HeyElsa (ELSA) is transforming the landscape of

decentralized finance (DeFi) and blockchain engagement by serving as an

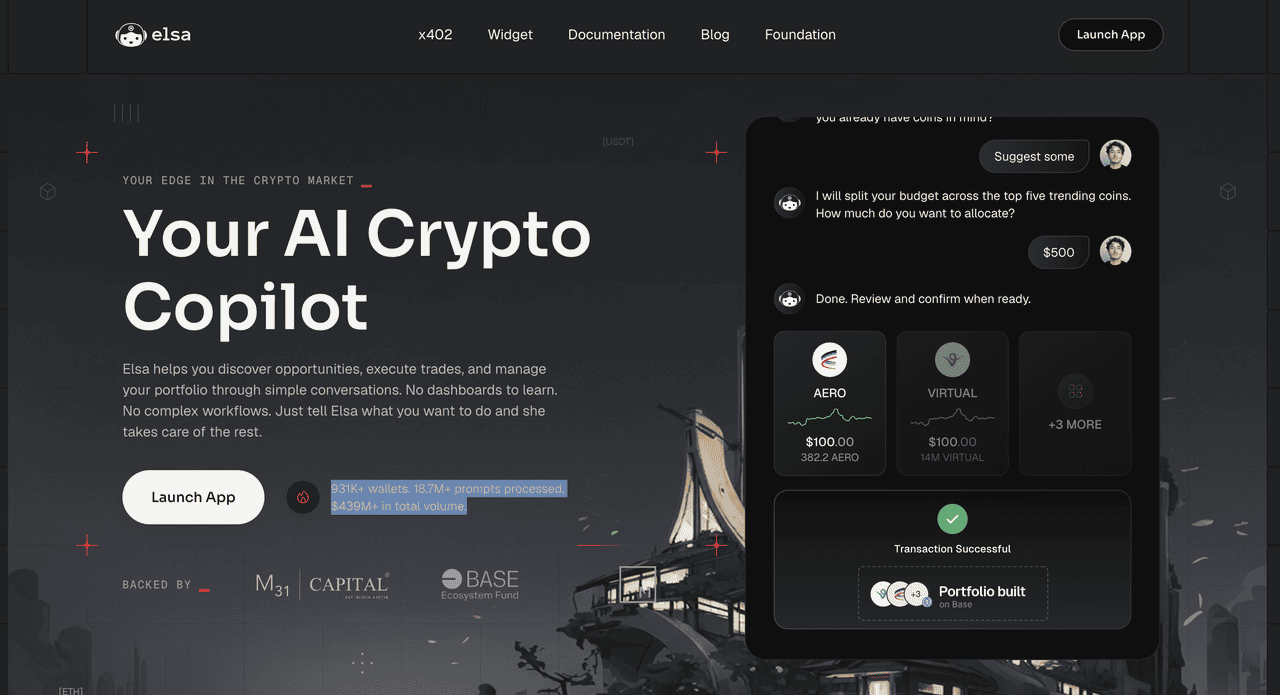

AI-powered crypto co-pilot that streamlines intricate operations through intuitive natural language interactions, catering effectively to both beginners and experienced users in the cryptocurrency space. Originating from insights gained at ETHDenver 2024, where a team of Web3 innovators identified the barriers posed by technical complexity and jargon-heavy platforms, HeyElsa was launched in mid-2024 to bridge this gap and make crypto more inclusive.

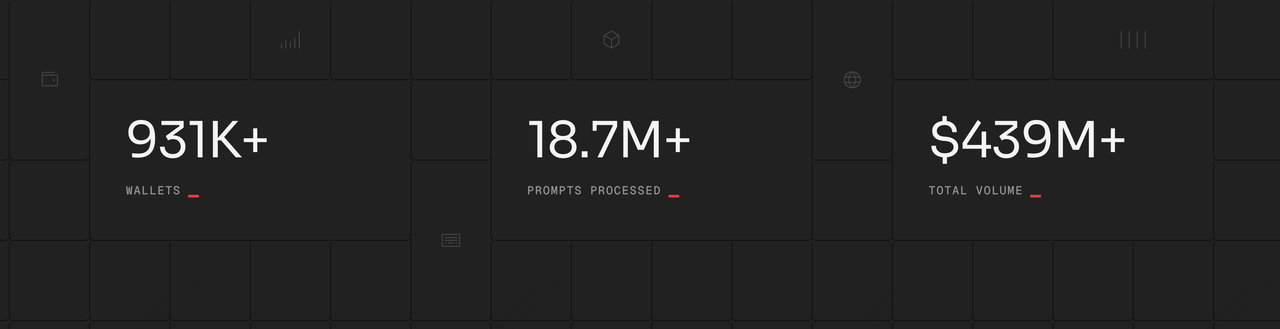

The platform has quickly amassed a user base reflected in its impressive metrics, such as handling over 18.7 million prompts and generating more than $439 million in transaction volume across multiple chains, including over 931,000 wallets created, processing more than 18.7 million prompts, and facilitating a total transaction volume exceeding $439 million, demonstrating its rapid adoption and utility in simplifying tasks like trading and portfolio management.

This article delves into the intricacies of the ELSA token, its underlying technology, economic model, and acquisition methods, providing a comprehensive overview for potential investors and users navigating the evolving DeFi ecosystem.

What Is HeyElsa AI Co-Pilot and How Does It Work?

HeyElsa is an AI-powered crypto co-pilot designed to simplify how you interact with blockchains and DeFi protocols by turning natural-language commands into on-chain actions. Instead of navigating complex wallets, bridges, and dApps, you can tell HeyElsa what you want to do, such as swap tokens, stake assets, rebalance a portfolio, or hunt for yield, and the platform handles the execution for you across multiple supported networks.

HeyElsa works through an intent-based AI engine that interprets your request, analyzes routes, risks, and costs, and then executes the required multi-step transactions automatically. This abstraction layer removes technical friction, making DeFi accessible to both beginners and advanced users, while still supporting advanced use cases like automated strategies, portfolio monitoring, and cross-chain operations, all powered by its underlying AI agent architecture.

Who Created HeyElsa?

HeyElsa was founded by Dhawal Shah, a veteran entrepreneur with a diverse background spanning franchising, investment banking, and

Web3 development, including his prior work on Frontier Wallet, who envisioned the platform after recognizing at ETHDenver 2024 the need for accessible crypto tools amid a market where only a fraction of the 420 million users comfortably navigate complex interfaces. As CEO, Shah assembled a team of seasoned Web3 builders to address this gap, securing $3 million in a combined pre-seed and seed funding round on June 5, 2025, led by M31 Capital and including participants like Coinbase Ventures'

Base Ecosystem Fund, MH Ventures, Absoluta Digital, 2Shares, Levitate Labs, and notable angels such as Martin Ochwat, Jonathan Man, Jaskanwar Singh, Alexey Bondar, and Yonatan Ben Shimon.

This investment, totaling exactly $3 million, has fueled the development of HeyElsa's

AI stack, transforming natural language into on-chain actions, and positioned the project for growth with endorsements from affiliates of Anoma, Zerolend,

LayerZero,

DeFiLlama, and P2P, highlighting Shah's leadership in creating a user-friendly DeFi ecosystem.

What Is ELSA, HeyElsa's Native Token?

The ELSA token is the core utility and governance asset of HeyElsa, an AI-powered crypto co-pilot that lets users execute on-chain actions through natural-language commands, simplifying DeFi access for more than 931,000 wallets, with 18.7 million prompts processed and $439 million in transaction volume. Built on Base, ELSA powers fee discounts, premium AI features, governance voting, and reward incentives, with a fixed supply of 1 billion tokens and a 10% protocol-fee burn that ties token value directly to platform usage.

The ELSA token is the native utility and governance asset of the HeyElsa ecosystem, used to unlock premium AI features, reduce platform fees through staking, and power reward boosts and priority conversions across the platform. ELSA also enables governance participation and supports a usage-based burn mechanism, where 10% of protocol fees are burned, directly linking token demand and long-term value to real platform activity.

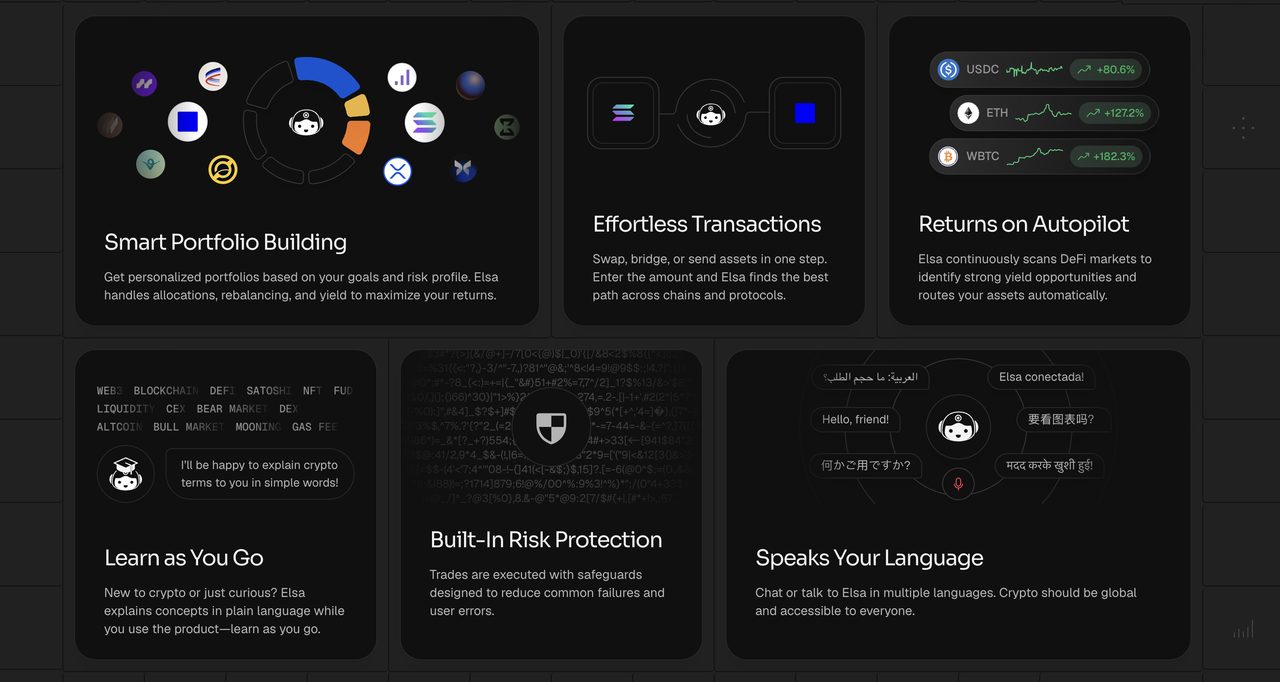

What Are the Key Features of HeyElsa AI Co-Pilot?

HeyElsa distinguishes itself through a robust array of features tailored to enhance crypto usability, including effortless transactions that allow users to swap, bridge, or send assets in a single step by identifying optimal paths across nine supported chains such as

Base,

Arbitrum,

BSC,

Optimism, Polygon,

Hyperliquid, Ink, Soneium, and

Solana, contributing to its impressive $439 million in total volume. Key among these is smart portfolio building, where personalized allocations are crafted based on individual goals and risk profiles, incorporating automatic rebalancing and yield optimization to maximize returns, alongside automated yield scanning that routes assets to high-opportunity DeFi protocols without user intervention.

Multi-language support enables interactions in various languages via chat or voice, promoting global accessibility for the platform's 931,000+ wallets, while built-in educational tools explain crypto concepts in plain language during usage, fostering knowledge growth amid processing 18.7 million prompts. Risk protection features, such as safeguards against common errors, stop-loss triggers, and portfolio monitoring, add a layer of security, complemented by advanced automations like limit orders, perpetual trading with leverage on platforms like Hyperliquid and Avantis, meme coin trading, and even token creation on Zora, all powered by multi-model

AI architecture ensuring rapid and precise executions.

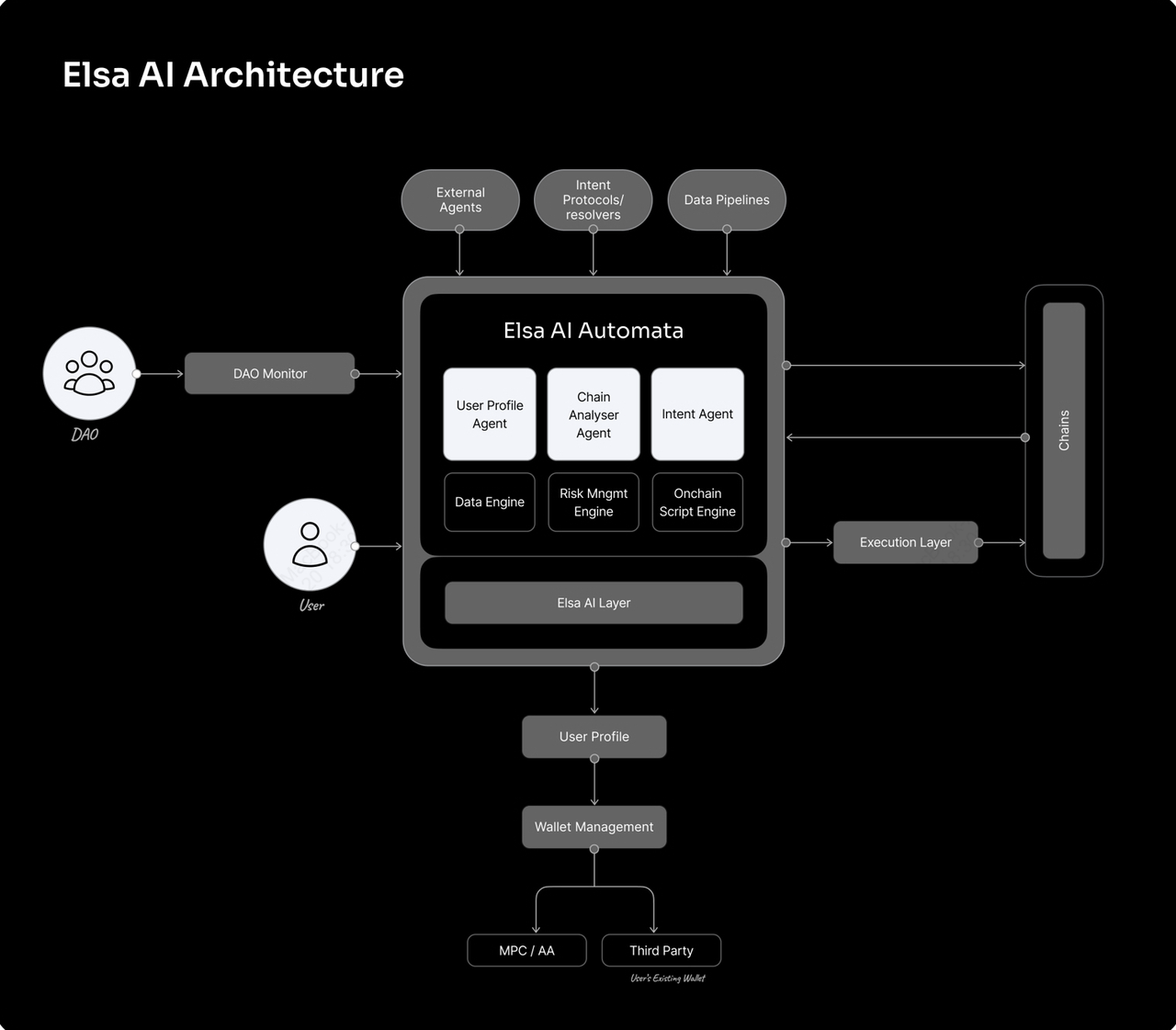

How Does HeyElsa (ELSA) Work?

HeyElsa functions via an intent-based

AI engine that interprets natural language commands, such as "Stake 0.1 ETH on Osmosis with a budget of 0.2 ETH," and orchestrates multi-step blockchain executions across supported networks, leveraging its Elsa AI Automata, a multi-layered system comprising agents for user profiling, chain analysis, intent processing, data engineering, risk management, and on-chain scripting, to handle over 18.7 million prompts efficiently. This architecture integrates with external data providers like Coingecko, Dune, Nansen,

Chainlink, Pyth, and social platforms such as Twitter and Discord for real-time insights, while employing large language models (LLMs) and retrieval-augmented generation (RAG) to deliver contextually accurate responses and automate tasks like portfolio alerts or yield optimization.

Security is ensured through multi-party computation (MPC) wallets and account abstraction, enabling seedless, gasless transactions on

Base, with the execution layer managing batch transactions to mitigate network congestion, as seen in its handling of $439 million in volume across 931,000+ wallets. Additional enhancements include

sentiment analysis agents and vision/voice APIs for diverse inputs, making HeyElsa a comprehensive co-pilot that not only reduces friction but also personalizes experiences based on user behavior and risk parameters.

What Are the Tokenomics of HeyElsa (ELSA)?

HeyElsa has a fixed total supply of 1,000,000,000 ELSA tokens on the

Base network, with no inflationary emissions and long-term, utility-driven incentives.

ELSA Token Distribution

• Community (40%): Allocated to airdrops and incentives; 20% unlocks at TGE (80M tokens), with the remainder vesting linearly over 48 months

• Foundation (34.49%): Supports protocol development; 20% unlocks at TGE after a 10-month cliff, then vests over 24 months

• Investors (10.51%): Subject to a 12-month cliff followed by 24-month linear vesting

• Liquidity (8%): Reserved for initial exchange listings and market stability

• Team (7%): 12-month cliff with 24-month vesting to align long-term incentives

What Are Elsa AI Automata and Elsa Wallet?

Source: Elsa Docs

The Elsa AI Automata is the sophisticated backbone of HeyElsa, a multi-agent system that integrates user profile management, storing behavioral and risk data for personalized suggestions like depositing $100 on Aave for 6% interest, with chain analysis for real-time alerts on trends such as new NFT releases or memecoin surges, processing data from providers like Token Terminal, Dune, Nansen,

Chainlink, and Pyth to inform decisions across over 931,000 wallets.

It features an intent agent for simplifying complex outcomes, a data engine for efficient pipelines and AI training, a risk management engine for portfolio monitoring and stop-loss triggers (e.g., selling all if BTC drops 10% in an hour), and an on-chain script engine for automating DAO-approved actions like staking across

Cosmos networks, all culminating in an execution layer that handles batch transactions and simulations to optimize efficiency amid $439 million in volume.

Complementing this is the Elsa Wallet, an MPC-based smart wallet auto-generated upon signup, supporting EVM and

Solana with seamless integration of external externally owned accounts (EOAs), enabling gasless transactions on Base and features like effortless swaps or bridges without key management.

How to Buy HeyElsa (ELSA) on BingX: A Step-by-Step Guide

ELSA is a leading AI

token available for trading on BingX. You can access ELSA through the spot market and use them within their respective ecosystems. Here's a step-by-step guide on how to buy ELSA on BingX Spot Market:

Step 1: Log in or Create a BingX Account

Log in to your BingX account. If you don't have one, you can register using an email or mobile number. Completing identity verification (KYC) is required for full access to trading features.

Step 2: Deposit Funds

Go to the Buy Crypto section to deposit funds into your account. BingX supports several payment options such as bank transfer, credit or debit card, and

peer-to-peer (P2P) transactions.

Step 3: Find the ELSA/USDT Pair

Navigate to the

Spot trading section and search for

ELSA/USDT. Select the pair to view the trading interface. Use

BingX AI tools to analyze ELSA trends and make smarter trading decisions.

Step 4: Place Your Order

Choose between a

Market Order to buy at the current price or a Limit Order to set your preferred entry. Enter the amount and confirm the order.

Conclusion: Is HeyElsa a Good Investment in 2026?

HeyElsa and its ELSA token embody an innovative convergence of

AI and DeFi, significantly lowering entry barriers for users while offering intelligent automation and risk management tools that have driven over $439 million in volume and 18.7 million prompts across 931,000 wallets, positioning it as a leader in accessible blockchain technology.

With verified tokenomics featuring a 1 billion fixed supply, community-focused allocations, and utilities like governance and fee burns, ELSA's current market performance, including a $32.39 million cap and $134.53 million 24-hour volume, highlights its growth potential on BingX. Backed by $3 million in funding and a strong team, the platform's multi-agent architecture and smart wallet ensure seamless experiences, making ELSA a promising asset for those seeking to capitalize on

AI-driven crypto innovations, though investors should conduct thorough due diligence in this volatile market.

Related Reading