Unlike DEXs on

Ethereum or Layer 2s, Hyperliquid’s custom chain is optimized for low latency, scalability, and smooth user experience. Traders benefit from zero gas fees, native on-chain matching, and a vibrant trading community that makes it one of the most active platforms in on-chain derivatives.The project recently gained major attention after announcing a $1 billion HYPE

airdrop, drawing comparisons to

Solana’s breakout phase.

This article covers how Hyperliquid works, key features of the HYPE token, and why it’s viewed as a leading contender in the next wave of on-chain derivatives trading.

What Is Hyperliquid (HYPE) and How Does It Work?

Source: Hyperliquid Foundation

Hyperliquid is a high-performance

decentralized exchange (DEX) built specifically for perpetual futures trading. Unlike most DEXs that run on

Ethereum Layer 2s or other general-purpose blockchains, Hyperliquid operates on its own custom Layer 1 blockchain, purpose-built to support a fully on-chain trading ecosystem.

The Hyperliquid Chain is optimized for speed, transparency, and scalability, allowing for real-time execution, a fully on-chain order book, and gas-free trading within a single unified system. By combining deep liquidity, advanced trading tools, and user-friendly interfaces, Hyperliquid delivers centralized-exchange-level performance while maintaining the security and self-custody of

decentralized finance (DeFi).

What Makes Hyperliquid So Special?

Source: Hyperliquid Foundation

Hyperliquid is a perpetual DEX built on its own custom blockchain, designed to deliver the speed and efficiency of centralized exchanges while keeping everything fully transparent and on-chain. Unlike most decentralized platforms that rely on general-purpose blockchains, Hyperliquid was developed specifically for real-time trading.

1. Custom Layer 1 Blockchain Build for Highspeed: Hyperliquid’s blockchain is engineered for performance, capable of processing over 200,000 orders per second with near-instant trade confirmation. This ensures smooth execution even during periods of high volatility.

2. Fully On-Chain Order Book: Instead of using

automated market makers (AMM), Hyperliquid runs a fully on-chain order book for tighter spreads, accurate pricing, and full transparency. Trades incur no gas fees, only low maker fees of 0.01% and taker fees of 0.035%. The platform supports over 130 perpetual markets, including niche and early-stage tokens.

3. Seamless Trading Experience: Users can trade with one click using a wallet or email login. The platform supports up to 50x leverage, both

cross- and isolated-margin, and advanced order types like limit, TWAP, and scale.

4. Transparent and Community-Owned: Trading is non-custodial with no KYC. Fees go back to users through vaults and the HYPE ecosystem. With no VC funding, Hyperliquid stays aligned with its community from day one.

Instead of sending fees to investors or a central entity, Hyperliquid redistributes value to users through vaults and the HYPE ecosystem. With no venture capital funding, the platform remains fully aligned with its community.

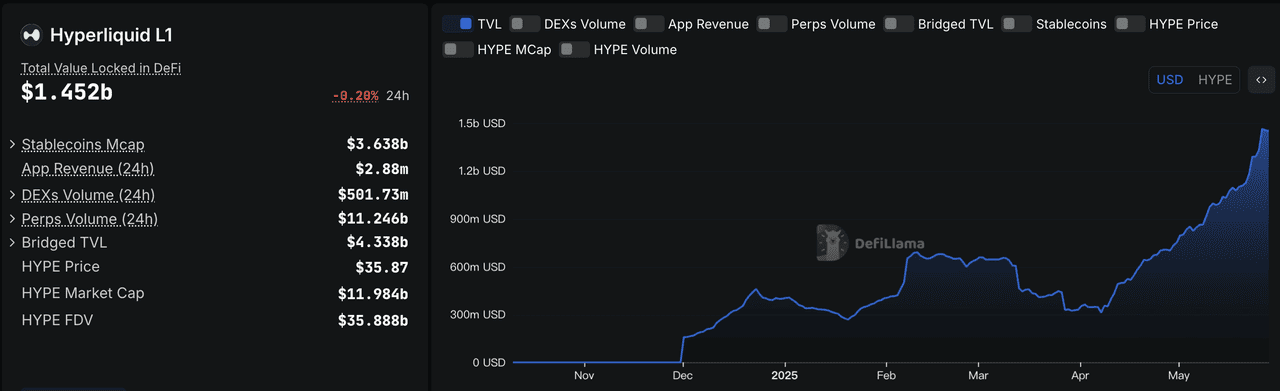

Why Is the Hyperliquid DEX Gaining Traction in 2025?

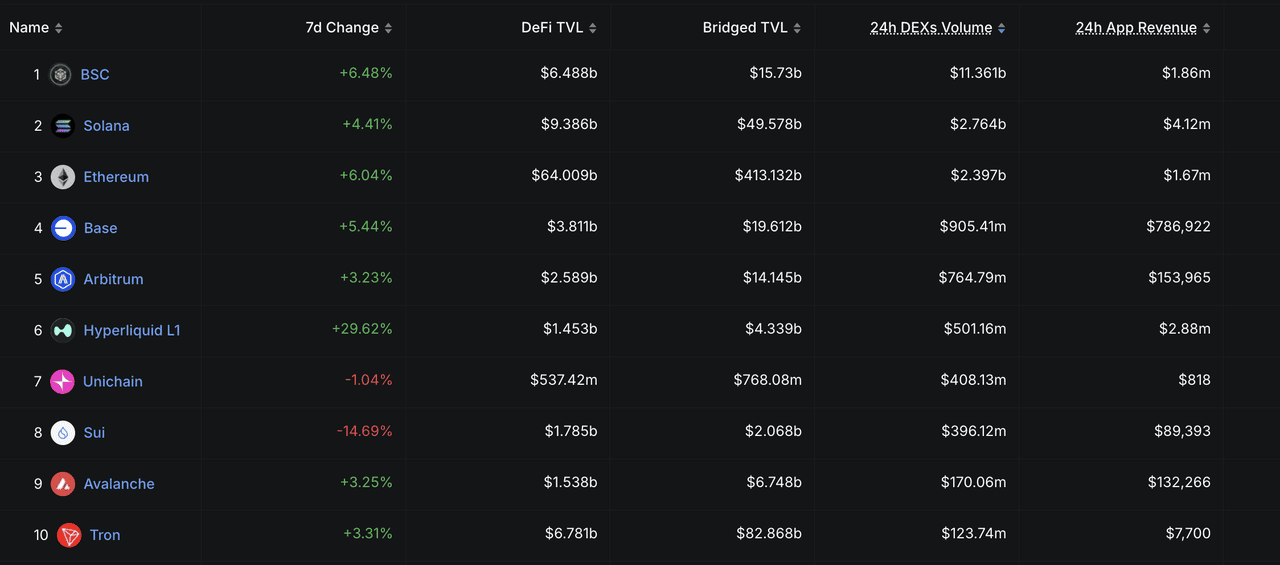

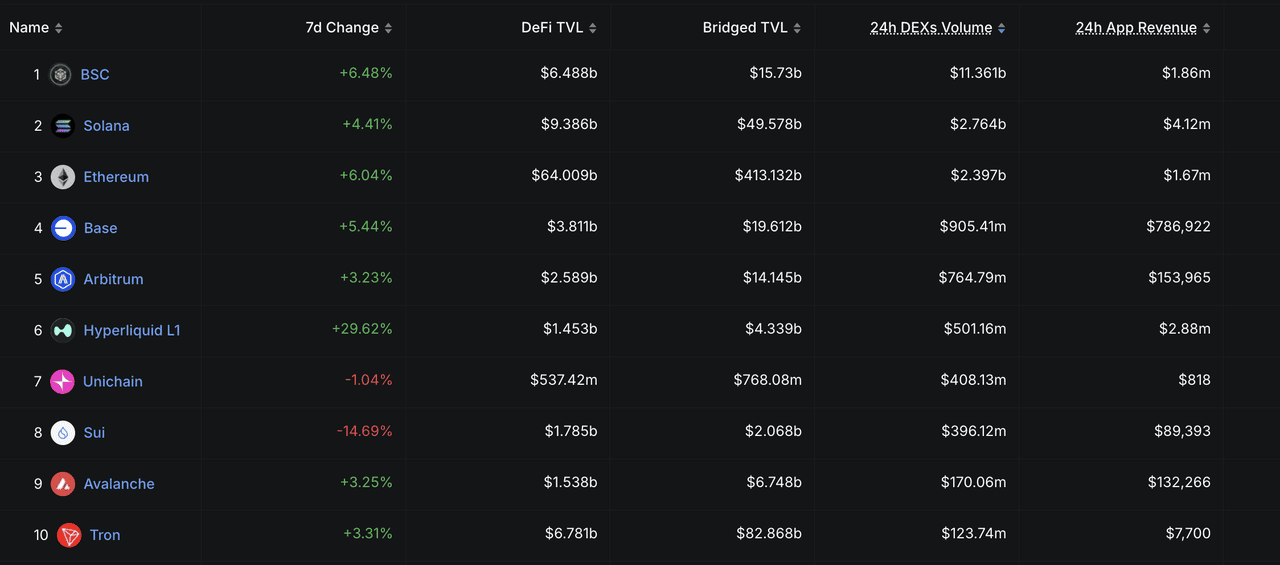

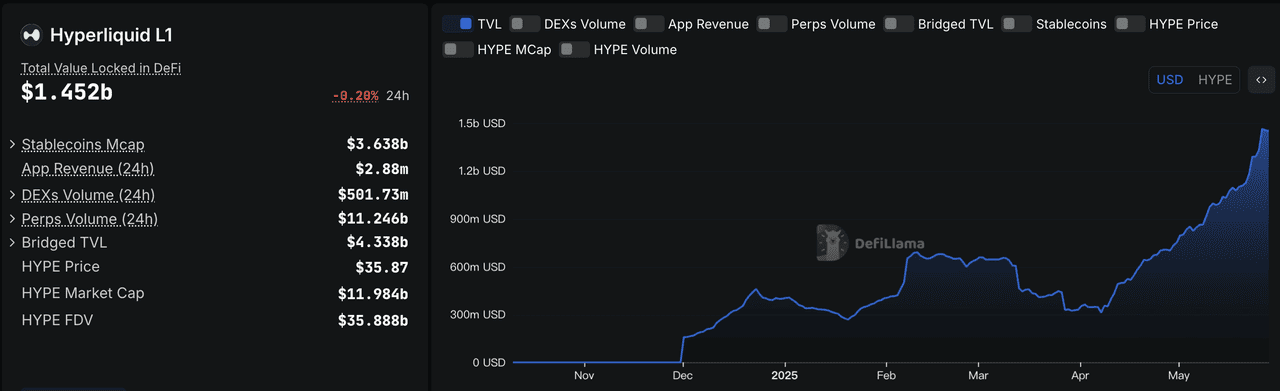

1. Hyperliquid Becomes a Top-6 DEX Chain by Daily Volume

Hyperliquid’s rapid rise in 2025 is driven by surging trading activity, viral whale engagement, and strong on-chain performance. In May 2025, it became one of the top six DEX chains by daily volume, recording over $501M in a single day and surpassing competitors such as

Sui,

Tron, and

Avalanche.

Beyond daily trading, Hyperliquid ranked 6th in total crypto fee revenue for the week, generating $21.6M and outperforming major platforms like

Lido,

Jito, and

Tron. Its all-time trading volume has exceeded $1.5T, underscoring both user growth and long-term retention.

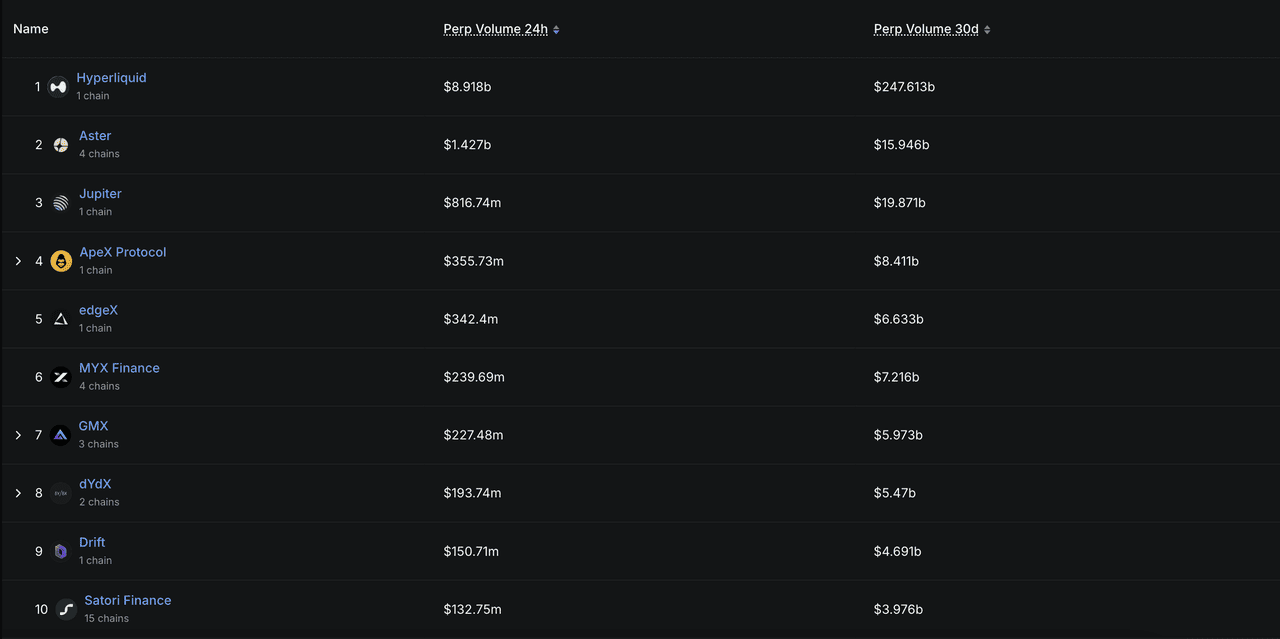

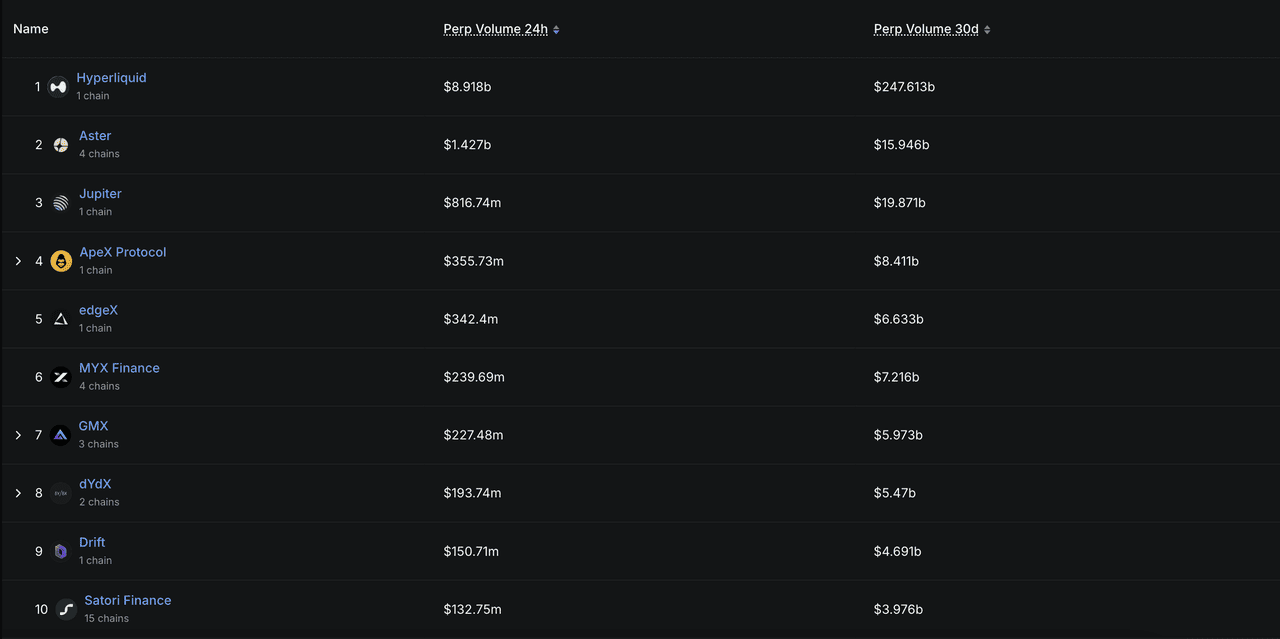

2. Hyperliquid Is the Largest On-Chain Perpetual DEX by Market Share

As of June 2025, Hyperliquid holds more than 73% of the on-chain perpetual futures market, making it the largest decentralized exchange for perpetual trading. This dominance stems from its custom Layer 1 blockchain, purpose-built to deliver gas-free, high-speed, fully on-chain order execution. The platform’s design enables scalability and transparency that set it apart from DEXs built on Ethereum or Layer 2 networks.

3. James Wynn’s Whale Trades Ignite Viral Growth and Record Fees

Much of Hyperliquid’s momentum came from crypto whale James Wynn, whose leveraged trades went viral across social media. Screenshots of his multi-million-dollar long positions sparked widespread interest and drove new traders to test the platform’s speed and reliability. Within one week, Hyperliquid generated over $55M in trading fees. Wynn’s activity became a catalyst for community expansion, showing how social proof and trader confidence can accelerate DeFi adoption.

4. HYPE Token Hits All-Time High as Perpetual DEX Momentum Grows

Hyperliquid’s native token HYPE hit an all-time high of $58.57 on September 19, 2025, before stabilizing near $34.60 with a $11.65B market cap. The rally was fueled by the platform’s Assistance Fund, which uses 97% of trading fees to buy back and burn tokens, now totaling over $1B, reinforcing HYPE’s long-term value capture and sustainability.

The surge aligns with the broader boom in perpetual DEXs, which have become DeFi’s fastest-growing sector. According to CoinGecko, the on-chain derivatives market cap jumped 654% over the past year to $18.9B, with perpetuals accounting for over $17.9B. Platforms like

MYX and

Aster are also driving this growth, showing traders’ accelerating shift from centralized exchanges to on-chain, gas-free trading environments led by Hyperliquid.

$HYPE Tokenomic Overview

HYPE is the native token of the Hyperliquid ecosystem, powering governance, staking, and trading rewards. Holders can vote on protocol proposals, stake to earn up to 55% annual yield, and use HYPE to pay trading fees for additional benefits. The token supports a user-owned model where platform revenue is redistributed to the community through buybacks, rewards, and burns.

HYPE has a fixed supply of 1B tokens, with allocations for early users, staking, contributors, and community growth. Over 110,000 tokens have already been burned, and contributor allocations unlock gradually to align long-term incentives.

HYPE Token Utilities

• Fee rewards: 97% of trading fees buy back or redistribute HYPE.

• Staking: Earn up to 55% yield while reducing circulating supply.

• Trading benefits: Lower fees and volume-based incentives for holders.

• Governance: Vote on protocol upgrades and reward policies.

• No VC allocation: 100% user-driven ownership and distribution.

HYPE fuels Hyperliquid’s on-chain economy by directly linking token demand to trading activity and community participation, reinforcing long-term value creation across the ecosystem.

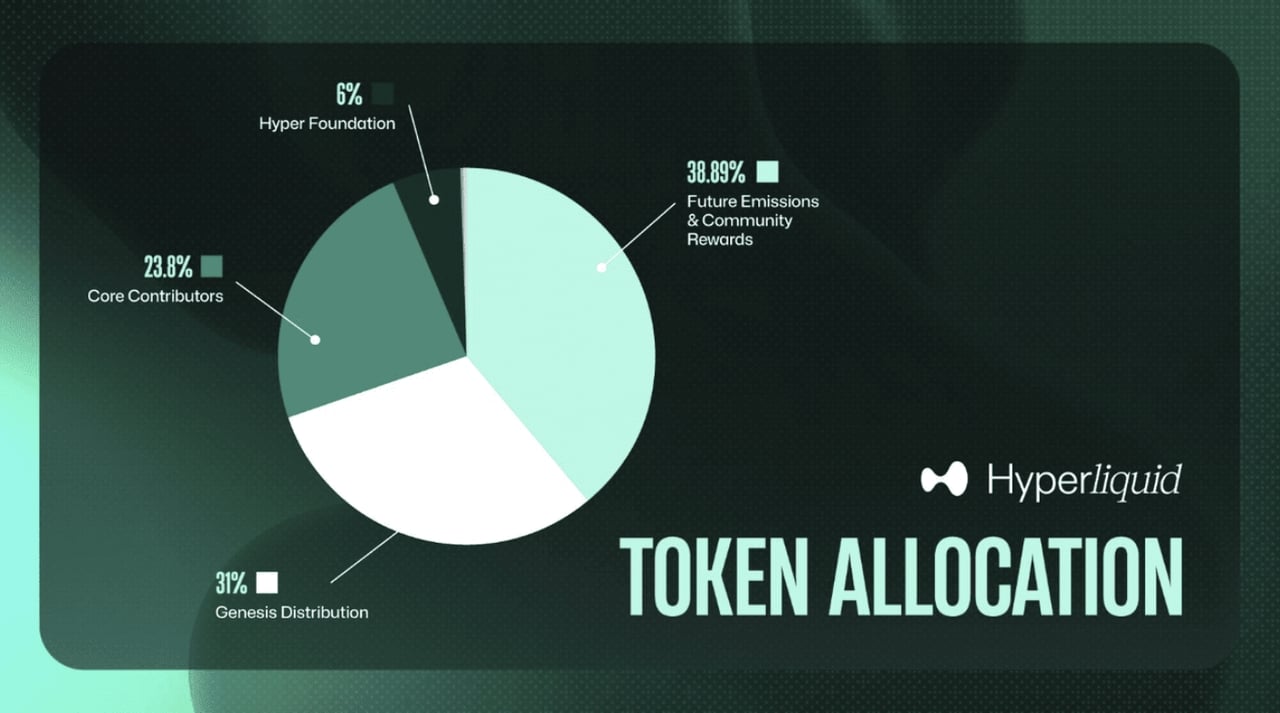

HYPE Token Allocation

Source: NFTevening

• 38.89% for future emissions and community rewards

• 31.00% distributed at genesis (Nov 29, 2024)

• 23.80% to current and future core contributors

• 6.00% for the Hyper Foundation budget

• 0.30% for community grants

• 0.012% via HIP-2 governance proposal

97% of trading fees are used to buy back, redistribute, or burn HYPE. More than 110,000 tokens have already been burned, reinforcing long-term utility and transparency.

What is USDH, the Stablecoin Issued by Hyperliquid?

USDH is the native dollar-pegged stablecoin of the Hyperliquid ecosystem, launched in September 2025 and issued by Native Markets after a governance vote. Fully backed 1:1 by fiat or U.S. Treasury-equivalent reserves, USDH serves as the main settlement and liquidity asset on Hyperliquid’s Layer 1 chain. Its design keeps yield and liquidity within the ecosystem instead of flowing to external stablecoins like USDC, strengthening Hyperliquid’s on-chain economy. By integrating USDH, the platform reduces dependency on third-party assets, improves capital efficiency, and aligns stablecoin utility directly with user activity and token value.

When Is the Hyperliquid Airdrop?

The main HYPE airdrop took place on December 2, 2024, following the token launch. Eligible users claimed rewards through the Hyperliquid app. Season 1 has ended, but future community-governed drops may continue rewarding active traders.

What Is the HYPE Airdrop, and Why Does It Matter?

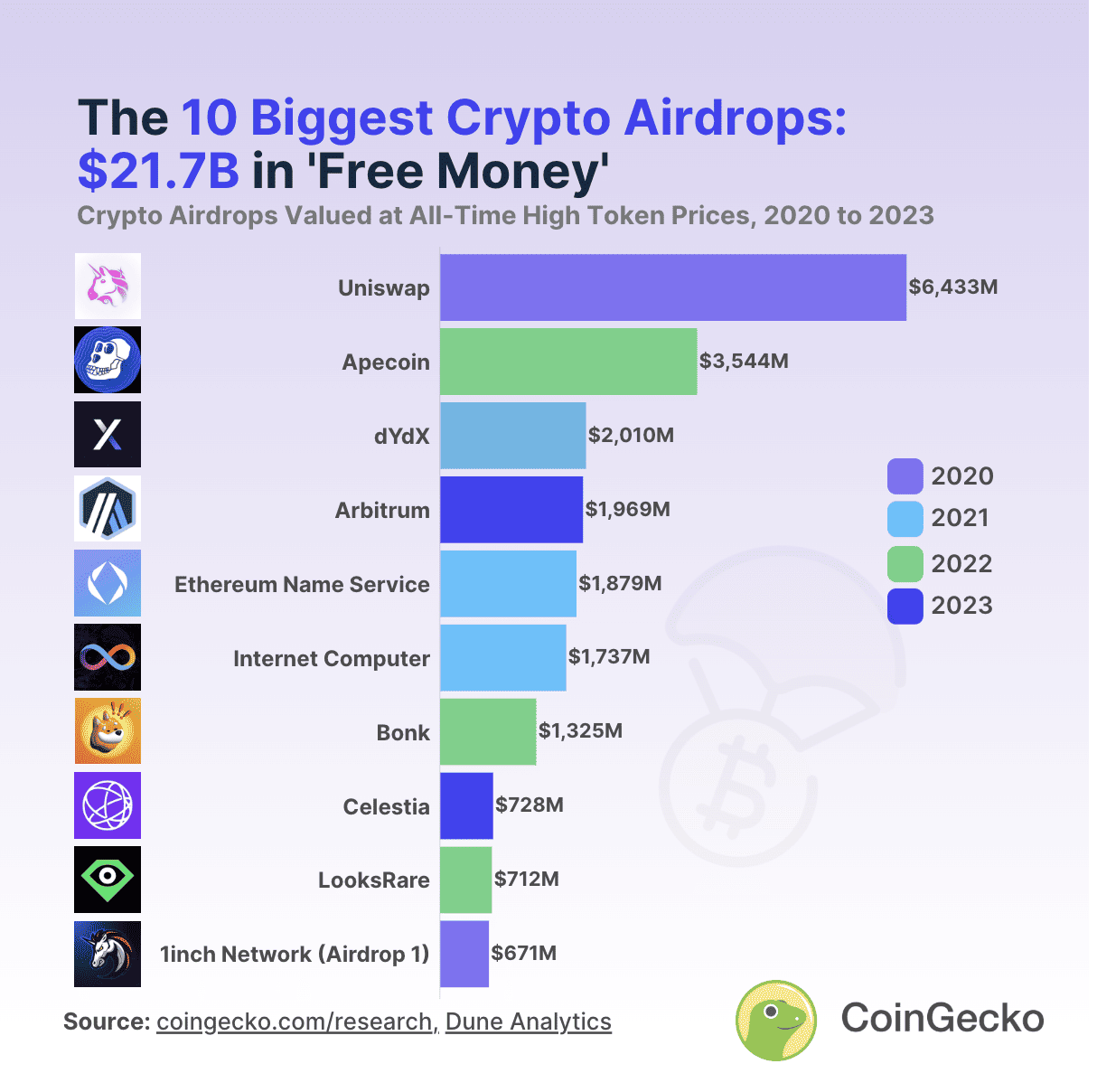

The launch of the HYPE token marked a turning point not just for Hyperliquid but for token distribution strategies across the DeFi space. It wasn’t just big; it was one of the largest and most community-driven airdrops in crypto history.

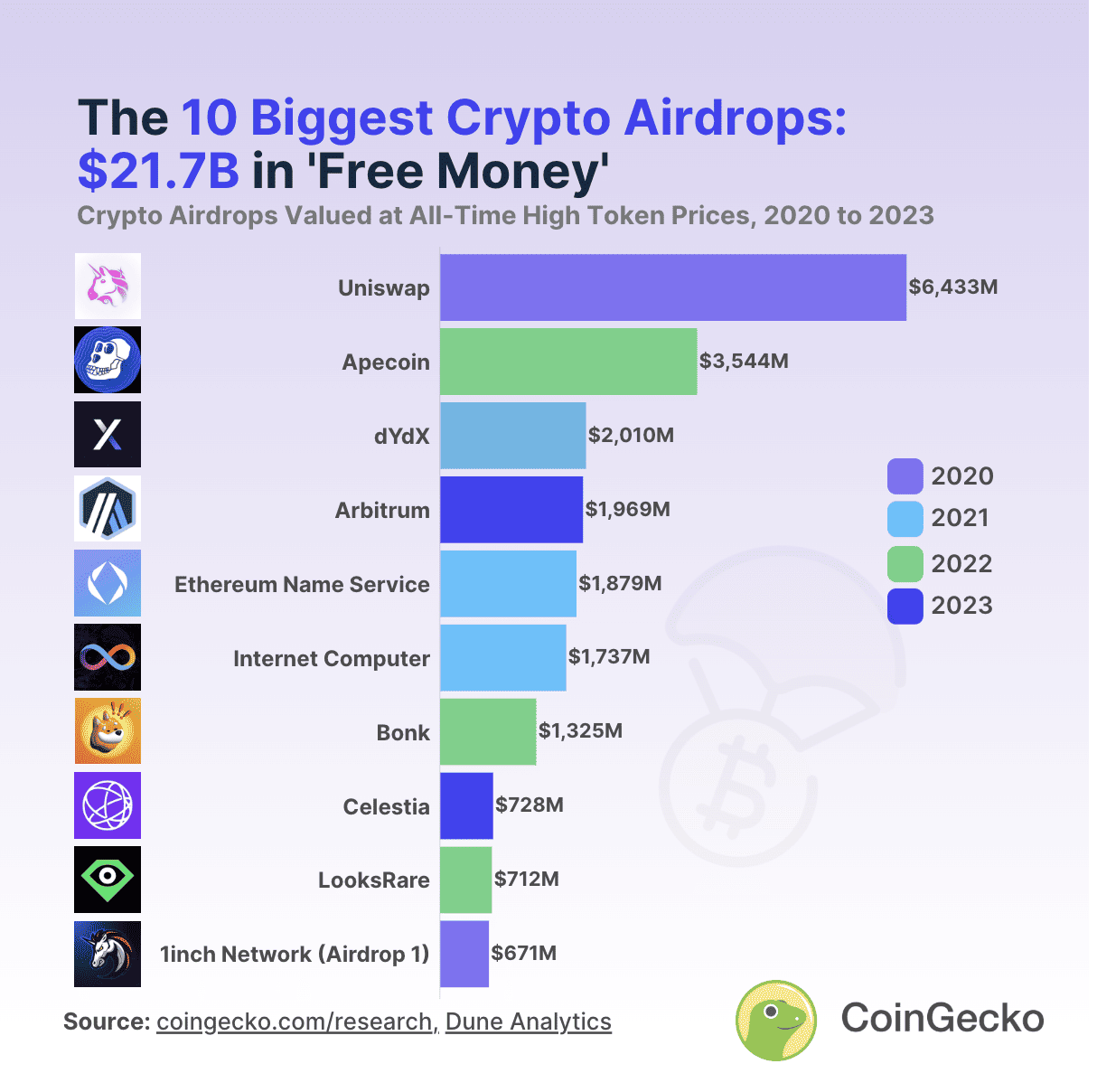

1. $1.6B HYPE Airdrop Becomes the 7th Largest in DeFi History

In December 2024, Hyperliquid distributed 310 million HYPE tokens, or 31% of its total supply, to over 94,000 eligible users. At launch, HYPE was priced at $3.90, valuing the airdrop at over $1.6 billion. Within 12 hours, the token jumped to $6.16 and later peaked at $14.99. This performance showed real market belief in Hyperliquid’s design and long-term vision. This also makes HYPE the 7th largest crypto airdrops in history.

2. 100% Community Allocation Sets a New Benchmark for Fair Launches

What made this airdrop stand out was its full commitment to the community. There were no allocations for venture capital firms, market makers, or insiders. No lockups or special deals. Every token went to users who had engaged with the platform.

3. Hyperliquid Proves That User-First Distribution Builds Real, Sustainable Value

The impact of the Hyperliquid airdrop went far beyond price:

• Community Formation: Nearly 100,000 users became direct stakeholders.

• Liquidity Bootstrapping: Tokens landed with real users, not private investors.

• Decentralized Ownership: Broad distribution kept control of the community.

• Ecosystem Signal: The success showed that user-first launches can outperform VC-backed models in traction and trust.

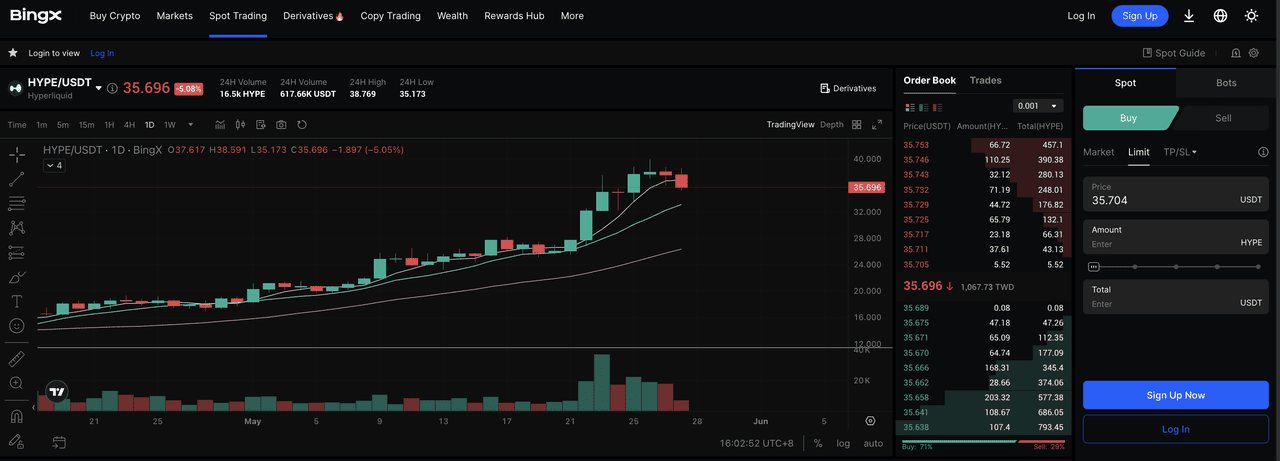

How to Buy Hyperliquid (HYPE) on BingX

If you’re looking to add HYPE, the native token of Hyperliquid, to your portfolio, BingX makes the process simple and accessible. With a beginner-friendly interface, multiple funding options, and robust trading features, BingX is a reliable platform for acquiring and managing HYPE.

Here’s how to get started in five straightforward steps:

Step 1: Create a BingX Account Sign up on BingX with your email and set a secure password. It only takes a few minutes.

Step 2: Secure Your Profile Verify your email, set up two-factor authentication, and complete

KYC if needed for full access.

Step 3: Add Funds Deposit

USDT or other supported crypto. You can also buy crypto directly on BingX with a bank card or local payment method.

Step 4: Buy HYPE Go to the spot market, search for

HYPE/USDT, and place a market or limit order using your funds.

Step 5: Hold or Trade After buying, you can hold HYPE on BingX or use trading tools available on the platform.

Final Thoughts

Hyperliquid is quickly becoming one of the most innovative platforms in decentralized finance. With its high-speed trading engine, fully on-chain order book, and gas-free experience, it redefines what users can expect from a DEX. But beyond raw performance, its real edge lies in a community-first approach.

The launch of the HYPE token was more than just a distribution. With no private investors or insider allocations, and one of the largest airdrops in DeFi history, Hyperliquid built a foundation rooted in user ownership. That same ethos drives the platform today, with HYPE supporting governance, rewards, and a value system designed around its community.

As crypto space evolves, Hyperliquid offers a clear example of what next-generation finance can look like. For traders, builders, and curious newcomers alike, it’s a platform built not just for growth, but for participation.

Related Reading

Frequently Asked Questions (FAQ) About Hyperliquid

1. When was the Hyperliquid airdrop?

The main Hyperliquid airdrop took place on December 2, 2024, distributing 310 million HYPE tokens worth over $1.6 billion to more than 94,000 eligible users.

2. How can I earn rewards on Hyperliquid?

Users can stake HYPE to earn up to 55% annual yield, participate in governance, and receive trading rewards based on activity and volume.

3. Does Hyperliquid charge gas fees?

No. Hyperliquid runs on its own Layer 1 blockchain, offering gas-free trading and real-time on-chain order execution.

4. Is Hyperliquid better than Solana?

Hyperliquid is not a general-purpose Layer 1 like Solana but is purpose-built for decentralized trading. It provides faster on-chain order execution, gas-free transactions, and deep liquidity, giving it an advantage in perpetual DEX performance.

5. Who is behind Hyperliquid?

Hyperliquid was founded by Jeff Yan and iliensinc, both Harvard alumni, along with a team of engineers from MIT, Caltech, and leading trading firms. The project is self-funded and has no venture capital backing.

6. Will there be more Hyperliquid airdrops?

Season 1 of the HYPE airdrop has ended, but around 38% of the total supply is reserved for future emissions and community rewards. While a second airdrop has not been officially confirmed, additional distribution rounds are likely to occur under community governance.