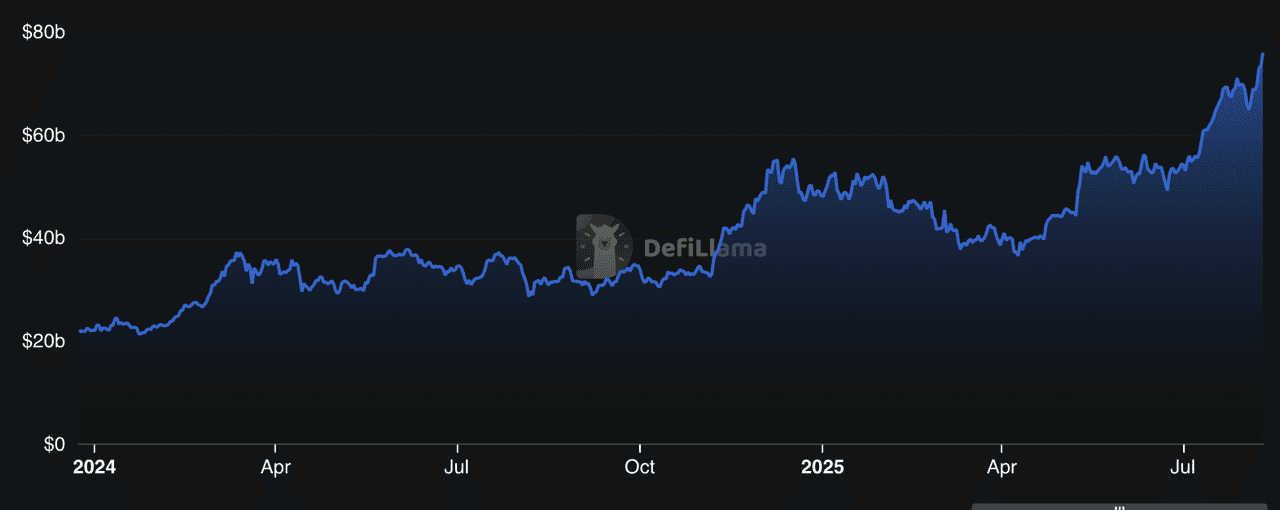

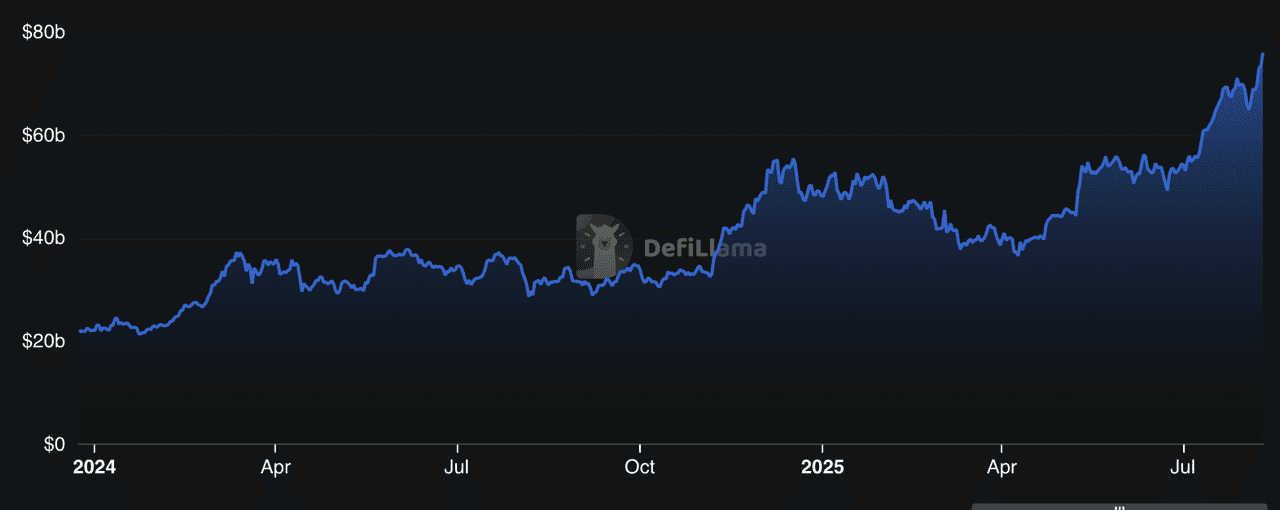

DeFi lending is one of the fastest-growing sectors in crypto, with protocols collectively securing over $78 billion in TVL as of 2025, according to DeFiLlama, representing nearly 50% of all DeFi activity. This surge is fueled by rising institutional inflows, high-yield lending strategies, and multi-chain deployments that make borrowing and lending accessible to millions worldwide. From undercollateralized credit markets to modular vault systems, the space is growing rapidly to meet the demands of both retail users and professional investors.

DeFi lending protocol TVL | Source: DefiLlama

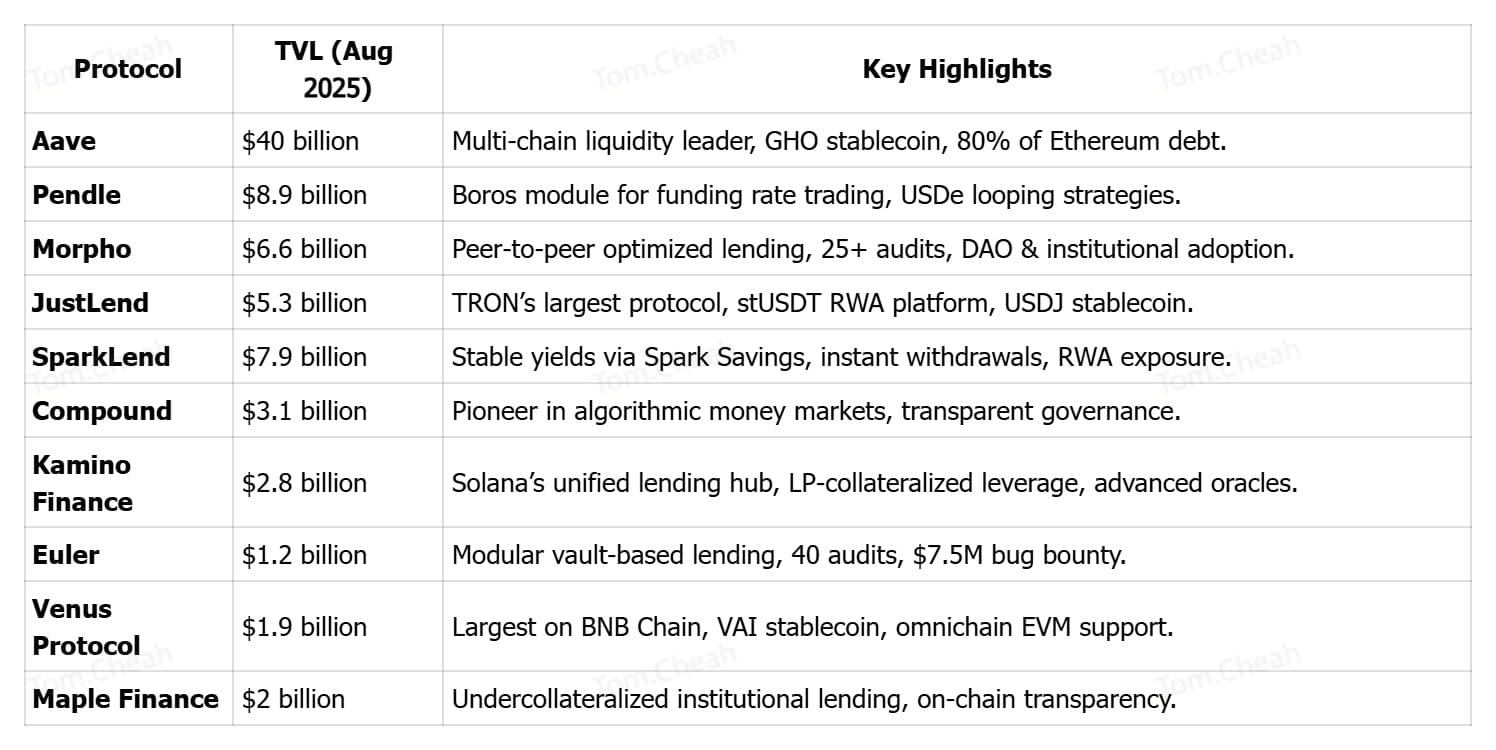

Discover the top 10 DeFi lending protocols of 2025, driving over $75 billion in total value locked (TVL) with innovative yield models, cross-chain expansion, and growing institutional adoption.

What Is DeFi Lending and How Does It Work?

A DeFi lending protocol is a blockchain-based platform that lets you borrow or lend cryptocurrencies without going through banks or brokers. Instead of a loan officer, smart contracts handle the entire process, from matching borrowers and lenders to enforcing repayment terms.

In 2025, DeFi lending accounts for over $25 billion in total value locked (TVL) across major platforms like

Aave,

Compound, and

Morpho, according to DeFiLlama. These protocols operate on public blockchains like

Ethereum,

Solana, or

Tron, which means anyone with a wallet and internet connection can participate globally, 24/7.

Here’s how a DeFi lending platform works in practice:

1. Deposit Assets to Earn Interest – Lenders supply tokens (e.g.,

USDC,

ETH) into a liquidity pool. The protocol automatically allocates these assets to borrowers and rewards lenders with interest, usually denominated in the same token they provided.

2. Borrow Against Collateral – Borrowers lock in crypto collateral worth more than the amount they want to borrow (overcollateralization). For example, to borrow $1,000 in

USDT, you might need to deposit $1,500 worth of ETH.

3. Dynamic Interest Rates – Rates change in real time based on supply and demand in the pool. When demand for borrowing rises, interest rates increase to attract more lenders.

4. Automatic Liquidations – If a borrower’s collateral value falls below a set threshold due to market volatility, the protocol liquidates part of it to protect lenders.

Some advanced protocols in 2025, like

Pendle with yield tokenization or

Maple with undercollateralized institutional loans, are expanding beyond the simple lend/borrow model, enabling strategies like funding rate speculation or real-world asset financing.

Why DeFi Lending Protocols Matter in 2025

In 2025, DeFi lending protocols are more than just crypto savings accounts; they’ve evolved into a core pillar of the decentralized finance ecosystem, facilitating billions in on-chain borrowing, lending, and yield strategies. As of August 2025, CoinGecko lists over 160 lending protocol tokens on its platform, with a combined market cap of over $10.3 billion.

For everyday users, these platforms offer global, permissionless access to credit, no bank accounts, no credit checks, just a

crypto wallet and internet connection. For institutions, they present on-chain alternatives to fixed income markets, enabling

KYC-compliant participation and high-efficiency yield opportunities.

The importance of these protocols in 2025 comes down to four key themes:

• Diversification – Lending markets now span multiple blockchains, from

Ethereum Layer-2s to Solana, TRON, and

BNB Chain. This gives users flexibility in fees, speed, and ecosystem access.

• Innovation – Yield tokenization like Pendle, modular lending vaults like

Euler, and institutional credit pools (Maple) redefine what’s possible in on-chain finance.

• Institutional On-Ramp – Platforms like Maple and Pendle integrate compliance frameworks, bridging traditional finance and DeFi.

• Security First – Top names maintain rigorous audit standards, bug bounties, and DAO-led governance to protect users in volatile markets.

For newcomers, the main appeal is passive income (lending) and capital efficiency (borrowing without selling holdings). However, risks like smart contract bugs, price volatility, and protocol insolvency mean that careful platform selection and risk management are crucial.

The 10 Best DeFi Lending Platforms

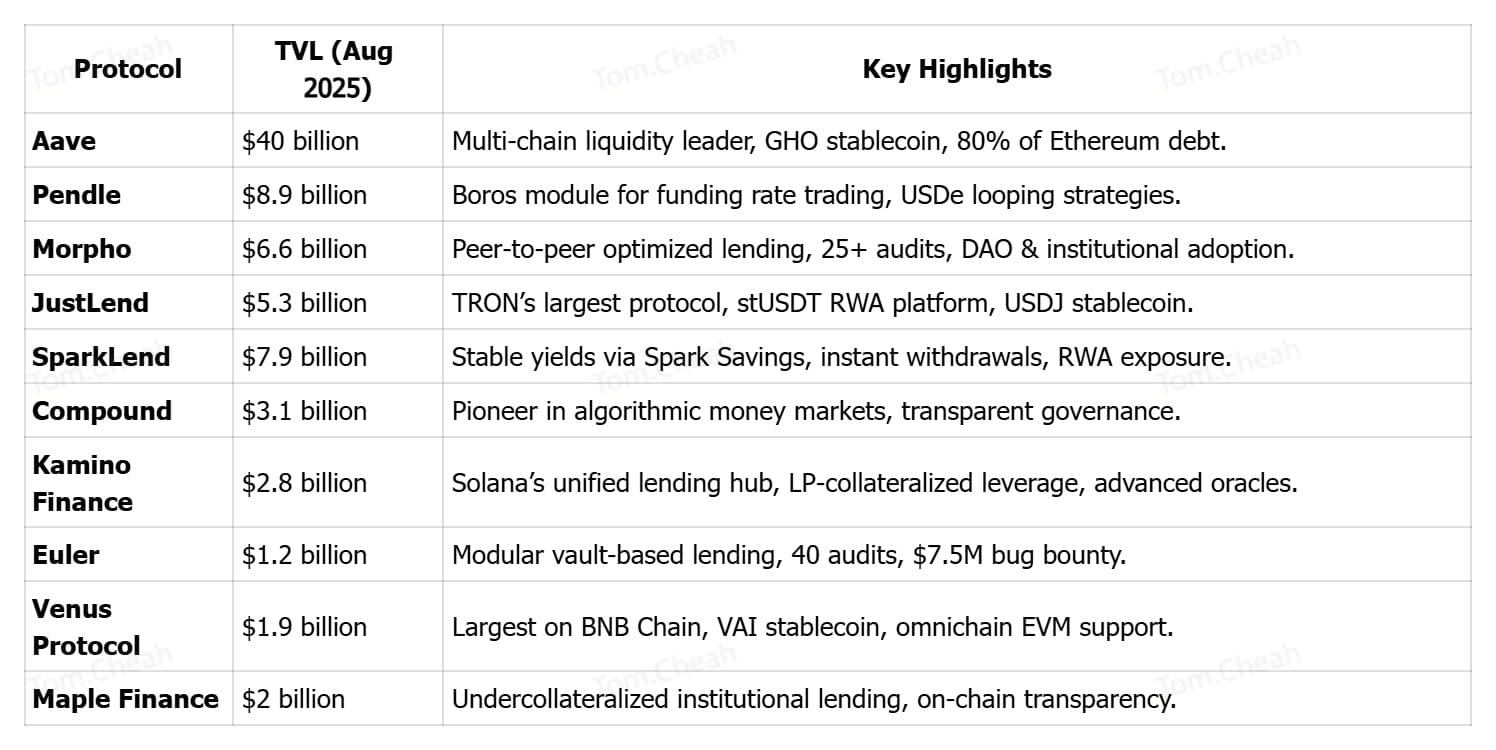

DeFi lending protocols in 2025 stand out for their rapid TVL growth and growing institutional adoption, with platforms like Pendle surpassing $8.27 billion thanks to products like Boros and enterprise-focused expansion. They introduce innovative yield models, from Pendle’s fixed-rate tokenization to Euler’s modular vaults and Maple’s undercollateralized credit pools, offering diverse ways to optimize capital.

Their multi-chain reach, Aave on Ethereum L2s,

Polygon, and

Avalanche; Morpho on Ethereum; JustLend on TRON; and Venus on BNB Chain, ensures accessibility across user bases and ecosystems. Finally, robust security practices, including multiple external audits, active governance, and bug bounty programs, help maintain user trust in volatile markets.

In 2025, the following platforms dominate the DeFi lending landscape, combining high liquidity, innovative yield structures, cross-chain accessibility, and strong security to serve both retail and institutional markets.

1. Aave (AAVE)

Aave, one of DeFi’s most established protocols, has evolved into a multi-chain liquidity powerhouse spanning Ethereum, Polygon, Avalanche, and other EVM-compatible networks. Its total value locked (TVL) surged from $8 billion in early 2024 to over $40 billion by August 2025, capturing roughly 80% of Ethereum’s outstanding debt and signaling growing institutional adoption. Aave’s appeal lies in permissionless, 24/7 access to capital without credit checks, combined with transparent smart contract execution for lending terms and rates.

Users can supply assets to earn yield, borrow against collateral, swap tokens, and even mint GHO, Aave’s overcollateralized native stablecoin, while retaining full custody of their funds. Backed by multiple security audits, a robust safety module, and community governance, Aave continues to serve as the backbone of decentralized lending, bridging traditional finance with the on-chain economy.

2. Pendle (PENDLE)

Pendle has rapidly emerged as the world’s largest crypto yield-trading platform, with its total value locked (TVL) surging to a record $8.9 billion in August 2025 following the launch of its flagship Boros module. Boros introduces On-Chain Yield Units (YUs), allowing traders to go long or short on interest rates, such as

Bitcoin and Ethereum funding rates, without holding the underlying assets, enabling hedging, fixed-yield locking, and leveraged yield speculation.

Within 48 hours of launch, Boros attracted $1.85 million in BTC and ETH deposits and boosted Pendle’s active addresses on

Arbitrum to 1,428, well above its monthly average. Strategic integrations, such as with Hyperliquid’s $221 million-TVL kHYPE token and

Ethena’s USDe stablecoin, have further expanded Pendle’s ecosystem, with USDe alone accounting for 60% of protocol TVL through profitable “looping” strategies. This blend of innovative yield tokenization, cross-protocol composability, and growing institutional participation has positioned Pendle as a key driver of structured yield markets in DeFi.

3. Morpho (MORPHO)

Morpho is an open lending infrastructure that merges the simplicity of vault deposits with the efficiency of optimized peer-to-peer matching, delivering better rates for both lenders and borrowers. With over $10 billion in total deposits and $3.4 billion in active loans, it has become a preferred choice for both institutional and retail participants seeking capital efficiency without sacrificing security.

The protocol’s minimalist design, paired with 25+ security audits, formal verification, and a $2.5 million bug bounty program, reinforces user trust while enabling developers, DAOs, and businesses to build tailored lending use cases. By integrating with major DeFi players like

Lido, Maker,

Frax, and Coinbase, Morpho continues to expand its reach and liquidity across the ecosystem.

4. JustLend DAO (JST)

JustLend, the largest lending protocol in the TRON ecosystem, has grown to a TVL of $5.37 billion as of August 2025 by offering fast, low-fee lending and borrowing across 19 mainstream markets. Users can supply assets to earn yield, borrow against collateral, stake TRX for double rewards, or rent Energy at ultra-low costs to reduce transaction fees.

The protocol also supports stUSDT, the first

RWA platform on TRON, and the over-collateralized

USDJ stablecoin. Governed by the JustLend DAO, it operates with a community-driven grants program, a dedicated Risk DAO for rapid market protection, and multi-layered security measures including audits, bug bounties, and decentralized price oracles, making it a key driver of DeFi growth on non-Ethereum chains.

5. SparkLend (SPK)

SparkLend, part of the Sky ecosystem and built on an Aave-derived framework, has emerged as a $7.9 billion TVL lending leader by combining blue-chip security with innovative yield strategies. It allows users to borrow USDC and USDS at governance-set rates unaffected by liquidity utilization, and to supply assets such as ETH, wstETH, rETH, cbBTC, and tokenized Bitcoin variants.

Through Spark Savings, depositors can earn up to 4.75% APY on stablecoins with instant, zero-slippage withdrawals into USDC,

USDS, or

DAI, powered by capital allocations to DeFi, CeFi, and real-world assets (RWAs). Backed by multi-layered audits, a $5 million bug bounty, and deep liquidity from the Sky treasury, SparkLend offers both institutional-grade stability and retail-friendly flexibility, while integrating seamlessly across Ethereum, L2s, and the growing tokenized asset market.

6. Compound (COMP)

Compound, one of DeFi’s longest-standing and most battle-tested lending protocols, holds roughly $3.15 billion in TVL and continues to set the standard for algorithmic money markets and decentralized governance. Operating across Ethereum and multiple L2s, Compound enables users to supply assets and earn yield via cTokens or borrow against collateral with interest rates dynamically set by on-chain algorithms.

Governance is fully community-driven, with

COMP token holders voting on upgrades, market parameters, and asset listings, ensuring the protocol evolves with user and market needs. Its open-source architecture, transparent interest rate models, and track record of security audits have helped Compound maintain deep liquidity and a reputation for reliability, making it a foundational pillar in the DeFi lending ecosystem.

7. Kamino Finance (KMNO)

Kamino Finance, Solana’s leading lending hub, powers Kamino Lend (K-Lend), a unified, peer-to-pool borrowing market designed for maximum capital efficiency, composability, and safety. Unlike fragmented multi-pool designs, K-Lend’s single liquidity market supports Elevation Mode for higher-LTV borrowing within correlated asset groups, accepts tokenized concentrated liquidity LP positions (kTokens) as collateral, and uses a sophisticated poly-linear interest curve for smoother rate adjustments.

It integrates automated risk controls such as deposit/borrow caps, partial and dynamic liquidations, auto-deleverage mechanisms, and advanced oracle protections leveraging

Pyth, Switchboard, TWAP, and EWMA pricing. Beyond lending, Kamino unifies DEX functions, yield vaults, and cross-collateral flows, enabling complex leveraged strategies within the same ecosystem. While its TVL trails Ethereum’s giants, Kamino’s innovation density, from LP-collateralized leverage loops to real-time risk simulation, has made it the go-to platform for Solana-based traders and DeFi power users.

8. Euler Finance (EUL)

Euler is a modular DeFi lending “super app” built around a vault-driven architecture that lets users create, customize, and manage their own lending markets with granular risk controls. Through the Euler Vault Kit (EVK) and Ethereum Vault Connector (EVC), users can deploy vaults for any asset, set collateral parameters, and even use vault positions as collateral in other markets, enabling deeply composable strategies.

Its design supports lending and borrowing for a broad range of tokens, maximizing capital efficiency while giving builders and traders full control over leverage, liquidation thresholds, and interest rate models. Security is a core focus, with ~40 audits and a $7.5M bug bounty program, making Euler one of the most heavily vetted lending protocols in DeFi.

9. Venus Protocol (XVS)

Venus Protocol is the largest DeFi lending platform on BNB Chain, combining decentralized money markets with its native stablecoin, VAI. Users can supply or borrow a wide range of BEP-20 assets, such as BTCB, ETH, BNB, and USDT, while earning yield or accessing liquidity without selling holdings. With a total value locked (TVL) of around $4.2 billion, Venus stands out for its scale, governance-driven interest rate models, and boosted reward system through Venus Prime.

Security is reinforced by over 20 independent audits, a fallback pool for extreme events, and a strong bug bounty program. The protocol’s omnichain, EVM-compatible design ensures fast, low-cost transactions, making it the go-to lending and borrowing solution for Binance Smart Chain users.

10. Maple Finance (SYRUP)

Maple Finance is a DeFi lending platform bridging institutional credit markets with on-chain infrastructure, specializing in undercollateralized lending structures. With over $3.2 billion in assets under management as of 2025, Maple enables institutions to access tailored financing solutions while allowing individuals and sophisticated allocators to earn competitive yields through curated products like syrupUSDC and BTC- or ETH-backed loans.

The protocol stands out for its institutional-grade risk management, full on-chain transparency of loan terms and collateral, and a global client support framework. Its rapid TVL growth earlier in 2025 underscores increasing demand for DeFi-native, compliant credit solutions that merge blockchain efficiency with traditional financial rigor.

Is DeFi Lending Safe?

DeFi lending offers transparent, non-custodial access to borrowing and lending, but it is not risk-free. Smart contract bugs, oracle manipulation, and liquidity crunches can cause losses, even in audited protocols. Leading platforms like Aave, Morpho, and Euler mitigate these risks with multiple security audits, bug bounty programs, overcollateralization, and active governance. Still, users should diversify, monitor protocol health metrics like TVL and collateral ratios, and only lend assets they can afford to lock up.

Final Thoughts

DeFi lending isn’t just thriving but also evolving at a rapid pace. From dominant players like Aave and Compound to emerging innovators like Pendle and Maple Finance, 2025 is solidifying decentralized lending as a core pillar of modern finance. Favorable crypto regulations in key markets, growing institutional adoption, and the rise of

real-world asset (RWA) tokenization are further accelerating growth.

Demand is being fueled by tokenized treasury bills, stable yield products, and integrations with compliant on-chain credit markets. Whether you’re maximizing yield, optimizing collateral, or bridging traditional and decentralized finance, these protocols offer a wide spectrum of options. Choose based on your risk appetite, chain preferences, and desired yield strategies, and as always, do your own due diligence.

Related Reading