Bitcoin (BTC) remains the world’s largest and most valuable cryptocurrency, hitting an all-time high above $124,000 in August 2025. Its market cap now sits near $2.3 trillion, reinforcing its dominance in the digital asset market. Every day, millions use

BTC for trading, investing, and payments.

Unlike bank accounts, Bitcoin ownership is tied to private keys, making wallet choice one of the most important decisions for any crypto user. Whether you’re a first-time investor, a Lightning Network user, or a long-term holder protecting family wealth, the right wallet ensures your BTC stays safe, accessible, and easy to manage.

This guide explores the best Bitcoin wallets in 2025, breaking down their features, advantages, and trade-offs so you can confidently choose what works best for you.

What Is a Bitcoin Wallet and How Does It Work?

A Bitcoin wallet is a digital tool that lets you store, send, and receive Bitcoin securely. Instead of holding coins physically, the wallet manages your private keys, the cryptographic codes that prove ownership of your Bitcoin on the blockchain. Whoever controls the private keys controls the Bitcoin.

Wallets work in pairs of keys:

• Public key / address: Like your bank account number, this is what you share to receive Bitcoin.

• Private key: Like your PIN or password, this must remain secret. It’s used to sign transactions and move Bitcoin.

Most modern wallets use a 12–24 word recovery phrase (seed phrase) to back up your private keys. If your device is lost or stolen, you can restore your funds using this phrase. According to industry estimates, between 2.3 million and 4 million BTC, or about 11–20% of Bitcoin’s total 21 million supply, are believed to be permanently lost due to forgotten passwords, misplaced keys, or damaged hardware. These lost coins remain on the blockchain but are functionally out of circulation, making secure seed storage vital.

Practically, wallets come in different forms:

• Hot wallets (mobile, web, or desktop apps) connect to the internet, making them fast for daily payments.

• Cold wallets (hardware devices, paper, or air-gapped systems) stay offline, offering maximum protection for long-term savings.

In simple terms, your Bitcoin wallet is both a digital safe and a payment tool. It decides how easily you can access your funds, how secure they are, and how flexible your Bitcoin use can be.

What Are the 7 Best Bitcoin Wallets in 2025?

Choosing the right wallet depends on your needs: long-term storage, fast transactions, or multi-asset management. Below are the seven best Bitcoin wallets in 2025, covering hardware, mobile, and advanced multisig setups.

1. BingX Exchange Wallet: The Simplest Way to Start Storing Bitcoin

The BingX Exchange Wallet is the most beginner-friendly way to start storing Bitcoin. When you buy BTC directly on BingX, it’s automatically stored in your exchange wallet without needing extra setup. This makes it easy to get started, since you don’t have to worry about downloading external apps, generating private keys, or backing up seed phrases right away.

Beyond storage, BingX gives you quick access to trading features, so you can buy, sell, or convert Bitcoin instantly on the

spot market. For more advanced users, the

futures market lets you trade BTC with leverage and hedge against price swings. You can also automate your strategy with trading bots, which help manage trades 24/7 without constant monitoring.

On top of that,

BingX Earn allows you to generate passive income, and

Copy Trading lets you follow top traders without handling strategies yourself. This mix of storage, trading, and automation makes the BingX wallet a practical choice for both beginners and experienced traders.

For new investors, the BingX wallet strikes a balance between security and convenience. It’s ideal if you’re still learning about private wallets and want to focus on buying and using Bitcoin first. Later, as your holdings grow, you can consider moving some BTC into more advanced options like hardware wallets for long-term cold storage.

2. Exodus Mobile Wallet: Beginner-Friendly Bitcoin Control with Multi-Asset Support

Mobile wallets like Exodus give you more independence than exchange wallets while keeping things simple for beginners. Unlike custodial wallets, Exodus lets you hold your own private keys and back them up with a secure 12–24 word recovery phrase, meaning you, not a third party, control your Bitcoin. The app is designed with a clean, intuitive interface, so sending, receiving, and tracking BTC feels as natural as using a mobile banking app. Features like QR-code scanning and face or fingerprint login make everyday use seamless.

Exodus is more than just a Bitcoin wallet. It supports 1,000+ cryptocurrencies across 50+ networks, letting you build and manage a diverse portfolio in one place. You can buy Bitcoin directly with card, PayPal, or bank transfer, and instantly swap BTC for other assets like

Ethereum,

Solana, or

Monero without leaving the app. With built-in price charts and portfolio tracking, Exodus makes it easy to see your holdings at a glance.

For added flexibility, Exodus syncs across mobile, desktop, and browser extension versions, so you can manage your Bitcoin anywhere. It also integrates with Trezor hardware wallets, offering an upgrade path to cold storage when you’re ready for advanced security. This balance of usability and control makes Exodus one of the most practical starting points for new Bitcoin users who want to move beyond exchange wallets while keeping things beginner-friendly.

3. BitGo Web Wallet: Flexible and Institutional-Grade Bitcoin Access

The BitGo web wallet makes Bitcoin management as simple as logging in from any browser, giving you flexibility whether you’re at home, on a work laptop, or traveling. Unlike exchange wallets, BitGo offers

self-custody hot wallets, where you control your own private keys while still benefiting from BitGo’s security policies and countersigning system. This means you can send, receive, and track your Bitcoin while knowing that no transaction leaves your wallet unless it meets the security rules you’ve set.

BitGo is designed not just for individuals but also for businesses and institutions. It supports 1,300+ assets, has processed over $3 trillion in lifetime transactions, and created more than 9 million wallets worldwide. Users can set advanced policies like transaction velocity limits, whitelisting of withdrawal addresses, and multi-user approval requirements. These features reduce the risk of human error and add layers of protection without sacrificing liquidity. For beginners, this translates into a wallet that feels like a web app but carries the same best practices that institutions use to safeguard billions.

Beyond storage, BitGo connects directly to DeFi and staking platforms, making it easier to put Bitcoin and other assets to work without moving them off your wallet. It also offers integration with cold storage solutions, meaning you can keep part of your BTC liquid for everyday use while securing the rest offline. For those ready to grow from an exchange wallet but not yet ready for hardware-only setups, BitGo provides a practical bridge, convenience with enterprise-level security.

4. Ledger Nano X Hardware Wallet: Offline Protection for Long-Term Bitcoin Storage

The

Ledger Nano X is one of the most popular hardware wallets in 2025, trusted by millions of crypto holders worldwide for its bank-grade offline security. It uses a Secure Element chip (CC EAL5+ certified), the same type of chip found in passports and credit cards, to ensure your private keys never leave the device. Unlike hot wallets that stay connected to the internet,

Ledger keeps your Bitcoin completely offline, making it resistant to hacks,

phishing, and malware. This makes it especially valuable for long-term holders and anyone safeguarding significant BTC savings.

What makes the Nano X stand out is its balance between strong security and everyday usability. The device is compact (72mm x 18.6mm, only 34 grams) and connects via Bluetooth or USB-C to your smartphone or computer. Using the Ledger Live app (available on desktop and mobile), you can send and receive Bitcoin, stake other supported assets like

ETH,

ATOM, or

ADA, and even buy or swap crypto securely in-app. Every transaction must be confirmed directly on the Nano X’s screen, so even if your phone or PC is compromised, your funds remain safe.

Ledger supports thousands of coins and tokens, including Bitcoin, Ethereum, Solana,

USDT, and many more, which makes it a versatile option if you’re building a multi-asset portfolio. For additional peace of mind, the Ledger Recover service offers an optional backup solution to restore access if your device is lost, though many advanced users still prefer manual backups with the 24-word seed phrase. For Bitcoin-only enthusiasts seeking extra transparency, devices like Coldcard or Blockstream Jade offer alternatives, but for most users, the Ledger Nano X strikes the right balance: robust offline protection, ease of use, and portability.

5. Bitcoin Core Desktop Wallet: Greater Control and Privacy for Your BTC

Bitcoin Core is the official full-node wallet and the backbone of the Bitcoin network. Unlike mobile or web wallets, Bitcoin Core downloads and validates the entire blockchain, over 350GB of data as of 2025, so you don’t rely on any third-party servers. This gives you maximum security, transparency, and independence, since your wallet directly verifies all transactions against the blockchain itself.

With Bitcoin Core, you get full control over your money. No third party can freeze or mismanage your funds, though you’re responsible for securing and backing up your wallet. It supports SegWit, Bech32, legacy addresses, and multi-signature setups, while also allowing complete fee customization. You can use advanced tools like Replace-by-Fee (RBF) and Child Pays for Parent (CPFP) to adjust fees after sending, ensuring your transactions confirm quickly without overpaying.

Privacy is another strong point. Bitcoin Core rotates addresses automatically to prevent tracking, doesn’t leak information to peers, and lets you run over Tor for IP protection. Its open-source, auditable code further guarantees trust and transparency. The trade-off is resource usage; it requires more disk space, memory, and setup time than lighter wallets.

6. Electrum Multisig BTC Wallet: Advanced Security with Shared Control

The Electrum multisig wallet raises Bitcoin security by requiring multiple private keys to authorize a transaction. For example, in a 2-of-3 setup, two out of three keys must sign before Bitcoin can move. Even in a stricter 2-of-2 setup, both cosigners must approve, which means a hacker or malware would need to compromise multiple devices or people at once, making theft far harder.

Electrum is multi-platform (desktop, mobile, and command-line), supports cold storage, and verifies all transactions with SPV (Simplified Payment Verification). Private keys never leave your device and remain encrypted, while recovery is possible using your seed phrase. You can even combine multisig with hardware wallets or Electrum’s plugins (like the Cosigner Pool) to approve transactions across devices securely.

This setup is especially valuable for families, businesses, or investment groups who need shared control of Bitcoin funds. For example, two business partners can run a 2-of-2 multisig, ensuring that company funds are only spent if both approve. Alternatively, a long-term holder might keep one key on a laptop and another on an offline machine, reducing the risk of remote attacks.

While multisig can feel technical, Electrum makes the process user-friendly with guided setups, QR code support, and file transfer options for signing. If you’re holding larger amounts of BTC or want to avoid depending on a single custodian, Electrum multisig is a proven way to add an extra layer of trustless, decentralized protection.

7. SeedSigner Cold Storage: Air-Gapped Security for Maximum Bitcoin Protection

The SeedSigner is one of the most secure ways to store Bitcoin because it’s fully air-gapped; it never connects to WiFi, Bluetooth, or the internet. Built using inexpensive, off-the-shelf hardware (like a Raspberry Pi Zero 1.3) that costs under $50, SeedSigner lets you generate and store private keys completely offline. Transactions are signed directly on the device and transferred via QR codes, not USB or Bluetooth, which dramatically reduces the risk of remote hacks or malware infections.

Beyond cold storage, SeedSigner is also designed for multisig setups, where multiple devices must approve transactions. This makes it especially attractive to institutions, family offices, and high-net-worth individuals who need resilience against both theft and accidental key loss. Advanced features include generating seed phrases from dice rolls or photos for added randomness, verifying addresses on demand, and deriving child keys (BIP85) for managing multiple wallets securely. SeedSigner is also compatible with tools like Specter Desktop, Sparrow Wallet, BlueWallet, and Nunchuk, making it flexible for different custody strategies.

For everyday Bitcoin users, SeedSigner may feel complex because it requires some DIY setup and a good understanding of seed phrase management. But for those holding large amounts of BTC or seeking sovereign-level self-custody, it’s a gold standard in protection. By removing all wireless connectivity and keeping signing fully offline, SeedSigner ensures your Bitcoin keys stay under your exclusive control, immune to most digital attack vectors.

How to Choose the Best Bitcoin Wallet in 2025

Picking the right Bitcoin wallet comes down to balancing security, convenience, and control. Since Bitcoin is bearer-based, whoever holds the private keys controls the coins, making your wallet both a storage solution and a security system.

1. Security vs. Convenience: Hot wallets, like mobile or web apps, are easy to use and great for small, everyday transactions. Cold wallets, such as hardware devices or air-gapped setups, keep your keys offline and safe from online threats, but they’re less convenient for frequent transfers. Many users find a mix works best—using a hot wallet for spending and a cold wallet for savings.

2. Self-Custody vs. Custodial Options: If you don’t hold the private keys, you don’t fully own your Bitcoin. Custodial services, like exchange wallets, are beginner-friendly and often come with added features, but self-custody wallets give you full independence and control over your funds.

3. Advanced Features in 2025: Today’s wallets go beyond basic storage. Lightning wallets make Bitcoin payments instant and cheap, while multisig setups offer shared access and inheritance planning. These features are becoming mainstream, giving you more flexibility in how you manage your Bitcoin.

Ultimately, the “best” wallet depends on your goals. If you want simplicity, a mobile or custodial wallet may work. If you’re holding large amounts for the long term, hardware or multisig solutions are safer. Choosing the right balance ensures your Bitcoin is both usable and protected.

How to Fund Your Bitcoin Wallet with BTC

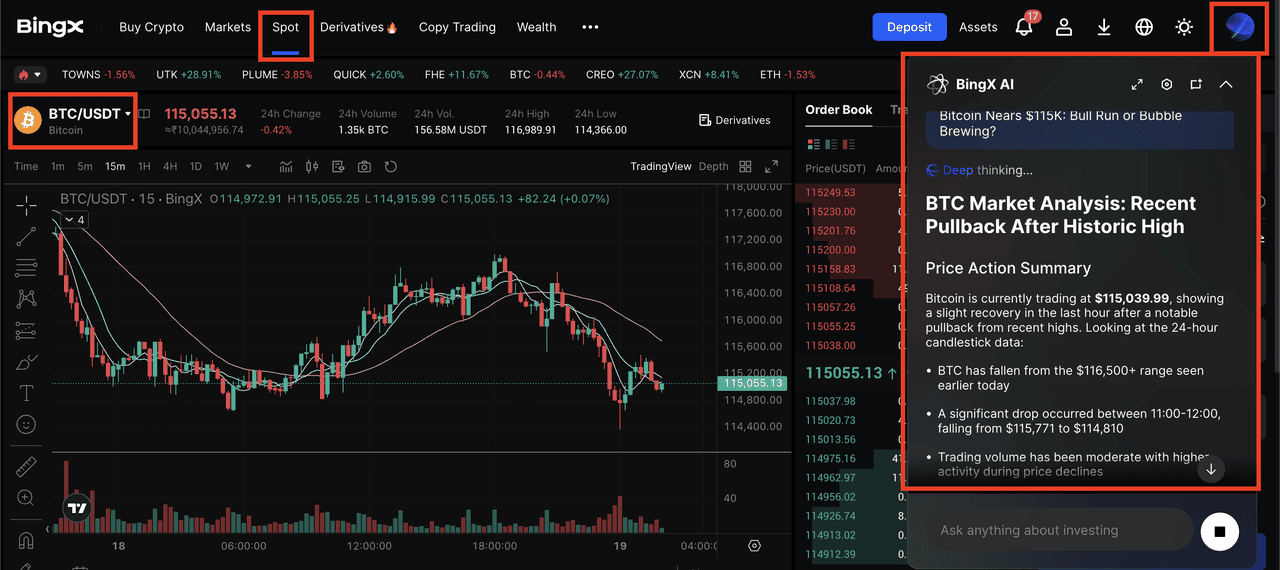

BTC/USDT trading pair on the spot market, powered by BingX AI insights

Before you can start using your Bitcoin wallet, you’ll need to deposit some BTC into it. If you’re just getting started, the easiest way is through BingX, where you can buy Bitcoin instantly and then move it to your personal wallet for safekeeping.

1. Buy BTC on BingX: Log in to your BingX account and go to Buy Crypto. Choose how you want to pay: stablecoins (USDT/USDC), card/bank transfer, or

P2P. You can use

BingX AI tools to get market insights, risk analysis, and trading suggestions. Complete the purchase; your BTC will appear in your Funding/Spot wallet on BingX.

2. Decide where you’ll hold it: If you’re keeping BTC on BingX for active trading, you can stop here. If you want self-custody (you hold the keys), continue with steps 3–10.

3. Set up your wallet (self-custody only): Install your chosen wallet (e.g., Exodus, Electrum, Ledger Live for hardware). Create a new wallet and write down the 12–24-word recovery phrase on paper/steel; store it offline. Set a strong passcode/biometrics.

4. Get your receive address: Open your wallet → Receive → copy your Bitcoin (BTC) address (starts with 1, 3, or bc1…). If you’re using Lightning, generate a Lightning invoice instead (for small, instant payments).

5. (Optional but recommended) Do a test send: On BingX, go to Withdraw → BTC. Paste your wallet address and send a small amount first (e.g., $5–$20) to confirm everything works.

6. Choose the correct network: Select Bitcoin (BTC) mainnet for on-chain withdrawals. Only use Lightning if your destination wallet supports it (e.g., Muun, BlueWallet, Phoenix) and you generated a Lightning invoice.

7. Enter amount & review fees: Input the BTC amount. Check the network fee shown by BingX (on-chain fees change with network congestion; Lightning fees are typically lower). Confirm the address (check the first/last 6 characters).

8. Secure the withdrawal: Complete 2FA (app/SMS/email) and any withdrawal PIN/whitelist you’ve enabled. Submit the withdrawal and save the TXID (on-chain) or payment hash (Lightning).

9. Track confirmations: For on-chain transfers, your wallet will show “pending” until confirmed (exchanges often credit after 1–3 confirmations; full finality is traditionally 6 confirmations). Lightning payments arrive near-instantly if the invoice is valid.

10. Verify & label: Once funds arrive, label the transaction/address in your wallet, e.g., “BingX withdrawal 2025-08-19.” For hardware wallets, always verify addresses on the device screen before sending to them in the future.

Closing Thoughts

In 2025, Bitcoin wallets are more accessible and user-friendly than ever, offering solutions for every type of holder. From hardware wallets like Ledger and Trezor to mobile Lightning apps such as BlueWallet and Muun, you can choose the option that best fits your needs and comfort level.

Cold storage remains the preferred choice for safeguarding large amounts, while hot wallets are practical for everyday spending. Multisig setups, like those offered by Bitkey, provide a balance between convenience and advanced security features, including shared access and inheritance planning.

No matter which method you choose, always remember the risks. Back up your recovery phrase and store it securely offline. Double-check wallet addresses before sending, and never share your private keys. A simple mistake can lead to irreversible loss in crypto, so caution and proper security practices are essential.

FAQs on Bitcoin Wallets

1. Which Bitcoin wallet is safest in 2025?

Cold wallets like Ledger and Trezor are the safest for large BTC holdings. Options like Tangem and Bitkey also offer strong physical and multisig security. For active trading, storing BTC on BingX is convenient and protected with 2FA, address whitelisting, and AI risk monitoring.

2. Can I use a hardware Bitcoin wallet with my phone?

Yes. Ledger Nano X and Tangem integrate with mobile apps, allowing you to send/receive BTC easily while keeping keys offline.

3. What’s the best BTC wallet for beginners?

Exodus and Tangem are beginner-friendly with simple interfaces and multi-asset support. For an even easier start, you can store and trade BTC directly on BingX, where your assets are protected with

AI-driven security and quick access to spot and futures markets.

4. Should I use a Bitcoin Lightning wallet?

Yes, if you plan to make small, frequent Bitcoin payments. BlueWallet and Muun are the most trusted options in 2025.

5. What happens if I lose my Bitcoin wallet?

As long as you have your recovery phrase backed up safely, you can restore your wallet and reclaim your BTC. Without it, funds are permanently lost.