In 2026, selecting a truly safe crypto exchange has become a top priority for users worldwide as regulatory enforcement tightens, institutional capital flows increase, and exchange hacks, though rarer, still occur with losses reaching hundreds of millions in isolated incidents.

Safety today goes well beyond basic

2FA (two-factor authentication), encompassing verifiable proof of reserves published monthly or in real time, segregated client assets, and cold storage ratios exceeding 95%. Leading platforms also maintain multi-billion-dollar protection funds and offer advanced security features such as IP whitelisting, biometric login, and

anti-phishing codes. In addition, strong oversight from regulators like NYDFS (US), MiCA (EU), MAS (Singapore), and the FCA (UK) adds an extra layer of institutional credibility and protection.

This article ranks the ten safest crypto exchanges based on these comprehensive criteria and offers a practical framework to help every user identify the platform that best aligns with their geographic location, trading volume, asset preferences and personal risk tolerance.

What Makes a Crypto Exchange Safe in 2026?

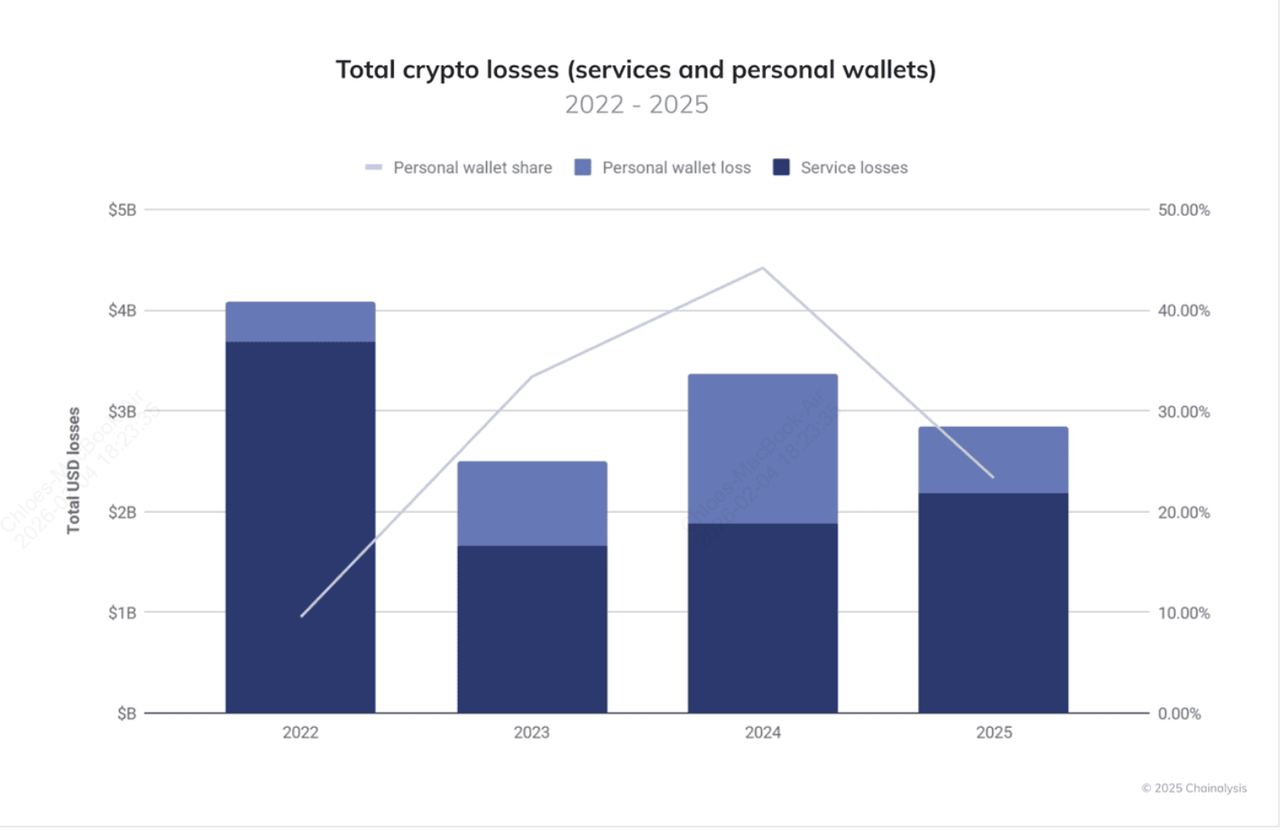

Source: Chainalysis

Security is reinforced by keeping at least 95% of client assets in cold storage, combined with segregated customer funds, regular third-party audits, such as SOC 2 Type II or ISO 27001, and compliance with major regulatory regimes like NYDFS (US), MiCA (EU), and MAS (Singapore). At the user level, mandatory hardware or app-based 2FA, anti-phishing codes, withdrawal address controls, and IP or device whitelisting protect accounts, while deep liquidity across major trading pairs helps ensure fair execution during volatile markets.

Today, exchanges such as BingX, Coinbase, Kraken, Gemini, and OKX consistently rank among the safest by meeting these benchmarks through transparent reserve reporting, strong capital protection, and global regulatory compliance. As regulation advances across the US, EU, UK, Singapore, Canada, and Australia, proof of reserves, asset segregation, and independent audits have become the baseline expectations for trust in the crypto industry.

The Safest Crypto Exchanges in 2026: Top 10 Ranked by Security

As regulation tightens and user expectations rise, the safest crypto exchanges in 2026 are those that combine verifiable proof of reserves, institutional-grade security, and global regulatory compliance to protect user assets at scale.

BingX ranks among the

safest exchanges in 2026 thanks to its monthly Merkle-tree proof-of-reserves audits, a 150 million dollar Shield Fund plus additional insurance coverage, 98% or higher cold-storage ratio, ISO 27001 certification and mandatory two-factor authentication combined with anti-phishing codes and IP whitelisting.

BingX has established a dedicated

Shield Fund currently valued at $125.55 million, composed of 1,000 BTC, 4,000 ETH, and 40,000,000 USDT (valuation based on live market prices), designed to provide an additional layer of real time protection for every user on the platform.

Created to reinforce trust and confidence beyond regular Proof of Reserves audits, the fund serves as a tangible safety net that automatically covers all BingX users with no registration or application required, safeguarding assets against unforeseen risks whether you are actively trading, staking, or simply holding cryptocurrencies. Live and active 24/7, the BingX Shield Fund underscores the platform’s commitment to reliability and transparency by backing user funds with substantial on chain reserves that stand ready to absorb potential losses from extraordinary events, ensuring peace of mind for the entire community regardless of account activity or market conditions.

Furthermore,

BingX security controls like anti-phishing code, withdrawal whitelist, emergency account lock help keep your funds safe, so you can trade with confidence.

2. Coinbase

Coinbase holds a very strong position with quarterly third-party proof-of-reserves

audits, up to 250 million dollars of per-user insurance through Lloyd's of London, 98% cold storage, SOC 2 Type II certification and full NYDFS BitLicense compliance, making it a preferred choice for US-based users. In April 2021, Coinbase became the largest public crypto company. That means we operate with more financial transparency: the company publishes financial statements quarterly and they're audited annually by an independent third-party as required by law.

3. Kraken

Kraken continues to excel in safety through monthly transparent proof-of-reserves reports, a protection fund exceeding 1 billion dollars, 95% plus cold storage, SOC 2 Type II certification and licenses aligned with European MiCA rules alongside bank-grade security protocols.

4. Gemini

Gemini maintains an exceptional safety profile with monthly proof-of-reserves audits, 250 million dollars per-user insurance coverage via the Aon syndicate, 100% cold storage for custody clients, full NYDFS BitLicense and institutional-grade compliance standards. Gemini has built a leading security program focused on developing innovative security solutions to help protect and secure our customers and their assets. The team has also invested considerable resources to remain transparent about our security posture, through third party security assessments, including their SOC2 Type 2, ISO 27001, and annual penetration testing.

5. OKX

OKX ranks highly with its real-time proof-of-reserves dashboard, monthly third-party

audits, a protection fund surpassing 700 million dollars, 95% cold storage, ISO 27001 certification and multiple global regulatory licenses.

6. Crypto.com

Crypto.com provides strong protection through monthly proof-of-reserves reports, SOC 2 Type II certification, 750 million dollars in insurance coverage, 100% reserve backing and regulatory approvals across the United States, European Union and Singapore alongside biometric login and Ledger Vault integration.

7. Binance

Binance offers robust safety with real-time proof of reserves plus monthly Merkle-tree

audits, a SAFU fund exceeding 1 billion dollars, 90% plus cold storage and licenses in numerous jurisdictions supported by device binding and anti-phishing protections.

8. Bybit

Bybit delivers solid security via monthly proof-of-reserves audits, a protection fund of over 1 billion dollars, 95% cold storage, ISO 27001 certification and advanced account safeguards including address management. Bybit is committed to always putting our users first with a security first approach, combining robust triple layer asset protection including offline cold wallets, advanced multi signature, Trusted Execution Environments (TEE), and Threshold Signature Schemes (TSS), alongside regular public Proof of Reserves audits.

Privacy is embedded by design across all products through transparent data practices, end to end encryption for data at rest and in transit, strict access controls, desensitized query interfaces, real time behavioral monitoring with immediate enhanced authentication on suspicious activity, and ongoing security enhancements via secure development lifecycles, rigorous testing, and active bug bounty programs.

9. Bitstamp

Bitstamp upholds long-standing safety with NYDFS BitLicense, full proof-of-reserves transparency, institutional custody arrangements and consistent high cold-storage percentages across its history of regulatory compliance.

10. KuCoin

KuCoin rounds out the top ten with monthly proof-of-reserves reports, a 300 million dollar plus insurance fund, 90% plus cold storage, ISO 27001 certification and a rapidly improving compliance posture that supports competitive liquidity on a wide range of assets.

Security & Compliance Metrics of the Top 10 Safest Exchanges in 2026

The comparison table highlights leading platforms like Gemini, Kraken, Coinbase, and Bitstamp, which consistently rank highest due to features such as cold storage for the majority of assets, regular third-party audits (e.x. SOC 2 Type 2), Proof of Reserves transparency, insurance coverage or protection funds, and strong regulatory compliance in jurisdictions like the US (NYDFS BitLicense, SEC oversight). Exchanges such as Bitget, Bybit, and Binance also appear in various 2026 rankings for robust security infrastructure, including multi-signature wallets, zero major historical breaches in recent years for some, and high compliance scores, though global regulatory challenges can vary by region and impact overall trust metrics:

| Exchange |

PoR Frequency |

Insurance / Protection Fund |

Cold Storage % |

Key Regulatory Licenses |

Advanced Security Features |

| BingX |

Monthly Merkle tree |

150 million dollar Shield Fund plus insurance |

98% plus |

Multiple jurisdictions |

2FA anti phishing IP whitelist AI monitoring |

| Coinbase |

Quarterly |

Up to 250 million dollars per user |

98% |

NYDFS BitLicense EU MiCA |

YubiKey address whitelisting biometrics |

| Kraken |

Monthly |

1 billion dollars plus coverage |

95% plus |

EU MiCA global registrations |

SOC 2 Type II bank grade security |

| Gemini |

Monthly |

250 million dollars per user Aon |

100% custody |

NYDFS BitLicense |

SOC 2 full reserve audits |

| OKX |

Real time plus monthly |

700 million dollars plus Protection Fund |

95% |

Multiple global licenses |

Real time PoR dashboard 2FA whitelist |

| Crypto.com |

Monthly |

750 million dollars coverage |

100% reserves |

US EU Singapore |

Biometrics Ledger Vault integration |

| Binance |

Real time plus monthly |

1 billion dollars plus SAFU Fund |

90% plus |

Global licenses |

Device binding anti phishing code |

| Bybit |

Monthly |

1 billion dollars plus Protection Fund |

95% |

Growing compliance |

Advanced 2FA address management |

| Bitstamp |

Regular audits |

Institutional coverage |

High |

NYDFS BitLicense EU |

Long compliance history |

| KuCoin |

Monthly |

300 million dollars plus insurance |

90% plus |

Improving compliance |

2FA security suite |

How to Choose the Safest Crypto Exchange for Your Needs: Top 7 Tips

Before trusting any crypto exchange with your funds, you should evaluate a unified set of security, transparency, and usability standards designed to protect against hacks, insolvency, and unfair trading conditions, while also matching your personal trading needs.

1. Proof of reserves: Confirm the exchange publishes monthly or real-time proof-of-reserves audits with Merkle-tree verification to ensure full 1:1 backing of user deposits.

2. Protection funds or insurance: Look for a dedicated protection fund or third-party insurance, ideally $100 million or more, to cover extreme security incidents or operational failures.

3. Cold storage and fund segregation: Prioritize platforms that keep at least 95% of client assets in cold storage and fully segregate user funds from operational accounts.

4. Regulatory oversight and audits: Verify licenses from recognized authorities such as NYDFS (US), MiCA (EU), or MAS (Singapore), along with independent audits like SOC 2 Type II or ISO 27001.

5. Account-level security: Mandatory 2FA (hardware key or authenticator app), anti-phishing codes, IP and device whitelisting, withdrawal address controls, and real-time session monitoring are essential protections.

6. Liquidity depth: Strong liquidity across your preferred trading pairs reduces the risk of price manipulation and poor execution during volatile markets.

7. Fit for your use case: Beginners often prefer Coinbase or Kraken for simplicity and compliance, active traders may choose BingX or OKX for advanced tools and liquidity, while institutions and high-net-worth users often select Gemini or Bitstamp for custody-grade security and long-standing regulatory credibility.

Why BingX Stands Out as One of the Safest Exchanges in 2026

BingX has established itself as one of the safest crypto exchanges in 2026 through a comprehensive security framework that includes monthly Merkle-tree proof-of-reserves audits, a dedicated 150 million dollar Shield Fund supplemented by additional insurance coverage, 98% or higher cold storage of client assets, ISO 27001 certification and mandatory account protections such as two-factor authentication, anti-phishing codes, IP whitelisting and AI-driven threat monitoring.

The platform publishes transparent reserve reports regularly, maintains segregated client funds and has achieved strong regulatory progress across multiple jurisdictions, making it highly trustworthy for both retail and professional users. Combined with deep liquidity on major trading pairs and proactive risk-management tools, BingX delivers institutional-grade safety in a user-friendly package that continues to gain recognition among security-conscious traders worldwide.

Conclusion

The

safest crypto exchanges are defined by verifiable proof of reserves, substantial protection funds, high cold-storage ratios, advanced account security measures and meaningful regulatory compliance that collectively minimize the risk of loss from hacks, insolvency or operational issues.

BingX, Coinbase, Kraken, Gemini, and OKX lead the industry by consistently meeting or exceeding these standards, while platforms like Crypto.com, Binance, Bybit, Bitstamp, and KuCoin also provide strong safety profiles tailored to different user needs.

The right exchange for you depends on your jurisdiction, trading habits, preferred assets and tolerance for risk, so always validate PoR reports, insurance details, regulatory status and security settings before depositing significant funds and consider diversifying across multiple trusted platforms to further protect your portfolio in this evolving digital asset landscape.

Related Reading