On August 26, 2025, the crypto market lit up after Crypto.com’s platform token

Cronos (CRO), together with Trump Media & Technology Group (DJT), was placed at the center of a landmark deal: the launch of a $6.4 billion CRO Treasury through a SPAC merger with Yorkville Acquisition Corp. The new entity, Trump Media Group CRO Strategy Inc. (ticker: MCGA), is set to become the largest publicly traded CRO treasury in history.

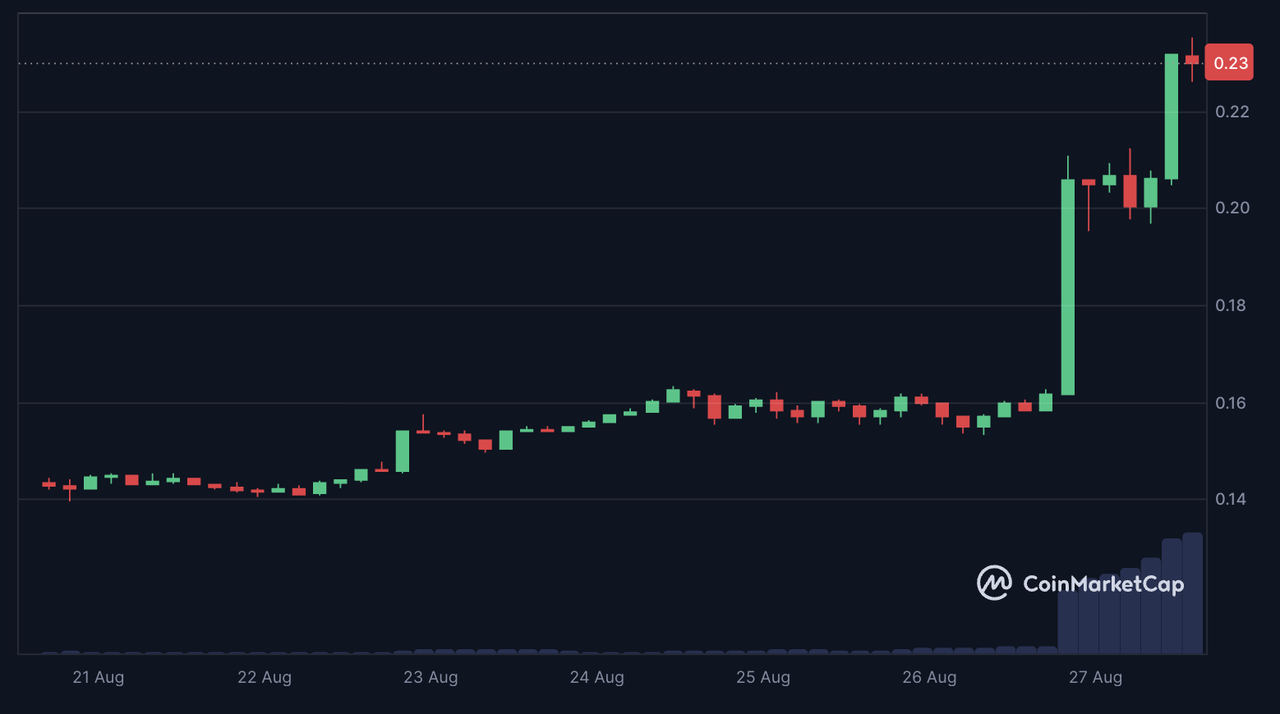

CRO price jumped more than 30% on August 26, 2025 | Source: CoinMarketCap

The news immediately moved markets. CRO price surged more than 30% in a single day, with trading volume climbing sharply as investors reacted to the announcement. Trump Media’s stock DJT also posted gains, rising 3.5% to $17.82, underscoring the significance of the partnership.

For investors, the deal highlights how exchange tokens are increasingly being adopted as part of corporate treasury strategies, building on the precedent set by companies that have accumulated Bitcoin and Ethereum.

What Is the CRO Token Treasury?

The CRO Treasury is a newly formed digital asset vehicle created through a partnership between Crypto.com and Trump Media & Technology Group. Announced on August 26, 2025, the venture will merge with the blank-check firm Yorkville Acquisition Corp., making it a SPAC (Special Purpose Acquisition Company) deal designed to fast-track a public listing.

The entity will operate as Trump Media Group CRO Strategy Inc., trading on Nasdaq under the ticker MCGA, short for “Make CRO Great Again.” Its goal is to accumulate and manage one of the largest treasuries of CRO, Crypto.com’s exchange token.

According to filings, the CRO Treasury will be funded with:

• $1 billion worth of CRO tokens (about 6.3 billion CRO, nearly 20% of supply)

• $200 million in cash

• $220 million in warrants

• A $5 billion credit line from Yorkville

Beyond simply holding assets, MCGA plans to stake CRO through a validator node on the Cronos blockchain, generating rewards and strengthening its governance role in the network.

This structure positions MCGA as the largest publicly traded CRO holder, highlighting how SPACs are increasingly being used to bring crypto-focused treasury companies to market.

What Is the CRO Token?

CRO is the native cryptocurrency of the Cronos blockchain, developed by Crypto.com. Originally launched as Crypto.com Coin, it powers transactions, staking, and rewards across the exchange and wallet ecosystem, while also supporting

DeFi, NFT, and Web3 projects on Cronos. Within Crypto.com, CRO functions as a utility token for trading fee discounts, cashback rewards, and staking incentives, helping drive user adoption.

As of August 2025, CRO has a market capitalization of about 6.8 billion dollars, with a maximum supply of 100 billion, nearly 98 billion created, and about 33.6 billion in circulation. On-chain reports show that Crypto.com and affiliated wallets collectively hold billions of CRO. Historical data indicated over 8 billion tokens were controlled directly by the exchange, and in 2025 the company transferred more than 680 million CRO in a single deal. The token supply is also shaped by a proposed 10-year vesting plan that locks 70 billion reissued tokens for five years before gradually releasing them, a structure aimed at reducing supply shocks while funding long-term ecosystem growth.

The Trump Family’s Growing Role in Crypto: From WLFI, USD1 to CRO

The Trump family’s involvement in digital assets goes beyond partnerships like the CRO Treasury. Over the past year, they have launched their own projects, invested in platforms, and tied crypto initiatives directly to their political and business branding. At the center of this push is

World Liberty Financial (WLFI) and its stablecoin

USD1, which together showcase how the family is positioning itself not just as participants in crypto but as builders of its infrastructure.

1. World Liberty Financial (WLFI)

Launched in 2025, WLFI is one of the Trump family’s signature ventures in digital assets. Built as a decentralized finance platform, it combines lending, payments, and governance under a single ecosystem while branding itself as a U.S.-anchored alternative to overseas DeFi projects. Its positioning ties directly to the Trump family’s narrative of “Made in America” finance, aiming to connect political identity with digital asset innovation.

2. USD1 Stablecoin

At the heart of WLFI is USD1, a multi-chain

stablecoin backed by U.S. dollars and short-term Treasury securities. In June 2025, WLFI distributed 2.1 million USD1 tokens to more than 25,000 wallets through an airdrop, creating early momentum and visibility. Unlike

algorithmic stablecoins, USD1 is fully collateralized and framed as a regulatory-compliant alternative to

USDT and

USDC. Beyond price stability, it is designed to serve as the foundation for WLFI’s governance and lending products, positioning the Trump family not just as investors in crypto but as architects of their own DeFi infrastructure.

CRO vs. Other Crypto Treasuries: BTC, ETH, BNB, SOL, and LINK Comparison

The CRO Treasury fits into a larger trend of corporations and projects treating digital assets as balance-sheet reserves. This approach was popularized by

Strategy (formerly MicroStrategy) in 2020, when it began buying Bitcoin in bulk as a treasury reserve. Since then, treasuries have expanded beyond Bitcoin into Ethereum, exchange tokens, and even specialized tokens like Chainlink.

1. Bitcoin (BTC): Bitcoin remains the benchmark for corporate treasuries. More than 170 public and private companies hold BTC on their balance sheets, with MicroStrategy alone controlling over 1% of the total supply. These holdings are generally classified as corporate treasury allocations. At the national level, the United States under President Trump established a

Strategic Bitcoin Reserve in 2025, positioning BTC as a formal part of government financial strategy. Its scarcity and global liquidity continue to make it the reference point for all other treasury strategies.

2. Ethereum (ETH): Ethereum is the most widely held treasury asset after Bitcoin, valued for its blend of store-of-value qualities and programmable blockchain infrastructure. Companies holding ETH gain exposure to the leading smart contract platform that powers DeFi, NFTs, tokenization, and a growing network of

Layer 2 solutions.

Staking also turns ETH into a yield-generating asset, allowing treasuries to earn rewards while supporting network security. For organizations, ETH offers diversification beyond Bitcoin and direct participation in the growth of Web3 applications.

3. Binance Coin (BNB): BNB is the most established exchange-issued token, valued for its combination of deflationary design and wide-ranging utility within Binance’s ecosystem. It underpins trading fee discounts, staking, and token launches, while quarterly burns steadily reduce its supply. For treasuries, holding BNB provides exposure to one of the most active exchanges in the world and a token whose demand is reinforced by ongoing exchange activity, positioning it as a core example of how exchange-native assets function as treasury holdings.

4. Solana (SOL): Solana has become a prominent treasury asset for institutions seeking growth-oriented exposure. Known for its high-speed transactions and low fees, the network has grown rapidly as a hub for NFTs, DeFi, and consumer applications. Companies allocating SOL gain access to one of the most developer-active ecosystems in Web3, making it both a diversification tool beyond Bitcoin and Ethereum and a direct bet on blockchain scalability and mainstream adoption.

5. Chainlink (LINK): Chainlink is increasingly recognized as a strategic treasury asset because of its role as the leading decentralized oracle network. In August 2025, the project launched the Chainlink Reserve, an on-chain mechanism that accumulates LINK from enterprise fees and on-chain usage. With a fixed maximum supply of 1 billion tokens, this model steadily reduces circulating supply and strengthens LINK’s scarcity. For treasuries, holding LINK provides exposure to critical Web3 infrastructure while tying token demand directly to the growth of Chainlink’s services, making it both a productive and deflationary asset.

Together, these playbooks highlight how crypto is evolving as a corporate reserve. Bitcoin leads as the standard, Ethereum adds programmability, BNB and CRO reflect exchange-token exposure, Solana offers growth potential, and Chainlink anchors infrastructure. For CRO, the challenge is proving its Treasury can balance scarcity with supply and governance.

Could CRO Price Surge above $0.5?

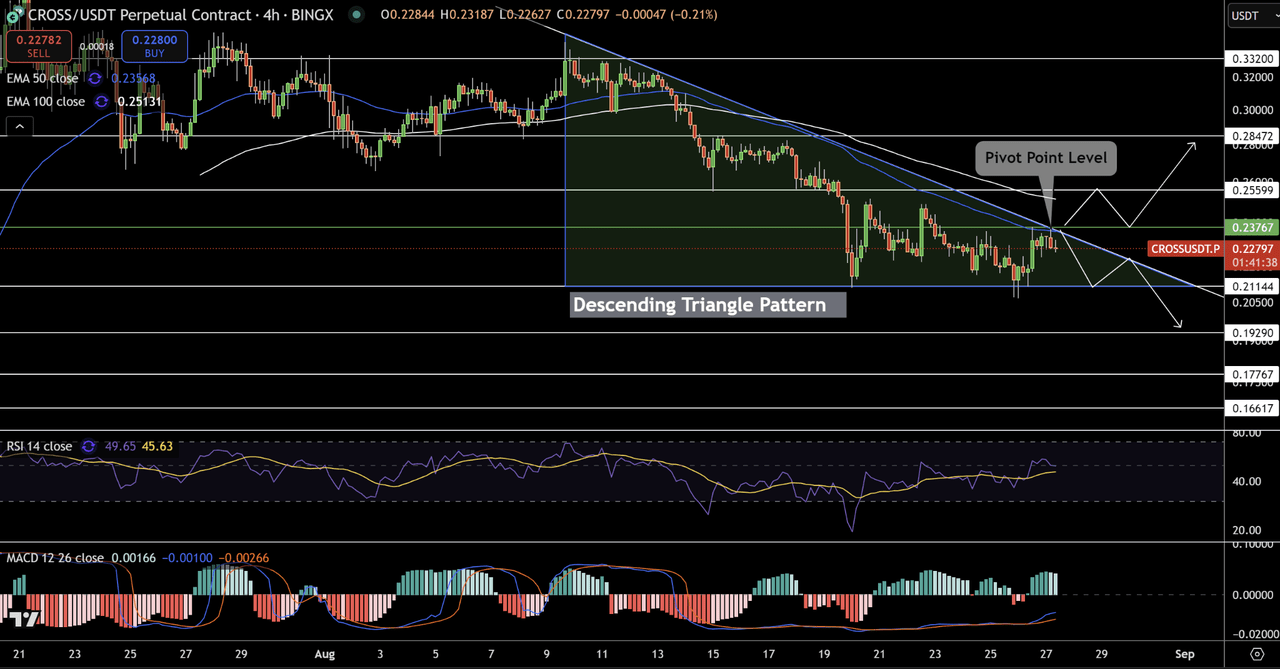

Cronos (CRO) has rebounded nearly 40% in the past 24 hours, but the token is now pressing against a key pivot at $0.238. On the 4-hour chart, CRO is consolidating within a descending triangle, anchored by resistance at the trendline and a flat support near $0.211.

While often seen as bearish, these setups can spark sharp reversals when volume builds at breakout levels.

The pivot zone around $0.238 is critical, overlapping with the 50-

EMA ($0.235). A breakout here could trigger a rally toward $0.256 and $0.284, with a larger push potentially eyeing the $0.32 region. If momentum strengthens, CRO could extend its path toward $0.50, a level not seen since its broader downtrend began.

Downside risks remain if $0.211 breaks, opening $0.192 and $0.178. But for traders, long setups above $0.238 are attractive, with growing volume and ecosystem growth bolstering optimism that CRO’s comeback could evolve into a larger bullish cycle.

How to Trade CRO Tokens on BingX

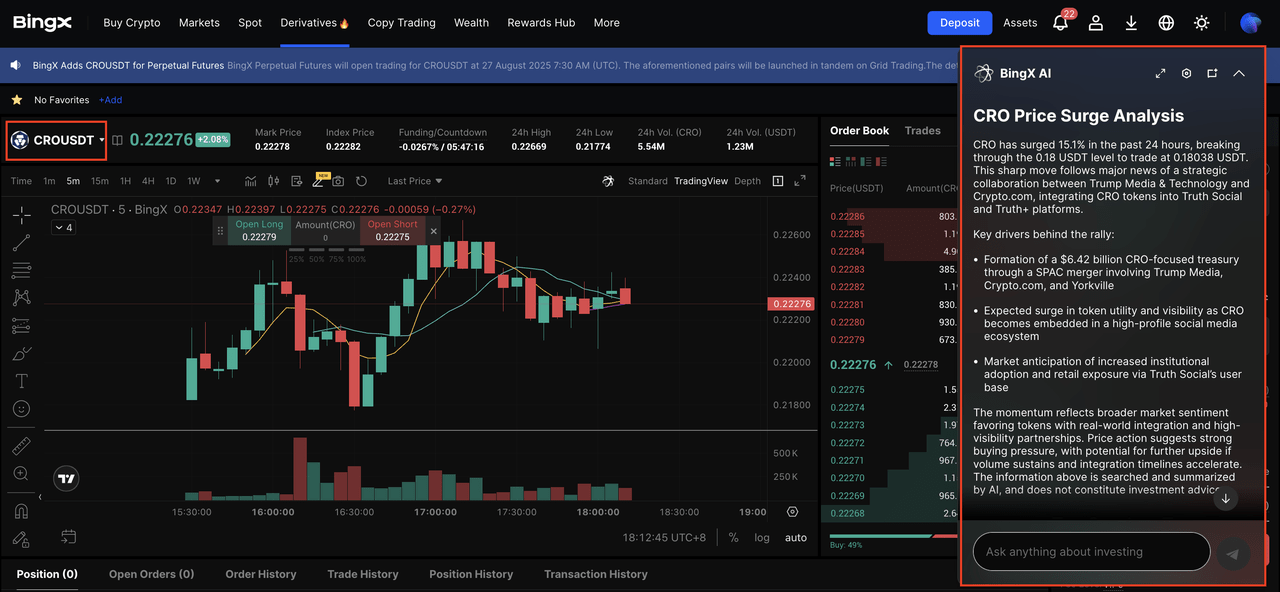

CRO is the platform token of Crypto.com and the native asset of the Cronos blockchain. It powers transactions, staking, and rewards within the Crypto.com ecosystem and has recently drawn attention with the launch of the CRO Treasury. On BingX, CRO is listed in the

Perpetual Futures Market, giving traders the flexibility to go long or short without expiration. BingX also offers real-time analysis through

BingX AI to help identify better trading setups.

Step 1: Search for CRO/USDT on Perpetual Futures

Go to the Perpetual Futures Market on BingX and search for

CRO/USDT. You can open long or short positions depending on market conditions. Leverage is available to amplify potential returns, but it also increases risk and should be managed carefully.

Step 2: Use BingX AI for Real-Time Market Insights

Click the AI icon on the trading chart to launch BingX AI. The tool highlights support and resistance levels, shows trend direction, and surfaces recent market-moving events such as the CRO Treasury launch and Cronos ecosystem activity. These insights can help refine your entry and exit strategies.

Step 3: Execute and Monitor Your Trade

Use a market order for immediate execution or a limit order to target your preferred entry price. Continue monitoring BingX AI to adapt your position and strategy based on market conditions.

Risks Beyond the Treasury: What CRO Investors Should Watch

CRO’s tokenomics already add complexity on top of the Treasury’s impact. Crypto.com previously revised its burn mechanism after announcing a 70 billion token burn, raising questions about supply transparency. In 2025, a 10-year vesting schedule was introduced that locks reissued supply for five years before gradually releasing it. These supply dynamics, combined with potential regulatory scrutiny of exchange-issued tokens, could amplify volatility and affect the long-term confidence of CRO holders.

Future Outlook

The launch of the CRO Treasury marks a shift in how exchange tokens are viewed. By structuring CRO holdings through a publicly traded SPAC, Trump Media and Crypto.com have elevated the token into the broader corporate treasury conversation, placing it in the same frame as Bitcoin and Ethereum.

The outlook for CRO will depend on adoption within the Cronos ecosystem, the effectiveness of staking strategies, and how supply policies such as vesting and burns are managed. These factors will determine whether the Treasury creates lasting value or leaves CRO vulnerable to concentration risks.

More broadly, the CRO Treasury highlights the growing trend of corporate treasuries diversifying beyond Bitcoin. If successful, it could establish a model for other exchange tokens. If not, it may underscore the limits of using platform-native coins as long-term reserve assets.

Related Reading