As of February 2026, Elon Musk has solidified his position as the wealthiest individual in human history, with a fortune that has decoupled from traditional market correlations. Unlike other tech billionaires whose wealth is tied to a single public entity, Musk’s net worth is a composite of dominant global infrastructure, aerospace dominance, and the "Orbital AI" frontier. According to the Bloomberg Billionaires Index, Musk’s net worth reached a consensus benchmark of $844 billion on February 9, 2026, marking a nearly 30-fold increase since the start of the decade.

Who Is Elon Musk?

Elon Musk is the founder, CEO, and lead engineer of a vertically integrated ecosystem of companies often referred to as the "Muskonomy." Born in 1971 in Pretoria, South Africa, Musk demonstrated an early aptitude for computing, selling his first software code at age 12. After moving to the U.S. and attending the University of Pennsylvania, he dropped out of a Stanford PhD program to pursue ventures in the burgeoning internet sector.

Before his current dominance in space and AI, Musk co-founded Zip2, an online financial services company that merged with Confinity, which became PayPal, and X.com. The $1.5 billion acquisition of PayPal by eBay in 2002 provided the seed capital for his most ambitious projects: SpaceX and

Tesla. Today, his influence extends from the depths of underground transit via The Boring Company to the literal stars, making him a central figure in global defense, telecommunications, and cognitive computing.

How Did Elon Musk Build His Wealth in 2026?

Elon Musk’s wealth in 2026 is the result of a "burn the ships" strategy, reinvesting nearly all personal capital into high-risk, capital-intensive ventures that have since become critical infrastructure. According to analysis by Forbes and CNBC, his wealth trajectory shifted from automotive-led growth to a diversified "Muskonomy" centered on aerospace and artificial intelligence.

The $1.25 Trillion SpaceX-xAI Merger

The primary engine of his 2026 wealth explosion was the February 2, 2026, merger between SpaceX and xAI Corp. This landmark transaction, valued at $1.25 trillion, fundamentally reordered his empire by centralizing satellite internet (Starlink),

generative AI (Grok), and rocket launch services under a single corporate umbrella.

As reported by The Guardian and Reuters, this merger allowed Musk to leverage SpaceX’s $8 billion annual EBITDA to fund xAI’s "insatiable need for capital." While Tesla served as the bedrock of his fortune for years, the Bloomberg Billionaires Index notes that SpaceX now accounts for nearly two-thirds of Musk's total net worth, effectively becoming his most valuable asset.

Legal Restoration of Musk's 2018 Tesla Pay Package

In addition to corporate mergers, a pivotal legal victory in late 2025 provided the necessary "equity floor" for his current valuation. On December 19, 2025, the Delaware Supreme Court reversed a previous lower court ruling that had voided Musk's 2018 Tesla compensation package.

This decision, highlighted by Forbes as a key catalyst for his jump past the $700 billion mark, restored approximately $139 billion in stock option value to his balance sheet. This restoration, combined with the new "Mars Shot" package approved by Texas-domiciled shareholders in November 2025, ensures that Musk’s wealth remains tightly linked to the long-term performance of the Tesla ecosystem.

How Much Is Elon Musk's Net Worth in 2026: Key Estimates

As of February 9, 2026, major financial indices report a historically wide gap between Musk and his closest peers.

| Rank |

Name |

Primary Source of Wealth |

Estimated Net Worth (USD) |

Wealth Gap with Musk |

| 1 |

Elon Musk |

SpaceX, Tesla, xAI, X |

$844.0 B |

-- |

| 2 |

Larry Page |

Alphabet (Google) |

$281.1 B |

$570.9 B |

| 3 |

Sergey Brin |

Alphabet (Google) |

$259.3 B |

$592.7 B |

| 4 |

Jeff Bezos |

Amazon |

$253.2 B |

$598.8 B |

Why Do Musk's Net Worth Estimates Vary?

1. Private Equity Discounts: Bloomberg applies a more conservative $690 billion estimate, factoring in "liquidity haircuts" for his 43% stake in the private SpaceX-xAI entity.

2. Option Valuation: Forbes-style trackers reflect the most recent tender offers and the full value of the restored 2018 Tesla options ($139 billion) without aggressive discounting.

3. The "Musk Premium": Analysts often struggle to value the synergy between Grok AI and the Starlink network, leading to discrepancies in projected market caps.

How Has Elon Musk’s Net Worth Changed Over Time?

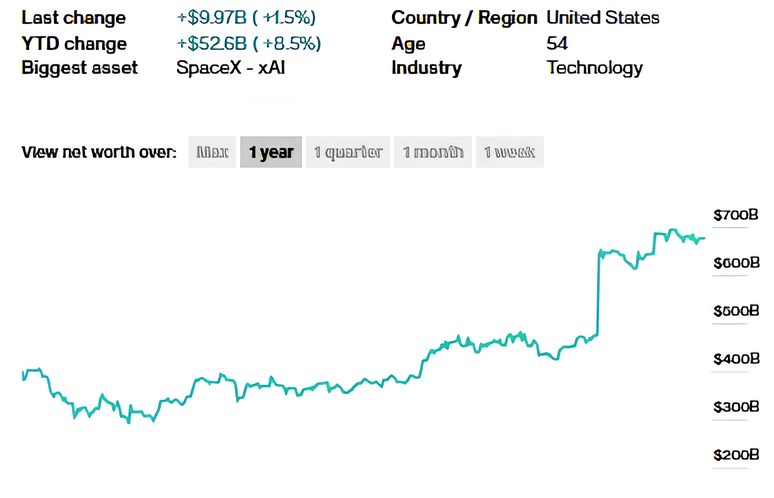

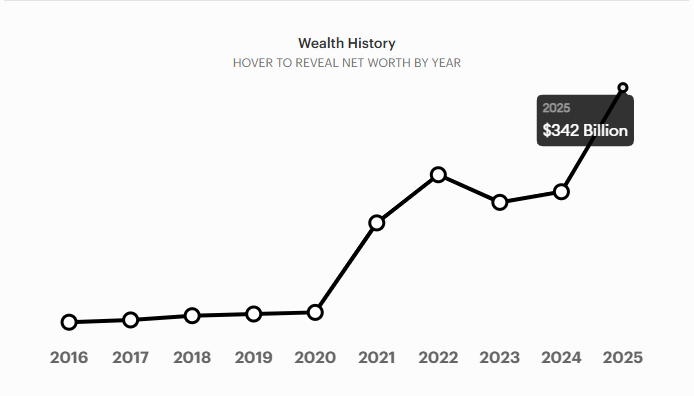

Elon Musk's wealth trajectory is characterized by exponential surges followed by periods of intense regulatory and market scrutiny.

• 2020–2021: Driven by Tesla’s meteoric rise and entry into the S&P 500, Musk’s wealth jumped from $27 billion to over $300 billion, briefly making him the first person to cross that threshold.

• 2022–2023: A "correction" phase saw his net worth dip during the acquisition of X (formerly Twitter) and a broader tech sell-off. At one point, he set a Guinness World Record for the largest loss of personal fortune.

• 2024–2025: The "AI Pivot" began. While Tesla's EV sales slowed, the growth of Starlink and the successful funding rounds for xAI ($250 billion valuation) set the stage for a rebound.

• 2026: Following the SpaceX-xAI merger and the rollout of Optimus Gen 3 robots, Musk’s net worth surged from $700 billion in December 2025 to $844 billion today.

What Drives Elon Musk’s Net Worth in 2026: 4 Key Factors

1. The SpaceX-xAI Conglomerate ($542B): Musk’s 43% stake in the merged entity is his "crown jewel." The vision of "Orbital AI"—placing data centers in space to draw continuous solar power—has incentivized private investors to value the firm at $1.25 trillion.

2. Tesla’s Robotics Pivot: Tesla has transitioned from an automaker to a robotics firm. The mass production of the Optimus Gen 3 humanoid robot and the pilot of the steering-wheel-less Cybercab in April 2026 are the new pillars of Tesla’s $1.5 trillion market cap.

3. Restored Compensation Tranches: The restoration of the 2018 pay package and the approval of the 2025 "Mars Shot" plan mean Musk’s ownership in Tesla could rise to 28.8% if the company reaches a $8.5 trillion valuation.

4. X (Social Media) & X Money: After a period of instability, X has stabilized as a data hub for xAI. The launch of "X Money" in early 2026—a peer-to-peer payment system—aims to capture global fund flows, further integrating his ecosystem.

Beyond Tech: Musk's Frontier Ventures

While SpaceX and Tesla dominate the headlines, two auxiliary ventures provide long-term "moonshot" upside to his net worth.

• Neuralink: Valued at approximately $18 billion in secondary markets as of early 2026, the company has expanded human trials to 21 participants. Clinical success in "Blindsight" technology has positioned it as a leader in neuroprosthetics.

• The Boring Company: Maintaining a $7 billion valuation, the firm recently signed the "Dubai Loop" contract, its first international pilot for high-speed underground transit using Tesla-based pods.

How Does Elon Musk's Wealth Compare to Other Tech Leaders?

By 2026, Musk is no longer just "the richest man"; he is an economic outlier.

• vs. Jeff Bezos: According to the Bloomberg Billionaires Index, Musk’s lead over the Amazon founder has expanded to nearly $600 billion. While Bezos continues to focus on Blue Origin’s "gradatim ferociter" (step by step, ferociously) philosophy, SpaceX’s aggressive Starship launch cadence has allowed it to capture 80% of the commercial launch market, leaving Bezos’s space venture to play catch-up.

• vs. Jensen Huang (NVIDIA): While Huang has seen historic gains from the terrestrial AI hardware boom, Musk’s wealth is viewed by analysts at Morgan Stanley as more vertically integrated. By controlling the chips (Tesla), the satellites (Starlink), and the physical interface (Optimus), Musk’s equity value has scaled beyond NVIDIA’s hardware-centric valuation.

• vs. Changpeng Zhao (CZ): As of early 2026, CZ remains the wealthiest individual in "pure crypto" with an estimated $88 billion. However, while CZ’s fortune is tied to the private valuation of Binance and its dominant trading volumes, Musk’s wealth is rooted in physical global infrastructure. This allows Musk's assets to command higher valuation multiples, as they are viewed as "hard assets" compared to exchange-based equity.

• vs. Brian Armstrong: Brian Armstrong serves as the primary proxy for U.S. institutional crypto adoption with a net worth of $9.35 billion. While Armstrong’s wealth is highly transparent due to Coinbase (COIN) being publicly traded, it remains extremely sensitive to crypto market cycles and regulatory shifts. In contrast, Musk’s "Muskonomy" is now so large that his daily net worth fluctuations often exceed Armstrong's entire fortune.

• vs. Satoshi Nakamoto: The Bitcoin creator’s estimated 1.1 million BTC is valued at approximately $77 billion in early 2026. While Satoshi represents the pinnacle of decentralized wealth, Musk’s centralized "Muskonomy" is now more than 11 times larger than the value of the most famous wallet in crypto history.

• vs. Vitalik Buterin: Compared to the Ethereum co-founder’s estimated $1.1 billion fortune, Musk’s daily net worth fluctuations (often +/- $5 billion) frequently exceed Buterin’s entire net worth.

What Are the Key Risks Affecting Elon Musk’s Net Worth?

• Regulatory Scrutiny: SpaceX’s 80% share of U.S. space launches has led to calls for antitrust investigations.

• xAI Cash Burn: The AI division consumes roughly $1 billion per month. If the upcoming June 2026 IPO fails to meet its $1.5 trillion target, his net worth could see a significant downward correction.

• Tesla Demand: A continued decline in traditional EV sales could pressure Tesla’s stock if the "Robotics and AI" narrative doesn't materialize in quarterly earnings.

Conclusion

Elon Musk’s net worth in 2026 is a barometer for the "Orbital Intelligence" era. His transition from a car manufacturer to the architect of a space-based AI economy has pushed his fortune to the brink of $1 trillion. For investors and enthusiasts, tracking the "Muskonomy" is no longer about following a single stock—it’s about monitoring the convergence of robotics, aerospace, and artificial intelligence.

Related Reading

FAQs on Elon Musk's Net Worth

1. What is Elon Musk’s net worth in 2026?

As of February 9, 2026, he is worth approximately $844 billion.

2. Will Elon Musk become a trillionaire?

If the SpaceX-xAI IPO in June 2026 hits its $1.6 trillion target, Musk is projected to become the world’s first trillionaire by late 2026.

3. Does Musk still own X (Twitter)?

Yes, X is now a subsidiary within the merged SpaceX-xAI structure.

4. How many Tesla shares does Musk own?

Following the restoration of his 2018 package, he owns approximately 13–15% of Tesla, with potential to reach 28% through the 2025 "Mars Shot" tranches.