The collectibles market has exploded in recent years, with rare Pokémon cards, sports memorabilia, and trading card games attracting both passionate fans and high-value investors. Yet traditional marketplaces like eBay often suffer from slow settlements, high fees, and fraud risks. This is where Collector Crypt, a Solana-based platform for tokenized collectibles, steps in.

Collector Crypt is a

Solana-based collectibles platform that transforms physical trading cards into tokenized NFTs. Each card is securely vaulted and redeemable, while the platform offers instant buybacks, lower fees, and transparent trading through its on-chain marketplace.

By bridging the gap between digital and physical assets, Collector Crypt makes buying, selling, and redeeming collectibles faster, safer, and more accessible worldwide. With its native token $CARDS, the platform introduces a new layer of liquidity and utility to the collectibles industry, attracting attention from both collectors and crypto traders.

What is Collector Crypt and How Does it Work?

Source: collectorcrypt.com

Collector Crypt (CARDS) is a Solana-based platform that modernizes the trading card market by turning physical collectibles such as Pokémon cards, sports cards, and other TCGs into tokenized

NFTs, making them secure, tradeable, and instantly redeemable.

Collector Crypt works by bridging real-world trading cards (

RWAs) with blockchain technology on Solana. At its core, the platform allows collectors to vault physical cards, mint tokenized NFTs that represent them, and redeem those NFTs back into physical form at any time.

Source: collectorcrypt.com

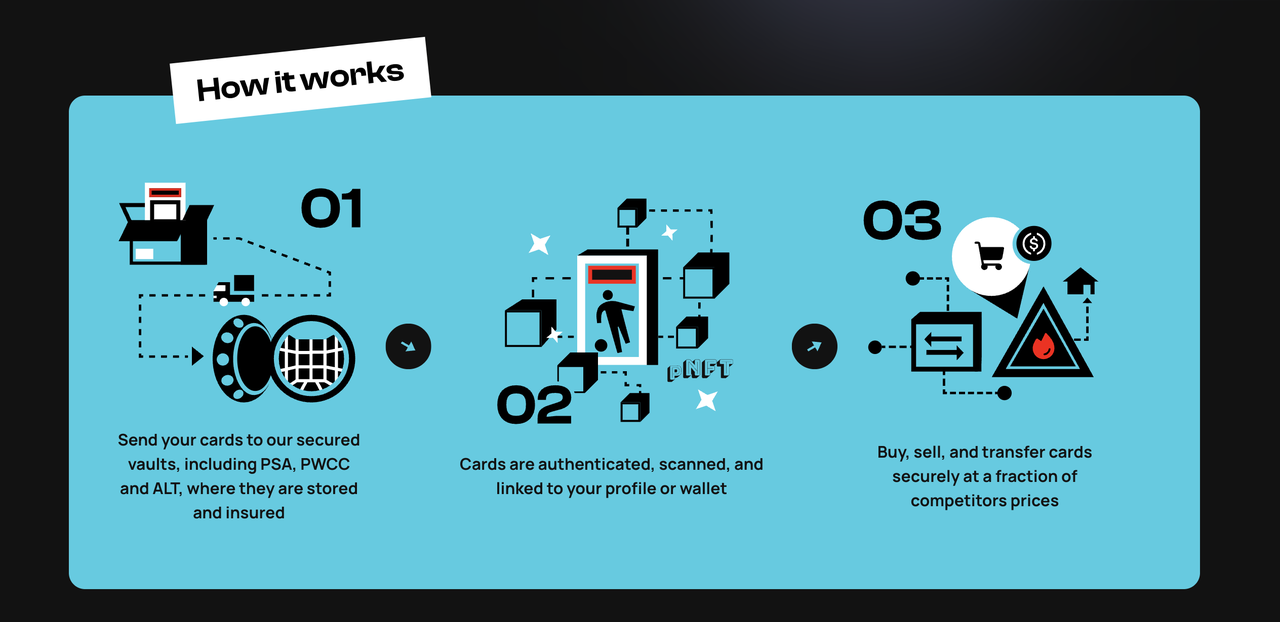

Here’s how the ecosystem functions:

• Secure Vaulting: Collectors deposit physical trading cards, which are professionally stored and tokenized into NFTs.

• NFT-to-Card Bridge: Each NFT is fully redeemable for the real card it represents, eliminating fraud and ensuring authenticity.

• Marketplace: A custom-built trading card marketplace enables fast, low-fee transactions with full transparency. Because the NFTs are interoperable, they can also be traded on external platforms like

Magic Eden.

• Instant Buybacks: Unlike traditional markets where selling may take days or weeks, Collector Crypt offers instant liquidity for vaulted assets through built-in buyback options.

This model solves long-standing problems in the collectibles space such as counterfeit risks, slow settlements, and high intermediary fees, while introducing a new level of liquidity and accessibility for both crypto-native users and traditional collectors.

Key Products in Collector Crypt Ecosystem: An Overview

Collector Crypt offers several innovative products that make trading cards more liquid, secure, and engaging. Its flagship features are the Marketplace and Gacha repack system, but the platform also provides a broader suite of tools:

1. Marketplace: A trading card marketplace with advanced filters and full transparency. Interoperability lets collectors also list and trade NFTs on platforms like Magic Eden.

2. Gacha: The most popular product on Collector Crypt. It is a digital repack system designed with +5 to +10% positive expected value. Collectors can keep discounted cards, sell back to chase rare epics worth up to 80x, or enjoy the thrill of ripping packs without losing value.

3. The Bridge: Every NFT is physically redeemable for its corresponding trading card. Collectors can deposit cards to mint tokenized RWAs, or burn the NFT to have the card shipped directly.

4. Sniper: A bidding tool for Web2 marketplaces like eBay. Users place deposits in USDC, set a maximum bid, and Collector Crypt executes the purchase at the last second. Over $10 million in bids have been facilitated to secure grail cards below market value.

5. Card Club: An exclusive NFT membership pass that grants holders access to whitelists, early product drops, and premium community benefits.

Together, these products make Collector Crypt more than just a marketplace. It is a complete ecosystem where collectors can vault, trade, and engage with cards in innovative and gamified ways.

Why is Collector Crypt Getting Traction in 2025?

Collector Crypt’s growth is being driven by a mix of platform efficiency, community engagement, and token performance. Together, these factors have helped it stand out in the collectibles and crypto markets.

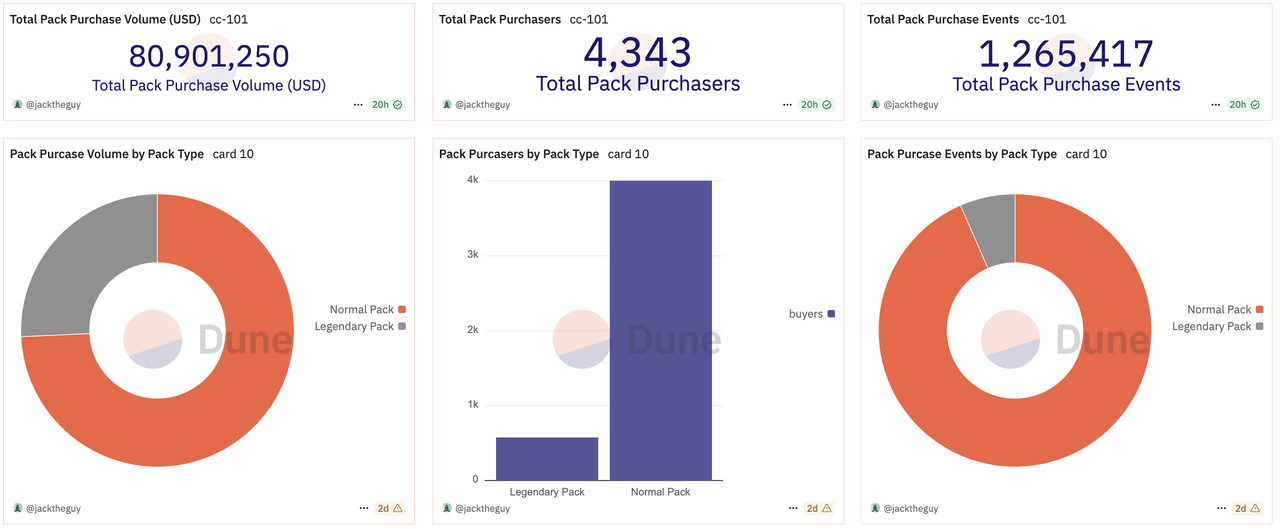

1. $74M in Trading Volume and Lower Fees Make Collector Crypt More Attractive

Source: Dune Analytics

According to

Pine Analytics Dataset on Dune, in 2025 alone, Collector Crypt processed over $80 million in transaction volume across over 4000 wallets, highlighting strong adoption. Its lower fee model charges just 4% for verified, vaulted assets compared to 10–15% on traditional platforms, making trading far more cost-effective. Combined with built-in buyback options that provide instant liquidity, the platform solves the long delays and high costs that have historically plagued collectibles trading.

2. 1M+ Gacha Repacks and a 200% Token Surge Accelerate Momentum

Source: CARDS/USDT on Jupiter

Collector Crypt’s traction also comes from its engaged community and the rise of its native token. Since late 2024, users have purchased more than 1 million Gacha repacks, with nearly $900,000 worth of free packs distributed through referrals, creating a gamified and sticky user experience. On top of that, according to

Solana Dex Jupiter, the $CARDS token surged more than 200% in just four days after launch, and another 200% the next day, reaching a market cap above $45 million. Strategic integrations with Raydium and Magic Eden further boosted liquidity and visibility, cementing Collector Crypt as one of the most dynamic platforms in tokenized trading cards.

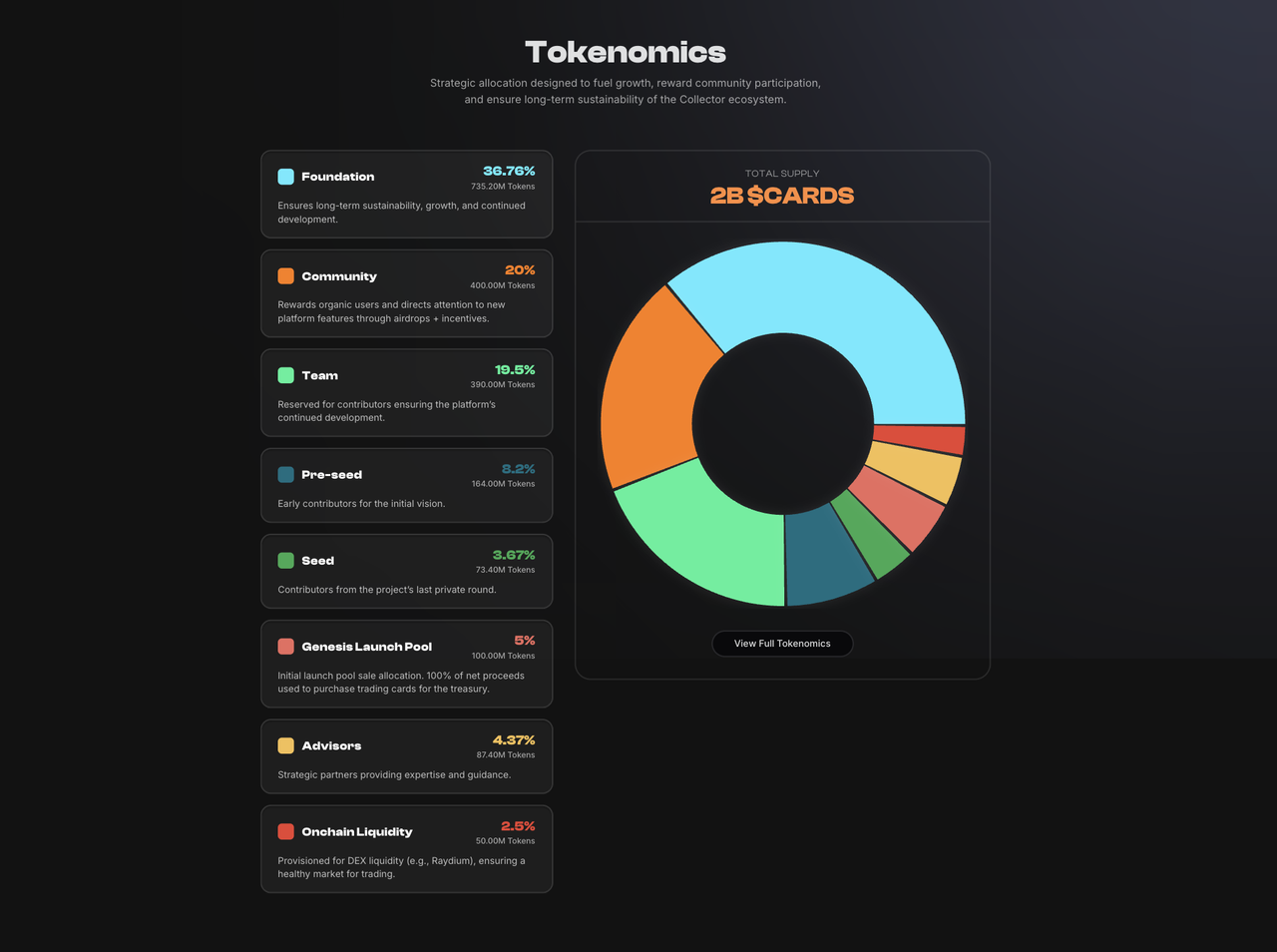

What Is the $CARDS Tokenomics?

The $CARDS token is the native asset of Collector Crypt, designed to link digital assets with real-world trading cards. Unlike many project tokens, $CARDS is treasury-backed, meaning proceeds from its launch are reinvested into physical collectibles to support liquidity and platform growth.

$CARDS Token Utilities and Mechanism

$CARDS is more than a speculative asset. After accounting for launch fees and liquidity provisioning, 100% of net proceeds from the token sale are used to purchase trading cards for the treasury. These assets power the platform’s Gacha machines, reinforce marketplace liquidity, and support partnerships with third parties. Because the token is tied to tangible collectibles, it creates a direct connection between token holders and the trading card ecosystem.

In addition, $CARDS integrates across the platform to enhance the collector experience. It fuels gamified features, unlocks access to new products, and strengthens instant buyback mechanisms. This makes the token both functional and aligned with the long-term sustainability of the Collector Crypt ecosystem.

$CARDS Token Distribution

Source: Collector Crypt

According to

Collector Crypt, the total supply of $CARDS is

2 billion tokens. The top five allocations are:

• Foundation: 36.76%

• Community (including TGE airdrop): 20%

• Team: 19.5%

• Pre-Seed: 8.2%

• Seed: 3.67%

The remaining supply covers Advisors (4.37%), On-Chain Liquidity (2.5%), and a 5% allocation to the Launch Pool sale at the Token Generation Event on August 29, 2025. With no lock-up period, tokens were liquid from day one, ensuring immediate accessibility for participants.

How to Trade CARDS Tokens on BingX?

CARDS is the native token of Collector Crypt, the Solana-based platform that tokenizes real-world trading cards into NFTs. It powers platform utilities such as the Gacha repack system, instant buybacks, and marketplace liquidity. CARDS is available on the

BingX spot market, making it easy for traders and collectors to gain exposure to the growing collectibles ecosystem.

Step 1: Search for CARDS/USDT on BingX Spot

Go to the Spot Market on BingX and search for

CARDS/USDT. You can place a market order to buy instantly or set a limit order for your preferred entry price. Spot trading is ideal for those who want to hold CARDS long term, participate in platform utilities, and gain exposure to the growth of tokenized trading cards.

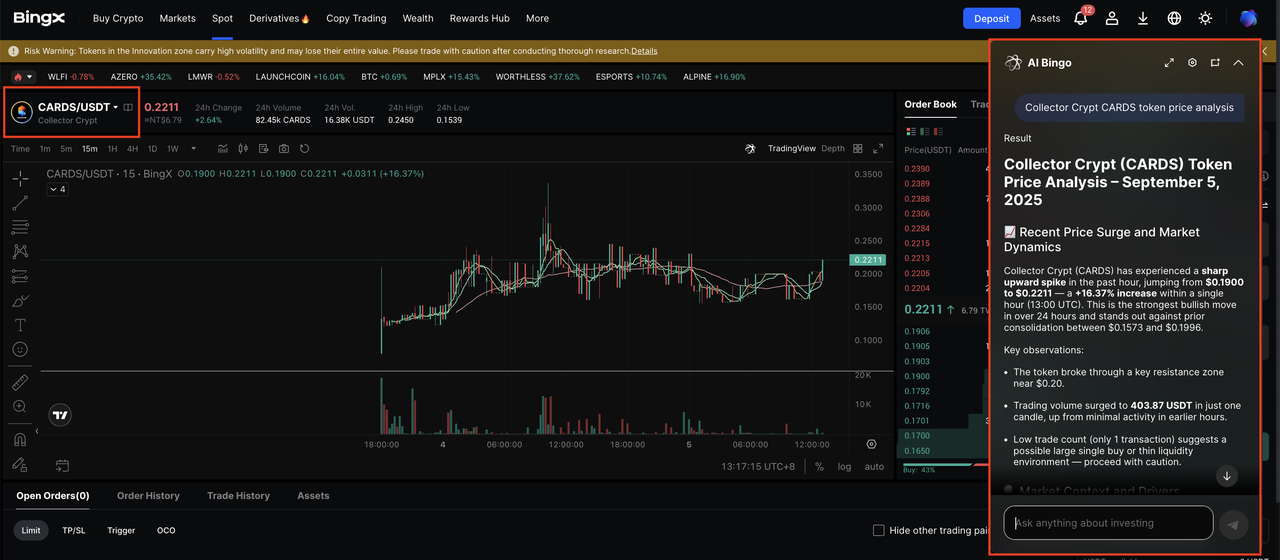

Step 2: Use BingX AI for Real-Time Market Insights

Click the AI icon on the trading chart to launch

BingX AI. The tool highlights support and resistance levels, shows trend direction, and surfaces recent market-moving events related to Collector Crypt and its ecosystem. These insights can help refine your entry and exit strategies.

Step 3: Execute and Monitor Your Trade

Use a market order for immediate execution or a limit order to target your preferred entry price. Continue monitoring BingX AI for updated signals to adapt your position based on market conditions.

Risks and Considerations Before Using Collector Crypt

While Collector Crypt modernizes the collectibles market, both the platform and its native token ($CARDS) carry risks that users should understand before participating.

Platform Risks: Collector Crypt relies on blockchain infrastructure and third-party vaulting services. While this creates transparency and efficiency, it also introduces operational risks such as smart contract bugs, security breaches, or custodial issues with vaulted cards. In addition, the collectibles market itself remains niche and highly competitive, with platforms like Courtyard on

Polygon also expanding aggressively. Sustained growth depends on Collector Crypt’s ability to maintain liquidity and keep collectors engaged.

Token Risks: The $CARDS token has shown extreme volatility, surging more than 300% in the first week after launch. As with most crypto assets, prices can swing sharply, creating both opportunities and risks. Distribution also concentrates a significant share with the foundation and team, which supports long-term development but raises concerns about centralization. Finally, the project’s smart contracts retain privileges such as adjusting fees or minting tokens, which could add risk if not managed transparently.

Regulatory Risks: Collector Crypt has already restricted participation from certain jurisdictions, including the United States, United Kingdom, and China. Future regulatory developments may further affect who can access the platform or trade $CARDS. Collectors and investors should ensure compliance with local laws before engaging.

Disclaimer: As with all crypto investments, users should only participate with funds they can afford to lose.

Final Thoughts

Collector Crypt is redefining the way collectibles are bought and sold by bridging physical trading cards with blockchain technology. With its flagship Gacha system, NFT-to-card bridge, and the $CARDS token tied directly to a treasury of real-world assets, the platform delivers a mix of transparency, liquidity, and gamified engagement that traditional marketplaces struggle to match.

The strong community response, rapid token adoption, and integrations within the Solana ecosystem highlight its potential to become a leader in tokenized collectibles. At the same time, challenges remain: market volatility, concentrated token distribution, and evolving regulations are all important factors users must weigh before participating.

Ultimately, Collector Crypt illustrates how blockchain can modernize real-world asset markets and create new opportunities for collectors and traders alike. If it can maintain its momentum and address these risks, the project could set a new standard for tokenized trading card ecosystems.

Related Reading