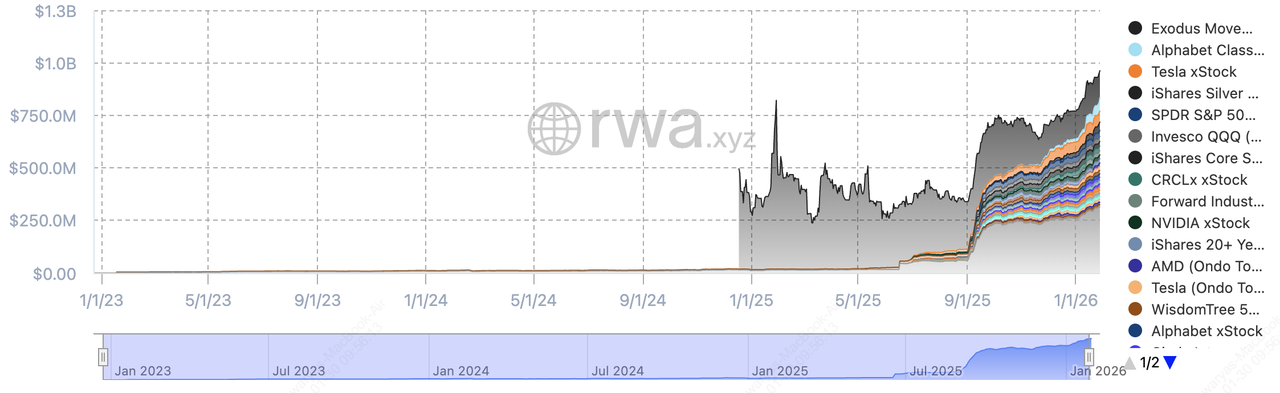

Tokenized stocks are rapidly transforming how global investors access equities. In less than a year, on-chain stock tokens have crossed over $2 billion in monthly transfer volume as of January 2026, with hundreds of thousands of active wallets trading digital versions of companies like

Tesla,

Apple, and

NVIDIA using crypto, often starting from just a few dollars and trading nearly 24/7.

Total value of tokenized stocks | Source: RWA.xyz

Instead of relying on traditional brokers, multi-day settlement, and limited market hours, tokenized stocks let you trade blockchain-based assets that track real share prices on networks such as

Solana and

Ethereum, with near-instant settlement and global accessibility. This shift is attracting both retail traders and institutions as legacy exchanges and regulators move toward

on-chain equity infrastructure.

Today, centralized platforms like BingX offer tokenized stocks alongside crypto trading, while advanced users can access the same assets through DeFi protocols,

DEXs like

Raydium, and multi-chain

web3 wallets.

In this guide, you’ll learn what tokenized stocks are, how they work, where to buy them safely, how to purchase tokenized stocks step by step on BingX, and the key risks and best practices you should understand before investing in tokenized equities.

What Are Tokenized Stocks and How Do They Work?

In a standard tokenization model:

• A regulated issuer or partner entity acquires real shares on traditional markets.

• These shares are held with licensed custodians.

• For each share held, one on-chain token is minted with 1:1 economic backing, ensuring the token closely tracks the underlying stock price.

Once issued, tokenized stocks trade on crypto infrastructure rather than legacy stock rails. They are listed on centralized exchanges like BingX and can also move across blockchains such as Solana, Ethereum, and

BNB Chain, enabling near-instant settlement and global transferability. Some platforms support redemption mechanisms (mainly for institutions), where tokens can be redeemed for cash equivalents and burned to preserve the 1:1 backing model. Retail users typically trade tokens for price exposure rather than redemption into physical shares.

Important: In most cases, tokenized stocks provide economic exposure only. They usually do not include voting rights, direct shareholder registration, or full corporate governance protections unless explicitly issuer-approved.

Why Buy Tokenized Stocks in 2026?

Tokenized equities are moving from niche experimentation to early mainstream financial infrastructure in 2026. As of January 2026, on-chain stock markets process over $2 billion in monthly transfer volume, with hundreds of thousands of active wallets holding tokenized equities across Ethereum, Solana, and BNB Chain. Institutional adoption is accelerating: platforms like

Ondo Global Markets alone have surpassed $500 million in tokenized stock TVL in under six months, while legacy exchanges such as the NYSE and Nasdaq are actively building regulated venues for 24/7 tokenized equity trading. At the same time, regulators have clarified how issuer-approved tokenized stocks fit within existing securities frameworks, reducing structural uncertainty and paving the way for broader adoption.

What Are the Key Benefits of Investing in Tokenized Equities?

Against this backdrop, tokenized stocks offer a set of practical advantages that traditional equities cannot match:

1. Near-24/7 Trading Access: Tokenized stocks trade almost continuously on crypto platforms, allowing you to react to earnings, macro news, or geopolitical events outside traditional market hours.

2. Fractional Ownership at Low Entry Cost: You can buy small fractions, often $10–$50 worth, of high-priced stocks like Tesla, Nvidia, or Amazon without purchasing a full share.

3. Global Market Access: Tokenized equities let users outside the U.S. access

U.S. stocks using crypto or

stablecoins, even where traditional brokerage access is limited.

4. Fast, On-Chain Settlement: Trades settle on-chain in seconds or minutes, compared with traditional T+2 or T+1 settlement cycles, reducing counterparty and funding risk.

5. DeFi Integration and Capital Efficiency: Tokenized stocks can be used as collateral, integrated into liquidity pools, or embedded in structured DeFi strategies, unlocking use cases not possible with traditional shares.

Where Can You Buy Tokenized Stocks Safely?

When investors search for where to buy tokenized stocks, they are usually looking for three things: regulatory clarity, reliable liquidity, and ease of use. In 2026, tokenized equities are mainly available through centralized exchanges (CEXs) and, for advanced users, on-chain DeFi platforms and Web3 wallets.

1. Centralized Exchanges (CEXs)

For most users, centralized exchanges are the safest and most practical way to buy tokenized stocks. Platforms like BingX combine familiar trading interfaces with crypto-native access to global equities, eliminating the need for a traditional brokerage account.

BingX supports tokenized stocks across spot and futures markets, offering diversified exposure, transparent pricing, and institutional-grade liquidity. Users trade with

USDT, while the platform manages custody integrations, KYC, and compliance checks behind the scenes.

i. Spot Tokenized Stocks on BingX

BingX lists a growing lineup of 35 spot tokenized equities as of early 2026, giving users unleveraged, 1:1 price exposure to major U.S. stocks without the complexity of traditional brokerage accounts. These assets are primarily issued by institutional providers such as Ondo Global Markets and xStocks, and include blue-chip names like

Alphabet (GOOGLon),

Apple (AAPLx),

NVIDIA (NVDAX),

Microsoft (MSFTx), and

Amazon (AMZNx), alongside market-wide trackers such as

S&P 500 tokenized exposure (SPYon) and tokenized ETFs like

SLVon. BingX also supports

Solana-based xStocks, which offer lower network fees and near-instant settlement, making them well-suited for active traders, while fractional pricing allows users to start with as little as $10–$50 per trade.

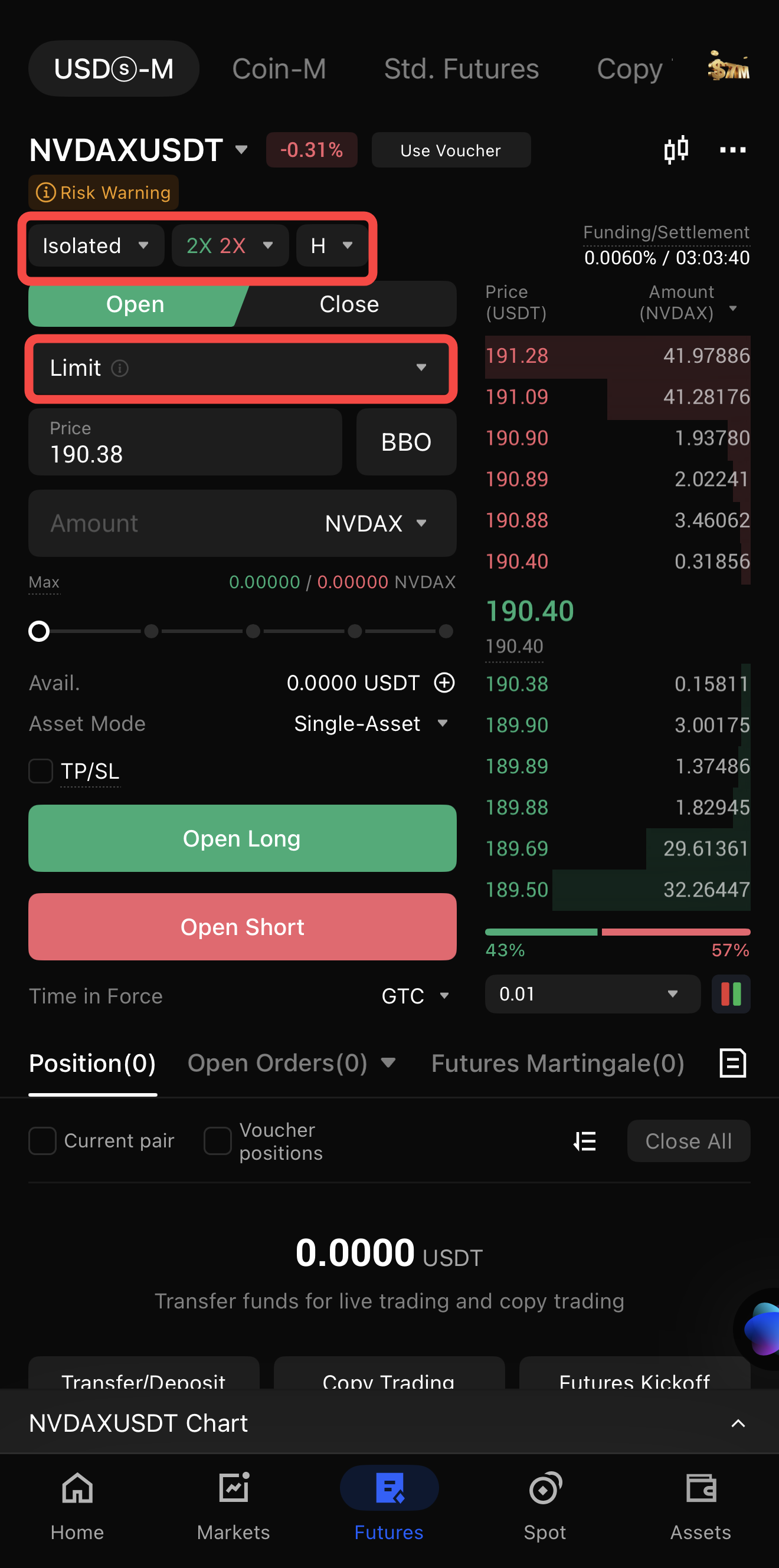

ii. Tokenized Stock Futures on BingX

For more active traders, BingX offers 26 tokenized stock futures markets backed by institutional liquidity providers such as NCKS, enabling leveraged exposure to major global equities and U.S. index benchmarks. These futures contracts cover leading names including Tesla (TSLA), Apple (AAPL), NVIDIA (NVDA), and Alphabet (GOOGL), alongside index-linked products that track broader U.S. equity performance. Tokenized stock futures on BingX support long and short positions, adjustable leverage, and margin controls, allowing traders to hedge risk or speculate on price movements nearly 24/7, including during earnings releases, macro events, and periods when traditional stock markets are closed.

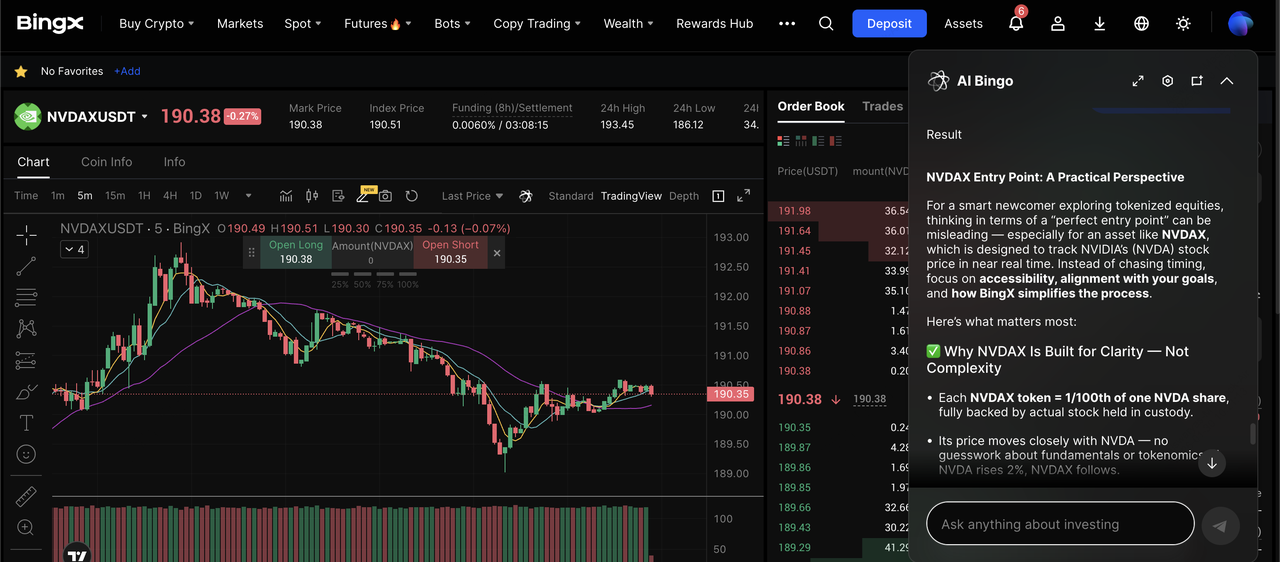

To assist decision-making, BingX AI Insights delivers real-time market analysis, trend signals, and volatility indicators, helping users navigate both spot and futures tokenized-stock markets with greater confidence.

2. Decentralized Exchanges (DEXs) and Web3 Wallets

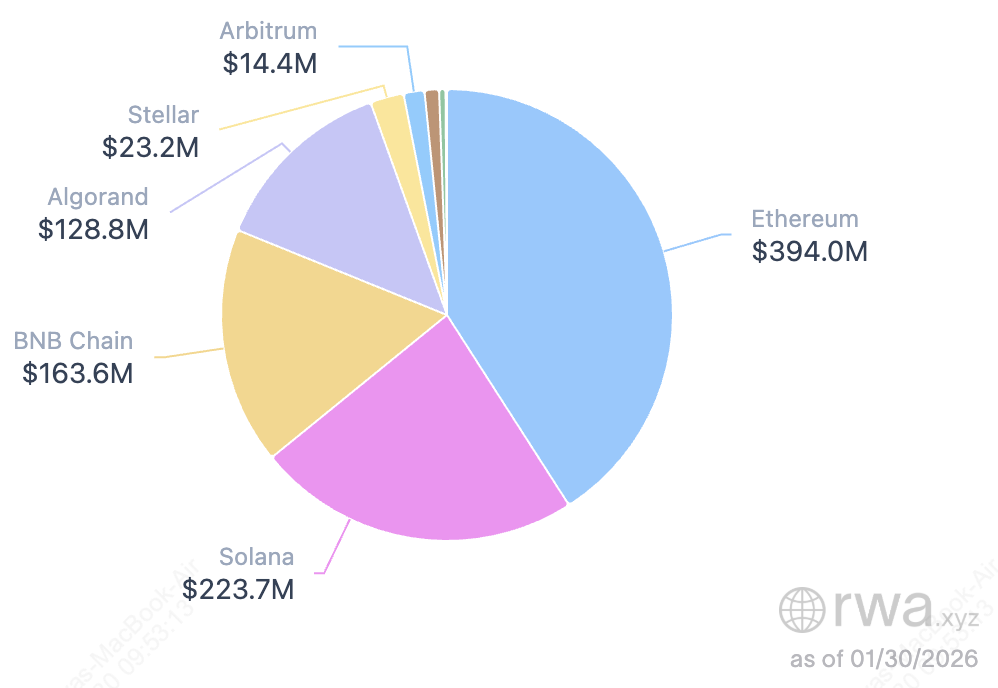

Total RWA value by blockchain network | Source: RWA.xyz

Advanced users can also access tokenized stocks directly on-chain via

decentralized exchanges and Web3 wallets, where liquidity is concentrated primarily on Ethereum and Solana. As of January 2026, Ethereum-based

tokenized RWAs account for over $394 million in on-chain market value, while Solana-based tokenized RWAs exceed $223 million, supported by faster execution speeds and lower transaction fees. On-chain access allows users to swap stablecoins for tokenized equities, self-custody assets in Web3 wallets, and deploy tokenized stocks across DeFi use cases such as lending, collateralization, and liquidity pools, offering greater composability and capital efficiency, but with higher technical complexity and smart-contract risk compared to centralized platforms.

However, decentralized access comes with higher complexity and risk. Users must manage private keys, smart-contract exposure, and often face lower liquidity and wider spreads than on centralized exchanges. For this reason, DEX-based tokenized stock trading is best suited for experienced users comfortable with self-custody and DeFi mechanics.

How to Trade Tokenized Stocks on BingX Web

BingX combines deep liquidity, institutional tokenized stock providers like

Ondo Global Markets and xStocks, and BingX AI insights to make buying and selling nearly 40 tokenized equities simple, fast, and accessible, making it one of the most user-friendly platforms to trade tokenized stocks in 2026. Trading tokenized stocks on the BingX website is ideal if you prefer a larger screen, advanced charts, and full market visibility.

Step 1: Log in and Complete Verification

Sign in to your BingX account and complete identity verification (

KYC) if required.

Step 2: Fund Your Account

Deposit or transfer USDT into your BingX account, then move funds from your Fund Account to either your Spot Wallet or Futures Wallet, depending on how you plan to trade.

Buy or Sell Tokenized Stocks on the Spot Market (Web)

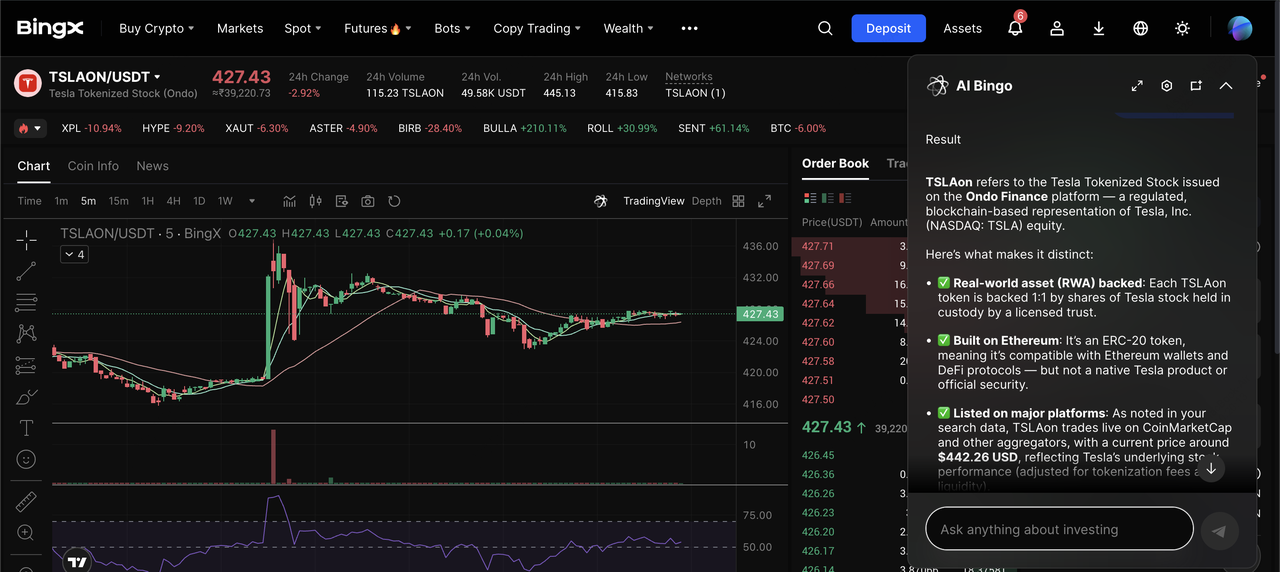

TSLAON/USDT trading pair on the spot market powered by BingX AI insights

Spot trading is best if you want direct, unleveraged price exposure to tokenized equities.

1. Navigate to Spot Market: Go to

Spot to access tokenized stocks such as

AAPLx,

NVDAX, or

TSLAon, designed for long-term holding or simple buy-and-sell strategies.

2. Select a trading pair: Search for your preferred tokenized stock and open its spot trading page.

3. Place your order: Choose a market or limit order and enter the amount you want to buy or sell.

4. Monitor with BingX AI Insights: Track price trends, volatility, and market sentiment using real-time AI-powered analytics.

Long or Short Tokenized Stocks with Leverage on Futures Market (Web)

NVDAX/USDT perpetual contract on the futures market powered by BingX AI insights

Futures trading is designed for active traders who want leverage, hedging tools, and two-way exposure.

1. Navigate to Futures Market: Go to Futures to access tokenized stock futures covering major equities and indices.

3. Configure leverage and margin: Set leverage, margin mode, and risk parameters like

stop-loss/take-profit before entering the trade.

4. Open a long or short position: Trade both rising and falling markets using long or short positions.

5. Manage positions with BingX AI Insights: Use AI-driven signals and risk indicators to monitor exposure and adjust positions in real time.

How to Trade Tokenized Equities on the BingX App

The BingX mobile app lets you trade tokenized stocks anytime, anywhere, combining fast execution with

BingX AI-powered insights for real-time market tracking and risk management.

Step 1: Log in and Complete Verification

Open the BingX app, sign in to your account, and complete identity verification (KYC) if required.

Step 2: Fund Your Account

Deposit or transfer USDT into your BingX account, then move funds from your Fund Account to either your Spot Wallet or Futures Wallet, depending on how you plan to trade.

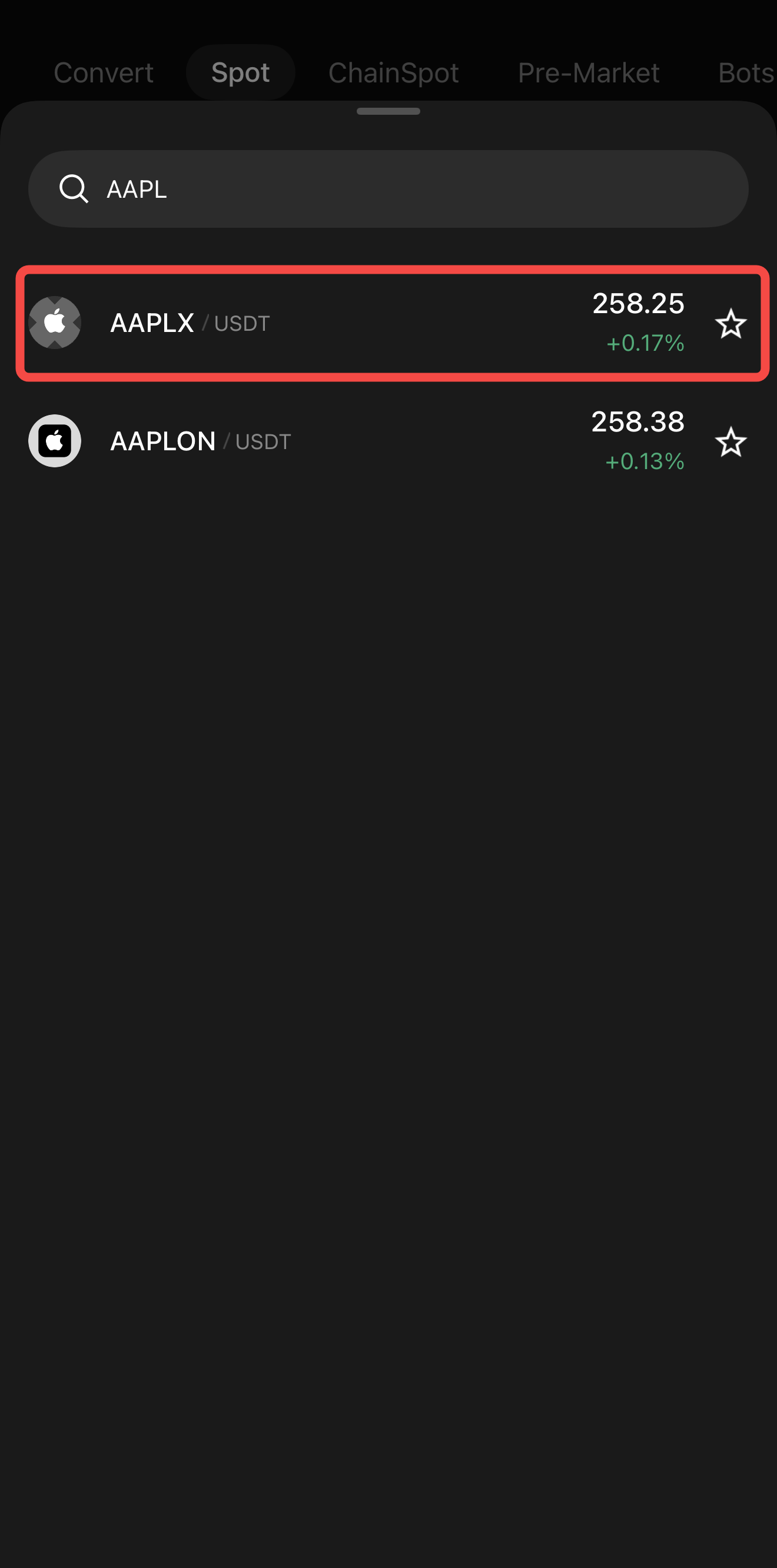

Buy or Sell Tokenized Stocks on Spot Trading (App)

Spot trading on the app is ideal if you want simple, unleveraged exposure to tokenized equities.

1. Tap “Spot:” Open the Spot market to access tokenized stocks such as AAPLx, NVDAX, or SPYon.

2. Search for a tokenized stock: Enter the stock name or ticker to open its trading page.

3. Place your order: Choose a market or limit order and set the amount. Fractional purchases are supported.

4. Monitor with BingX AI analytics: Track price trends, volatility, and market sentiment directly from the app.

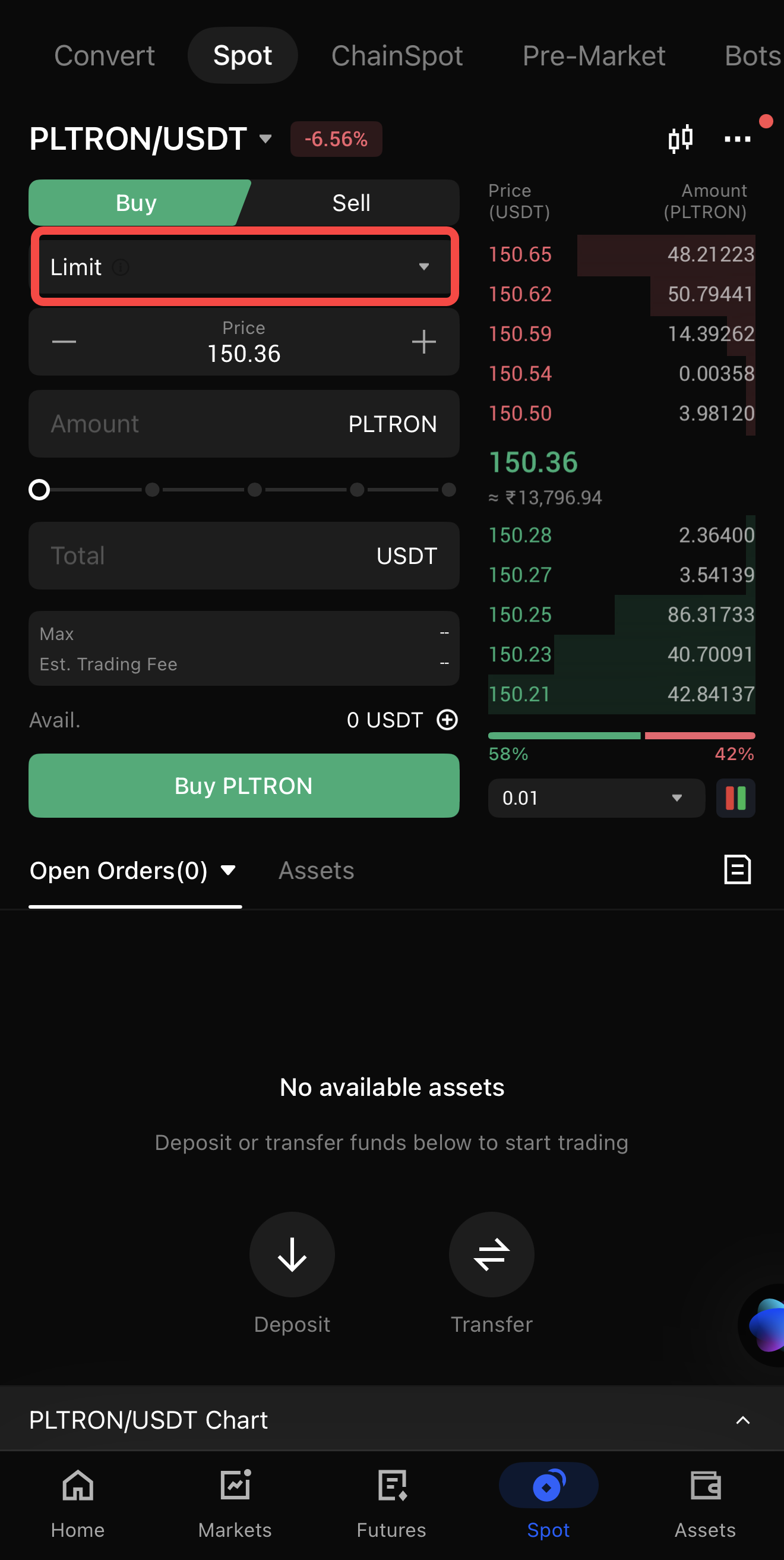

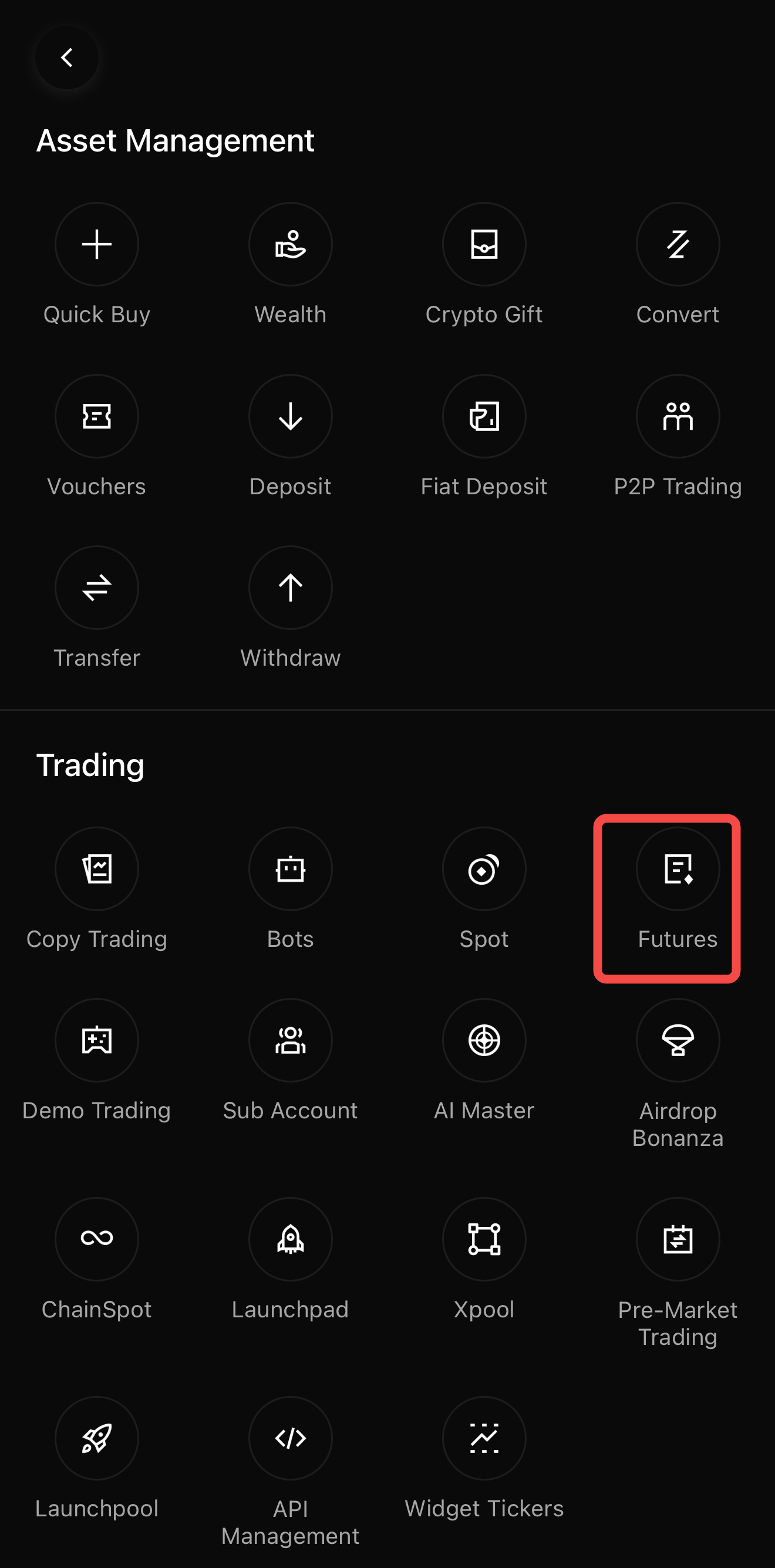

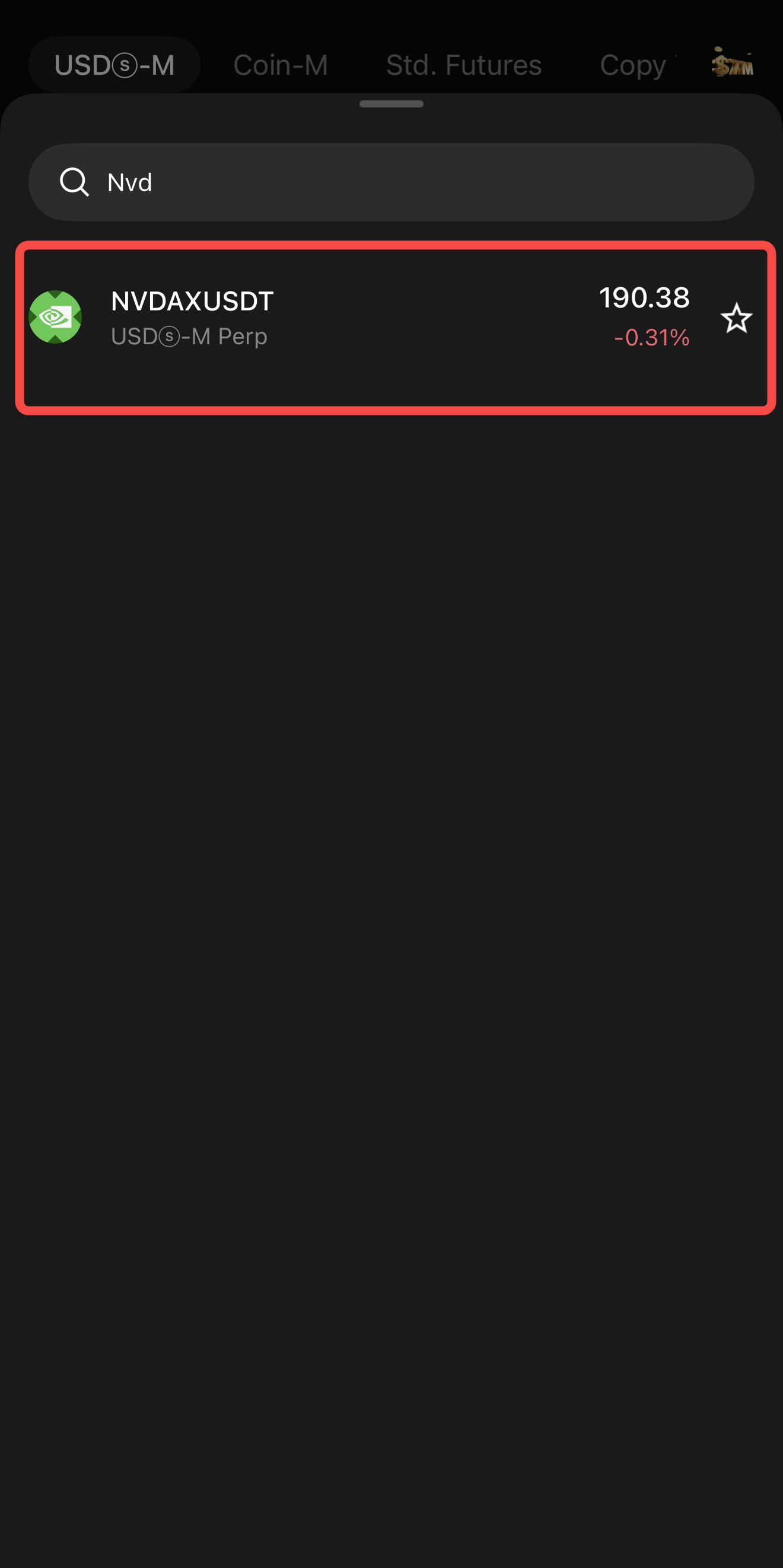

Trade Tokenized Stock Futures with Leverage (App)

Futures trading on the app is designed for active traders seeking leverage and two-way market exposure.

1. Tap “Futures:” Open the Futures section to access tokenized stock futures covering major equities and indices.

2. Select a futures contract: Search for the tokenized stock futures pair you want to trade.

3. Configure leverage and margin: Set leverage, margin mode, and risk parameters before opening a position.

4. Open a long or short position: Trade both rising and falling markets with long or short positions.

4. Track positions with BingX AI Insights: Use in-app AI-driven signals and risk indicators to manage positions in real time.

Bottom line: Whether you trade on web or mobile, BingX offers a simple entry point for beginners and advanced tools for active traders, combining tokenized stocks, AI-driven insights, and near-24/7 market access in one platform.

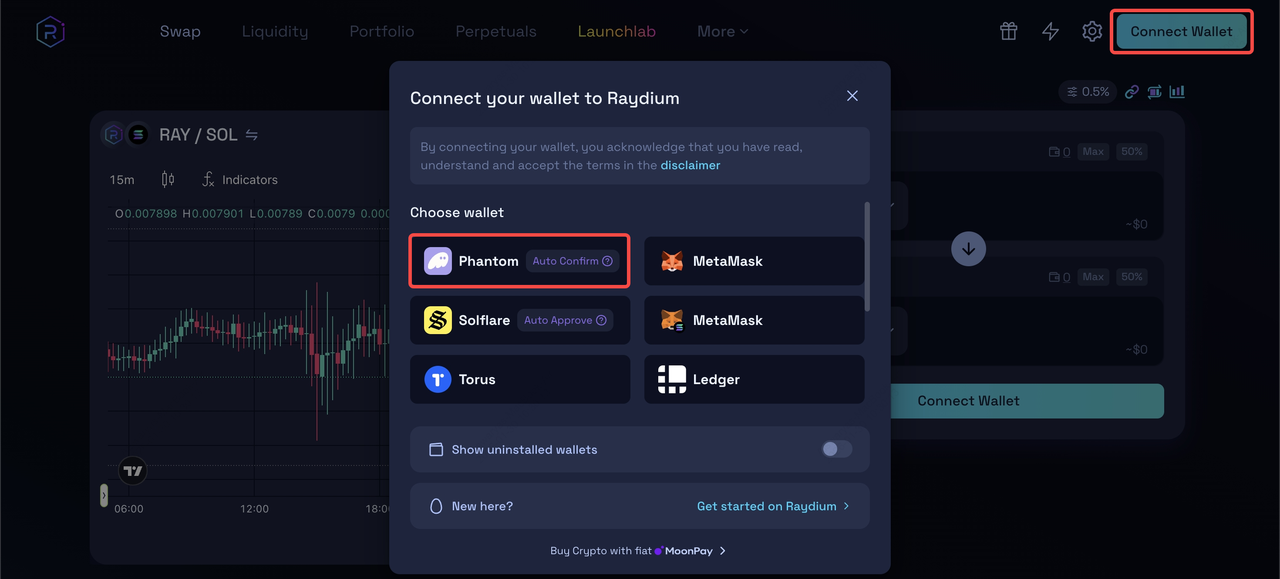

How to Buy Tokenized Stocks On-Chain on DEXs

If you want full self-custody and direct DeFi access, you can buy tokenized stocks on-chain using a Web3 wallet and decentralized exchange (DEX). This approach is popular on Solana and Ethereum, but it is best suited for users already comfortable with wallets, gas fees, and smart-contract risk.

1. Set up a compatible Web3 wallet: Use a wallet that supports the target network and tokenized stock standard. For Solana-based xStocks,

Phantom is commonly used. For Ethereum or EVM-based tokenized stocks,

MetaMask is the standard option.

2. Fund your wallet with stablecoins: Buy USDC or USDT on a centralized exchange such as BingX, then withdraw the funds to your wallet on Solana, Ethereum, or another supported chain. Make sure you select the correct network to avoid loss of funds.

3. Connect to a supported DEX: On Solana, tokenized stocks are commonly traded on DEXs like Raydium or other xStock-compatible venues. Connect your wallet and confirm network access.

4. Swap stablecoins for tokenized stocks: Choose the relevant trading pair, for example, TSLAX/USDC or AAPLx/USDC, review liquidity and price impact, set slippage tolerance, and confirm the swap on-chain.

5. Use or manage tokenized stocks in DeFi: Once acquired, tokenized stocks can be self-custodied, transferred across wallets, or, where supported, used in DeFi applications such as collateralized lending, liquidity provision, or structured yield strategies.

Important considerations: Trading tokenized stocks on-chain offers maximum control and composability, but it also introduces smart-contract risk, wallet security risk, and typically lower liquidity than centralized exchanges. Prices may deviate slightly from CEX markets during volatile periods, and there is no platform-level customer support if transactions fail. For beginners, CEX trading is usually safer; on-chain DEX trading is better suited for experienced users who understand DeFi mechanics.

How to Store Tokenized Stocks Securely

How you store tokenized stocks depends on where you trade them and your experience level. For most users, custodial storage on a regulated exchange is the safest and simplest option, while self-custody wallets are better suited to advanced users who actively use DeFi.

If you buy tokenized stocks on BingX, your assets are stored in your Spot Wallet, protected by platform-level custody, withdrawal risk controls, address whitelisting, and mandatory security features such as

2FA and account monitoring. This setup eliminates private key management and significantly reduces the risk of user-side errors, making it the preferred choice for beginners and active traders who prioritize convenience and liquidity.

If you trade tokenized stocks on-chain via DEXs, storage shifts to self-custody Web3 wallets such as Phantom or MetaMask. While this offers full ownership and DeFi access, it also introduces additional risks, including private key loss, phishing attacks, smart-contract vulnerabilities, and irreversible errors from sending tokens to incorrect addresses. There is no recovery mechanism if access is lost.

Best practices: always verify token contract addresses, enable all available security settings, back up recovery phrases offline, and choose a storage method that aligns with your technical experience and risk tolerance.

What Are the 5 Key Considerations When Buying Tokenized Stocks?

If you’re new to tokenized equities, a disciplined approach matters; these assets follow real equity markets but trade on crypto rails, which can amplify volatility outside U.S. market hours.

1. Start small and observe behavior first: Begin with modest allocations, for example, $10–$50 per position, to understand how tokenized stocks move during earnings releases, macro news, and overnight sessions when traditional markets are closed.

2. Prioritize high-liquidity blue-chip stocks: Focus initially on widely traded names such as Tesla, Apple, NVIDIA, and Alphabet, which tend to have tighter spreads, deeper liquidity, and more reliable price tracking than smaller or niche tokenized equities.

3. Start on a reputable centralized platform: Use a regulated, high-liquidity exchange such as BingX, which provides KYC, custody safeguards, audited market data, and institutional liquidity, before moving to DEXs or self-custody setups.

5. Manage portfolio-level risk, not just individual trades: Tokenized stocks remain equity-linked assets and can react sharply to tech-sector volatility, rate expectations, and earnings cycles. Balance exposure across tokenized stocks, crypto assets, and stablecoins rather than concentrating solely in equities.

Closing Thoughts: Should You Buy Tokenized Stocks in 2026?

Tokenized stocks are quickly becoming a core on-chain extension of global equity markets. By early 2026, tokenized equities process billions of dollars in monthly transfer volume, support hundreds of thousands of active wallets, and are drawing attention from both crypto-native platforms and traditional institutions building regulated, 24/7 tokenized stock infrastructure. This shift reflects growing demand for faster settlement, fractional access, and global participation, capabilities that traditional equity rails struggle to deliver efficiently.

For beginners, BingX offers a practical and lower-friction entry point, with a curated lineup of spot tokenized stocks (xStocks), institutional liquidity, crypto-based funding, fractional trading starting from small amounts, and a familiar spot-trading interface supported by BingX AI insights. As you gain experience, on-chain trading via DEXs and Web3 wallets can unlock deeper DeFi integration and self-custody, though with higher technical and security responsibilities.

Final reminder: tokenized stocks remain equity-linked assets traded on crypto infrastructure. Prices can be volatile outside traditional market hours, and product structures vary by issuer. Always review product details, understand whether exposure is custodial or synthetic, use strong account security, and invest only capital you can afford to lose.

Related Reading

FAQs on How to Buy Tokenized Stocks

1. Where can I buy tokenized stocks safely?

You can buy tokenized stocks on regulated centralized exchanges such as BingX, which work with institutional issuers and custodians, apply KYC/AML controls, and provide clear disclosures on how each product is structured. Certain EU users can also access tokenized stocks via Robinhood’s European offering. More advanced users may trade tokenized stocks on DEXs like Raydium using Web3 wallets, but this involves self-custody and higher technical risk.

2. Do I actually own the underlying stock when buying a tokenized stock?

In most cases, no. You typically own a blockchain token that provides economic exposure to the stock’s price, while the underlying shares are held by a custodian or issuer. This distinction has been reinforced by regulators and public disclosures, most notably when companies like OpenAI clarified that certain “stock tokens” did not represent direct equity ownership. Voting rights and shareholder privileges usually do not apply unless explicitly stated.

3. Can I trade tokenized stocks 24/7?

Yes, in most cases. Tokenized stocks often trade with extended or near-24/7 availability on crypto exchanges and DEXs, allowing you to react to earnings, macro events, or global news outside traditional U.S. market hours. However, liquidity is usually highest when underlying stock markets are open, and spreads may widen during off-hours or weekends.

4. Are tokenized stocks legal?

Tokenized stocks are generally legal when issued and traded under existing securities or financial regulations, but rules vary by jurisdiction. In Europe, many tokenized equity products operate under established securities frameworks, while global regulators, including the SEC and IOSCO, have clarified that tokenized stocks remain subject to traditional securities laws. Availability, structure, and investor protections differ by country, so always review local regulations and exchange disclosures before trading.

5. Should I trade tokenized stocks on CEXs or DEXs/Web3 wallets?

Choose a CEX like BingX if you want simplicity, KYC-backed security, institutional liquidity, and an easy trading interface for spot or futures tokenized stocks. Opt for DEXs and Web3 wallets only if you are comfortable with self-custody, smart-contract risk, and managing private keys, and if you plan to use tokenized stocks within on-chain DeFi strategies. For most beginners, starting on a CEX like BingX is safer and more practical.