In the dynamic cryptocurrency landscape of 2026, spot trading remains the core method for investors to buy and sell digital assets at current market prices with immediate settlement, and the top 10 spot trading crypto exchanges leading the space this year are BingX, Crypto.com, Binance, Kraken, Coinbase, MEXC, Bybit, OKX, Gemini, and Pionex, each distinguished by unique strengths ranging from

AI-powered tools and ultra-low fees to institutional-grade security and extensive

altcoin selection.

Spot trading volumes showed impressive resilience in 2025, reaching a cumulative total of $18.6 trillion across centralized and decentralized exchanges, which marked a healthy 9% year-over-year increase.

Futures contracts added even stronger momentum with $61.7 trillion in volume, a 29% rise that brought combined exchange activity close to $80 trillion.

As 2026 advances, daily spot volumes on leading platforms regularly surpass $100 billion, and full-year projections point to spot trading activity climbing between $20 trillion and $25 trillion, supported by

AI analytics, tokenized

real-world assets (RWA), and improving regulatory clarity in major markets. Security continues to be a top priority, with premier exchanges offering verified

proof-of-reserves, multi-signature custody, and proactive threat monitoring. Fee structures remain highly competitive, typically between zero maker fees and 0.1% base rates, while innovations like copy trading, automated bots, and recurring buys make spot trading more accessible to users of every experience level.

What Is Spot Trading in Crypto?

Spot trading in cryptocurrency means buying or selling digital assets directly at the current market price, with the transaction completing instantly and ownership transferring to the buyer without delay. Unlike f

utures, options, or margin trading, spot trades do not involve leverage, expiration dates, borrowing, or liquidation risks, which makes this method straightforward and appealing for both beginners and long-term investors.

Participants place orders on an exchange's order book, matching buyers and sellers through market orders for immediate fills at the best available price or limit orders that execute only at a specified price or better. The primary advantage lies in true asset ownership: once purchased, cryptocurrency belongs fully to the trader and can be held in a personal

wallet, staked, or transferred freely.

Platforms support this process with real-time price charts, depth-of-market views, mobile trading apps, and fiat gateways that allow users to enter the market using credit cards, bank transfers, or stablecoins. In 2025, spot trading volumes expanded steadily to $18.6 trillion, highlighting its essential position in establishing fair price discovery, providing deep liquidity, and serving as the foundation for the broader crypto economy amid continued retail and institutional participation.

Crypto Spot Trading Volume Crosses $18.6 Trillion in 2025: Key Market Statistics

The spot cryptocurrency market delivered solid growth in 2025, posting a total trading volume of $18.6 trillion across all centralized and decentralized platforms, representing a 9% increase compared to 2024. This performance was complemented by the derivatives side, where

perpetual futures contracts jumped 29% year-over-year to $61.7 trillion, pushing the combined volume of centralized and decentralized exchange activity near the $80 trillion mark.

Institutional contributions were substantial, including billions in net spot demand from

Bitcoin ETFs and structured investment vehicles. Entering 2026, early monthly figures suggest spot volumes are on pace to exceed $1.5 trillion regularly, with daily averages frequently topping $100 billion on major exchanges. Market observers forecast annual spot trading to reach between $20 trillion and $25 trillion in 2026, propelled by continued

AI integration, growth in tokenized assets, and progressive regulatory developments across Europe, Asia, and North America.

What Are the Top Spot Trading Crypto Exchanges in 2026?

Exchanges secure their place among the top 10 in 2026 by combining high liquidity, attractive fee schedules, broad asset coverage, proven security protocols, and forward-looking features such as

AI assistance, automated strategies, and user-friendly interfaces.

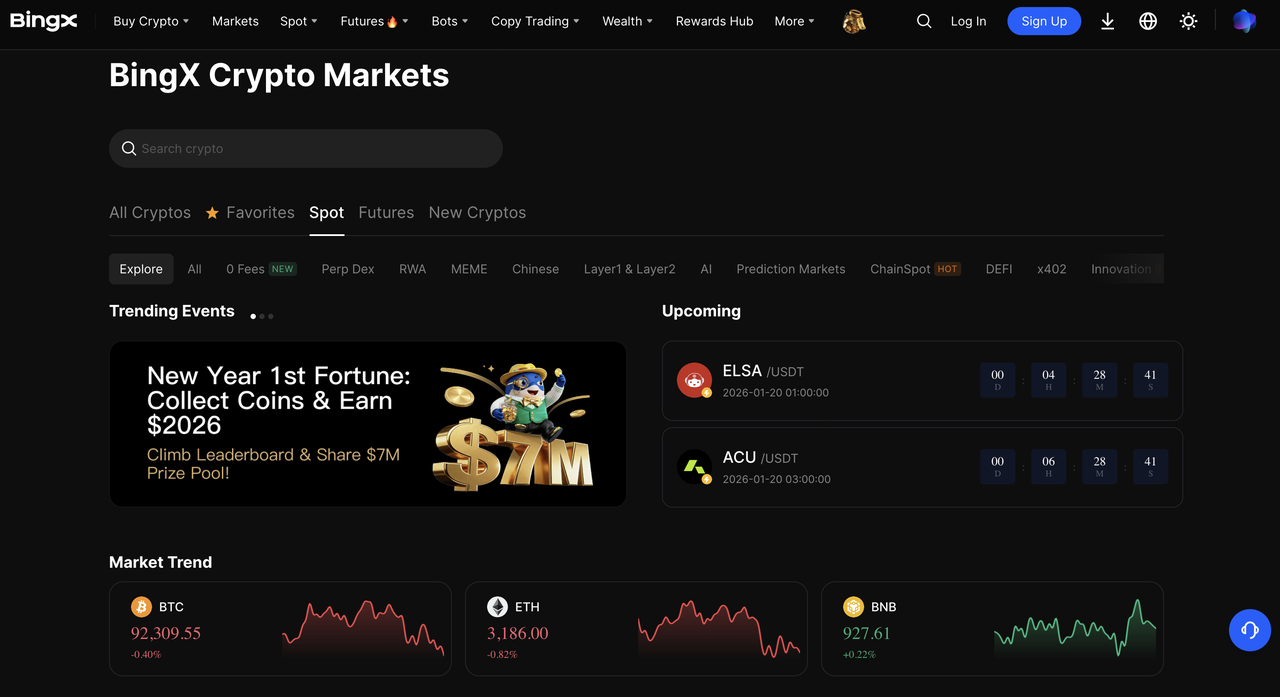

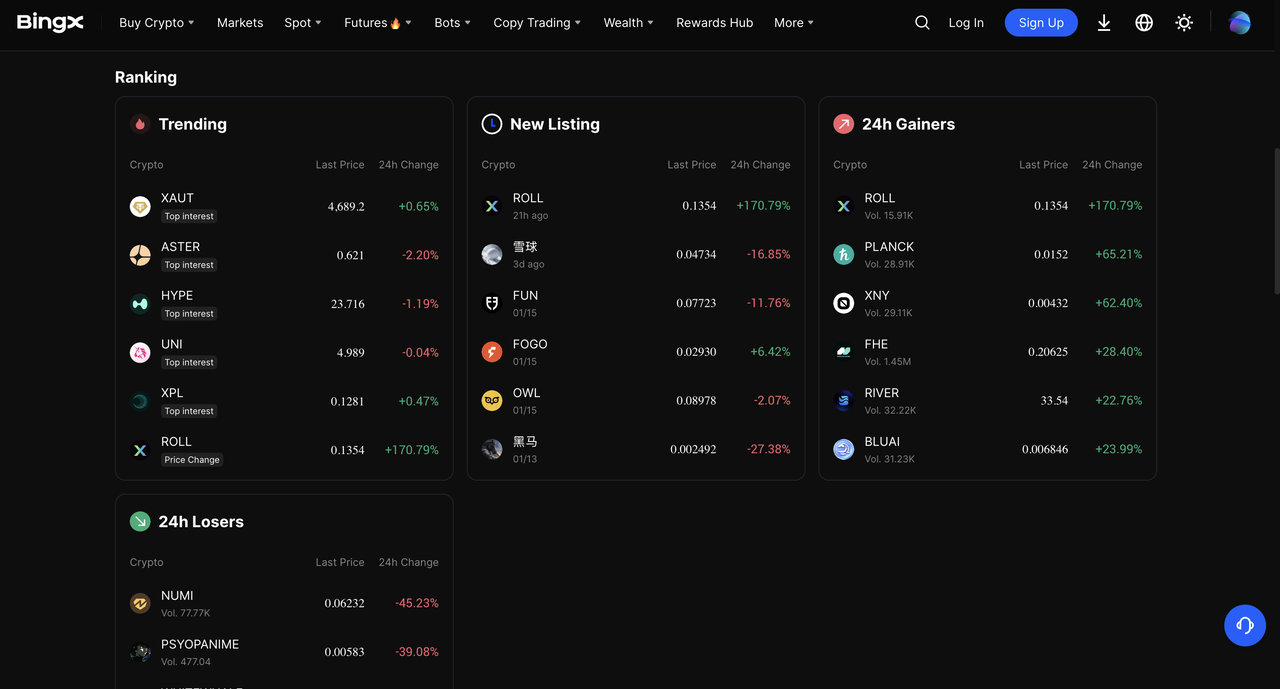

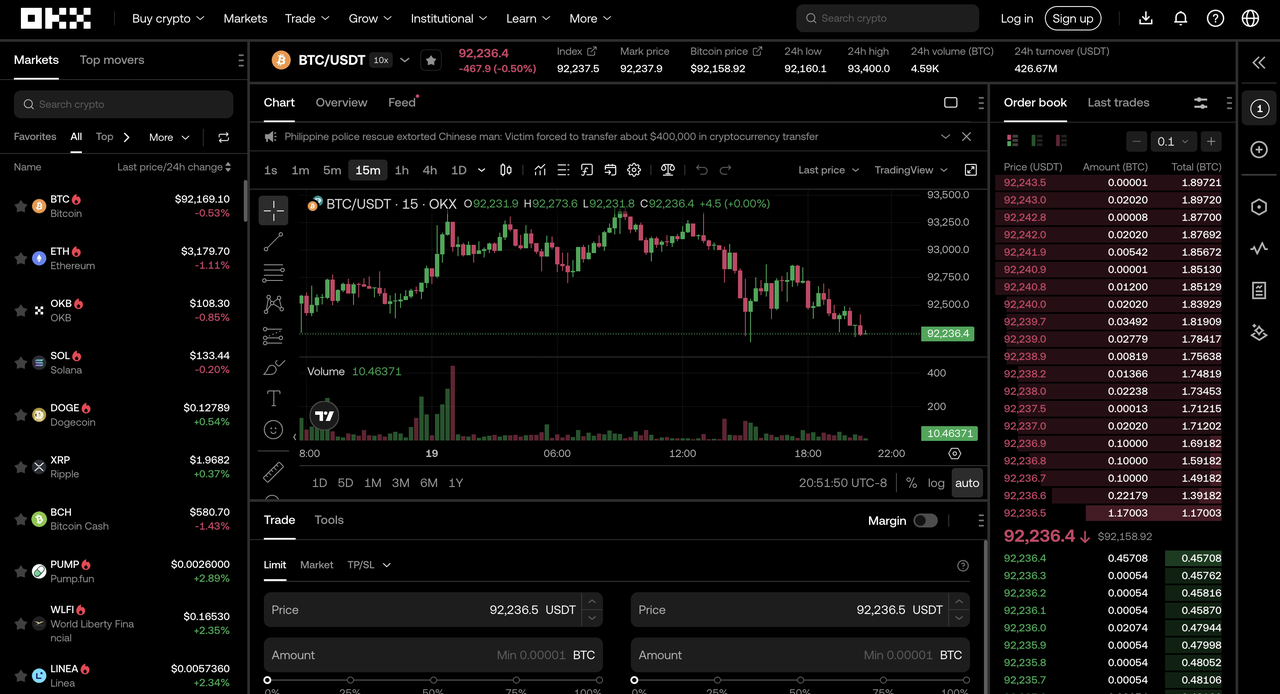

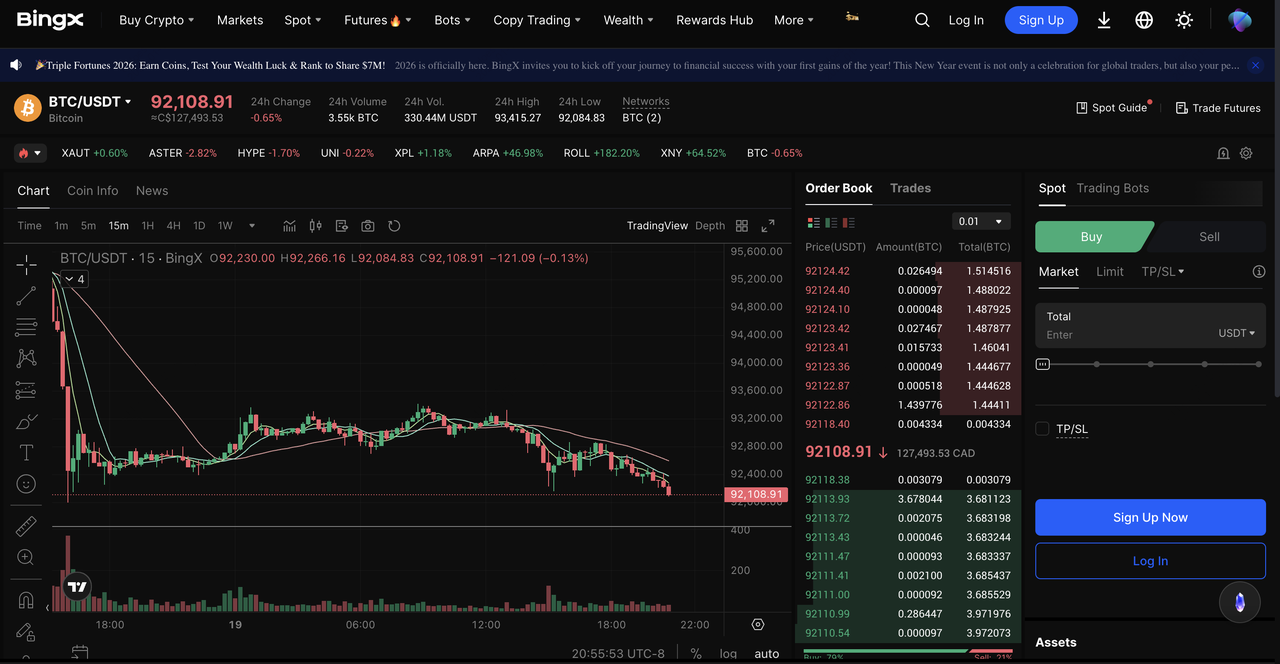

1. BingX

BingX stands at the forefront of spot trading in 2026 thanks to its deeply integrated

BingX AI ecosystem that provides real-time market insights, natural-language query responses, and automated strategy optimization. The platform lists more than 1,000 cryptocurrencies across over 1,120 spot trading pairs, covering major coins like

BTC/USDT and

ETH/USDT as well as newer tokens that often launch with temporary zero-fee promotions.

Standard trading fees are set at 0.1% for both makers and takers, with meaningful reductions offered through VIP levels and native token discounts. Security is reinforced by 100% proof-of-reserves audits, CertiK-verified smart contracts, multi-factor authentication, withdrawal address whitelisting, and proprietary

AI-based threat detection.

Security and trust remain central to BingX's strategy. The platform maintains a

150 million USD Shield Fund and 100 percent Proof of Reserves, alongside ISO 27001 security certification, reinforcing confidence in solvency and operational safety. BingX also supports a thriving copy trading ecosystem, with hundreds of thousands of elite traders, allowing users to follow and replicate successful strategies while deepening community engagement.

Together, these factors, strong adoption, liquidity, diverse instruments,

AI integration, and robust security, position BingX as one of the most versatile and reliable crypto futures platforms in 2026. BingX's clean, responsive interface performs equally well on mobile devices and desktops, while the

BingX AI suite delivers powerful tools, including Bingo AI for instant market answers and AI Master, which draws from a library of over 1,000 professional trading templates to help users refine their approach.

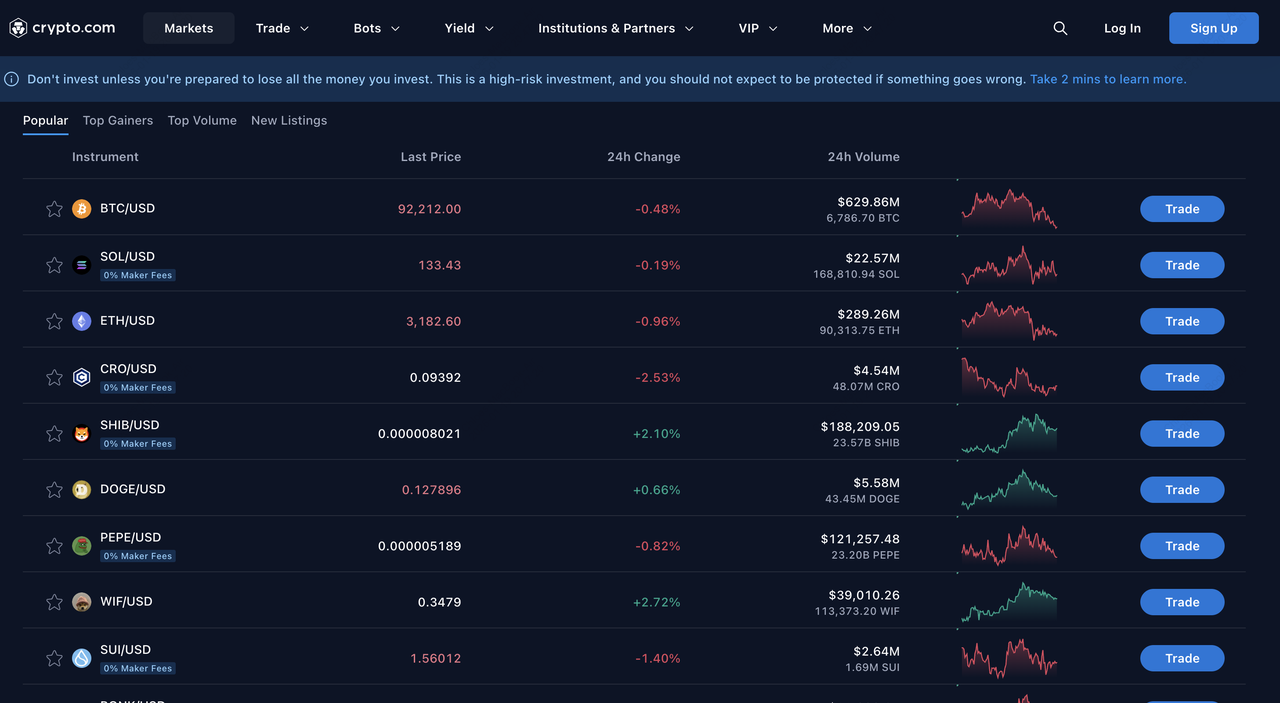

2. Crypto.com

Crypto.com delivers a polished spot trading experience with zero-fee USD deposits via ACH, wire, or select methods, and maintains support for more than 400 cryptocurrencies including

Bitcoin,

Ethereum, and a wide range of stablecoins. The exchange generated $1.3 trillion in spot volume during 2025, helped significantly by built-in trading bots such as dollar-cost averaging and grid strategies that saw strong adoption.

Fees are competitive and variable depending on trading volume and CRO staking, while advanced users benefit from OTC desks and API connectivity. Security credentials include SOC2 Type 1 compliance, PCI:DSS Level 1 certification, ISO standards, and cold storage for the majority of assets. With a global user community exceeding 150 million, Crypto.com combines an intuitive mobile app with a full-featured exchange platform to serve both casual investors and active traders.

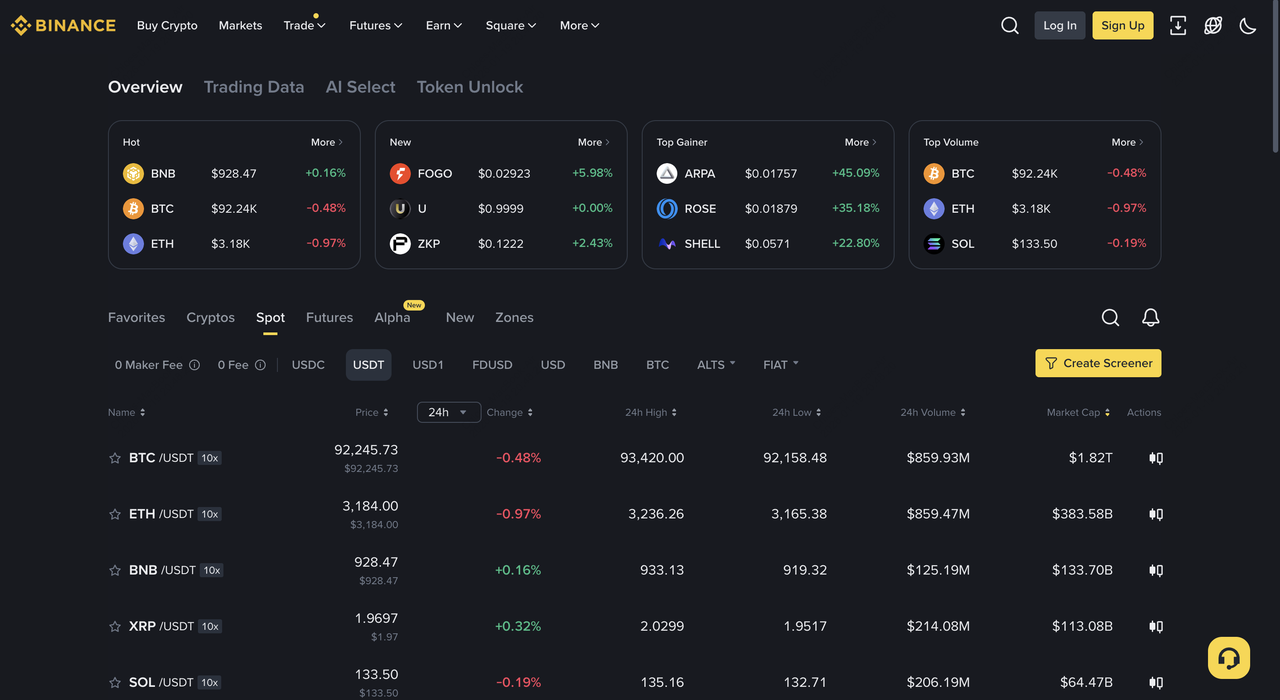

3. Binance

Binance remains the undisputed volume leader in spot trading, supporting over 500 cryptocurrencies and handling approximately $7 trillion in 2025 spot activity, which equates to 41% of the centralized exchange market share. Base spot fees start at 0.1% for makers and takers, with further savings available through BNB payments, trading volume tiers, or holding VIP status.

The SAFU emergency insurance fund, held primarily in USDC and valued in the billions, has successfully reimbursed users in past security events. Binance serves more than 275 million registered users worldwide through a highly responsive mobile app that includes advanced charting, staking rewards, token launchpads, and one-click trading options.

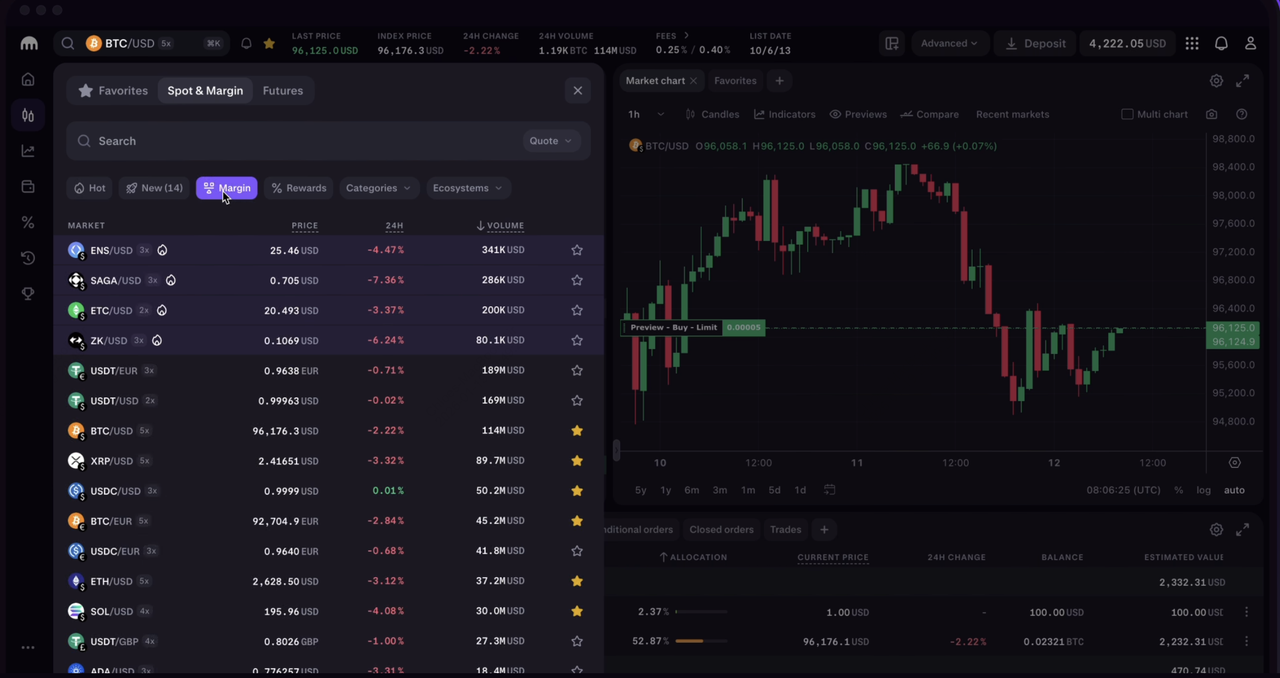

4. Kraken

Kraken provides access to over 600 cryptocurrencies with tight spreads and offers zero-fee spot trading through its Kraken+ subscription tier. The platform rewards users with staking yields up to 22% APR on eligible assets and conducts regular, publicly verifiable proof-of-reserves audits to demonstrate full asset backing. Millions of clients across more than 190 countries rely on Kraken's professional-grade interface, which includes deep order book liquidity, margin trading up to 10x, and robust API support for algorithmic strategies.

5. Coinbase

Coinbase supports thousands of digital assets and eliminates trading fees for users enrolled in its membership programs, while operating under strict licensing from the New York Department of Financial Services. The exchange processed billions in daily spot volume throughout 2025 and maintains a user base of over 110 million people who value its educational content, clean mobile application, institutional custody services, and straightforward asset management tools.

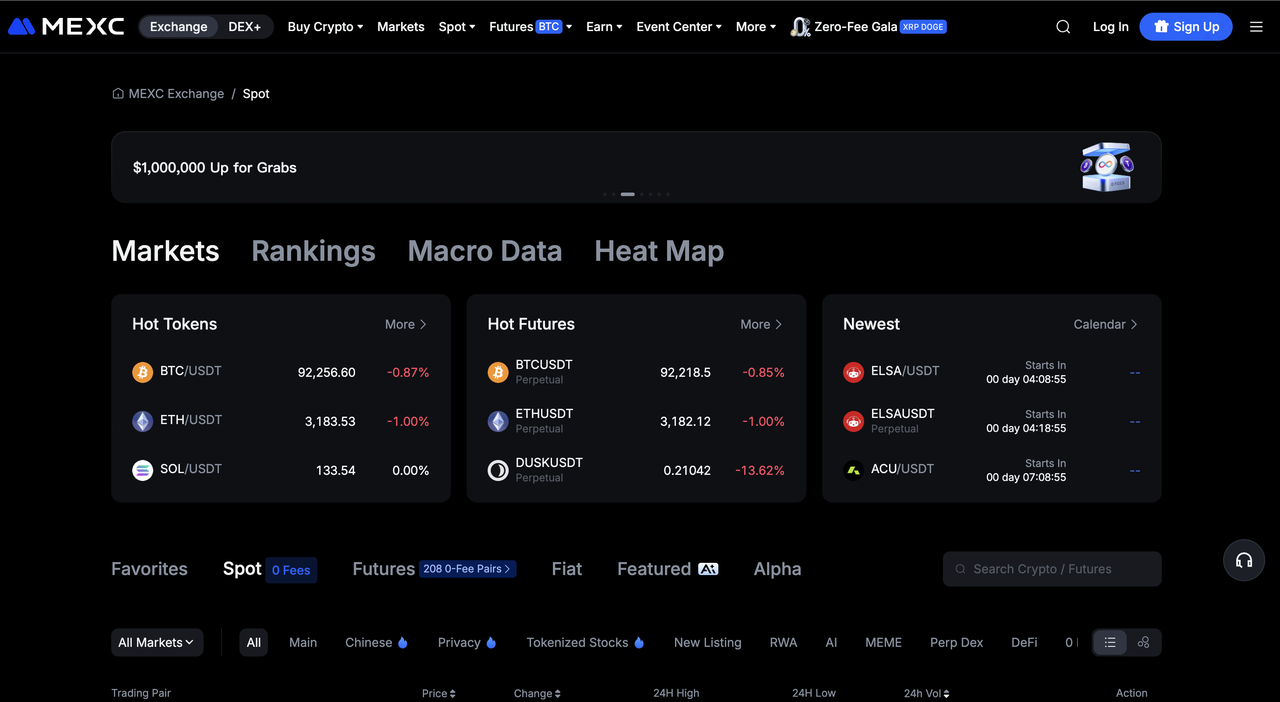

6. MEXC

MEXC specializes in

altcoin diversity, listing more than 3,000 cryptocurrencies and thousands of spot pairs while charging 0% maker and taker fees, with extra discounts available through MX token holdings. The platform achieved $1.4 trillion in spot volume in 2025, protected by a $100 million guardian fund and 1:1 reserve attestation. Frequent meme coin launches, airdrop campaigns, and promotional zero-fee trading periods continue to draw active traders looking for high-potential opportunities.

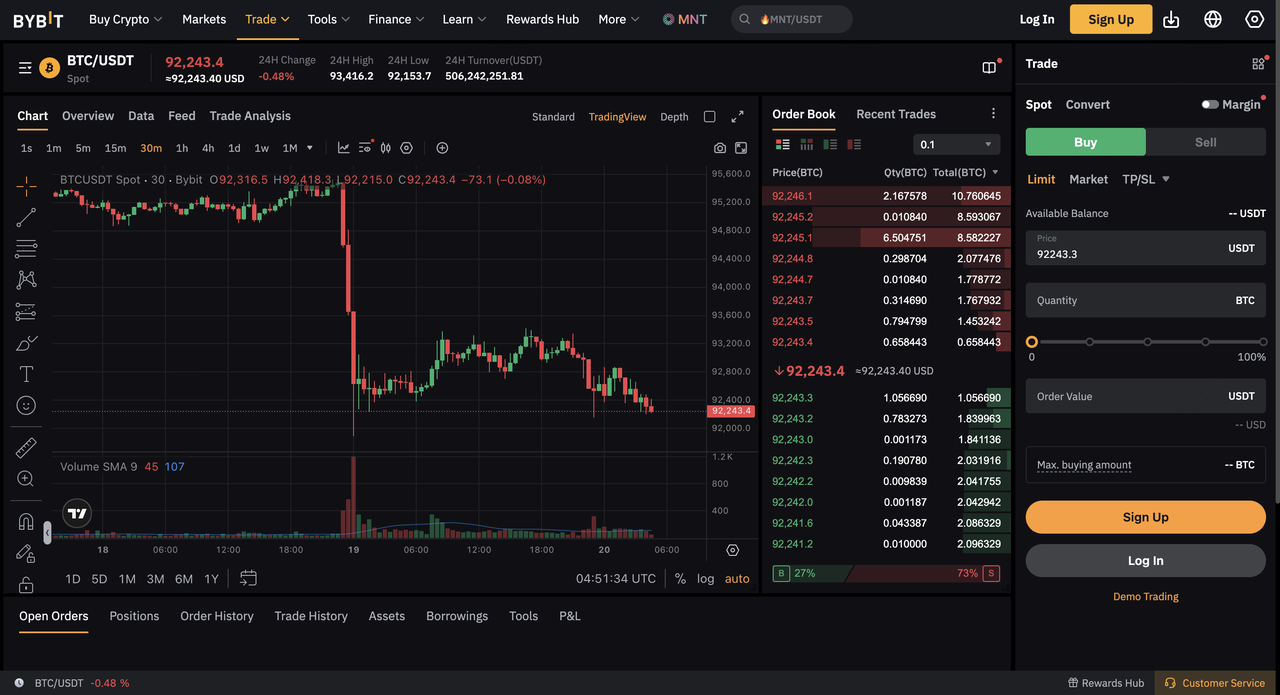

7. Bybit

Bybit offers more than 650 cryptocurrencies with standard 0.1% spot fees and recorded $1.5 trillion in 2025 trading volume. Transparency is ensured through Merkle Tree proof-of-reserves, while deep liquidity pools and copy trading functionality serve over 120 million users who appreciate rapid order execution and comprehensive risk management options.

8. OKX

OKX supports over 340 cryptocurrencies with maker fees beginning at 0.08% and taker fees at 0.10%, boasts a flawless security history with no major breaches, and publishes monthly proof-of-reserves reports. Daily spot volumes often exceed $1 billion, enhanced by integrated trading bots, a native

Web3 wallet, and beginner-friendly onboarding resources.

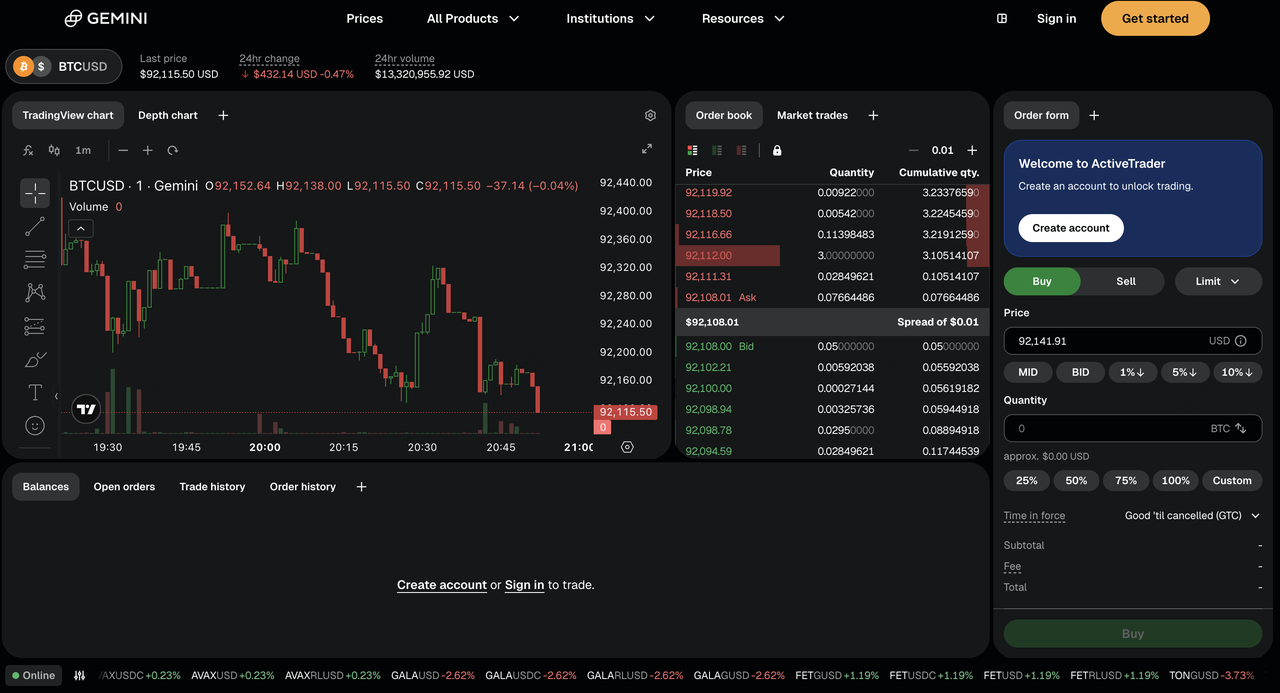

9. Gemini

Gemini maintains a focused selection of more than 80 high-quality assets with maker fees of 0.20% and taker fees of 0.40%, while providing FDIC insurance on USD balances up to applicable limits and holding SOC compliance certifications. The exchange prioritizes regulatory adherence and institutional-grade security, making it a trusted choice for users in regulated jurisdictions who place a premium on transparency and asset protection.

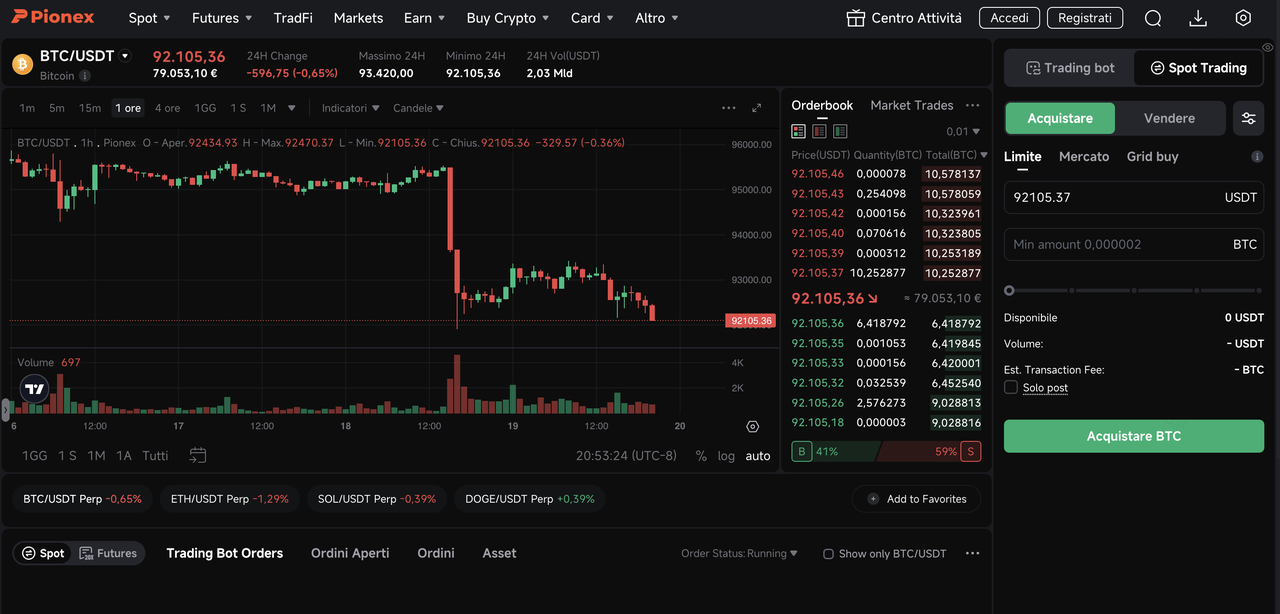

10. Pionex

Pionex combines spot trading with a suite of free built-in trading bots optimized for major pairs such as

BTC/USDT and

ETH/USDT, applies zero fees on certain deposit methods, and upholds 100% reserve backing alongside strict AML procedures. The platform excels at automated grid trading and arbitrage strategies, enabling users to generate returns from market volatility with minimal ongoing management.

Key Metrics of the Top 10 Spot Trading Platforms in 2026: A Comparison

| Platform |

Fees (Maker/Taker) |

Supported Coins |

24h Spot Volume (Est. USD) |

Security Features |

User Base |

Trust Score |

| BingX |

0.1%/0.1% |

1,000+ |

$500M+ |

MFA, 100% PoR, CertiK Audits, AI Detection |

40M+ |

10-Oct |

| Crypto.com |

0%/Variable |

400+ |

$1.3B (annual avg.) |

SOC2, PCI:DSS, ISO Certs |

150M+ |

10-Oct |

| Binance |

0.1%/0.1% |

500+ |

$7B (annual avg.) |

$1B SAFU Fund, 2FA |

275M+ |

10-Oct |

| Kraken |

0%/Low Spreads |

600+ |

$1B+ |

PoR Audits, Battle-Tested |

Millions |

10-Oct |

| Coinbase |

0% (Membership) |

Thousands |

$2B+ |

NYDFS Licensed, 2FA |

110M+ |

10-Oct |

| MEXC |

0%/0% |

3,000+ |

$1.4B (annual avg.) |

$100M Guardian Fund, 1:1 Reserves |

Millions |

10-Oct |

| Bybit |

0.1%/0.1% |

650+ |

$1.5B (annual avg.) |

Merkle Tree PoR |

120M+ |

10-Oct |

| OKX |

0.08%/0.10% |

340+ |

$1B+ |

Monthly PoR, Never Hacked |

Millions |

10-Oct |

| Gemini |

0.20%/0.40% |

80+ |

$500M+ |

FDIC USD, SOC Certs |

Millions |

10-Oct |

| Pionex |

0% (Card) |

Wide Range |

$300M+ |

100% Reserves, AML |

Millions |

N/A |

Why BingX Stands Out as the Best Spot Trading Platform in 2026

BingX sets itself apart in 2026 by centering its entire platform around

artificial intelligence, offering traders seamless access to advanced analytics, automated strategy execution, and risk management tools that go far beyond what most competitors provide as add-ons. Supporting over 1,000 cryptocurrencies with a consistent 0.1% fee structure and frequent promotional incentives, BingX built strong momentum in 2025 and carried that forward in 2026 with interface improvements and expanded pair coverage.

Layered security including 100% proof-of-reserves, CertiK audits, multi-factor authentication, and proactive

AI threat monitoring creates confidence in an environment where cyber risks continue to evolve. As global spot volumes march toward the multi-trillion-dollar range, BingX's intelligent automation and user-focused design make it the most capable choice for traders who want to stay ahead of fast-moving markets without sacrificing control or simplicity.

What Makes BingX Ideal for Spot Traders in 2026?

BingX excels for spot traders because its native

AI tools deliver immediate, actionable value: Bingo AI answers complex market questions in plain language, while AI Master refines trading approaches using a database of more than 1,000 proven strategies.

Recurring buy orders automate

dollar-cost averaging into volatile assets, and selective integrations with traditional finance channels help users build balanced portfolios. The flat 0.1% fee,

VIP tier discounts, and regular zero-fee listing events keep trading costs low even during high-frequency activity.

Security features such as

withdrawal whitelists, multi-factor authentication, and

AI-powered risk alerts provide robust protection, while 2025 enhancements in real-time data processing and listing velocity ensure the platform remains responsive to the fast-changing conditions expected throughout 2026.

How to Start Spot Trading on BingX: A Step-by-Step Guide

BingX lets you buy, hold, and actively trade Bitcoin through both spot markets and BTC/USDT perpetual futures, giving you flexible exposure to long-term growth or short-term price movements with

BingX AI–powered risk and market insights.

How to Buy and Sell BTC on the Spot Market

BTC/USDT trading pair on the spot market

2. Choose a

market order for instant execution or a limit order to set your preferred price.

3. Hold BTC for long-term exposure or trade price swings without leverage.

Long or Short BTC Perpetuals with Leverage on the Futures Market

BTC/USDT perpetual contract on the futures market

2. Choose Long if you expect prices to rise or Short if you expect a decline.

After the trade executes, track your positions in the portfolio dashboard and use secure withdrawal options with address verification to move assets to a personal wallet whenever desired.

Key Considerations Before Spot Trading Crypto

Cryptocurrency prices remain highly volatile, with major assets experiencing double-digit percentage swings multiple times in 2025, so it is wise to set stop-loss orders, limit position sizes, and maintain a diversified portfolio to limit exposure to sudden downturns. Fees differ significantly between platforms, ranging from zero to around 0.4% per trade, so calculate the full cost including deposit, withdrawal, and network charges, and consider volume-based discounts or loyalty programs to reduce expenses.

Security should never be overlooked: always enable two-factor authentication, store large holdings in hardware

wallets, and choose exchanges that publish regular proof-of-reserves audits to confirm they hold client assets in full. Regulatory rules vary by country and can change quickly, so verify that your chosen platform is available and compliant in your jurisdiction before depositing funds.

Conduct thorough research using built-in charting tools,

AI assistants, community discussions, and trusted news sources, especially in markets that regularly exceed $18 trillion in annual spot volume. Finally, keep detailed records of every trade because most tax authorities treat cryptocurrency gains as taxable events, and accurate reporting helps avoid penalties or unexpected liabilities.

Conclusion

Spot trading in 2026 continues to evolve as a mature, high-volume segment of the cryptocurrency industry, with BingX leading through its comprehensive

AI-driven features that empower traders to make faster, smarter decisions in real time. Powerhouses like Binance deliver unmatched scale with $7 trillion in annual volume, Coinbase provides trusted accessibility to over 110 million users, and MEXC offers unbeatable zero-fee entry into thousands of

altcoins for those chasing emerging trends.

The right platform ultimately depends on your specific goals, whether prioritizing the lowest costs, strongest regulatory protections, broadest asset variety, or most advanced automation tools. With spot trading volumes projected to reach $20 trillion to $25 trillion this year and institutional participation showing no signs of slowing, the opportunity to participate in the digital asset economy has never been more compelling. Approach every trade with discipline, stay informed about market shifts, and apply consistent risk management to thrive in this exciting and rapidly advancing space.

Related Reading