Decentralized Finance (DeFi) on the

BNB Chain remains a cornerstone of the blockchain ecosystem in 2025, offering innovative financial solutions powered by low fees, high scalability, and strong community support. As one of the leading

EVM-compatible blockchains, BNB Chain hosts a diverse range of DeFi projects spanning trading, lending,

staking, and yield optimization. These protocols leverage the network’s robust infrastructure and fast transaction speeds to deliver accessible and efficient financial services to users worldwide.

In 2025, the spotlight on BNB Chain is growing steadily as more users and organizations look for reliable platforms to build and interact with decentralized finance. From decentralized exchanges to yield-focused protocols, BNB projects continue to develop practical tools that make DeFi easier to access and more useful for everyday participants.

Why BNB DeFi Projects Are Important in 2025

As the DeFi sector matures, the importance of blockchain networks goes beyond retail speculation. Institutional players, regulators, and corporations are increasingly shaping the landscape, driving demand for platforms that combine stability, liquidity, and real utility. BNB Chain stands out in this shift, offering a mix of affordability, developer activity, and expanding use cases that make it a key player to watch this year.

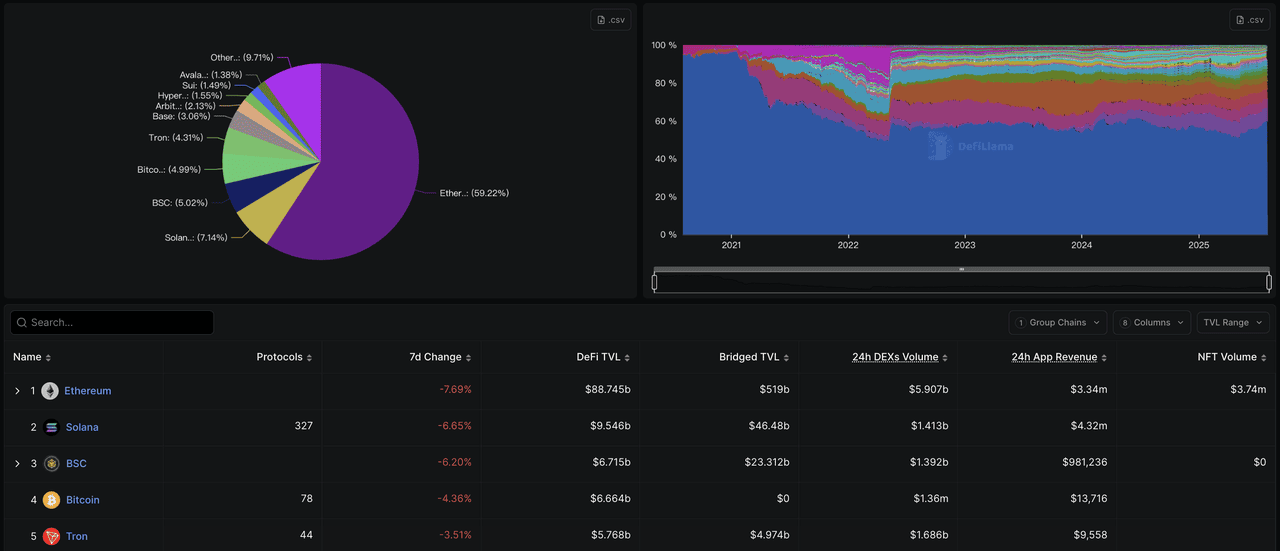

1. The BNB Ecosystem’s Role in DeFi

BNB Chain continues to hold a significant place in the DeFi landscape, ranking 3rd by

total value locked (TVL) behind

Ethereum and

Solana. According to

DefiLlama, BNB Chain accounts for 5.02% of the global DeFi TVL, with approximately $6.7 billion locked across its ecosystem. While Ethereum dominates the market and Solana has gained traction in recent years, BNB Chain’s consistent share reflects its ability to stay relevant through affordable transactions, active developer engagement, and strong retail participation.

With 78 protocols actively building on the network and daily DEX volume of over $1.3 billion, BNB Chain remains one of the most liquid ecosystems for decentralized trading. Its position as an EVM-compatible chain also attracts developers seeking to deploy scalable applications without the high costs associated with Ethereum. This combination of accessibility, liquidity, and community support ensures BNB Chain continues to play a meaningful role in the evolving DeFi market.

2. Regulatory Environment Supports BNB’s Growth

The regulatory clarity shaping the crypto industry in 2025 is also benefiting BNB and its DeFi ecosystem. Landmark U.S. legislation in the

U.S. Crypto Week, including the GENIUS Act, CLARITY Act, and Anti-CBDC Act, has provided clearer definitions for digital assets, reduced compliance uncertainty, and reinforced the importance of decentralized finance over government-controlled alternatives.

Although BNB is not a U.S.-native asset, the global ripple effect of these regulations is fostering greater institutional confidence in multichain ecosystems. Clearer rules have lowered perceived risks, making it easier for companies and investors to engage with BNB Chain protocols. This regulatory backdrop is helping BNB projects attract more capital, developers, and partnerships, reinforcing their role in a more stable and transparent DeFi environment.

3. Institutional Adoption and Treasury Integration Drive Momentum

The trend of

corporate treasuries holding Bitcoin pioneered by

Strategy as a hedge against fiat volatility continues in 2025, but companies are now looking beyond

Bitcoin for assets that offer additional yield opportunities through DeFi participation.

Ethereum has led this shift thanks to staking rewards and its robust DeFi infrastructure. BNB is now emerging as another strategic asset, offering similar benefits with its own diverse DeFi ecosystem.

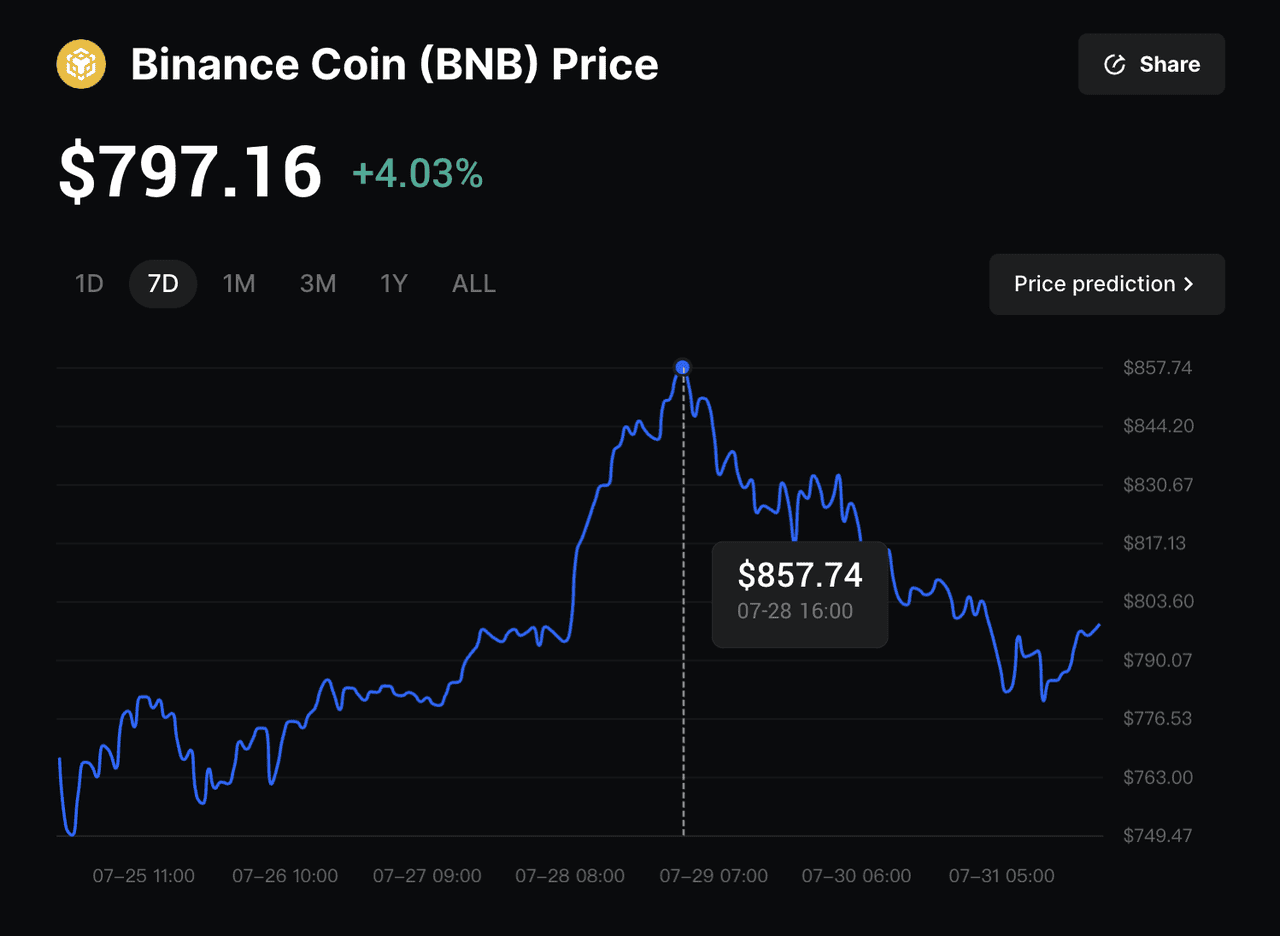

BNB’s appeal lies in its ability to combine the stability of a large-cap asset with the utility of an active DeFi network. Corporate interest in BNB accelerated after Changpeng Zhao (CZ) revealed that over 30 public companies were preparing projects involving

BNB reserves. This confidence was further strengthened when BNB hit a new

all-time high of $857 in July 2025, fueled by institutional demand and rising on-chain activity. With a five-year Sharpe ratio of 2.5, BNB demonstrates consistent returns relative to risk, supporting its case as a reliable asset even during market volatility.

By offering both liquidity and DeFi-enabled yield opportunities, BNB positions itself alongside Bitcoin and Ethereum as a core component of modern corporate treasury strategies, while also standing out for the unique ways its ecosystem supports real-world financial use cases.

Top 7 BNB DeFi Projects to Watch in 2025

BNB Chain continues to host a wide variety of DeFi protocols, from decentralized exchanges to structured finance platforms. These projects stand out not only for their adoption within the ecosystem but also for their ability to address evolving user needs. Below are 7 BNB DeFi projects worth watching in 2025 and the unique value they bring to the network.

1. PancakeSwap (CAKE)

Project Type: Decentralized Exchange (DEX) - BNB Chain Native

PancakeSwap (CAKE) maintains its position as the largest

decentralized exchange (DEX) on BNB Chain with a commanding market share of 56.6% and total value locked of over $4 billion. The DEX ecosystem has undergone significant evolution, with BNB Chain surpassing Ethereum in weekly DEX volume for the first time since 2021, reaching nearly $30 billion. This surge demonstrates the growing institutional and retail confidence in BNB Chain's trading infrastructure.

PancakeSwap continues to innovate beyond simple token swapping, offering comprehensive DeFi services including yield farming, lottery systems, and NFT marketplaces. The platform boasts 1.9 million users and 55 million trades over the past 30 days, powered by the native CAKE token used for farming and staking. The protocol's integration with other major BNB Chain projects creates a synergistic ecosystem where users can seamlessly move between different DeFi applications while maintaining optimal capital efficiency.

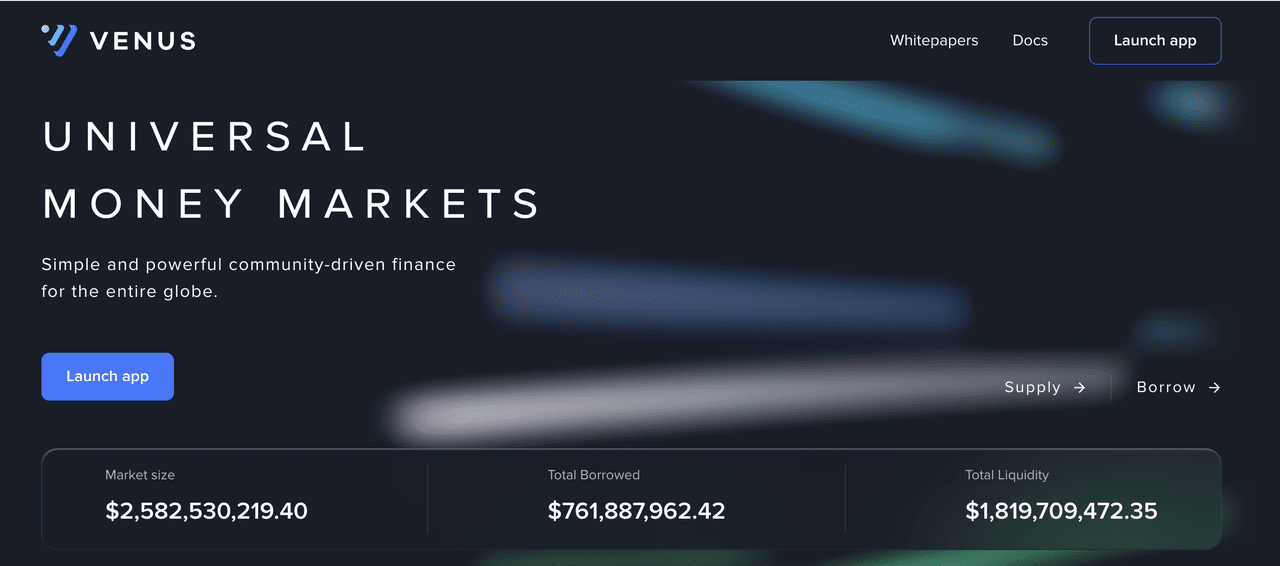

2. Venus Protocol (XVS)

Project Type: Lending and Borrowing Platform - BNB Chain Native

Venus Protocol (XVS) stands as the second-largest DeFi protocol on BNB Chain by TVL, functioning as the first lending and borrowing platform on the network with endorsement from Binance Launch Pool. The lending protocol sector continues to demonstrate robust growth, with Venus Protocol offering users the ability to stake BNB,

USDT, and

USDC directly within integrated wallets to earn up to 10.33% APY. This represents a significant advancement in user accessibility and yield optimization.

Venus enables the world's first decentralized

stablecoin, VAI, built on Binance Smart Chain that is backed by a basket of stablecoins and crypto assets without centralized control. The protocol has evolved into an all-in-one platform through strategic integrations, particularly with PancakeSwap, allowing users to swap crypto directly within the Venus ecosystem. After facing several challenges in 2021, the team underwent rebranding and launched V4 updates in November 2022 with significant improvements that align for a stronger future, demonstrating resilience and commitment to long-term sustainability.

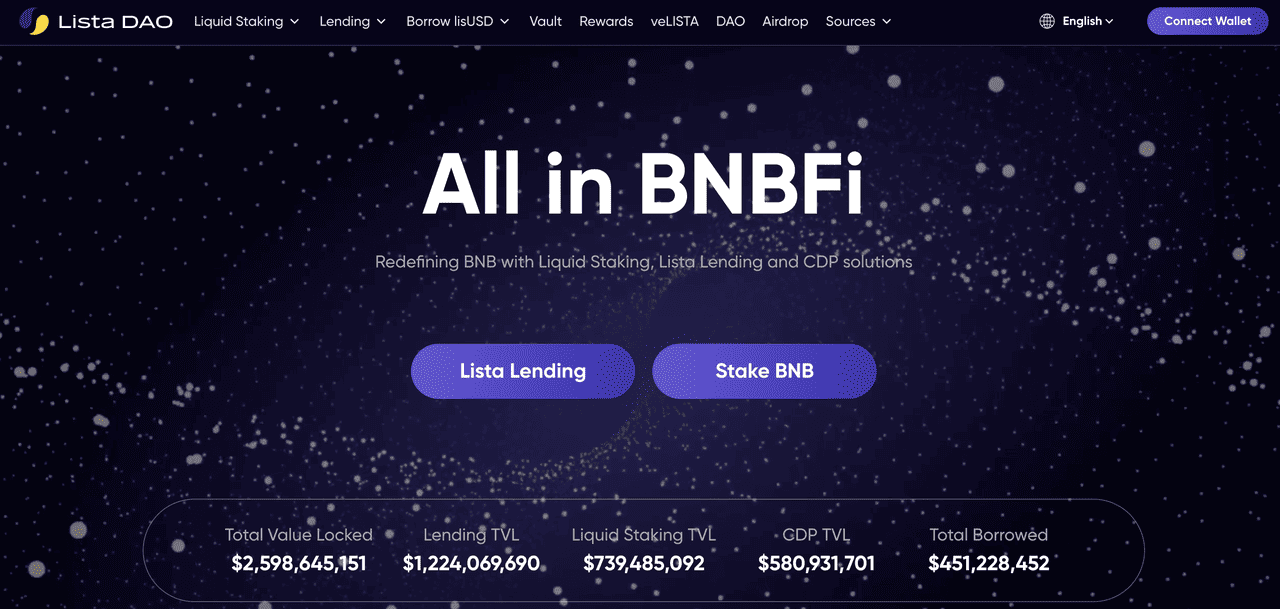

3. Lista DAO (LISTA)

Project Type: Liquid Staking and CDP Protocol - BNB Chain Focused

Lista DAO (LISTA) has emerged as the third-largest protocol on BNB Chain by TVL, with total value locked surging past $2.85 billion as of 2025. The liquid staking derivative market has experienced explosive growth, with Lista DAO becoming the largest on-chain liquidity hub for

USD1 with over 80 million USD1, reflecting strong demand and trust in the ecosystem. This positions Lista DAO at the forefront of the institutional

stablecoin adoption wave.

Operating as an open-source decentralized stablecoin lending protocol, Lista DAO provides lisUSD through its Collateral Debt Position (CDP) system, allowing users to borrow against various crypto assets including BNB, ETH, slisBNB, and wBETH. The protocol offers three main focus areas: liquid staking solutions for BNB holders, stablecoin lending features, and building a BNBFi ecosystem to empower holders with earning opportunities, including being the first protocol to have DeFi BNB assets recognized for Binance Launchpools. This unique integration allows users to participate in Binance ecosystem rewards while earning on-chain yield simultaneously.

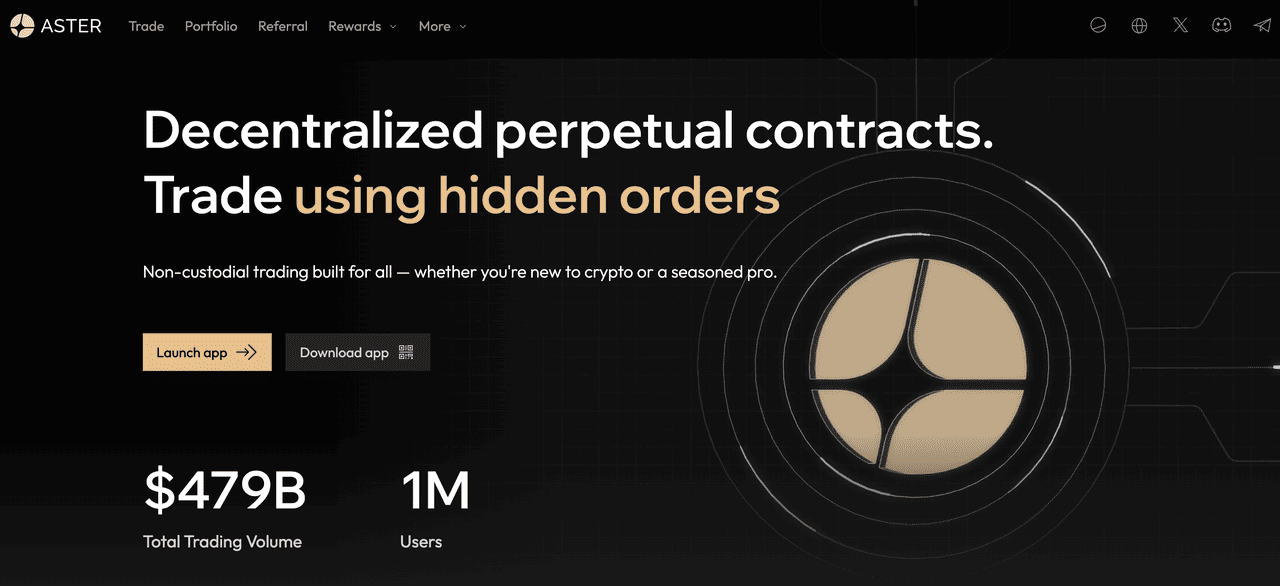

4. Aster Protocol

Project Type: Perpetual DEX and Restaking - BNB Chain Focused

Aster DEX earned recognition in BNB Chain's fifth TVL Incentive Program, receiving 4% delegation support amounting to 3,512 BNB for its contributions to integrating liquid staking tokens into DeFi protocols and making liquid staking accessible within decentralized trading environments. The restaking sector has gained significant momentum, with this incentive program doubling down on ecosystem-building efforts around restaking and liquid staking technologies that represent foundational pieces of next-generation decentralized infrastructure.

Aster operates as a next-generation decentralized perpetual exchange offering MEV-free, one-click trading for crypto with up to 1001x leverage in Simple Mode, and recently launched

tokenized stock perpetual contracts allowing 24/7 trading of U.S. equities including

Coinbase(COINX),

Apple(AAPLX),

Meta(METAX),

Alphabet(GOOGLX),

NVIDIA(NVDAX), and

Tesla(TSLAX). The protocol's asBNB token serves as a BNB liquid staking derivative that accrues rewards from Binance Launchpools, HODLer airdrops, and Megadrops, creating multiple yield streams for users while maintaining trading flexibility.

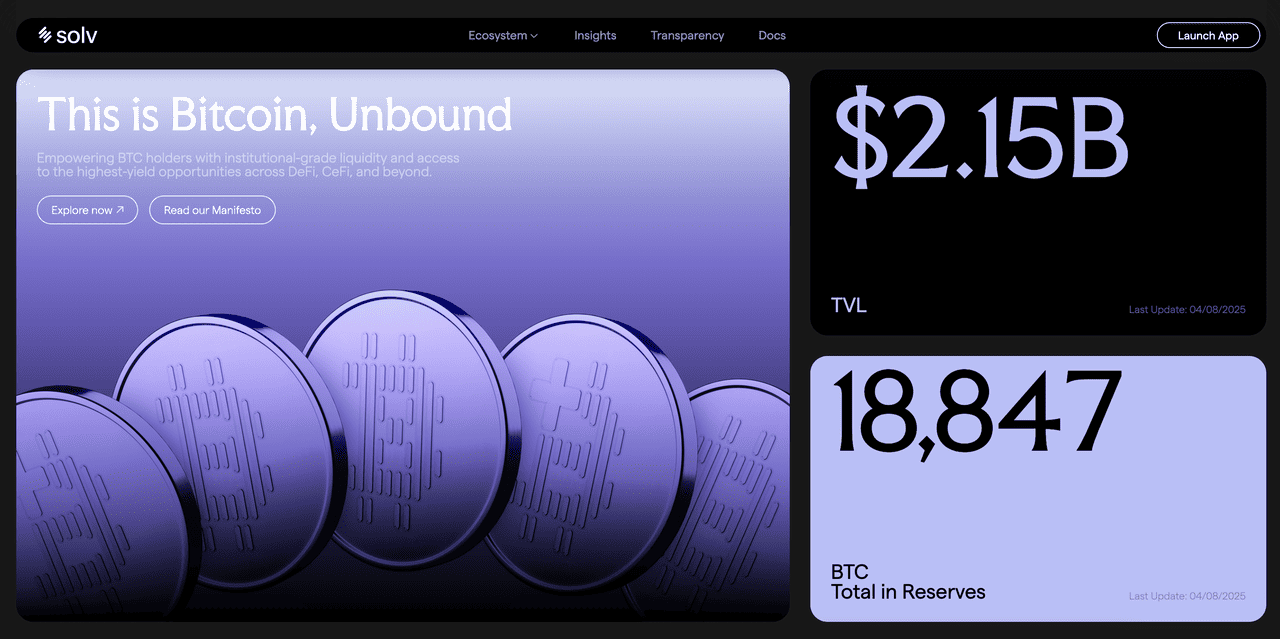

5. Solv Protocol (SOLV)

Project Type: Bitcoin Staking and Yield Protocol - Cross-Chain Protocol

Solv Protocol (SOLV) operates as a well-known Bitcoin staking platform that has established significant presence across multiple networks including BNB Chain,

Arbitrum, and

Merlin Chain. The protocol's Total Value Locked (TVL) has exceeded $200 million, with over 55,000 users generating $7.03 million in income, demonstrating strong adoption and utility within the Bitcoin DeFi ecosystem. The Bitcoin liquid staking derivative market represents one of the fastest-growing segments in DeFi, particularly as institutional adoption of Bitcoin-based financial products accelerates.

SolvBTC, issued by Solv Protocol, serves as the first full-chain Bitcoin income asset, functioning as an

ERC-20 token with considerable liquidity that allows users to stake idle Bitcoin assets to generate secure basic income. The protocol has formed strategic partnerships within the BNB Chain ecosystem, notably with Lista DAO to launch a $SolvBTC/$USD1 lending market with early liquidity pools up to $1 million and attractively low borrowing rates at 0.74%. This collaboration provides SolvBTC holders with new utility while strengthening the wider DeFi ecosystem on BNB Chain, allowing users to collateralize SolvBTC and borrow USD1 stablecoin without requiring the sale of their Bitcoin holdings.

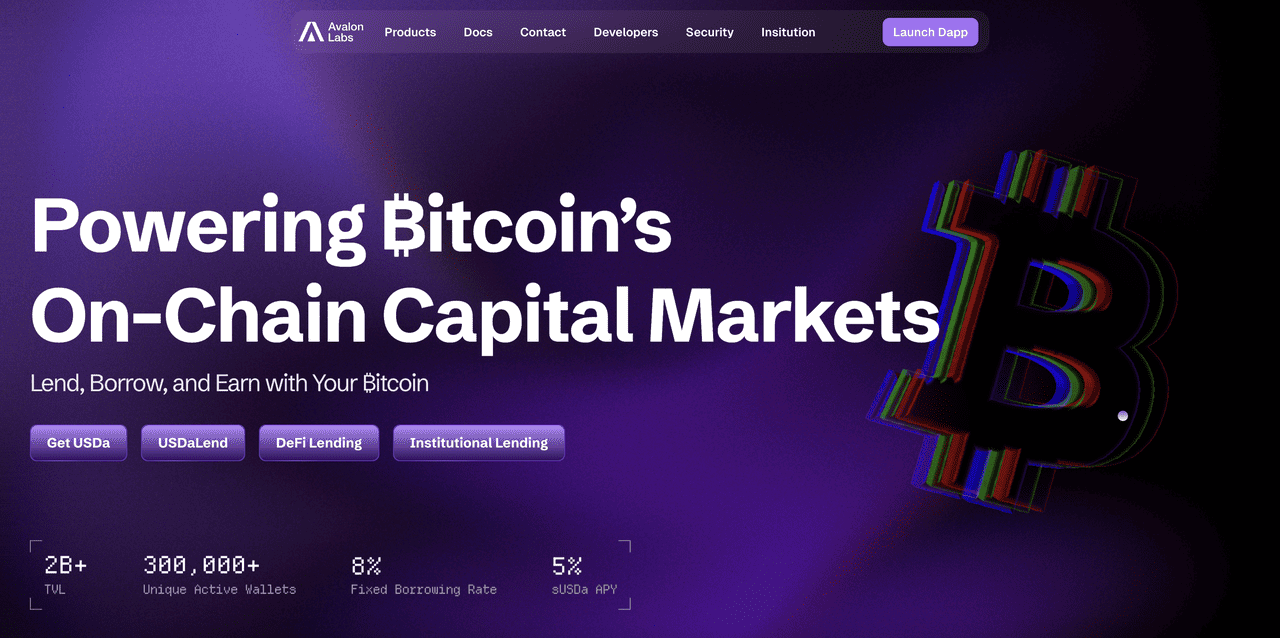

6. Avalon Labs (AVL)

Project Type: Bitcoin Lending and Stablecoin Protocol - Cross-Chain Protocol

Avalon Labs (AVL) operates as a lending protocol for BTC-based assets across multiple networks, having experienced significant growth with the platform achieving over $2 billion in total value locked and issuing over $1.2 billion in Bitcoin-backed loans by 2025. The Bitcoin DeFi sector has emerged as a major growth driver, with Avalon's USDa stablecoin ranking as the second-largest Collateralized Debt Position (CDP) stablecoin project with around $613 million in TVL, distributed across multiple blockchains including BNB Smart Chain.

Avalon Labs is building the premier on-chain financial center for Bitcoin, offering a seamless ecosystem that includes BTC-backed lending, Bitcoin-backed stablecoin, yield-generating accounts, and credit card services. The protocol has introduced a first-of-its-kind fixed-rate borrowing system with institutional liquidity access, allowing institutions to secure billions of USDT loans at a stable 8% interest rate. Recent strategic investment from YZi Labs (formerly Binance Labs) will help pursue regulatory compliance across multiple jurisdictions and expand institutional lending business, aiming to become the first fully regulated on-chain Bitcoin financial institution.

7. Pendle Finance (PENDLE)

Project Type: Yield Trading Protocol - Cross-Chain Protocol

Pendle Finance (PENDLE) operates as a permissionless yield-trading protocol that splits yield-bearing assets into principal tokens (PT) and yield tokens (YT), allowing users to execute various yield-management strategies such as fixed yield, long yield, and hedging against yield downturns. The yield trading market has matured significantly, with Pendle Finance supporting 25 different pools spanning Ethereum, Arbitrum, and BNB Chain, with a significant portion being Liquid Staking Derivative (LSD) pools.

Pendle's v3 upgrade introduces transformative features including funding rate trading and expansion to non-EVM chains, broadening its user base and increasing potential fees for vePENDLE holders. Binance Labs' strategic investment in Pendle Finance reinforces its position in shaping the next generation of DeFi primitives, with funds being utilized to extend reach across various blockchain ecosystems. The protocol has demonstrated remarkable growth with TVL increasing nearly 300% despite challenging market conditions, holding the tenth-largest TVL on Arbitrum and serving as the biggest RocketPool ether holder.

How to Trade BNB DeFi Project Tokens on BingX

BNB DeFi tokens are becoming increasingly popular in 2025 as investors seek exposure to protocols driving growth on the BNB Chain. Tokens linked to projects like PancakeSwap, Venus, and Solv Protocol attract both long-term holders and active traders thanks to their strong utility within the network and integration into BNB’s expanding DeFi ecosystem. BingX provides an all-in-one platform that simplifies access to these tokens, combining centralized exchange features with AI-powered tools to help you trade more confidently.

Use BingX’s All-in-One Platform with AI Assistance

You can buy and trade top BNB DeFi tokens directly on the BingX

spot market. For traders looking to apply more advanced strategies, BingX also offers

perpetual futures,

copy trading, and AI-driven analysis to optimize decision-making.

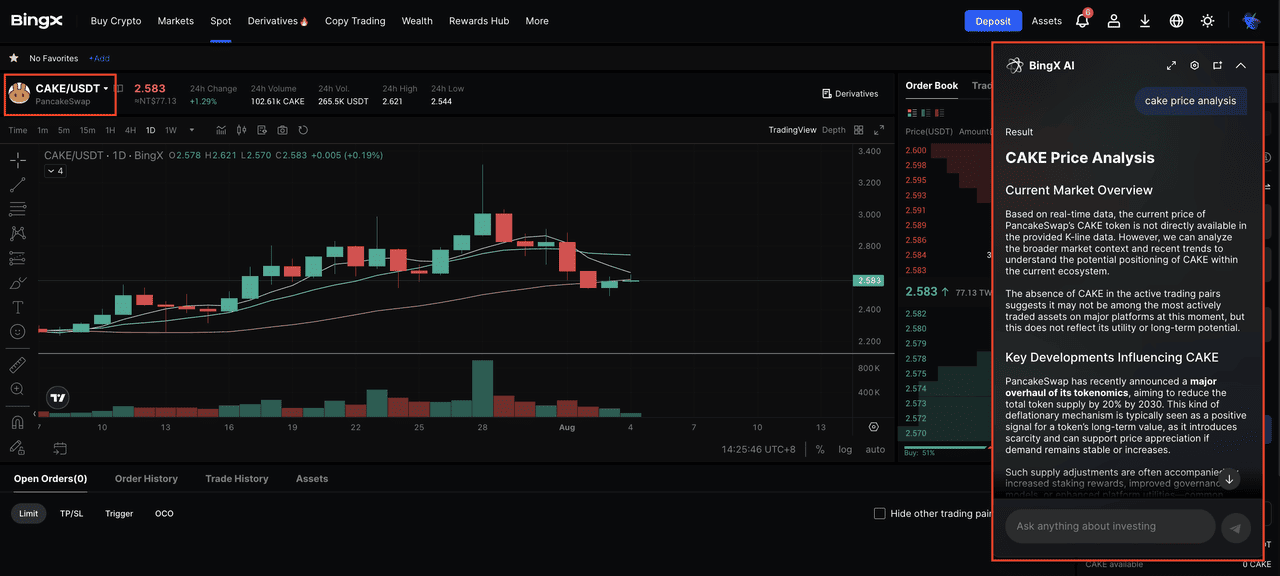

Step 1: Find Your Trading Pair

Type the token pair you want to trade (for example,

CAKE/USDT or

XVS/USDT) in the BingX search bar. Select spot for straightforward buying and selling or futures if you want to use leverage.

Step 2: Review Market Conditions with BingX AI

Activate

BingX AI on the trading page to get real-time market insights. It scans recent price data, highlights key support and resistance levels, and summarizes what the signals could mean in the current environment.

Step 3: Execute and Adjust Your Trade

Based on the analysis, choose between a market order for instant execution or a limit order to target a specific price. Continue monitoring AI updates to refine your position and adjust your strategy as market conditions change.

Risks and Considerations Before Using DeFi Projects on BNB

While DeFi on BNB Chain offers many opportunities, it also carries risks that users should carefully evaluate. Understanding these risks is essential to protecting your assets and making informed decisions.

1. Smart Contract Vulnerabilities: Even audited protocols can have hidden bugs or exploits that malicious actors may target. Users should always verify a project’s security measures and consider using only well-established platforms.

2. Market Volatility: DeFi tokens are highly sensitive to price swings. Sudden fluctuations can lead to losses, liquidation of collateralized positions, or reduced yields. Risk management strategies such as stop-loss orders and portfolio diversification are important.

3. Regulatory Uncertainty: The global regulatory environment for DeFi is still evolving. Changes in policy can affect user access, project operations, and token valuations. Staying informed about regulatory developments can help mitigate unexpected disruptions.

4. Security Threats and Scams: Beyond technical risks, rug pulls and phishing attacks remain threats in the DeFi space. Always use official project links, store private keys securely, and avoid interacting with suspicious contracts.

By being aware of these factors and approaching DeFi with caution, users can better balance the potential rewards with the risks involved.

Final Thoughts

BNB Chain continues to prove its relevance in the DeFi space by supporting a diverse range of protocols that combine usability, liquidity, and innovation. In 2025, projects like PancakeSwap, Venus, Solv Protocol, and others are not just keeping pace with industry trends; they are actively shaping how decentralized finance evolves.

For users, this means access to more efficient tools for trading, lending, staking, and yield generation. However, the opportunities come with risks, making it important to research each protocol thoroughly and stay informed about both technical and market developments.

As the ecosystem matures, BNB DeFi projects are likely to play an even greater role in connecting traditional finance with blockchain-based alternatives. Whether you are a trader, an investor, or simply exploring the space, the BNB Chain offers a growing number of ways to participate in the next chapter of decentralized finance.

Related Reading