Base itself has rapidly grown into one of the largest

Ethereum Layer 2 ecosystems with over $4.6 billion in TVL and more than one million active addresses, creating fertile ground for protocols like Aerodrome to thrive. Alongside

DeFi leaders such as Aerodrome, creator-focused platforms like

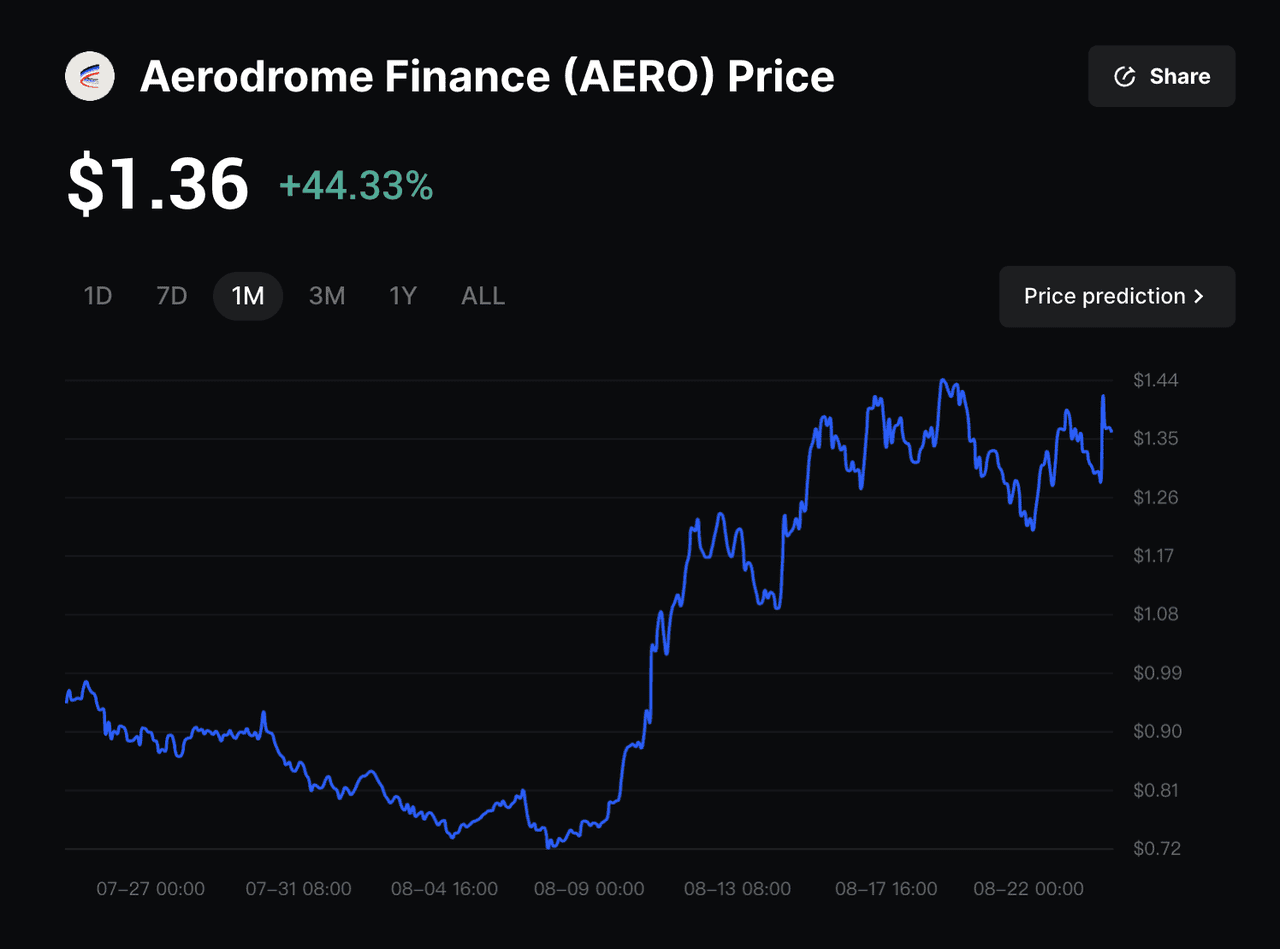

Zora have also surged in adoption, showing the breadth of activity taking place on Base. AERO’s rally reflects both its role as the central liquidity hub for Base and the broader wave of adoption sweeping across the chain.

What Is Aerodrome Finance (AERO)?

Aerodrome Finance is a next-generation

automated market maker (AMM) that serves as the central liquidity hub for Base, an Ethereum Layer 2 network developed by Coinbase.

The protocol launched in August 2023 to provide Base with its own native decentralized exchange and liquidity layer. Built on the design of

Velodrome V2 from

Optimism, Aerodrome offers low slippage swaps, liquidity incentives for providers, and a vote-escrow governance model where token holders determine how rewards are distributed.

Why Aerodrome Matters for Base?

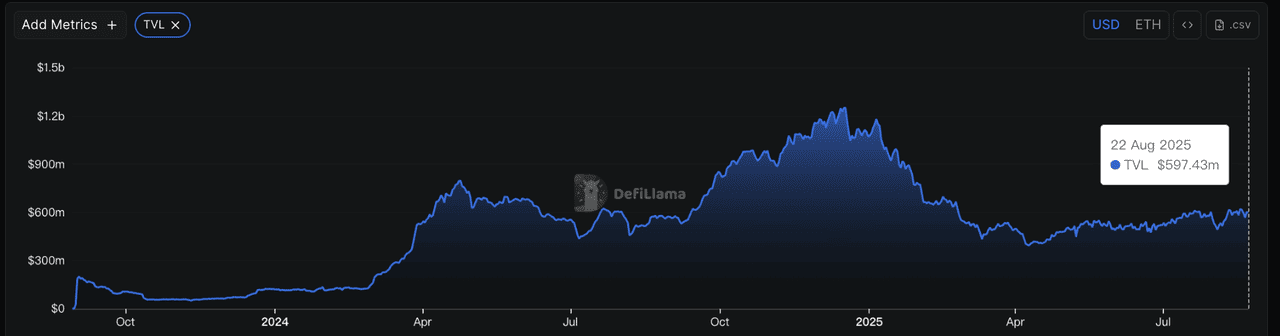

Aerodrome’s ecosystem-first approach has quickly paid off. According to

DefiLlama, it is now the No.1 DEX on Base with more than $600 million in total value locked (TVL) and ranks No.3 among all Defi projects on Base, and No.8 among all decentralized exchanges across chains.

What makes Aerodrome unique is its exclusive focus on the Base ecosystem. Instead of spreading liquidity across multiple chains, the protocol channels all incentives and resources into Base. This concentrated strategy has allowed it to become the primary marketplace for token swaps and liquidity provision on the network, similar to how Velodrome became the dominant liquidity hub on Optimism.

By aligning incentives between traders, liquidity providers, and veAERO governance participants, Aerodrome is positioning itself as the core decentralized exchange of Base. Beyond enabling efficient token trading, it also serves as a launchpad for new projects, accelerates ecosystem growth, and directs resources toward public goods that strengthen the long-term sustainability of Base.

How Does Aerodrome Finance Work?

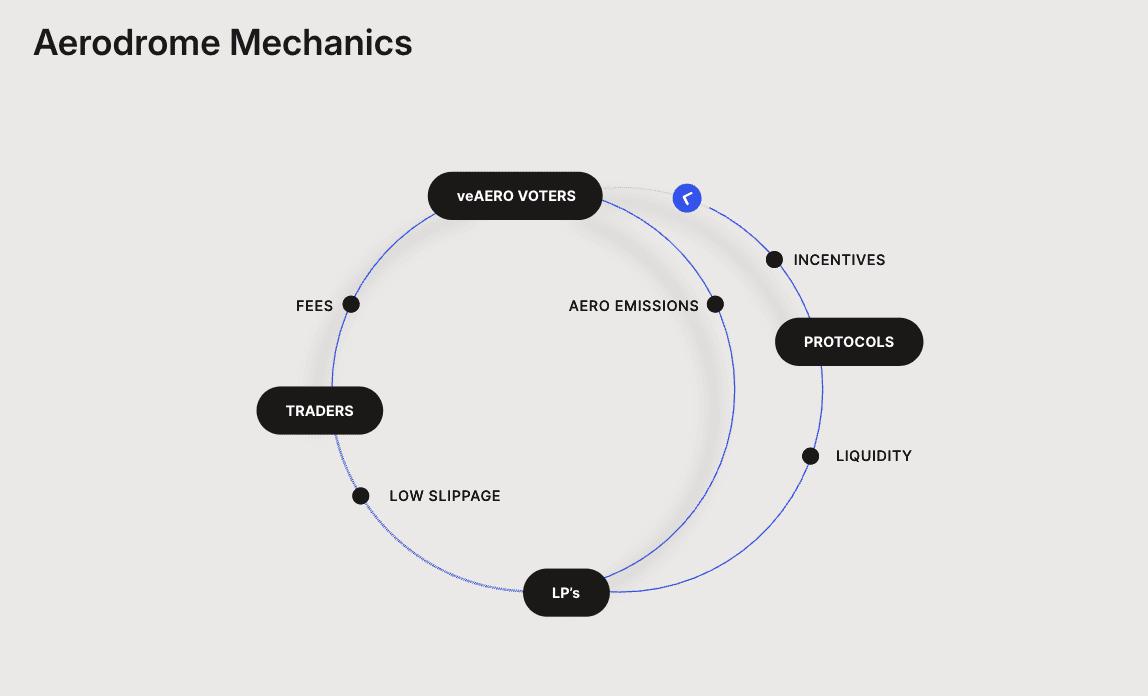

Aerodrome Finance is built on a flywheel system that connects traders, liquidity providers, and veAERO voters in a continuous cycle of incentives. The design ensures that liquidity flows where it is most valuable, while participants are rewarded for their role in the ecosystem.

• Traders use Aerodrome to swap tokens with low

slippage and competitive fees. Every trade generates fees that fuel the rest of the system.

• Liquidity providers (LPs) deposit token pairs into pools and stake their LP tokens in gauges. Each week, they receive AERO emissions based on how many votes their pool has earned from veAERO holders.

• veAERO voters lock AERO to mint veAERO NFTs, which give them governance rights. Each epoch, they vote on which pools should receive emissions (known as gauge voting). In return, they receive 100% of protocol trading fees from the previous week plus additional incentives (“bribes”) offered by projects competing for liquidity.

• Epoch cycles keep the system predictable. Every epoch lasts seven days, starting Thursday at 00:00 UTC and ending Wednesday at 23:59 UTC. Votes, emissions, fees, and incentives are distributed at the end of each epoch.

This circular model creates a balanced incentive structure: traders get efficient swaps, LPs are rewarded for providing liquidity, and veAERO holders are compensated for directing emissions. Over time, this flywheel strengthens liquidity on Base and makes Aerodrome its central exchange.

How to Start Using Aerodrome Finance : A Step-by-Step Guide

Aerodrome Finance serves four main types of users, each with different goals. Whether you want to trade tokens, earn yield, decide how AERO emissions are allocated, or invest for the long term, the platform provides tailored products to match your intent.

Quick Tip: Every transaction on Aerodrome requires gas fees paid in

ETH on the Base network. Always keep a small amount of ETH in your

Base wallet to cover swaps, liquidity deposits,

staking, or voting.

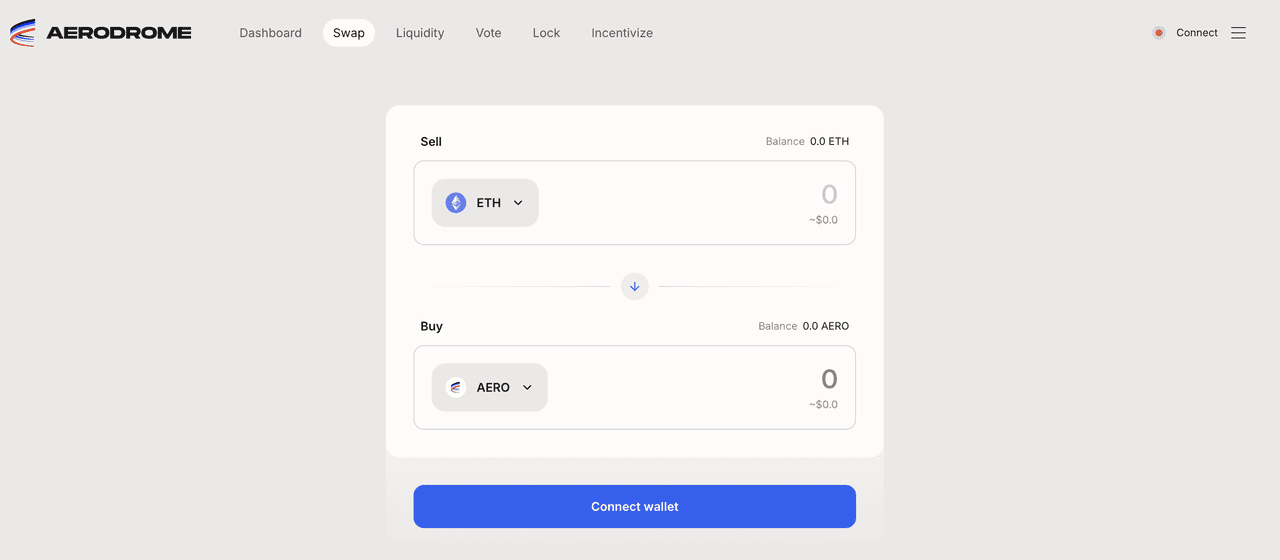

1. For Traders: Swap Tokens

For users who simply want to exchange assets on Base, Aerodrome offers fast swaps across hundreds of pairs with competitive rates and minimal slippage.

Step 2: Switch your wallet network to Base and ensure you have a small amount of ETH in your wallet to cover gas fees.

Step 3: Select the token pair you want to swap.

Step 4: Enter the amount and review the quote.

Step 5: Confirm the transaction and receive your tokens instantly.

2. For Yield Farmers: Provide Liquidity

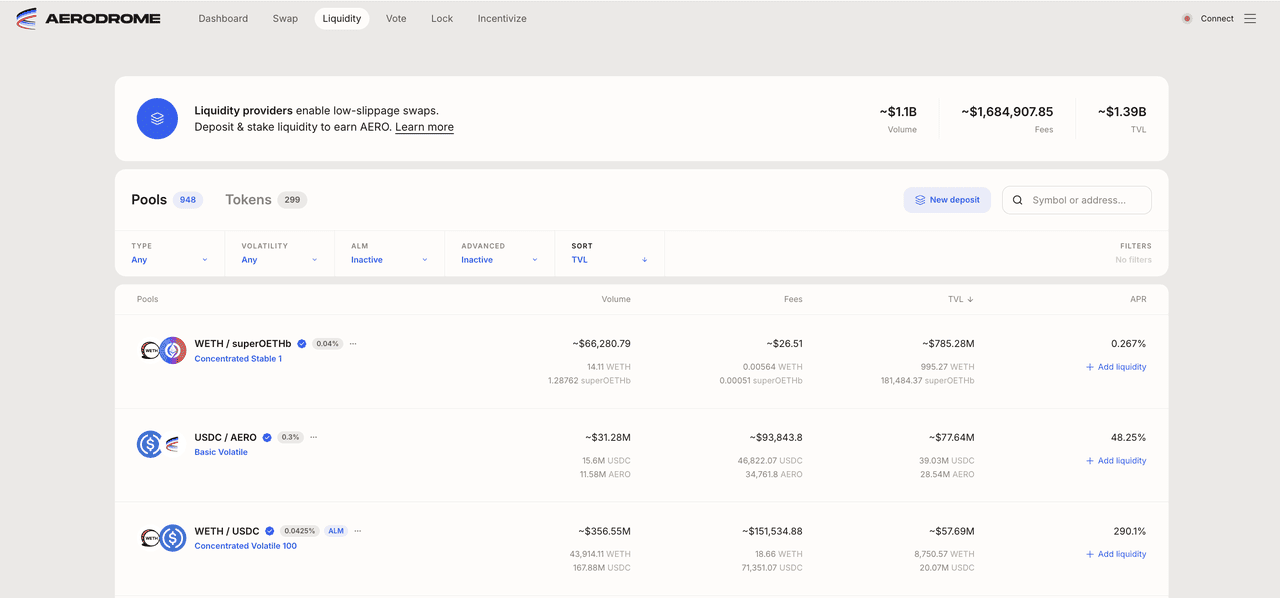

If your goal is to earn passive income, Aerodrome allows you to provide liquidity in stable or volatile pools, stake LP tokens, and earn rewards from both swap fees and AERO emissions.

Step 1: Go to

Aerodrome Liquidity Page, connect a Web3 wallet on Base, and make sure you have the two tokens you want to pair, plus ETH for gas fees.

Step 2: Go to the Aerodrome interface and choose a liquidity pool.

Step 3: Deposit equal amounts of both tokens into the pool.

Step 4: Receive LP tokens and stake them in the corresponding gauge.

Step 5: Claim AERO emissions and trading fees during each epoch.

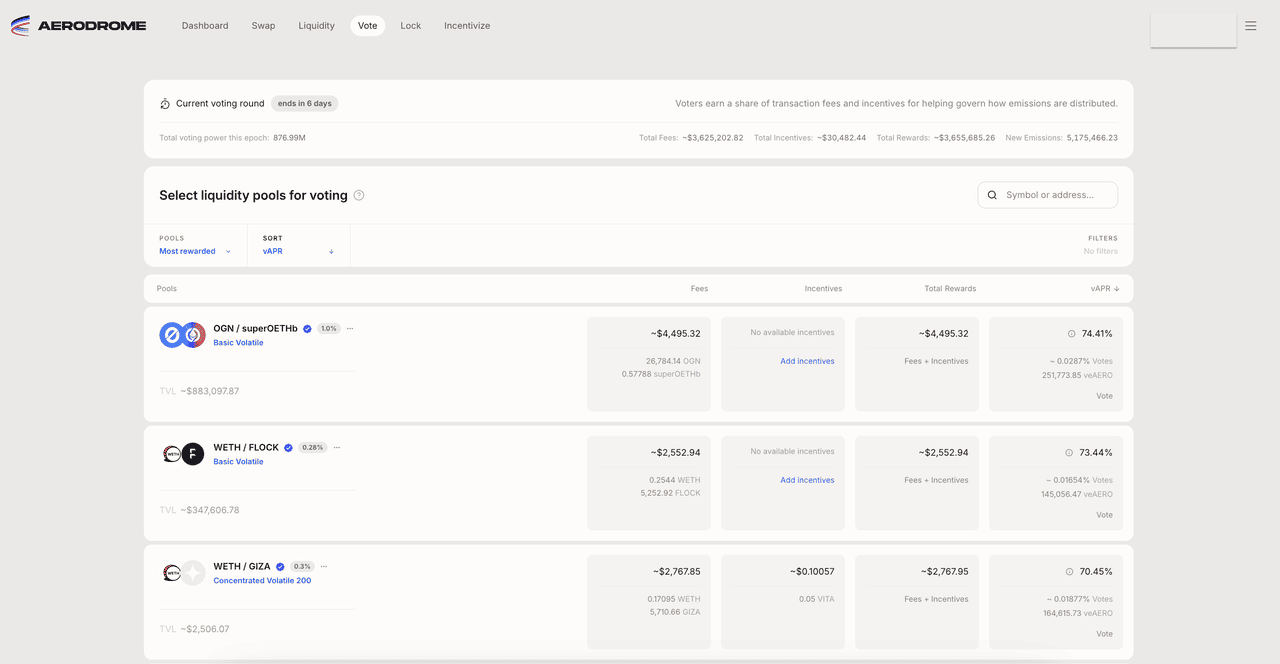

3. For Governance Participants: Active Voting and Fee Earning

This strategy is for users who want to be hands-on in shaping Aerodrome’s incentives. By locking AERO into veAERO NFTs, you can take part in gauge voting, which decides how weekly AERO emissions are allocated to liquidity pools.

Step 1: Go to

Aerodrome Vote page, connect a Web3 wallet and make sure you hold AERO tokens, along with ETH for gas.

Step 2: Go to the Lock section of the Aerodrome app.

Step 3: Choose your lock duration (up to 4 years for maximum voting power).

Step 4: Confirm the transaction to mint your veAERO NFT.

Step 5: Each epoch, use the Vote tab to research pools and cast votes. By actively directing emissions, you receive 100% of protocol trading fees plus additional “bribes” from projects competing for liquidity. Active voters often maximize their earnings by supporting the most profitable pools.

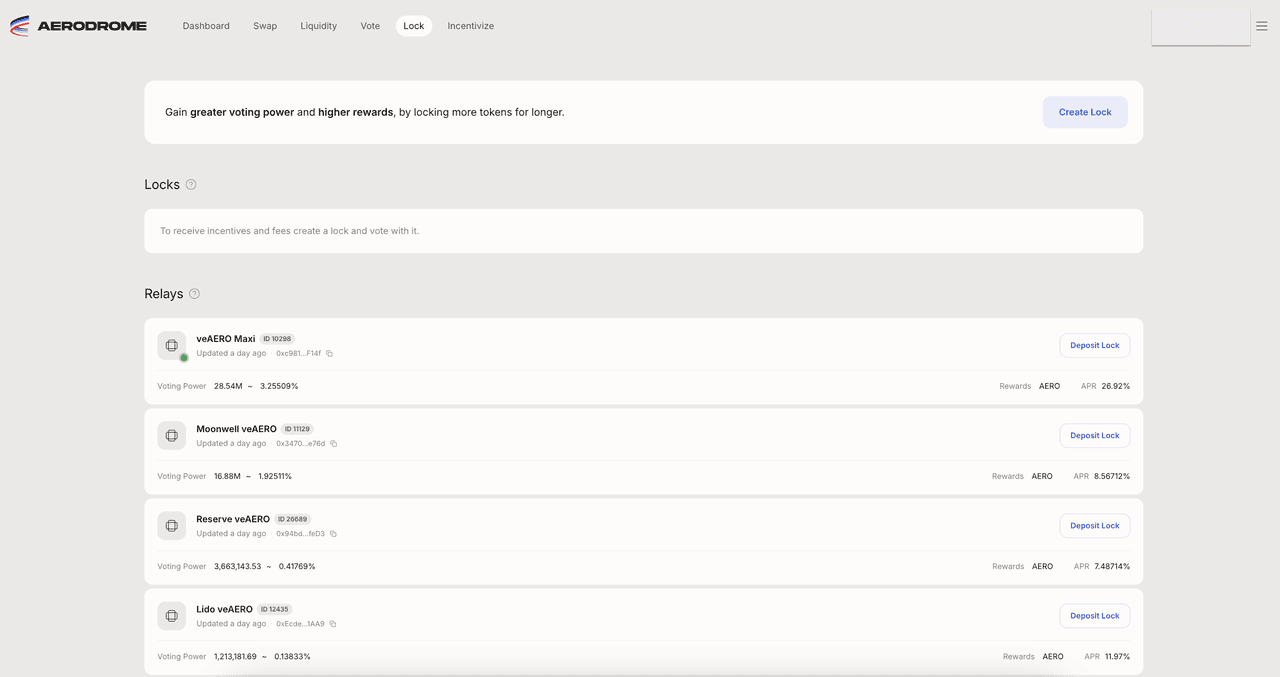

4. For Long-term Investors: Passive Lock Strategies

This strategy is for users who want steady returns without weekly engagement. By locking AERO for the maximum period and enabling Auto-Max Lock, you maintain full governance weight and continue earning rewards automatically.

Step 1: Go to

Aerodrome Lock page, connect a Web3 wallet and acquire AERO tokens, making sure you also have ETH for gas.

Step 2: Navigate to the Lock section on Aerodrome.

Step 3: Select a lock duration, up to 4 years for maximum power (100 AERO locked for 4 years = 100 veAERO, compared to 25 veAERO for 1 year).

Step 4: Enable Auto-Max Lock to prevent your voting power from decaying.

Step 5: Confirm your lock transaction. With this passive approach, you’ll continue earning protocol fees and rebase rewards automatically, whether or not you participate in weekly voting.

The Weekly Epoch System

All Aerodrome products operate within a seven-day cycle known as an epoch, which begins every Thursday. During each epoch, emissions are distributed, votes are tallied, and rewards are made available. This predictable cycle makes it easier for users to plan their trading, liquidity, and governance strategies.

What Is AERO Token: The Aerodrome Finance Tokenomics

Aerodrome Finance runs on a dual-token system: AERO for utility and rewards, and veAERO for governance and long-term incentives.

1. AERO : The Reward and Utility Token

AERO is the protocol’s utility token, distributed to liquidity providers as weekly emissions. It encourages users to add liquidity and participate in the ecosystem. At launch, the total supply was capped at 500 million, with weekly emissions starting at 10 million and gradually declining over time.

2. veAERO : The Governance and Incentive Token

When users lock AERO, they receive veAERO in the form of an NFT. The longer the lock, the more voting power it represents. For example, 100 AERO locked for four years equals 100 veAERO, while the same amount locked for one year equals 25 veAERO.

veAERO holders gain:

• The right to vote on which liquidity pools receive emissions

• A share of all trading fees generated by the protocol

• Additional incentives from projects seeking to attract votes

• Control of monetary policy through the Aero Fed once weekly emissions fall below 9 million

Together, AERO and veAERO balance short-term rewards with long-term governance, ensuring that liquidity providers, traders, and investors all have a stake in the health and growth of the Base ecosystem.

How to Trade Aerodrome (AERO) Tokens on BingX

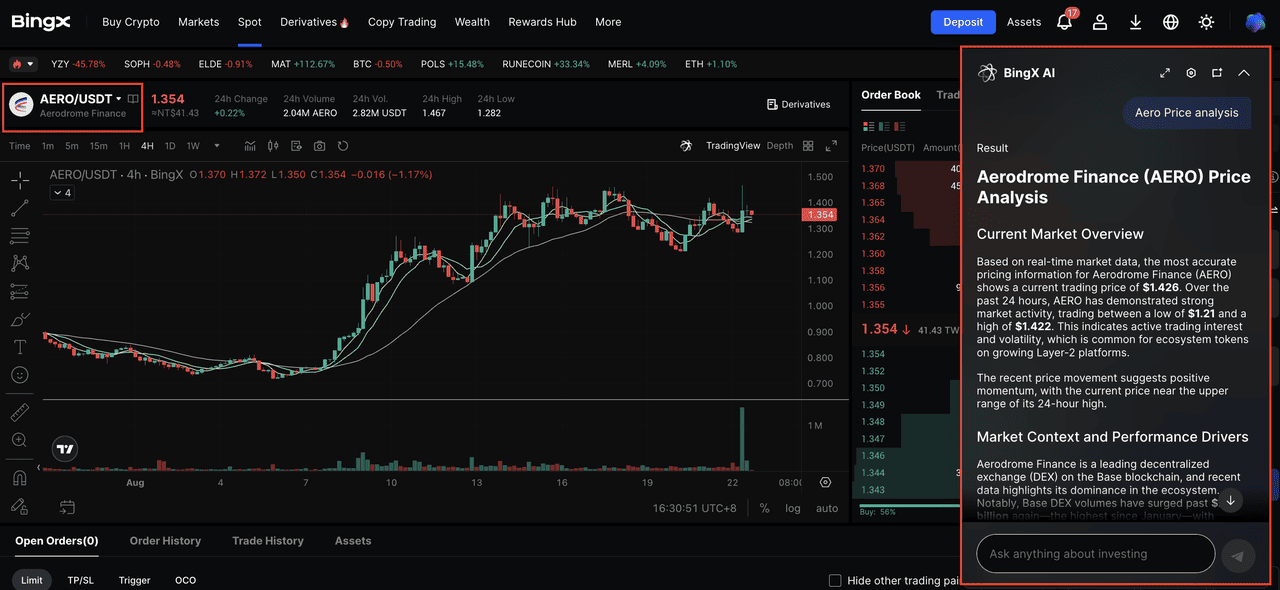

Aerodrome (AERO) is the utility and governance token of Aerodrome Finance, the leading decentralized exchange on Base. It powers liquidity incentives through emissions and vote-escrow governance with veAERO. AERO is listed on both the BingX Spot Market and Perpetual Futures Market, giving traders the flexibility to either build a long-term position or trade short-term price movements. BingX also offers real-time analysis through

BingX AI to help identify better trading setups.

Step 1: Search for AERO/USDT on Spot or Perpetual Futures

AERO Spot Trading

Go to the

Spot Market on BingX and search for

AERO/USDT. Place a market order to buy instantly or set a limit order for your preferred entry price. Spot trading is ideal for those who want to hold AERO long term, participate in governance through veAERO, or gain exposure to the growth of Base’s DeFi ecosystem.

1. For Traders: Swap Tokens

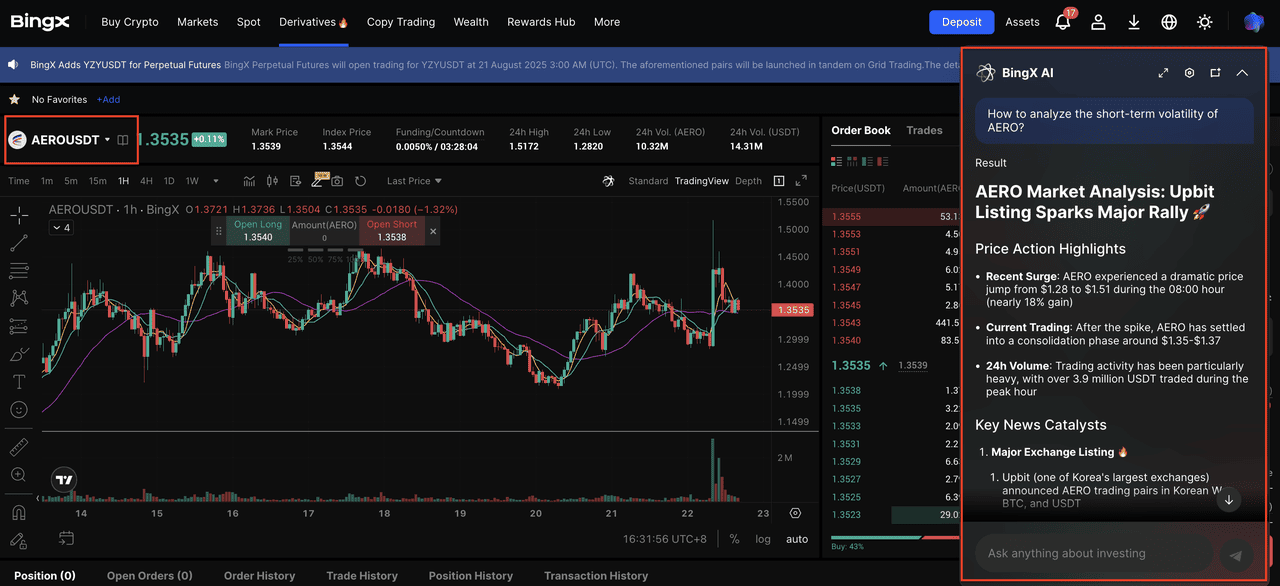

AERO Perpetual Futures

Search for

AERO/USDT in the

Perpetual Futures Market to go long or short without an expiration date. This gives traders flexibility in both bullish and bearish conditions. Leverage can amplify returns but also increases risk, so it should be managed carefully.

Step 2: Use BingX AI for Real-Time Market Insights

Click the AI icon on the trading chart to launch

BingX AI The tool highlights support and resistance levels, shows trend direction, and surfaces recent market-moving events such as Aerodrome’s TVL growth and Base ecosystem adoption. These insights can help refine your entry and exit strategies.

Step 3: Execute and Monitor Your Trade

Use a market order for immediate execution or a limit order to target your preferred entry price. Continue monitoring BingX AI to adapt your position and strategy based on market conditions.

Buy Button: https://bingx.com/en/spot/AEROUSDT

Conclusion

Aerodrome Finance has quickly become the central liquidity hub of Base, offering traders, liquidity providers, and long-term investors a unified platform to participate in DeFi. Its dual-token system of AERO and veAERO ensures that incentives are aligned across short-term activity and long-term governance, creating a sustainable model for growth.

With more than $600 million in TVL and a top-ten global ranking among decentralized exchanges, Aerodrome is positioning itself as the “Uniswap of Base.” As the Base ecosystem expands, AERO’s role as both a reward and governance token is likely to strengthen, giving users exposure to one of the most important platforms driving adoption on Coinbase’s Layer 2 network.

For those looking to trade AERO, BingX provides an easy entry point with spot and perpetual futures markets, along with AI-powered analysis to guide decision-making. Whether your goal is trading, farming, or governance, Aerodrome represents a gateway into the fast-growing Base ecosystem.

Related Reading