Decentralized finance has proven demand, but for many traders and institutions, blockchains still feel slow, fragile, and inefficient compared to centralized exchanges. Latency, congestion, MEV, and inconsistent execution remain major barriers for real-time markets.

Fogo (FOGO) was built to address these constraints directly. Instead of treating latency and network variance as edge cases, Fogo designs around physical infrastructure, validator performance, and market-grade execution from day one. The result is an SVM-based Layer-1 optimized for speed, reliability, and financial precision.

In this article, you’ll learn what Fogo is, how its architecture works, why it’s different from other SVM chains, and how the FOGO token fits into the ecosystem.

What Is Fogo SVM-Compatible Layer-1 Blockchain?

Fogo is a purpose-built

Layer-1 blockchain designed for trading-centric DeFi and financial markets. It is fully compatible with the

Solana Virtual Machine (SVM), allowing existing

Solana programs, tooling, and developer workflows to migrate seamlessly while benefiting from significantly faster confirmations and lower latency.

Fogo targets use cases where milliseconds matter and where execution quality directly impacts profit and risk. Unlike general-purpose chains that try to serve every use case equally, Fogo is vertically optimized for finance, supporting applications such as:

• Perpetual futures and derivatives

• Real-time auctions

• Precise liquidations

• Reduced MEV extraction

Fogo launched its public mainnet on January 15, 2026, following a community-first funding approach and a strategic Binance token sale, showcasing around 40 ms block times, 1.3-second confirmations, high throughput under load, and full SVM compatibility. Since launch, the network has quickly attracted early trading, lending, staking, and liquidity protocols, including spot swaps, perpetuals, money markets, and liquid staking, while the FOGO token became tradable on major exchanges such as BingX, enabling access via both

spot and

derivatives markets.

How Does Fogo Blockchain Work?

Key components of Fogo network

Fogo is built on Solana’s core technology but redesigned to prioritize what matters most for on-chain trading: low latency and consistent execution. Rather than optimizing for average performance, Fogo minimizes worst-case delays by reducing physical network distance, standardizing validator performance, and localizing consensus. This results in faster confirmations and more predictable transaction execution, which is critical for order books, perpetuals, and liquidations.

The network is fully SVM compatible, meaning existing Solana apps, wallets, and developer tools work without modification. Fogo runs a

Firedancer-based validator client optimized for parallel processing, zero-copy data flow, and low-level networking, allowing the network to maintain stable performance even during periods of high activity or volatility.

Fogo further differentiates itself through zone-based consensus, where validators are geographically co-located in active zones that rotate over time. This reduces coordination delays while preserving decentralization and resilience. Combined with

proof-of-stake, a curated validator set, and low-friction user features like gas-sponsored Sessions, Fogo is designed to support always-on, high-frequency financial applications with lower energy overhead.

What Are the Real-World Use Cases for Fogo Network?

Fogo is designed for applications that struggle on slower or congested chains:

1. On-Chain Order Books: Unified liquidity and fast matching without fragmentation

2. Perpetual Futures and Derivatives: Low-latency pricing, funding, and liquidation logic

3. Institutional DeFi: HFT-style strategies with predictable execution

4. Real-Time Auctions: Time-sensitive bidding without MEV leakage

5. Cross-Chain Liquidity Hubs: Assets bridged via

Wormhole into a high-speed trading layer

What Is the FOGO Token Used For?

FOGO is the native utility and governance token of the Fogo network. Its core functions include:

1. Network Gas: Paying transaction fees, with support for sponsored gas

2. Staking and Security: Validators and delegators stake FOGO to secure consensus

3. Rewards: Inflation and fees distributed to active validators and stakers

4. Governance: Protocol upgrades, parameters, and ecosystem decisions

5. Ecosystem Alignment: Revenue-sharing agreements funnel value back to the network

Fogo operates with a 2% annual inflation rate, distributed to validators and stakers, aligning incentives with long-term network health.

FOGO Tokenomics Overview

FOGO token distribution | Source: Fogo blog

$FOGO has a fixed genesis supply, with 63.74% locked at launch and unlocking gradually over four years to align contributors, investors, and the community with long-term network growth.

FOGO Token Allocation

• Community Ownership – 16.68%: Echo raises, Binance Prime Sale, and community airdrops

• Core Contributors – 34%: Fully locked at TGE, 4-year vesting with a 12-month cliff

• Foundation – 21.76%: Ecosystem grants, incentives, and network growth programs

• Institutional Investors – 12.06%: Fully locked, unlocks starting September 26, 2026

• Advisors – 7%: Fully locked, 4-year vesting with a 12-month cliff

• Launch Liquidity – 6.5%: Fully unlocked to support market liquidity

• Burned – 2%: Permanently removed from supply

What Is the Fogo Airdrop and How to Claim FOGO Tokens?

The

Fogo airdrop went live on January 15, 2026, rewarding early users who participated in Fogo’s testnet, ecosystem apps, and community programs. To claim your allocation, visit the official claim portal at claim.fogo.io, connect the wallet you used during Fogo participation, review your eligible $FOGO amount, and confirm the claim. Tokens are fully unlocked at claim, and the portal will remain open until April 15, 2026, after which unclaimed tokens may be forfeited. Always verify the URL carefully and avoid third-party links to

protect against phishing.

For eligibility details, allocation breakdowns, and a step-by-step process, read our comprehensive

FOGO airdrop guide on BingX News.

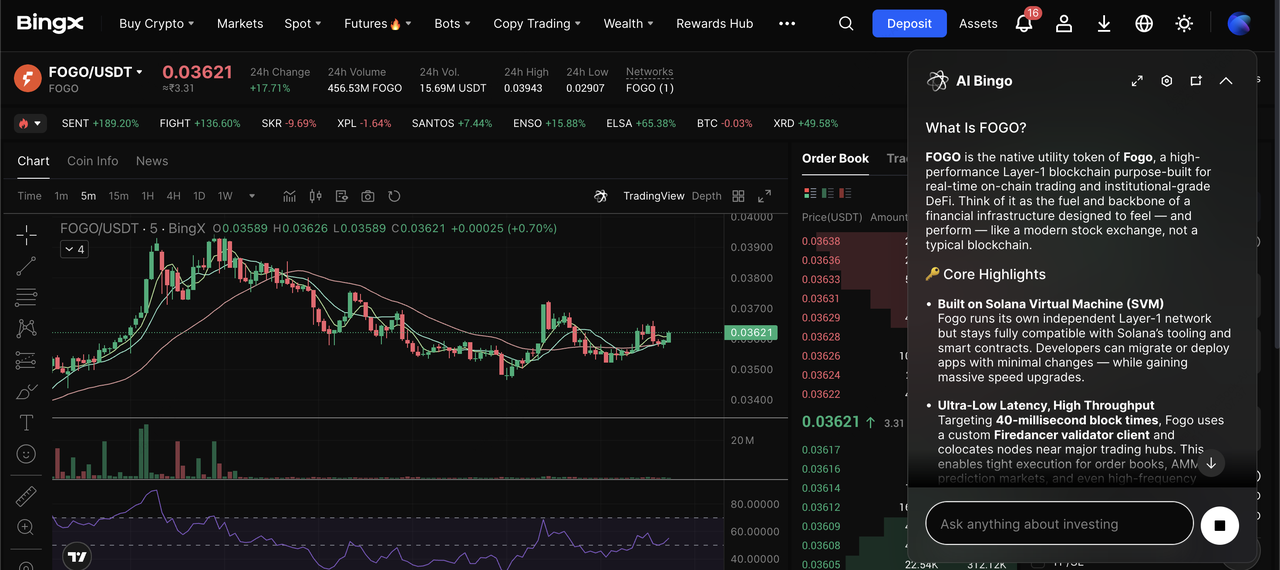

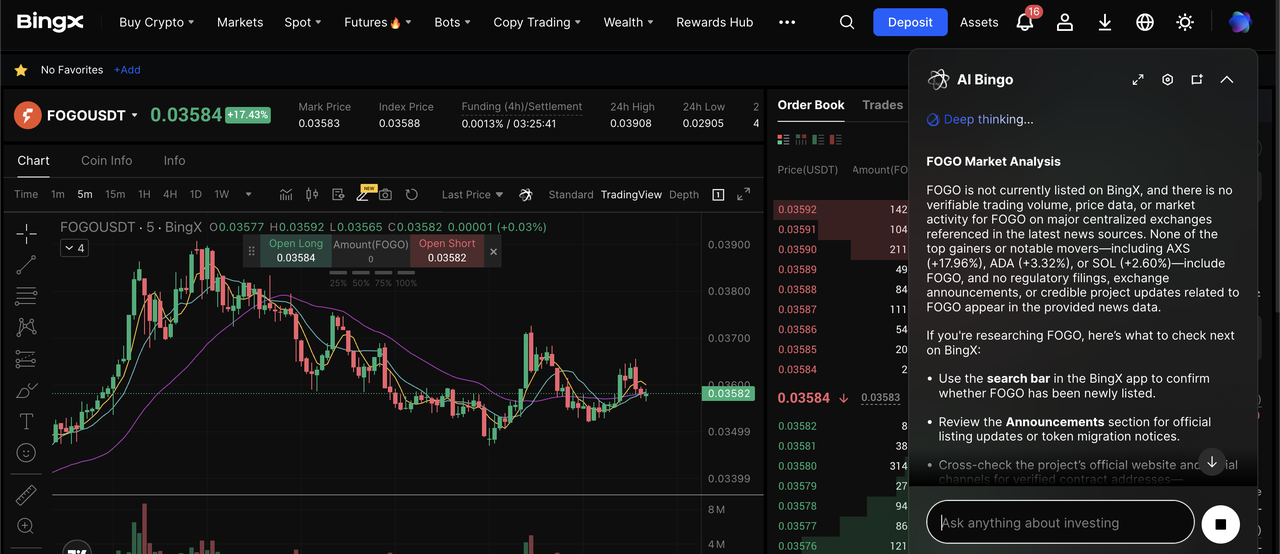

How to Trade Fogo (FOGO) on BingX

FOGO is available for trading on BingX, which offers spot and futures markets supported by

BingX AI tools for market insights and risk analysis.

Buy or Sell FOGO on the Spot Market

1. Log in to BingX and fund your Spot Wallet with

USDT.

4. Enter the amount and confirm the trade.

Long or Short FOGO with Leverage on the Futures Market

1. Transfer USDT to your Futures Wallet.

3. Set leverage carefully.

4. Choose Long or Short and place your order.

Risk reminder: Futures trading involves leverage and higher risk. Always trade responsibly.

What Makes Fogo Different From Other SVM Blockchains?

| Feature |

Fogo |

Typical SVM Chains |

| Consensus topology |

Zone-based, localized |

Fully global |

| Validator clients |

Standardized Firedancer |

Mixed implementations |

| Latency focus |

First-class design goal |

Secondary |

| Trading optimization |

Protocol-level |

App-level |

| UX friction |

Sessions + gas sponsorship |

Wallet-heavy |

What sets Fogo apart from other SVM blockchains is its explicit focus on worst-case latency rather than average throughput. While many SVM chains advertise high TPS under ideal conditions, real trading performance is dominated by tail latency, the slowest transactions that determine whether orders fill, liquidations trigger on time, or arbitrage opportunities are captured. Fogo addresses this by localizing consensus geographically, standardizing validator performance, and reducing quorum distance, enabling 40 ms block times and 1.3-second confirmations even under load, rather than only in benchmarks.

In contrast, globally distributed validator sets and heterogeneous client implementations introduce latency variance that compounds during congestion, making execution unpredictable for time-sensitive strategies. Fogo’s zone-based consensus and Firedancer-derived client reduce this variance at the protocol level, allowing applications such as on-chain order books, perpetuals, and liquidations to operate with deterministic, exchange-like execution quality. This design shifts performance from best-case metrics to consistently reliable outcomes, which is what ultimately matters for traders and market makers operating at scale.

Final Thoughts

Fogo is not trying to be everything for everyone. It is built for one core purpose: fast, reliable, on-chain markets. By confronting physical network limits, standardizing validator performance, and optimizing the full execution stack, Fogo pushes decentralized finance closer to the speed and reliability traders expect from centralized systems.

That said, adoption depends on ecosystem growth, sustained usage, and market conditions. As with any blockchain network, participation carries technical and market risk. Understanding how Fogo works helps users and builders decide whether its performance-first design fits their needs.

Related Reading