The rise of artificial intelligence (AI) has propelled NVIDIA (NASDAQ: NVDA) into the spotlight as one of the most valuable and innovative companies in the world. Known for its cutting-edge GPUs and AI solutions, NVIDIA’s stock has surged over the past few years, attracting both institutional investors and retail traders. However, high share prices and restrictions in traditional stock markets can make it difficult for global investors to participate directly.

This challenge is being addressed by the

tokenization of real-world assets (RWAs), a trend that uses blockchain technology to create digital tokens representing traditional assets like stocks, real estate, and commodities. Tokenized stocks in particular are gaining popularity because they allow 24/7 trading, fractional ownership, and seamless integration with crypto portfolios. Well-known examples include

Apple (AAPLX) and

Tesla (TSLAX), both of which give traders exposure to their stock prices without the limitations of conventional brokerage accounts.

Following the same approach,

Nvidia tokenized stock (NVDAX) offers a tokenized version of NVIDIA stock that mirrors NVDA’s market performance while providing the flexibility of crypto trading. For investors who believe in NVIDIA’s long-term growth story but prefer trading through blockchain, NVDAX opens a new way to gain exposure. In this guide, we’ll explore what NVDAX is, how it works, how it differs from traditional stocks, and what you should consider before adding it to your portfolio.

What Is NVIDIA?

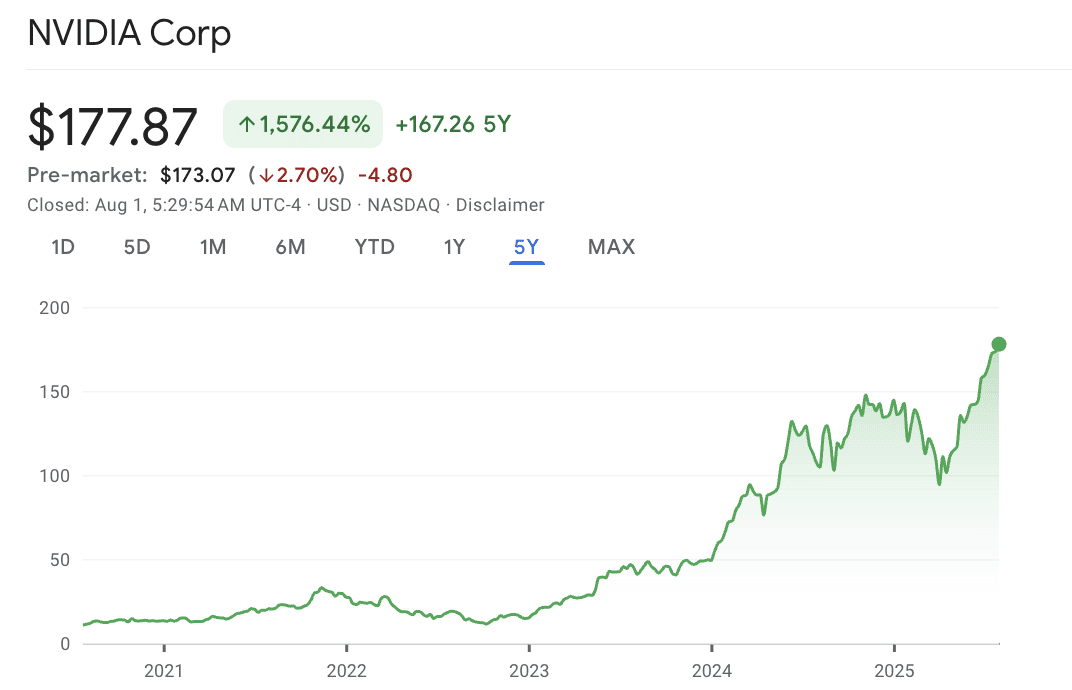

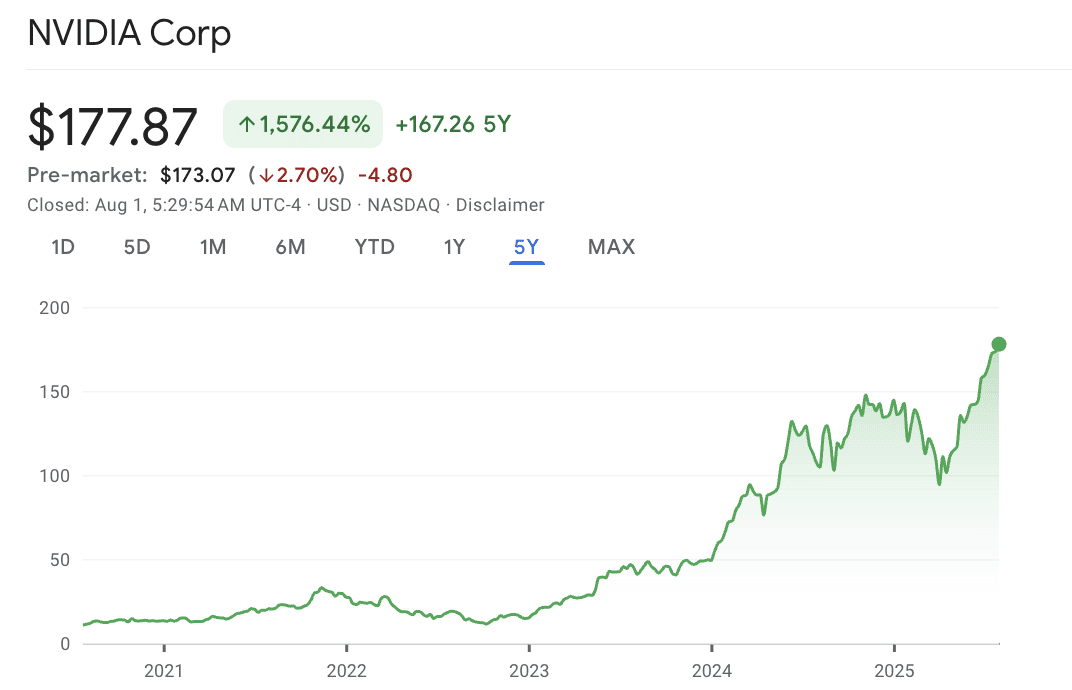

NVIDIA’s stock price has increased by 1,576% over the past five years | Souce: Google Finance

NVIDIA Corporation has become the undisputed leader of the AI revolution, transforming from a gaming graphics company into one of the most influential tech giants of the decade. Founded in 1993, NVIDIA now powers everything from ChatGPT to autonomous vehicles, making it nearly impossible to talk about artificial intelligence without mentioning the company. Its meteoric rise has captured headlines and dominated conversations across Wall Street and social media alike.

The growth numbers speak for themselves. Over the past five years, NVIDIA’s stock price has increased by 1,576%, cementing its reputation as one of the top-performing equities in global markets. In fiscal 2025, the company reported $130.5 billion in revenue, up 114% year-over-year, while its stock gained over 25% year-to-date after soaring 171% in 2024. In July 2025, NVIDIA became the first public company to hit a $4 trillion market cap. Major tech players such as OpenAI, Google, Microsoft, and Meta rely heavily on its chips, with data center revenue alone reaching $39.1 billion in Q1 2025, a 73% increase from the previous year.

NVIDIA’s GPUs now power not just gaming computers, but also data centers, AI models, autonomous vehicles, and even cryptocurrency mining. Its core business spans data centers, gaming, professional visualization, automotive technologies, and blockchain applications. This extraordinary growth and market dominance make NVIDIA stock a prime target for both traditional investors and those seeking exposure through innovative products like tokenized stocks.

What Are Tokenized Stocks or xStocks?

Tokenized stocks are blockchain-based versions of traditional equities. Each token represents the real-time price of a publicly traded stock and is typically backed 1:1 by actual shares held in regulated custody. This setup allows investors to gain exposure to companies like NVIDIA, Apple (AAPLX), and

S&P 500 (SPYX) directly through a crypto wallet, without needing a traditional brokerage account.

By merging the familiarity of conventional stocks with the advantages of digital assets, tokenized stocks offer several benefits. They can be traded around the clock, bypassing stock market hours, and support fractional ownership, allowing users to start investing with small amounts. This flexibility makes them an appealing option for traders looking to diversify their portfolios in a crypto-native way.

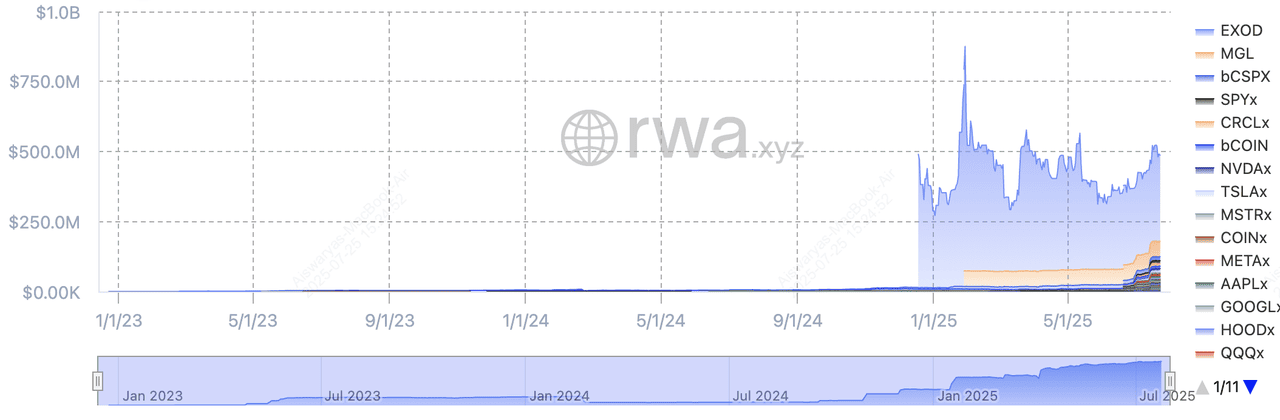

Tokenized stocks' TVL | Source: RWA.xyz

Among the leading products in this space is xStocks, issued by Backed Finance. These tokens are fully collateralized, backed by real shares held by a licensed custodian, and designed to mirror the price movements of the underlying equities. Their transparency and accessibility have fueled strong growth: as of July 2025, tokenized stocks have a

total value locked (TVL) of $487 million, up over 20% since June, with Backed Finance commanding 77% of the market.

What Is NVDAX NVIDIA Tokenized Stock and How Does It Work?

NVDAX offers traders a dynamic way to invest in NVIDIA, a company at the heart of the AI revolution and one of the most valuable tech giants in history. NVIDIA’s stock (NASDAQ: NVDA) has consistently posted record-breaking performance, trading at around $1300 per share in mid-2025 after gaining more than 25% year-to-date, following an astonishing 171% surge in 2024. On traditional markets, NVIDIA ranks among the most actively traded stocks, often generating tens of billions of dollars in daily trading volume as investors worldwide seek exposure to its AI-driven growth. These strong fundamentals and high liquidity make NVIDIA an ideal candidate for tokenization, as its price action is both highly liquid and closely watched by global markets.

As a tokenized version of NVIDIA stock, NVDAX mirrors the real-time value of NVDA while removing many barriers found in conventional trading. It allows 24/7 access, supports fractional ownership, and settles instantly through cryptocurrencies like USDT. With NVDAX, traders do not need a brokerage account or large capital to invest. Instead, they can participate in NVIDIA’s price movements directly through a crypto wallet, at any time of the day.

NVDAX is typically backed 1:1 by actual NVIDIA shares held in regulated custody, ensuring that its value stays aligned with the underlying stock. By combining the market appeal of a high-performing equity with the flexibility of blockchain, NVDAX provides investors with a powerful alternative to traditional stock trading. For those looking to capture NVIDIA’s momentum while leveraging the advantages of digital assets, NVDAX stands out as a compelling choice.

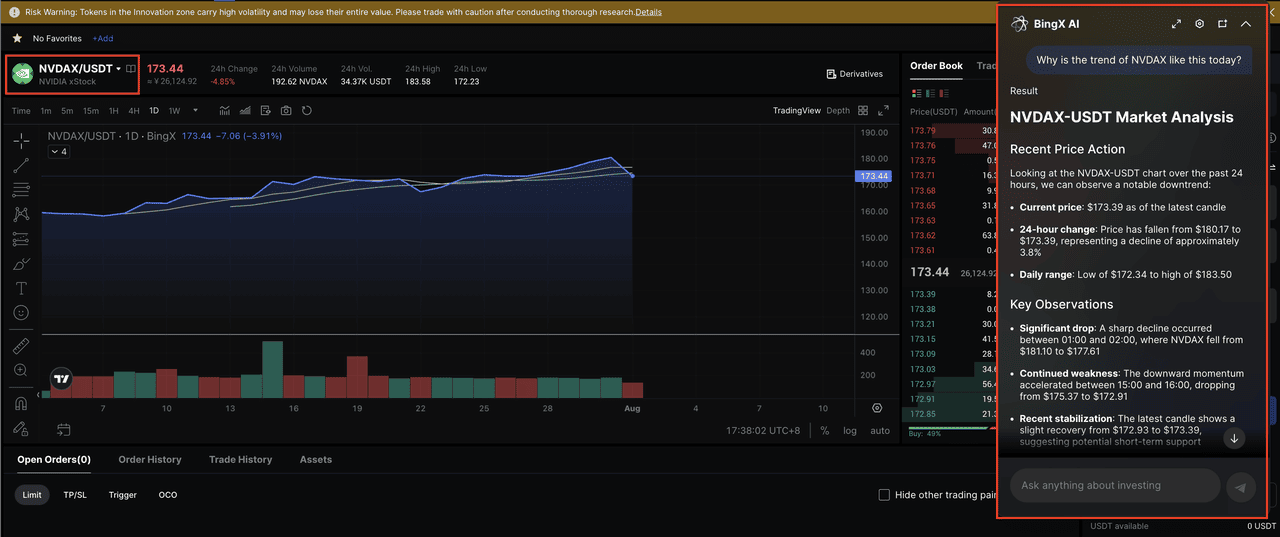

Tokenized Stock Mirroring the Price in Stock Market | Source: BingX

NVDAX & CNBC

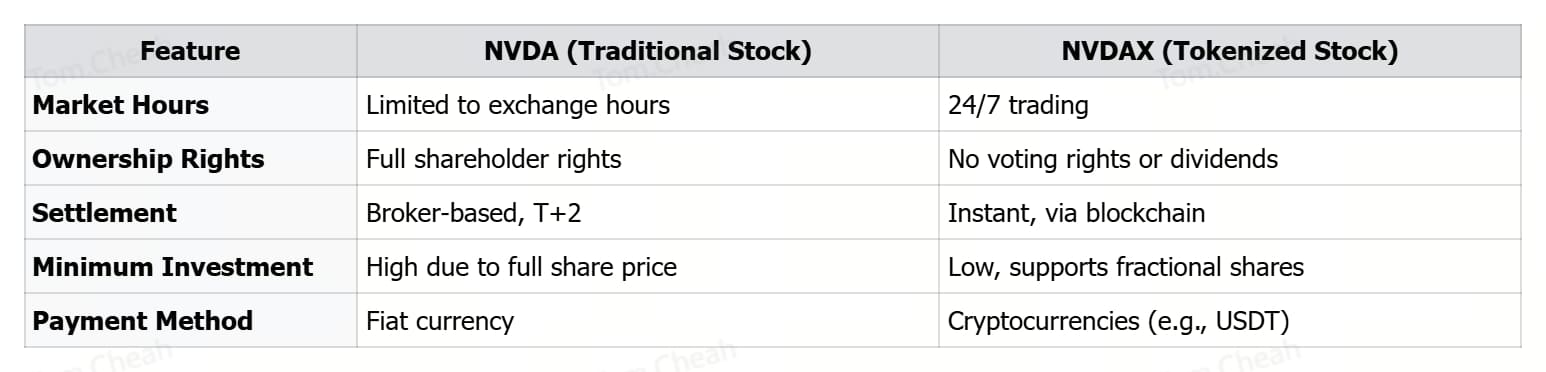

What’s the Difference Between Trading NVIDIA Stocks and Tokenized Stocks?

Both traditional NVIDIA shares (NVDA) and the tokenized version NVDAX track the same underlying asset, but the trading experience is very different. Traditional stocks trade on regulated exchanges like NASDAQ, which operate within fixed hours and require a brokerage account. Settlements take a couple of days to clear, and investors typically need to buy whole shares to participate. While this offers full ownership rights, including dividends and voting, it also creates barriers for smaller investors and those outside the U.S. markets.

Tokenized stocks like NVDAX take a different approach. They live on the blockchain, enabling 24/7 trading and instant settlements. Instead of going through brokers, traders can use a simple crypto wallet to buy or sell at any time. NVDAX also supports fractional ownership, allowing users to invest in NVIDIA with only a small amount of capital. However, these tokens generally do not come with shareholder rights or dividends.

The table below summarizes the key differences between NVDA and NVDAX:

These differences make NVDAX an appealing alternative for traders who value flexibility, global accessibility, and lower barriers to entry while still gaining exposure to NVIDIA’s market performance.

How to Trade NVDAX on BingX

NVDAX is available on both BingX spot market and perpetual futures market, giving traders an easy way to buy and sell NVIDIA’s tokenized stock. Whether you are building a long-term position or taking advantage of short-term price swings,

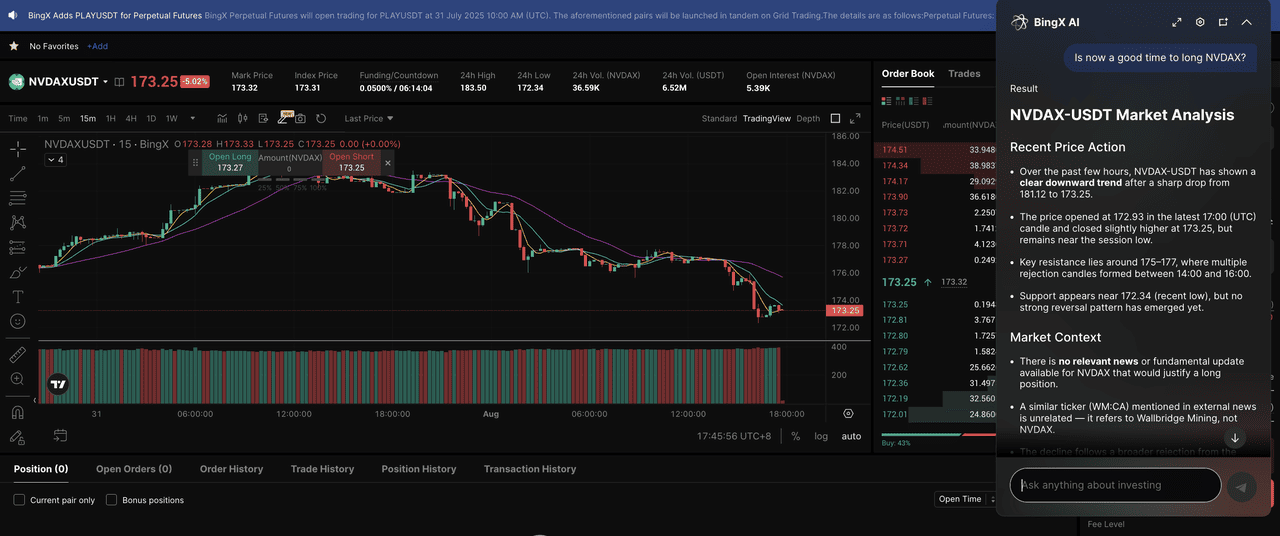

BingX AI provides real-time market analysis to help you trade with more confidence.

Step 1: Search for NVDAX/USDT on Spot Market or Perpetual Futures Market

For Spot Trading

Go to the

Spot Market on BingX and enter

NVDAX/USDT in the search bar. You can place a market order to buy instantly at the current price or set a limit order if you prefer to wait for your target entry. Spot trading is ideal for those looking to build a long-term position in NVDAX or simply buy and hold.

For Perpetual Futures Trading

If you are an experienced trader who wants to speculate on short-term price movements, you can head to the

Perpetual Futures Market. Enter

NVDAX/USDT to access the trading pair. Perpetual futures allow you to go long or short on NVDAX without an expiration date, offering more flexibility in capturing price swings. Remember to manage your risk carefully, as futures trading can amplify both gains and losses.

Source:

NVDAX/USDT Perpetual Futures Market on BingX

Step 2: Activate BingX AI for Real-Time Market Analysis

Click the AI icon on the chart to activate BingX AI. The tool will scan price movements, identify key support and resistance levels, and highlight the current trend, giving you a clearer view of market conditions.

Step 3: Plan Your Trades with AI Insights

Use BingX AI’s analysis to find better entry points, spot potential reversals, and adjust your strategy based on NVIDIA-related news or broader market developments. By monitoring how buy orders cluster around critical levels, you can avoid chasing rapid price spikes.

Because NVDAX tracks the performance of NVIDIA stock, staying updated on NVDA earnings, AI industry news, and overall market sentiment can further improve your trading decisions.

Key Considerations Before Investing in NVDAX

While NVDAX provides a convenient way to gain exposure to NVIDIA’s price movements, traders should be aware of several important factors before investing:

1. Regulatory Environment: Tokenized stocks operate in a regulatory gray area in many regions. They may not offer the same investor protections as traditional stocks, and regulations can vary widely by jurisdiction.

2. Custody and Backing: Most tokenized stocks, including NVDAX, are backed 1:1 by real shares held by a licensed custodian. Always verify that the platform you use clearly discloses its custody arrangements.

3. Liquidity Differences: NVIDIA’s traditional stock is highly liquid, but NVDAX liquidity depends on the trading volume of the crypto exchange where it is listed. Lower liquidity can lead to wider spreads and higher slippage.

4. Ownership Rights: Unlike NVDA shares, NVDAX does not grant shareholder rights such as voting or dividends. It is designed purely to mirror the stock’s price performance.

5. Market Volatility and Risks: Although NVDAX follows NVDA’s price, crypto markets can introduce additional volatility due to exchange dynamics and investor sentiment. Proper risk management is essential when trading.

Being aware of these considerations can help you use NVDAX more effectively as part of your trading or investment strategy.

Final Thoughts: Should You Buy NVIDIA xStock (NVDAX)?

NVDAX offers a modern way to gain exposure to NVIDIA, a company that has become the face of the AI boom and a dominant force in global markets. With its rapid growth, high trading volumes, and central role in powering AI technologies, NVIDIA remains one of the most sought-after assets among investors. Tokenizing this stock gives traders the opportunity to participate in its price performance with greater flexibility.

Through 24/7 trading, fractional investment, and direct access via a crypto wallet, NVDAX removes many of the barriers found in traditional stock trading. However, it is important to weigh the considerations, such as regulatory uncertainties, lower liquidity compared to NVDA on NASDAQ, and the lack of shareholder rights.

For investors who believe in NVIDIA’s long-term trajectory and want the added convenience of blockchain markets, NVDAX can be a smart addition to a diversified portfolio. As tokenized stocks gain traction, products like NVDAX are likely to become an increasingly important part of how people invest in the world’s leading companies.

Related Reading