You’ve already heard of

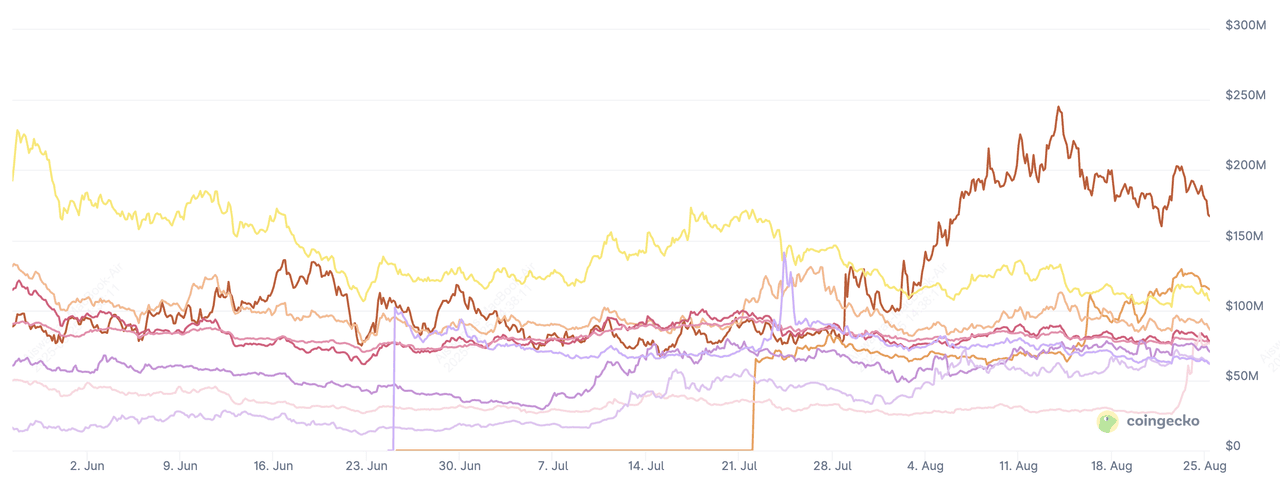

AI (artificial intelligence) and DeFi (decentralized finance). Now meet DeFAI, the fusion of AI and DeFi that’s building the next layer of on-chain finance. As of August 2025, CoinGecko tracks nearly 150 DeFAI projects with a combined market cap of about $1.62 billion. While still early and volatile, momentum is growing as

AI agents, oracles, and verifiable automation frameworks begin reshaping how decentralized finance operates.

Top DeFAI coins by market cap | Source: CoinGecko

In this article, you'll discover the top seven DeFAI projects to keep on your radar, their standout features, what sets them apart, and how to buy DeFAI tokens on BingX.

What Is DeFAI and How Does It Work?

DeFAI stands for Decentralized Finance + Artificial Intelligence. At its core, it’s about using AI tools to make DeFi easier, smarter, and safer for everyday users.

Normally, DeFi can be overwhelming; you need to compare yields across multiple apps, calculate gas fees, monitor price swings, and execute trades manually. DeFAI simplifies this by using AI agents (autonomous bots) that can analyze real-time data, recommend strategies, and even carry out tasks on your behalf.

Here’s how it works in practice:

1. Natural Language Commands: Instead of learning complex interfaces, you can just type, “Swap 1

ETH for USDC and stake it for yield”. A DeFAI agent scans liquidity pools, bridges, and staking platforms to find the best rates with minimal fees, then shows you the recommended route.

2. AI-Guided Decisions: DeFAI agents process massive datasets, on-chain activity, price feeds, liquidity depth, and even social media sentiment. For example, they can analyze millions of transactions per second, spotting opportunities or risks faster than any human trader.

3. Automation of Strategies: Want to protect yourself from market dips? You can set a goal like “Sell 50% of my ETH if the price falls below $3,500.” The AI agent monitors prices 24/7 and executes automatically, removing emotional bias from trading.

4. Trust and Transparency: Unlike black-box bots, many DeFAI projects (like Newton Protocol) use zero-knowledge proofs or secure enclaves to prove that the agent followed your instructions correctly. This gives beginners confidence that their funds are handled fairly.

5. Personalized Finance: Over time, AI agents learn your portfolio history, risk appetite, and trading patterns. If you often use stablecoins, the agent may suggest high-yield

stablecoin staking or low-volatility strategies tailored to you.

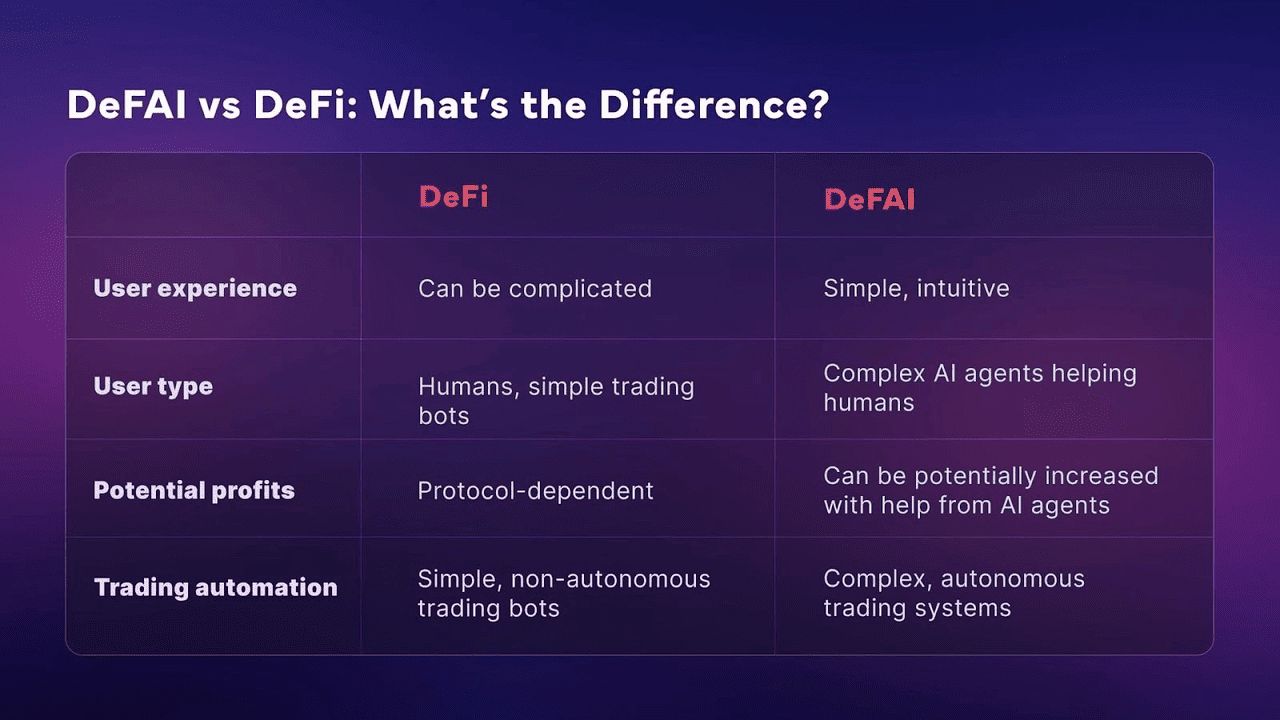

How Is DeFAI Different From DeFi?

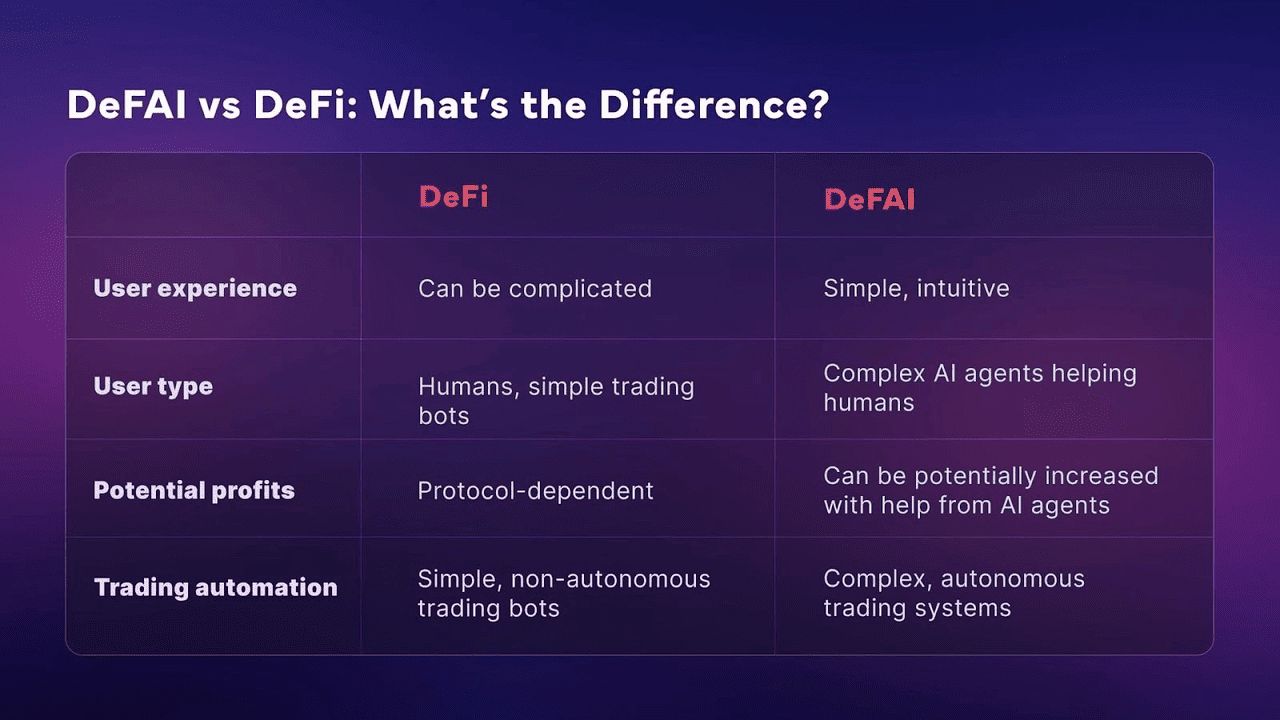

DeFAI vs. DeFi | Source: IQ.wiki

While DeFi relies on users to manually execute trades, manage liquidity, and monitor protocols, DeFAI brings automation and intelligence into the process. By integrating AI agents, natural-language interfaces, and verifiable automation, DeFAI can analyze market conditions, execute strategies, and optimize yields without constant user input.

This makes DeFi more accessible, efficient, and adaptive, lowering entry barriers for beginners while offering advanced tools for experienced traders. However, unlike traditional DeFi, DeFAI also introduces new risks tied to AI reliability and system complexity, making careful monitoring and risk management essential.

Why the DeFAI Sector Matters in 2025

DeFAI (Decentralized Finance + AI) is about making crypto simpler and smarter. Instead of manually jumping between DeFi apps, comparing yields, and worrying about complex contracts, DeFAI projects use artificial intelligence to handle the heavy lifting. You can type natural commands like “Swap my ETH for USDC and stake it for yield”, and an AI agent figures out the best and safest way to do it.

These DeFAI projects stand out because they each tackle a different challenge in bringing AI to decentralized finance.

ChainGPT (CGPT) and

Solidus Ai Tech (AITECH) deliver end-to-end infrastructure, from smart contract tools to GPU compute marketplaces.

Newton Protocol (NEWT) emphasizes security with zero-knowledge proofs and secure enclaves, ensuring AI agents execute instructions transparently. Supra (SUPRA) embeds automation directly into its blockchain, enabling features like on-chain liquidations and portfolio rebalancing. Meanwhile, Hey Anon (ANON) and

GRIFFAIN (GRIFFAIN) simplify user experience with natural-language interfaces that make DeFi as easy as chatting. Finally, strong investor interest in tokens like CGPT, SUPRA, and ANON highlights growing market momentum behind the DeFAI narrative.

In short, DeFAI lowers the barrier to DeFi by combining AI’s intelligence with blockchain’s transparency. It helps newcomers take part without learning every technical detail, while also giving advanced users smarter, faster tools to manage their portfolios.

The 7 Best DeFAI Crypto Projects to Know

If you’re looking to explore the leading tokens driving this new wave of AI-powered finance, here are seven standout DeFAI projects in 2025 and what makes each of them unique.

1. ChainGPT (CGPT) — AI Stack for Web3

ChainGPT is building one of the most complete AI ecosystems in Web3. Its platform already includes tools like an AI chatbot for crypto research, a smart contract generator and auditor, an AI trading assistant, and a multi-chain NFT generator. At the core is its AI Virtual Machine (AIVM), which will allow AI agents to run directly on-chain. This means developers can deploy intelligent bots that automate DeFi strategies, manage liquidity, and execute trades securely without relying on centralized platforms. With a large community of over 750K Telegram members and 600K Twitter followers, ChainGPT has positioned itself as a go-to hub for

AI + blockchain innovation.

The project continues to expand with major updates: the AIVM Testnet (expected in Q3 2025), Crypto AI Hub V2 for predictive analytics, and a revamped ChainGPT Pad launchpad featuring “Buzzdrops” and cross-chain IDO access. Its token, CGPT, trades around $0.09–$0.10 with roughly 860M tokens in circulation, giving it a market cap of over $80M. Beyond speculation, CGPT holders gain access to AI services, staking rewards, and early-stage project launches. By combining AI infrastructure, real-world utility, and active community backing, ChainGPT is shaping up to be a cornerstone of the growing DeFAI sector.

2. Supra (SUPRA) — AutoFi Powerhouse L1

Supra is a high-speed Layer-1 blockchain built specifically for AutoFi, or automatic decentralized finance. Unlike traditional DeFi platforms where users must manually execute trades, claim rewards, or manage liquidations, Supra bakes automation directly into the chain. Its features include native oracles for real-time price feeds, cross-chain messaging, and built-in protection against MEV (Maximal Extractable Value) attacks. This makes Supra one of the first blockchains to run system-level auto-arbitrage and auto-liquidations on every block, executing strategies multiple times per second without human intervention.

The upcoming Supra 2.0 upgrade (mid-2025), announced at Permissionless IV, will bring these automation primitives to mainnet. Instead of external bots extracting value at the expense of users, Supra’s enshrined automation redistributes profits from arbitrage and liquidations to its decentralized treasury, node operators, and dApps. This creates a fairer and more sustainable economic model where retail users get transparent execution, while the ecosystem generates continuous revenue. With backing from top investors like Coinbase Ventures, Animoca, and Hashed, and a growing list of ecosystem partners, Supra is positioning itself as the foundation for a new era of self-sustaining DeFi infrastructure.

3. Newton Protocol (NEWT) — Trust-Minimized Agent Layer

Newton Protocol is building the infrastructure layer for secure DeFi automation, where AI agents can execute financial tasks under strict cryptographic guardrails. Instead of relying on centralized bots that require private key access, Newton combines Trusted Execution Environments (TEEs) and Zero-Knowledge Proofs (ZKPs) to deliver what it calls “verifiable automation.” This means every action taken by an AI agent, whether it’s rebalancing a portfolio, managing collateral, or executing trades, can be proven on-chain to follow user-defined rules. Within just 30 days of launch, the protocol recorded 1M sign-ups, 463K verified agent transactions, and 280K active agents, underscoring its rapid adoption.

The native token, NEWT, powers the ecosystem by paying for compute services, gas, staking, and governance. Beyond DeFi, Newton’s registry of compute services makes it possible to compose workflows for AI analysis, batch processing, and privacy-preserving tasks, creating a public “cloud compute” utility on-chain. Its recent ranking as the #2 DeFAI project in mid-2025 sector interest shows strong momentum, especially after its Binance HODLer Airdrop and major exchange listings. By giving users confidence that automation is transparent, rule-bound, and tamper-proof, Newton Protocol positions itself as a trusted foundation for the next generation of AI-driven decentralized finance.

4. Solidus Ai Tech (AITECH) — AI Compute Meets DeFAI

Solidus Ai Tech bridges AI infrastructure and decentralized finance through its eco-conscious 8,000 sq. ft. HPC data center in Europe. The platform provides on-demand GPU access, an AI marketplace, and no-code tools like Agent Forge, which lets anyone build and deploy AI agents without writing code. Its ecosystem also features AITECH Pad, a launchpad for early-stage AI and Web3 projects, giving token holders priority access to new opportunities. By combining compute resources, AI development tools, and blockchain payment rails, Solidus positions itself as a one-stop shop for AI-driven innovation.

The AITECH token fuels this ecosystem as a deflationary utility asset. It is used to pay for services, stake for governance, and access premium launchpad tiers, with 5–10% of tokens burned each time they are spent, creating long-term scarcity. Trading around $0.037 with a $57M–$60M market cap, AITECH reflects growing investor confidence in decentralized compute. With more than 7.8M community members, 100+ partnerships, and 300K+ monthly visitors across its platforms, Solidus Ai Tech is building both the infrastructure and the user base to become a leader in decentralized AI computing.

5. Hey Anon (ANON) — Multi-Chain DeFAI Interface

Hey Anon is an AI-powered DeFi assistant designed to make crypto feel as simple as chatting with a friend. Built across

Solana,

Sonic, Base, and

Arbitrum, the platform lets users type natural commands like

“Bridge my

USDC to Arbitrum

” or

“Stake 2 ETH for yield

” and have AI agents execute the task automatically. Beyond transactions, Hey Anon aggregates data from multiple sources, including Twitter, Telegram, GitHub, and Gitbook, to deliver real-time insights into project updates, sentiment shifts, and developer activity. This makes it both a transactional assistant and an informational companion for navigating DeFi’s fast-changing landscape.

Backed by a strategic partnership with DWF Labs and supported by a $20M AI Agent fund, Hey Anon is scaling as a global DeFAI solution. Its ecosystem combines conversational AI with autonomous DeFi agents that can manage wallets, execute multi-step strategies, and analyze risks in real time. By simplifying complex actions and providing verifiable insights, Hey Anon lowers the barriers for newcomers while giving advanced users an edge in cross-chain strategies. With the ANON token at its core, the project is shaping up as one of the most user-friendly gateways to AI-driven decentralized finance.

6. GRIFFAIN (GRIFFAIN) — Natural Language DeFi on Solana

GRIFFAIN is a Solana-based DeFAI project that turns complex DeFi actions into simple conversations. Its “Agent Engine” lets users create AI-powered agents that can handle everything from trading tokens and launching memecoins on pump.fun to automating multi-step DeFi strategies, all through natural language commands. Users interact with delegated wallets, add “energy” (credits), and then instruct their agents in plain text, making DeFi execution as easy as chatting with an assistant. This intuitive approach lowers barriers for beginners while still offering advanced functionality for power users.

Since launching as a hackathon experiment, GRIFFAIN has quickly grown into one of Solana’s most talked-about projects, even securing a Binance

futures listing within months. Its ecosystem already features specialized agents like Agent Pump (

memecoin trading), Agent Warhol (NFT creation), and Agent Moby Dick (whale tracking and copy-trading). With the launch of the @ Store, an app store for AI agents, users can now choose from a growing catalog of tools that automate DeFi, NFTs, trading, and more. By combining multi-agent coordination with an easy-to-use interface, GRIFFAIN is redefining how users interact with decentralized finance.

7. Hive AI (BUZZ) — Intent-Based DeFi Agents

Hive AI is a Solana-based DeFAI platform that uses modular AI agents to turn user intentions into automated DeFi strategies. Instead of manually managing trades, staking, or liquidity, users can type simple instructions like “allocate 100 USDC to the highest-yield pools” and Hive AI’s Orchestrator Agent selects and coordinates the right tools to execute them. Each agent specializes in tasks such as trading, lending, or analytics, while the system as a whole works like a crypto concierge, managing complex financial workflows on behalf of the user. This makes Hive AI especially powerful for newcomers who want automation without giving up control.

The project gained strong credibility after winning first place in the Solana AI Hackathon in early 2025, securing a $60,000 prize. Its roadmap includes intent-based execution, social analytics, multi-agent expansion, and Bubblemaps V2, allowing real-time insights like Twitter sentiment to influence DeFi actions. The BUZZ token powers this ecosystem, used for fees, governance, and incentives, with a total supply near 1B. Having already crossed a $100M market cap at its January 2025 peak, Hive AI is emerging as a fast-growing project that blends automation, transparency, and social-driven intelligence into the DeFAI space.

How to Trade DeFAI Projects on BingX

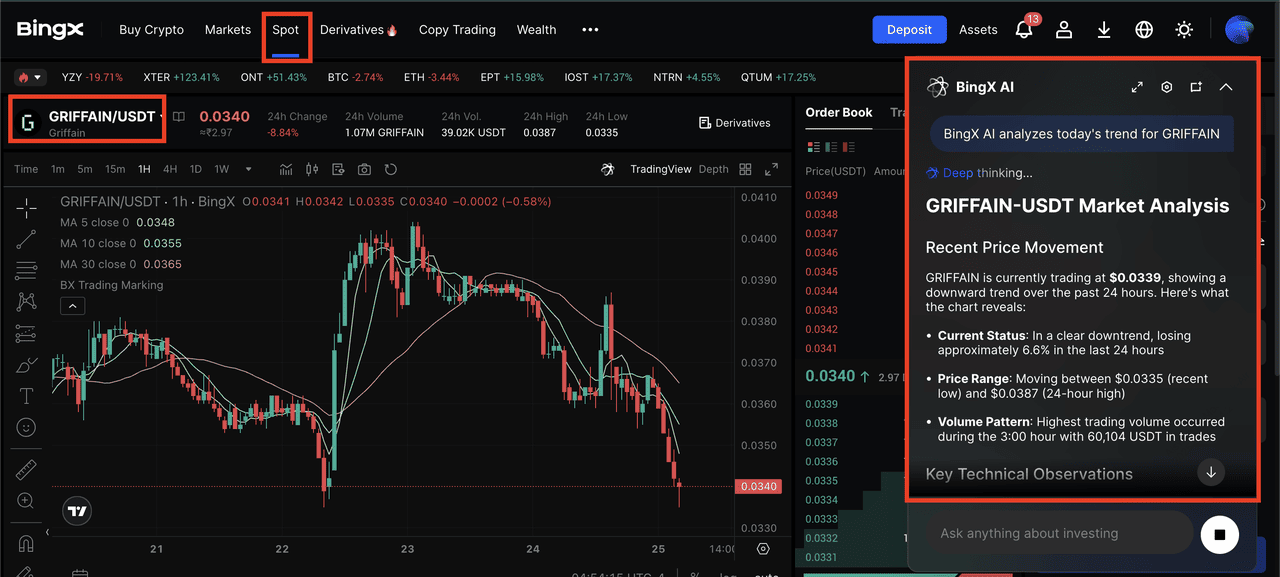

GRIFFAIN/USDT trading pair on BingX spot market powered by BingX AI

1. Create and Verify Your BingX Account: Sign up on BingX with your email or phone number. Complete

KYC verification by uploading your ID and selfie. This unlocks higher withdrawal limits and full trading access.

3. Deposit Funds: Go to Assets → Deposit and choose

USDT,

USDC, or another supported asset. You can fund via crypto transfer, bank card, or third-party providers. Deposits typically confirm in minutes.

4. Find Your Token: Navigate to Trade →

Spot Trading. Search for the DeFAI token pair, e.g.,

CGPT/USDT or

BUZZ/USDT. Use BingX’s real-time charts, order books, and

BingX AI insights to evaluate entry points.

5. Place an Order

•

Market Order: Buy/sell instantly at the current best price.

• Limit Order: Set your preferred price for more control.

6. Manage and Store Your Assets: After your order executes, you’ll see your DeFAI tokens in your BingX Spot Wallet.

Pro Tip: Use BingX AI for smart trading insights. It highlights market sentiment, liquidity zones, and trend signals to help you make more informed trading decisions.

Conclusion

The rise of DeFAI (Decentralized Finance + AI) is reshaping how finance operates on-chain. Projects like ChainGPT and Solidus AI Tech are building infrastructure, Newton Protocol focuses on secure automation, Supra brings native AutoFi execution, while Hey Anon, GRIFFAIN, and Hive AI make DeFi more approachable through natural language and intent-based agents. Together, they showcase a shift toward smarter, more efficient, and user-friendly DeFi systems.

Still, the sector is in its early stages. Roadmaps, deployments, and token utilities should be monitored closely, as adoption and delivery will determine long-term value. DeFAI tokens can be highly volatile, and the technology is experimental. Always DYOR (Do Your Own Research), start small, and diversify to manage risks effectively.

Related Reading