Warden Protocol is a groundbreaking modular infrastructure that allows for the creation, distribution, and verifiable execution of

AI Agents. As of February 2026, Warden has processed over 60 million agentic tasks and supports approximately 20 million total users, positioning itself as the leading distribution layer for autonomous economic actors in Web3. By abstracting the complexities of wallets, gas, and bridges, Warden enables a world where users simply "set intent" while agents handle the heavy lifting.

In this article, you will learn what Warden Protocol is, how its unique Statistical Proof of Execution (SPEx) ensures

AI integrity, the utility of the $WARD token, why Warden is transforming crypto from self-custody to intelligent agency, and how to trade Warden Protocol (WARD) on BingX spot and futures marketd.

What Is Warden Protocol (WARD) AI Agent Infrastructure?

Warden Protocol is a

Layer 1 blockchain built on the

Cosmos SDK that functions as an "operating system" for AI Agents. It provides the standardized tools and security frameworks needed for agents to trade, research, and manage assets autonomously across any chain, including

Ethereum,

Solana,

Base, and

BNB Chain.

In January 2026, Warden secured a $4 million strategic funding round at a $200 million valuation from partners including 0G, Messari, and Venice.AI, highlighting the massive demand for verifiable AI infrastructure in the crypto market.

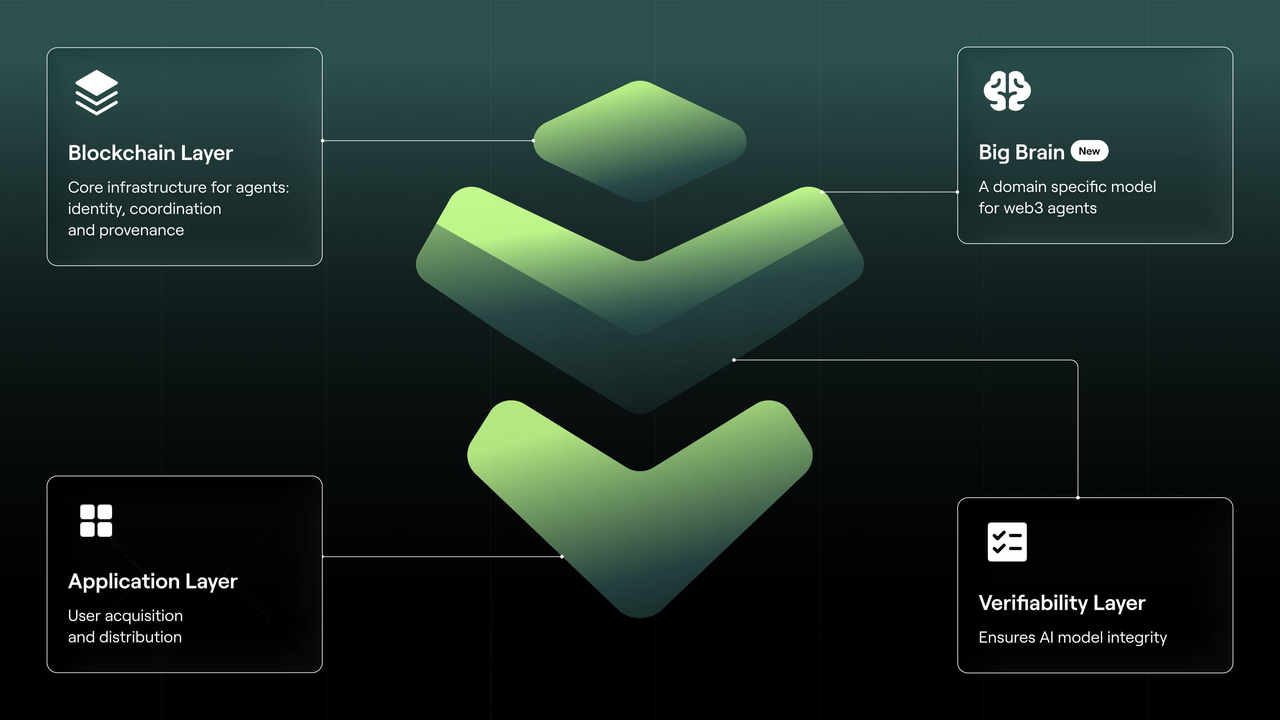

The protocol operates through four tightly connected pillars:

1. Warden Chain: A purpose-built EVM-compatible blockchain that serves as the settlement layer where agents gain

on-chain identity, track records, and the ability to hold balances.

2. Agent Hub: A decentralized marketplace, the "App Store for Agents," where users discover specialized AI agents for trading, DeFi automation, and market research.

3. Warden Studio: A developer toolkit that allows builders to create, test, and monetize AI agents in under a minute.

4. Warden Agentic Wallet: The primary consumer interface where users interact with the entire ecosystem through natural language chat or voice commands.

What Are the Key Components of the Warden Ecosystem?

An overview of AI agent infrastructure | Source: Warden blog

• SpaceWard: An omnichain SAFE (Multi-Sig) that serves as the "custody center" for AI agents, allowing for decentralized, group-managed agentic activity.

• Messari Deep Research Agent: An institutional-grade agent providing real-time market intelligence and token signals directly into the Warden interface.

• BetFlix: A hyper-casual "swipe-to-trade" game that gamifies financial markets, often referred to as the "Tinder of Trading."

• The Big Brain: An upcoming, protocol-native LLM designed specifically for financial and on-chain tasks, trained on trillions of tokens.

How Does Warden Protocol Work?

Warden replaces the manual, fragmented Web3 experience with an Intent to Command to Execution pipeline. It ensures that when an agent acts on your behalf, it remains within secure, auditable boundaries.

1. Identity and Policy-Based Permissions

Every agent on Warden is assigned a unique cryptographic ID. Users can define "Policies," programmable rules that restrict what an agent can do, such as setting daily transaction limits or requiring multisig approval for large withdrawals.

2. Intent-Based Execution

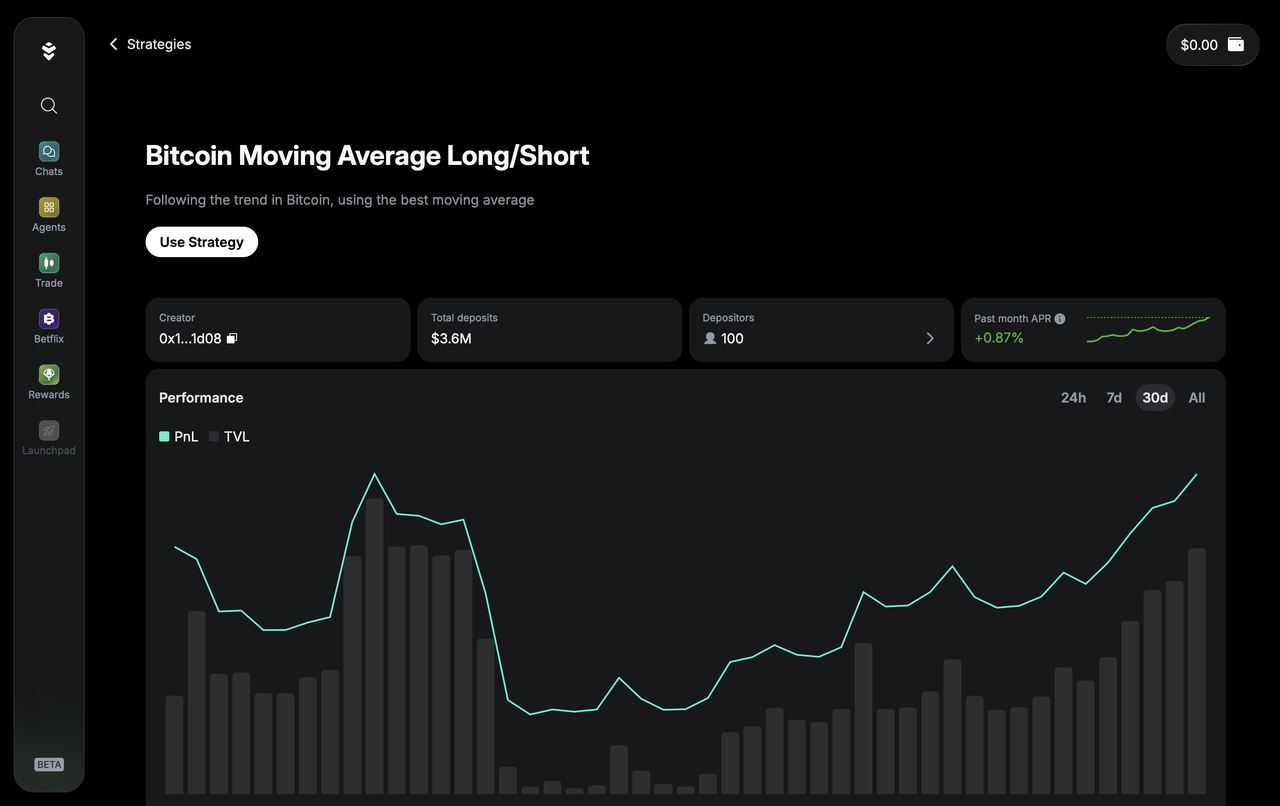

Instead of navigating multiple dApps, users issue a command: "Find the best yield for my USDC on Solana and move it there." Warden’s intent engine routes this to the most efficient agent to handle the routing, bridging, and staking automatically.

Strategies on Warden Protocol | Source: Warden blog

3. Verification via SPEx (Statistical Proof of Execution)

To solve the "black box" problem of AI, Warden uses SPEx. This protocol uses probabilistic sampling and cryptographic proofs to verify that the agent actually ran the specific AI model it claimed to, and that the output hasn't been tampered with.

4. Cross-Chain Orchestration

Using interoperability frameworks like IBC and

Hyperlane, Warden agents can switch "seamlessly" between different blockchains. This allows for complex workflows, such as an agent researching a token on Ethereum and instantly executing a trade on a

Solana DEX.

What Is the WARD Token Used for?

The $WARD token is the native utility and governance backbone of the Warden ecosystem. With a fixed supply of 1 billion tokens, it is designed to capture value from the growth of the agentic economy.

• Gas Abstraction: WARD acts as the universal currency for all transaction fees, eliminating the need to hold multiple native tokens.

• Agent and Subscription Fees: Users pay in WARD to unlock premium agents in the Agent Hub or to access higher-tier subscription benefits.

• Staking and Security: Validators and delegators stake WARD to secure the Warden Chain and participate in consensus.

• Governance: WARD holders vote on protocol upgrades, agent listings, and the allocation of ecosystem incentives through the Warden DAO.

• Developer Monetization: Developers who publish agents on Warden earn revenue in WARD based on user interactions.

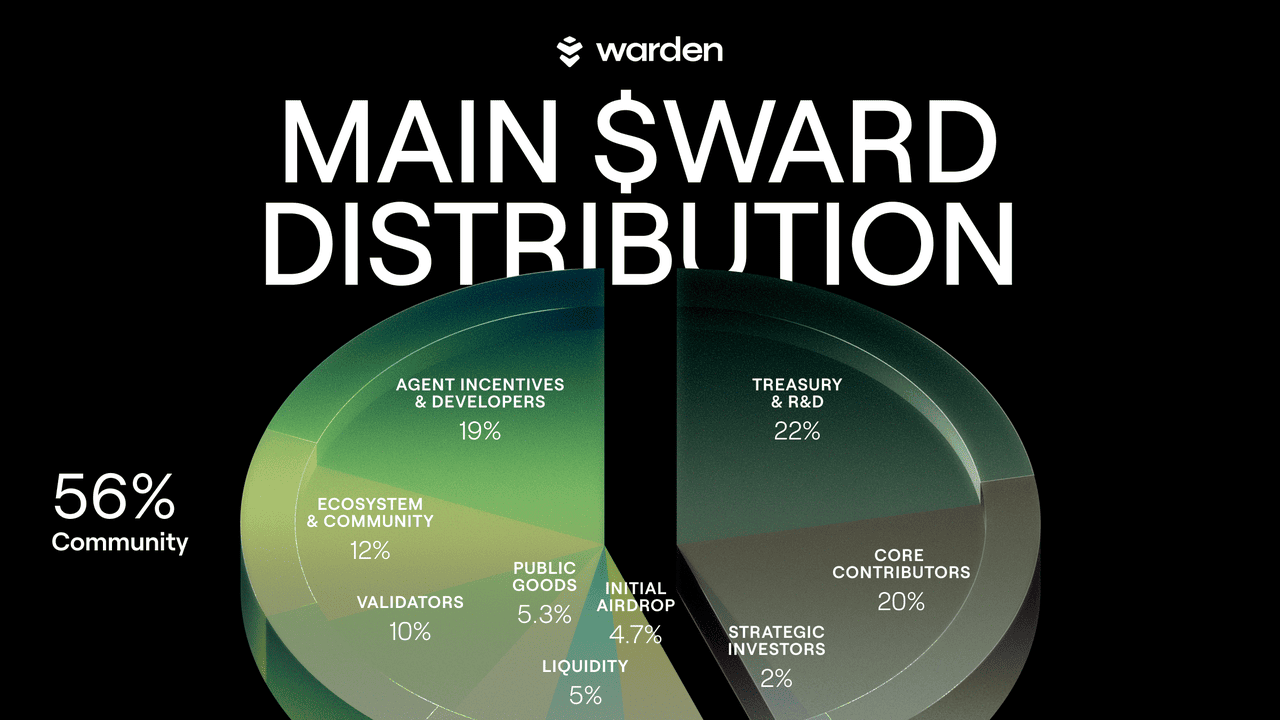

What Is Warden (WARD) Tokenomics?

Warden Protocol features a fixed maximum supply of 1,000,000,000 WARD. The distribution is structured to ensure long-term sustainability and decentralized ownership.

WARD token allocation | Source: Warden blog

WARD Token Distribution Model

• Treasury and R&D (22.0%): Dedicated to the development of frontier technology in decentralized AI.

• Core Contributors (20.0%): Reserved for the founding team and advisors, subject to a 6-month cliff and 2-year linear vesting.

• Agent Incentives & Developers (19.0%): A massive pool to attract top-tier AI developers to build on Warden Studio.

• Ecosystem & Community (12.0%): Funding for marketing, partnerships, and critical infrastructure like block explorers.

• Public Goods (5.3%): Allocation for ongoing growth activities and engagement rewards.

• Initial Airdrop (4.7%): 47 million tokens allocated to early testnet users and "The Great Pump Off" participants, with 30.32M available at genesis.

What Is the Warden Airdrop and How to Claim WARD Tokens?

The $WARD airdrop is a multi-phased distribution event designed to transition the Warden Protocol into a community-governed ecosystem. Launched on February 4, 2026, the airdrop rewards early adopters from the Alfama, Buenavista, and Chiado testnets, as well as participants in "The Great Pump Off" campaign. Unlike traditional "claim-and-dump" models, Warden utilizes a compounding claim mechanic where your allocation increases the longer you wait to claim, reaching its maximum value at the six-month mark.

Additionally, claiming the airdrop boosts your "Allocation Power," a reputation metric that grants priority access to future AI agents and IDOs on the upcoming Warden Agent Launchpad.

For a detailed walkthrough on eligibility, compounding multipliers, and step-by-step claiming instructions, please refer to our comprehensive

Warden Protocol Airdrop guide.

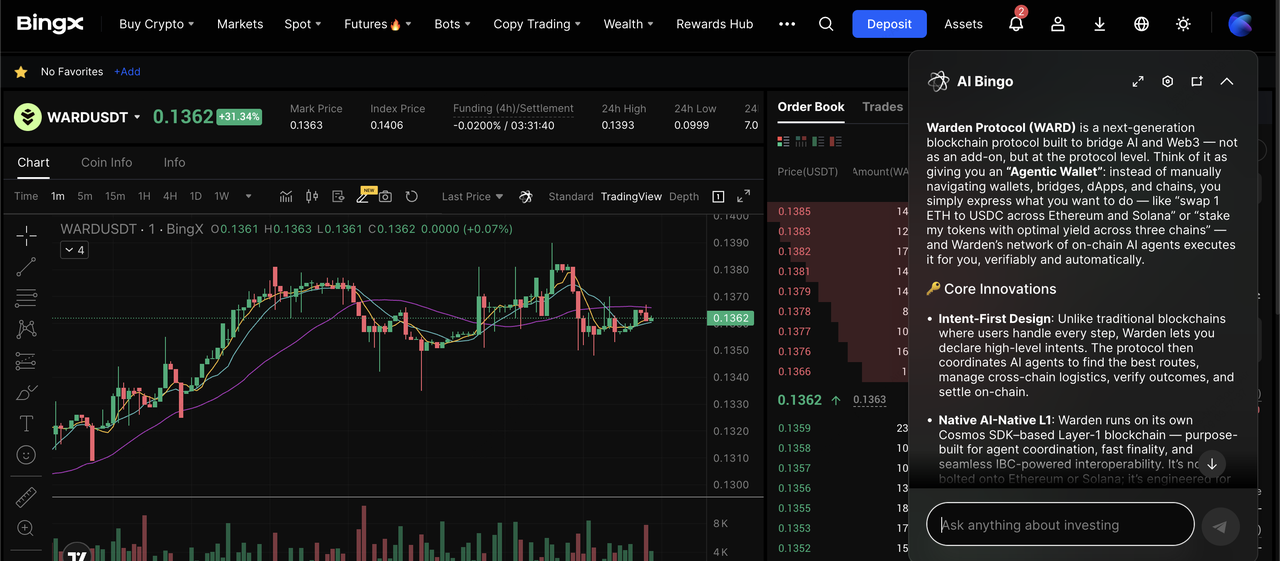

How to Trade Warden Protocol (WARD) on BingX

Powered by

BingX AI insights, you can trade WARD across both spot and derivatives markets while utilizing real-time sentiment analysis to navigate the volatility of the emerging AI sector.

How to Buy or Sell WARD on the Spot Market

WARD/USDT trading pair on the spot market featuring BingX AI insights

1. Fund Your Account: Deposit USDT or buy it directly via credit card on BingX.

How to Long or Short WARD with Leverage on the Futures Market

WARD/USDT perpetual contract on the futures market powered by BingX AI insights

3 Key Considerations Before Investing in Warden Protocol (WARD)

Before committing to the Warden ecosystem and buying WARD tokens, it is vital to evaluate the unique regulatory, technical, and market dynamics that distinguish this AI-driven infrastructure from traditional crypto assets.

1. Warden Protocol's "Do-It-For-Me" Adoption: The value of WARD is tied to how many users shift from manual trading to agentic execution. If agents become the primary way we interact with Web3, the utility of WARD will scale significantly.

2. Infrastructure vs. Hype: Unlike "memecoins" with AI branding, Warden is a Layer 1 infrastructure project. Its success depends on developers building and monetizing agents in the Warden Studio.

3. Early Stage Volatility: As a project that launched in early 2026, WARD may face significant price discovery volatility. Investors should monitor ecosystem metrics like "Daily Agent Tasks" and "Cumulative Agent Revenue" to gauge real adoption.

Final Thoughts: Is Warden (WARD) the Future of the Agentic Internet?

Warden Protocol represents a fundamental shift in the blockchain landscape, moving from a model of "manual execution" to one of "intelligent agency." By providing the necessary infrastructure, identity, security policies, and verifiable execution, Warden addresses the primary barriers to mass crypto adoption: complexity and trust. If the long-term trajectory of the internet is indeed "agentic," where autonomous software manages digital outcomes, Warden’s role as the underlying network layer positions $WARD as a central asset in this new economy.

However, the success of Warden depends on the protocol's ability to transition from its initial hype into a sustainable ecosystem characterized by active developer participation and reliable agent performance. As the industry moves past the "beta phase" of AI, the focus will shift toward measurable ROI and the stability of these autonomous systems in live market conditions.

Risk Reminder: Investing in $WARD involves high volatility typical of early-stage AI-crypto protocols, with risks stemming from market sentiment and the technical complexity of verifiable AI. Always conduct thorough research and apply strict risk management, as regulatory changes and technical vulnerabilities could impact the token's value.

Related Reading