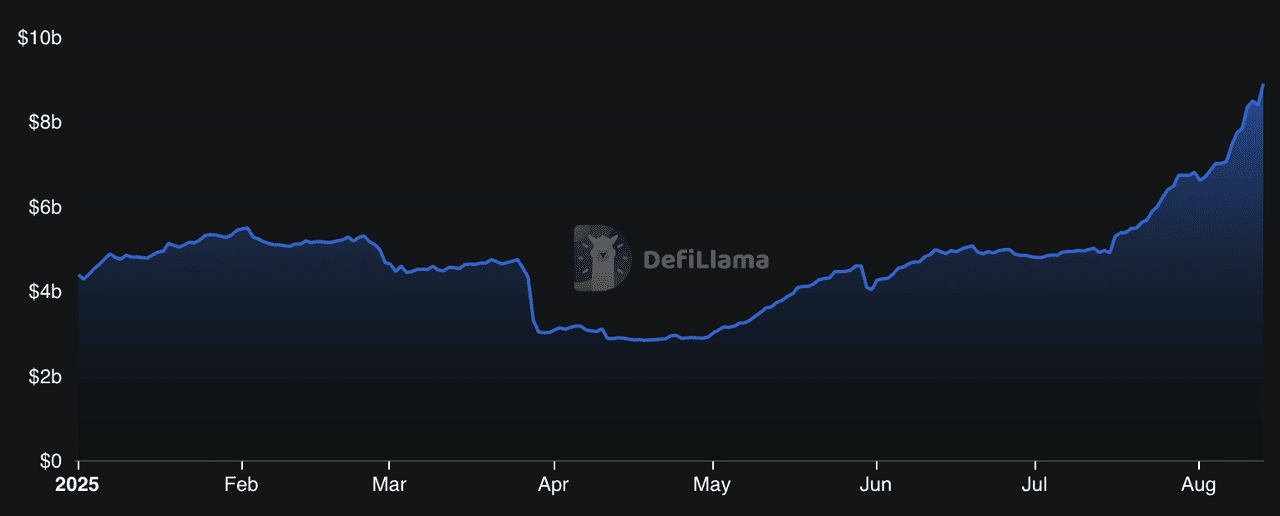

Pendle Finance (PENDLE) is rewriting the rules of DeFi yield trading. In just one month, its total value locked (TVL) has skyrocketed from roughly $5 billion to over $8.9 billion (August 2025), cementing its place among the fastest-growing protocols in the industry. At the heart of its success is a simple yet powerful idea, splitting your crypto into two parts: one representing your original asset, and the other representing all the future rewards it will generate.

Pendle Finance TVL | Source: DefiLlama

This process, known as yield tokenization, allows both conservative investors and active traders to manage yield like never before. With Pendle, you can lock in fixed returns during volatile markets or speculate on changing yields for potentially higher gains, all within a permissionless, transparent, and on-chain environment.

What Is Pendle Finance (PENDLE) and How Does It Work?

Pendle Finance is a decentralized finance (DeFi) protocol that gives you the power to take control of your crypto yields. Instead of holding a yield-bearing asset and simply hoping rates stay favorable, Pendle lets you split that asset into two separate tokens, one for the original value (principal) and one for the future yield it generates. This opens up a range of strategies for locking in stable returns, speculating on yield changes, or building structured income products, all without giving up custody of your funds.

Pendle has rapidly emerged as a dominant force in DeFi, with its total value locked (TVL) soaring from under $300 million at the beginning of 2024 to nearly $9 billion by August 2025. This explosive growth has been fueled by its capital-efficient design and strong adoption in points farming and restaking strategies, which attract both retail users and professional

yield farmers.

Holding 50–60% of the yield tokenization market, Pendle is now a cornerstone protocol for institutions and advanced DeFi traders alike. Its ability to split assets into principal and yield components gives users unmatched flexibility, whether locking in fixed returns, speculating on future yields, or combining both approaches, offering opportunities that traditional staking simply can’t match.

Turning Uncertain Yields Into Opportunities

In DeFi, rewards from staking or providing liquidity can change daily depending on market demand, token prices, and protocol incentives. Pendle takes these unpredictable yields and turns them into structured, tradeable products. This means you can decide whether to:

• Secure a fixed yield for peace of mind.

• Speculate on yield increases for higher potential gains.

• Hedge against falling yields to protect your income stream.

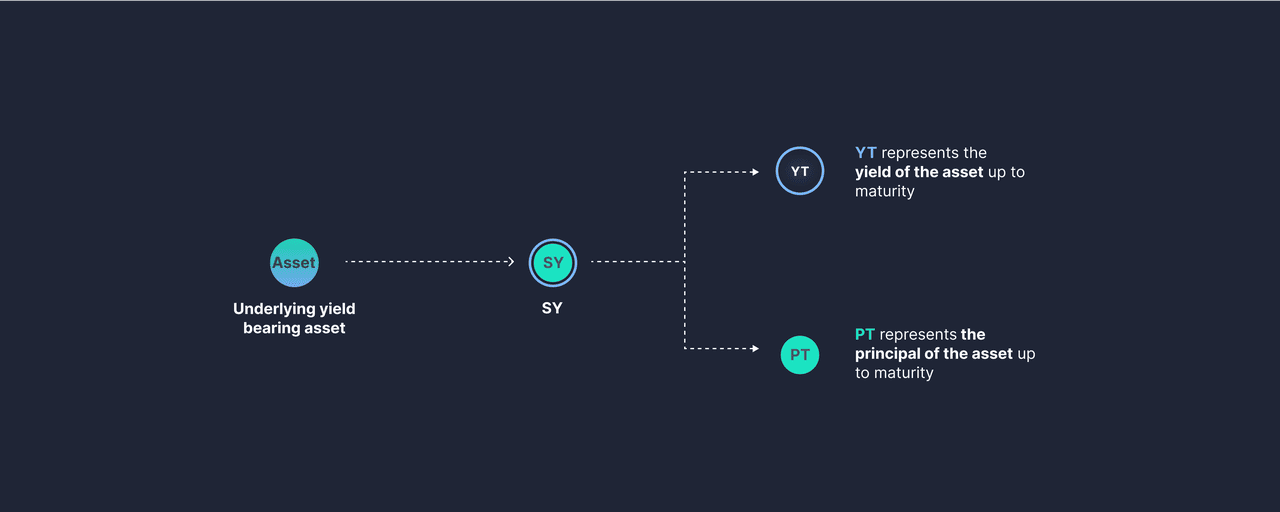

Pendle's Two-Token System

How Pendle's YT and PT tokens work | Source: Pendle docs

Pendle uses a mechanism inspired by bond stripping in traditional finance, but executed fully on-chain:

• Principal Token (PT): Represents your original asset. It’s redeemable 1:1 for the underlying token at maturity, offering predictable returns.

• Yield Token (YT): Represents all future yield from the asset until maturity. YT holders collect yield over time, making it ideal for traders who believe yields will rise.

For example, if you deposit stETH into Pendle, you’ll receive PT-stETH (your principal) and YT-stETH (your future

staking rewards). You can hold them, sell them, or trade them independently, depending on your strategy.

How Pendle V2 Works: A Step-by-Step Breakdown

Pendle V2 is the upgraded version of Pendle Finance’s yield-trading protocol, designed to make yield tokenization more efficient, flexible, and user-friendly. While the original Pendle introduced the concept of splitting assets into Principal Tokens (PT) and Yield Tokens (YT), V2 refined it with Standardized Yield (SY) tokens for broader asset compatibility, a custom

AMM (automated market maker) optimized for time-decaying assets, and improved capital efficiency. These upgrades allow traders to enter, exit, and manage fixed or variable yield positions with less slippage, deeper liquidity, and more strategic options than ever before.

Pendle V2 makes yield tokenization simple, even if you’re new to DeFi. Here’s exactly how the process works from start to finish:

1. Deposit Your Asset

Suppose you own 1 wstETH (wrapped staked ETH), which earns staking rewards from the Ethereum network. You deposit this into Pendle. The protocol automatically converts it into a Standardized Yield (SY) token, a wrapped version that gives all yield-bearing assets a uniform format. This SY standard (EIP-5115) makes your asset compatible with Pendle’s trading and yield-splitting system.

2. Mint Principal & Yield Tokens

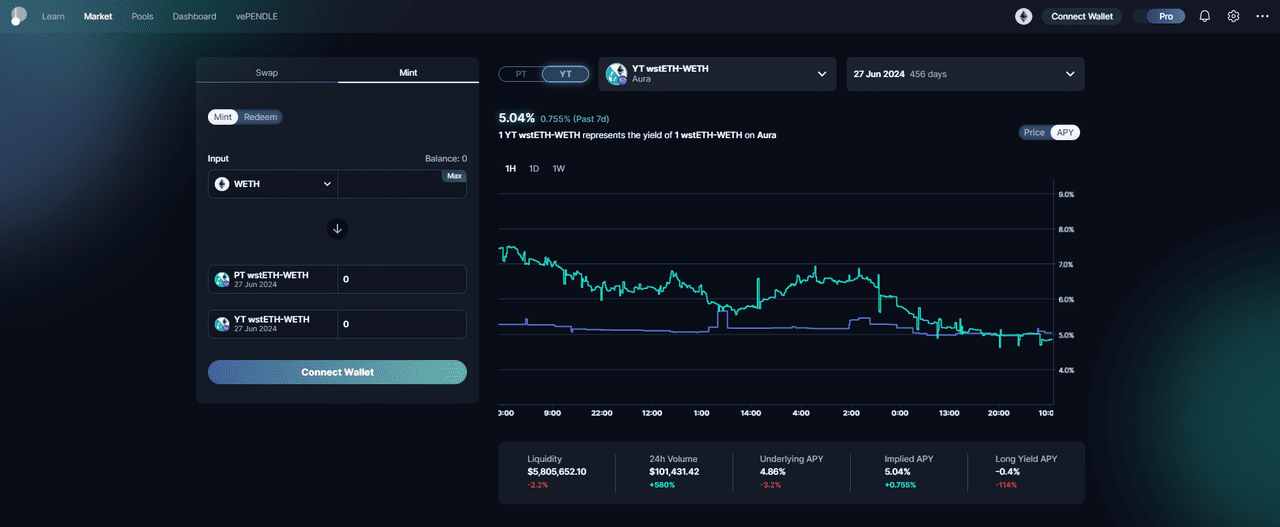

How to mint principan and yield tokens on Pendle | Source: Pendle docs

From your SY-wstETH, Pendle mints two new tokens:

• 1 PT-wstETH (Principal Token): Represents your original staked ETH value, redeemable 1:1 at maturity. Think of it as your “safe” portion.

• 1 YT-wstETH (Yield Token): Represents all the staking rewards your wstETH will generate until maturity. This is the “variable” portion, which fluctuates with staking yields.

If your stETH staking APY is 5% and maturity is one year away, the YT-wstETH entitles you to ~0.05 stETH by the end of that period, minus any price changes from trading.

3. Trade on the Pendle AMM

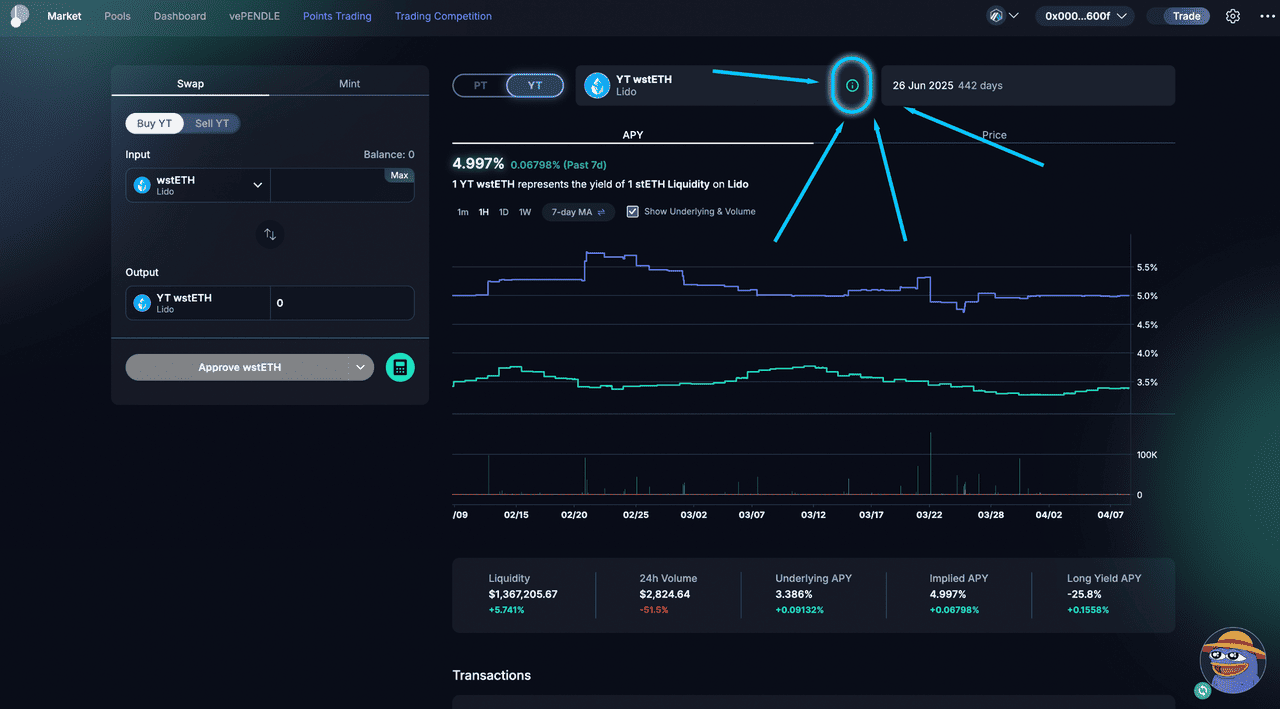

How Pendle's AMM works | Source: Pendle docs

Both PT and YT are tradeable on Pendle’s custom AMM, which is optimized for time-decaying assets. The AMM offers:

• Deep liquidity for major yield-bearing assets like stETH, aUSDC, and ezETH.

• Accurate pricing models that account for yield decay as maturity approaches.

• Lower slippage compared to traditional AMMs, especially for large trades.

As a result, you can enter or exit yield positions efficiently at any time before maturity.

4. Choose Your Strategy

Pendle’s two-token system unlocks multiple strategies:

• Fixed Yield: Buy PT at a discount and hold to maturity for a predictable return, regardless of how yields change.

• Speculative Gain: Buy YT if you expect yields (Underlying APY) to be higher than the market’s Implied APY, potentially earning more than a fixed yield.

• Hybrid & Hedging: Hold both PT and YT, or use them to hedge existing DeFi positions, balancing safety with upside potential.

• Liquidity Provision: Deposit PT, YT, or SY into Pendle’s liquidity pools to earn swap fees and PENDLE incentives.

5. At Maturity

When the maturity date arrives:

• PT holders redeem their tokens for the underlying asset at full value (e.g., 1 PT-wstETH → 1 stETH), regardless of how yields moved.

• YT holders stop earning yield; their tokens drop to zero value. All yield collected until this point can be claimed directly from the Pendle dashboard.

This structure means PT behaves like a fixed-income instrument, while YT acts more like a short-term yield futures contract, both fully on-chain and tradeable at any time.

What Is Pendle’s Boros and How Does It Work?

Pendle’s Boros, originally referred to as Pendle V3, marks the protocol’s evolution into margin-enabled yield trading, pushing beyond its original on-chain yield tokenization model. While earlier versions of Pendle focused on splitting staking rewards or lending yields into tradable Principal Tokens (PT) and Yield Tokens (YT), Boros brings a new dimension by tokenizing off-chain funding rates from perpetual futures markets. This innovation allows traders to speculate on, hedge, or lock in funding rate movements for top digital assets, opening a market that was previously inaccessible in DeFi.

Boros officially launched on Arbitrum in early 2025, starting with

BTC and

ETH funding rates sourced from Binance. High demand quickly pushed open interest caps higher, and Pendle announced expansion plans to support

SOL,

BNB, and integrations with exchanges like

Hyperliquid. Within weeks, funding rate markets saw tens of millions of dollars in cumulative trading volume, and Boros became one of Pendle’s most traded products. Today, Boros plays a major role in Pendle’s rise to over $8.9 billion TVL, accounting for 58% of the on-chain yield trading market.

A major growth catalyst has been Pendle’s collaboration with Ethena, integrating its

synthetic dollar USDe into Pendle’s fixed-yield markets. This created a looping strategy that also leverages

Aave’s lending pools. The loop works as follows:

1. Buy PT-USDe on Pendle to lock in a fixed yield.

2. Use that PT as collateral on Aave to borrow

USDC.

3. Convert USDC back into USDe and repeat the cycle.

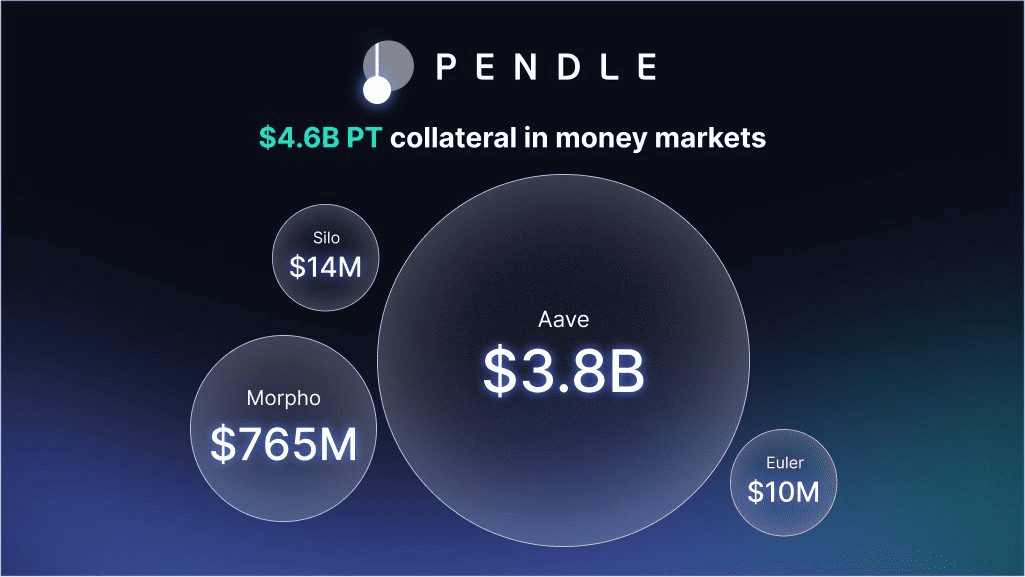

Source: Pendle on X

Yields on PT-USDe have averaged 8.8%, while Aave’s USDC borrowing rates sit between 4% and 6%, creating a profitable spread. Both protocols benefit: Aave earns 10% of borrowing fees, while Pendle charges 5% on PT issuance. The strategy’s popularity is clear; when Aave raised the PT-USDe (Sep 2025) collateral cap by $600 million, it was fully utilized within an hour, pushing PT-as-collateral TVL to a record $4.6 billion.

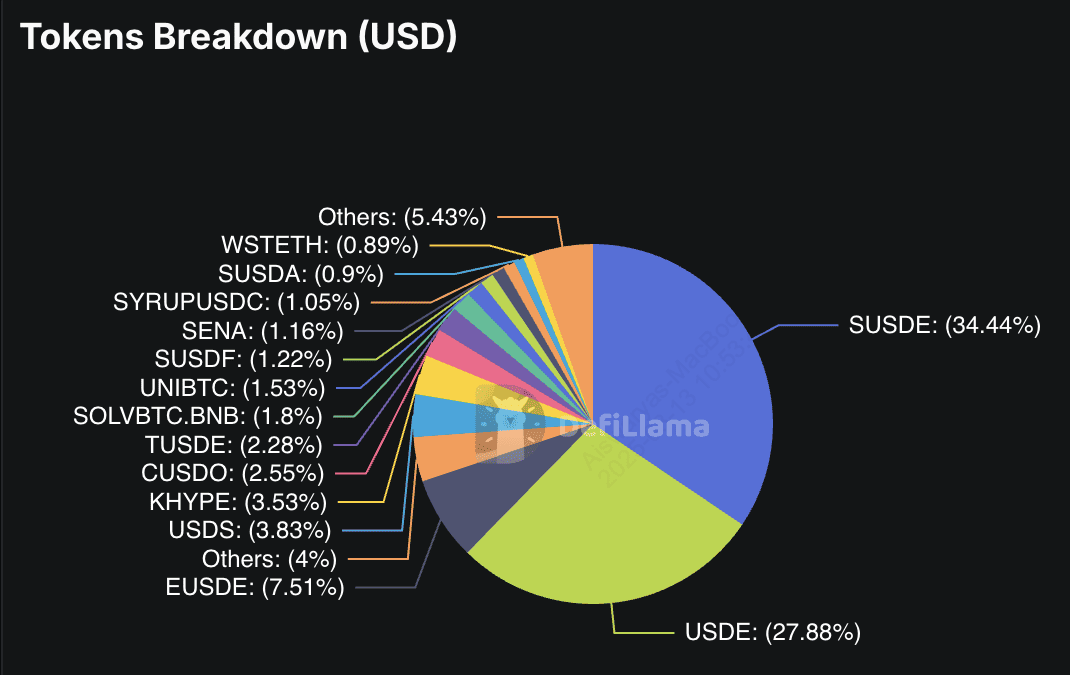

Ethena USDe among Pendle's token breakdown | Source: DefiLlama

Ethena’s USDe now accounts for over $6.1 billion (~70%) of Pendle’s total TVL, and demand for fixed-yield stablecoin products is at an all-time high, supported by the broader DeFi trend toward purpose-built stablecoin ecosystems. While this creates powerful growth momentum for Pendle, traders should note that if PT yields fall below borrowing costs, the loop’s profitability vanishes, making active monitoring essential.

1. Yield Units (YUs): The Core Building Block

Boros introduces Yield Units (YUs), a new tokenized representation of funding rate income or expense. Each YU corresponds to the yield from 1 unit of an underlying asset, for example, 1 BTC or 1 ETH, earned (or paid) through

perpetual futures funding until maturity. This means traders can directly buy or sell the future funding rate stream without taking a directional position on the asset price itself.

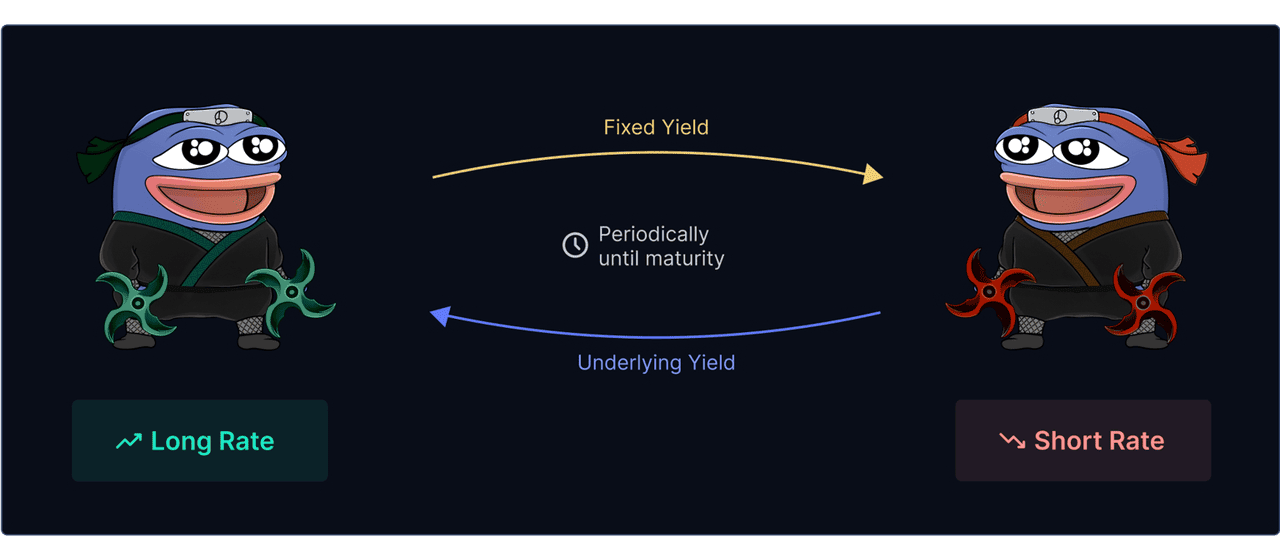

2. Long vs. Short YUs

Long rate vs. short rate on Boros | Source: Pendle docs

Boros lets traders take two opposing positions:

• Long YU: You pay a fixed funding rate and receive the actual rate. If the actual funding rate ends up higher than the fixed rate, you profit from the difference.

• Short YU: You receive a fixed funding rate and pay the actual rate. If the actual rate ends up lower than the fixed rate, you come out ahead.

In other words, Long YUs benefit when funding rates rise, while Short YUs benefit when funding rates fall, making it possible to bet on funding rate trends just like traders in traditional interest rate markets.

3. Mechanics, Vaults, and Risk Management

To maintain market stability, Boros rolled out with conservative limits, $10M in open interest per market and 1.2× leverage, which have since been increased to $28M caps as liquidity deepened.

• Vaults for Liquidity Providers: Boros features dedicated LP Vaults where users can deposit assets to provide liquidity for YU trading pairs. In return, they earn swap fees, PENDLE incentives, and potentially extra yield if implied funding rates move in their favor.

• Risk Controls: Boros uses margin requirements, open interest caps, and oracle pricing to minimize the risk of extreme volatility or market manipulation.

Why Boros Matters in the Pendle Finance Ecosystem

Boros matters because it unlocks a part of the crypto yield market that was previously out of reach for on-chain traders, the ability to trade volatile funding rates from perpetual futures in a structured, transparent way. This means traders can now speculate on, hedge against, or lock in funding rates just as they might trade interest rates in traditional finance. For institutions and advanced DeFi protocols like Ethena, this is game-changing, allowing them to hedge funding exposure or secure fixed rates to power delta-neutral strategies without leaving the blockchain.

Its impact on Pendle’s growth has been immediate and significant. Within just 48 hours of launch, Boros attracted $1.85 million in BTC and ETH deposits, pushing Pendle’s TVL to over $8.27 billion and sparking a 45% surge in the PENDLE token price. This momentum has cemented Pendle’s position as the market leader in on-chain yield trading, now holding 58% market share, with Boros serving as the key driver behind this dominance.

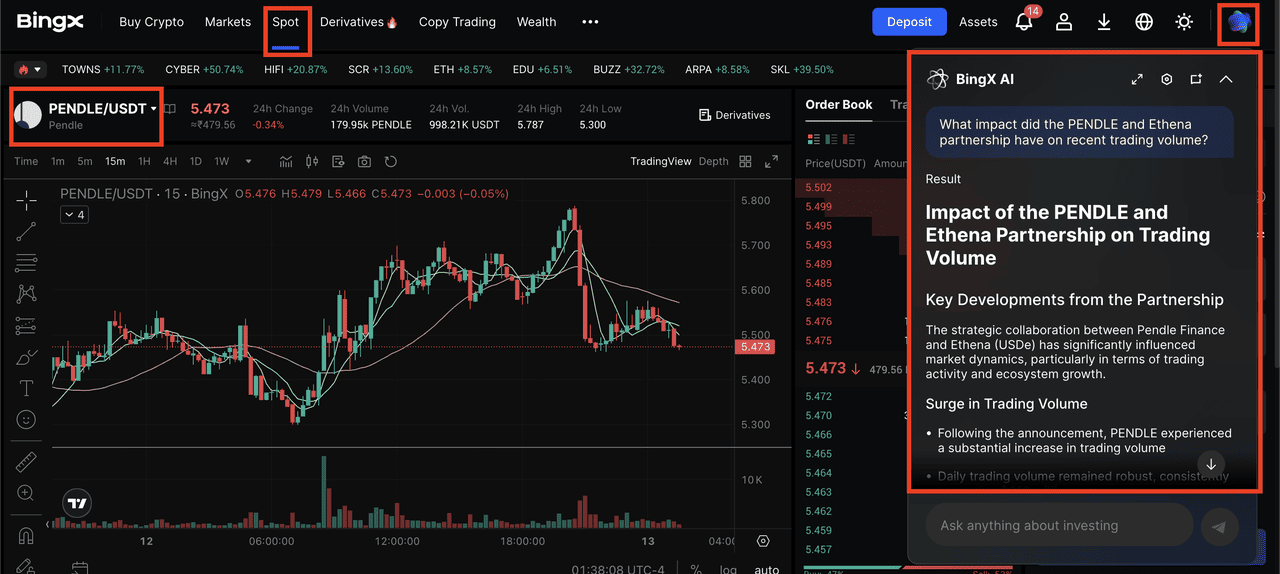

How to Trade PENDLE on BingX

You can trade PENDLE on BingX through both the Spot and Futures markets, giving you flexibility depending on your strategy.

1. Spot Trading: Buy or Sell PENDLE

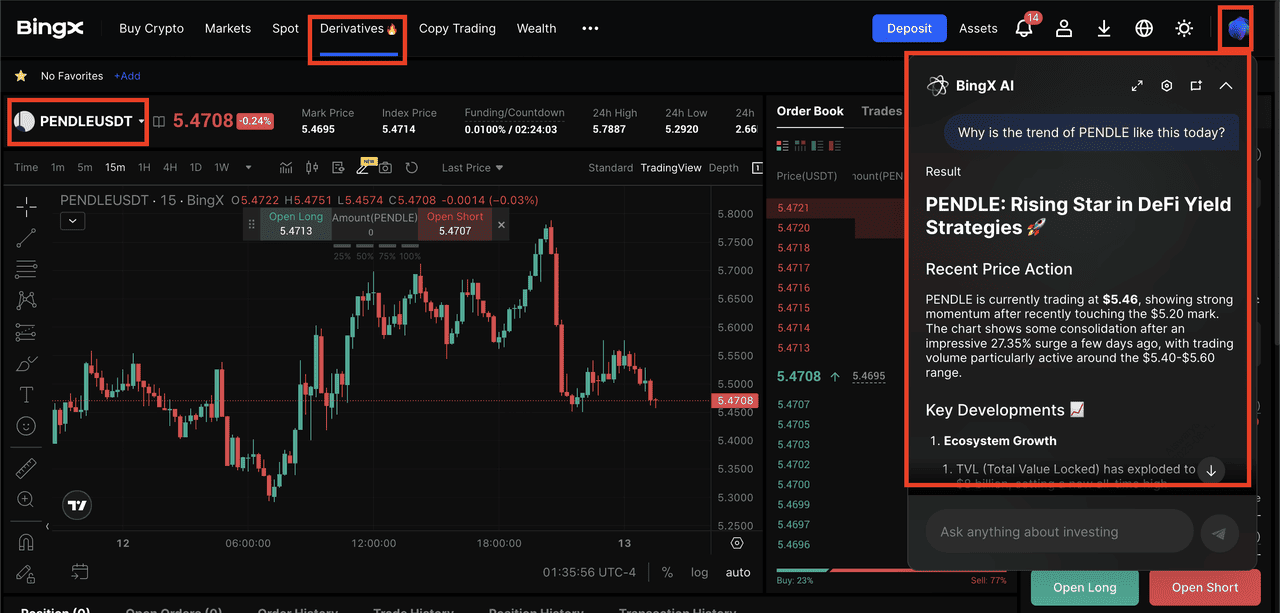

PENDLE/USDT trading page on the spot market with BingX AI

1. Log in or create a BingX account.

2. Deposit USDT or another supported cryptocurrency.

4. Place a market or limit order to buy or sell PENDLE instantly.

2. Futures Trading: Go Long or Short on PENDLE with Leverage

1. Open the Futures tab and select the PENDLE/USDT pair.

2. Choose your leverage level and set your entry price.

3. Place long (buy) or short (sell) orders based on your market outlook.

4. Manage risk with stop-loss and take-profit settings.

BingX AI can help you trade smarter by providing real-time market sentiment, volatility alerts, and technical analysis insights. Whether you’re on Spot or Futures, you can use BingX AI to track price trends, identify entry and exit points, and adapt to changing market conditions.

Final Takeaways

Pendle Finance has positioned itself as a leading player in DeFi’s yield markets, offering a structured way to navigate unpredictable returns. With V2, users can split assets into principal and yield components, enabling strategies that range from fixed-income style returns to yield speculation, all while maintaining flexibility over their capital. With Boros, the protocol extends its reach into derivative-linked yields, giving traders and institutions new tools to hedge or capitalize on funding rate movements.

While Pendle’s growth and innovation have been impressive, yield trading, especially with leveraged or derivatives-linked products, comes with inherent risks. Market volatility, liquidity shifts, and incorrect rate predictions can lead to losses. As with any DeFi strategy, participants should assess their risk tolerance, understand the mechanics before committing capital, and start with amounts they can afford to lose.

Related Reading