As silver prices surged past $80 and tokenized commodity volumes jumped more than 1,200% in December 2025, SLVON has emerged as one of the fastest-growing real-world asset tokens, driven by rising demand for 24/7 access, on-chain liquidity, and inflation hedging. This guide explores what Ondo's tokenized silver ETF is, how SLVON works, why it’s gaining traction, and how investors can buy SLVON on BingX.

What Is Ondo iShares Silver Trust Tokenized ETF (SLVON)?

Each SLVON token provides economic exposure to the price of silver, tracking the performance of the underlying trust rather than granting direct ownership of physical metal. The token is backed by regulated custodial infrastructure and is designed to reflect the net asset value (NAV) of the underlying silver holdings.

Unlike traditional silver ETFs, SLVON can be traded 24/7 on crypto exchanges, transferred on-chain, and integrated into decentralized finance (DeFi) workflows, bringing commodity exposure into the digital asset ecosystem.

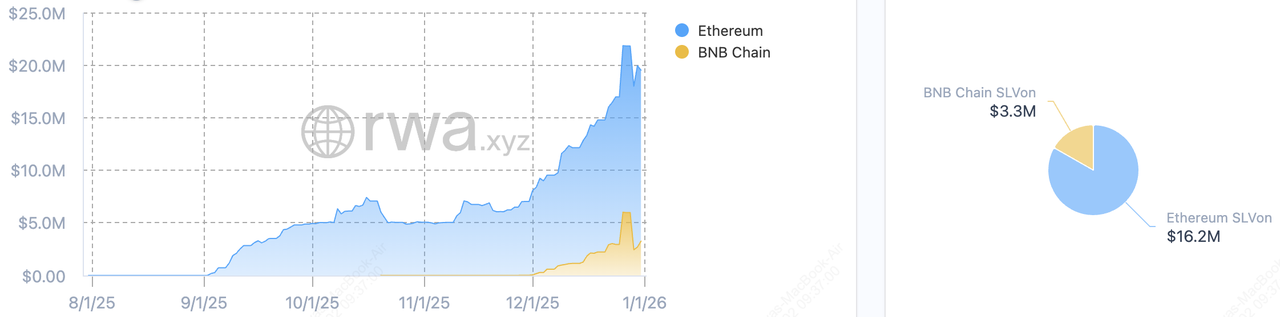

Tokenized Silver ETF SLVON Volumes Surge by 1,200% in December 2025

SLVON has recorded rapid growth as demand for tokenized silver accelerates alongside the recent rally in precious metals. In December 2025, monthly transfer volume surged past $117 million, marking a 1,200% increase, while the number of holders jumped more than 340%, surpassing 1,100 wallets. At the same time, total on-chain asset value climbed above $19.5 million, with $16.2 million on

Ethereum and $3.3 million on

BNB Chain, reflecting strong capital inflows and expanding market participation.

This surge in activity closely follows silver’s breakout above $80 per ounce, which renewed investor interest in inflation hedges and alternative stores of value. As a result, SLVON has emerged as a preferred on-chain vehicle for gaining silver exposure, combining traditional commodity demand with the flexibility, accessibility, and 24/7 liquidity of

tokenized real-world assets (RWAs).

How Does SLVON Tokenized Silver ETF By Ondo Global Markets Work?

1. Backing and Custody: Ondo’s structure involves holding silver-linked assets through regulated custodians. These assets back the issuance of SLVON tokens, ensuring each token represents proportional economic exposure to the underlying silver holdings.

2. Minting and Redemption: Eligible users can mint or redeem SLVON through Ondo’s infrastructure using stablecoins. This mechanism helps keep the token’s market price closely aligned with the underlying silver NAV.

3. On-Chain Trading: Once issued, SLVON trades freely on supported blockchains and centralized exchanges. Market participants can buy, sell, or transfer SLVON 24/7 without the constraints of traditional commodity market hours.

How Does iShares Silver Trust Tokenized ETF SLVON Differ From Traditional Silver ETFs?

While SLVON and traditional silver ETFs like iShares Silver Trust (SLV) both track the price of physical silver, they operate under very different market structures, offering distinct advantages and trade-offs for modern investors.

1. Always-on trading: SLVON trades 24/7 on blockchain networks, unlike SLV, which is limited to U.S. market hours and subject to exchange holidays and settlement delays.

2. Faster settlement: SLVON transactions settle near-instantly on-chain, compared to the T+2 settlement cycle used by traditional ETFs.

3. Global accessibility: SLVON can be accessed by eligible non-U.S. users without a brokerage account, while SLV is restricted to traditional equity markets.

4. On-chain flexibility: SLVON can be transferred, held in

self-custody wallets, or integrated into DeFi protocols, enabling composability not possible with ETF shares.

5. No shareholder rights: Unlike SLV, SLVON does not grant voting rights or direct claims on physical silver, and instead provides economic exposure through tokenized representation.

6. Different risk profile: SLVON introduces smart contract and issuer risk, while SLV carries traditional fund structure and custody risks tied to centralized financial institutions.

Together, these differences position SLVON as a digitally native alternative to silver ETFs, designed for investors seeking 24/7 liquidity, on-chain accessibility, and integration with the broader crypto ecosystem rather than conventional equity market exposure.

Why Is SLVON Tokenized Silver ETF Gaining Attention in 2026?

SLVON’s rapid rise reflects a powerful convergence of macroeconomic pressure and on-chain adoption. Over the past month alone, tokenized silver trading volume surged more than 1,200%, with SLVON’s total asset value climbing above $20 million and holder counts increasing by over 340%. This surge closely mirrors silver’s rally above $80 per ounce, driven by tightening global supply, record industrial demand, and growing investor interest in inflation-resistant assets. Physical silver markets are facing acute stress, with COMEX inventories shrinking, Asian premiums reaching multi-year highs, and China’s new export controls tightening global supply further.

At the same time, tokenized silver has emerged as a preferred on-chain alternative for gaining exposure to these market dynamics. SLVON allows investors to access silver 24/7 without relying on traditional brokers, while benefiting from on-chain liquidity, instant settlement, and fractional ownership. As capital continues rotating into real-world assets, SLVON’s growth reflects a broader shift toward tokenized commodities as efficient, programmable alternatives to legacy precious metal markets.

How to Buy Ondo Tokenized iShares Silver Trust ETF (SLVON) on BingX

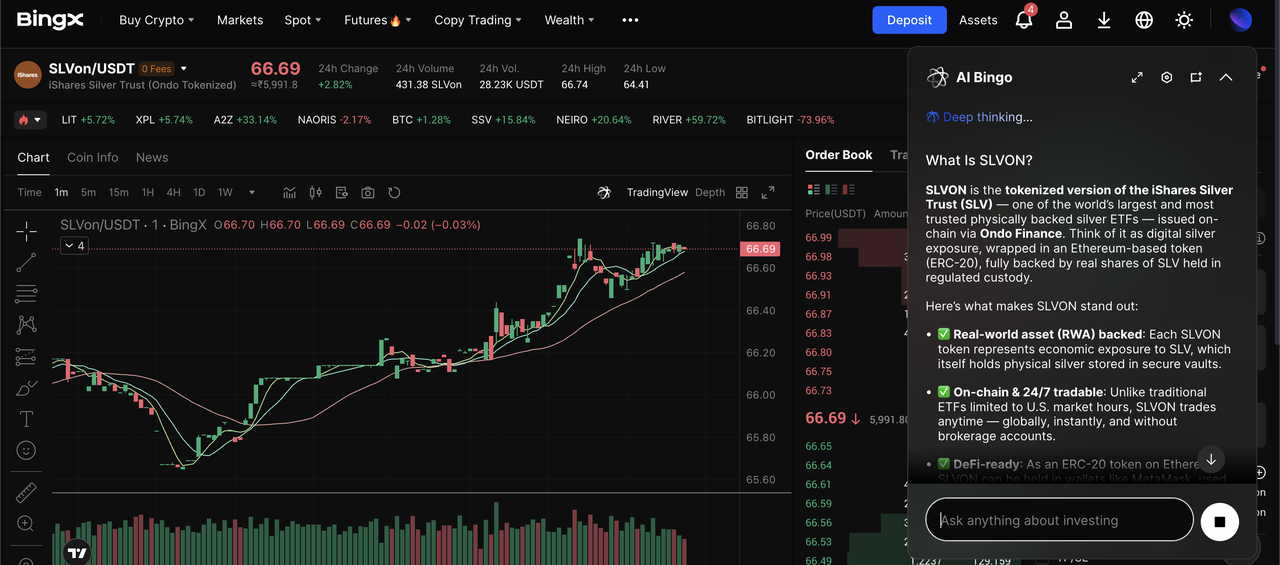

SLVON/USDT trading pair on the spot market powered by BingX AI insights

BingX is one of the most convenient and reliable platforms to buy and trade SLVON, offering deep liquidity, fast execution, and 24/7 access to the spot market. As a leading global crypto exchange, BingX combines institutional-grade security with user-friendly tools, allowing traders to buy, sell, and manage SLVON seamlessly. With built-in

BingX AI insights, real-time market analytics, and advanced

risk-management tools, users can track price movements, analyze trends, and execute trades with greater confidence, all from a single, streamlined trading interface.

Step 1: Create or Log in to Your BingX Account

Step 2: Fund Your Account

Step 3: Find the SLVON/USDT Trading Pair

Step 4: Place Your Trade

Choose a

market order for instant execution or a limit order to set your desired entry price.

Step 5: Manage or Store Your SLVON

Hold SLVON on BingX for easy trading or withdraw it to a compatible wallet for self-custody.

How to Store SLVON Safely

You can store SLVON securely either on BingX or in a self-custody wallet, depending on your trading needs. Keeping SLVON on BingX is ideal for active traders, as it provides instant access to deep liquidity, advanced trading tools, real-time price alerts, and eliminates the need to manage private keys.

For users who prefer full control, SLVON can also be withdrawn to

ERC-20 compatible self-custody wallets, allowing direct ownership of the asset on-chain; though this option requires careful management of private keys and correct network handling to avoid loss of funds.

Top Risks and Considerations Before Investing in Ondo SLVON

Before investing in SLVON, it’s important to understand the specific risks associated with tokenized commodities and on-chain financial products:

1. Market Volatility: SLVON closely tracks silver prices, which can fluctuate sharply due to macroeconomic shifts, industrial demand, and geopolitical events.

2. Issuer and Custodial Risk: SLVON depends on Ondo and its custodial partners to manage underlying assets; operational or regulatory issues could affect token value or accessibility.

3. Smart Contract Risk: As an on-chain asset, SLVON relies on smart contracts that may be exposed to technical bugs or security vulnerabilities.

4. Regulatory Uncertainty: Tokenized assets operate in an evolving regulatory environment, which may affect future availability, trading conditions, or compliance requirements.

5. Liquidity Variability: While liquidity has grown rapidly, trading volumes may fluctuate during periods of market stress or reduced participation.

Conclusion: Should You Buy SLVON iShares' Tokenized Silver ETF?

SLVON offers a modern way to gain exposure to silver through blockchain-based infrastructure, combining the price dynamics of a traditional precious metal with the accessibility and flexibility of on-chain trading. For investors comfortable operating in crypto markets, it provides 24/7 liquidity, fractional ownership, and integration with digital asset platforms that traditional silver ETFs cannot offer.

However, SLVON also carries important risks. It does not provide direct ownership of physical silver, is subject to issuer and smart contract risk, and operates within an evolving regulatory landscape. As with any tokenized asset, it should be considered a complementary allocation rather than a replacement for physical bullion or regulated ETFs. Investors should assess their risk tolerance, understand the product structure, and use SLVON as part of a diversified investment strategy rather than a standalone holding.

Related Reading

FAQs on Ondo Tokenized iShares Silver ETF (SLVON)

1. How is Ondo's tokenized silver ETF SLVON different from owning physical silver?

SLVON does not involve holding physical silver bars. Instead, it provides digital exposure to silver’s price movements, allowing faster trading, fractional ownership, and on-chain transfers without storage or transportation costs.

2. Is Ondo iShares Silver Trust Tokenized ETF (SLVON) backed by real silver?

Yes. SLVON is designed to track the value of the iShares Silver Trust, which is backed by physical silver held by regulated custodians. However, SLVON holders do not have direct redemption rights to physical metal.

3. Where can I buy SLVON?

You can buy and trade SLVON on the BingX spot market using USDT. It is available 24/7, unlike traditional silver ETFs that trade only during market hours.

4. Is tokenized silver ETF SLVON by Ondo suitable for long-term investment?

SLVON may appeal to investors seeking long-term exposure to silver through a digital asset, but it also carries risks such as price volatility, regulatory uncertainty, and smart contract dependencies. It should be considered as part of a diversified investment strategy.

5. How is SLVON different from traditional silver ETFs like SLV?

Unlike traditional ETFs, SLVON trades 24/7, settles on-chain, and can be integrated into DeFi ecosystems. However, it does not provide shareholder rights and relies on blockchain infrastructure rather than traditional custodianship alone.