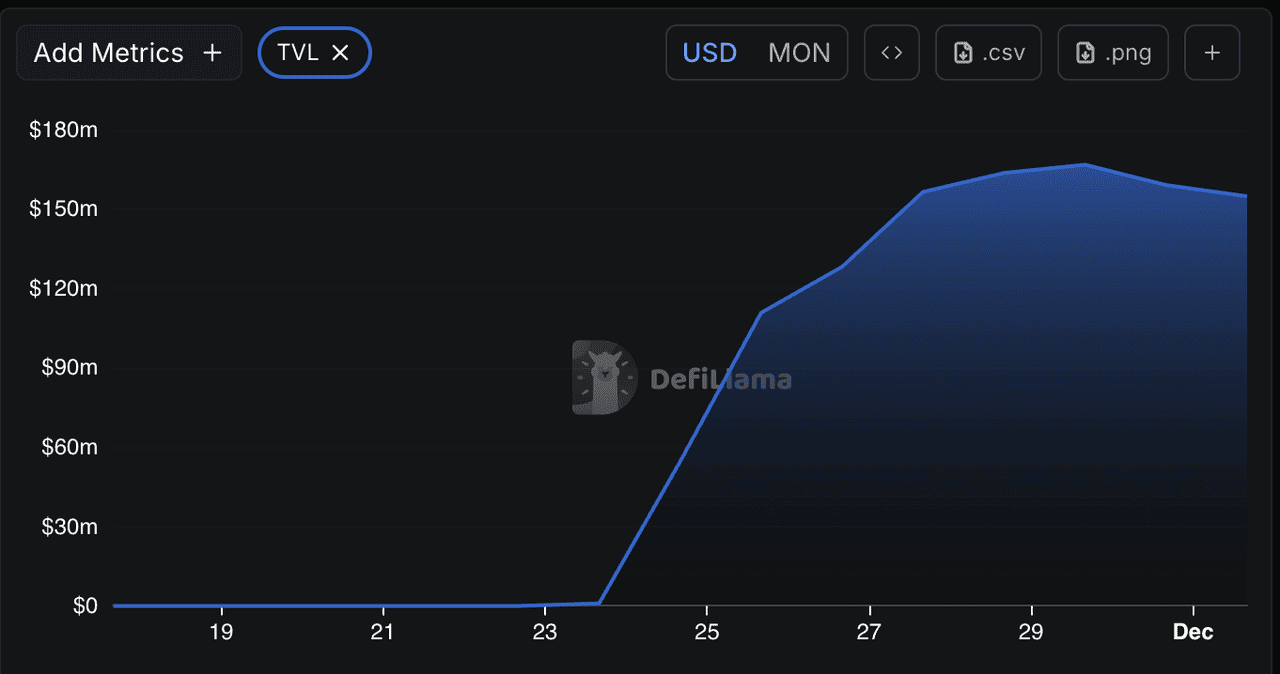

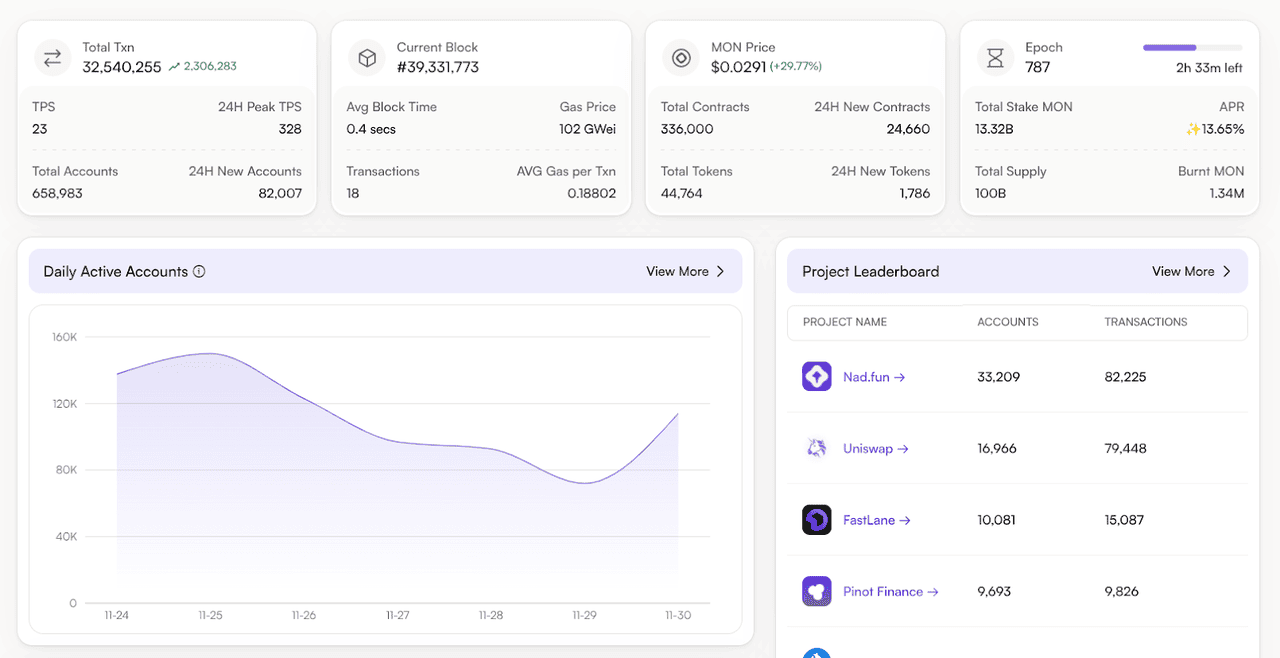

Staking Monad (MON) puts you at the center of a rapidly growing

Layer-1 ecosystem that has already surpassed $158 million in TVL (total value locked), processed 3.7 million transactions on day one, and onboarded 153,000+ active addresses. By connecting your wallet to Monad, you tap into a next-generation EVM-compatible blockchain built for 10,000+ TPS, 400 ms block times, and sub-1-second finality, all while paying gas fees that average fractions of a cent. Powered by a pipelined, multi-threaded execution engine and a circulating supply of around 10.8 billion MON, the network is seeing accelerating developer adoption and rising validator participation, driving a surge in demand for MON staking.

This guide breaks down what Monad is, why staking is gaining traction, and how to stake MON step-by-step using MetaMask to earn rewards and support the network.

What Is Monad (MON) Layer 1 EVM Blockchain and How Does It Work?

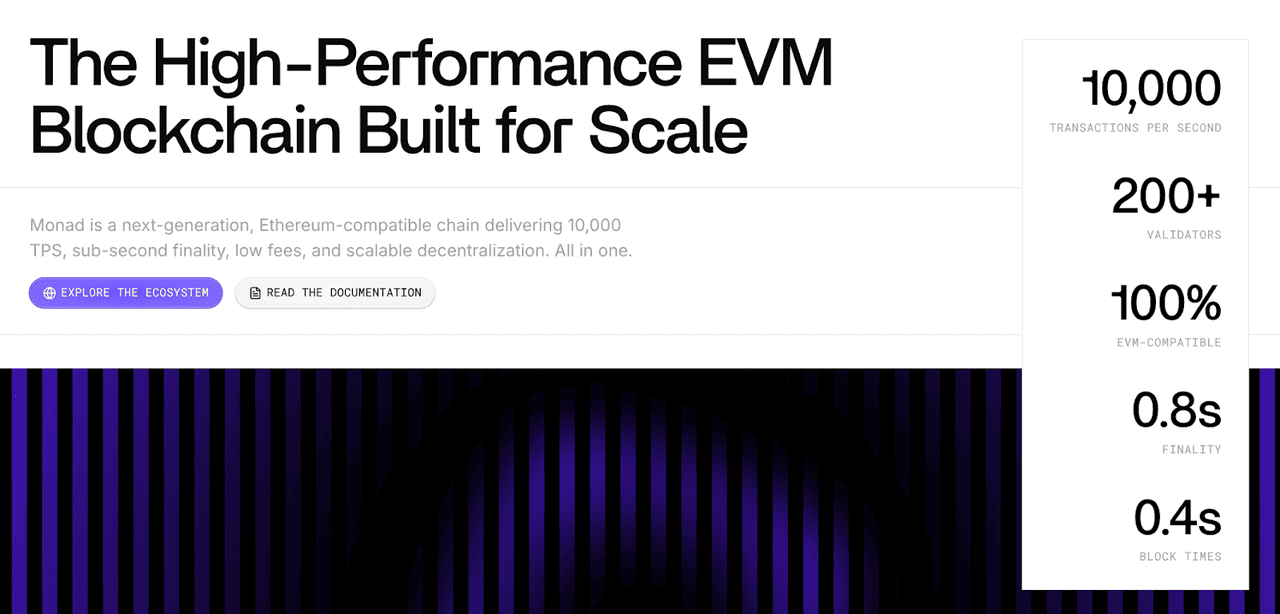

Monad is a high-performance

Layer-1 blockchain founded in 2022 by Keone Hon and James Cowling, designed to deliver full EVM bytecode compatibility with far higher throughput than today’s major L1s. Its deterministic parallel execution engine processes non-conflicting transactions simultaneously, supported by a pipelined, multithreaded architecture that targets tens of thousands of TPS with sub-$0.01 gas fees. Blocks are produced every 400 ms under MonadBFT, with finality reached in roughly 800 ms, around 2 blocks. The native token MON powers gas fees, validator

staking, and network incentives.

Monad supports 128 KB contract sizes, uses MonadDB, a high-concurrency storage engine optimized for fast state access, and aims for a 150–200 validator set with consumer-grade hardware to keep decentralization accessible. Developers can deploy Solidity contracts without modification thanks to complete EVM equivalence. During testnet and early mainnet phases, Monad processed billions of transactions, demonstrating stable performance at scale. With its combination of high throughput, low latency, and EVM compatibility, Monad is engineered for bandwidth-intensive applications such as DeFi, NFT marketplaces, on-chain games, real-time social apps, and Web3 payments.

Why Is MON Staking Gaining Traction?

MON staking is gaining momentum as the Monad network shows strong on-chain growth and rising ecosystem activity. With over $158 million in TVL, 3.7 million transactions on launch day, and more than 153,000 active addresses, user participation is accelerating. The circulating supply of 10.8 billion MON out of a fixed 100 billion total, combined with an expanding validator set, has increased delegation demand as more nodes compete for stake and rewards. Developer activity is also climbing, with new DeFi protocols, wallets, bridges, and tooling launching across the Monad ecosystem which boasts nearly 100 dApps as of December 2025.

Users are staking MON to earn rewards while supporting a high-throughput L1 capable of 10,000+ TPS and seamless EVM compatibility. Low gas fees, sub-second finality, and strong early-stage momentum make Monad an attractive network for real-time applications such as trading, gaming, and payments. As more users lock MON for staking, circulating supply tightens, validator competition increases, and long-term network participation continues to strengthen.

What Is MonadVision for Staking on Monad?

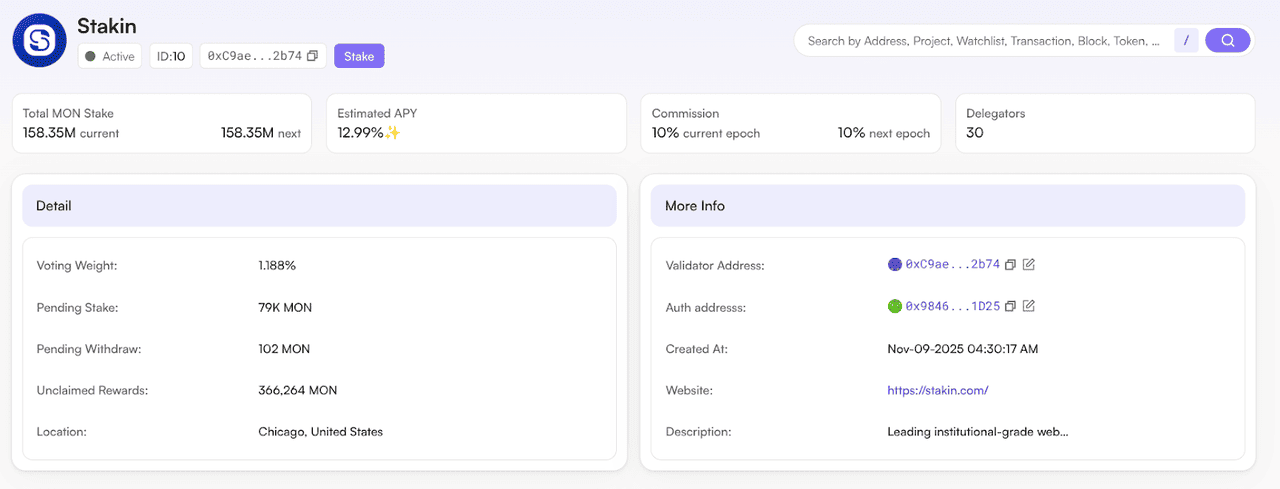

MonadVision is Monad’s official analytics and staking dashboard, offering real-time data on validator performance, uptime, commission rates, stake concentration, block-signing history, and missed blocks. It includes epoch-by-epoch stats, performance heatmaps, delegation flow charts, historical reward data, slashing-risk indicators, and sortable leaderboards to compare validator reliability.

Each validator profile displays commission %, total delegated MON, active-set status, and detailed signed-vs-missed block logs. With 100 billion MON total supply and about 10.8 billion circulating as of December 2025, top validators routinely manage 1–1.5 million+ MON in delegated stake. Because staking returns depend on uptime and commission levels, MonadVision provides delegators with transparent, quantitative data to assess validator performance and minimize risk.

Alternatives for MON Staking

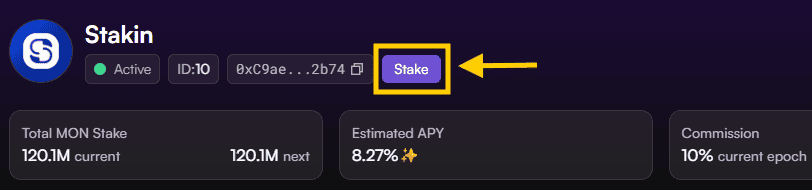

Besides MonadVision, users can stake MON through several reputable third-party validator platforms, including Nansen, Stakin, Everstake, Figment, and P2P.org, all of which operate professional-grade validators and offer their own dashboards for delegating MON and tracking rewards. These alternatives provide additional features such as enhanced analytics, institutional-level infrastructure, and simplified staking interfaces, while still allowing users to delegate MON non-custodially through standard EVM wallets like MetaMask.

How to Stake MON Tokens on Monad Blockchain: Step-by-Step Guide

This section explains the general process of staking MON regardless of which wallet you use.

1. Buy MON on BingX and Fund Your Wallet

To stake MON, you must first buy it on a supported exchange like BingX, then transfer it to an

EVM wallet like MetaMask. Here's our full guide on how to set up your

MetaMask wallet.

MON is officially listed on the BingX Spot Market. Here's how to approach buying and trading MON:

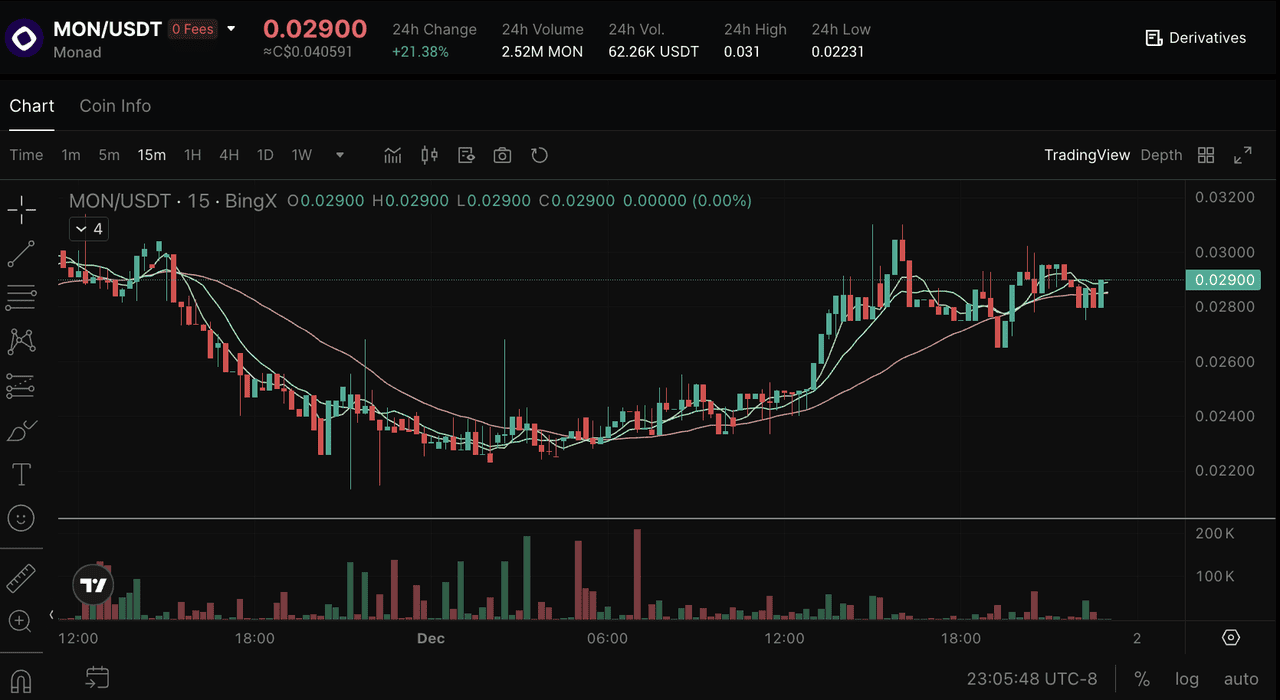

MONAD/USDT trading pair on the spot market powered by BingX AI insights

1. Create, verify, and fund your BingX account using supported payment methods such as bank transfer, SWIFT, card payments,

P2P, or

crypto deposits.

3. Place a market order for instant execution, or a limit order if you want a specific entry price.

4. Use limit orders and monitor liquidity and slippage. Initial listing periods often bring sharp price swings and thin order books.

5. Transfer MON from BingX to your MetaMask or any EVM wallet. Copy your wallet address, withdraw MON from BingX, and confirm the transaction on-chain. Once transferred, your wallet becomes eligible for staking and on-chain activity.

2. Connect Your Wallet to the Monad Network

Add the Monad RPC to your wallet by entering the correct network name, RPC endpoint, chain ID, and explorer link. After adding the network, switch your wallet to Monad, so transactions execute on the correct chain.

Network Details

• Network Name: Monad Testnet

• RPC Endpoint: https://testnet-rpc.monad.xyz

• Chain ID: 10143

• Explorer Link: https://testnet.monadexplorer.com

Source: Stakin

3. Choose a Validator

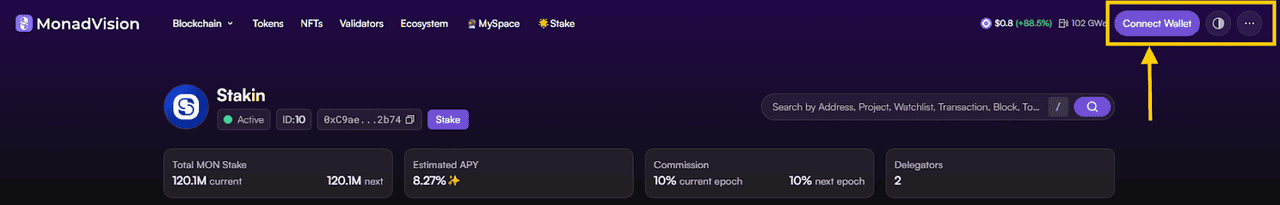

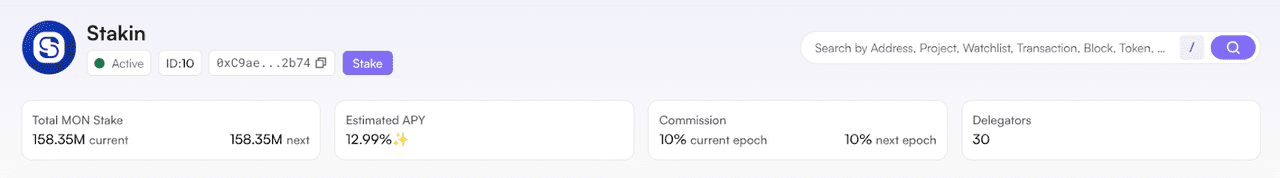

Visit a validator dashboard such as MonadVision to compare commission rates, total delegated MON, uptime, and reliability. Validators with high uptime and moderate commissions often benefit delegators with consistent rewards.

Source: MonadVision

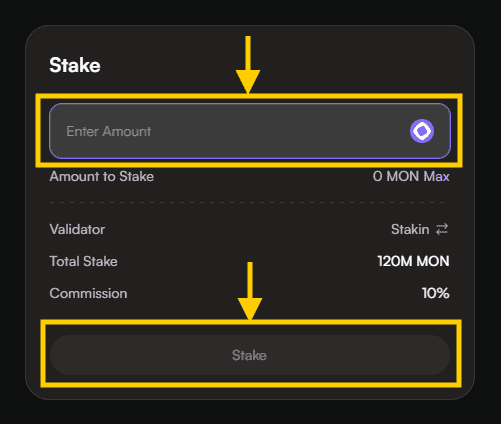

4. Delegate MON to Validator

Open the staking interface, select the validator, enter the amount of MON you want to delegate, and approve the transaction through your wallet. Delegations typically activate after the next epoch, depending on the network's staking cycle.

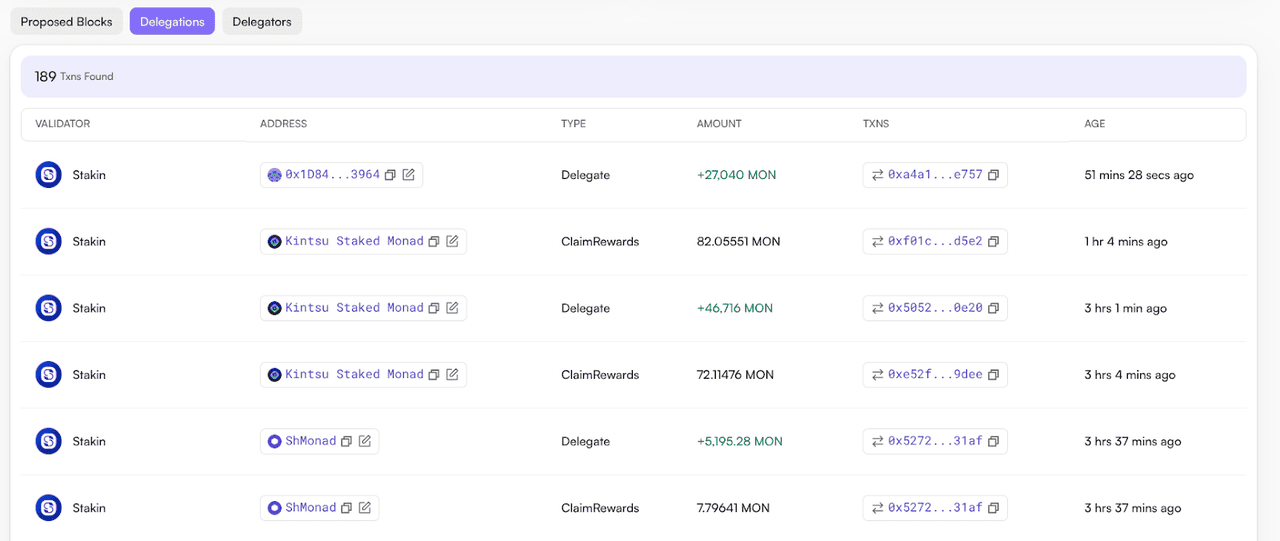

Source: Stakin

5. Monitor MON Staking Rewards

Staking rewards accumulate based on the validator's performance. Users can claim rewards, redelegate to another validator, or increase stake by delegating additional MON. Monitoring tools make it easy to track reward growth over time.

Source: MonadVision

How to Stake Monad (MON) With MetaMask

Staking Monad (MON) with MetaMask is a simple process that lets you earn passive rewards by delegating your tokens to reliable validators on the Monad network. Here's how to stake MON tokens via MetaMask:

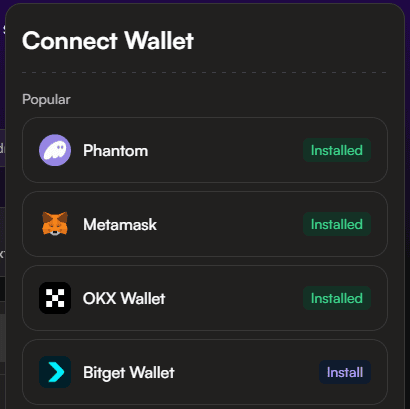

Step 1: Connect Your MetaMask Wallet to Monad Network

Open the official staking interface on MonadVision or a validator's page. Click the “Connect Wallet” button in the top right corner and select

MetaMask from the options. Approve the connection request in MetaMask so your wallet is linked to the staking portal.

Source: Stakin

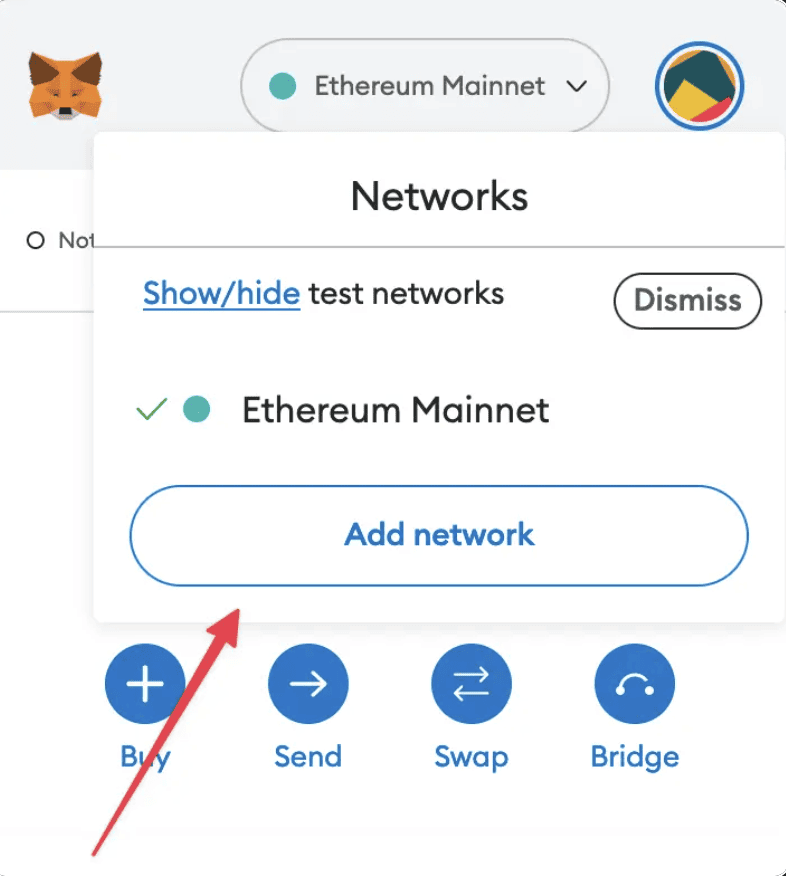

Step 2: Add the Monad Network to MetaMask

If MetaMask is not yet set up for Monad, add the network by selecting “Add Network” and then “Custom Network.” Enter the required RPC information for the Monad blockchain and switch MetaMask to this network. This ensures that all MON transactions are processed correctly.

Network Details

• Network Name: Monad Testnet

• RPC Endpoint: https://testnet-rpc.monad.xyz

• Chain ID: 10143

• Explorer Link: https://testnet.monadexplorer.com

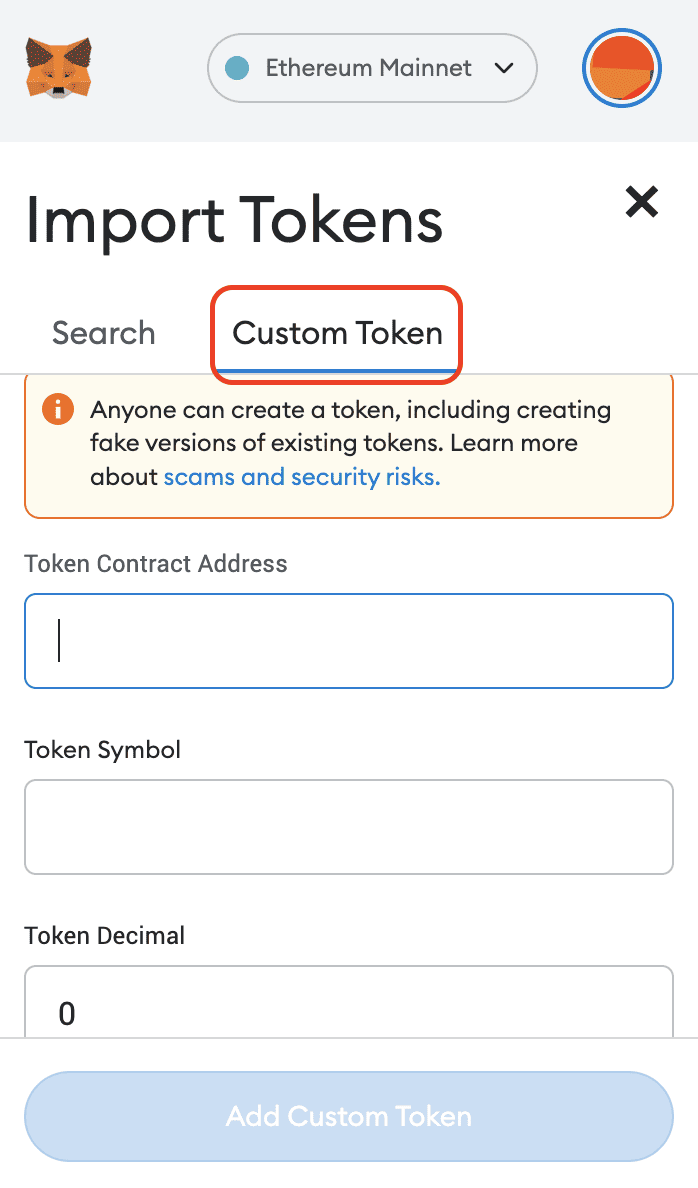

Step 3: Import Your MON Token

To see your MON balance, import the MON token into MetaMask using its contract address. This allows your wallet to display the correct balance and makes it easy to confirm how much you have available for staking.

Step 4: Choose a Monad Network Validator

Navigate to the list of validators on the staking interface. Review validator information such as uptime and performance, and select the one you trust. Delegating to a validator is how your MON participates in securing the network and earning rewards.

Source: MonadVision

Step 5: Delegate your MON tokens

Enter the amount of MON you wish to stake with your chosen validator and click the “Stake” or “Delegate” button. Confirm the transaction in MetaMask. Gas fees on Monad are extremely low, usually under one cent per transaction, due to its high-performance execution model.

Source: Stakin

Step 6: Track and Manage Your MON Staking

Once the transaction is confirmed, your MON is actively staked. You can track your delegation, claim rewards, or redelegate at any time using MetaMask or the staking dashboard. Staking is non-custodial, so you retain full control of your tokens while contributing to network security.

Source: Stakin

Conclusion

Staking MON on the Monad network enables users to support a high-performance Layer-1 that emphasizes EVM compatibility, low fees, and parallel execution. The ecosystem continues to expand in validator participation, total staked MON, and developer activity as more applications deploy on its optimized infrastructure. By staking through MetaMask or any supported wallet, users contribute to network security and decentralization while earning rewards tied to validator performance and stake size.

However, staking carries risks, including validator downtime, slashing penalties (if implemented), smart contract vulnerabilities, and potential token price volatility. Users should review validator metrics carefully, understand lock-up conditions, and only stake amounts aligned with their risk tolerance.

Related Reading