In 2025, more than 11.4 million BingX users used

copy trading, showing the growing demand for automated strategies and expert trader guidance. Copy trading lets you follow top traders, but instead of chasing short-term double or triple ROI, the key is learning how to manage risk. Effective risk management is what helps copy traders achieve steady and sustainable results over the long term.

This guide outlines the most powerful BingX tools and features that help you stay in control. Whether you're a beginner or an advanced trader, these built-in solutions offer protection against market volatility, emotional trades, and poor decision-making.

A Brief Introduction to BingX Copy Trading

BingX is one of the leading platforms for crypto copy trading, trusted by over 20 million users globally. It offers a range of advanced features, including

Copy Trading 2.0, AI-powered trader analysis, and built-in risk tools, to make copying trades smarter and safer.

With three flexible copy modes such as Position Ratio, Per Order, and Spot Market Copy, beginners can choose how much control they want over their trades. Most importantly, BingX provides transparent trader metrics like win rate, ROI, drawdown, and PnL history, helping users make informed decisions before copying anyone.

What Are the Top 5 Risks in Crypto Copy Trading?

Copy trading lets you mirror the trades of experienced traders in real time, but it also exposes you to some important risks. Many beginners enter copy trading expecting “hands-free” profits, only to be caught off guard by sudden losses, emotional trades, or misaligned strategies. That’s why understanding these risks is essential before you start.

1. Market Volatility and Sudden Losses: Even elite traders can suffer big losses during rapid price swings. Crypto markets are highly volatile, and while a trader may have a strong track record, past performance is never a guarantee of future results.

2. FOMO and Emotional Copying: It’s easy to copy traders who show high ROI or have huge followings — especially during hype or FOMO cycles. But many use risky, high-leverage strategies that can backfire fast. When you copy them blindly, you also mirror their behavior. If they panic or chase losses, your portfolio follows. Always assess a trader’s strategy, risk level, and discipline, not just their recent profits.

3. Putting All Eggs in One Basket: Allocating all your copy funds to a single trader or strategy increases your exposure. If that trader hits a losing streak, your portfolio takes the full impact. Diversifying across multiple traders with different styles helps reduce this risk.

4. Slippage and Delays in Fast Markets: Your copied trades may not execute at the exact same price or time as the lead trader’s. In fast markets, this can lead to slippage, entering or exiting a position at a worse price, which affects your profitability.

5. Misaligned Strategies and Risk Profiles: Not every trader’s strategy fits your financial goals or risk appetite. Some focus on short-term scalping, others on long-term holds or high-leverage futures. Before copying, study their trading history, leverage level, and drawdown rate to ensure their approach aligns with your strategy.

Top BingX Tools to Manage Copy Trading Risk

BingX equips you with powerful, built-in tools to help you manage copy trading risk, whether you're a beginner or experienced user. These five standout features give you more control over your capital, execution quality, and exposure to volatile markets.

1. Choose the Right Copy Trader Fit for Your Risk Appetite

Before selecting your copy trader, take time to analyze their trading style, risk appetite, and leverage level, not just their ROI. A trader with high short-term gains might use risky, high-leverage strategies that don’t suit your comfort level or long-term goals.

Look deeper into metrics like average drawdown, trade frequency, and asset type. Consistent, moderate performers are often safer than traders chasing big wins. Avoid relying 100% on ROI or follower counts, as they can be misleading during market hype or FOMO cycles.

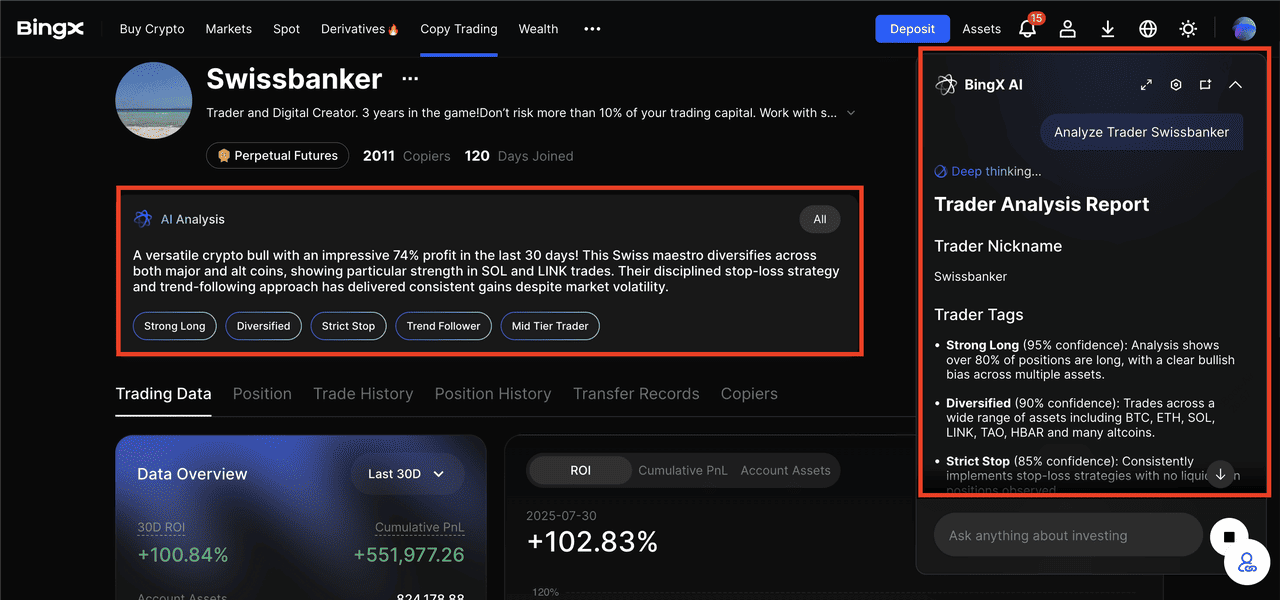

BingX AI can simplify this process by helping you filter traders based on risk-adjusted metrics, such as ROI stability, win/loss ratio, and behavior patterns. It also alerts you if a trader’s strategy changes suddenly, helping you stay aligned with your personal trading goals and avoid unnecessary exposure.

2. Try Copy Trading 2.0 Subaccounts

Every time you want to copy a trader, you’ll first need a dedicated subaccount on BingX. This subaccount that BingX will create keeps your copy trading activity separate from your main wallet and provides a clear view of each trade’s leverage, margin used, liquidation price, and PnL (profit and loss).

Isolating trades this way helps you avoid confusion, prevents unwanted overlap between your main trading and copied trades, and allows you to track and manage each strategy individually. You can pause or stop copying a trader anytime without affecting other funds or active trades in your main account, making risk management clearer and more controlled.

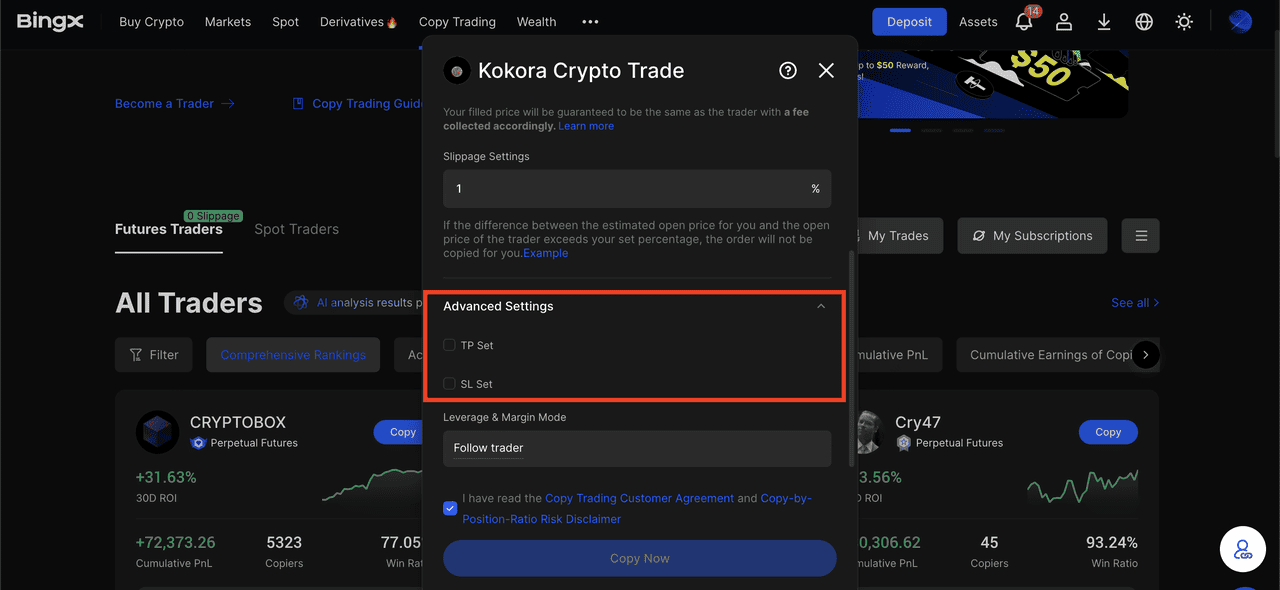

3. Set Take Profit (TP) and Stop Loss (SL) Levels

With BingX Futures Copy Trading, you can predefine Take Profit and Stop Loss levels to automatically stop copying once specific performance thresholds are reached. For instance, you might set TP at +10% to lock in gains or SL at -5% to cut losses.

These settings help prevent emotional decision-making and protect your funds from sharp drawdowns during volatile conditions. You can activate TP/SL when you begin copying a trader or modify them anytime from your copy trading dashboard.

4. Specify Limits for Copy Amount

BingX's Standard Futures copy trading allows you to set strict caps on how much capital is allocated to copy trading each day and in total:

• Daily Copy Amount: Limits the daily margin used to copy trades from a specific trader, helping you manage high-frequency or large-volume trading styles.

• Max Copy Amount: Caps the total amount you allocate to a trader, ensuring you don’t exceed your intended budget or risk threshold.

By setting both limits, you can prevent sudden overexposure to any one trader or strategy, especially useful in fast-moving markets or when copying aggressive traders. These tools are ideal for beginners looking to stick to a disciplined allocation plan.

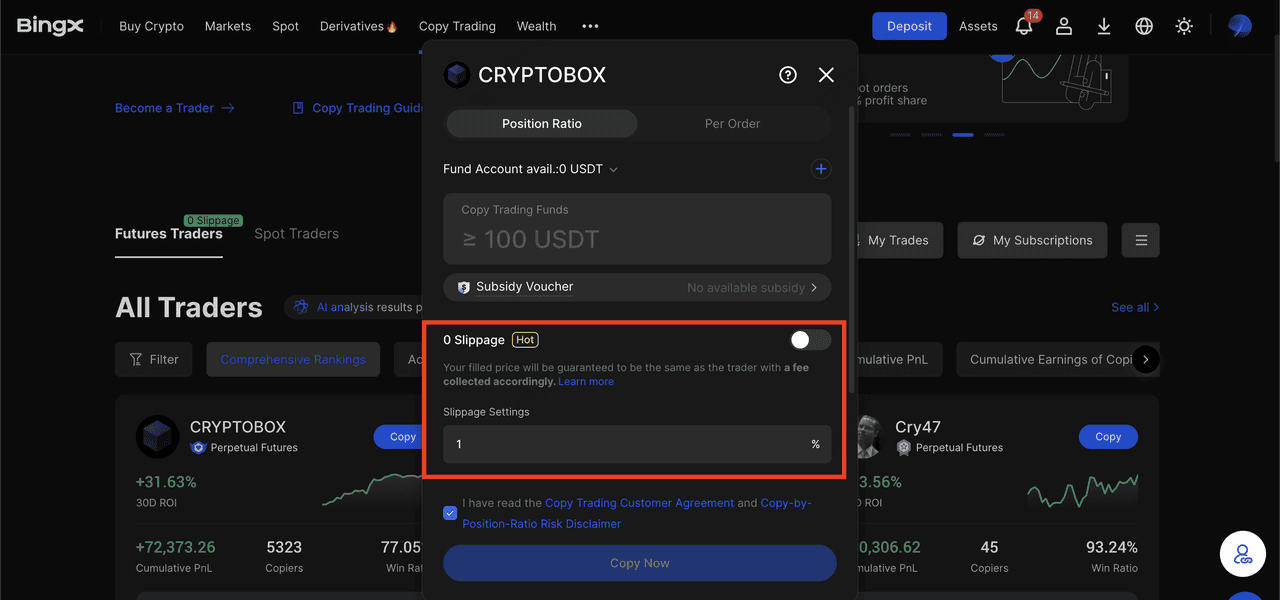

5. Try Copy Trading with 0 Slippage

Slippage is when a copied trade gets executed at a different price than the original trade, usually caused by market volatility or execution delays. BingX’s

Copy with 0 Slippage feature ensures your copy order matches the exact execution price of the lead trader.

This is especially helpful when copying popular traders with large followings or those who trade volatile pairs. While this feature includes a small fee, it significantly improves execution accuracy and fairness, helping you avoid hidden costs from price mismatches.

Final Thoughts

Copy trading on BingX makes it easier to follow professional strategies, but it’s important to understand that it’s not a guaranteed path to profit. Success comes from pairing automation with smart risk management. That means setting clear goals, defining how much you’re willing to risk, and using built-in tools like Take Profit/Stop Loss, daily margin caps, and Copy with 0 Slippage. Diversifying across multiple traders with different styles can also help reduce the impact of a single trader's poor performance.

Even experienced traders have losing streaks, and market volatility can affect outcomes quickly. That’s why it’s essential to monitor your copy trading portfolio regularly and adjust when needed. Avoid emotional decisions, start small, and never invest more than you’re comfortable losing. With the right mindset and tools, copy trading on BingX can be a powerful way to grow your portfolio steadily while staying protected from unnecessary risks.

Related Reading