MicroStrategy

tokenized stocks are digital assets that track the share price movements of the Bitcoin-focused corporate treasury company

Strategy Inc (formerly MicroStrategy). Best known for holding the largest Bitcoin reserves among publicly traded firms, Strategy has become closely associated with Bitcoin market cycles, making its stock a popular proxy for investors seeking amplified

BTC exposure.

As equity tokenization continues to expand in 2025, products such as

MSTRX (xStocks) and

MSTRON (Ondo) have become two of the most accessible ways for crypto-native investors to gain on-chain exposure to Strategy’s publicly listed shares. Instead of purchasing MSTR through a traditional brokerage, these tokenized formats allow users to trade price-linked representations of the stock directly on platforms like BingX, typically using

USDT pairs. This structure supports fractional position sizing, extended trading availability beyond U.S. market hours, and easier access for global users who prefer operating within the crypto ecosystem.

What Is Strategy (Former MicroStrategy) and What Does It Do?

Strategy Inc (formerly MicroStrategy) is a U.S.-based enterprise software company that has become globally recognized for pairing a legacy analytics business with one of the most aggressive

Bitcoin treasury strategies among publicly listed firms. Founded in 1989 as MicroStrategy, the company originally focused on business intelligence solutions that help enterprises analyze data, build dashboards, and support decision-making.

A major turning point came under the leadership of Michael Saylor, the company’s co-founder and long-time executive chairman. Beginning in 2020, Saylor championed the idea of holding

Bitcoin as a primary reserve asset, arguing that BTC offered superior long-term protection against currency debasement compared to cash or bonds. This philosophy reshaped the company’s capital allocation strategy and public identity.

Today, Strategy operates through two closely linked pillars:

• Enterprise analytics and AI-driven software, which continues to generate operating revenue

• A Bitcoin-centric balance sheet, funded through equity issuance, instruments such as

STRC, convertible debt, and other financing mechanisms used to accumulate BTC

Because of this structure, Strategy is no longer valued purely as a traditional software company. Its stock performance is heavily influenced by Bitcoin price movements and market sentiment around crypto adoption, making MSTR a widely watched proxy for institutional Bitcoin exposure.

Strategy (MSTR) Stock Analysis and Outlook for 2026

The outlook for MSTR, the publicly traded shares of Strategy Inc, is primarily shaped by two forces: the scale of its Bitcoin holdings and how the stock trades as a Bitcoin-linked equity. Unlike traditional enterprise software companies, MSTR’s valuation and volatility are now closely tied to crypto market cycles and investor sentiment toward leveraged BTC exposure.

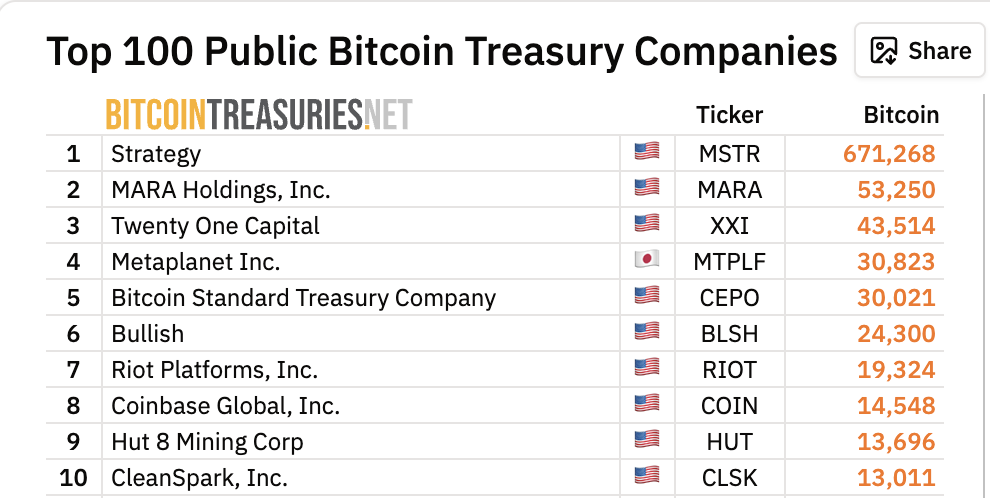

MicroStrategy Bitcoin Holdings: The Largest Corporate Holder of Bitcoin

As of December 2025, Strategy is the largest corporate holder of Bitcoin, with total holdings exceeding 670,000 BTC, representing more than 3% of Bitcoin’s circulating supply. This concentration means that movements in Bitcoin’s price have a direct and material impact on the company’s balance sheet value. During

Bitcoin bull markets, this structure can significantly amplify upside for shareholders; during downturns, it can magnify losses due to the sheer scale of BTC exposure embedded in the equity.

Strategy MSTR Stock Performance 2025: Mid-Year Peak Near $450, Year-End 65% Drawdown

MSTR’s 2025 price action illustrates this dynamic clearly. As

Bitcoin rallied in the first half of the year, the stock climbed steadily and reached a year-to-date high near $450 in July 2025, delivering approximately 80% upside from spring levels. However, momentum reversed in the second half of the year as Bitcoin prices softened and investor focus shifted toward dilution risk and financing costs. By December 24, 2025, MSTR was trading around $158, reflecting a year-to-date decline of roughly 45% and a drawdown of more than 65% from its mid-year peak.

Additional Factors Influencing the Microstrategy (MSTR) 2026 Outlook

Beyond Bitcoin price movements and equity volatility, several secondary considerations may affect MSTR heading into 2026:

• Capital structure risk: Continued equity issuance, convertible debt, and preferred shares can dilute existing shareholders and pressure per-share returns.

• Index and market structure considerations: Potential changes in index inclusion criteria for companies with large digital asset exposure could impact passive investment demand.

• Software business contribution: While no longer the primary valuation driver, Strategy’s enterprise analytics segment continues to generate recurring revenue and supports operational stability.

Overall, MSTR entering 2026 is best viewed as a high-beta Bitcoin-linked equity, where performance is driven mainly by

Bitcoin market cycles, with additional influence from financing decisions and broader market structure developments rather than traditional software growth metrics.

What Are MicroStrategy Tokenized Stocks and How Do They Work?

MicroStrategy tokenized stocks are blockchain-based representations designed to track the market price of Strategy Inc (MSTR) without requiring investors to hold the actual shares through a traditional brokerage. Instead of owning equity directly, users gain price-linked or economic exposure to MSTR through digital tokens that trade on crypto platforms.

In practice, this means MSTR exposure can be accessed using

stablecoins like

USDT, with fractional sizing and, in many cases, 24/7 trading availability, features that appeal to crypto-native investors who prefer to manage portfolios entirely within the Web3 ecosystem.

Two Common Formats: MSTRX (xStocks) vs. MSTRON (Ondo)

While both products aim to mirror MSTR’s market performance, they are issued under different tokenization models:

• MSTRX (xStocks): MSTRX belongs to the

xStocks category, which typically offers

synthetic or platform-issued price tracking of publicly traded shares. These tokens are designed to follow the market price of MSTR and trade like other crypto assets on supported exchanges. They emphasize accessibility, continuous trading, and simplified settlement, but do not grant shareholder rights such as voting.

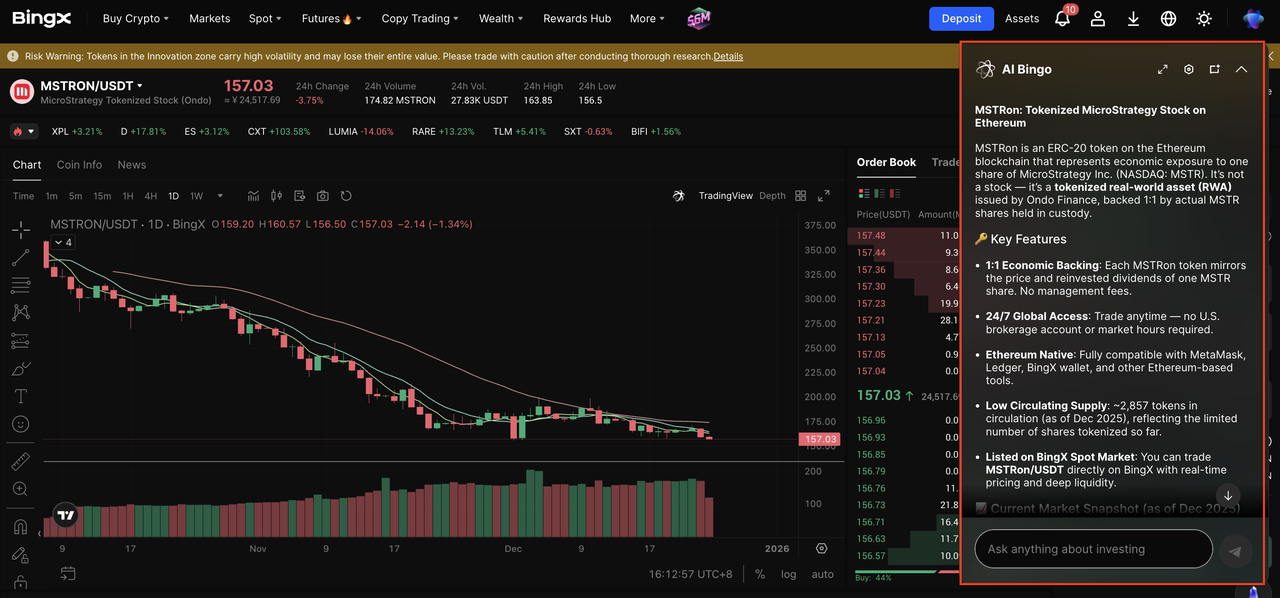

• MSTRON (Ondo): MSTRON is issued under the framework of

Ondo Global Markets, which focuses on tokenizing

real-world assets (RWAs) with structured compliance and disclosure standards. Ondo’s model is often described as providing economic exposure to the underlying stock, while still clarifying that holders are not direct shareholders and do not receive traditional equity privileges.

How Tokenized MSTR Differs from Owning the MicroStrategy Stock?

Although tokenized MSTR products track the same underlying market reference, they are not equivalent to owning MSTR shares:

• No shareholder voting rights or corporate governance participation

• Dividend treatment (if any) depends on the issuer and platform rules

• Prices can deviate slightly from the underlying stock, especially outside U.S. market hours

• Settlement, custody, and redemption depend on the tokenization model and exchange policies

For many users, tokenized stocks function as a trading and exposure tool, rather than a long-term replacement for traditional equity ownership.

How to Buy MicroStrategy Tokenized Stocks MSTRX and MSTRON on BingX

BingX supports trading for selected tokenized stocks, allowing users to gain price exposure to U.S. equities such as Strategy Inc (formerly MicroStrategy) without using a traditional brokerage account. On BingX, users can access Strategy-related exposure through spot tokenized stocks like MSTRX (xStocks) and MSTRON (Ondo), as well as MSTR stock price–linked futures.

Availability may vary depending on region and regulatory requirements, and product offerings can differ between spot and futures markets.

1. Buy MicroStrategy Tokenized Stocks MSTRX, MSTRON on BingX Spot

If you prefer continuous access, fractional exposure, and a crypto-native trading experience, you can buy MicroStrategy tokenized stocks directly on

BingX Spot using USDT.

Step 2: Deposit USDT or supported assets: Transfer USDT or other supported stablecoins into your BingX wallet. Make sure to select the correct blockchain network and review any minimum deposit requirements or fees.

Step 3: Search for MicroStrategy tokenized stocks in Spot Trading: Go to the Spot market and search for

MSTRX/USDT or

MSTRON/USDT, depending on availability. Review the real-time price, order book depth, and recent trading activity before proceeding.

Step 4: Use BingX AI to assess market conditions: Before placing an order, you can ask

BingX AI about recent price trends, key technical levels, or short-term sentiment related to MSTR and Bitcoin market movements.

Step 5: Place your buy order: Choose a market order for immediate execution or a limit order to set your desired entry price. Enter the purchase amount and confirm the trade.

Once completed, MicroStrategy tokenized stocks will appear in your BingX spot wallet and can be held alongside other crypto assets.

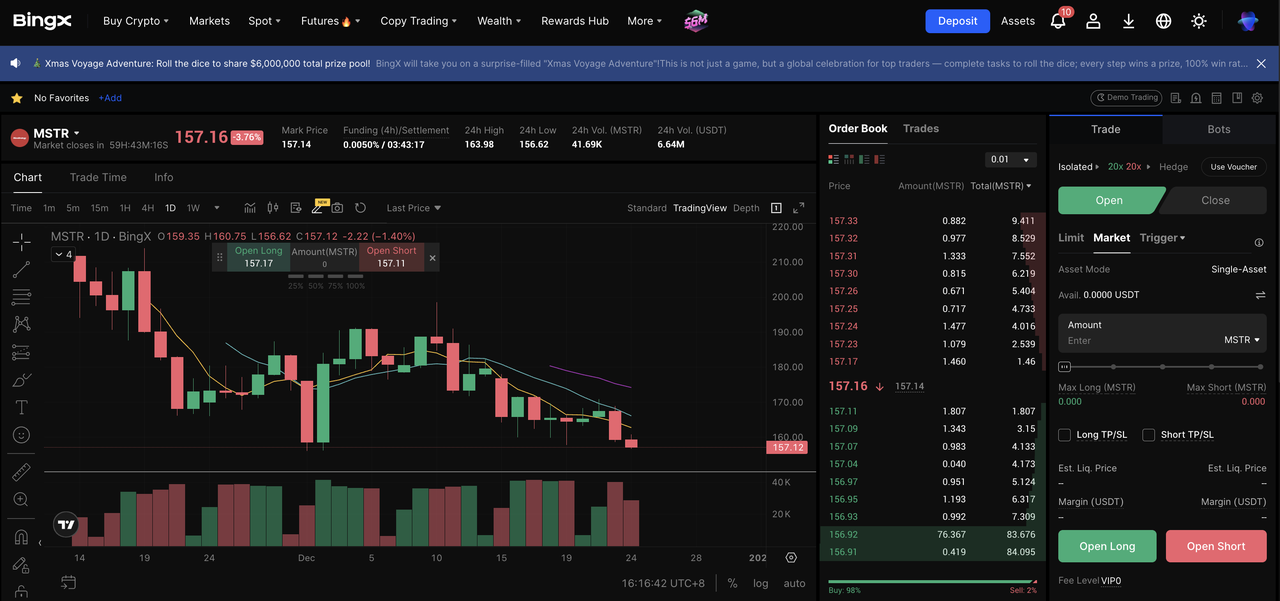

2. Trade MicroStrategy Stock (MSTR) Price–Linked Futures on BingX

For users seeking leverage, directional exposure, or hedging opportunities,

BingX Futures offers MSTR stock price–linked futures. These contracts allow traders to speculate on MicroStrategy’s stock price movements without holding the spot tokenized stock.

Step 1: Enable futures trading: Log in to your BingX account, complete the required verification, and transfer USDT or supported collateral into your Futures wallet.

Step 2: Open the MSTR stock price–linked futures market: Search for the

MSTR-USDT perpetual contract and review leverage options, funding rates, and margin requirements before opening a position.

Step 3: Use BingX AI to evaluate volatility and sentiment: Ask BingX AI about recent volatility, trend direction, or Bitcoin-related sentiment that may influence MSTR’s price behavior.

Step 4: Choose long or short with your preferred leverage: Go long if you expect MSTR’s price to rise, or short if you anticipate a decline. Adjust leverage carefully based on your risk tolerance.

This structure allows investors and traders to access MicroStrategy exposure on BingX through both spot tokenized stocks and futures, depending on whether they prioritize long-term holding, active trading, or leveraged strategies.

Risk and Considerations Before Investing in MicroStrategy Tokenized Stock

Before trading MicroStrategy tokenized stocks, it’s important to understand the specific risks involved. Products like MSTRX and MSTRON provide exposure to Strategy Inc, but they also introduce risks that differ from both direct Bitcoin ownership and traditional stock investing.

Key considerations include:

• Bitcoin concentration risk: Strategy’s stock price is heavily influenced by Bitcoin. Sharp BTC price swings can lead to amplified volatility in tokenized MSTR products.

• Tokenized structure risk: Tokenized stocks do not represent direct share ownership. Voting rights, dividends, and shareholder protections typically do not apply and depend on issuer and platform rules.

• Tracking and liquidity differences: Prices may deviate from the underlying MSTR stock, especially outside U.S. market hours or during periods of low liquidity.

• Platform and regulatory risk: Availability, trading rules, and product structures can change based on regional regulations or exchange policies.

Overall, MicroStrategy tokenized stocks are best treated as price-exposure instruments within the crypto ecosystem. Investors should assess their risk tolerance carefully and understand how tokenized equities differ from both spot crypto assets and traditional shares before investing.

Is MicroStrategy Tokenized Stock a Good Investment?

MicroStrategy tokenized stocks such as MSTRX and MSTRON are best suited for investors seeking price exposure to Strategy Inc in a crypto-native format. Because Strategy holds a large amount of Bitcoin, its stock often behaves like a high-volatility Bitcoin proxy, amplifying both gains and losses relative to BTC.

These tokenized products appeal to users who value USDT-based trading, fractional sizing, and extended trading availability without opening a traditional brokerage account. However, they do not grant shareholder rights, and any dividend-related treatment depends on platform rules. As a result, tokenized MSTR is generally more appropriate for active traders and crypto-native investors than for long-term equity holders seeking traditional ownership benefits.

Related Reading

FAQs on MicroStrategy (MSTR) Tokenized Stocks

1. What is the difference between MSTRX and MSTRON?

MSTRX is an xStocks product that tracks MSTR’s share price in a crypto-native format. MSTRON is issued via Ondo Global Markets and provides economic exposure to MSTR under an RWA-style framework. The key difference lies in their issuance structure and disclosures.

2. Do MSTRX or MSTRON provide shareholder rights?

No. Holding MSTRX or MSTRON does not grant voting rights, corporate governance participation, or direct shareholder privileges. These tokens provide price or economic exposure only.

3. Do tokenized MSTR stocks pay dividends?

Dividend treatment depends on the issuer and exchange rules. In most cases, tokenized stocks do not function like traditional dividend-paying shares, and investors should not assume dividend entitlement unless explicitly stated by the platform.

4. Can tokenized MSTR trade outside U.S. market hours?

Yes. One advantage of tokenized stocks is that they often trade 24/7 on crypto exchanges. However, prices may deviate from the underlying MSTR stock when U.S. markets are closed.

5. Is tokenized MSTR the same as holding Bitcoin?

No. While Strategy Inc holds a large amount of Bitcoin, MSTR tokenized stocks represent equity-linked exposure, not direct BTC ownership. They carry additional risks related to corporate financing, dilution, and market structure.

6. Who should consider trading MicroStrategy tokenized stocks?

They are generally best suited for crypto-native investors and active traders who want flexible, USDT-based exposure to MSTR’s Bitcoin-linked price action, rather than long-term investors seeking traditional equity ownership benefits.