雪球 (Snowball / Xueqiu) is a Chinese meme coin launched in early January 2026, built around a deflationary trading design intended to create a “snowball effect” through automated buybacks and token burns. Deployed on the BNB Chain, 雪球 is actively traded across decentralized markets and is also available for spot and derivatives trading on BingX, making it accessible to a global user base.

The emergence of 雪球 reflects a broader revival of

Chinese meme coins in 2026, where narrative symbolism, rapid liquidity formation, and on-chain mechanics converge to drive short-term market momentum. This article breaks down what 雪球 is, how it works, why it has drawn attention from traders, and how its tokenomics are structured, offering a clear primer for anyone tracking the latest developments in the Chinese meme coin space.

What Is 雪球 Chinese Memecoin and How Does It Work?

Source: xueqiu.live

雪球 (Snowball / Xueqiu) is a Chinese-language meme coin deployed on the

BNB Smart Chain (BEP-20 standard) and launched via FLAP, a

BNB Chain–based meme coins launch platform. The project does not position itself as an application, protocol, or governance token. Instead, it is designed purely as a mechanism-driven meme asset, with price behavior closely tied to trading activity.

At the smart-contract level, 雪球’s mechanics operate as follows:

1. 3% transaction tax: Every on-chain transfer applies a fixed 3% tax.

2. Automatic accumulation: Fees are routed to a buyback-and-burn wallet until the balance reaches 0.1 BNB.

3. Triggered buyback: Upon reaching the threshold, the contract automatically buys 雪球 from the open market and burns the tokens.

4. Deflation by design: Burned tokens are permanently removed from circulation, with the entire process executed on-chain and without manual intervention.

The so-called “snowball effect” refers to the direct relationship between trading volume and deflation speed. Higher transaction frequency accelerates fee accumulation and increases the frequency of buyback-and-burn events, while lower activity slows the process proportionally. As a result, 雪球’s supply dynamics are volume-dependent rather than utility-driven, making its market behavior highly sensitive to liquidity conditions and short-term trader participation.

Like most

meme coins, 雪球 does not generate cash flow, protocol revenue, or real-world usage metrics. Its price performance is primarily driven by market sentiment, speculative positioning, and turnover, with the burn mechanism influencing supply but not eliminating volatility or guaranteeing sustained appreciation.

Chinese Meme Coin Market Crosses $337 Million in January 2026

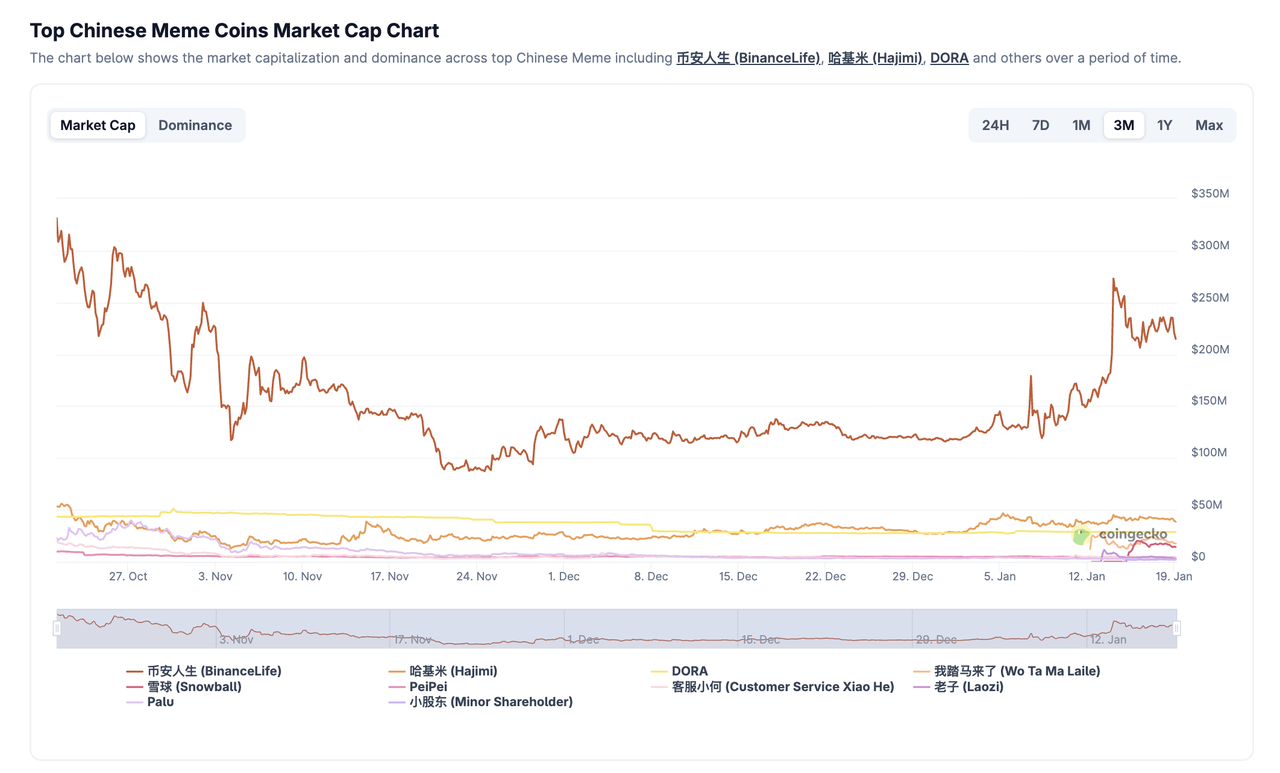

The Chinese meme coin sector has evolved into a recognizable sub-market, with total market capitalization exceeding $490 million at its first peak in October 2025 and later stabilizing around $337 million in mid-January 2026, alongside 24-hour trading volume above $100 million during peak activity.

The data highlights a two-phase structure:

• 1st Wave (October 2025): Known as the

BNB meme season, this phase marked the first major breakout of Chinese-language meme coins. On Oct 21, 2025, leading tokens including

币安人生 (BinanceLife),

哈基米 (Hakimi),

DORA,

Palu,

PeiPei, and

客服小何 collectively reached a combined market cap of about $492 million. Low fees, fast settlement on BNB Chain, and strong Chinese-speaking retail participation helped build momentum across the category.

• 2nd Wave (Mid-January 2026): After the November–December drawdown, the sector entered a broader revival, with total market cap recovering to around $337 million. Liquidity rotated across multiple names, including 币安人生 (BinanceLife), 雪球 (Snowball),

我踏马来了(Wo Ta Ma Lai Le), DORA, and

老子 (Laozi), driven by theme-based rotation and rapid launches rather than a single dominant token.

While individual tokens experienced sharp drawdowns and rebounds, the overall Chinese meme coin market maintained higher lows compared with late November, suggesting sustained speculative interest rather than a one-off spike. This environment favored rapid launches, short attention cycles, and fast liquidity formation, reinforcing the role of meme coin launchpads and cross-chain deployment tools in accelerating how new Chinese meme coins entered circulation.

What Is FLAP, the Cross-Chain Meme Coin Launchpad?

Source: Flap.sh

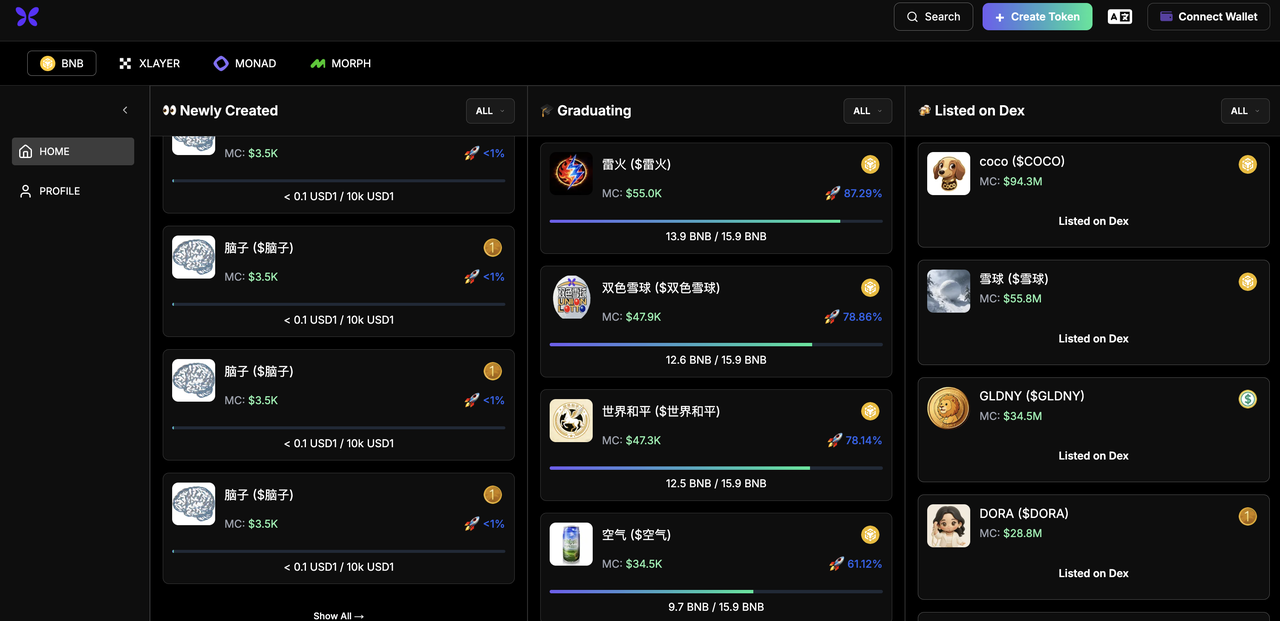

FLAP is a cross-chain

memecoin launchpad built on EVM-compatible networks, originally developed following an ETHGlobal hackathon. It allows users to deploy tokens across BNB Chain,

Monad,

X Layer, and Morph. The platform positions itself strictly as infrastructure rather than a curator or validator, emphasizing in its official messaging that “Engagement ≠ Endorsement.” FLAP does not assess project quality, sustainability, or expected returns, and provides tooling rather than guarantees.

Unlike traditional launchpads that focus on fundraising rounds, vesting schedules, or long-term roadmaps, FLAP follows a low-friction, fair-launch-oriented model. Tokens are deployed directly on supported chains and enter open market price discovery shortly after launch. FLAP incorporates bonding-curve-based mechanics to bootstrap early liquidity and facilitate initial trading, reducing the need for manual liquidity provisioning and enabling rapid, standardized deployment through on-chain execution.

FLAP’s cross-chain deployment strategy reflects where speculative liquidity is forming:

• BNB Chain serves as the most established base for meme coin trading and retail participation.

• Monad targets early-stage experimentation on a high-performance

Layer 1 environment.

• X Layer connects meme launches to OKX’s Layer 2 ecosystem and exchange-adjacent liquidity flows.

• Morph extends FLAP’s reach into the

Ethereum Layer 2 landscape, where emerging ecosystems often attract short-term speculative interest.

From a market perspective, FLAP functions as neutral deployment infrastructure rather than a quality filter. Meme coins launched via FLAP, including 雪球, derive their market value entirely from liquidity depth, trading activity, and trader sentiment, rather than platform backing, endorsements, or structural guarantees.

FLAP vs. Four.meme: Which Chinese Memecoin Launchpad Should You Choose?

As Chinese meme coins gained momentum in 2025–2026, FLAP and

Four.meme emerged as two of the most visible launch options. Both lower the barrier to launching meme tokens, but they reflect different design philosophies.

| Dimension |

FLAP |

Four.meme |

| Platform focus |

Cross-chain, EVM-based token launch protocol |

Single-chain, BNB-focused meme launchpad |

| Chain coverage |

BNB Chain, Monad, X Layer, Morph |

BNB Chain |

| Launch philosophy |

Flexible launch design with configurable mechanics |

Opinionated, standardized meme launch flow |

| Liquidity model |

Bonding-curve-based bootstrapping with adjustable parameters |

Direct, fast liquidity formation with fixed structure |

| Creator control |

Higher control over token standards and mechanics |

Lower control in exchange for simplicity and speed |

| Typical use case |

Cross-chain experiments and mechanism-driven memes |

Rapid BNB meme launches targeting retail flow |

How to choose:

• Pick FLAP if you want cross-chain reach and mechanism flexibility.

• Pick Four.meme if you want speed, familiarity, and fast access to BNB Chain retail liquidity.

Chinese Meme Coin Launchpads Beyond FLAP and Four.meme

Beyond FLAP and Four.meme, a small number of other platforms have seen notable usage by Chinese meme coin communities, even if they are not language-exclusive.

1. Trends.fun: A

Solana-based meme coin launchpad with clear Chinese community traction. The Chinese meme coin

索拉拉 (Solala) launched on Trends.fun, tied to the Chinese transliteration of Solana. Trends.fun represents the most visible example of Chinese meme culture extending into the Solana ecosystem.

2. Base.meme: A meme coin launch zone within the

Base ecosystem that has hosted Chinese-language meme experimentation. The Chinese meme coin

Base人生 gained attention after launching via

Base memecoin launchpad Base.meme, reflecting how Chinese meme narratives have begun to appear on Base during later phases of the 2025 cycle.

Together, these platforms show that while BNB Chain remains the primary home for Chinese meme coin launches, Chinese meme activity has gradually expanded into

Solana and Base, following liquidity and experimentation rather than strict platform loyalty.

How to Buy and Trade 雪球 (Snowball) (XUEQIU) on BingX

Whether you want to accumulate 雪球 for short-term speculation, trade volatility during active meme cycles, or capture momentum as liquidity rotates across Chinese meme coins, BingX makes it accessible through both spot and futures markets. With

BingX AI integrated directly into the trading interface, traders can also access real-time market insights to support more informed decision-making.

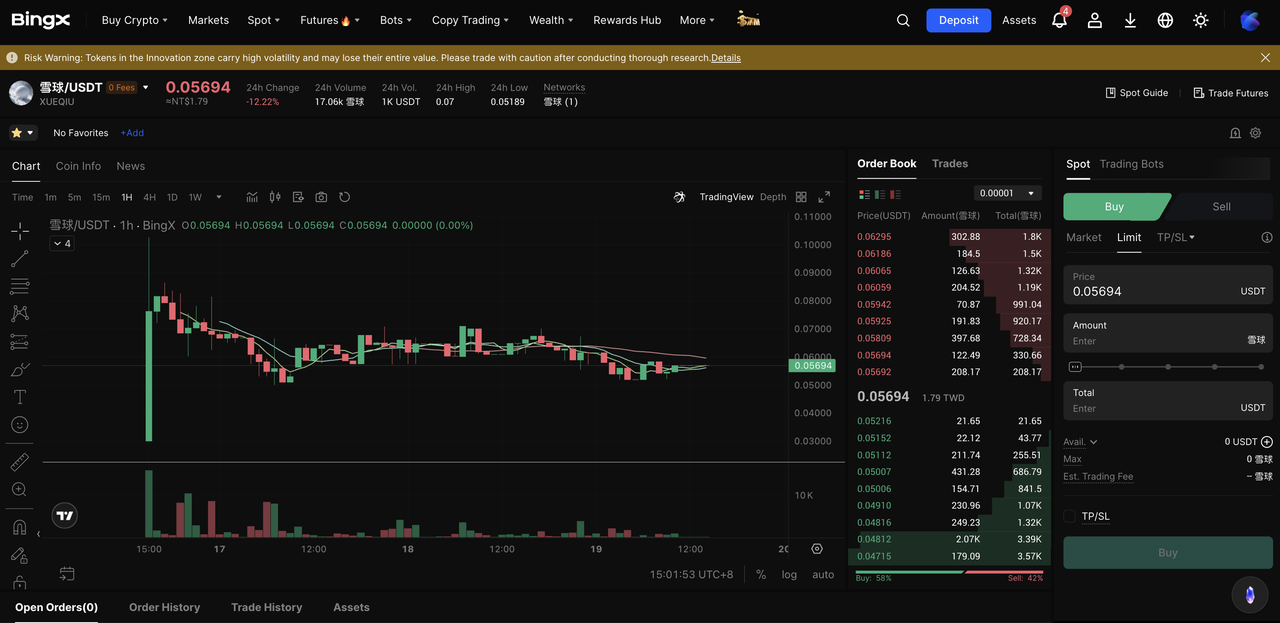

1. Buy or Sell 雪球 on the Spot Market

Source: BingX 雪球 Spot Market

If your goal is to buy and hold 雪球 or enter during pullbacks,

BingX Spot Market is the most straightforward option.

Step 1: Go to the BingX Spot Market and search for

雪球/USDT.

Step 2: Before placing an order, click the AI icon on the chart to activate BingX AI. The tool highlights support and resistance levels, potential breakout zones, and suggested entry ranges based on recent price action.

Step 3: Choose a

market order for instant execution or a limit order at your preferred price. Once filled, your 雪球 will appear in your BingX wallet, where it can be held or transferred externally.

2. Trade 雪球 with Leverage on Futures

Source: BingX 雪球 Futures Market

For more active traders,

BingX Futures allows you to go long or short on 雪球, making it possible to trade both upward and downward price movements during volatile meme coin cycles.

Step 1: Search for

雪球/USDT in the BingX Futures section.

Step 2: Activate BingX AI to analyze momentum, volatility, and short-term trend strength, helping identify potential entry and exit zones.

Final Thoughts

雪球 (Snowball / Xueqiu) captures the current phase of the Chinese meme coin market, where culturally specific narratives, rapid launches, and liquidity-driven price discovery dominate over long-term utility. Its buyback-and-burn design aligns with common meme coin mechanics, while its distribution reflects how Chinese retail traders engage with short-cycle speculation.

At the same time, 雪球 remains a high-volatility, sentiment-driven asset. Price movements depend largely on timing and market attention rather than fundamentals. For traders, platforms like BingX offer both spot and futures access, but participation should be paired with disciplined risk management and an understanding of meme coin market dynamics.

Related Reading