In 2025, Ethena has been one of the biggest breakout stories in DeFi sector, delivering explosive growth across both its governance token ENA and its flagship stablecoin USDe. ENA has rallied over 140% in the past month (July 2025), reflecting surging investor interest and strong market confidence. At the same time, its synthetic dollar,

USDe, has climbed the stablecoin rankings to become the third-largest by market capitalization, trailing only

USDT and

USDC.

The protocol’s rapid ascent is being fueled by sustained demand from both retail and institutional users, growing integration across DeFi platforms, and an active community that continues to drive adoption. With momentum accelerating, Ethena is emerging as one of the most influential players in the stablecoin sector, and its trajectory is setting the stage for a potentially transformative role in the broader crypto market.

What is Ethena?

Ethena is a

decentralized finance (DeFi) protocol that creates scalable, crypto-native alternatives to the U.S. dollar on Ethereum. Instead of relying on bank reserves like traditional

stablecoins, Ethena uses crypto collateral such as

ETH,

stETH, and

BTC, combined with delta-neutral hedging in derivatives markets, to maintain a stable 1:1 peg with the U.S. dollar.

The protocol was founded by Guy Young and is backed by notable investors including Dragonfly Capital, Arthur Hayes, and traditional institutions like Fidelity, Franklin Templeton and CMS Holdings. Since its launch, Ethena has quickly grown into one of the leading players in the stablecoin sector. It offers both DeFi-native and regulated stablecoin solutions, targeting a broad spectrum of users from retail traders seeking high-yield savings to institutions requiring compliant, real-world asset–backed products.

What Makes Ethena Stand Out

• Innovative Stablecoin Model: Uses crypto collateral such as ETH, stETH, and BTC, paired with delta-neutral hedging in perpetual futures, to maintain a 1:1 dollar peg without relying on bank reserves.

• Attractive Yield Opportunities: Its

yield-bearing stablecoin sUSDe offers around 10–19%

APY, sourced from staking rewards and perpetual funding rate spreads.

• Rapid Ecosystem Integration: USDe is listed on major DeFi platforms such as

Aave and

Curve, enabling lending, borrowing, and liquidity provision, while fiat access is available via Transak.

• Strong Investor Support: Backed by prominent names in crypto including Dragonfly Capital, Arthur Hayes, and CMS Holdings, providing both capital and strategic guidance.

By combining decentralized architecture, yield generation, and regulatory-ready products, Ethena positions itself at the intersection of DeFi innovation and traditional finance adoption.

What Makes Ethena the Fastest-Rising Stablecoin Protocol in 2025

Ethena has become one of the most closely watched DeFi protocols in 2025, combining rapid market expansion with high-profile partnerships and a yield model that continues to attract capital. Its growth story is anchored in exceptional performance, influential alliances, and a unique position in the evolving stablecoin market.

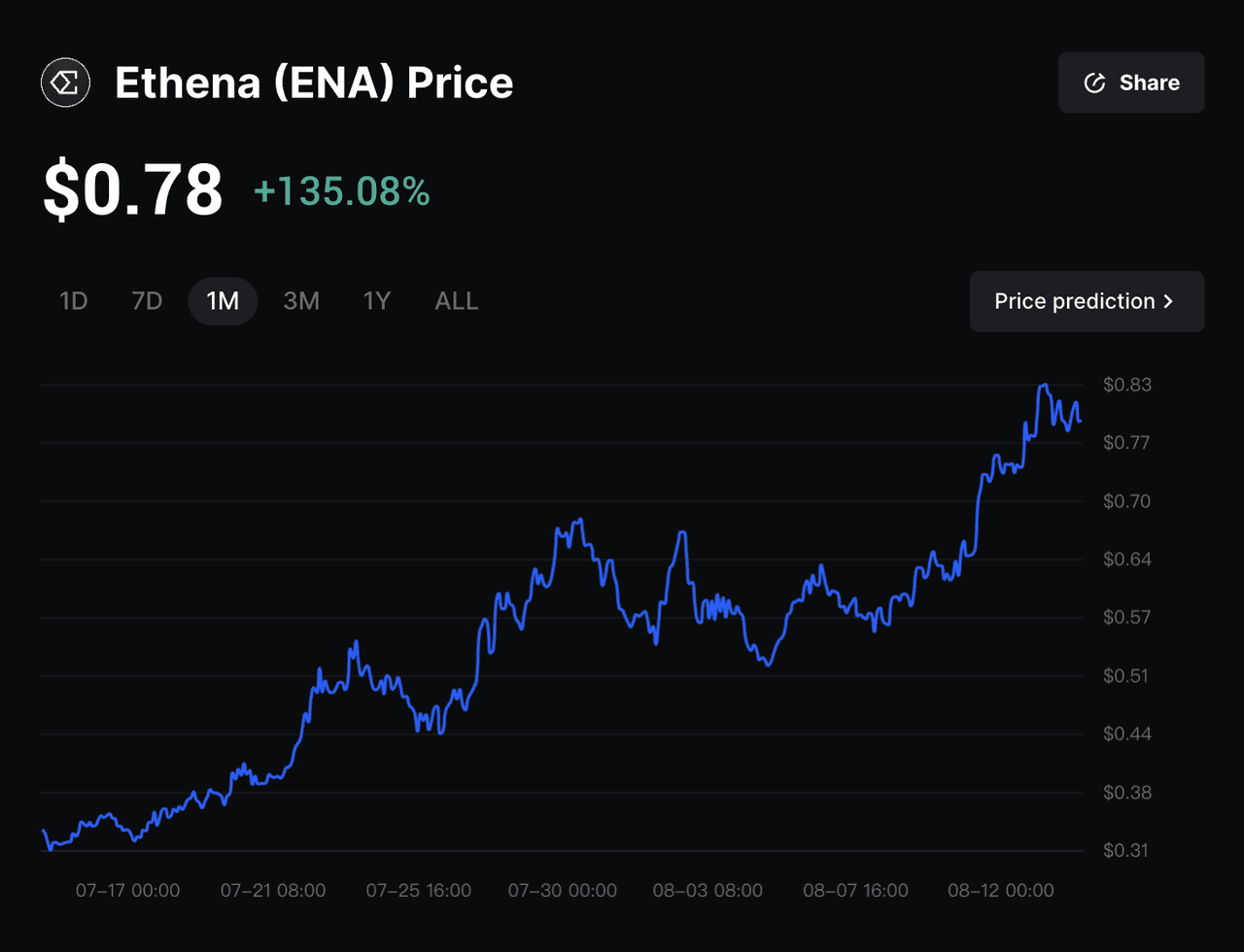

1. ENA Price Surges 135% in July and TVL Hits $9.47B

Ethena is the second-fastest protocol in crypto history to surpass $100 million in cumulative revenue, reaching the milestone in just 251 days. In July 2025, its governance token ENA surged over 135%, climbing from around $0.36 to a peak of $0.855 before consolidating above $0.80.

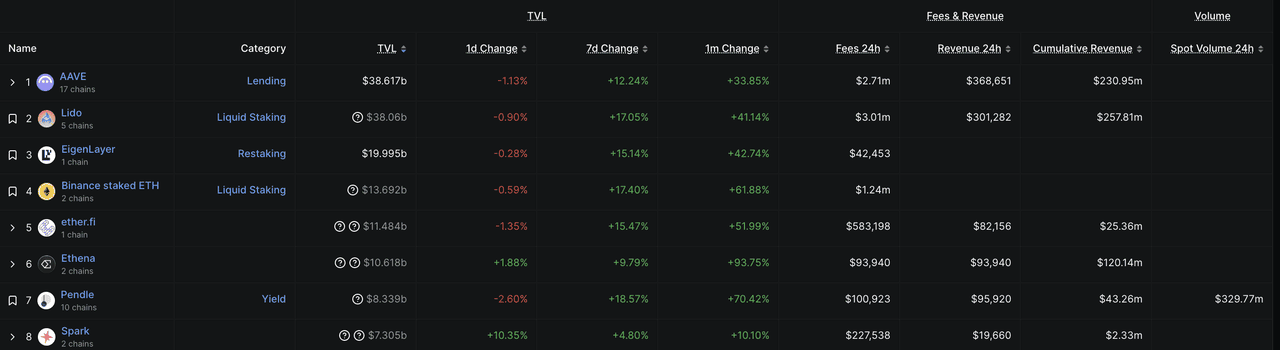

Ethena also generated $50 million in fees and $10 million in protocol revenue over the past month, ranking 6th in monthly fee generation across all DeFi protocols. Its

total value locked (TVL) now stands at $9.47 billion, making it the sixth-largest DeFi protocol on both Ethereum and the whole DeFi market.

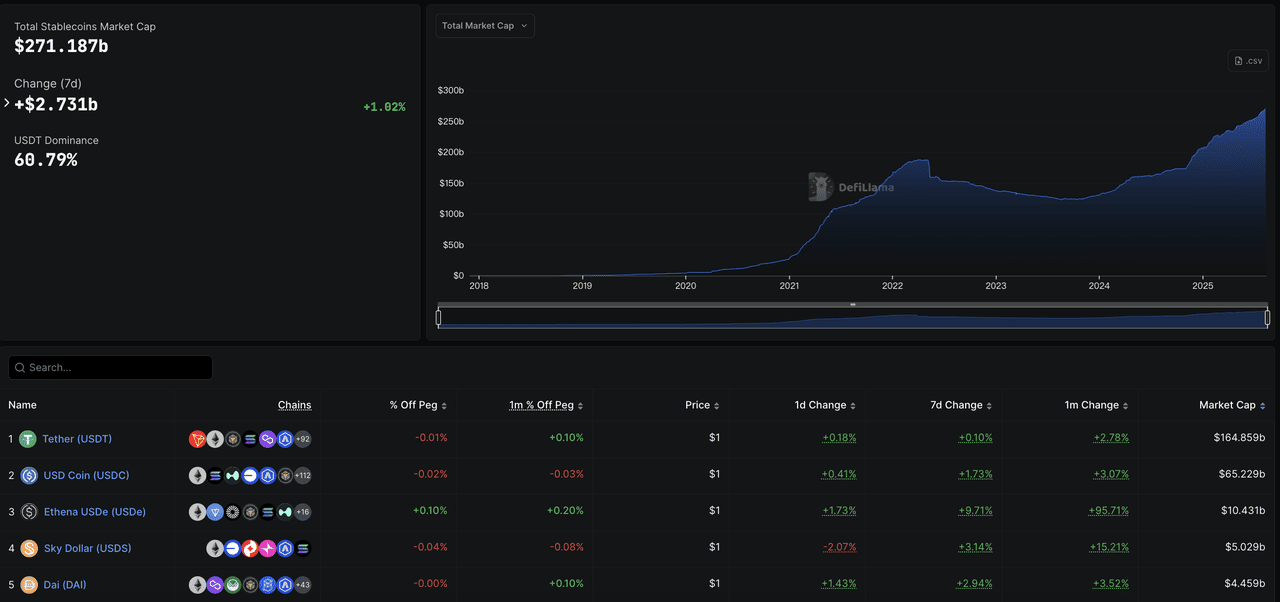

2. USDe Supply Jumps 75% in 3 Weeks to Become Third-Largest Stablecoin

Ethena’s synthetic dollar USDe has seen explosive adoption, growing 75% in just three weeks to reach $9.3 billion in circulating supply. This growth allowed USDe to overtake

FDUSD and become the 3rd-largest stablecoin by

market capitalization.

According to

Coindesk, between July 17 and early August, USDe added $3.1 billion in supply, outpacing inflows into

BlackRock’s Bitcoin ETF ($1.6 billion) and

Spot Ethereum ETF ($2.75 billion). The expansion of USDe’s market share highlights its increasing role as a high-yield alternative to traditional fiat-backed stablecoins, with integrations into Aave, Curve, and other DeFi platforms deepening its utility.

3. BlackRock-Backed USDtb Launch and Regulatory Advantage Under GENIUS Act

Ethena made a major institutional breakthrough with the launch of USDtb, a yield-bearing stablecoin backed 90% by

BlackRock’s BUIDL fund, which tokenizes U.S. Treasury bills. This integration with the world’s largest asset manager strengthens Ethena’s credibility among institutional players and offers a compliant yield-bearing alternative in the

stablecoin market.

The launch comes at a pivotal time following the

GENIUS Act in July 2025, which prohibits fiat-backed stablecoins like USDC and USDT from paying yield to holders. This gives USDtb and USDe a regulatory advantage, enabling them to offer competitive yields without violating the new framework.

On the DeFi front, Ethena has expanded USDe’s utility through integrations with Aave and Curve for lending, borrowing, and liquidity provision. Its partnership with

World Liberty Financial (WLFI) further boosted adoption by allowing sUSDe to serve as collateral on WLFI’s Aave v3 instance, rewarding users in both sUSDe and WLFI tokens.

How Does Ethena Work?

Ethena operates through a connected suite of products designed to offer a stable on-chain dollar, competitive yield opportunities, and a governance framework that can adapt over time. At its core, the protocol blends crypto collateral with derivatives-based hedging to maintain price stability, while selectively integrating real-world assets for regulatory adoption.

Each product serves a specific role, from providing a dollar-pegged asset for everyday DeFi use to delivering yield-bearing options for savers and compliant structures for institutions. Together, they form an ecosystem that bridges the gap between decentralized finance and traditional markets.

1. USDe - Synthetic Stablecoin

USDe is the foundation of the Ethena ecosystem. It is minted when users deposit crypto collateral such as ETH, stETH, or BTC into the protocol’s smart contracts. To keep the value pegged to the U.S. dollar, Ethena simultaneously opens short positions in perpetual futures equivalent to the value of the deposited collateral.

This delta-neutral approach means that any gains or losses in the collateral’s value are offset by the corresponding futures positions. If ETH’s price rises, the short futures lose value but the collateral gains the same amount, and vice versa. As a result, USDe’s value remains stable around $1 without depending on traditional banking rails or fiat reserves. All collateral and positions are visible on-chain, giving USDe a level of transparency often missing from centralized stablecoins.

2. sUSDe - Yield-Bearing Stablecoin

sUSDe is created when holders stake their USDe within Ethena. Staking converts the stablecoin into a yield-bearing asset that generates returns from two primary sources:

• Collateral staking rewards – If the deposited collateral is a yield-generating asset like stETH, the protocol captures its staking rewards.

• Funding rate spreads – The perpetual futures used for hedging often have positive funding rates, which the protocol collects.

These yield streams are combined and distributed to sUSDe holders, offering APYs that have historically ranged between 10% and 19%, depending on market conditions. This structure makes sUSDe attractive to DeFi users seeking a higher-yielding alternative to holding stablecoins passively, while maintaining exposure to a dollar-pegged asset.

3. USDtb - RWA-Backed Stablecoin

USDtb is Ethena’s bridge to regulated markets and real-world assets. It is a GENIUS Act–compliant stablecoin backed 90% by BlackRock’s BUIDL fund, which tokenizes short-term U.S. Treasury bills. The remaining backing is typically held in highly liquid, low-risk assets to ensure redemption stability.

By linking on-chain dollars directly to tokenized Treasuries, USDtb provides a yield-bearing alternative to fiat-backed stablecoins like USDC or USDT, which under the GENIUS Act cannot pay yield to holders. This makes USDtb appealing for institutional investors and corporate treasuries that require both regulatory compliance and predictable returns. At the same time, it remains usable within DeFi for lending, borrowing, and liquidity provision.

4. iUSDe - Institutional Variant of USDe

iUSDe is a specialized version of USDe designed to meet institutional compliance requirements. It includes transfer restrictions, whitelist-based access, and mandatory KYC verification for all participants.

From a technical standpoint, iUSDe uses the same delta-neutral minting and hedging mechanism as USDe, ensuring the same price stability and on-chain transparency. However, its regulated structure enables asset managers, investment funds, and other institutional players to integrate it into their portfolios without violating compliance frameworks. This opens the door for large-scale adoption of synthetic stablecoins in regulated environments.

5. ENA - Governance Token

ENA is Ethena’s native governance token, granting holders the ability to shape the protocol’s future. Governance participants can vote on proposals such as:

• Adjusting collateral and leverage parameters for USDe

• Allocating protocol reserves or treasury assets

• Integrating new collateral types or yield sources

• Activating the governance-controlled “fee switch,” which would route a share of protocol revenue to staked ENA holders

By decentralizing decision-making, ENA ensures that Ethena’s direction reflects the collective interests of its community and stakeholders. Over time, the token could evolve into a key coordination mechanism for both technical upgrades and economic incentives within the ecosystem.

How to Trade Ethena ENA Tokens on BingX

Ethena (ENA) is the governance token of the Ethena protocol, known for its synthetic dollar USDe and high-yield sUSDe staking model. ENA is available on both the BingX Spot Market and Perpetual Futures Market, giving traders flexibility whether building a long-term position or trading short-term market moves. BingX also offers real-time analysis through BingX AI to help identify better trade setups.

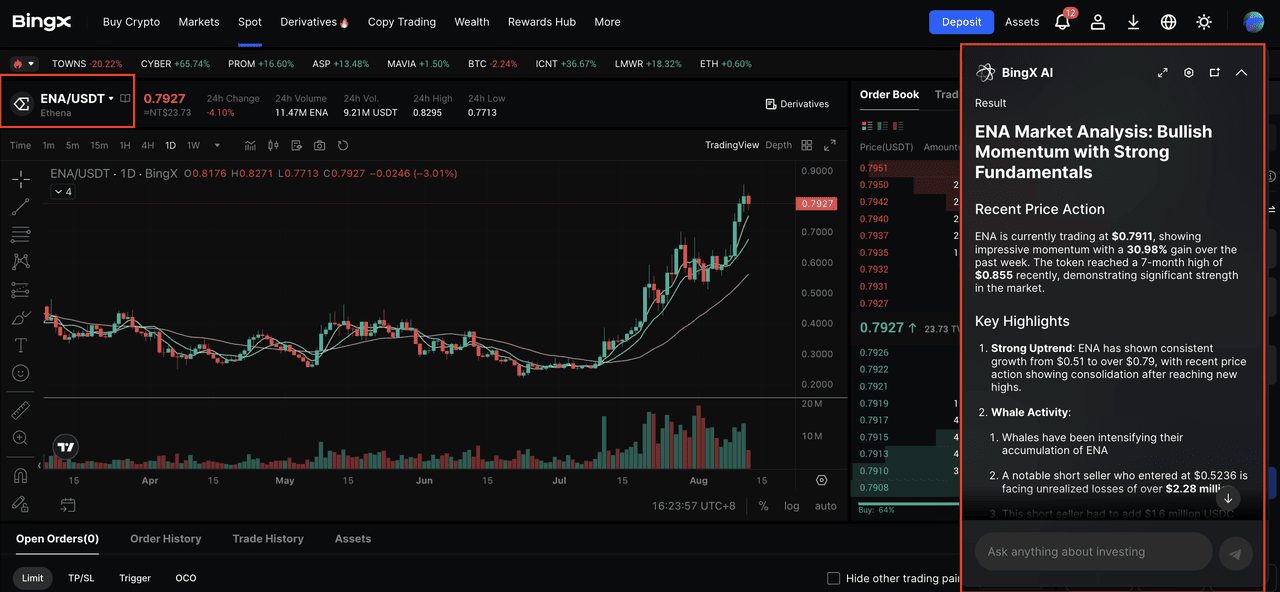

Step 1: Search for ENA/USDT on Spot or Perpetual Futures

For Spot Trading

Go to the Spot Market on BingX and search for

ENA/USDT. Place a market order to buy instantly or set a limit order for your target entry. Spot trading suits those looking to hold ENA for the long term or add it to a diversified portfolio.

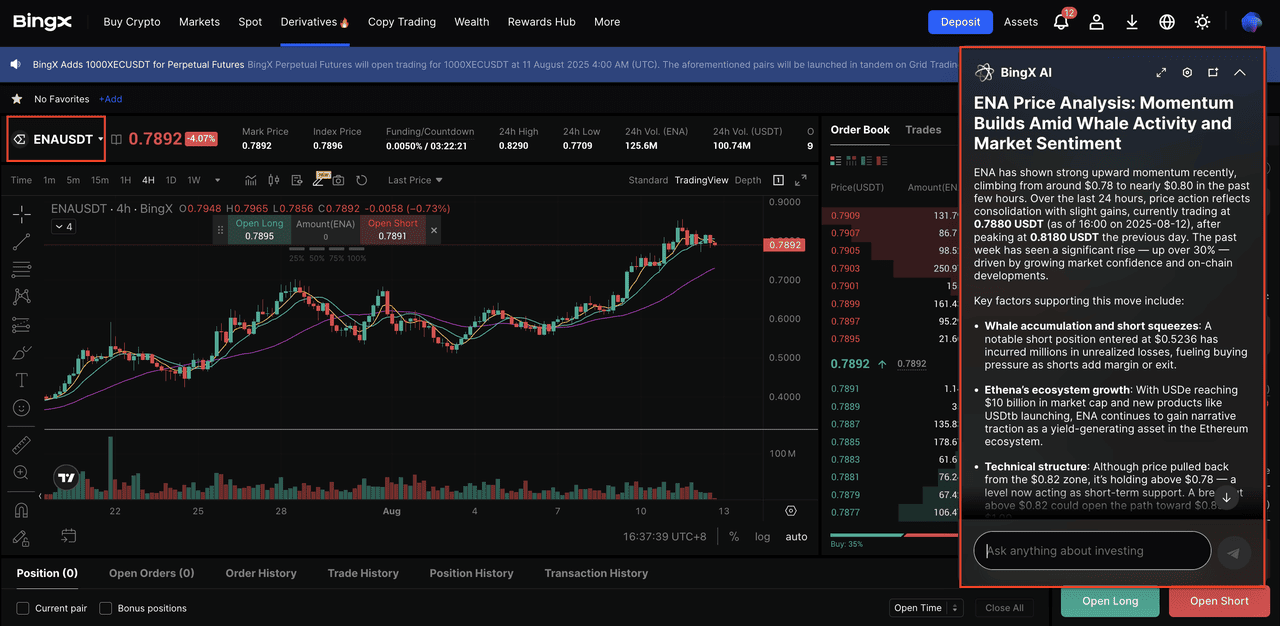

For Perpetual Futures

Search

ENA/USDT in the Perpetual Futures Market to go long or short without expiration. This allows strategies for both bullish and bearish markets. Leverage can increase potential returns but also raises risk, so use it with caution.

Step 2: Use BingX AI for Real-Time Market Insights

Click the AI icon on the trading chart to launch BingX AI. The tool highlights key support and resistance levels, trend direction, and recent market-moving events such as ENA’s price rally and USDe’s rapid supply growth to help refine your strategy.

Step 3: Execute and Monitor Your Trade

Use a market order for immediate execution or a limit order to target your entry price. Continue monitoring BingX AI to adapt your position and strategy based on shifting market conditions.

Key Risks to Understand in the Ethena Ecosystem

While Ethena offers innovative stablecoin designs and competitive yields, its model carries structural and operational risks that users should understand before participating.

1. Market Risk in Delta-Neutral Hedging: USDe’s stability depends on perpetual futures markets staying liquid and functional. In extreme conditions like sharp price crashes or exchange outages, hedges may fail to track perfectly, risking the peg.

2. Counterparty and Platform Risk: Short positions that hedge USDe are placed on centralized or semi-centralized derivatives exchanges. Failures, regulatory actions, or liquidity issues on these venues could disrupt operations.

3. Regulatory Uncertainty: While USDtb is GENIUS Act compliant, changes in global regulations could limit access, add requirements, or alter its yield structure.

4. Smart Contract Vulnerabilities: Bugs or exploits in Ethena’s contracts could cause loss of collateral or disrupt product functions, even with audits in place.

5. Funding Rate Dependence: sUSDe yields partly rely on positive funding rates in perpetual markets. Prolonged negative rates could reduce or eliminate returns.

Final Thoughts and Future Outlook for Ethena

Ethena is evolving from a synthetic stablecoin protocol into a comprehensive financial platform with the potential to redefine how dollars operate on-chain. Its combination of delta-neutral stability, yield-bearing options, and regulated RWA-backed products allows it to address both the fast-moving DeFi sector and the cautious needs of institutional capital. The roadmap points toward deeper integrations, greater liquidity, and expanded real-world asset adoption, all while strengthening compliance frameworks.

If Ethena can execute on its vision, maintain stability, and build lasting market confidence, it could establish itself as a cornerstone of the next generation of decentralized finance. In the years ahead, its growth will likely be measured not just by market cap, but by the role it plays in making on-chain dollars a trusted and widely used part of the global financial system.

Related Reading