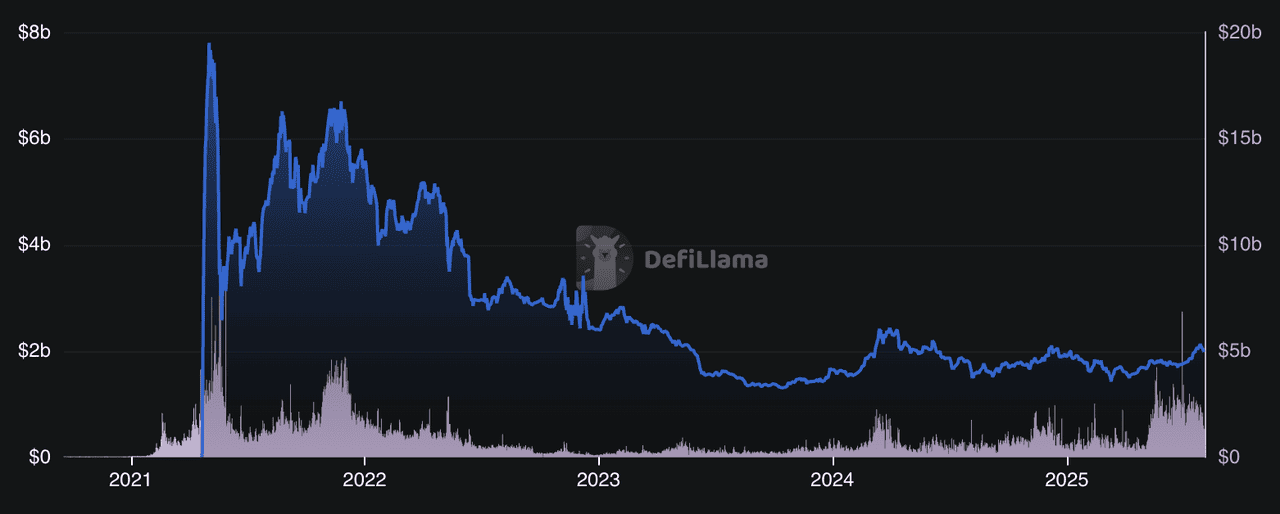

With over $2 billion in total value locked (TVL) and more than 425,000 daily transactions,

PancakeSwap (CAKE) has become one of the most active and trusted decentralized exchanges (DEXs) in crypto. Built initially on

BNB Chain, the platform now spans multiple blockchains and supports over 169,000 daily active users. Known for its low fees, wide asset support, and beginner-friendly interface, PancakeSwap dominates the BNB Chain ecosystem and ranks among the top DEXs globally. Whether you're swapping tokens, farming yields, or launching your own crypto asset, PancakeSwap powers a full-suite DeFi experience at scale.

PancakeSwap TVL and DEX volume | Source: DefiLlama

In this guide, you’ll learn what PancakeSwap is, how to get started, key features, how the CAKE token works, supported chains, and more.

What Is PancakeSwap, BNB Chain's Flagship DEX?

PancakeSwap is a safe decentralized exchange (DEX) that lets you trade cryptocurrencies directly from your crypto wallet, without needing to register, complete KYC, or hand over custody of your funds. Launched in September 2020 on the BNB Smart Chain (formerly Binance Smart Chain), PancakeSwap was designed as a faster and cheaper alternative to

Ethereum-based platforms like

Uniswap. As of August 2025, PancakeSwap ranks among the top three decentralized exchanges by trading volume, with over $1.8 trillion in cumulative trades since launch and more than 1.6 million active wallets per month.

At its core, PancakeSwap uses an

automated market maker (AMM) model. This means trades happen through liquidity pools instead of order books. You can swap one token for another instantly, provide liquidity to earn rewards, or stake tokens to earn passive income, all without relying on a centralized intermediary.

Over time, PancakeSwap has expanded beyond simple token swaps. As of 2025, it supports a wide range of DeFi services across nine major blockchains, including BNB Chain, Ethereum,

Arbitrum, Base,

Solana, opBNB,

Polygon,

zkSync Era, and

Aptos (via integration with wallets and bridges).

When Did PancakeSwap DEX Launch?

PancakeSwap was launched in September 2020 by a team of anonymous developers who go by food-themed pseudonyms like “Chef Kids” (Head Chef) and “Chef Jackson” (Lead Developer). The team is reportedly based in Unoshima, Fukuoka, Japan, and has since grown to over 250 contributors, including developers, product managers, and community moderators.

The project was born out of a simple idea: build a cheaper and faster version of Uniswap on the BNB Smart Chain. At that time, Ethereum gas fees were sky-high, often exceeding $50 per transaction. PancakeSwap filled the gap by offering near-instant transactions with fees typically under $0.10.

The DEX gained momentum quickly. Within its first year, it recorded over $100 billion in trading volume and attracted thousands of liquidity providers. Its user-friendly design, gamified rewards (like lotteries and NFT farming), and low fees helped it grow beyond the BNB Chain.

Over the years, PancakeSwap has rolled out major upgrades such as:

• PancakeSwap V2 & V3 – With tiered fees and concentrated liquidity

• StableSwap pools – Optimized for stablecoin trading with minimal slippage

• Infinity (2025) – A new smart router and pool engine with cross-chain trading, ERC-6909 support, and hooks for custom logic

• SpringBoard – A no-code platform for launching tokens with built-in liquidity and trading

Despite being anonymous, the PancakeSwap team maintains transparency through weekly governance updates, audits, and community AMAs. Their long-term vision is to become a universal DeFi hub where users can access any on-chain service across any major blockchain, without needing to leave the PancakeSwap interface.

How Does PancakeSwap Work?

PancakeSwap offers much more than just token swaps. It’s a full-featured decentralized finance (DeFi) platform where you can trade, earn, stake, predict, and even launch your own tokens, all from a single interface. Here’s a breakdown of everything you can do on PancakeSwap in 2025:

1. Swap Tokens (Spot Trading)

PancakeSwap allows you to instantly trade crypto using an automated market maker (AMM) system, no sign-ups or order books required. You can choose between V2, V3, or StableSwap pools, with V3 offering flexible fee tiers (0.01% to 1%) for optimized slippage control. StableSwap pools are best for stablecoin pairs like USDT/USDC, offering low-cost, low-slippage trades.

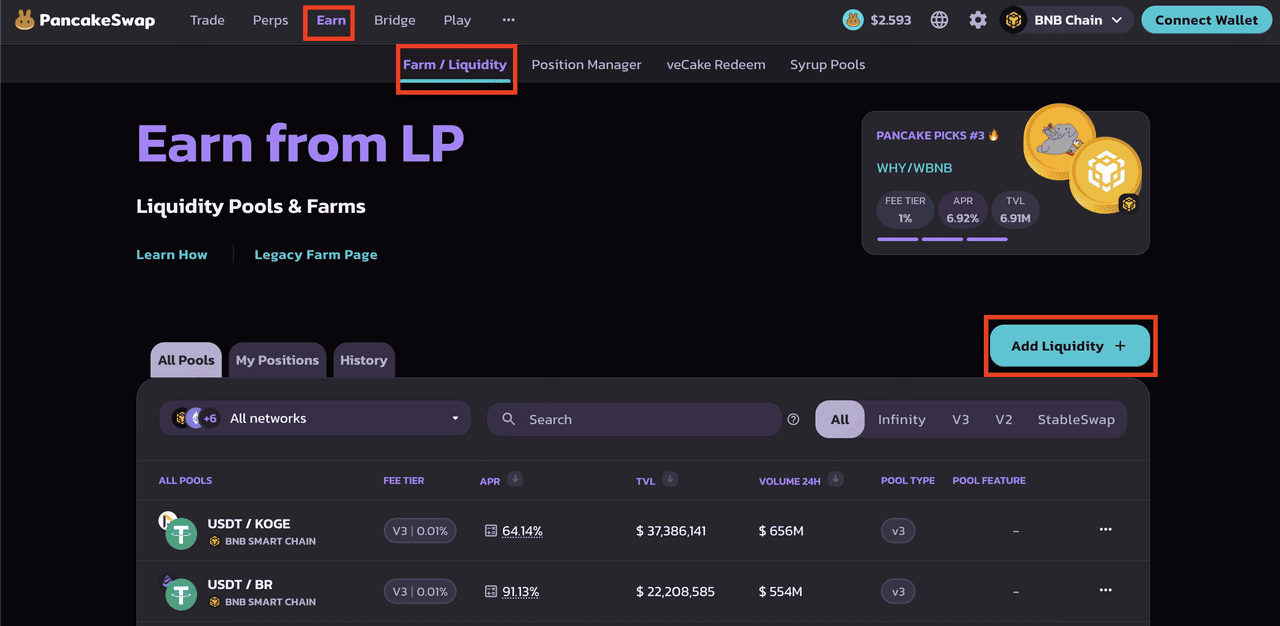

2. Earn CAKE with Yield Farming

You can earn CAKE by providing liquidity to trading pairs like CAKE/BNB or ETH/USDT. After depositing tokens, you receive LP (liquidity provider) tokens, which can be staked in Farms to earn trading fees plus CAKE rewards. Some pools offer APYs over 100%, but rates vary with market activity.

3. Stake CAKE in Syrup Pools

Syrup Pools let you stake CAKE tokens directly to earn more CAKE or rewards in partner tokens, without the risks of impermanent loss. You can choose between flexible and locked staking options, with a 2% performance fee and a 0.1% early withdrawal penalty if you unstake within 72 hours. Over 150 million CAKE has been distributed through staking as of July 2025.

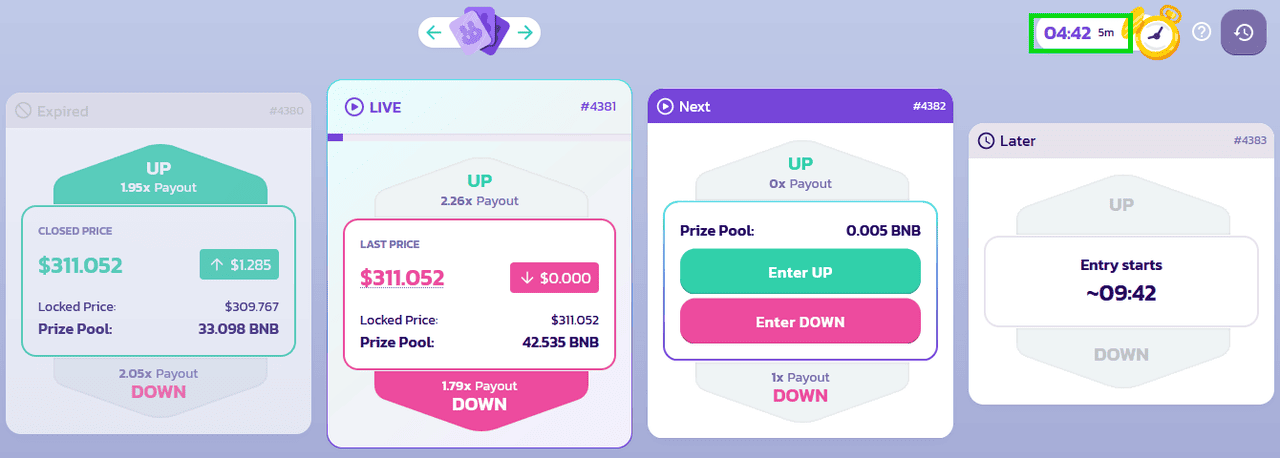

4. Try Prediction Markets

How prediction markets on PancakeSwap work | Source: PancakeSwap docs

In PancakeSwap's prediction game, you can bet on whether the price of BNB, ETH, or CAKE will rise or fall over 5-minute intervals. Winners split the prize pool, minus a 3% treasury fee. This feature is currently available on BNB Chain and zkSync Era.

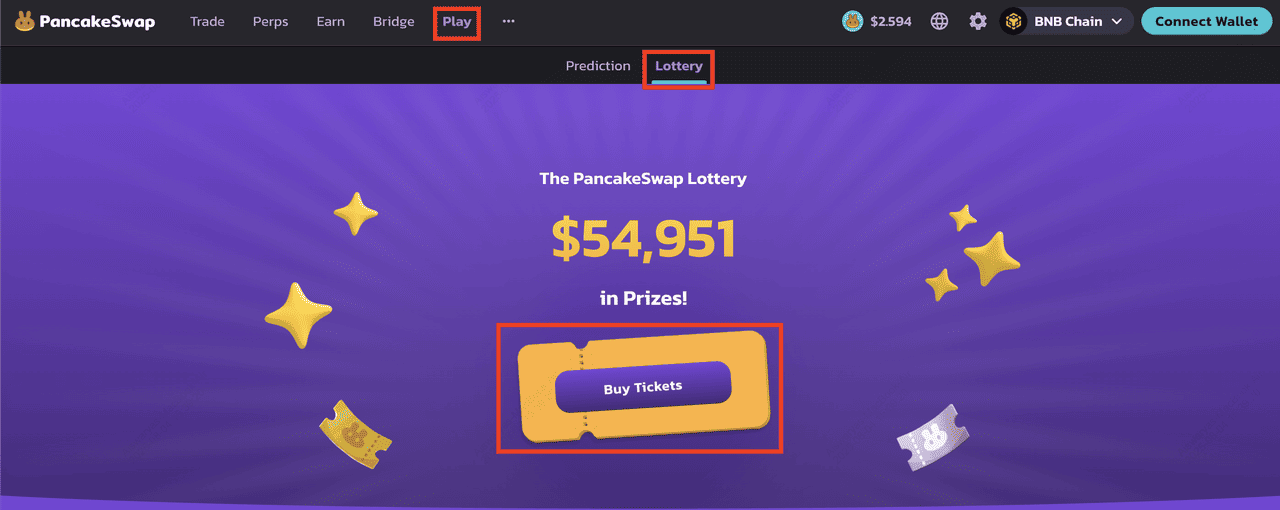

5. Enter Lottery Games

Buy lottery tickets (~$5 in CAKE each) for a chance to win based on matching a 4-digit number. The more digits matched (from left to right), the bigger the prize. You can purchase up to 100 tickets per round, and prizes are funded by CAKE ticket sales.

6. Trade Perpetual Futures

PancakeSwap supports leveraged perpetual contracts (up to 50x) on networks like BNB Chain, Ethereum, Base, and Solana. V2 Perpetuals offer two modes:

i. Degen Mode for experienced traders and

ii. Dumb Mode for beginners seeking a one-click interface.

Trading fees are low, at 0.02% for makers and 0.07% for takers, but leverage increases risk.

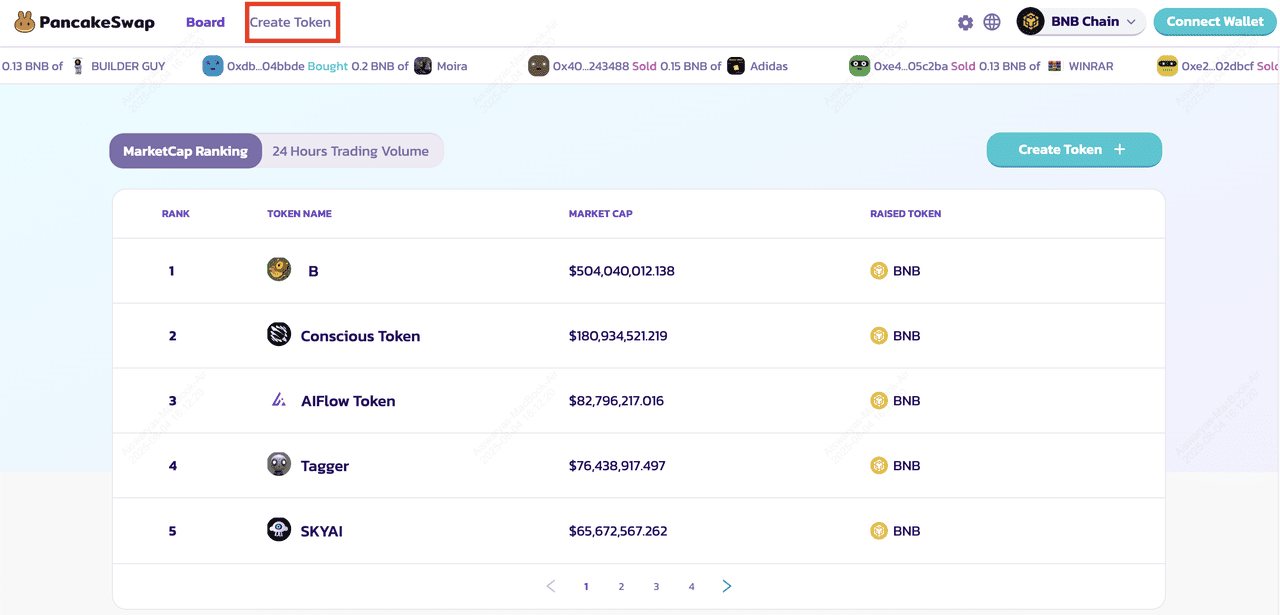

7. Launch Tokens with SpringBoard

SpringBoard is a no-code launchpad where anyone can create and launch a crypto token on PancakeSwap. You can set your own tokenomics, fundraising goals (minimum ~$2,000), and liquidity pools. The bonding curve model helps automatically adjust price based on demand.

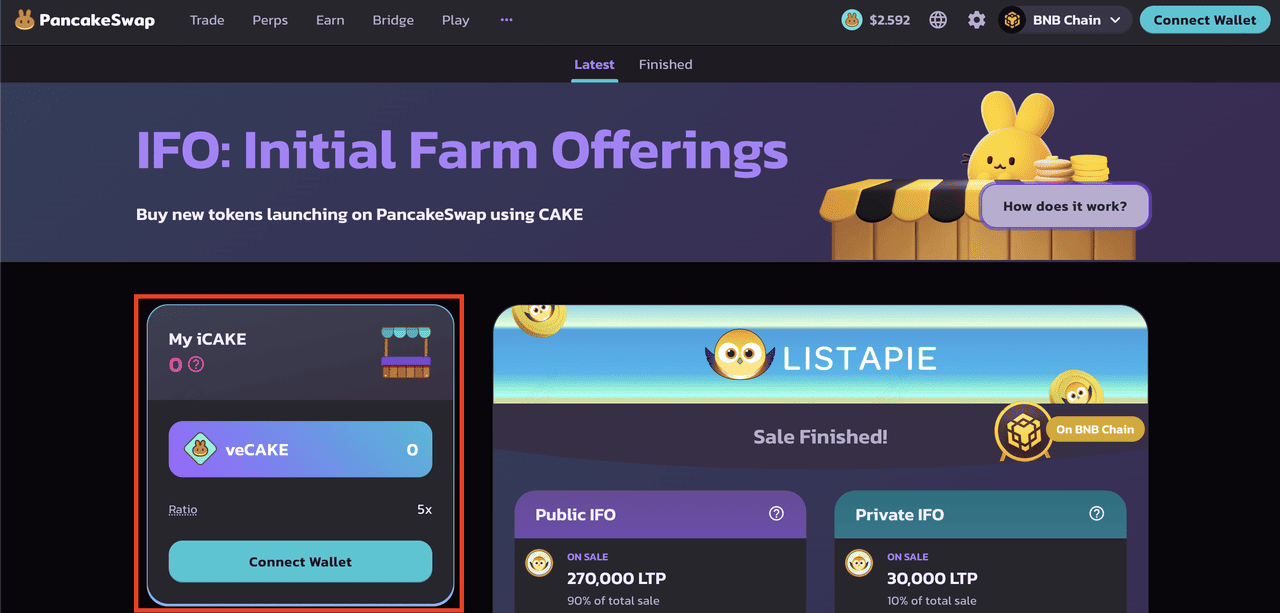

8. Access Early Tokens with IFOs

Initial Farm Offerings (IFOs) let users buy new tokens before they launch publicly. To participate, create a PancakeSwap profile (cost: 1 CAKE), stake CAKE to earn iCAKE, and use it to buy IFO tokens. All proceeds are burned, making IFOs deflationary for the CAKE supply.

9. Buy and Sell NFTs

PancakeSwap features an NFT marketplace on the BNB Chain where you can trade collectibles and art. Creators earn royalties from each sale, and buyers pay a 2% platform fee in wrapped BNB (wBNB). It’s a low-fee, community-driven way to explore NFTs without leaving the DEX.

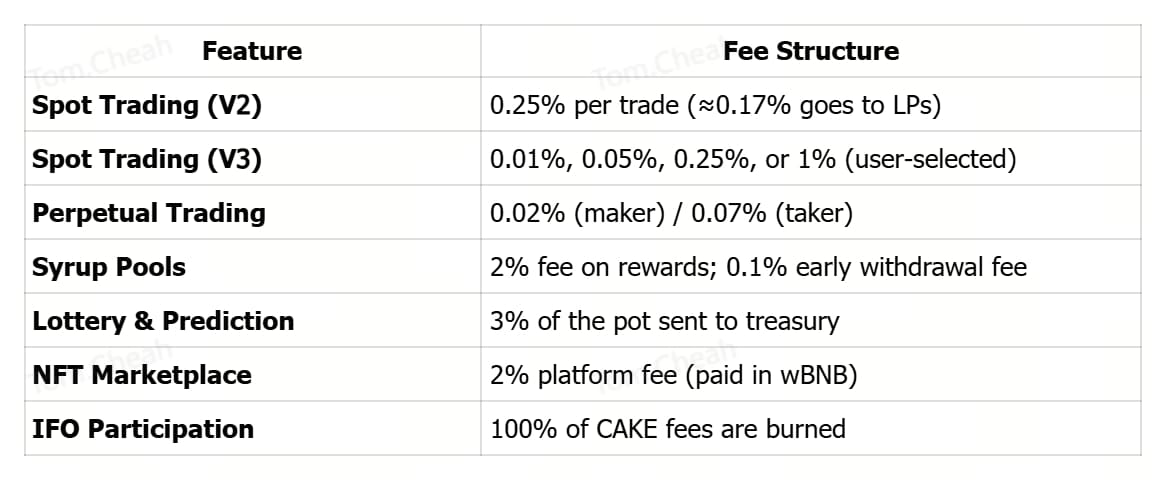

PancakeSwap Fees at a Glance

How PancakeSwap Works

PancakeSwap may look simple on the surface, but behind the scenes, it’s powered by an advanced and highly optimized trading engine. It uses smart contracts and algorithmic routing to ensure your crypto trades are fast, low-cost, and always searching for the best price. Here’s a closer look at how it all works:

1. Token Swaps with Smart Router V3

At the heart of PancakeSwap’s trading system is Smart Router V3, an algorithm that automatically finds the most efficient route to execute your trade.

• When you initiate a token swap (e.g., BNB → USDT), the Smart Router checks across multiple liquidity pools, including V2, V3, StableSwap, and market makers, to give you the best rate with the lowest slippage.

• It also supports multi-hop routing, meaning it can break your trade into multiple steps (e.g., BNB → CAKE → USDT) if that results in better pricing.

• For power users, Smart Router offers a “Customize Routing” interface, where you can select or exclude specific liquidity sources and toggle features like multi-hop and split routing.

Why it matters: This smart routing system helps protect users, especially during volatile markets, by avoiding poor price execution and reducing costs. As of 2025, Smart Router V3 is the default path for over 70% of swaps on PancakeSwap.

2. PancakeSwap Infinity & Developer Hooks

Launched in April 2025, PancakeSwap Infinity is a major protocol upgrade that brings unmatched efficiency and customization to decentralized trading.

Key innovations include:

• Singleton Architecture: Instead of deploying a new smart contract for every liquidity pool, Infinity stores all pools in a single contract, called the PoolManager. This reduces gas fees on pool creation by up to 99%.

• Flash Accounting: Optimizes gas by consolidating all token transfers into a single transaction. Ideal for multi-hop swaps and large-scale liquidity moves.

• Native Token Support: Enables direct trading with tokens like

BNB or

ETH; no need to wrap them first (e.g., WBNB or WETH).

• ERC-6909: A next-gen token standard used internally for faster and cheaper transaction processing across multiple assets.

But Infinity doesn’t stop there. It introduces Hooks, modular plugins for liquidity pools.

What Hooks Can Do

• Apply dynamic fees based on market volatility

• Add custom logic for limit orders, rebates, or TWAMM-style trades

• Allow automated LP management, such as auto-adjusting positions based on price changes

As of Q2 2025, over 40% of new pools launched on PancakeSwap use Infinity, and developers have created more than 150 custom hook contracts to enhance user trading strategies.

3. Multi-Chain Integration

PancakeSwap has grown beyond its roots on BNB Chain to become a full-fledged multi-chain DeFi hub. From a single interface, you can now trade, stake, farm, and launch tokens across major networks like BNB Chain (known for low fees and deep liquidity), Ethereum (home to top ERC-20 assets), Base (Coinbase-backed Layer-2), Arbitrum (DeFi-optimized Layer-2), and Solana (ultra-fast with near-zero gas costs). It also supports zkSync Era, Polygon, and opBNB for select features. Thanks to cross-chain swaps powered by

Across Protocol, you can move assets between chains in under a minute, no third-party bridges required.

Example: Want to swap ETH on Base for

USDT on Arbitrum? PancakeSwap handles the bridge + trades in one click.

What Is CAKE, PancakeSwap’s Native Token?

CAKE is the utility and governance token that powers the entire PancakeSwap ecosystem. Whether you’re trading tokens, farming yields, staking assets, or voting on protocol decisions, CAKE plays a central role. It was launched alongside PancakeSwap in 2020 and has since evolved through several major tokenomics upgrades to improve sustainability, reduce inflation, and strengthen community governance.

CAKE Token Utility: What Can You Do with $CAKE?

Beyond being a reward token, CAKE is deeply integrated into nearly every product on PancakeSwap. Here's how it's used:

• Earn Rewards: Stake CAKE in Syrup Pools or use it to farm yield from liquidity pairs.

• Participate in Token Launches: Lock CAKE to receive iCAKE and access Initial Farm Offerings (IFOs).

• Enter Games: Use CAKE to buy lottery tickets and place predictions on BNB and ETH price movements.

• Governance Voting: CAKE holders vote on proposals that shape PancakeSwap’s future, including feature updates, fee structures, and product launches.

• Discounts & Perks: Future features may include reduced trading fees and hook-based rewards for CAKE holders in the Infinity protocol.

CAKE Governance: Your Vote Matters

Before 2025, governance was based on veCAKE, a model requiring users to lock CAKE for voting power. Under Tokenomics 3.0, this has been simplified:

• Direct Voting: All CAKE holders now have equal voting rights, no staking or locking required.

• Proposal Threshold: You must hold at least 100,000 CAKE to submit a community proposal.

• Vote Rights: The PancakeSwap Core Team retains emergency powers to pause smart contracts or override gauge votes for protocol safety.

This governance model ensures that active community members can shape PancakeSwap’s direction while maintaining safeguards for the ecosystem’s stability.

CAKE Tokenomics: Supply, Emissions & Allocation

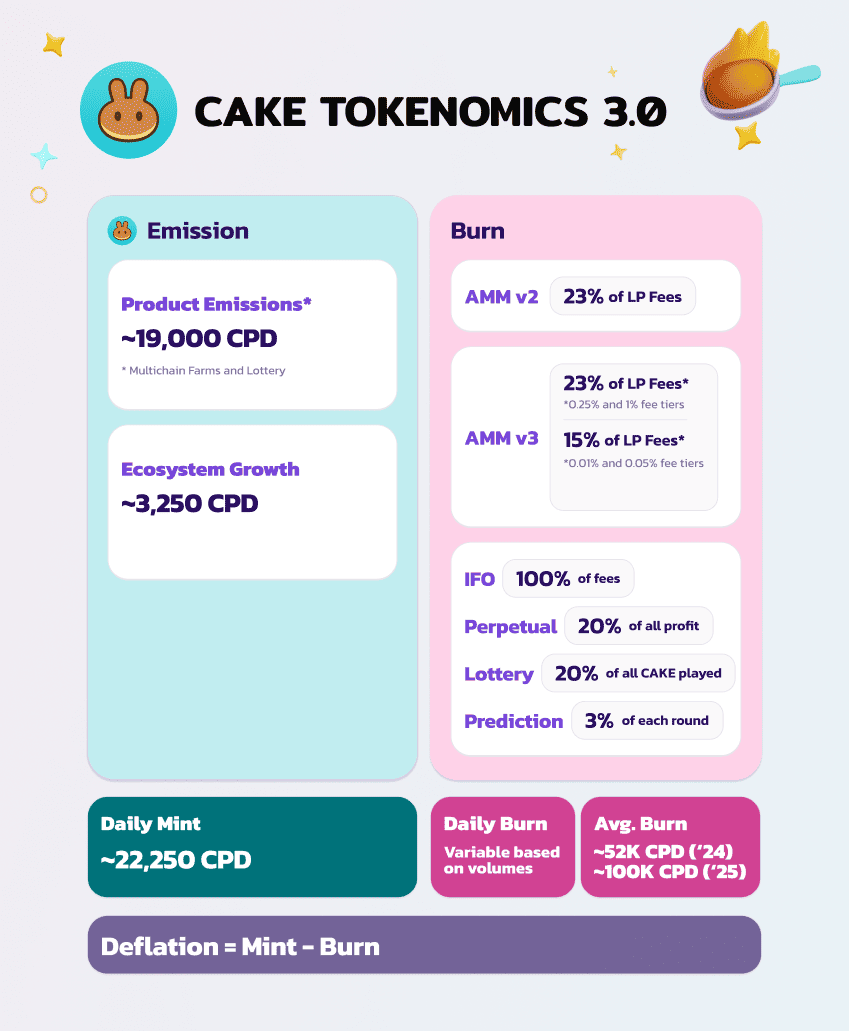

CAKE Tokenomics 3.0 | Source: PancakeSwap docs

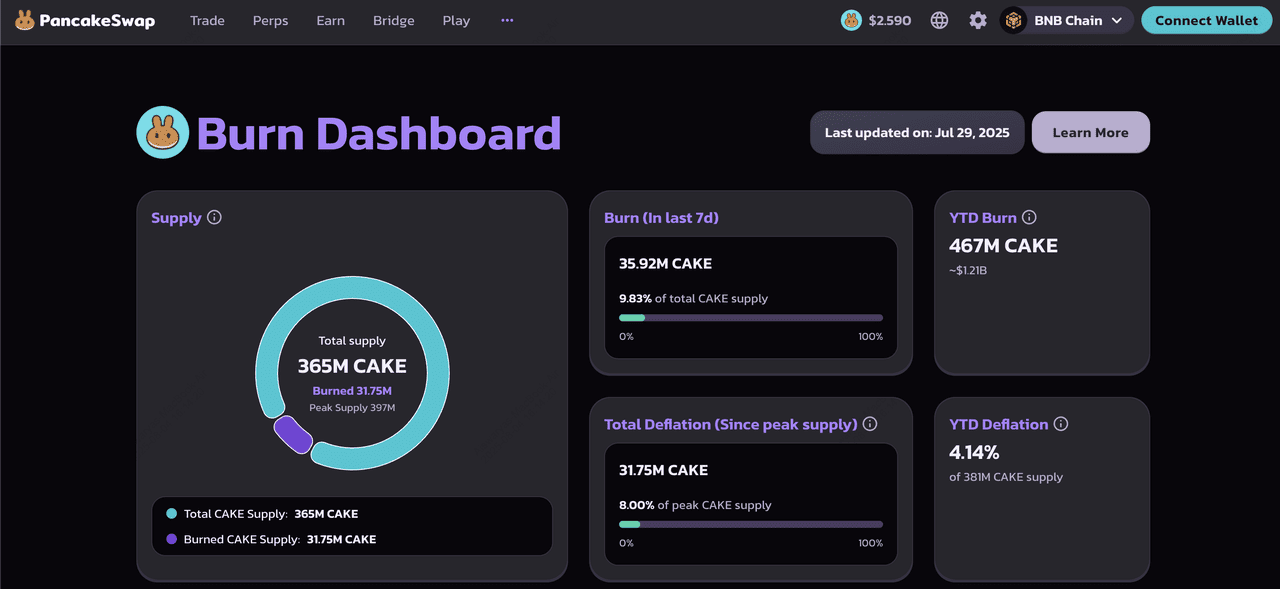

In April 2025, PancakeSwap launched Tokenomics 3.0 to address inflation concerns and improve long-term sustainability. PancakeSwap has reduced the maximum supply of CAKE from 750 million to 450 million, aiming to make the token more scarce and valuable over time. As of mid-2025, the circulating supply is around 321 million CAKE, or approximately 71% of the cap, with daily emissions limited to ~22,250 CAKE. Under its deflationary model, PancakeSwap targets a ~4% annual reduction in supply, with a long-term goal of cutting total supply by 20% by 2030.

This means PancakeSwap is gradually reducing new token issuance while increasing the number of tokens burned, creating a deflationary effect over time.

CAKE Burn Mechanics: How Tokens Are Destroyed

Instead of relying solely on minting incentives, PancakeSwap has integrated a buyback-and-burn model into its revenue streams. This means CAKE is regularly purchased from the open market using platform-generated fees and permanently burned (removed from circulation).

Here’s how CAKE is burned:

• Spot Trading Fees: 15% – 23% of fees are burned

• Perpetual Futures Profits: 20% of profits are burned

• IFO Participation Fees: 100% of fees are burned

• Prediction & Lottery Rounds: 3% of each round’s prize pool is burned

June 2025 Highlight: PancakeSwap burned ~2.6 million more CAKE than it minted during the month, demonstrating strong platform-driven deflation.

Start trading CAKE tokens today on the

BingX Spot Market with real-time pricing, low fees, and smart insights powered by

BingX AI to help you make informed decisions.

How to Use PancakeSwap: A Step-by-Step Guide

New to PancakeSwap? Follow these simple steps to start swapping tokens, earning rewards, and exploring DeFi, no account or KYC needed.

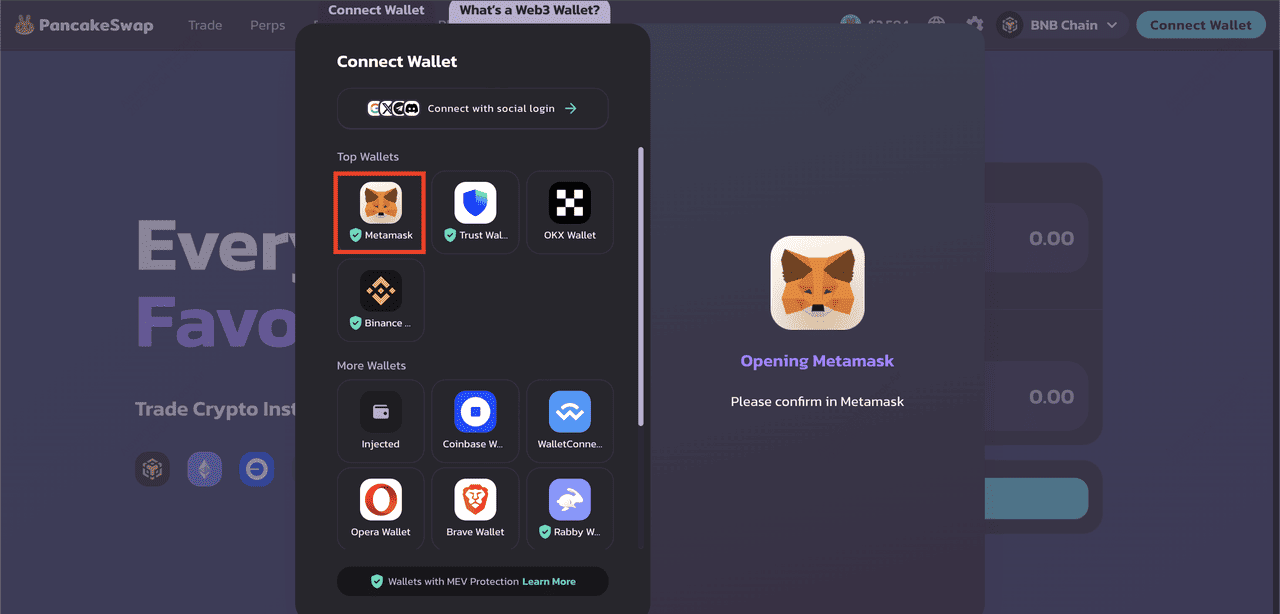

1. Set Up a BNB Wallet: To get started with PancakeSwap, first install a crypto wallet that supports the BNB Smart Chain. Popular options include

MetaMask (browser and mobile),

Trust Wallet, SafePal, or TokenPocket. Once installed, make sure to back up your recovery phrase securely, as it grants full access to your wallet and funds.

2. Add the BNB Chain: Most wallets are set to Ethereum by default, so you’ll need to switch to the BNB Smart Chain network. In MetaMask, you’ll need to manually add BNB Chain by entering the network details. In Trust Wallet, simply toggle on BNB Smart Chain from the list of available networks.

3. Fund Your Wallet: Next, transfer crypto to your wallet by either withdrawing from a centralized exchange like BingX. Buy BNB or USDT and choose the BEP-20 (BNB Chain) network, or by using a cross-chain bridge. PancakeSwap’s built-in Crosschain Swap lets you move assets from networks like Ethereum or Base directly to BNB Chain in just a few clicks.

Note: Keep a small amount of BNB for gas fees.

4. Connect Your Wallet: Visit

pancakeswap.finance → click

Connect Wallet → choose your wallet provider → approve the prompt.

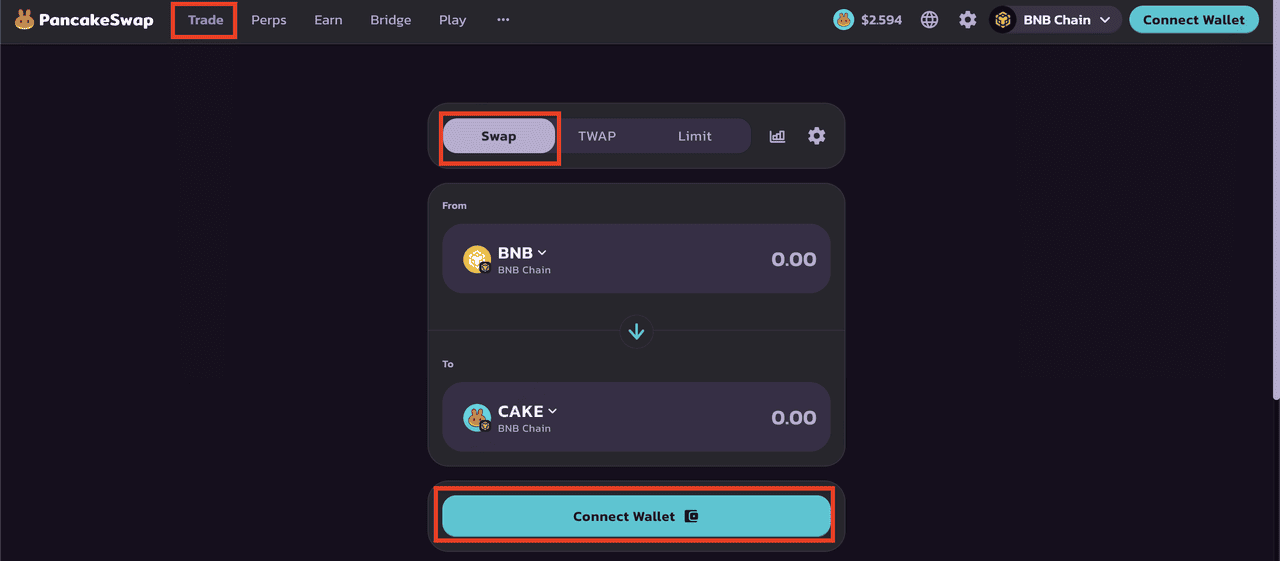

5. Swap Tokens: Use the Swap tab to trade tokens:

• Select a token pair (e.g., BNB → USDT)

• Enter the amount

• Adjust slippage if needed

• Smart Router V3 will auto-route for best pricing

• Confirm the trade in your wallet

6. Farm or Stake to Earn: Once you’ve swapped tokens, you can start earning by either farming or staking. In Farms, you provide liquidity by depositing token pairs like CAKE/BNB, receive LP (liquidity provider) tokens, and stake them to earn CAKE rewards. Alternatively, Syrup Pools let you stake CAKE directly to earn more CAKE or partner project tokens, without the risk of impermanent loss.

7. Explore More Features: Beyond earning, PancakeSwap offers a variety of interactive features. Try your luck in the Lottery (around $5 per ticket), or make short-term price predictions on CAKE or BNB to win rewards. Builders can launch tokens on SpringBoard, PancakeSwap’s no-code token platform, while early adopters can participate in new token sales through Initial Farm Offerings (IFOs). There's also an NFT Marketplace where users can trade collectibles and creators can earn royalties.

Beyond PancakeSwap: Alternative Options

PancakeSwap sets itself apart from other decentralized exchanges like Uniswap with its lower fees, multi-chain access, and strong support for BNB Chain users. However, centralized platforms like BingX remain popular alternatives, especially for beginners who prefer a streamlined trading experience with fiat deposits,

KYC security, and responsive customer support. While these platforms offer easier onboarding and advanced trading tools, PancakeSwap appeals more to users who prioritize self-custody, on-chain rewards, and a fully decentralized DeFi experience. BingX, in particular, provides a good middle ground with integrated spot,

futures, and

copy trading options, making it a flexible choice for users not yet ready to dive into DeFi.

What Are the Pros and Cons of PancakeSwap?

Before diving in, it’s helpful to understand the key advantages and potential trade-offs of using PancakeSwap as your go-to DeFi platform.

Pros

• Full Control Over Your Crypto: You keep custody of your assets at all times, no account or KYC required.

• Low Fees: Trading fees are much cheaper than centralized exchanges, starting from as low as 0.01% with V3 pools.

• Multi-Chain Access: Trade on multiple blockchains like BNB Chain, Ethereum, Solana, and Base from one interface.

• Wide Range of DeFi Features: From token swaps and staking to IFOs, NFTs, and predictions, everything is built in.

• Security Focus: PancakeSwap is regularly audited by firms like CertiK and offers a public bug bounty program for added protection.

Cons

• No Native Bitcoin Support: You can’t trade BTC directly, only wrapped versions like wBTC.

• May Confuse Beginners: The interface includes advanced tools that can overwhelm first-time DeFi users.

• No Standalone Mobile App: Access is browser-based or through wallet dApps; there’s no dedicated PancakeSwap app.

• Limited Customer Support: There’s no live support team; most help comes from community forums or FAQs.

• Impermanent Loss Risk: Providing liquidity in pools can lead to losses if token prices shift significantly.

Conclusion

PancakeSwap delivers a feature-rich DeFi experience, offering seamless token swaps, staking, yield farming, and token launches across multiple blockchains. With its continued expansion, deflationary CAKE tokenomics, and innovations like Infinity and Hooks, PancakeSwap remains one of the most versatile and cost-efficient DEX platforms in 2025.

However, it’s important to use caution. DeFi involves risks such as impermanent loss, smart contract vulnerabilities, and price volatility. Make sure to understand how each feature works and never invest more than you can afford to lose.

Related Reading

FAQs on PancakeSwap

1. What is PancakeSwap used for?

PancakeSwap is a decentralized exchange (DEX) that lets users swap tokens, provide liquidity, earn yields, and participate in DeFi tools like prediction markets, lotteries, NFT trading, and token launches, all without needing a centralized intermediary.

2. Is PancakeSwap safe to use?

PancakeSwap is open-source and regularly audited, with a strong track record since its 2020 launch. However, like all DeFi platforms, it carries risks such as smart contract bugs, impermanent loss, and market volatility, so always use caution and manage risk wisely.

3. What blockchain networks does PancakeSwap support?

As of 2025, PancakeSwap supports BNB Chain, Ethereum, Base, Arbitrum, Solana, zkSync Era, Polygon, and opBNB, allowing users to interact with assets across multiple chains through a unified interface and cross-chain swaps.

4. What is the CAKE token used for?

CAKE is the native utility token of PancakeSwap. It’s used for staking, yield farming, IFO participation, governance voting, and can also be used to pay for certain platform fees. CAKE features a deflationary supply model with regular token burns to reduce circulation. You can also trade CAKE tokens on the BingX Spot Market, where BingX AI provides real-time insights and low-fee execution for smarter trading.

5. How do I start using PancakeSwap?

To start, install a BNB Chain-compatible wallet like MetaMask or Trust Wallet, connect it to PancakeSwap, and fund it with crypto such as BNB or USDT. You can then begin swapping tokens, staking in Syrup Pools, or exploring advanced features like SpringBoard and perpetuals.

6. Does PancakeSwap have a mobile app?

No, PancakeSwap does not have a standalone mobile app. Instead, users access PancakeSwap through wallet apps that include a built-in dApp browser, such as Trust Wallet, SafePal, or TokenPocket, enabling full DeFi functionality directly from your smartphone or tablet.

7. Do I need to complete KYC (Know Your Customer) to use PancakeSwap?

No, PancakeSwap is fully decentralized and permissionless, so no KYC or user identification is required to swap tokens, stake CAKE, participate in IFOs, or explore any of its features. You just need a compatible wallet and some assets to get started.