Trading and investing are long-term skills built through experience, discipline, and repeated exposure to market cycles. Over time, traders learn that consistent success is less about predicting every market move and more about managing risk effectively while allowing profitable trades enough room to develop.

In crypto markets, this lesson matters even more. High volatility, sudden news events, and the use of

leverage can amplify gains and losses within minutes. Without a clear risk framework, a handful of poorly structured trades can undo weeks of disciplined progress. This is why experienced traders focus on controlling downside risk before thinking about potential upside.

The risk-to-reward ratio is one of the most practical and widely used

risk management tools in crypto trading. It helps traders evaluate whether a trade is worth taking before committing capital. Instead of asking whether a trade will win, the risk–reward ratio asks a more important question: Is the potential reward justified by the risk involved?

Understanding how to calculate and apply this ratio allows traders to build structured trading plans, avoid impulsive decisions, and improve consistency across different market conditions.

What Is the Risk-to-Reward Ratio in Crypto Trading?

The risk-to-reward ratio, often referred to as the RR ratio, measures the relationship between the potential loss of a trade and its potential gain. In simple terms, it shows how much a trader is willing to risk in order to earn a specific return.

The ratio answers two basic questions before a trade is placed:

How much can I lose if the trade fails, and how much can I gain if it succeeds?

Risk is defined by the distance between the entry price and the

Stop-Loss level. Reward is defined by the distance between the entry price and the take-profit target. By comparing these two values, traders can quickly assess whether a setup offers a favorable balance between downside risk and upside potential.

For example, a trade with a 1:3 risk–reward ratio means the trader risks one unit of capital to potentially earn three units in return. This structure allows traders to remain profitable over time even if not every trade works, because the gains from winning trades can offset multiple small losses.

It is important to understand that the risk-to-reward ratio does not guarantee profits. Instead, it acts as a decision-making filter, helping traders manage downside exposure and avoid trades where the potential loss outweighs the expected return. When applied consistently, it becomes a core component of a disciplined trading strategy and a practical risk management framework.

How to Calculate the Risk–Reward Ratio

Calculating the risk–reward ratio begins with clearly defining three key levels: the entry price, the stop-loss, and the take-profit target. These levels should always be based on market structure, such as support and resistance or trend behavior, rather than arbitrary percentages.

Assume Bitcoin is trading near $100,000, a major psychological level that often attracts increased volatility. After technical analysis, you identify support around $97,000 and resistance near $106,000.

• Entry price: $100,000

• Stop-loss: $97,000

• Take-profit: $106,000

The risk is the distance between entry and stop-loss: $100,000 − $97,000 = $3,000

The reward is the distance between entry and take-profit: $106,000 − $100,000 = $6,000

Using the formula:

Risk–Reward Ratio = Risk ÷ Reward

$3,000 ÷ $6,000 = 1:2

This means the trader is risking $1 to potentially earn $2. If $300 is risked on this trade through position sizing, the expected profit is $600. The ratio remains the same regardless of position size.

What matters most is that the stop-loss and take-profit levels reflect realistic market behavior, such as prior support, resistance, and trend structure, rather than being forced to achieve an attractive-looking ratio.

Practical Risk–Reward Example Using the BTC/USDT Chart

The chart below shows a BTC/USDT daily setup where the risk–reward ratio is defined clearly before the trade is executed. Price failed to reclaim resistance near $106,000, turning that zone into a short-entry area aligned with the broader bearish structure.

• Entry price: $106,000

• Stop-loss: $117,000 (above recent swing highs)

• Take-profit: $87,600 (major support zone)

The risk in this trade is approximately $11,060, while the potential reward is around $18,399, resulting in a risk–reward ratio of roughly 1:1.6. While this is not an aggressive ratio, trade remains valid because it aligns with market structure, resistance rejection, and trend direction.

This example highlights an important point: a good risk–reward ratio is not about chasing perfect numbers. It’s about placing stop-losses and targets at logical technical levels and accepting trades where the potential reward reasonably outweighs the risk.

What Is a Good Risk–to-Reward Ratio for Crypto Trading?

There is no single “perfect” risk–reward ratio that applies to every trader or every market condition. The ideal ratio depends on your trading style, risk tolerance, and the level of market volatility at the time of entry.

As a general guideline, many traders aim for a minimum risk–reward ratio of 1:2, meaning the potential reward is at least twice the potential loss. This structure allows traders to remain profitable over time even if they do not win every trade. Ratios such as 1:3 or higher are often used in swing trading and trend-following strategies, where price is expected to move decisively in one direction.

Lower ratios, such as 1:1 or 1:1.5, are more common in short-term strategies like scalping. These setups rely on higher win rates and precise execution, especially in fast-moving crypto markets. However, during periods of high volatility, lower ratios increase the risk of being stopped out by normal price fluctuations.

It’s also important to recognize that a higher ratio does not automatically make a trade better. A setup with a large reward but low probability of success can be less effective than a moderate ratio aligned with strong market structure. The objective is to balance probability and payoff, not to chase the largest possible target.

A good risk–reward ratio is one that fits your strategy, respects current market conditions, and can be applied consistently over time.

What Are the Top Risk–Reward Strategies for Crypto Traders?

The risk–reward ratio is most effective when it is applied within a clear trading strategy and executed using tools that allow precise control over entries, exits, and position size. Different strategies naturally require different risk–reward profiles, and the right product setup helps traders apply those ratios consistently.

1. Trend-following strategies typically target higher risk–reward ratios such as 1:2 or 1:3, as strong trends allow prices to move well beyond the initial risk. Traders often enter pullbacks, place stop-losses below structure, and aim for continuation toward major resistance or expansion zones.

2. Breakout strategies also favor higher ratios, especially when volatility expands. Risk is defined tightly below the breakout level, while reward targets the next major price range.

3. Scalping and short-term trading usually operate with lower ratios like 1:1 or 1:1.5, relying on higher win rates and quick execution. These setups demand tight risk control and disciplined exits.

3. Range and mean-reversion strategies tend to use moderate ratios, focusing on repeated small gains rather than large directional moves.

Remember, the risk–reward ratio defines whether a trade makes sense, while the trading product determines how effectively that plan is executed.

How to Implement Risk-Reward Trading Strategies on BingX

Risk–reward management is the foundation of consistent crypto trading. On BingX, you can control both sides of every trade, your potential loss and profit target, using built-in features designed for precision and discipline. Here’s how to apply it across the platform’s core products.

1. Perpetual Futures (USDT-M & Coin-M)

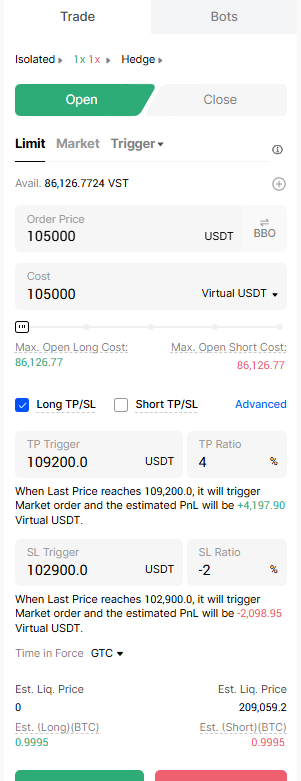

BingX Perpetual Futures lets you predefine both stop-loss and take-profit levels before opening a position, ensuring your risk–reward ratio is fixed from the start.

For example, if you open a

BTC/USDT long at $105,000, you might place a stop-loss at $102,900 (risking 2%) and a take-profit at $109,200 (rewarding 4%). That creates a 2:1 reward-to-risk ratio, the minimum most professional traders aim for.

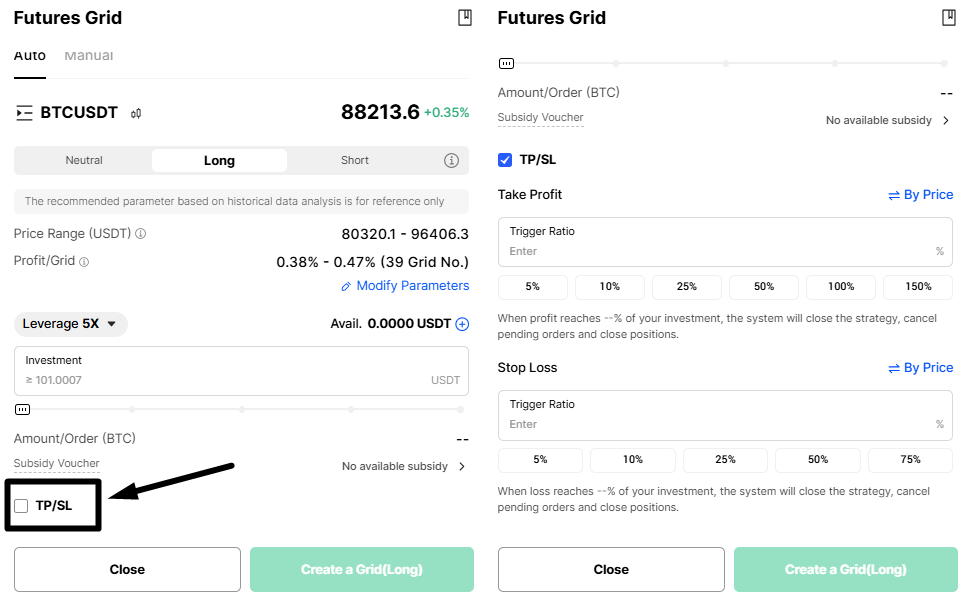

BingX Futures Order Panel with SL/TP Setup - Source: BingX

Use the “

Stop-Loss & Take-Profit” panel directly in the Futures order window to automate exits. BingX allows you to use up to 150x leverage on selected pairs, but higher leverage demands tighter control.

Visit

BingX Perpetual Futures and set your SL/TP before confirming your trade to see how your position auto-manages in real time.

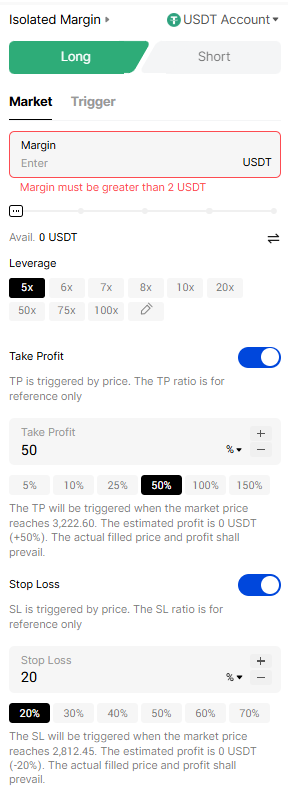

2. Standard Futures

Standard Futures on BingX are ideal for traders who prefer time-based or hedged strategies. Unlike perpetual contracts, these have an expiry date, making them useful for short-term swing positions or for hedging long-term spot holdings.

Example: If you hold ETH in your wallet, you can open a short

ETH/USDT Standard Futures position near a key resistance level to offset potential downside risk.

ETH/USDT Standard Futures Chart with Entry and TP Levels - Source: BingX

This balances your exposure and helps protect gains without selling your original holdings. Use limit orders to plan your entries and exits in advance, aligning your contract expiry with your market view.

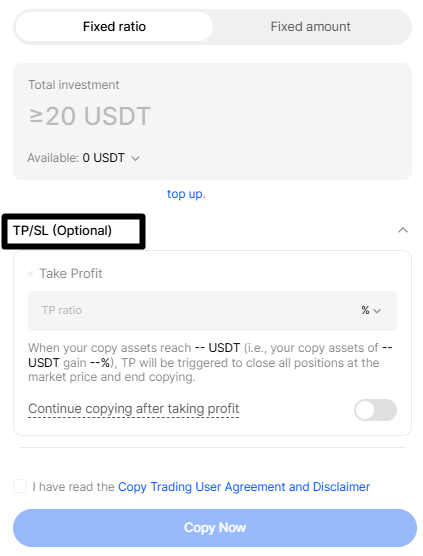

3. Copy Trading

For beginners, BingX

Copy Trading provides a practical way to learn risk–reward discipline from experienced traders. You can view each trader’s historical win rate, average ROI, and drawdown, helping you identify strategies that match your own risk tolerance.

Copy Trading Dashboard showing Trader Risk Settings - Source: BingX

For instance, if a top-ranked trader typically maintains a 2:1 risk–reward ratio, following them allows you to mirror structured trade management in real time. You can also set independent stop-loss limits on your copied trades to control exposure even when following others.

4. Automated Trading Bots

BingX

Grid strategies and Futures Bots execute risk–reward logic automatically, making them ideal for ranging or volatile markets. A Grid Bot, for example, divides your capital into smaller trades across price intervals, buying low and selling high within a set range. You can set the grid spacing, number of grids, and take-profit per trade to align with your desired risk–reward ratio.

Grid Bot Setup Window with Range and TP Settings - Source: BingX

If BTC/USDT ranges between $104,000 and $108,000, your Grid Bot might place 10 evenly spaced orders, locking small profits on each swing. Futures Bots extend this to leveraged trades, using margin and stop-loss tools for greater precision.

5. Spot Trading

Spot Trading offers a lower-risk way to practice risk–reward principles without leverage. You own the underlying digital asset, meaning no liquidations, only market exposure.

Use tools like limit orders to set predefined entry and exit levels, ensuring you only buy and sell at planned prices.

For example, if you want to

buy ETH when it dips to $3,200 and sell near $3,500, simply place both orders in advance. You can also use BingX’s Advanced Spot Orders to trigger partial take-profits as targets are hit.

On BingX, traders can use the

Margin Calculator before opening a position to estimate how much they stand to lose or gain at different leverage levels. This helps align trade size with acceptable risk.

Conclusion: How to Improve Your Risk–Reward Performance Over Time

Improving your risk–reward ratio is rarely about setting bigger profit targets. More often, it comes from better entries and clearer structure. Waiting for prices to move closer to support or resistance allows traders to define risk more precisely while keeping realistic upside intact.

Effective stop-loss placement should reflect where the trade idea fails, not where the loss feels uncomfortable. Stops placed beyond clear technical levels are more likely to withstand normal market volatility. Profit targets, in turn, should align with obvious resistance zones or prior highs rather than optimistic projections.

Trading in the direction of the broader trend improves the probability of reaching those targets, while consistent position sizing ensures that individual losses remain manageable. Over time, maintaining a trading journal helps identify which setups consistently deliver strong risk–reward outcomes and which ones are better left aside.

Ultimately, successful trading is not about winning every trade. It’s about structuring trades where the potential reward justifies the risk, and applying that process consistently across changing market conditions.

Related Articles

FAQs Risk-to-Reward Ratio in Crypto Trading

1. What is a good risk–reward ratio for crypto trading?

There is no single best ratio, but many traders aim for a minimum of 1:2, meaning the potential reward is at least twice the potential loss. Higher ratios like 1:3 are common in trend-following strategies, while lower ratios may be used in scalping with higher win rates.

2. Can I be profitable with a low win rate?

Yes. A favorable risk–reward ratio allows traders to remain profitable even with a lower win rate. For example, with a 1:3 ratio, winning just 40% of trades can still result in positive returns over time.

3. Is a higher risk–reward ratio in crypto always better?

Not necessarily. A very high ratio may reduce the probability of reaching the target. A moderate ratio aligned with strong market structure and trend direction is often more effective than chasing unrealistic profit targets.

4. How does the risk–reward ratio work with stop-loss orders?

The stop-loss defines the risk side of the ratio. It should be placed at a level where the trade idea is invalidated, such as below support or above resistance, not adjusted simply to improve the ratio.

5. Does position size affect the risk–reward ratio?

No. The ratio remains the same regardless of position size. Position sizing controls how much capital is at risk, while the risk–reward ratio defines the trade structure.

6. Is the risk–reward ratio useful for beginners?

Yes. It helps beginners focus on process and discipline rather than predictions. Using a predefined ratio encourages better planning and reduces emotional decision-making.

7. Can the risk–reward ratio be used in spot trading?

Absolutely. While leverage is not involved, spot traders can still apply risk–reward principles by defining clear entry points, stop levels, and profit targets.

8. Should I use the risk–reward ratio alone?

No. The risk–reward ratio works best when combined with technical analysis, market structure, and proper risk management. It is a decision filter, not a standalone strategy.