Bitcoin (BTC) is once again at the mercy of U.S. monetary policy. Ahead of Fed Chair Jerome Powell’s keynote at the Jackson Hole symposium on August 22, crypto markets are experiencing

range-bound trading. In the last week alone, Bitcoin slipped to $113,500,

Ethereum (ETH) retreated below $4,200, and over $1.9 billion flowed out of crypto ETFs as investors braced for clarity on interest rates.

Why does this matter? The Federal Reserve influences the cost of borrowing money, which shapes overall market liquidity. When interest rates remain high, borrowing becomes more expensive and investors often move toward safer assets, limiting demand for riskier markets such as Bitcoin. When rates are lowered, capital tends to flow back into equities, gold, and crypto, sometimes triggering stronger rallies. Powell’s remarks at Jackson Hole will therefore be closely watched for signals on whether the Fed plans to maintain its current stance or move toward rate cuts in September.

This article breaks down what’s at stake for the Fed, why Powell’s words matter for Bitcoin, and the trading scenarios crypto investors should prepare for on August 22.

Why Does the Fed's Interest Rate Decision Matter for Bitcoin and Crypto?

The U.S. Federal Reserve (Fed) is the most powerful central bank in the world, and its decisions on interest rates ripple through every financial market. When the Fed raises or cuts rates, the impact is felt not only in stocks and bonds but also in Bitcoin and other cryptocurrencies.

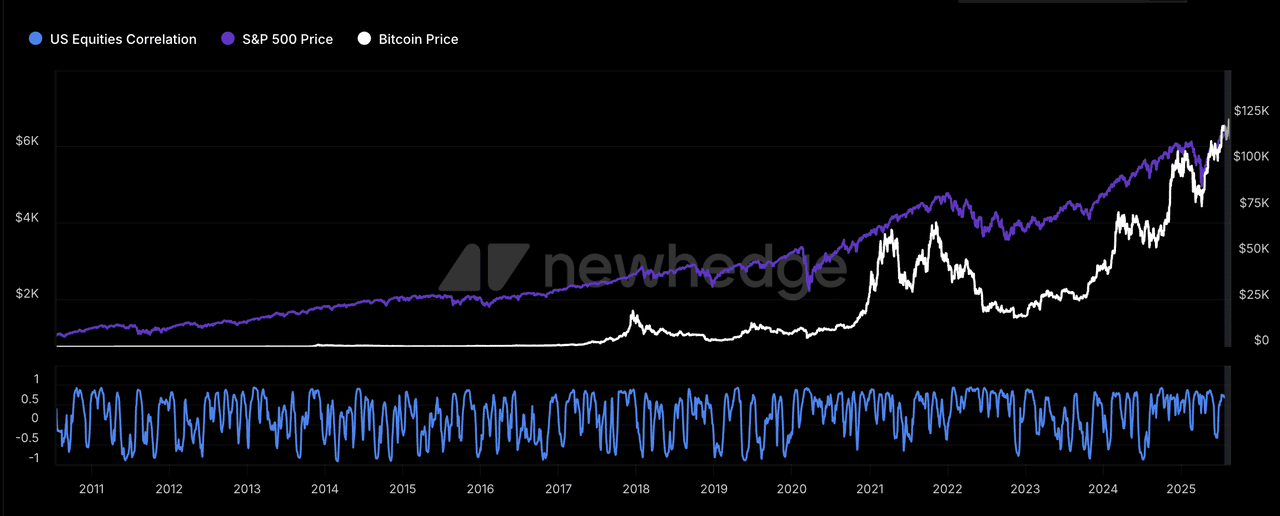

Over the past three years, Bitcoin’s correlation with traditional markets has shifted noticeably. During the Fed’s aggressive rate hikes in 2022, BTC traded almost in lockstep with the Nasdaq, showing a correlation above 0.6, as both assets sold off under tighter liquidity. At the same time, gold, typically a safe-haven asset, held steadier, highlighting how Bitcoin behaved more like a risk asset than “

digital gold.” More recently, as inflation fears persist, Bitcoin has started to show a renewed correlation with gold (0.4–0.5 range), reinforcing its narrative as a hedge against monetary debasement.

Bitcoin's correlation with U.S. equities | Source: Newhedge

For traders, this means Powell’s decisions influence crypto in multiple ways. A hawkish Fed tends to push the U.S. dollar index (DXY) higher, weighing on both stocks and Bitcoin, while a dovish shift often sparks rallies across equities, gold, and crypto simultaneously. In practice, watching how S&P 500 futures, Nasdaq indices, and gold prices react to Fed signals can provide valuable clues for Bitcoin’s next move.

- When interest rates are high: Borrowing becomes expensive for businesses and consumers. Investors prefer “safer” assets like U.S. Treasury bonds, which pay higher yields with lower risk. This drains liquidity from speculative markets. In practice, it means less money flows into Bitcoin, Ethereum, and

altcoins, leading to weaker price momentum. For example, during the Fed’s aggressive rate hikes in 2022, Bitcoin fell from nearly $69,000 to under $20,000.

- When the Fed cuts interest rates: Money becomes cheaper to borrow. Banks, corporations, and investors start searching for higher returns outside of traditional assets. This often pushes capital into risk-on markets such as stocks, gold, and especially crypto. Historically, Bitcoin has rallied strongly in these periods, after the Fed’s emergency rate cuts in 2020, BTC surged from around $5,000 in March to over $29,000 by December.

Simply put, the Fed controls the cost of money, and crypto is one of the biggest beneficiaries when money is cheap and plentiful. For traders, this means keeping a close eye on Powell’s speeches, FOMC meeting minutes, and inflation data isn’t optional, it’s critical for anticipating crypto market moves.

Bitcoin Trades in a Range Under $115,000 Before Powell’s Speech

BTC/USDT trading pair on BingX spot market

Bitcoin is trading in a tight range near $113,500–$114,000, slipping from last week’s local high of $116,000. Ethereum has also pulled back to around $4,200, marking a 5% decline earlier this week. The weakness isn’t limited to tokens; crypto-related equities such as

Coinbase (COIN) and Marathon Digital (MARA) both fell 5–7% on August 20, showing that traders across markets are cutting exposure ahead of the Fed’s decision.

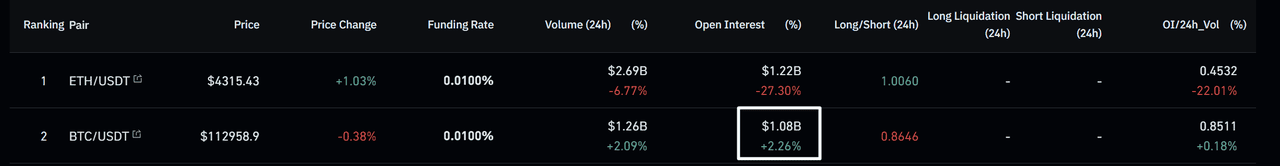

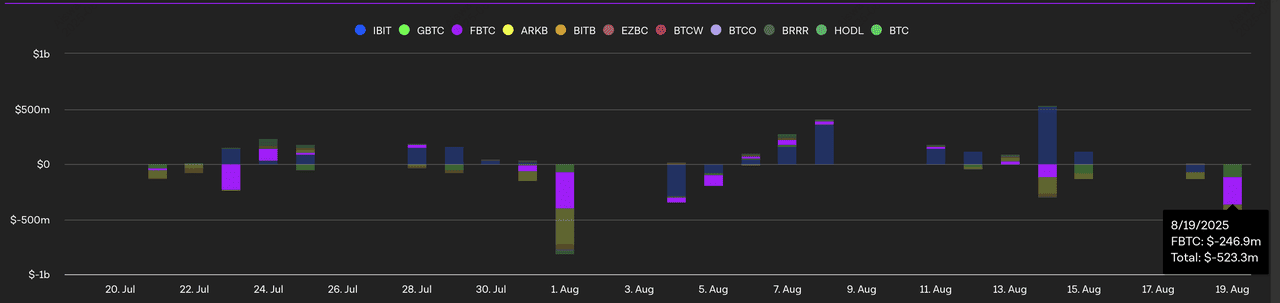

Spot Bitcoin ETF flows | Source: TheBlock

Institutional sentiment is equally cautious. More than $1.9 billion has exited Bitcoin and

Ether ETFs over the past week, reflecting profit-taking and a “wait-and-see” approach before Powell’s remarks. Historically, ETF flows are a useful gauge of institutional confidence, and such large outflows usually suggest investors expect short-term volatility or downside risk.

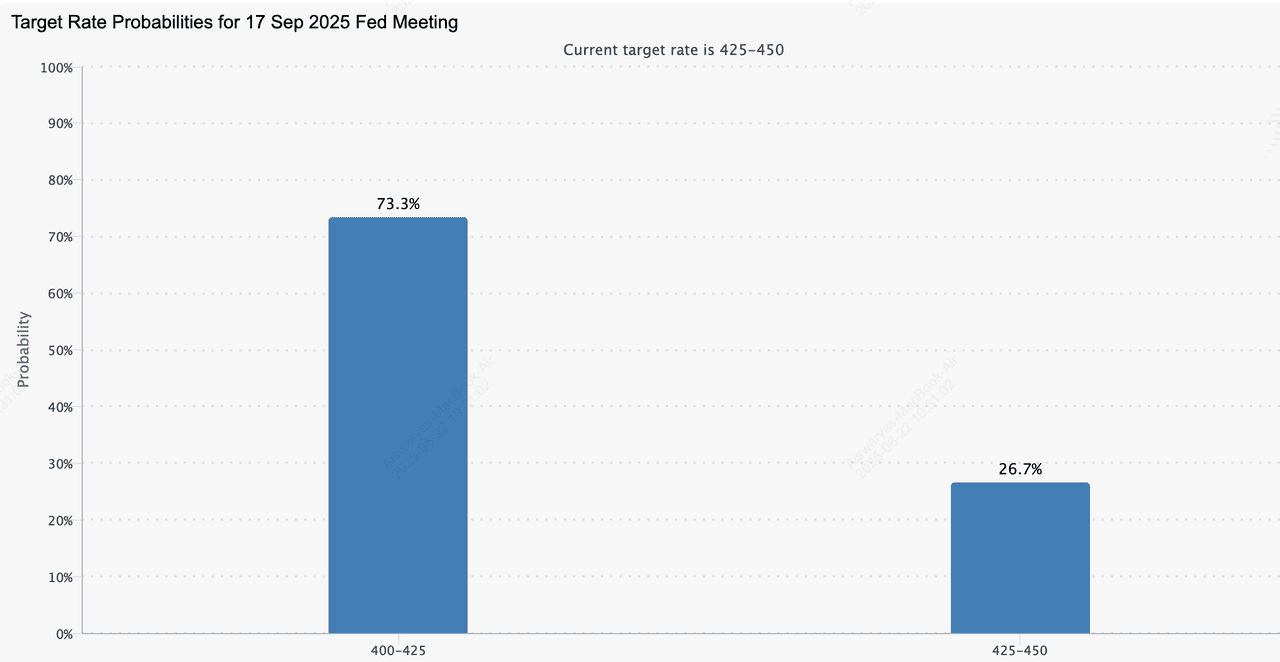

Odds of a September Fed rate cut | Source: CME FedWatch

Adding to the uncertainty, the odds of a September rate cut have dropped sharply, from 99% last week to roughly 73.5% today, after July’s Producer Price Index (PPI) jumped 0.9%, its hottest reading in three years. This data has tilted expectations back toward a more hawkish Fed.

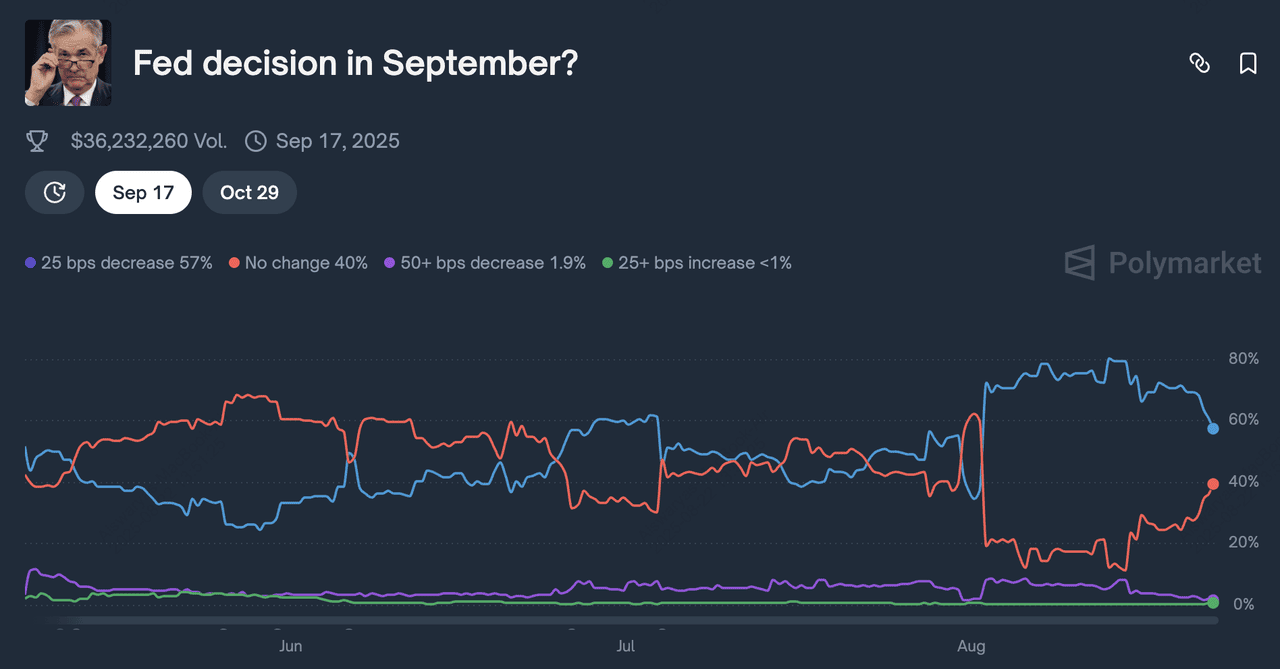

Prediction markets echo this caution. On Polymarket, which lets traders bet on real-world events, the probability of a 25 bps rate cut in September is currently priced around 57%, while “no change” in rates stands at 40%. A deeper 50 bps cut has only a 2% chance, and the odds of a surprise rate hike are below 1%. With over $36 million in volume traded, these odds provide a real-time snapshot of how investors are positioning ahead of Powell’s speech.

Polymarket poll on Fed rate cut likelihood in September | Source: Polymarket

Together, these signals highlight why Powell’s Jackson Hole speech at 10 a.m. ET on August 22 is being treated as a make-or-break moment for both traditional and crypto markets.

What Are the Key Factors Behind the Fed’s Interest Rate Debate?

The Federal Reserve is weighing multiple economic and political pressures as it decides whether to cut rates in September. These factors explain why the decision is far from straightforward.

1. Rising Tariff Costs and Inflation Pressure

Many U.S. companies have so far absorbed higher tariff costs to protect consumers, but analysts warn this cannot continue. Once businesses pass these costs down, prices for goods and services will rise, adding fuel to inflation. With the Producer Price Index (PPI) already jumping 0.9% in July, the highest in three years, the Fed may be reluctant to ease policy too soon.

2. Challenges in U.S. Job Growth and Labor Market

The U.S. economy added just 73,000 jobs in July, well below expectations, indicating that hiring is slowing compared to earlier months. In addition, May and June job figures were revised down by a combined 258,000, showing that recent labor market gains were smaller than initially reported. While this doesn’t confirm a weak job market, it does suggest that growth momentum is cooling, which could strengthen the case for cheaper borrowing costs if the trend continues.

3. Political Pressure from the Trump Administration

Although the U.S. President has no legal authority to set Fed interest rates, political pressure can still shape expectations. President Donald Trump has been vocal in criticizing Fed Chair Jerome Powell and has suggested he may not reappoint him when Powell’s term ends in 2026. The White House continues to call for aggressive rate cuts to boost household spending power and short-term economic growth.

This dynamic raises concerns about the Fed’s independence, which is designed to keep monetary policy insulated from political cycles. Even though the President cannot directly order rate changes, repeated criticism and the possibility of appointing more dovish Fed officials in the future may indirectly increase market expectations for cuts.

4. Internal Divisions at the U.S. Federal Reserve

The Federal Reserve itself is split on what to do next. Most officials (hawks) argue that inflation risks are still greater than employment risks, and want to keep rates higher. However, Governors Michelle Bowman and Christopher Waller openly pushed for a 25 bps cut at the July FOMC meeting, highlighting rare public divisions that make September’s outcome especially uncertain.

Market Scenarios for August 22: How Will Bitcoin React?

Traders headed into Jackson Hole with caution, as the odds of a September Fed rate cut dropped to 73% from 92%, tightening conditions and weighing on risk assets. Powell’s speech sets the immediate tone for Bitcoin, with three potential outcomes in play:

1. Hawkish Scenario: If Powell stresses that inflation remains elevated and signals patience on rate cuts, crypto markets could come under pressure. Bitcoin may retest $111,900–$112,000 support, with further downside toward $110,500 or even the $103,000–$108,000 zone if selling accelerates. Altcoins would likely see sharper declines, while BTC dominance could rise as investors rotate into relative safety. Miners and exchanges may also feel the squeeze from tighter liquidity and higher borrowing costs.

2. Neutral Scenario: If Powell avoids clear guidance and repeats that the Fed is “data dependent,” markets are likely to stay cautious. Bitcoin would probably range between $113,000–$114,000, with traders waiting for more decisive data like the September 5 jobs report or the next CPI reading. This outcome would keep volatility lower in the short term but leave uncertainty hanging over the crypto market.

3. Dovish Scenario: Should Powell highlight labor market weakness and suggest the Fed is ready to cut rates in September, risk assets could rally. Bitcoin may break above $115,000–$116,000, potentially extending higher on ETF inflows, while Ethereum could test $4,400 and altcoins like Solana and XRP might outperform as speculative flows return. Historically, such remarks have fueled “buy-the-news” rallies across crypto.

How to Trade BTC After Powell's Jackson Hole Speech on 22 August?

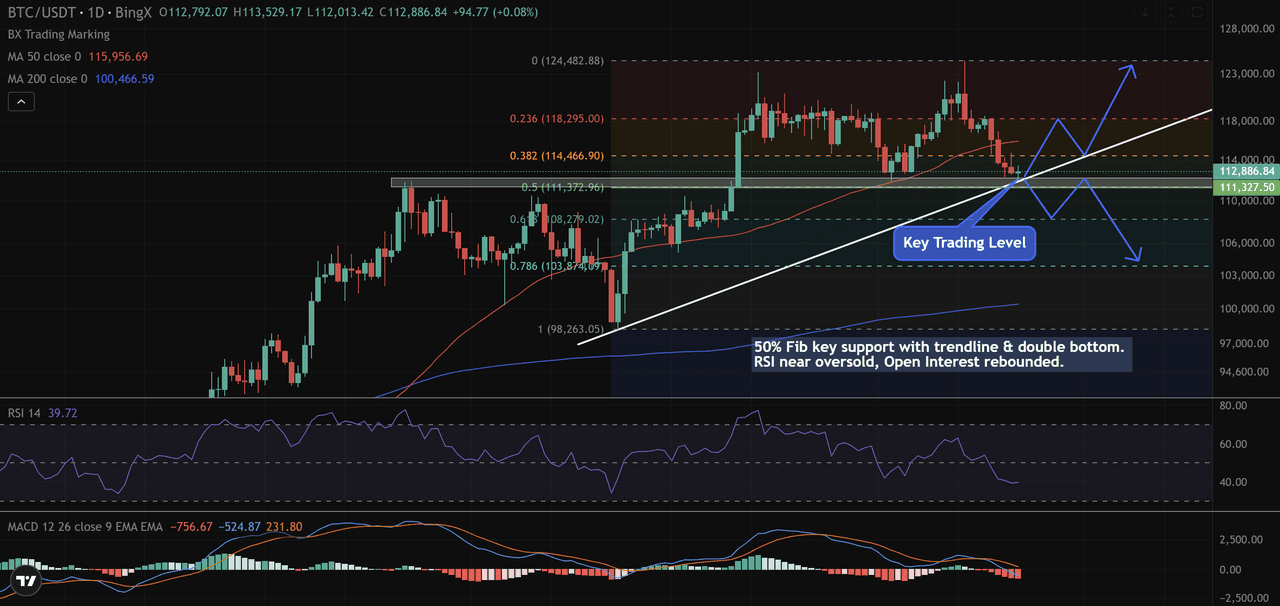

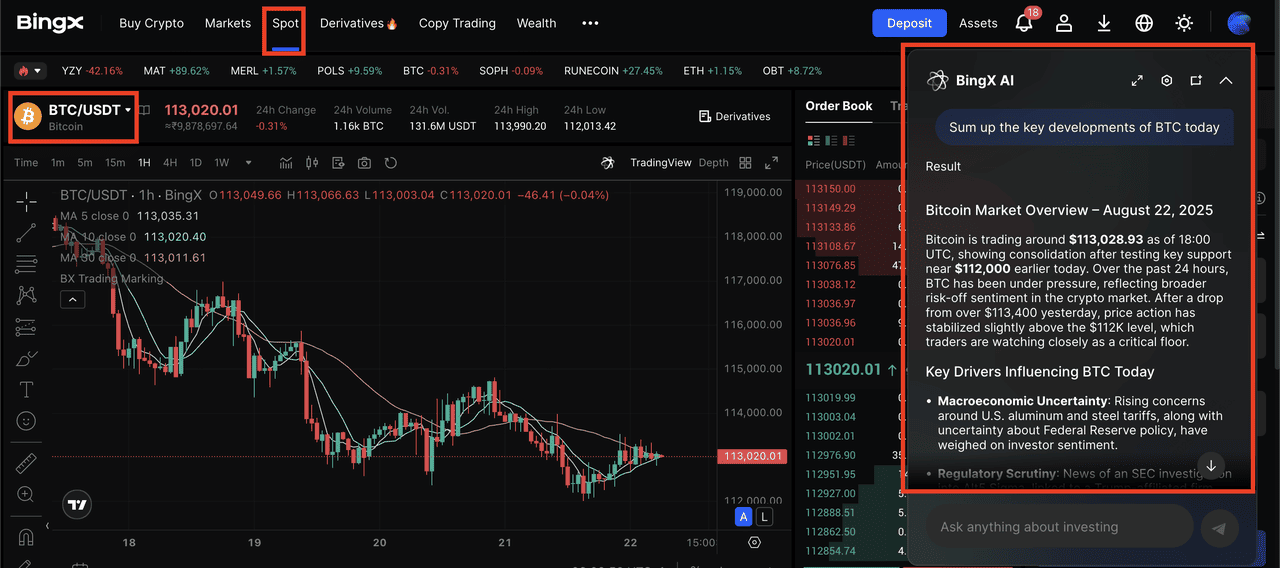

BTC/USDT technical analysis on BingX spot market, powered by BingX AI

Bitcoin is currently holding near $112,958, stabilizing around the 50%

Fibonacci retracement level that has flipped from resistance into support. Earlier in the session, BTC tested $112,013 but quickly recovered, with the upward trendline reinforcing this area as a

double bottom formation. The price structure suggests traders are defending this zone, though sentiment remains fragile, leaving room for $2,000–$3,000 intraday swings depending on follow-through momentum.

A sustained break below $111,900 could expose targets at $110,500 (100-day

EMA) and $108,000, while a clean move above $113,500–$113,900 resistance would open the way toward $114,900 (50-day EMA) and the broader $118,000 retracement cluster.

Technical Indicators and Trading Signals

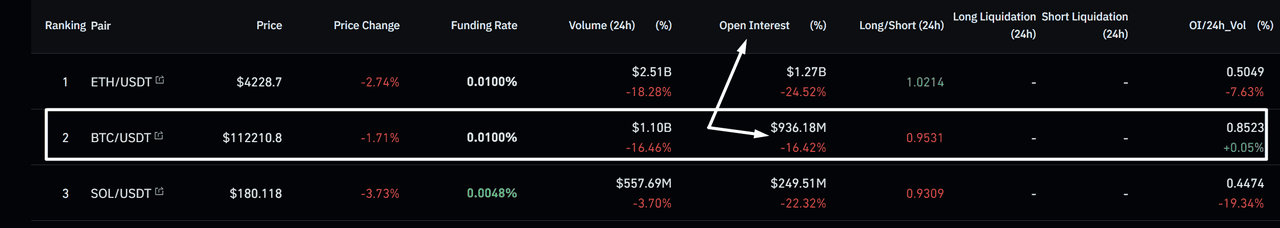

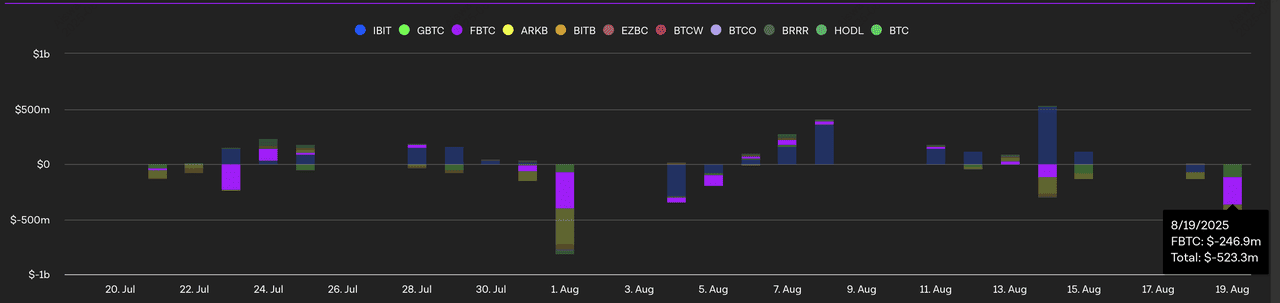

Open Interest Rate – August 21, Source:

Coinglass

Open interest tells its own story. Yesterday, BTC’s OI fell sharply by -16%, showing traders were reducing exposure amid price weakness. Today, however, OI has rebounded by +2%, signaling new contracts entering the market. When paired with a daily Doji candle, this shift hints that a bullish bounce could be forming as fresh positioning comes in at key support.

Open Interest Rate – August 22, Source:

Coinglass

Still, the broader trend shows that leveraged traders remain cautious, with OI swings reflecting repositioning rather than full conviction. Such patterns often precede sharper directional moves once volatility returns. The price is also coiling inside a symmetrical triangle, and a decisive breakout on volume, either above $114,000 or below $112,000, will likely define Bitcoin’s next major leg.

How to Trade Bitcoin on BingX

BTC/USDT trading pair on spot market, powered by BingX AI insights

Beyond analysis, traders can act directly on

BingX Spot and

Futures markets, where BTC/USDT pairs offer deep liquidity and flexible order types. On spot, you can buy and sell Bitcoin instantly, while the futures market lets you apply leverage to amplify gains, or losses, based on short- or long-term price moves. BingX AI insights provide real-time trend detection, support/resistance mapping, and sentiment signals, helping you make data-driven decisions in volatile conditions like those following Powell’s Jackson Hole speech.

Risk Management and Trade Outlook

With more than $530 million in leveraged positions liquidated earlier this week, risk discipline remains essential. Stop-loss orders just under $110,000 protect against deeper downside, while scaling into positions above $113,500 provides exposure to a potential rally toward $118,000 and $124,000.

Should bulls reclaim momentum with a bullish engulfing candle, Bitcoin could extend its advance toward $130,000, reinforcing optimism that this cycle still carries substantial upside potential for long-term investors.

If Powell sounds dovish, altcoins like Ethereum,

Solana, and

XRP could outperform as traders rotate into higher-beta assets. On the other hand, if Powell takes a hawkish stance, Bitcoin may prove more resilient than altcoins, with

BTC dominance likely to rise as investors seek relative safety.

Bitcoin’s Future Outlook

Bitcoin’s path after Powell’s August 22 speech will depend heavily on how the Fed balances inflation risks against labor market weakness. In the bearish case, a hawkish tone could push BTC down to its 100-day EMA near $110,500, with some analysts warning of a potential dip toward $107,000 if selling accelerates. In the

bullish case, dovish signals may ignite short liquidations, sending Bitcoin back above $115,000 and possibly toward $120,000 by September.

Beyond the immediate volatility, the longer-term picture looks more favorable for crypto. Banks like Goldman Sachs expect the Fed to deliver three rate cuts by the end of 2025, a shift that could restore liquidity and strengthen Bitcoin’s position as both a risk-on asset and an inflation hedge. Historical patterns show Bitcoin tends to rally strongly in easing cycles, and many traders view upcoming cuts as a tailwind for digital assets.

Some experts remain especially optimistic. Research firm Bernstein has projected Bitcoin could reach $150,000–$200,000 within the next 12–18 months, driven by institutional adoption and regulatory clarity. Meanwhile, PlanB, creator of the

Stock-to-Flow model, has reiterated his bold forecast that

Bitcoin could hit $1 million before 2028, citing its programmed scarcity and accelerating demand from both institutions and sovereign entities. While short-term swings may unsettle traders, the longer-term outlook suggests Bitcoin’s role as a global store of value is only growing stronger.

Related Reading

Spot Bitcoin ETF flows | Source: TheBlock

Spot Bitcoin ETF flows | Source: TheBlock