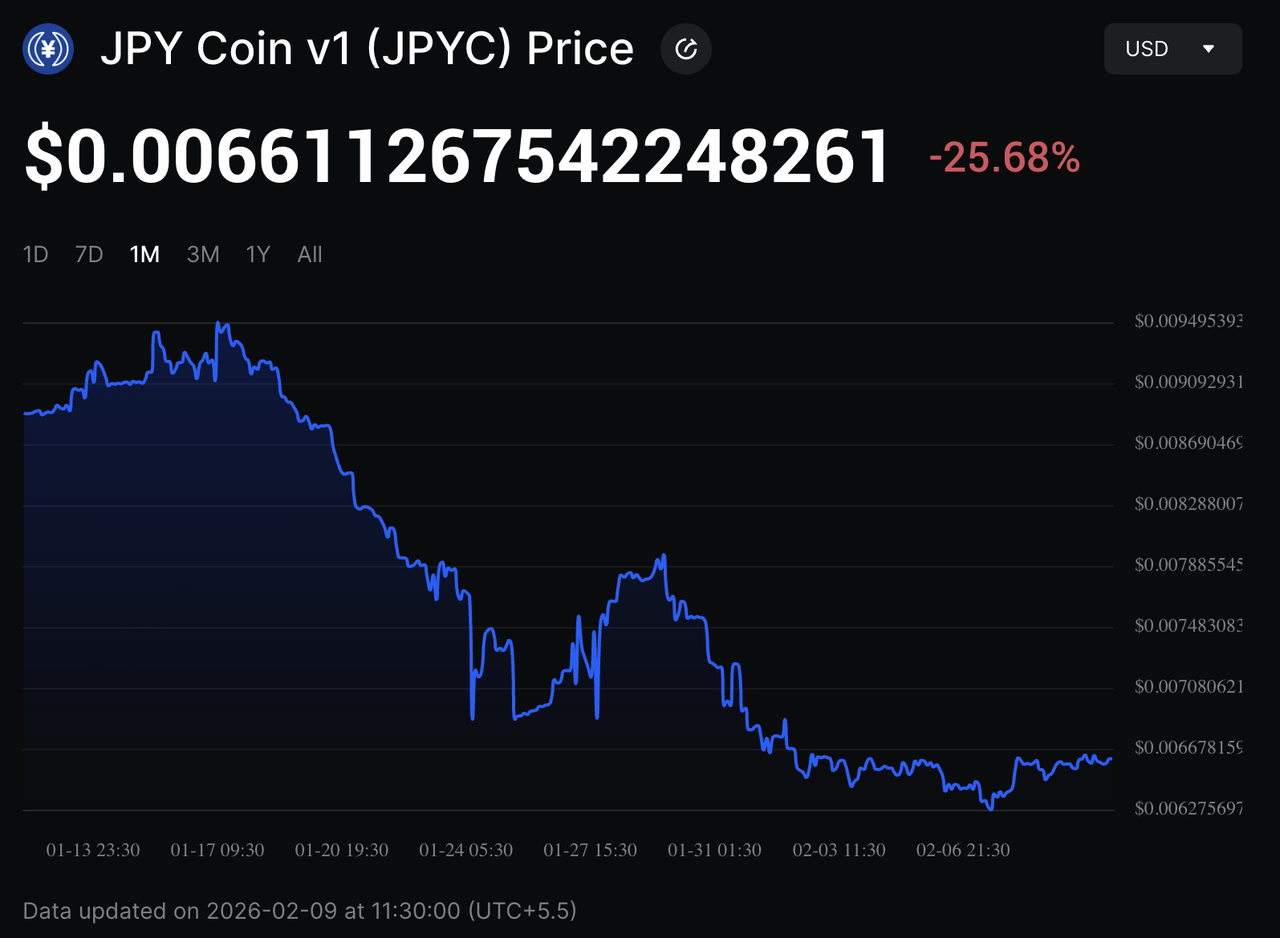

JPYC market cap crosses $14.5 million as of February 2026 | Source: Coinmarketcap

Operating on

Ethereum,

Avalanche, and

Polygon and launched in October 2025, JPYC is designed for real-world payments, cross-border remittances, corporate settlements, and Web3 use cases, allowing users to send Japanese yen globally in seconds with blockchain-level transparency and low fees. Unlike volatile cryptocurrencies, JPYC mirrors the value of the yen and can always be redeemed back to fiat through the official issuance platform JPYC EX.

With growing adoption, official regulatory approval, and new integrations across messaging, payments, and Web3 platforms, JPYC is emerging as a core building block for yen-denominated digital finance in Japan and across Asia-Pacific.

This article explores how JPYC stablecoin works, its regulatory security, and its role in modernizing cross-border payments.

What Is JPY Coin (JPYC), the Japanese Yen Stablecoin?

JPYC is a fiat-backed Japanese yen stablecoin. Each token represents exactly 1 yen and is intended to maintain that value at all times. You can hold JPYC in a supported wallet, send it globally, or use it for payments and blockchain-based services without worrying about price volatility. With a circulating supply reaching 2.63 billion tokens and a growing market cap of approximately $17.1 million as of February 2026, JPYC is bridging Japan’s traditional financial sector with the Web3 economy.

To maximize utility and accessibility, JPYC operates as a multi-chain asset integrated across several high-speed networks. It leverages Ethereum as the robust backbone for institutional and complex DeFi integrations, while utilizing Polygon and Avalanche to facilitate low-fee, high-velocity retail payments and everyday consumer transactions.

Why JPYC Stablecoin Stands Out

What makes JPYC unique is its regulatory status. JPYC is the first domestically approved yen stablecoin under Japan’s revised stablecoin framework. JPYC Inc. is registered with the Kanto Local Finance Bureau (No. 00099) and operates under the same legal category used for regulated money transfer services.

JPYC is also non-custodial by design. Users control their own wallets, while issuance and redemption occur on-chain. JPYC EX does not hold customer assets, which significantly reduces custodial and bankruptcy risk compared to traditional exchanges.

JPY Coin's 100% Reserve Backing

To ensure stability, every JPYC in circulation is backed by a combination of:

• Cash Deposits: Held in Japanese banks.

• Japanese Government Bonds (JGBs): Providing a secure, low-risk yield and sovereign backing.

These reserves are strictly segregated from company operating funds and are monitored under Japan’s rigorous Anti-Money Laundering (AML) standards, supported by a world-class partnership with Elliptic.

JPYC vs. JPYC Prepaid: What’s the Difference?

JPYC has two distinct products, which are often confused:

JPYC Redeemable Japanese Yen Stablecoin

• Fully redeemable 1:1 for Japanese yen

• Classified as a funds-transfer type electronic payment instrument

• Issued and redeemed via JPYC EX

• Designed for remittances, payments, DeFi, and corporate use

JPYC Prepaid

• A prepaid payment instrument, not a redeemable stablecoin

• Cannot be refunded into cash

• New issuance ended on June 1, 2025

• Existing tokens remain usable for payments, gift cards, and purchases

For most users and businesses today, JPYC (not JPYC Prepaid) is the primary product relevant for stablecoin use, redemption, and Web3 integration.

How JPY Coin (JPYC) Works: Issuance, Redemption, and Regulation

JPYC operates through a dedicated exchange platform called JPYC EX. This platform ensures that the supply and demand of tokens are always balanced by actual fiat reserves.

How Is JPYC Stablecoin Issued and Redeemed via JPYC EX?

JPYC is issued and redeemed through a streamlined, non-custodial process on the JPYC EX platform, designed to bridge traditional Japanese banking with the blockchain.

To Issue JPYC

• Complete account registration and KYC (My Number card required)

• Send Japanese yen via bank transfer

• JPYC is issued 1:1 and delivered directly to your wallet

How to redeem JPYC for Japanese Yen (JPY) | Source: JPYC

To Redeem JPYC

• Send JPYC back through JPYC EX

• Tokens are burned on-chain

• Yen is transferred to your registered bank account

This mechanism ensures that the circulating supply is always 100% backed by reserves, maintaining the stablecoin's 1:1 peg while allowing users to retain full control of their digital assets without relying on a centralized intermediary for storage.

Note: As of June 1, 2025, the older JPYC Prepaid model ceased new issuance. While JPYC Prepaid tokens still circulate, the new JPYC (Funds Transfer Type) is the standard for those seeking direct redemption into yen.

Legal and Regulatory Framework

JPYC operates under Japan’s revised Payment Services Act, which since June 2023 defines legal requirements for stablecoin issuers, including licence requirements, asset backing, segregation of user assets, and AML/KYC compliance.

JPYC Inc. successfully registered with the Kanto Local Finance Bureau as a Funds Transfer Service Provider, giving it legal legitimacy to issue a yen-stablecoin. Because of this compliance, JPYC is classified not as a volatile crypto-asset, but as a regulated electronic payment instrument, enhancing trust for users, businesses, and regulators alike.

In November 2025, JPYC Inc. became the first issuer to receive FSA approval for a yen-pegged stablecoin, with its compliance framework strengthened by enterprise-grade AML solutions from Elliptic, enabling real-time wallet and transaction screening. JPYC Inc. is also an active member of key Japanese industry bodies, including the Japan Payment Service Association, Japan Cryptocurrency Business Association, JVCEA, and the Blockchain Promotion Association, giving JPYC one of the deepest regulatory and industry-aligned compliance profiles among fiat-backed stablecoins globally.

What Are the Real-World Use Cases of JPYC Yen Stablecoin?

JPYC is designed for practical, high-frequency financial activity, with clear parameters that distinguish it from speculative stablecoins:

• Instant Remittances: JPYC enables global transfers starting from as little as 1 JPY, with on-chain settlement often completed in 1 second and transaction costs typically below 1 yen, depending on the network used, such as Ethereum, Polygon, or Avalanche. There are no limits on holding or peer-to-peer transfers, making it suitable for micro-payments and cross-border remittances.

• Payments and E-commerce: JPYC functions as a 1:1 digital yen, allowing users to pay for goods, services, gaming, and Web3 applications without FX conversion. Because the value is fixed to the yen, merchants and users avoid price volatility common with crypto payments.

• Corporate and B2B Settlements: Through JPYC EX, businesses can issue and redeem JPYC in sessions of ¥3,000 or more, with a daily cap of ¥1 million, enabling regulated

on-chain settlement for invoices, supplier payments, and international transfers while maintaining yen-denominated accounting. Companies like Densan System and Asteria are integrating JPYC into retail POS systems and enterprise data software to streamline supplier payments.

• Web3 and DeFi Integration: As a multi-chain token, JPYC can be used as a stable settlement asset in DeFi protocols, NFT marketplaces, and blockchain-based financial services, bridging traditional yen liquidity with on-chain infrastructure.

• LINE Messenger Integration: In January 2026, LINE NEXT signed an MOU with JPYC to explore integrating yen stablecoins into a LINE Messenger–based stablecoin wallet, highlighting JPYC’s growing role in mainstream consumer payments and rewards beyond crypto-native use cases.

Notably, JPYC also offers fraud compensation policy under certain conditions, giving additional protection to users, a rare feature among stablecoins.

How to Buy JPY Coin (JPYC)

Buy JPYC on JPYC EX

You can buy JPYC directly through JPYC EX, the official issuance platform operated by JPYC Inc. Here's how:

1. After completing account registration and identity verification using your My Number card, you simply pre-order the amount you want and send a bank transfer in Japanese Yen.

2. Once the transfer is confirmed, JPYC EX issues the equivalent amount of JPYC at the rate of 1 JPYC = 1 JPY to your registered wallet address.

3. There are no purchase or redemption fees, and users can later redeem JPYC back into yen via bank transfer at the same 1:1 rate.

Safety Tip: Always use official JPYC channels and verified contract addresses to avoid fake tokens.

What Are the Pros and Cons of JPY Coin (JPYC)?

JPYC brings the reliability of the Japanese yen onto public blockchains, offering users a safer, faster, and more practical way to move money across Web3 and the real world.

Key Benefits of JPYC

• Native yen on-chain without FX exposure: JPYC maintains a strict 1 JPYC to 1 JPY peg, allowing users and businesses to transact in Japanese yen directly on public blockchains without incurring foreign-exchange conversion costs or exposure to USD-denominated stablecoins.

• Fully regulated and FSA-approved issuance: JPYC is issued by JPYC Inc., a licensed Type II Fund Transfer Service Provider (Kanto No. 00099) under Japan’s Payment Services Act, placing it among the smallest group of nationally approved fiat-backed stablecoins worldwide.

• Non-custodial issuance and redemption model: Users retain full control of their assets in self-managed wallets. JPYC EX does not custody customer funds, materially reducing operator risk, bankruptcy exposure, and unauthorized asset access compared with custodial exchanges.

• Instant global transfers from as little as 1 yen: JPYC supports on-chain transfers starting from 1 JPY, with settlement often completed in seconds and transaction costs typically below 1 yen, depending on the blockchain network used.

• Enterprise-grade compliance and fraud mitigation: JPYC’s transaction monitoring is supported by Elliptic, enabling real-time wallet screening, AML checks, and a fraudulent transaction compensation policy, a feature rarely offered by stablecoin issuers.

• Expanding integrations across payments and Web3: JPYC is live on Ethereum, Polygon, and Avalanche, with growing integrations across payment services, Web3 platforms, and consumer applications, including planned wallet integration within LINE NEXT’s ecosystem.

Risks and Limitations of JPYC Yen Stablecoin

• Regulatory dependency on Japanese oversight: JPYC’s issuance and redemption depend on continued compliance with Japanese regulations. Future changes to the Payment Services Act or stablecoin rules could affect usage conditions or availability.

• Ecosystem scale still smaller than USD stablecoins: With a circulating supply of approximately 2.14 billion JPYC, JPYC’s liquidity and DeFi integrations remain limited compared with dominant

USD stablecoins such as

USDT or USDC.

• User-managed wallet security: Because JPYC operates under a non-custodial model, users are responsible for safeguarding private keys, wallet access, and transaction accuracy. Errors or security lapses are generally irreversible.

• Liquidity variability across chains and dApps: While JPYC is multi-chain, depth of liquidity and availability of trading pairs can vary by network and application, potentially affecting execution for larger transactions.

Overall, JPYC deliberately prioritizes stability, regulatory compliance, and real-world usability over yield generation or speculative features, which may limit its appeal for users seeking high-return DeFi strategies but strengthens its role as a trusted digital yen for payments and settlements.

Conclusion: Should You Use the JPY Stablecoin JPYC?

JPYC represents one of the clearest examples of real-world stablecoin adoption in Japan, moving beyond experimental crypto use cases into regulated, everyday financial activity. By evolving from a prepaid token model to a fully redeemable, FSA-approved funds-transfer instrument, JPYC has positioned itself as a practical digital extension of the Japanese yen, suitable for remittances, payments, and on-chain settlements rather than speculation. Its growing integrations, including collaborations with major consumer platforms such as LINE NEXT, signal a deliberate push toward mainstream usage.

For individuals and businesses seeking a yen-denominated stablecoin with strong regulatory backing, JPYC currently offers the most compliant and operationally mature option in the Japanese market. That said, JPYC is best used as a payment and settlement tool, not an investment product. Users should remain aware of risks related to wallet security, blockchain transactions, regulatory changes, and ecosystem liquidity, and should only transact through official platforms and supported wallets after fully understanding the associated terms and conditions.

Related Reading

FAQs on JPYC Yen-Pegged Stablecoin

1. Is JPYC always worth 1 Japanese yen?

Yes. JPYC is designed to maintain a fixed value of 1 JPYC = 1 JPY. Each token is issued and redeemed at par through JPYC EX, with backing in yen-denominated assets such as bank deposits and Japanese Government Bonds (JGBs), allowing users to convert JPYC back into real yen.

2. Is JPYC stablecoin regulated and legally approved in Japan?

Yes. JPYC is issued by JPYC Inc., a licensed Type II Funds Transfer Service Provider under Japan’s Payment Services Act. This places JPYC under direct oversight by Japan’s Financial Services Agency (FSA), with requirements covering KYC, AML, reserve management, and consumer protection.

3. How is JPYC different from JPYC Prepaid?

JPYC is a redeemable yen stablecoin that can be converted back into Japanese yen via bank transfer. JPYC Prepaid, whose new issuance ended in June 2025, is a prepaid payment instrument that cannot be refunded into cash but can still be used for purchases and payments.

4. What can I use JPY Coin (JPYC) for?

JPYC can be used for low-cost remittances, online and offline payments, business and B2B settlements, and as a stable asset in Web3 and DeFi applications on Ethereum, Polygon, and Avalanche. Some supported services also enable gasless transactions, allowing payments without holding native network tokens.

5. What is the minimum amount to issue or redeem JPYC stablecoins?

Issuance and redemption through JPYC EX require a minimum of 3,000 JPY per transaction, with a daily cap of up to 1 million JPY. There is no limit on how much JPYC you can hold or send once issued.

6. How do I convert JPYC back into Japanese yen?

To redeem JPYC, users send their tokens via JPYC EX, where the tokens are burned on-chain. The equivalent amount of Japanese yen is then transferred to the user’s registered bank account, typically reflecting quickly depending on the financial institution.

7. Which wallets support JPYC yen-based stablecoin?

JPYC recommends HashPort Wallet for compatibility and ease of use. JPYC also works with other wallets that support WalletConnect, custom tokens, and the Ethereum, Polygon, or Avalanche networks, such as MetaMask.

8. Are there any fees for issuing or redeeming JPYC?

JPYC EX does not charge issuance or redemption fees. However, users may still incur bank transfer fees or blockchain gas fees, depending on their bank and the network used.