Power Protocol (POWER) is a modular infrastructure layer designed to unify the fragmented economies of digital entertainment and

Web3 gaming. The protocol operates as a shared economic engine that addresses siloed user engagement and fragmented value across decentralized applications.

In early 2026, Power Protocol expanded through strategic partnerships, increasing visibility around the native token $POWER. As trading interest accelerated, POWER gained traction across major exchanges, including BingX, where it is now available for both spot and futures trading.

Power Protocol reflects a broader shift in Web3 toward infrastructure-driven and sustainability-focused growth. This article examines the drivers behind its recent market attention, explains how its modular architecture fits into the evolving

GameFi landscape, and outlines what users should evaluate before engaging with the ecosystem.

What Is Power Protocol (POWER)?

Source: Power Protocol Website

Power Protocol (POWER) is a decentralized infrastructure layer that provides a unified economic foundation for next-generation consumer applications and games. While traditional engines like Unity focus on creation and Unreal focus on rendering, Power Protocol focuses on value flow. The protocol offers a plug-and-play suite of modular tools that allows developers to manage rewards, staking, and cross-application progression without building blockchain infrastructure from scratch.

Power Protocol aims to solve what it describes as the "isolated island" problem in Web3. In many current ecosystems, a player’s achievements or assets in one game rarely carry meaningful value into another. By using $POWER as a cross-application token, the protocol enables value to move with the user across a broader network of products.

The ecosystem is anchored by its flagship title, Fableborne, and has expanded into a wider network of interconnected projects. Through Power Labs, a selective incubator supporting teams in gaming,

AI, and blockchain, Power Protocol has accelerated ecosystem growth. Projects launched through Power Labs either denominate activity in $POWER or integrate mechanisms such as buybacks and token swaps that return value to the broader system, helping sustain demand beyond the performance of any single application.

How Does the Power Protocol Ecosystem Work?

At its core, Power Protocol is an Economic Engine delivered through a series of modular APIs. Instead of developers building complex on-chain logic, they connect to the protocol’s architecture which is built upon four foundational pillars:

1. Power Protocol Infrastructure: This layer manages live economies, creates sticky token-driven live-ops, and integrates fiat users seamlessly. It acts as the functional rails for games and brands, capturing and recycling value on-chain to ensure economic sustainability even as the user base scales.

2. AI and Web3 Power Labs Incubator: Serving as the ecosystem's growth engine and funnel, Power Labs funds and mentors teams building gaming, AI, and blockchain products. By ensuring these products integrate $POWER as their core unit of value, the incubator creates a constant stream of demand sources independent of any single project's performance.

3. Fableborne Flagship: Developed by Pixion Games, "Fableborne" serves as the live validation of the protocol. This flagship ARPG demonstrates how $POWER and decentralized economics can act as a primary in-game currency and reward mechanism in a high-retention environment, providing a blueprint for third-party studios and global IP holders to follow.

4. AI-Driven Reward Routing Engine: The protocol uses sophisticated reward mechanisms to shift traditional advertising budgets directly to users. By incentivizing social sharing and referrals through verifiable on-chain assets, it creates an efficient growth model. This layer also pioneers AI-native experiences, ensuring $POWER remains a long-term driver of value across diverse consumer applications.

Why Did POWER Price Jump Over 80% in February 2026: Key Drivers Explained

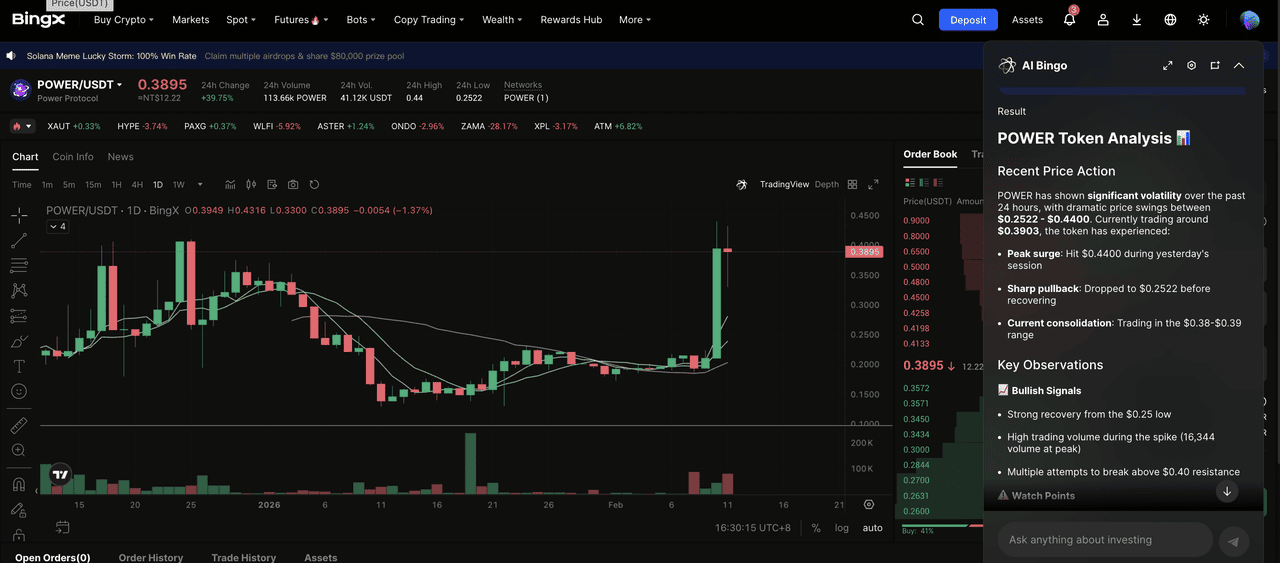

Power Protocol (POWER) price chart on BingX

As of February 10, 2026, the $POWER token has emerged as a top performer in the GameFi sector, posting a staggering 80% rally. This breakout was driven by a convergence of high-impact ecosystem developments and aggressive speculative momentum.

1. Explosive Volume and Accumulation: Trading volume exploded by over 150% in a single 24-hour window, reaching upwards of $51 million. This surge was led by heavy buying on spot markets and a ramp-up of leveraged longs in the futures market. This activity created a self-reinforcing loop where rising visibility triggered a wave of

FOMO, clearing sell-side liquidity.

2. Technical Breakout Momentum: After months of consolidation, the price decisively broke above the key $0.30

resistance level. This technical milestone triggered classic breakout trading, with charts showing clean impulse moves as the token entered a price discovery mode. Traders have piled in on this strength, targeting levels between $0.42 and $0.50 as the token outperforms a sideways broader market.

3. Social Hype and Altcoin Rotation: $POWER has become a central point of discussion on social platforms, being highlighted as a mid-cap powerhouse and a leader in the

BNB chain ecosystem. While no specific new partnership dropped this week, the token is riding a wave of capital rotation where investors move into high-beta GameFi assets while major cryptocurrencies stall.

4. The High Roller and OpenSea Legacy: The market is still reacting to the mid-january partnership with High Roller Technologies (NYSE: ROLR) and the late-2025 integration with OpenSea. These established the fundamental narrative of $POWER as an invisible rail for both regulated iGaming and

NFT marketplaces, providing the long-term confidence needed to fuel the current speculative rally.

What Is the POWER Token Used for?

The $POWER token is the native utility and coordination mechanism of the ecosystem. Its functions include:

• Settlement and Execution: The native functional unit required for proof settlement and protocol execution across all partner apps.

• Validator Collateral: Node operators post $POWER as collateral to ensure network uptime and reliable data processing.

• Network Credits: Operates as on-chain credits for recording contributions, including verifiable computation and game integrations.

• Universal Staking: Users stake $POWER to participate in "Seasons," which unlock rewards and governance rights across all first-party and third-party apps in the ecosystem.

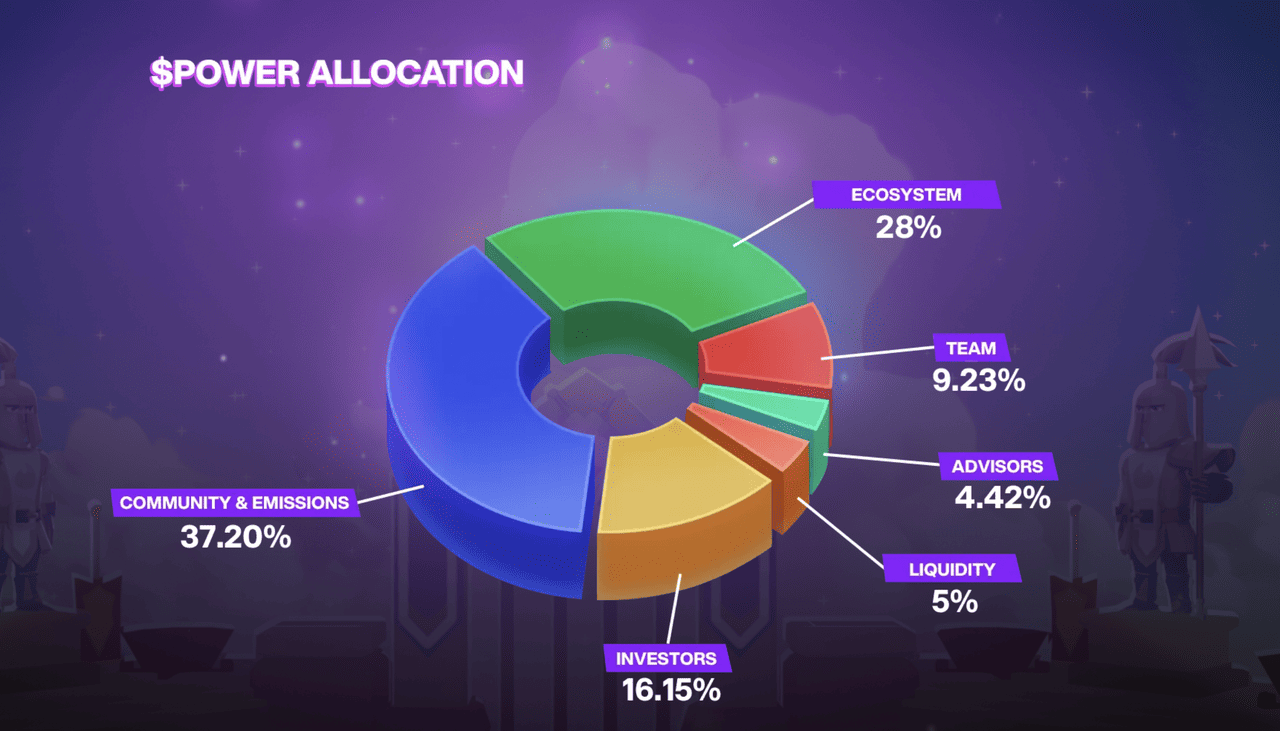

What Is the Power Protocol (POWER) Tokenomics?

The tokenomics of $POWER are designed to align the interests of developers, players, and investors. The total supply is capped at 1,000,000,000 (1 Billion) tokens.

Source: Powe Protocol Tokenomics

• Community Rewards & Emissions (37.2%): The largest portion, dedicated to player incentives, seasonal airdrops, and network growth.

• Ecosystem Fund (28.0%): Reserved for long-term expansion, strategic partnerships, and grant programs.

• Early Investors (16.15%): Allocated to partners who supported early development. These tokens typically have a 12-month cliff followed by 18 to 36 month linear vesting.

• Team & Advisors (13.65%): Vested over 48 months to ensure long-term commitment to the project's vision.

• Liquidity (5.0%): Dedicated to ensuring smooth trading across decentralized and centralized exchanges.

Power Protocol also employs a Deflationary Mechanism where a portion of every verification and infrastructure fee is permanently burned, reducing the total supply as ecosystem activity increases.

How to Trade Power Protocol (POWER) on BingX

Whether you are looking to hold $POWER for long-term ecosystem growth or capitalize on short-term price discovery, BingX offers a user-friendly suite of tools. By integrating AI-powered analysis by

BingX AI with high-liquidity markets, the platform allows traders to execute precise entries and manage risk effectively during periods of high volatility.

1. Buy and Sell POWER on the Spot Market

The

BingX Spot Market is the ideal choice for investors who want to buy and hold $POWER tokens as they accrue value within the ecosystem. This method allows for a straightforward acquisition of the asset without the complexities of leverage, providing a foundational entry into the Power Protocol network.

Step 1: Navigate to the BingX Spot Market and search for the

POWER/USDT pair.

Step 2: Activate

BingX AI on the chart to identify key "institutional accumulation" zones and potential breakout levels.

Step 3: Place a

market order for immediate entry or a limit order during pullbacks. Once filled, your $POWER appears in your secure BingX wallet.

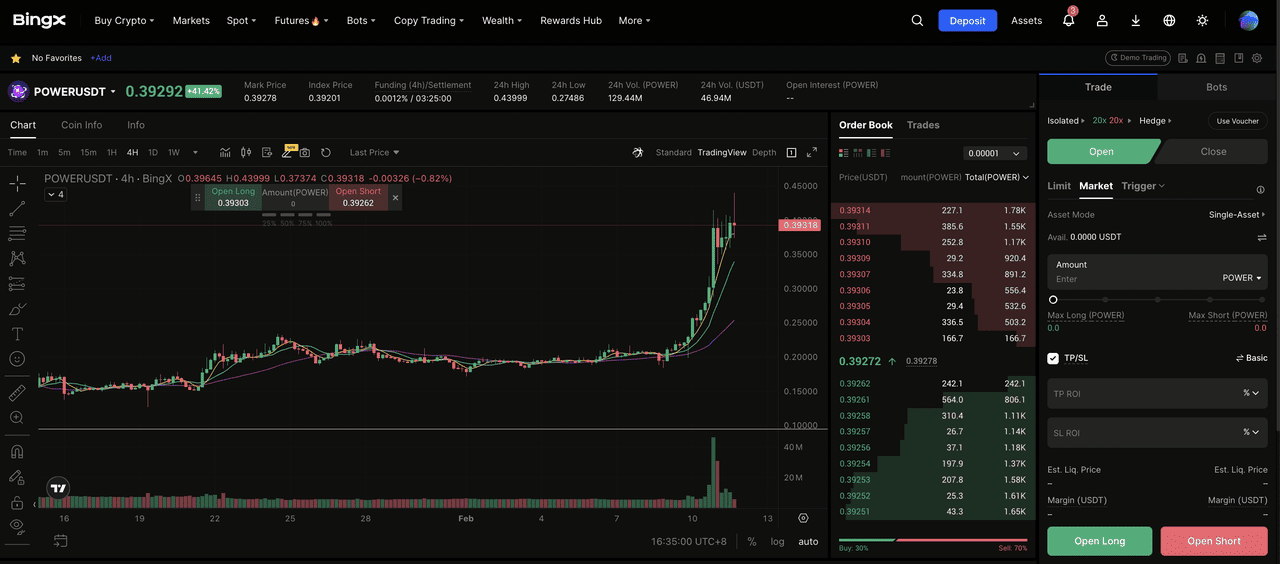

2. Trade POWER with Leverage on Futures

For those looking to trade shorter-term price movements and leverage the current 80% momentum,

BingX Futures offers more advanced tools. This market allows traders to gain greater exposure to $POWER's price discovery phase through flexible position sizing and directional flexibility.

Step 1: Select

POWER/USDT in the BingX Futures section.

Step 2: Use BingX AI to monitor trend strength and

RSI divergence, which is essential for

managing risk during high-volatility rallies.

Step 3: Set your leverage and define

stop-loss and take-profit targets to protect your capital while riding the 80% momentum.

4 Key Considerations Before Investing in $POWER

While the recent growth of Power Protocol highlights its potential as a cornerstone of Web3 infrastructure, investors should carefully evaluate the unique risks associated with its ecosystem and the broader GameFi sector. Understanding the following factors is essential for navigating the volatility and structural dynamics of the $POWER token in 2026.

1. Adoption Dependencies: $POWER’s value compounds with the number of apps in the ecosystem. While Fableborne is successful, the long-term price floor depends on the successful rollout of third-party games.

2. Vesting Overhang: Monitor the vesting schedule for early investors (16.15%). Large monthly unlocks throughout 2026 could introduce periodic sell-side pressure during periods of market weakness.

3. Deflationary Efficacy: The burn mechanism is tied to network usage. Investors should look at "Protocol Fees" metrics to judge if the burn is significant enough to offset emissions.

4. Momentum Volatility: The current rally is heavily driven by speculative volume and technical breakouts. While momentum is strong, these moves are prone to rapid reversals if the broader market turns or if profit-taking triggers a leverage unwind.

Final Thoughts: Is Power Protocol (POWER) a Good Investment in 2026?

In 2026, Power Protocol has successfully transitioned from a gaming-centric project into a robust infrastructure play. By positioning itself as the economic invisible layer for digital entertainment, it has established a more sustainable and scalable model than traditional play-to-earn tokens. This shift toward providing the "rails" for other applications ensures that the token's value is derived from actual utility and network activity rather than pure speculation on a single game's popularity.

With high-profile institutional partnerships like High Roller and a thriving incubator in Power Labs, the protocol is building the essential foundation for a unified Web3 economy. As the ecosystem continues to onboard new IP holders and third-party studios, $POWER stands out as a structural investment in the future of decentralized entertainment. While market volatility remains a factor, the protocol’s ability to capture and recycle value across diverse apps positions it as a long-term leader in the space.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.

Related Reading