Linea, a cutting‑edge zkEVM

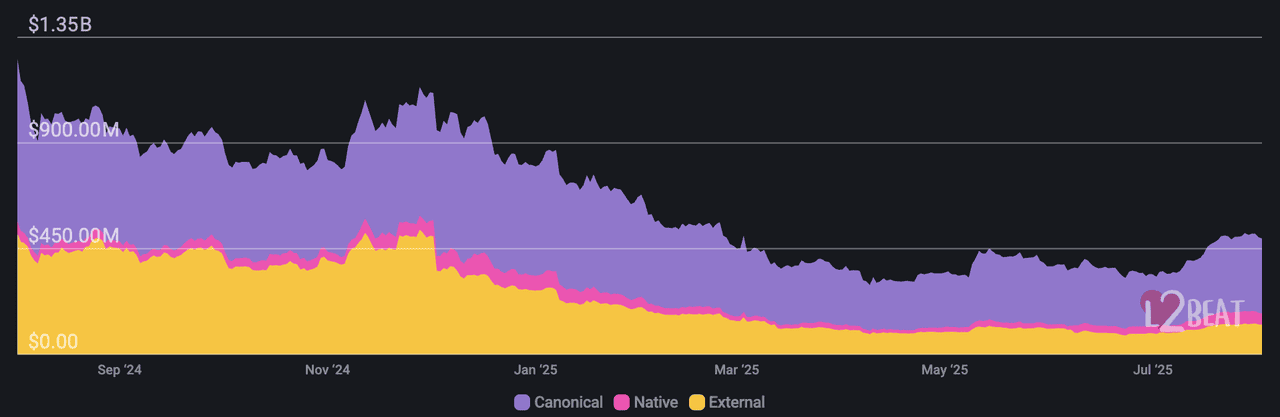

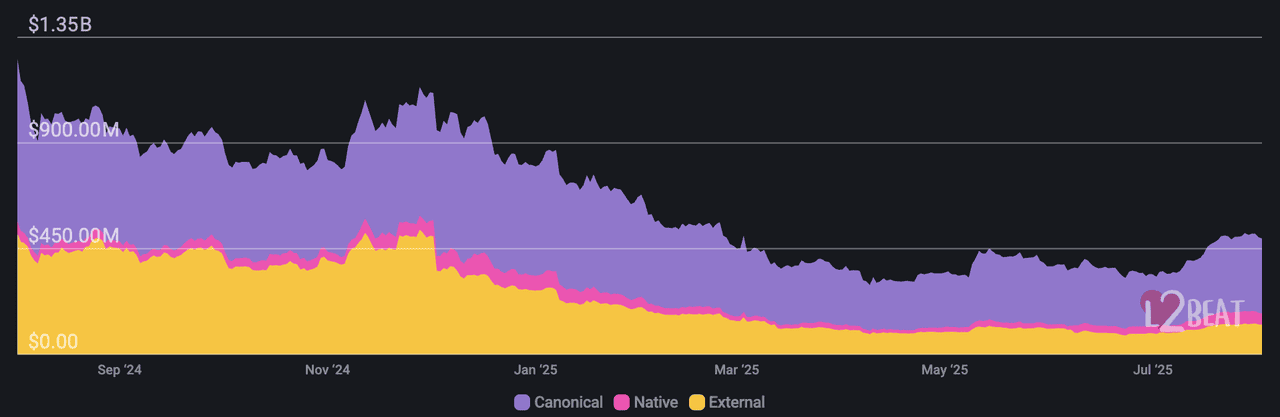

Ethereum Layer‑2 network developed by ConsenSys, is finally approaching its long‑awaited Token Generation Event (TGE) scheduled for Q3 2025. With over $500 million in total value secured (TVS), seamless Ethereum compatibility, and deep

MetaMask integration, anticipation is mounting, especially around what price it may debut at on exchanges like BingX.

This article explores Linea's tokenomics, factors driving the possible $LINEA listing price, compares market forecasts, and outlines what could make the token succeed, or stall, post‑listing.

What Is Linea Layer-2 Blockchain and Why Does It Matter?

Linea TVL | Source: L2Beat

Linea is a fully EVM‑equivalent zk‑rollup Layer‑2 built by ConsenSys, offering

Ethereum‑level security with low gas fees (~$0.0014 per transaction), high throughput, and near‑instant withdrawals, eliminating the delays found in optimistic rollups. Launched in July 2023, it secured upwards of $500M in TVS by mid‑2025 and supports a robust ecosystem powered by MetaMask, Infura, and major DeFi apps.

As of August 2025, Linea is still in Stage 0 of decentralization, with a roadmap toward sequencer decentralization, governance participation, and trustless finality. Its native $LINEA token will enable governance, staking opportunities, fee discounts, and ecosystem incentives for users and builders.

What Is the LINEA Token Utility?

The $LINEA token is designed as an economic coordination tool, not a governance or gas token. It exists to reward real usage, support Ethereum-aligned builders, and fund public goods across the Linea and Ethereum ecosystems. Here's how LINEA is used within its unique design framework:

1. Ecosystem Incentives and Grants: LINEA is distributed to users, developers, liquidity providers, and ecosystem contributors as a reward for participating in Linea’s growth. This includes airdrop allocations (e.g., LXP), liquidity mining programs, application development, and milestone-based grants for mission-aligned projects.

2. Public Goods Funding: A portion of the token supply, managed by the Linea Ecosystem Fund (LEF), is dedicated to funding Ethereum public goods, open-source infrastructure, research, and long-term ecosystem sustainability. This aligns Linea’s success with the broader Ethereum network.

3. Fee Burn Model for Value Accrual: While ETH is used as gas on Linea, the protocol burns 80% of net ETH revenue (after L1 costs) to buy and burn LINEA tokens. This mechanism ties LINEA’s value directly to real network usage and reduces its total supply over time.

4. Staking and Liquidity Support (Future Potential): Although Linea currently operates with centralized sequencing, future stages of decentralization may introduce staking-like roles or incentives using LINEA for validators, relayers, or community-run infrastructure. Additionally, LINEA may be used as liquidity on DEXs or CEXs to support smoother trading and adoption.

It’s important to note that LINEA is not used for gas payments. All transaction fees on the network are paid in ETH. Additionally, there is no on-chain governance for LINEA holders; instead, key decisions are made by the Linea Consortium, a council of Ethereum-aligned stewards. Finally, LINEA is earned through meaningful participation, such as using dApps or contributing to the ecosystem, rather than through capital investment or speculation.

$LINEA Tokenomics: What Is the LINEA Token Allocation?

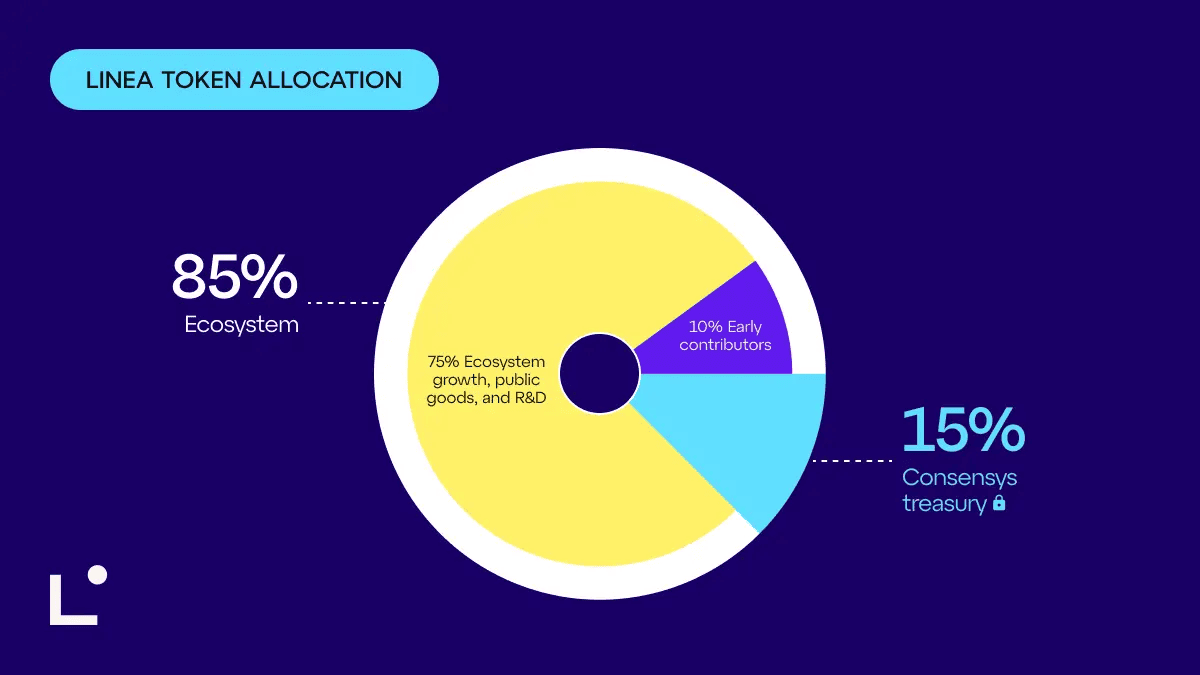

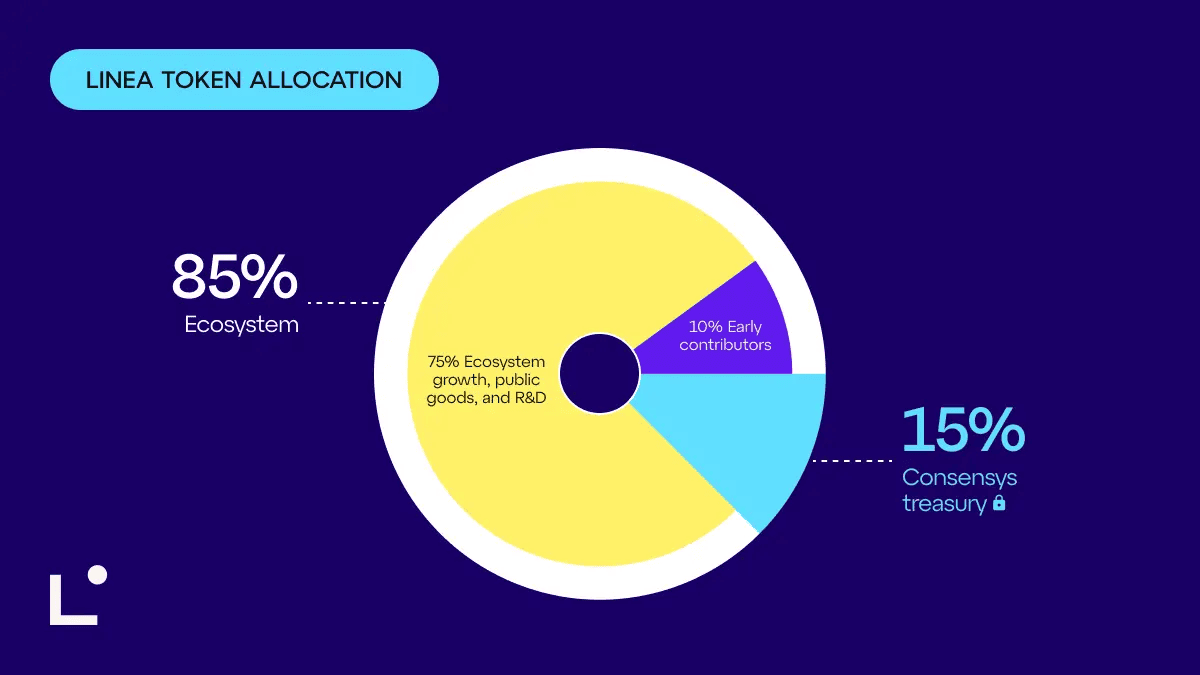

LINEA token distribution | Source: Linea blog

The total supply of the LINEA token is 72,009,990,000 LINEA, modeled after Ethereum’s genesis distribution. It’s designed to reward authentic participation, bootstrap builders, and support Ethereum-aligned public goods. At the Token Generation Event (TGE), approximately 22% of the supply (~15.8 billion LINEA) will enter circulation, with the remainder unlocking gradually over time.

• 75% – Ecosystem Fund: The largest share of tokens is allocated to the Linea Ecosystem Fund (LEF), governed by a consortium of Ethereum-native organizations including ConsenSys, ENS Labs, SharpLink, Status, and Eigen Labs.

-- 25% is reserved for short-term activation: liquidity provisioning, exchange listings, strategic partnerships, and future airdrops.

-- 50% will be distributed over a 10-year period on a decaying schedule to support long-term adoption, shared infrastructure, R&D, and Ethereum public goods.

• 10% – Early Contributors (Linea Airdrop): This portion is allocated to users who earned Linea Voyage XP (LXP), participated in campaigns like Surge, and completed Proof of Humanity. These tokens will be fully unlocked at TGE, with individual allocations based on wallet activity and on-chain contribution metrics.

• 1% – Strategic Builders: Reserved for dApps, developer teams, and community partners aligned with Linea’s long-term goals. Allocations may take the form of grants, milestone-based releases, or co-deployments with ecosystem collaborators.

• 15% – ConsenSys Treasury: Held by ConsenSys, this allocation is subject to a strict 5-year lockup with a full cliff. These tokens may be deployed during the lock period to support ecosystem health, such as providing liquidity or staking capital, but cannot be transferred or sold. This reflects ConsenSys’ long-term commitment to Ethereum and its infrastructure.

Linea's tokenomics design emphasizes transparency, sustainability, and Ethereum alignment, ensuring that $LINEA remains a tool for rewarding participation and strengthening decentralized infrastructure, without speculative overreach or centralized control.

What Is the LINEA Token Price Prediction?

Analysts across the crypto market have shared a wide range of predictions for what the $LINEA token might be worth once it officially launches. Most forecasts center around its strong technical foundation, active user base, and backing from ConsenSys, the team behind MetaMask.

Some early pre-market trading data and community-driven predictions, such as those seen on social media platforms have even suggested price targets of $1 to $3 or more. These higher numbers reflect optimistic sentiment but lack detailed breakdowns or confirmed exchange liquidity support.

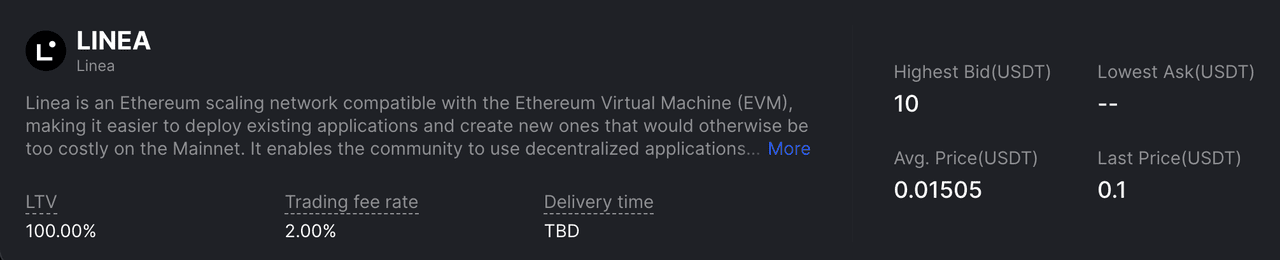

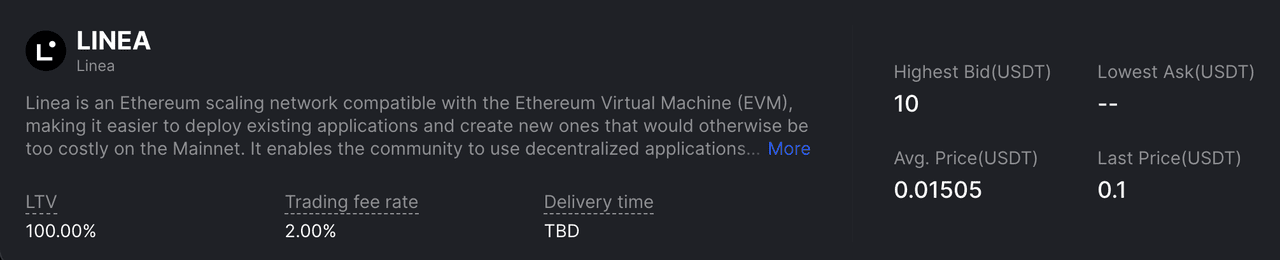

Trading LINEA tokens on BingX pre-market

On BingX Pre-Market, early orders have shown significant activity, with the average filled price recorded at around $0.01505, and recent bids reaching as high as $0.10. These rates indicate strong user interest and offer a reference point for early valuation, though the final listing price will depend on actual supply dynamics and broader market sentiment at launch.

For a more grounded comparison, analysts have pointed to similar zkEVM projects like

zkSync,

Scroll, and

StarkNet. Many of these launched tokens in the $0.20 to $0.50 range initially, before price discovery took place. Given that Linea has already secured over $500 million in total value and processed more than 230 million transactions, this range appears both credible and sustainable for its early trading period.

In short, while high-end estimates are generating excitement, most trusted research outlets agree that $0.20 to $0.50 is a realistic price band for LINEA’s early listing phase, especially if the project delivers on its roadmap and user engagement continues to rise.

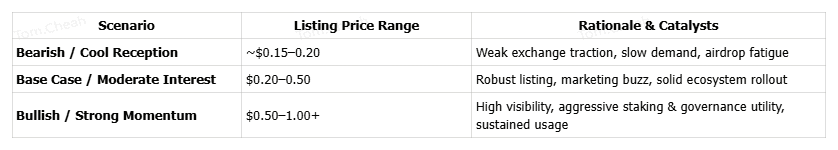

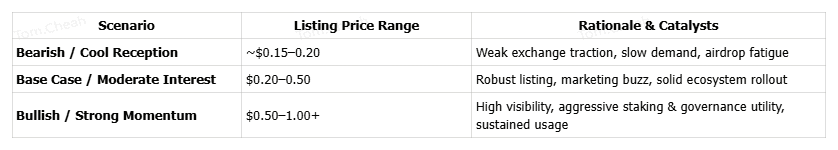

Scenario-Based LINEA Price Forecast at Listing

Long-Term Outlook: Can LINEA Price Cross $1?

Longer‑term strategies and performance could push $LINEA above $1, but only with sustained on‑chain activity, governance uptake, staking rewards, and new DeFi/NFT integrations on the Linea network. Without persistent utility drivers, short‑term speculation is likely to taper.

Final Thoughts

$LINEA token listing in Q3 2025 could be one of the standout crypto events of the summer. Most credible projections target an opening between $0.20 and $0.50, contingent on exchange listing strength and community engagement. While speculative upside up to $1 remains possible, long‑term value will rely on true network utility, user retention, and governance activation.

Disclaimer: These forecasts are speculative and not financial advice. Always conduct your own research (DYOR), assess your own risk tolerance, and avoid investing based solely on price projections.

Related Reading