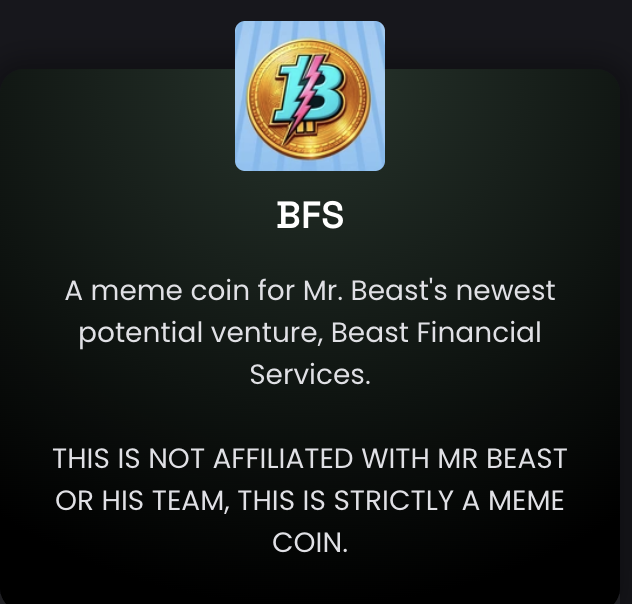

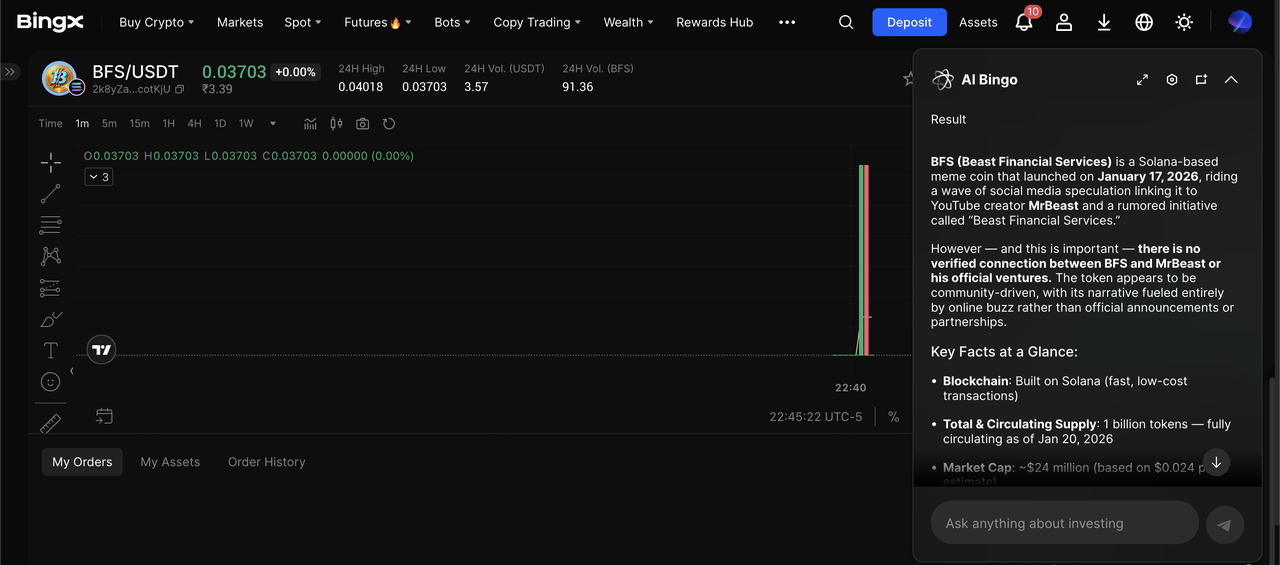

BFS (BFS) is a newly launched Solana-based meme coin that began circulating on January 17, 2026, after social media posts linked it to YouTube creator MrBeast and a project referred to as “Beast Financial Services.”

In the days that followed, BFS drew increased attention as short-form videos and screenshots spread across X, TikTok, and Instagram, referencing MrBeast’s recent discussions around a Super Bowl advertising campaign. As interest grew, trading activity picked up quickly, and BFS briefly appeared on DEXScreener’s trending lists between January 18 and January 21, 2026.

For readers encountering BFS for the first time, a few straightforward questions naturally follow: What is BFS? Is it actually connected to MrBeast or Beast Financial Services? How did the narrative form, and what does the available on-chain and public information show? This guide walks through those questions step by step.

What Is BFS (BFS), Solana Meme Coin Claiming a MrBeast Connection?

Source: DEXScreener

BFS (BFS) is a

Solana-based meme coin launched on January 17, 2026, that gained rapid attention after social media posts suggested a connection to YouTube creator MrBeast and a rumored initiative referred to as Beast Financial Services.

The timing of BFS’s appearance coincided with increased discussion around MrBeast’s broader involvement in the crypto industry. On January 15, 2026, BitMine Immersion Technologies, an

Ethereum-treasury-focused firm chaired by Tom Lee, announced a $200 million investment into Beast Industries. The announcement drew attention to MrBeast’s expanding business interests related to blockchain and financial infrastructure. Around the same period, short video clips from MrBeast’s recent content discussing a Super Bowl advertising project and a related contest began circulating widely on social media, later being reused in posts that framed BFS as connected to these developments.

Following its launch, BFS experienced a sharp speculative surge. According to DEXScreener data, the token spiked more than 300%, rising from early low-liquidity trading levels to a peak above $0.07 on January 20, 2026, as Super Bowl-related clips, screenshots, and price charts spread across X, TikTok, and Instagram. By January 21, 2026, BFS had fallen back to around $0.018, representing a drawdown of more than 70% from its local high within a short time frame.

The token itself launched quietly, without an official announcement, whitepaper, or disclosed development team. Public listings on DEXScreener show that BFS trades on the Solana blockchain and does not outline a specific utility, roadmap, or long-term use case. Its early price movement appears to have been shaped largely by short-term social media attention during a period of heightened interest in MrBeast-related crypto narratives.

BFS Is a Meme Coin and Is Not Affiliated With MrBeast

The ticker name and branding led some traders to interpret BFS as being connected to MrBeast and his business activities. However, this perception emerged from how the token was framed on social media rather than from confirmed information. To date, no official channels linked to MrBeast or his companies have announced, promoted, or acknowledged BFS.

As BFS continued to circulate across social platforms, clarification began to appear publicly. On January 20, 2026, Chucky, an employee associated with MrBeast, commented on X that they were not launching a coin and cautioned users about the risks of tokens claiming a connection to MrBeast. In addition, the BFS project description on DEXScreener explicitly states that the token is not affiliated with MrBeast or his team.

Taken together, these statements help clarify the distinction between the social narrative and the project’s stated status. In practice, BFS functions as a meme coin, with price movements largely influenced by short-term attention, viral momentum, and speculative trading activity rather than underlying fundamentals.

Common Celebrity-Based Crypto Narratives in Meme Coin Markets

Celebrity-based narratives are a recurring feature in meme coin markets, where attention often forms around the perceived involvement of well-known public figures, even when no formal relationship exists. These narratives usually spread through edited clips, screenshots, or selectively framed comments that circulate rapidly on social media before clear confirmation is available.

In the case of MrBeast, his attitude has historically been cautious. He has publicly stated multiple times that he is not launching meme coins and has warned his audience about tokens falsely claiming his involvement. Similar patterns have appeared repeatedly with

Elon Musk, where casual remarks, jokes, or unrelated posts have been interpreted by traders as endorsements of meme coins, often leading to short-lived price spikes driven by speculation rather than fundamentals. Other influencers, athletes, and entertainment figures have seen comparable narratives emerge without direct participation.

From a market perspective, these situations often resemble

pump-and-dump dynamics, where prices rise quickly as attention peaks and then retrace once momentum fades. In less transparent projects, this can also introduce rug-pull risk, particularly when liquidity, token distribution, or developer intentions are unclear. Understanding these recurring patterns helps place projects like BFS within a broader market context, where visibility and timing can temporarily outweigh verified information.

What Is the BFS (BFS) MrBeast Meme Coin Tokenomics?

Based on publicly available on-chain data as of January 21, 2026, the BFS (BFS) tokenomics can be summarized as follows:

• Token name: BFS (BFS)

• First mint: January 16, 2026 (UTC)

• Current supply: ~999,999,336 BFS (approximately 1 billion tokens)

• Token address: 2k8yZaJjf61unHriuqdmvbxe7CUhEYML5kVJDbcotKjU

Note: The token address is unverified on major explorers. Users should exercise caution and verify the contract before interacting.

BFS does not publish a whitepaper or formal tokenomics documentation, and there is no publicly disclosed information on token allocations, vesting schedules, governance, or defined utility.

As a result, BFS follows a straightforward meme coin structure, with valuation and price movements driven mainly by liquidity, market participation, and short-term sentiment rather than long-term fundamentals.

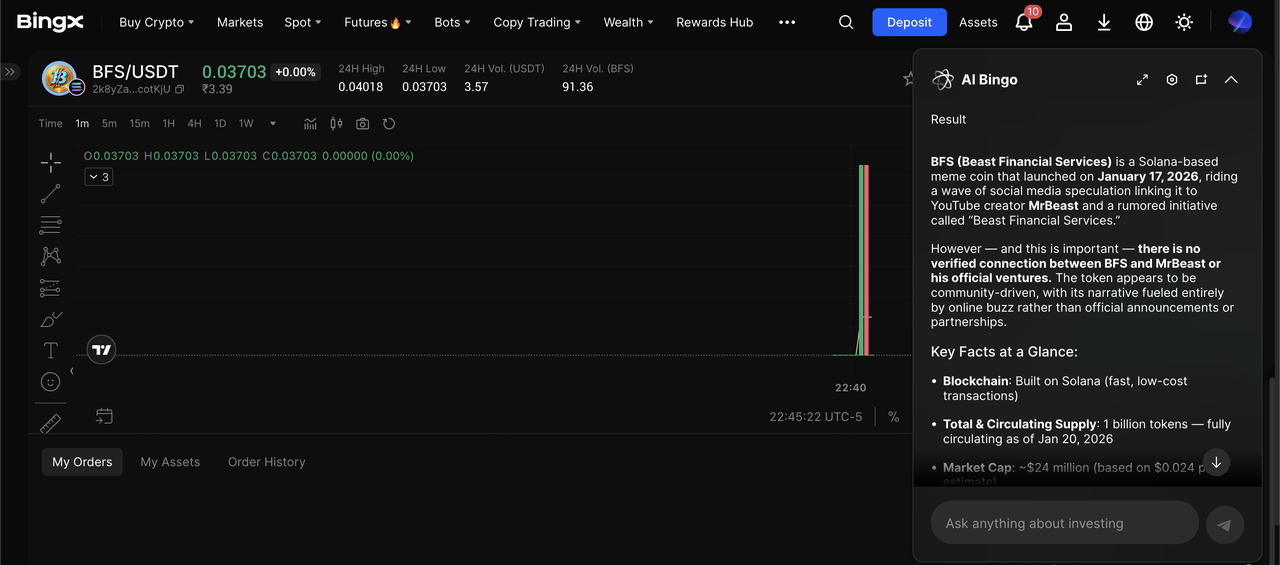

How to Buy BFS (BFS) on BingX ChainSpot: Step-by-Step Guide

With BingX AI helping you spot trends and manage timing with market insights, you can trade BFS (BFS) on BingX ChainSpot in a few straightforward steps.

1. Log in to BingX and open

ChainSpot from the main navigation.

2. Complete your

KYC and ensure your account is ready for trading.

3. Deposit or fund your account with a supported asset like

USDT, so you have buying power for ChainSpot trades.

4. In ChainSpot, search for “BFS” and open the

BFS/USDT trading page/pair.

5. Review key details like price, liquidity, and fees, then choose your

order type like Market for instant execution or Limit to set your price.

6. Enter the amount you want to buy or sell and confirm the order.

7. After execution, check Assets / Wallet to view your BFS balance, and optionally set a price alert or plan your next trade using BingX tools.

Reminder: On-chain markets can be volatile, so consider position sizing and risk controls before trading.

How to Invest in BFS (BFS) On-Chain: A Step-by-Step Guide

Investing in meme coins like BFS (BFS) carries a high level of risk and may not be suitable for all participants. Prices can move quickly, information may be limited, and losses can occur rapidly. Anyone considering exposure should understand these risks before proceeding.

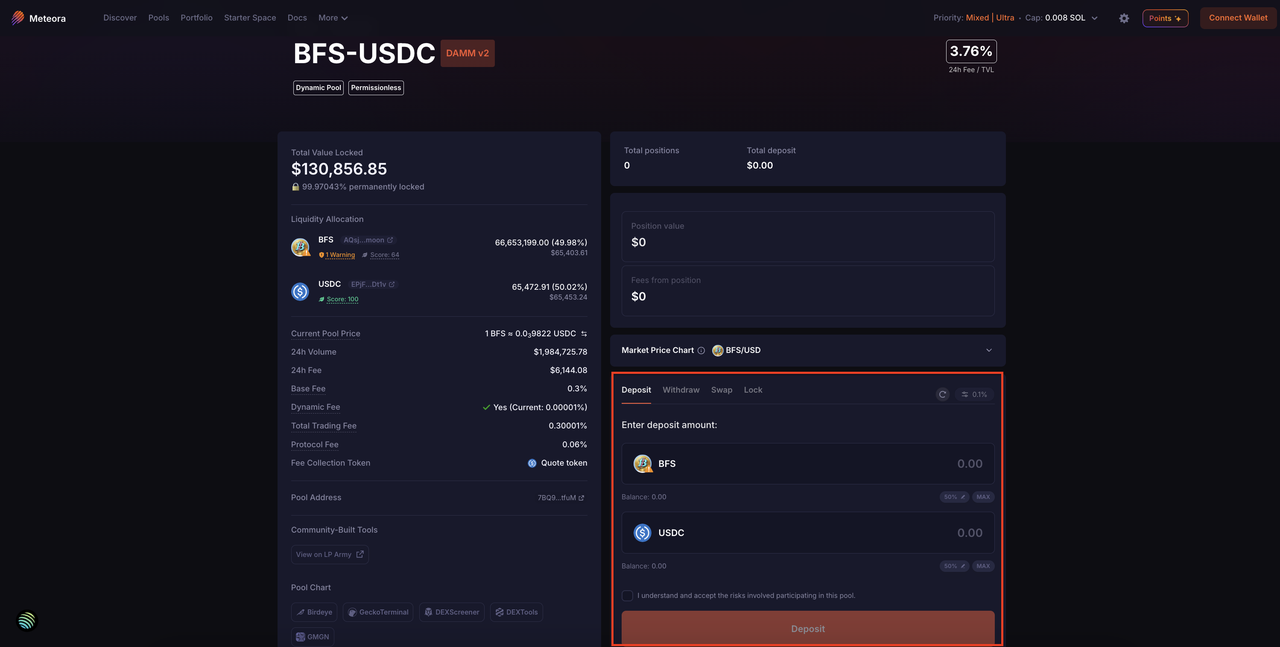

Method 1: Buy BFS Through a Solana DEX Meteora

Step 1: Connect a Solana Wallet to Meteora

Step 2: Navigate to the BFS–USDC Pool

Locate the

BFS/USDC trading pair on Meteora to view current pricing and liquidity conditions.

Step 3: Use the Swap Function to Trade for BFS

Enter the amount of USDC or SOL to swap for BFS, reviewing the quoted price and estimated slippage.

Step 4: Confirm the transaction

Approve the swap in your wallet and wait for on-chain confirmation.

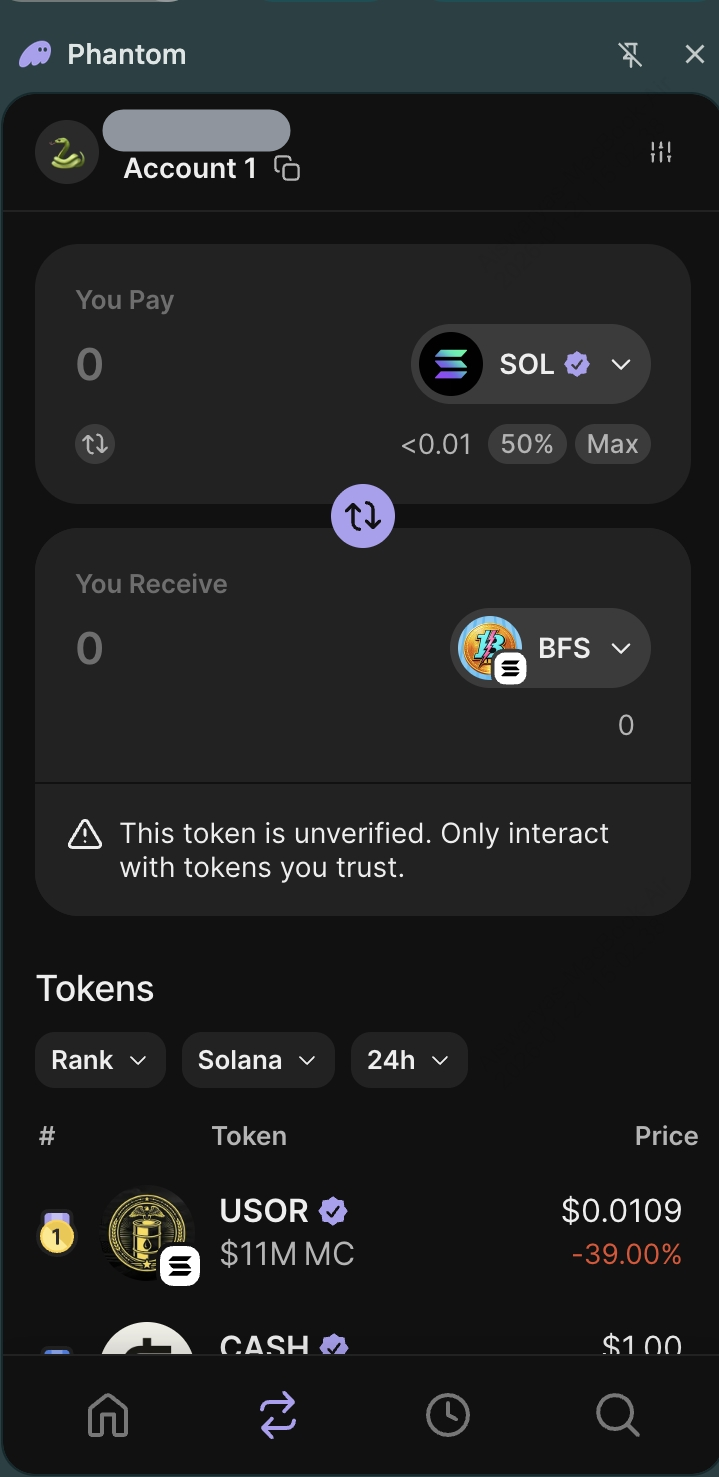

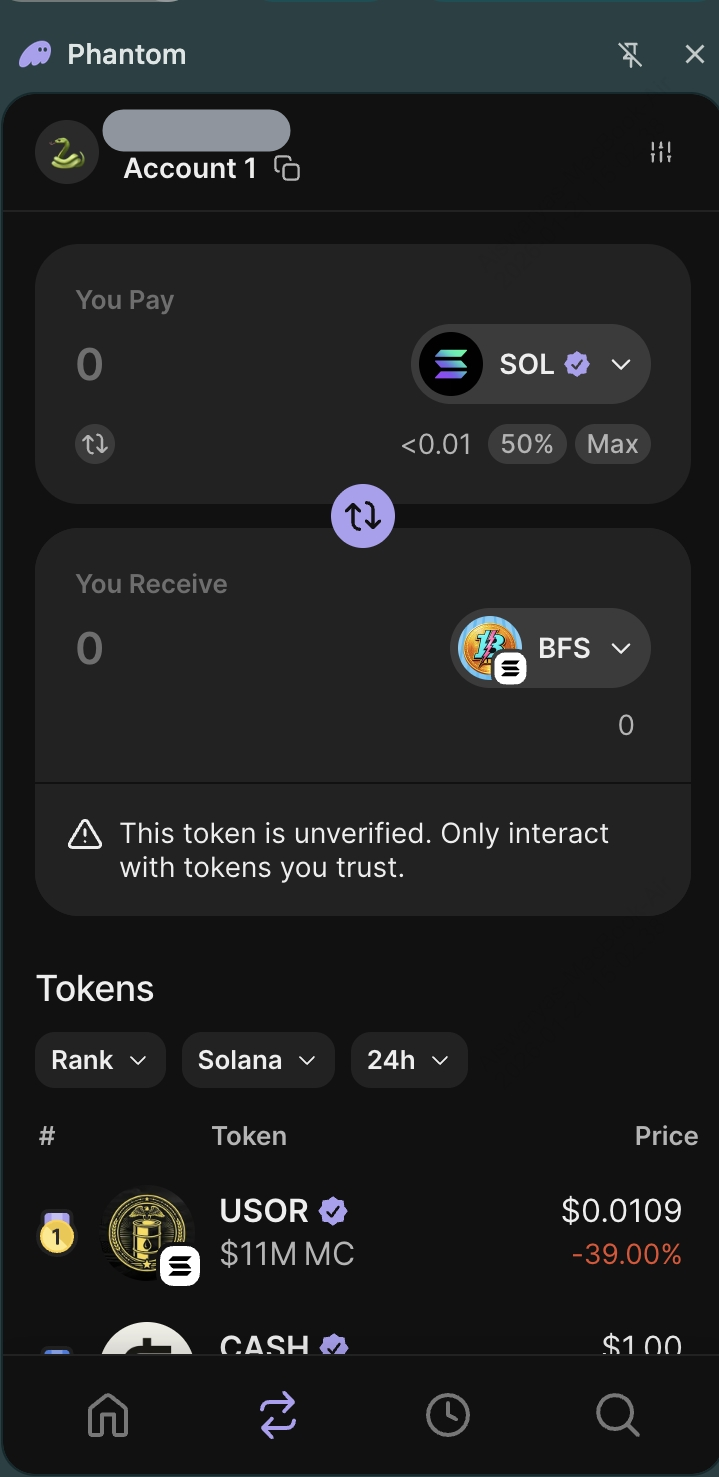

Method 2: Buy BFS Directly Within a Solana Wallet Like Phantom

Step 1: Open the Wallet’s Swap Feature

Navigate to the built-in swap or trade section within the wallet.

Step 2: Select SOL and Paste the BFS Contract Address

Choose SOL as the input token and manually enter the BFS address.

Step 3: Review the Quote and Fees

Confirm the displayed price, slippage, and estimated fees.

Step 4: Confirm the Transaction

Approve the swap and wait for on-chain confirmation.

Note: This section is intended for informational purposes only. Participation in high-volatility assets requires careful consideration of personal risk tolerance and financial circumstances.

Risks and Considerations Before Investing in BFS Memecoin

Before considering exposure to BFS (BFS), the following points are worth keeping in mind:

1. Pump-and-dump and rug-pull risk: Meme coins with unclear token distribution or liquidity arrangements can experience rapid price increases followed by sharp reversals. In some cases, this structure also carries rug-pull risk when control over liquidity or supply is not clearly disclosed.

2. Narrative-driven volatility: BFS’s price movements have been closely tied to social media attention and short-term narratives. Assets driven primarily by sentiment can change direction quickly as attention fades.

3. Limited project transparency: BFS does not publish a whitepaper, roadmap, or detailed documentation, and information about long-term plans or development intent is limited.

4. Liquidity sensitivity: With relatively modest liquidity, BFS may experience amplified price swings and higher slippage during periods of increased trading activity.

5. No defined utility: The token does not currently outline a specific use case or governance function, leaving valuation largely dependent on market participation and sentiment.

These considerations help frame BFS as a high-volatility, narrative-driven asset and may be useful when assessing whether it aligns with individual risk tolerance and trading objectives.

Final Thoughts: Should You Invest in BFS?

BFS (BFS) emerged amid heightened attention around MrBeast-related business news and quickly became part of a broader meme coin narrative driven by social media momentum. While the token attracted notable trading activity in a short period, publicly available information indicates that BFS functions as a meme coin without a confirmed connection to MrBeast or his companies.

Like many narrative-driven assets, BFS shows how quickly speculation can form when recognizable names, viral content, and market timing align. Its price behavior, liquidity profile, and lack of formal documentation place it in the high-volatility segment of the crypto market, where sentiment often outweighs fundamentals.

Whether investing in BFS (BFS) is appropriate depends on individual risk tolerance and approach to short-term speculation. While some traders may view it as a sentiment-driven opportunity, the absence of a defined roadmap, limited transparency, and reliance on attention-driven momentum may not suit longer-term or fundamentals-focused strategies.

Related Reading

Frequently Asked Questions (FAQ) on BFS

1. Is BFS (BFS) officially related to MrBeast?

No. There is no confirmed affiliation between BFS and MrBeast or his companies. The connection originated from social media narratives, not official announcements.

2. Why is BFS associated with MrBeast online?

The association stems from the token’s name, branding, and launch timing, which overlapped with increased online discussion about MrBeast’s business activities and Super Bowl–related content.

3. Did anyone from MrBeast’s team comment on BFS?

Yes. On January 20, 2026, an individual associated with MrBeast stated they were not launching a coin and warned users about tokens claiming a connection.

4. Is BFS a scam?

There is no public confirmation labeling BFS as a scam. However, it operates as a meme coin with limited disclosed information and elevated risk.

5. What blockchain is BFS on, and where can it be traded?

BFS is a Solana-based token and is traded via decentralized exchanges and wallet-based swaps within the Solana ecosystem.

6. Is BFS suitable for long-term investment?

BFS does not outline a roadmap or defined utility. It is generally considered a high-volatility, sentiment-driven asset.