Microsoft Ondo tokenized stock (MSFTON) is a blockchain-based asset that mirrors the real-world price of Microsoft (MSFT) shares. It is issued by

Ondo Global Markets and designed to give you economic exposure similar to owning Microsoft stock, with dividends automatically reinvested into the underlying value, but without traditional shareholder rights.

MSFTON has been listed on BingX, where you can buy and trade it like any other crypto pair, combining U.S. equity exposure with 24/7 crypto-style trading and simple

USDT settlement.

What Is Microsoft Ondo Tokenized Stock (MSFTON)?

Microsoft Ondo tokenized stock (ticker: MSFTON or MSFTon) is a blockchain-based tokenized representation of Microsoft Corporation’s common stock issued by Ondo Global Markets. MSFTON is designed to be fully backed by underlying Microsoft shares held by custodians within Ondo’s Global Markets structure, giving you economic exposure similar to holding MSFT with reinvested dividends. Each token mirrors the total return of MSFT, allowing its on-chain value to follow Microsoft’s long-term performance.

Instead of trading on NASDAQ via a traditional broker, MSFTON trades on public blockchains and crypto exchanges.

Ondo’s infrastructure holds the underlying Microsoft shares through regulated custodians and issues tokens that reflect the value of those shares for eligible non-U.S. investors. It offers non-U.S. investors economic exposure equivalent to holding MSFT with automatically reinvested dividends, operating 24/5 with direct routing to traditional U.S. equity-market liquidity.

Microsoft Ondo Tokenized Stock total value and market cap by blockchain | Source: RWA.xyz

As of December 2024, MSFTON holds $2.48 million in total on-chain asset value, split across $2.4 million on

Ethereum and over $55,000 on

BNB Chain, with a Net Asset Value (NAV) of $483 and 217 tokenholders, representing a 42.76% increase in holders over the past 30 days. Monthly transfer volume has surged to $38.5 million, up nearly 1,800%, while 30-day total asset value grew +1.19%, reflecting rising adoption of

tokenized U.S. equities.

How Does Ondo's Microsoft Tokenized Stock (MSFTON) Work?

MSFTON follows the general design of Ondo tokenized stocks: it’s a total-return tracker for MSFT shares, fully backed by underlying securities held off-chain.

1. Backing and Custody

Ondo’s special-purpose entities buy and hold Microsoft shares in brokerage accounts with regulated custodians. MSFTON tokens are issued to represent exposure to those shares, including the effect of reinvested dividends after withholding taxes. Tokenholders do not receive direct legal title to MSFT shares but get economic exposure designed to match “owning MSFT and reinvesting dividends” over time.

2. Minting and Redemption

Eligible non-U.S. users can mint MSFTON by sending stablecoins or cash to Ondo’s Global Markets platform, which purchases the underlying MSFT and issues tokens. They can redeem tokens back for stablecoins or cash at NAV during trading hours, with Ondo routing orders to traditional U.S. equity markets. Tokens can also circulate independently on secondary markets like BingX,

Uniswap, and other supported venues.

3. Price Tracking and Liquidity

MSFTON’s price tracks Microsoft’s underlying stock via:

• Real-time MSFT prices from traditional exchanges.

• Ondo’s RFQ and market-making system.

•

On-chain liquidity on Ethereum and BNB Chain, plus CEX/DEX order books.

Because minting and redemption are designed to be fast and low-friction,

arbitrageurs can help keep MSFTON’s price closely aligned with MSFT, reducing the persistent premiums or discounts seen in earlier tokenized stock experiments.

How Does MSFTON Tokenized Stock Differ From Regular Microsoft Stock (MSFT)?

Although MSFTON closely mirrors the price movements of Microsoft stock, reacting to earnings reports, macro trends, and overall tech-sector sentiment, and gives holders economic exposure similar to owning MSFT with reinvested dividends, it is not the same as holding actual shares.

Instead, it functions as an on-chain representation designed for flexible trading and diversification, allowing users to blend Microsoft exposure with other crypto and tokenized assets without granting traditional shareholder rights.

• No shareholder rights: You do not get voting rights, direct dividends, or corporate communications from Microsoft.

• Token structure: You hold an on-chain token, not brokerage-registered shares in your name.

• Jurisdiction and eligibility: MSFTON is generally not available to U.S. persons and is offered under a different regulatory regime than U.S. retail brokerage accounts.

• DeFi compatibility: Unlike traditional MSFT, MSFTON can be moved between

crypto wallets, used in DeFi protocols, or combined with other on-chain strategies where supported.

What Are the Other Microsoft Tokenized Stocks, MSFTx and DMSFT?

There are several different on-chain ways to get exposure to Microsoft stock. The three most visible products today are Microsoft xStock (MSFTx), Microsoft Ondo Tokenized Stock (MSFTON), and Microsoft tokenized stock on DeFiChain (DMSFT). They all reference Microsoft (MSFT), but they differ a lot in structure, backing, and where they trade.

Microsoft xStock (MSFTx) by Backed Finance

MSFTx is a tracker certificate issued by Backed Finance as both an ERC-20 token on Ethereum and an SPL token on

Solana. It’s fully backed 1:1 by real Microsoft shares held with regulated custodians under a Swiss legal wrapper, designed to provide “regulatory-compliant access” to MSFT’s price performance with the usual blockchain benefits like fast settlement and fractional units. MSFTx mainly targets users who are already active in the EVM and

Solana DeFi ecosystems and want a fully collateralized, share-backed structure integrated with xStocks and

Solana DEXs.

Microsoft Tokenized Stock DeFiChain (DMSFT)

DMSFT is the older

DeFiChain implementation of Microsoft exposure, issued as a “dToken” on the DeFiChain network. DeFiChain dTokens like dTSLA, dAAPL, etc., are synthetic assets minted by over-collateralizing crypto such as DFI or BTC, using price oracles to mirror the value of the underlying stock rather than holding real shares in custody. In practice, DMSFT trading activity and liquidity have dropped sharply, with very low volumes and fragmented markets on DeFiChain DEX venues and aggregators.

MSFTON vs. MSFTX vs. DMSFT: Key Differences

1. Backing model

• MSFTON is total-return tracker backed by MSFT shares via Ondo’s institutional infrastructure, enabling fast minting/redemption and tighter price alignment with the underlying stock.

• MSFTx is a fully collateralized 1:1 tracker certificate backed by real Microsoft shares held with regulated Swiss custodians, offering a traditional asset-backed structure on-chain.

• DMSFT is a synthetic asset on DeFiChain backed by over-collateralized crypto and oracle pricing, meaning users gain price exposure without any underlying MSFT shares being held.

2. Networks and Ecosystem

• MSFTON is available on Ethereum and BNB Chain, deeply integrated into Ondo’s RWA stack, including tokenized Treasuries and institutional on-chain market infrastructure.

• MSFTx is issued on Ethereum and Solana, making it ideal for users active in the xStocks lineup and the Solana DeFi ecosystem.

• DMSFT is limited to the DeFiChain network, where declining liquidity and fewer cross-ecosystem integrations restrict its broader usability.

3. Liquidity and Practical Usage

• MSFTON offers the strongest, exchange-style liquidity with active USDT markets on major CEXs like BingX and expanding DeFi support, making it the most practical choice for frequent trading and RWA strategies.

• MSFTx works best for users who want Solana-native execution or who already participate in xStocks liquidity pools and Solana DeFi venues.

• DMSFT behaves more like a legacy synthetic product and is generally less suitable for new users due to thin liquidity and ecosystem-specific risks.

How to Buy Microsoft Ondo Tokenized Stock (MSFTON) on BingX

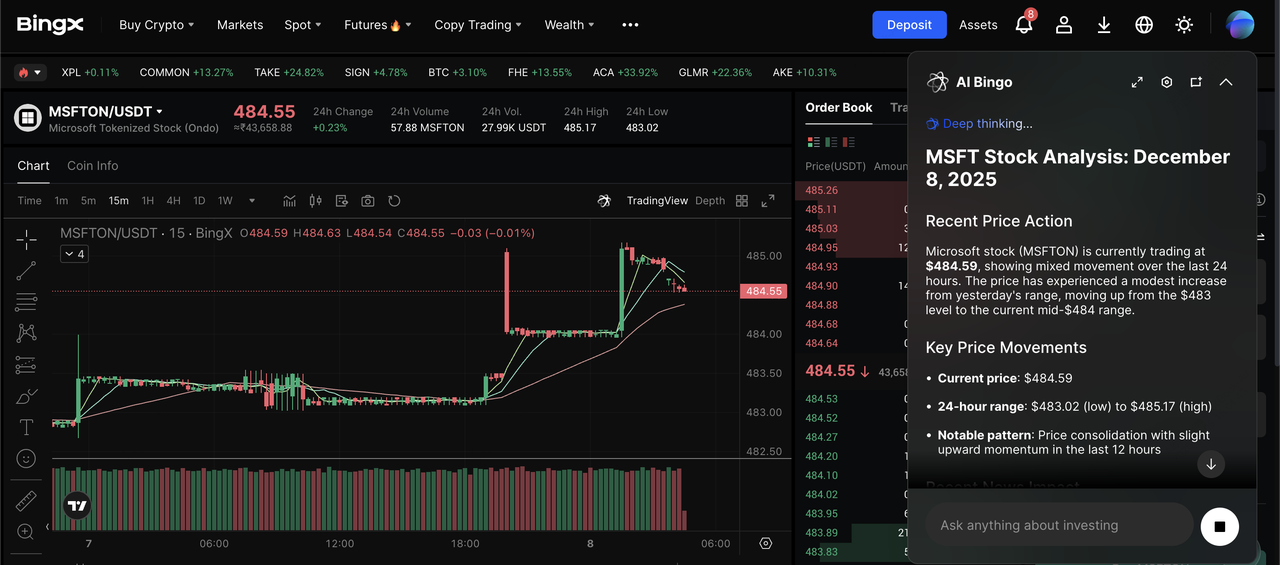

MSFTON/USDT trading pair on the spot market powered by BingX AI insights

Microsoft tokenized stock (MSFTON) is listed on BingX, where you can buy and sell it using USDT just like any other crypto trading pair.

Step 1: Create or Log In to Your BingX Account

Step 2: Deposit Funds

Deposit USDT or another supported currency into your BingX account via bank transfer, card,

P2P, or

crypto transfer. Confirm that your funds have arrived in your Spot wallet.

Step 4: Place a Buy Order

Choose

Market Order if you want to buy instantly at the best available price. Choose Limit Order if you want to specify your own price. Enter the amount of MSFTON or USDT you want to trade, then click Buy. Once the order is filled, you will see your MSFTON balance in your Spot wallet.

Step 5: Manage Your Position

You can place sell orders any time you want to realize profits or cut losses. Use BingX tools like price alerts,

TP/SL orders, and

BingX AI insights to monitor Microsoft tokenized stock volatility and key market events.

How to Store and Use MSFTON Safely

Storing MSFTON directly on BingX is the most convenient option for active traders, giving you instant access to buy, sell, or convert back to USDT without managing private keys or paying network gas fees. It’s ideal if your main goal is fast execution and easy portfolio management rather than long-term storage.

If you prefer full control, you can withdraw MSFTON to a personal Ethereum or BNB Chain wallet such as

MetaMask,

Ledger, or

Trust Wallet. This offers greater self-custody and potential DeFi usage, but requires careful management of your seed phrase and correct network handling.

What Are the Pros and Cons of Microsoft Ondo Tokenized Stock (MSFTON)?

Before investing, it’s important to understand the key advantages and limitations of Microsoft Ondo Tokenized Stock (MSFTON) so you can decide whether it fits your strategy.

Pros of MSTFON Tokenized Stock

MSFTON combines blue-chip equity exposure with crypto-native features:

1. 24/7-Style Trading Access: Trade MSFTON on BingX and DEXs even when U.S. stock markets are closed, subject to venue hours and liquidity.

2. Fractional Ownership: Buy small fractions of Microsoft exposure without needing to purchase a full share, making it easier to build a position incrementally.

3. Global Reach for Non-U.S. Users: Non-U.S. investors can access MSFT-like exposure without a U.S. brokerage account, subject to local rules and Ondo’s eligibility checks.

4. DeFi and Composability: Where supported, MSFTON can be integrated into lending markets, structured products, or automated strategies, letting you treat Microsoft exposure like any other DeFi-compatible token.

5. Portfolio Diversification: You can blend large-cap tech exposure with

Bitcoin, Ethereum,

stablecoins, and other assets in a single on-chain portfolio.

Cons of Microsoft Tokenized Stock

Before you buy Microsoft tokenized stock, you should understand the trade-offs:

1. No Direct Shareholder Rights: You do not hold registered MSFT shares. You don’t receive proxy voting rights or traditional dividend payouts in your brokerage account.

2. Regulatory Uncertainty: Tokenized equities operate in a fast-evolving regulatory landscape. Rules may change, affecting access, redemption, or where MSFTON can be listed.

3. Issuer and Custody Risk: You rely on Ondo’s entities to hold the underlying Microsoft shares, manage reserves, and operate smart contracts securely. If the issuer or custodian fails, there could be delays or losses despite safeguards like bankruptcy-remote structures and third-party security agents.

4. On-Chain Liquidity Risk: Liquidity for MSFTON can be thinner than NASDAQ’s order book. Large trades may face slippage or wider spreads, especially outside peak trading hours.

5. Jurisdictional Limits: MSFTON and other Ondo Global Markets tokens are usually not available to U.S. persons or residents of high-risk jurisdictions, and some exchanges may impose additional restrictions.

Is Microsoft Ondo Tokenized Stock (MSFTON) a Good Investment?

Microsoft Ondo Tokenized Stock (MSFTON) offers a flexible way to gain on-chain exposure to Microsoft’s long-term growth areas, like cloud computing, AI, productivity software, and gaming, while benefiting from the programmability and accessibility of crypto, including 24/7 trading, fractional units, and seamless integration with other tokenized assets. However, MSFTON should not be viewed as a substitute for holding traditional MSFT shares, as it lacks shareholder rights and introduces additional smart contract, issuer, and regulatory risks. Always treat MSFTON as a speculative investment that blends elements of both equity and crypto, and only commit capital you can afford to lose.

Related Reading

FAQs on Microsoft Ondo Tokenized Stock (MSFTON)

1. Is MSFTON backed by real Microsoft shares?

Yes. MSFTON is designed to be fully backed by underlying Microsoft shares held by custodians associated with Ondo’s Global Markets structure, giving you economic exposure similar to holding MSFT with reinvested dividends.

2. Does MSFTON give me dividends or voting rights?

No. You do not receive direct dividends or voting rights. Instead, dividends at the issuer level are factored into the token’s economics as a total-return tracker, net of applicable withholding taxes.

3. Which blockchain networks does MSFTON exist on?

MSFTON is currently live on Ethereum as an ERC-20 token and on BNB Chain as a BEP-20 token, with contract addresses visible on block explorers like Etherscan and BscScan.

4. Where can I buy or trade MSFTON tokenized Microsoft shares?

You can buy and trade MSFTON on BingX via the MSFTON/USDT pair, as well as on selected centralized exchanges and DEXs like Uniswap, subject to your jurisdiction and venue support.

5. Can MSFTON be used in DeFi?

Yes, MSFTON can be used on certain DeFi platforms, where supported. For example, you may find MSFTON liquidity pools or swap routes on Uniswap, and some protocols may allow it as collateral or in structured yield products. However, support varies widely, so always check smart contract risk, liquidity depth, and the platform’s reputation before depositing MSFTON into any DeFi application.