Venice AI (VVV) is the world’s leading platform for private and uncensored

artificial intelligence. Founded by Erik Voorhees, founder of ShapeShift, Venice allows users to interact with high-performance models like Claude 4.5, GPT-5.2, and Flux 2 without the surveillance or restrictive bias found in mainstream AI services. As of February 2026, Venice has burned over 33 million

VVV tokens or 42.8% of total supply and processed millions of inferences for users seeking digital sovereignty.

In this article, you will learn what Venice AI is, how its unique privacy architecture protects your data, why it is a leader in the Separation of Mind and State, the role of the VVV token and the DIEM compute unit, and how to trade VVV tokens on BingX spot and futures markets.

What Is Venice AI (VVV) Private Intelligence Platform?

Venice AI is a decentralized inference platform that tokenizes access to abliterated large language models (LLMs). Unlike ChatGPT or Gemini, which store user conversations on central servers, Venice treats AI as a private utility. It operates as an aggregator of the world's best open-source models, removing the safety filters that often result in biased or refused responses.

Venice operates through two core pillars:

1. Unrestricted Inference: Users can access text, image, and video generation models, including stable diffusion and specialized coding models, without an account, though Pro features offer higher limits and more advanced models.

2. Decentralized Compute Commons: Instead of a single server farm, Venice routes encrypted prompts to a global network of GPU providers. This ensures the platform is censorship-resistant and cannot be easily shut down by a single entity.

In early 2026, Venice reached a major milestone by introducing Memoria, a local-first long-term memory system. This allows the AI to remember previous interactions across chats while keeping that memory data exclusively on the user's device, not on Venice’s servers.

What Are the Key Components of the Venice Ecosystem?

1. The VVV Token: The Foundation

VVV is the native utility token on the

Base network. It serves as the access key to the network. By staking VVV, users and

AI agents gain a pro-rata share of the network's daily computing power.

2. DIEM for Tokenized Intelligence

Launched in late 2025, DIEM is a tradeable ERC-20 token that represents perpetual AI compute, designed to help developers lock in long-term AI usage costs. Each 1 DIEM equals $1 of daily API credit forever, and DIEM is minted by locking staked VVV (sVVV) into the protocol. By converting recurring AI API expenses into a fixed, on-chain asset, DIEM allows developers and businesses to hedge against rising compute costs and treat AI access as a predictable capital investment rather than an ongoing operational expense.

3. Venice API and Agents

The platform is designed specifically for AI Agents. By staking VVV, an autonomous agent can generate its own income through staking yield while consuming free inference via its DIEM allocation. This makes Venice the primary choice for the growing Agentic Web.

How Does Venice AI Work?

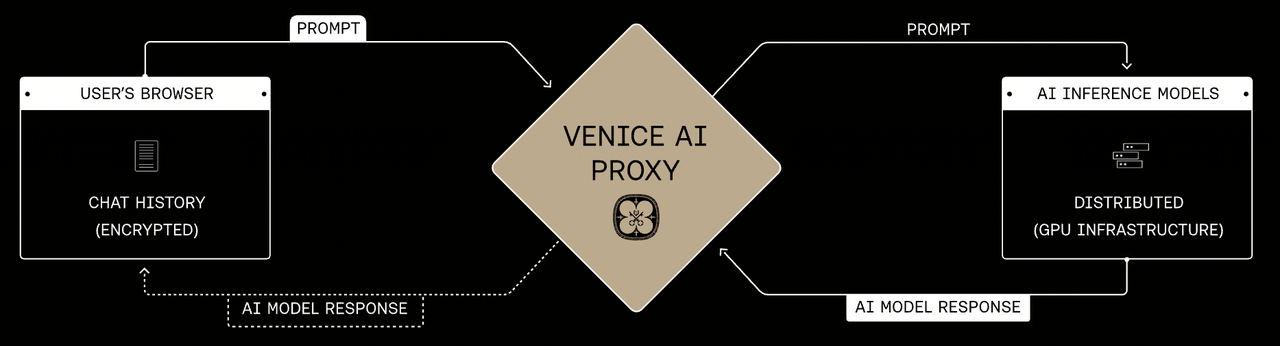

How Venice AI works | Source: Venice AI

Venice replaces the traditional pay-per-prompt SaaS model with a programmable, token-based system. It follows a privacy-first local storage model combined with blockchain-based settlement on the Base Layer 2 network.

1. Local-First Privacy Architecture When you send a prompt, it is encrypted via SSL and routed through a proxy to a GPU provider. The response is streamed back directly to your browser. Crucially, Venice does not log the prompt or response. All conversation history is stored in your browser's local storage, meaning if you clear your cache, the history is gone forever.

2. Abliterated Open-Source Models Venice utilizes abliterated models, open-source weights where the refusal mechanisms have been surgically removed. This ensures the AI provides objective information on sensitive topics like religion, politics, or complex research without moralizing or lecturing the user.

3. Revenue-Based Buy and Burn Since November 2025, Venice has used a portion of its monthly revenue to buy back VVV tokens from the open market and burn them. This creates a deflationary pressure that rewards long-term holders as platform adoption grows.

4. Emission Management On February 10, 2026, Venice executed a permanent 25% reduction in emissions, dropping annual token issuance from 8 million to 6 million VVV. This halving-style event was designed to curb inflation and increase the scarcity of the access token.

What Is the VVV Token Used for?

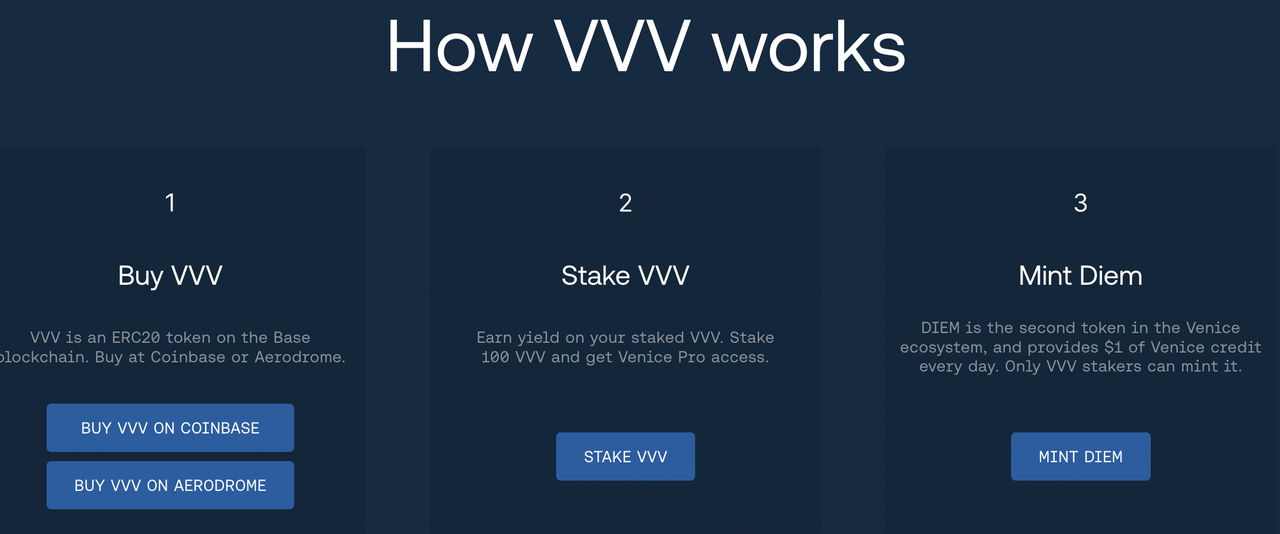

VVV token utility in the Venice AI ecosystem | Source: Venice AI

The VVV token is the economic backbone of the Venice ecosystem. It is not a speculative "meme" coin; it has direct functional utility:

• Staking for Access: Staking VVV grants you "Pro" status, removing watermarks from images and providing unlimited text prompts.

• Yield Generation: Stakers earn a portion of the 6 million VVV emitted annually as rewards for securing the network's liquidity.

• Governance: ONDO holders (and similarly VVV holders in their respective DAOs) influence the "Target DIEM Supply" and model additions.

• Minting DIEM: VVV is the only asset that can be used to mint DIEM, the liquid representation of AI compute.

Note: VVV is a high-beta AI asset. Its value is tied to the demand for private, uncensored compute. As more agents and developers join the platform, the pro-rata share of compute per VVV becomes more valuable.

What Is Venice Token (VVV) Tokenomics?

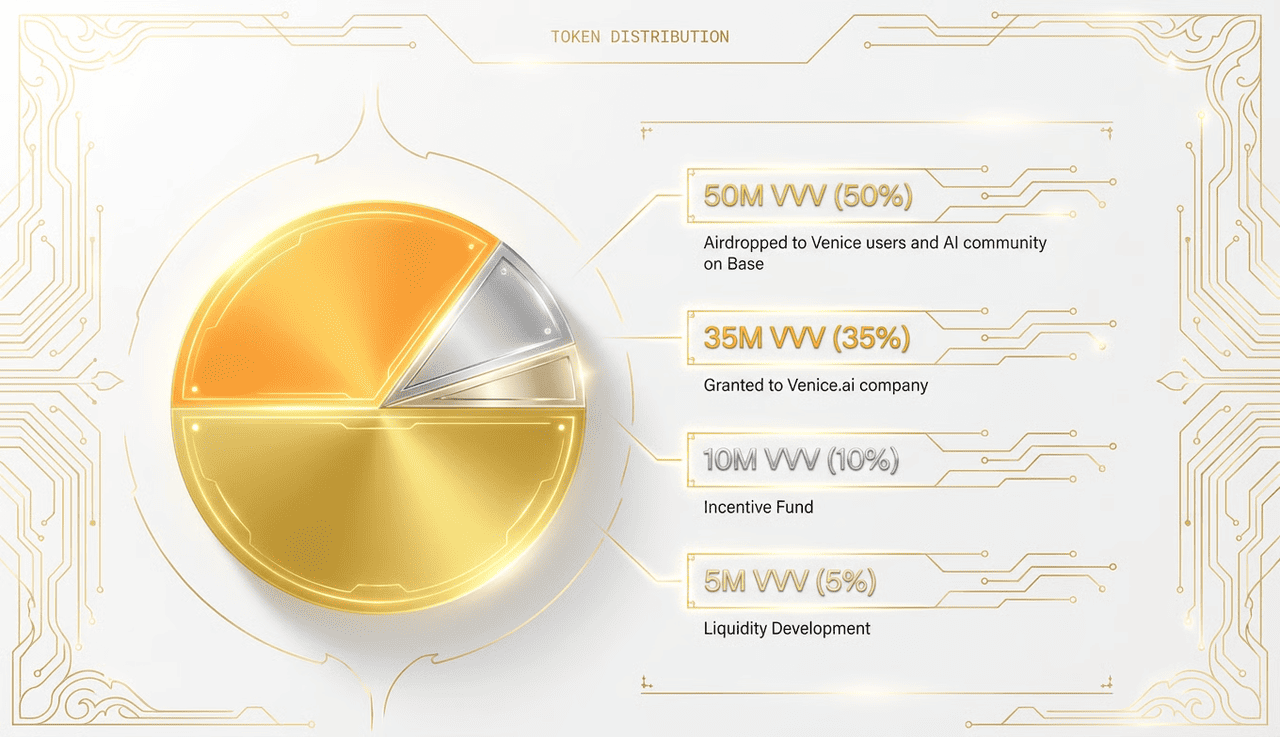

Venice Token (VVV) launched with an initial supply of 100 million tokens, though this total was significantly reduced in March 2025 when approximately 33.68 million unclaimed airdrop tokens were burned.

Based on its original genesis distribution, the token allocation is as follows:

• 50% (50 million VVV): Airdropped to the Venice community and AI-related projects on the Base network.

• 35% (35 million VVV): Granted to the Venice.ai company for development and growth.

• 10% (10 million VVV): Designated for the Venice Incentive Fund.

How to Trade Venice (VVV) on BingX

BingX provides real-time analytics to help you navigate the volatile AI sector. You can gain exposure to Venice's growth through both the spot and futures markets with the power of

BingX AI.

How to Buy or Sell VVV on the Spot Market

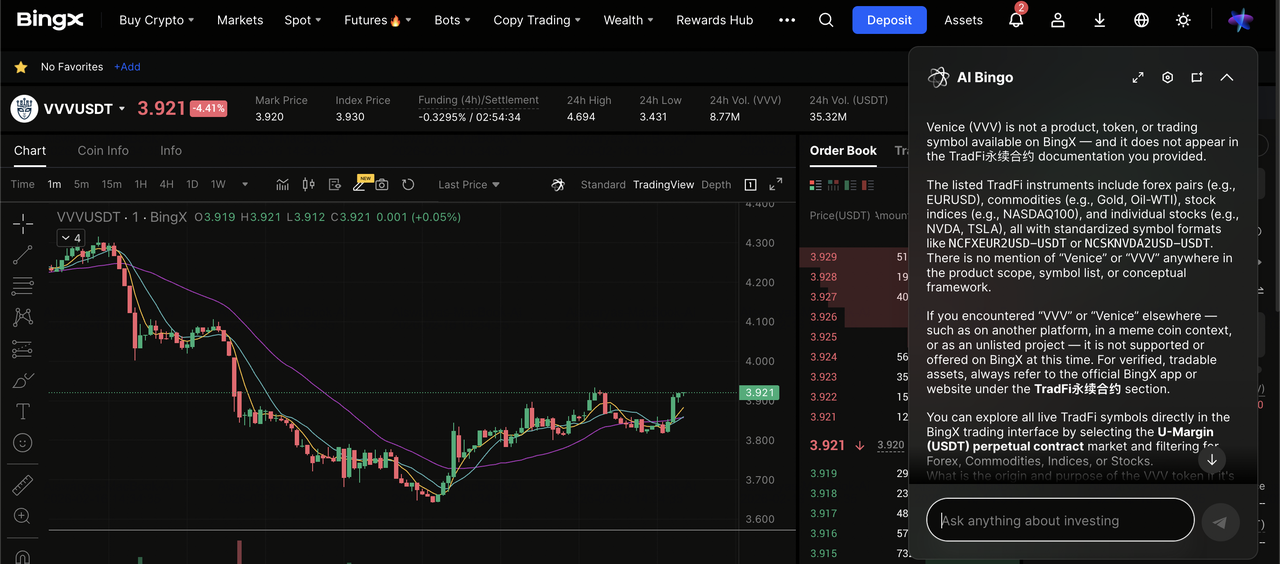

VVV/USDT trading pair on the spot market powered by BingX AI insights

2. Locate the Pair: Search for

VVV/USDT.

3. Execute Trade: Use a

Limit Order to set your preferred entry price or a Market Order for instant execution.

Long or Short VVV Futures with Leverage

VVV/USDT perpetuals on the futures market powered by BingX AI insights

1. Open BingX and go to Futures and search for the VVV/USDT perpetual contract.

2. Choose Cross or Isolated margin, then set your leverage based on your risk tolerance.

3. Review the chart and order book, then pick an order type: Market (instant) or Limit (target price).

4. If you expect price to rise, tap Open Long; if you expect price to fall, tap Open Short.

6. Monitor your position, such as PnL, liquidation price, margin level, and adjust leverage, margin, or exits as needed.

Top 3 Considerations Before Investing in Venice (VVV)

Before investing in Venice (VVV), it’s important to understand the key factors that influence its value, risk profile, and long-term sustainability within the AI compute and Web3 ecosystem.

1. AI Narrative Volatility: AI tokens often move in hype cycles. While Venice has strong fundamentals, the price can fluctuate based on news from non-crypto AI giants like OpenAI or DeepSeek.

2. Deflationary vs. Inflationary Forces: While the recent emission cut to 6M/year is bullish, the total supply is still increasing annually. The success of the Buy and Burn mechanic is crucial to offset this.

3. GPU Supply Risks: Venice relies on decentralized GPU providers. Any global shortage of high-end chips (like NVIDIA H100s) could impact the Diem capacity of the network.

Final Thoughts: Should You Buy Venice Token (VVV) in 2026?

Venice AI positions itself as a decentralized alternative to mainstream Big Tech models, emphasizing privacy and uncensored access through a local-first architecture. By utilizing abliterated open-source models, the platform removes centralized safety filters, allowing for unrestricted text, image, and code generation. The 2026 introduction of the dual-token system, comprising the VVV utility token and the DIEM compute unit, marks a significant maturation in its tokenomics, specifically designed to commoditize and stabilize the cost of AI inference for developers and autonomous agents.

The project’s economic model shifted towards a more sustainable structure in February 2026 following a permanent 25% reduction in annual emissions, dropping from 8 million to 6 million VVV tokens. This deflationary pressure is further supported by a revenue-based buy-and-burn mechanism, aligning the token's scarcity with the actual growth of the decentralized compute network. As the ecosystem expands, the value of VVV remains intrinsically tied to its utility as the primary access key for private machine intelligence.

Risk Reminder: Investing in VVV involves significant risks, including high price volatility, regulatory uncertainty, and the experimental nature of decentralized AI infrastructure. The token's value is dependent on continued platform adoption and the availability of decentralized GPU resources; past performance, including recent price surges, does not guarantee future results.

Related Reading