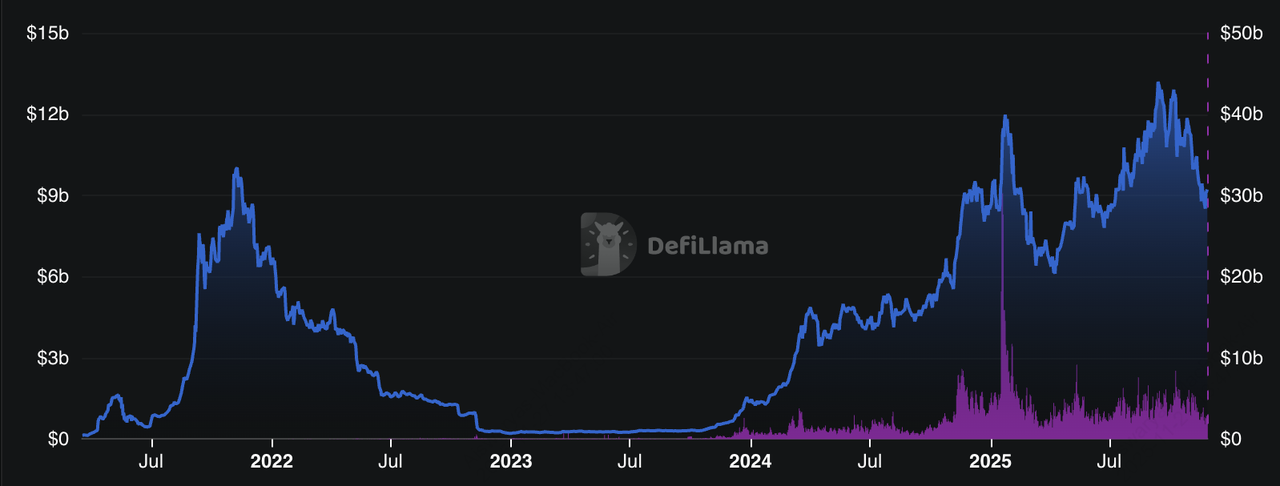

In 2025, cross-chain activity is steadily climbing higher, with total bridging volume across all chains reaching nearly $30 billion in November 2025, with daily transfers hovering around $600–700 million. If you hold

Ethereum (ETH) and want to access the lightning-fast, ultra-low-fee world of

Solana (SOL), for DeFi, NFTs, or yield, bridging is now faster, cheaper, and more secure than ever.

Total bridge volume | Source: DefiLlama

While Ethereum remains the backbone of DeFi, Solana offers blistering throughput of tens of thousands of transactions per second in ideal conditions and near-zero fees. By bridging, you get the best of both ecosystems, liquidity and maturity from Ethereum, plus speed and low cost on Solana.

This guide walks you through the most trusted bridges of 2025, real numbers, and step-by-step instructions to help you move

ETH to Solana without risking your funds.

What Is Solana (SOL)?

Solana is a high-performance

Layer-1 blockchain engineered for speed, scalability, and ultra-low fees. Powered by its hybrid Proof-of-History (PoH) + Proof-of-Stake (PoS) consensus, Solana optimizes the way transactions are ordered, allowing throughput that far exceeds most competing networks.

In typical conditions, Solana processes 1,500–4,000 transactions per second (TPS), with stress tests showing peaks above 50,000 TPS. Average block times hover around 400 milliseconds, and transaction fees generally stay under $0.01, making Solana one of the most cost-efficient blockchains available.

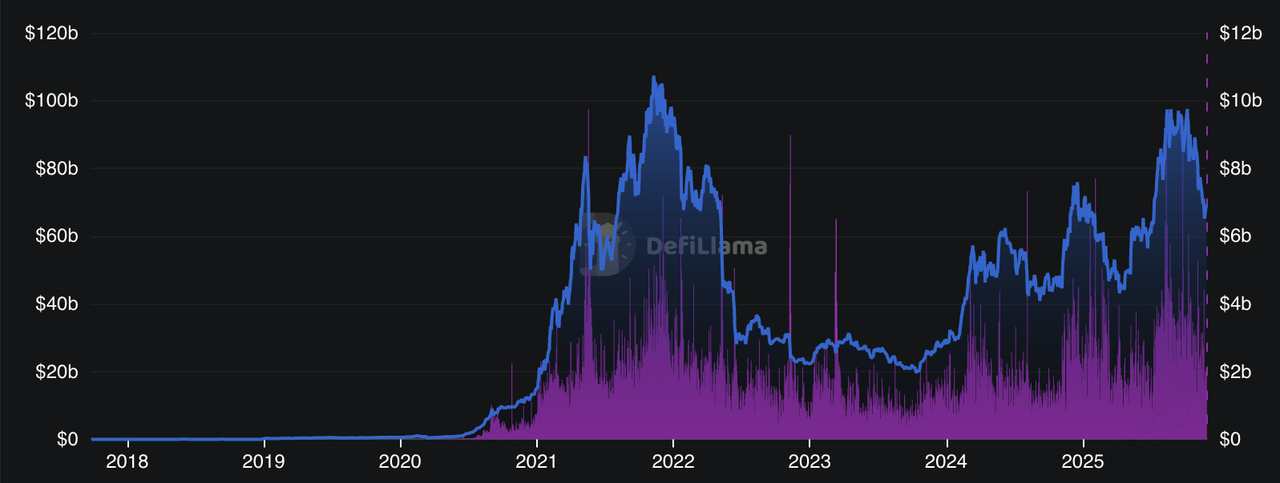

Solana DeFi TVL | Source: DefiLlama

The network’s adoption has surged since 2023. Solana now records tens of billions of dollars in monthly transaction volume, supports millions of active wallets, and powers leading DeFi, NFT, and gaming applications. As of November 2025, the Solana ecosystem accounts for over $9.2 billion in total value locked (TVL). Its combination of speed, affordability, and developer activity positions Solana as one of the most influential chains in Web3.

What Is Ethereum (ETH)?

Ethereum is the world’s most established smart contract platform and remains the largest DeFi ecosystem by total liquidity and developer activity. After its transition to Proof-of-Stake, Ethereum’s block times stabilized at roughly 12 seconds, sustaining 15–30 TPS under normal network load.

Ethereum DeFi TVL | Source: DefiLlama

Despite its lower throughput compared to modern chains like Solana, Ethereum dominates Web3 economics, securing nearly $70 billion in TVL across

lending,

staking,

DEXs,

stablecoins, and

tokenized assets as of November 2025. It hosts thousands of decentralized applications, supports millions of daily active users, and maintains one of the industry's most decentralized validator sets.

Ethereum’s deep liquidity and mature infrastructure make it the primary settlement layer for global decentralized finance.

What Are Crypto Bridges and How Do They Work?

Crypto bridges enable assets to move across blockchains that would otherwise remain isolated. They work by locking tokens on the source chain like Ethereum and minting wrapped equivalents on the destination chain like Solana. This ensures value preservation while enabling multi-chain usage.

For example:

•

SOL to Ethereum becomes wrapped SOL (wSOL)

• ETH to Solana becomes wrapped ETH (wETH)

Major bridges, such as deBridge, Portal by

Wormhole, Allbridge, and Synapse, use smart contracts, validator networks, and secure message relays to handle transfers safely.

deBridge alone has processed over $10 billion in cross-chain volume since launching in 2023.

Bridges are now a foundational part of 2025’s multi-chain environment, enabling liquidity flow, multi-chain DeFi strategies, and seamless app interoperability.

Why Should You Use Crypto Bridges?

Crypto bridges unlock powerful benefits that centralized exchanges cannot provide:

1. Access to Better Yield and DeFi Opportunities: Ethereum hosts blue-chip protocols like

Aave,

Lido,

Rocket Pool,

Curve, and

Uniswap, offering yields unavailable on Solana. Solana, meanwhile, offers lightning-fast trading and high-performance dApps like

Jupiter,

Raydium,

Kamino,

Drift, and Sanctum.

2. Cost Efficiency amd Flexibility: deBridge charges 0.03 SOL flat fees for many transfers Ethereum gas typically ranges from $5–$15, but can spike during congestion.

On the other hand, Solana transfers cost fractions of a cent. Bridging allows you to use assets without selling, preserving tax lots and avoiding unnecessary trades.

3. Multi-Chain Diversification: Holding assets across chains reduces exposure to:

• Network downtime

• Congestion

• Single-chain smart contract failures

Bridges help users deploy capital where opportunities are best without changing their core holdings.

How Do Cross-Chain Bridges Work?

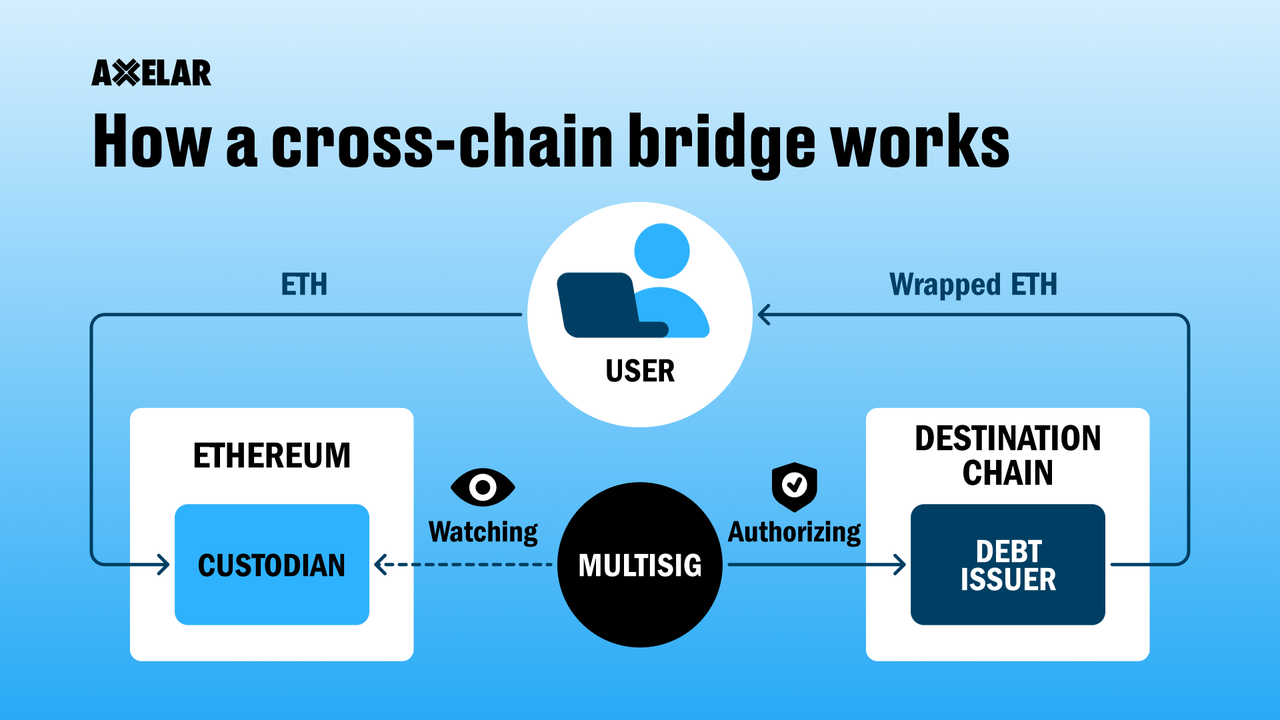

How cross-chain bridges work | Source: Axelar Network

Cross-chain bridges combine three core components:

1. Smart Contracts for Lock and Mint Mechanism: Smart contracts lock your original tokens on Chain A and mint a wrapped version on Chain B to preserve value and prevent changes in total supply. This “lock-and-mint” model ensures your asset remains usable across networks without moving the original token.

2. Validators or Guardians: Validators (or guardians) independently verify each bridging transaction to prevent double-spending and confirm that tokens were correctly locked before wrapped assets are issued. Their signatures ensure that both chains maintain synchronized and accurate states.

3. Audits, Relayers and Governance: Security audits from firms like Halborn, Zokyo, and Immunefi review bridge contracts to reduce exploit risk, while relayers transmit verified messages between chains. Many bridges also rely on decentralized governance to set fees, choose supported assets, and approve system upgrades, helping maintain transparency and trust.

Transfer speeds typically range from 5–20 seconds on fast bridges like Portal to 1–5 minutes during peak network congestion, enabling smooth interoperability across ecosystems such as Solana, Ethereum,

Polygon,

Base, and

Sui.

What Are the Top Ways to Bridge Assets Between Solana and Ethereum?

Here are 2025’s most reliable Solana to Ethereum bridges:

1. Portal by Wormhole (W)

Portal by Wormhole is one of the most widely used cross-chain bridges and supports fast, reliable transfers between Solana, Ethereum, and several other major ecosystems. Its infrastructure is built around high-security guardians and frequent audits, allowing it to complete transfers within seconds under normal network conditions. Many DeFi users choose Portal for its strong reputation, straightforward interface, and ability to handle both tokens and NFTs efficiently.

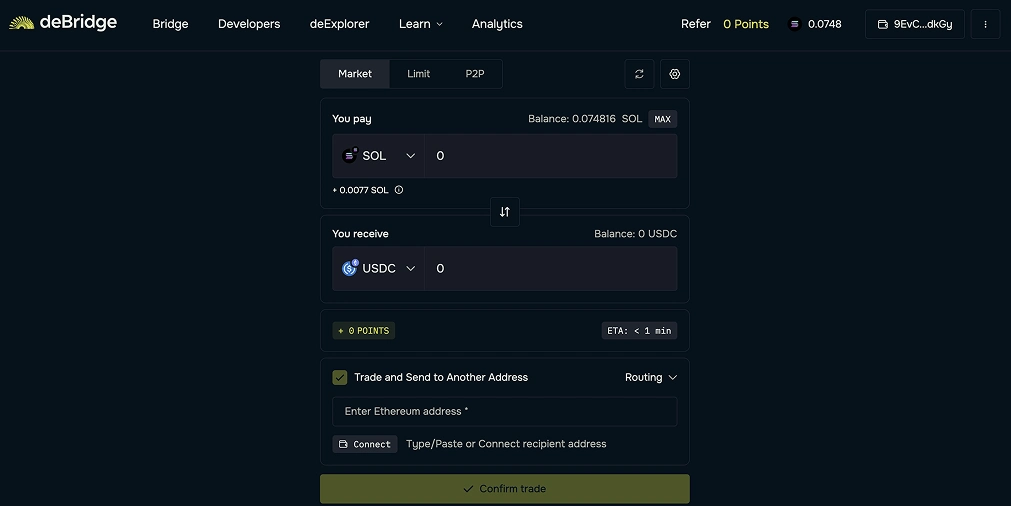

2. deBridge (DBR)

deBridge is another major cross-chain solution that enables seamless transfers between Solana, Ethereum, and more than fifteen other blockchains. Known for its stability and security, deBridge has processed over ten billion dollars in cross-chain volume as of 2025 without major security incidents. It charges a flat fee of 0.03 SOL for Solana-originating transfers and offers additional cross-chain use cases such as swaps, lending access, and DeFi app integrations. deBridge is especially popular for users who want predictable fees and consistent settlement times.

3. Allbridge

Allbridge is a user-friendly platform designed to connect assets across a wide range of blockchain networks, including both Solana and Ethereum. Its simple interface and broad token support make it accessible to beginners who want a clean, fast experience without unnecessary complexity. Allbridge is also known for its wide coverage of niche blockchains, giving users more flexibility if they plan to bridge assets beyond the major ecosystems.

4. Rhino.fi

Rhino.fi is optimized for high-liquidity swaps and cross-chain transfers, offering a streamlined experience for users who want both bridging and swapping in a single workflow. It handles roughly $2 billion dollars in monthly volume and typically completes transfers in one to two minutes. The platform charges about 0.19 percent in fees and is especially useful for users who want to move assets quickly without manually managing multiple wallets and networks.

5. Synapse

Synapse focuses on low-cost cross-chain transfers and extremely high uptime, making it a preferred option for users who frequently interact across ecosystems. It supports quick bridging routes, a wide token list, and a strong history of reliable performance. While Synapse is often used for EVM-to-EVM bridging, it also provides efficient pathways for Solana-to-Ethereum flows through partnered routes.

6. Phantom’s Built-In Bridge

Phantom's role as a bridge facilitator continues to grow, with over $1.15 billion in bridged assets processed through its ecosystem. Many users prefer Phantom because it eliminates setup friction by allowing bridging directly inside the wallet, using trusted partner routes. This gives Solana users a native, streamlined experience with fewer steps, making Phantom one of the most convenient options for beginners moving assets to Ethereum.

7. Cross-Chain Swapper

Portal by Wormhole, deBridge, and Allbridge offer robust cross-chain bridging solutions and remain excellent choices for users looking to move assets across different blockchains. However, even with these platforms, bridging can still feel complicated. Users often encounter multiple approval steps, network switching, unpredictable gas fees, and the need to manually track settlement progress.

To remove this friction and simplify the entire experience, the Crosschain Swapper was introduced as an all-in-one tool that abstracts away the technical complexity behind traditional crypto bridges. Instead of juggling networks, confirmations, and contract interactions, users can simply choose the asset they want to swap and the destination chain, and the Swapper handles the rest. It is designed to offer a smooth, frustration-free way to bridge between Ethereum and Solana, making it the ideal option for users who want seamless cross-chain functionality without navigating the usual hassles.

How to Bridge from Solana to Ethereum: Step-by-Step Guide

Bridging from Solana to Ethereum is straightforward, but accuracy matters. Follow these steps to avoid failed transfers, stuck transactions, or irreversible token loss.

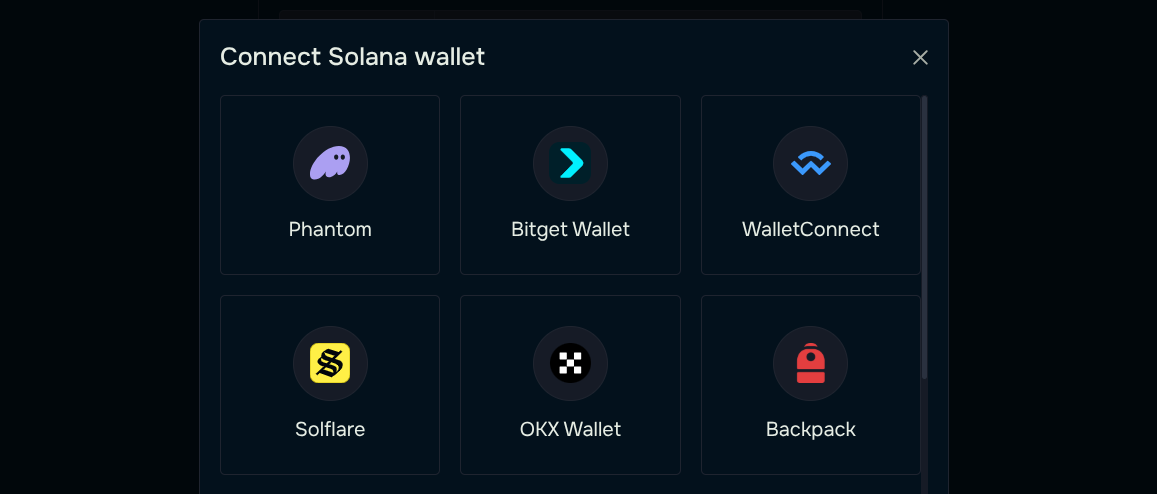

Step 1: Connect Your Solana and Ethereum Wallets

Open a trusted bridge such as deBridge, then connect your

Solana wallet like Phantom and

Ethereum wallet like

MetaMask. The platform performs a quick authentication transaction, usually under 30 seconds, to confirm wallet permissions. Keeping both wallets updated reduces common issues like failed connections, invalid session caches, or incorrect network settings, the top causes of bridge errors.

Source: DataWallet

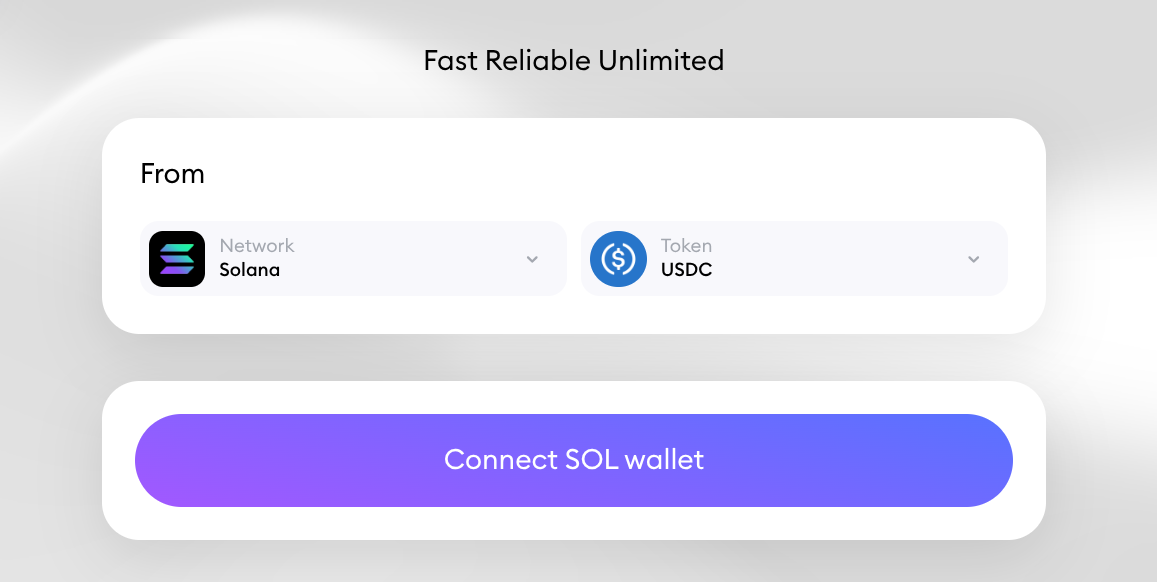

Step 2: Select Networks and Tokens

Select Solana to Ethereum as your transfer route and choose the SPL token you want to bridge like SOL,

USDC,

USDT, etc. Always verify token compatibility: unsupported SPL tokens cannot be minted on Ethereum and may become unrecoverable. Check minimum transfer requirements; for example, 0.1 SOL on deBridge or 10 USDC on Portal, and review network conditions, since Ethereum gas fees can jump from $8 to over $25 during congestion.

Source: deBridge

Step 3: Confirm and Authorize

Enter the amount you want to bridge and approve the locking transaction in Phantom. Validators will confirm the lock on Solana, and the bridge will mint the wrapped ERC-20 equivalent on Ethereum. Expect total fees around $6–$10, including bridge fees and Ethereum gas, though spikes can occur during NFT mints or volatile market periods. Before confirming, double-check the destination address, token type, and amount; mistakes at this stage cannot be reversed.

Source: DeFiWay

Step 4: Receive Bridged Tokens on Ethereum

Your wrapped tokens typically arrive in seconds to a few minutes, depending on Ethereum network load. Once visible in MetaMask, you can use them for trading, DeFi, staking, or liquidity provision. Always verify that:

• The token balance shows correctly in MetaMask

• The receiving address matches your intended wallet

• The transaction hash is confirmed on Etherscan or the bridge’s explorer

This helps detect anomalies early, especially during periods of high chain activity.

What Are the Common Issues When Bridging Solana to Ethereum?

Even with reliable bridges, several common issues can interrupt transfers. Here’s what to watch for and how to prevent them.

1. Network Congestion Delays: High traffic on Solana can slow RPC nodes, while Ethereum gas spikes can push fees from the usual $8–$15 range up to $40+. To avoid delays or costly transactions, bridge during off-peak hours and slightly increase your gas settings when the network is busy.

2. Wallet Connection Errors: Phantom and MetaMask may fail to connect due to outdated wallet versions, cached sessions, or conflicting browser tabs. Updating the extensions, clearing browser data, and manually selecting the correct network usually resolves these issues instantly.

3. Unsupported Tokens: Some SPL tokens do not have ERC-20 equivalents, which can cause transfers to fail or permanently trap assets. Always confirm the token contract and ensure there’s sufficient liquidity on Ethereum before bridging.

4. Insufficient Gas Funds: A large share of failed transfers simply occurs because users don’t have enough SOL for the locking transaction or ETH for gas on the destination chain. Keep a buffer in both wallets to ensure the bridge can complete all required steps.

5. Bridge Downtime: Bridges may temporarily pause service during audits, upgrades, or security checks, causing transfers to stall. Checking the bridge’s status page, Discord, or Telegram before large transactions helps you avoid unexpected delays.

6. “Stuck” Transactions: Transfers can appear stuck if validator messages are delayed or if one chain hasn’t indexed the transaction yet. Track your Solana and Ethereum transaction hashes, use the bridge’s retry/redeem tools, or contact support with the TX hash to complete settlement.

Top Risks to Consider Before Bridging Ethereum and Solana Assets

Bridging carries several security and operational risks, so understanding these before transferring large amounts is essential.

• Smart contract vulnerabilities: Bridges are frequent targets for exploits, leading to multi-million-dollar losses in past attacks.

• Gas price volatility: Ethereum gas can surge during peak activity, making transfers suddenly expensive or causing them to fail.

• Validator or relayer failures: If validators go offline or relayers stall, your assets may remain locked until the network stabilizes.

• Incorrect token or wallet addresses: Mistakes in contract addresses or destination wallets can result in irreversible fund loss.

Best practice: Always test the bridge with a small trial transfer before sending larger amounts.

How to Buy ETH or SOL Directly on BingX

ETH/USDT trading pair on the spot market powered by BingX AI insights

1. Create or log in to your BingX account: Sign up with your email or mobile number and

complete KYC if required in your region.

3. Go to Spot Trading: Open the Spot Market and search for

ETH/USDT or

SOL/USDT.

4. Use BingX AI for market insights: Check AI-generated signals, market trends, and price analysis to make informed decisions before placing your trade.

5. Enter the amount of ETH or SOL you want to buy: Choose

Market Order for instant execution or Limit Order to set your preferred price.

6. Confirm your purchase: Review your order, tap Buy, and your ETH or SOL will be added to your BingX Spot Wallet.

7. Store or transfer your ETH, SOL tokens: Keep your ETH or SOL securely on BingX or withdraw to a self-custody wallet for DeFi, staking, or Web3 apps.

Conclusion

Bridging between Solana and Ethereum is now a standard part of the multi-chain ecosystem. Platforms such as Portal, deBridge, Rhino.fi, Synapse, and Phantom’s Cross-Chain Swapper offer fast, secure, and cost-efficient transfers that help users access yield opportunities, liquidity, and DeFi applications across both networks.

With proper preparation, security checks, and risk management, users can move assets safely between chains and benefit from Solana’s transaction speed and Ethereum’s deep liquidity. However, bridging still carries risks, including smart contract vulnerabilities, network congestion, and fee volatility, so you should always verify details and consider testing with a small amount first.

Related Reading